- Home

- »

- Healthcare IT

- »

-

Women’s Digital Health Market Size And Share Report, 2030GVR Report cover

![Women’s Digital Health Market Size, Share & Trends Report]()

Women’s Digital Health Market Size, Share & Trends Analysis Report By Type (Mobile Apps, Wearable Devices, Diagnostic Tools, Others), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-267-9

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Women’s Digital Health Market Size & Trends

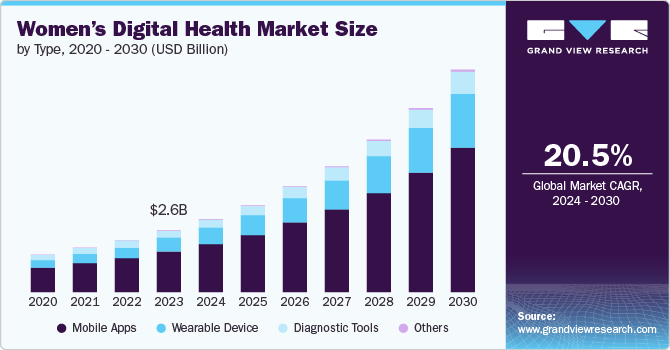

The global women’s digital health market size was valued at USD 2.59 billion in 2023 and is projected to grow at a CAGR of 20.5% from 2024 to 2030. The proliferation of mobile devices has made it easier for women to access digital health tools that allow them to monitor their health conveniently. Mobile apps designed for menstrual tracking, fertility monitoring, and overall wellness have become integral to women’s daily routines. This accessibility empowers women to take charge of their health by providing real-time data and insights, thus fostering a proactive approach to healthcare management.

The rapid development of digital technologies, including mobile health apps, wearable devices, and telemedicine platforms, has created a dynamic ecosystem that supports women’s health management. These technologies offer personalized, accessible, and real-time health monitoring, crucial for managing conditions such as hormonal imbalances, reproductive health issues, and chronic diseases. As these tools become more sophisticated and user-friendly, they empower women to take charge of their health with greater autonomy and accuracy. According to Rock Health’s survey, 80% of consumers are willing to use at least one digital health tool, and 82% of women respondents reportedly use telemedicine, highlighting a growing trust in these technologies.

Additionally, the broader acceptance of telemedicine and remote consultations has accelerated access to and adoption of digital health solutions, especially during the COVID-19 pandemic. The pandemic highlighted the importance of remote healthcare and drove widespread adoption of virtual consultations and digital health platforms. For women, this means greater accessibility to healthcare professionals, particularly for reproductive health and mental health services, which are often challenging to access in person. This enhanced accessibility supports better health outcomes and encourages ongoing engagement with digital health solutions.

Type Insights

Mobile apps dominated the market and accounted for a share of 65.5% in 2023 due to their convenience, accessibility, and effectiveness. Mobile applications offer women the convenience of managing their health from the palm of their hand, with a range of features tailored to specific needs such as menstrual cycle tracking, pregnancy monitoring, and mental health support. With the increasing smartphone use, women prefer mobile apps more often to handle their health-related requirements. For instance, MyFitnessPal, Inc. has designed mobile apps that allow women to monitor their diet and workout schedules and track their menstrual cycles.

Wearable devices are expected to register the fastest CAGR of 23.8% during the forecast period. Wearable devices, such as smartwatches and fitness trackers, have evolved to incorporate a range of sophisticated sensors and features that cater specifically to women's health needs. These devices now offer heart rate monitoring, sleep tracking, and ovulation and menstrual cycle tracking. Integrating these advanced features into wearable technology enhances the accuracy and relevance of health data and appeals to a growing segment of women who are increasingly conscious of their health and fitness.

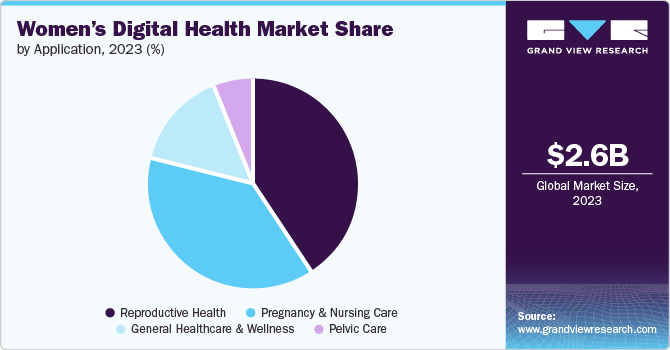

Application Insights

Reproductive health accounted for the largest market revenue share in 2023. Conditions such as polycystic ovary syndrome (PCOS), endometriosis, and irregular menstrual cycles affect a significant portion of the female population and often require ongoing management. Digital health solutions that provide symptom tracking, educational resources, and management strategies are increasingly sought after by women dealing with these conditions. By offering specialized tools and support, digital health applications help women better manage their health and navigate their conditions, driving demand for reproductive health solutions.

Pregnancy & nursing care is expected to register the fastest CAGR during the forecast period. Expectant and new mothers increasingly seek digital solutions that provide real-time information, health tracking, and personalized advice throughout their pregnancy and nursing journey. Mobile app and online platforms that offer features such as fetal development tracking, contraction timing, and breastfeeding guidance cater to these needs. The convenience and accessibility of these digital tools make them highly appealing to women who want to manage their pregnancies and nursing experiences more effectively, increasing the market.

Regional Insights

North America women’s digital health market dominated the market and accounted for a market revenue share of 41.6% in 2023. This is attributable to the increasing use of digital health technology and the rising prevalence of smartphones, which allow women in the region to obtain essential healthcare resources quickly. The increasing public awareness of women's health concerns has also contributed to boosting the requirement for digital health resources. These platforms empower women to take control of their health and make educated choices regarding their wellness.

U.S. Women’s Digital Health Market Trends

The U.S. women’s digital health market dominated the North America market in 2023. Digital platforms such as the Mayo Clinic’s Women’s Health app and the American College of Obstetricians and Gynecologists (ACOG) resources have been crucial in educating women about reproductive health, pregnancy, and menopause. These platforms provide access to expert advice, educational content, and symptom-tracking tools, helping to demystify and address specific health concerns.

Europe Women’s Digital Health Market Trends

Europe women’s digital health market was identified as a lucrative region in 2023. Digital health solutions that offer personalized health monitoring and proactive management are gaining traction. For instance, the Dutch company FibriCheck provides a mobile app that allows users to monitor their heart rhythm and detect atrial fibrillation. This condition can have implications for women's health. By offering tools that help in early detection and personalized health management, these solutions align with the European healthcare focus on prevention and personalization, contributing to expanding the digital health market.

The UK women’s digital health market is expected to grow rapidly in the coming years. The emphasis on preventive and proactive healthcare is another crucial factor fueling the women’s digital health market expansion in the UK. The NHS Long Term Plan highlights the importance of early intervention and preventive care, which is well-supported by digital health solutions. Apps such as NHS Digital’s Healthier You, which focuses on managing risk factors for diabetes and cardiovascular health, empower women to proactively take control of their health.

Asia Pacific Women’s Digital Health Market Trends

Asia Pacific women’s digital health market is anticipated to register the fastest CAGR over the forecast period. The proliferation of smartphones and internet connectivity across the Asia Pacific has made healthcare services more accessible than ever before. Women can now access telehealth services, mobile applications for tracking menstrual cycles or pregnancy, and online communities that offer support and information at their fingertips.

China women’s digital health market held a substantial market share in 2023. The Chinese government and various health organizations have been increasingly proactive in addressing women's health concerns through public health campaigns and educational initiatives. For instance, the government's Healthy China 2030 initiative emphasizes comprehensive healthcare, including women's health, leading to a greater emphasis on digital health solutions.

Key Women’s Digital Health Company Insights

Some of the key companies in the women’s digital health market include HeraMED, iSono Health, Clue by Biowink, Chiaro Technology Ltd, Natural Cycles, and others.

-

HeraMED provides HeraCARE, a digital platform that offers remote patient monitoring, tailored care plans, telehealth functions, and educational material for healthcare professionals and pregnant women. It also offers a home fetal heart rate monitor named HeraBEAT, which allows mothers to hear their baby's heartbeat.

-

iSono Healthoffers a comprehensive suite of digital health solutions that integrate seamlessly into existing healthcare workflows. Their platform facilitates real-time image acquisition and provides tools for data management and patient engagement.

Key Women’s Digital Health Companies:

The following are the leading companies in the women’s digital health market. These companies collectively hold the largest market share and dictate industry trends.

- HeraMED

- iSono Health

- Clue by Biowink

- Chiaro Technology Ltd.

- Natural Cycles

- Ava Science, Inc.

- NURX Inc.

- Prima-Temp, Inc.

- Glow

- Lucina Health

- MobileODT Ltd.

- Braster SA

- Athena Feminine Technologies

- Plackal Tech

Recent Developments

-

In March 2024, HeraMed partnered with FemBridge to create a scalable and comprehensive maternity care solution that addresses the diverse needs of expectant mothers and healthcare providers. This collaboration aims to develop a solution that leverages digital health technologies to enhance the quality of care provided to expectant mothers.

-

In November 2023, AstraZeneca launched Evinova, a health-tech business that accelerates innovation across the life sciences sector. This represents a significant step forward in integrating technology into healthcare. By utilizing advanced data analytics and digital platforms, Evinova can facilitate more inclusive clinical trials that consider women's unique physiological and psychological needs.

Women’s Digital Health Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.10 billion

Revenue forecast in 2030

USD 9.53 billion

Growth Rate

CAGR of 20.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, Kuwait, UAE, and South Africa

Key companies profiled

HeraMED; iSono Health; Clue by Biowink; Chiaro Technology Ltd; Natural Cycles; Ava Science, Inc.; NURX Inc.; Prima-Temp, Inc.; Glow; Lucina Health; MobileODT Ltd; Braster SA; Athena Feminine Technologies; Plackal Tech

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Women’s Digital Health Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global women’s digital health market report based on type, application, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Mobile Apps

-

Wearable Device

-

Diagnostic Tools

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Reproductive Health

-

Pregnancy & Nursing Care

-

Pelvic Care

-

General Healthcare & Wellness

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."