- Home

- »

- Next Generation Technologies

- »

-

Workplace Transformation Market Size, Industry Report, 2030GVR Report cover

![Workplace Transformation Market Size, Share, & Trends Report]()

Workplace Transformation Market (2025 - 2030) Size, Share, & Trends Analysis Report By Service (Application Management, Asset Management, Desktop Virtualization, Field Services), By Enterprise Size, By End-use (BFSI, Government), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-181-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Workplace Transformation Market Summary

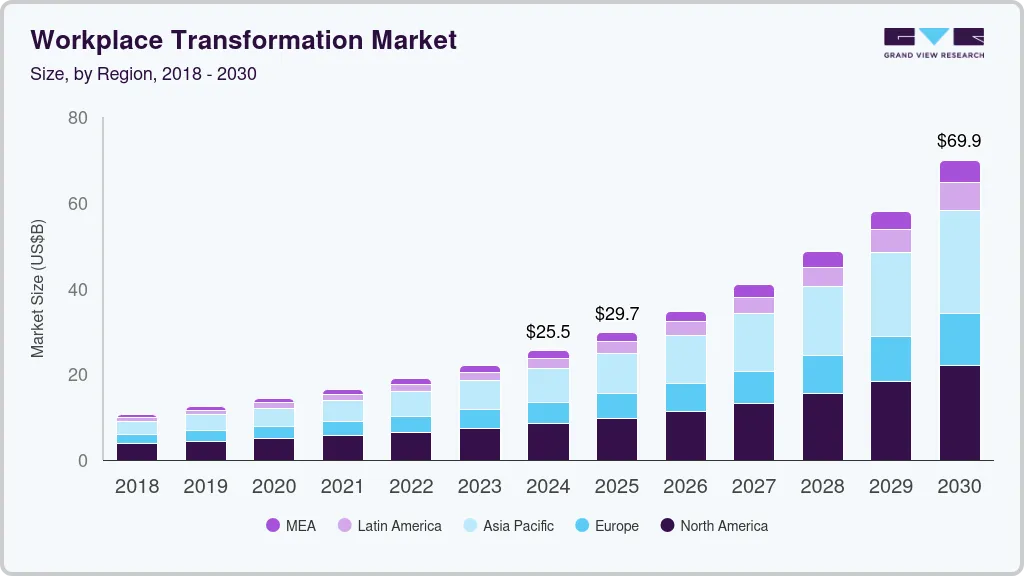

The global workplace transformation market size was estimated at USD 25,465.2 million in 2024 and is projected to reach USD 69,890.1 million by 2030, growing at a CAGR of 18.7% from 2025 to 2030. The workplace transformation market encompasses a wide range of services and solutions aimed at modernizing traditional work environments to align with the digital era. It includes components such as digital transformation, employee experience enhancement, workplace analytics, and change management services.

Key Market Trends & Insights

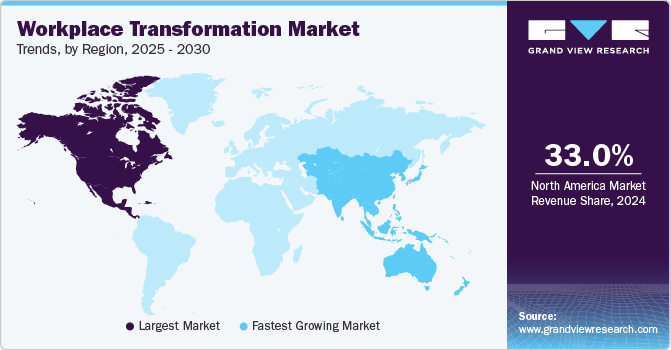

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, South Korea is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, enterprise mobility & telecom accounted for a revenue of USD 5,173.4 million in 2024.

- Workplace Automation is the most lucrative service segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 25,465.2 Million

- 2030 Projected Market Size: USD 69,890.1 Million

- CAGR (2025-2030): 18.7%

- North America: Largest market in 2024

The shift to hybrid work models has redefined workplace dynamics, creating a significant demand for solutions that support remote and in-office collaboration. Employers are investing in tools and infrastructure to ensure seamless communication and workflow continuity.

Hybrid work is also driving the need for flexible office designs, hot-desking solutions, and cloud-based resource management. The market has gained substantial momentum in recent years, fueled by the pandemic-induced shift to remote and hybrid work models. Organizations across sectors, from IT and BFSI to healthcare and retail, are embracing workplace transformation to stay competitive and cater to changing employee expectations.

Sustainability has become a cornerstone of workplace transformation, with organizations prioritizing eco-friendly practices to align with global environmental goals and corporate social responsibility. Green workspaces incorporate energy-efficient technologies such as smart lighting, automated HVAC systems, and IoT-enabled energy monitoring to reduce carbon footprints. Sustainable office designs often use eco-friendly materials, modular furniture, and layouts that maximize natural light, promoting energy conservation. Beyond environmental benefits, such practices enhance employee well-being by fostering healthier and more comfortable working environments. The adoption of green certifications such as LEED and BREEAM is also growing, as organizations seek to showcase their commitment to sustainability. In addition, hybrid work models reduce the need for large office spaces, further decreasing resource consumption. These efforts not only contribute to environmental preservation but also resonate with eco-conscious employees and stakeholders, enhancing brand reputation and long-term business sustainability. Sustainability-driven initiatives are poised to play an increasingly critical role in workplace transformation.

Several large organizations have implemented cloud technology, that are contextual and insights-enabled, simple to consume, and powered by AI, and other automation technologies. Moreover, cloud computing enables businesses to easily scale up or scale down their IT requirements as needed. Furthermore, cloud computing facilitates and organizes group collaboration by allowing employees to work from a centralized repository of files with real-time updates, resulting in increased productivity. Integrating tools such as instant messaging, file hosting/sharing, and collaboration applications facilitates communication between departments, allowing for more innovation. These benefits of cloud technology in workplace transformation will supplement the growth of the market during the forecast period.

As workplaces increasingly rely on digital tools and remote work setups, cybersecurity risks become a significant restraint. The integration of cloud platforms, IoT devices, and AI-driven systems increases vulnerabilities to cyberattacks, data breaches, and unauthorized access. For organizations dealing with sensitive data, such risks can have severe financial and reputational consequences. Implementing robust security measures requires additional resources, expertise, and ongoing monitoring, adding to the overall cost of workplace transformation. These concerns often deter organizations from adopting digital workplace solutions at scale.

Service Insights

The enterprise mobility & telecom segment accounted for a market share of over 17% in 2024. The widespread adoption of BYOD policies allows employees to use their personal devices for work, driving demand for enterprise mobility solutions. These tools ensure secure access to corporate applications, protect sensitive data, and enable seamless connectivity, creating a flexible work environment. BYOD policies enhance productivity while reducing hardware costs for organizations. Similarly, the rise of remote and hybrid work models has increased the need for secure access to enterprise applications and data. Mobility and telecom solutions such as VPNs, mobile device management (MDM), and secure collaboration platforms empower distributed workforces by ensuring seamless communication, productivity, and data security, regardless of location.

The workplace automation segment is anticipated to grow at a significant CAGR during the forecast period. The growing adoption of hybrid work environments has significantly boosted the demand for workplace automation solutions. Automated tools play a critical role in ensuring seamless workflow continuity across remote and in-office setups. Technologies such as cloud-based platforms, smart scheduling systems, and automated document management enable employees to access resources, collaborate, and complete tasks from anywhere. Automation also helps integrate virtual and physical workspaces by optimizing communication tools, managing shared resources such as hot desks, and streamlining processes such as onboarding and task allocation. These solutions enhance productivity, minimize disruptions, and create a unified experience for hybrid teams, making them indispensable in the modern workplace transformation landscape.

Enterprise Size Insights

The large enterprises segment accounted for the largest market share in 2024. Large enterprises are increasingly adopting digital tools and technologies to enhance operational efficiency, communication, and collaboration. Cloud computing allows for scalable, on-demand access to resources, reducing infrastructure costs and improving flexibility. AI-powered solutions automate routine tasks, optimize decision-making, and provide predictive analytics for better outcomes. Collaboration platforms, such as Microsoft Teams and Slack, facilitate real-time communication, file sharing, and remote collaboration, supporting hybrid and distributed work models. Digital workflows streamline business processes by automating tasks, reducing manual effort, and improving accuracy. These technologies empower enterprises to adapt quickly to changing demands, enhance employee productivity, and drive innovation, resulting in improved overall performance and competitiveness.

The small & medium sized enterprise segment is expected to grow at a significant rate during the forecast period. Having small organizational infrastructure, SMEs are rapidly deploying digital workplace services. It provides several benefits to SMEs, including increased workforce productivity and business efficiency, mobilized desk-based operations, faster time to market, lower costs, and improved customer experience. Furthermore, it allows for better decision-making and the most efficient use of resources and time. These aforementioned factors are propelling the growth of the workplace transformation market in SMEs during the forecast period.

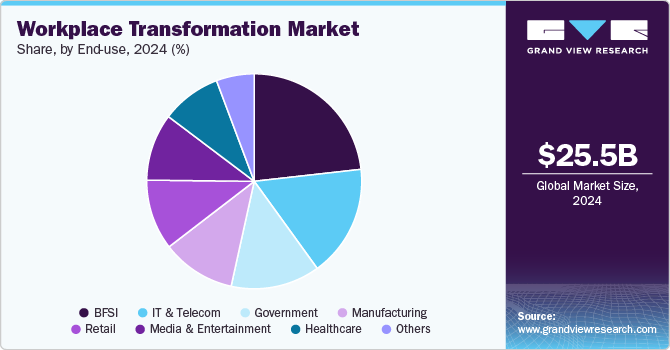

End-use Insights

The BFSI segment accounted for the largest market share of over 23% in 2024. BFSI organizations are embracing digital transformation by integrating technologies such as cloud computing, AI, and data analytics to modernize their operations. Cloud solutions offer scalability, cost efficiency, and secure data storage, enabling easy access to applications and data across the organization. AI is leveraged for automation, fraud detection, and customer service, enhancing efficiency and reducing manual effort. Data analytics provides valuable insights into customer behavior, financial trends, and operational performance, supporting data-driven decision-making. By adopting these technologies, BFSI companies streamline workflows, reduce operational costs, improve customer experience, and enhance agility, enabling them to adapt quickly to market shifts and stay competitive in an evolving financial landscape.

The healthcare segment is expected to register a significant CAGR during the forecast period. The growing demand for electronic data across patient outreach and operation Enterprise Sizes is expected to propel the industry forward. For instance, healthcare providers can use healthcare apps on patients' smartphones to measure heart rates, blood pressure, and glucose levels. Furthermore, it improves the patient experience by allowing for better decision-making and the most efficient use of resources and time. These factors are driving the growth of the segment during the forecast period.

Regional Insights

North America held the significant share of over 33% of the workplace transformation industry in 2024. The regional growth can be attributed to the increasing adoption of emerging technologies, such as BYOD, AI, and enterprise mobility management solutions, among others. Several workplace transformation providers in the region are rapidly adopting cloud technologies and incorporating AI into their service offerings. In addition to this, the region has a strong demand for software and robotics solutions, owing to high manufacturing, retail, and automotive activity. This ultimately propels the development of the market in the region over the forecast period.

U.S. Workplace Transformation Market Trends

The workplace transformation industry in the U.S. is expected to grow significantly from 2025 to 2030. U.S. companies are increasingly adopting cloud computing and SaaS solutions to achieve scalability, cost efficiency, and flexibility. SaaS platforms enhance collaboration, streamline workflows, and enable remote access, reducing the need for on-premise infrastructure. These technologies support digital transformation by improving operational efficiency and driving business agility.

Europe Workplace Transformation Market Trends

The workplace transformation market in Europe is growing significantly at a CAGR of over 16% from 2025 to 2030. European companies are heavily investing in digital transformation initiatives, adopting technologies such as cloud computing, AI, and automation to modernize their operations, boost productivity, and enhance customer experiences. These investments are fueling demand for workplace transformation solutions that improve efficiency and agility. Simultaneously, there is a growing focus on employee experience and well-being, with organizations prioritizing work-life balance, engagement, and health initiatives. To support these goals, businesses are implementing technologies that enable flexible workspaces, enhance remote work capabilities, and provide personalized experiences for employees. These efforts not only foster a positive work culture but also help attract and retain top talent, positioning companies for long-term success in a competitive environment.

The UK workplace transformation industry is expected to grow rapidly in the coming years. Many UK companies are focusing on reducing their carbon footprint and embracing sustainability initiatives, which are influencing workplace transformation strategies. This includes creating energy-efficient workspaces, promoting remote work, and investing in green technologies to support environmental goals.

The Germany workplace transformation market held a substantial market share in 2024. Germany is a leader in embracing digital transformation, with companies heavily investing in cloud computing, AI, IoT, and automation to modernize operations, streamline workflows, and enhance overall productivity. This transformation is key to creating flexible and efficient workplaces.

Asia Pacific Workplace Transformation Market Trends

The workplace transformation market in the Asia Pacific is growing significantly at a CAGR of over 20% from 2025 to 2030. The rapid adoption of digitization by different industry and service sectors. Several companies in the region are encouraging widespread adoption of cloud-based technology and BYOD with large-scale acceptance of digital workplace services by enterprises. Furthermore, rapid economic development, globalization, and foreign direct investment are some of the factors driving the growth of the regional market during the forecast period.

The China workplace transformation industry held a substantial market share in 2024. The Chinese government has prioritized digitalization as part of its broader economic development strategy, providing support through initiatives like "Made in China 2025" and funding for technology innovation. These initiatives encourage the adoption of digital workplace technologies, driving market growth.

The Japan workplace transformation industry held a substantial market share in 2024. Japanese companies are heavily investing in digital transformation initiatives to modernize operations, improve customer engagement, and drive innovation. Cloud computing, AI, big data, and IoT are being integrated into the workplace to enable smarter, more flexible environments.

In India, the shift toward remote and hybrid work in India has accelerated, especially following the COVID-19 pandemic. This has led to an increased demand for digital collaboration platforms, cloud-based solutions, and virtual meeting tools to facilitate seamless communication and collaboration across distributed teams. Indian companies are prioritizing employee experience by adopting technologies that support flexibility, work-life balance, and engagement. Digital tools for wellness programs, flexible workspaces, and personalized experiences are becoming integral to workplace transformation efforts.

Key Workplace Transformation Company Insights

The key market players in the global workplace transformation market include Accenture PLC, NTT Data Corporation, Cisco Systems, Inc., Atos, Hewlett Packard Enterprise Development LP (HPE), Capgemini, Cognizant Technology Solutions Corporation, HCL Technologies Ltd., Citrix Systems, Wipro Ltd., IBM Corporation, Tata Consultancy Services, Infosys, and Intel Corporation. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In January 2024, Accenture agreed to acquire Work & Co, a global digital product company. This acquisition aims to strengthen Accenture's digital products and experience transformation capabilities within Accenture Song. Work & Co specializes in blending design, technology, and innovation to create cutting-edge digital products. It will join Accenture's expanding efforts to help clients modernize and innovate in a rapidly evolving digital landscape.

-

In September 2023, ANZ Bank partnered with HCLTech to transform its digital workplace across 33 countries. This collaboration involves HCLTech providing digital workplace services and experience management for ANZ's End User devices, including laptops, mobile phones, and tablets. HCLTech will leverage technologies such as extended reality, generative AI, and IoT-powered workspaces to enhance employee experiences. The deal represents a significant step in ANZ’s digital transformation strategy, aiming to improve employee-centric services and foster a better digital environment.

-

In October 2024, Atos SE in partnership with Nexthink, launched the Experience Operations Center to enhance digital workplace performance. This center will enable organizations to improve employee experiences by leveraging real-time data insights, predictive analytics, and AI. It aims to empower IT teams to proactively manage and optimize digital environments, addressing user needs and boosting workplace productivity. This collaboration supports companies in their journey towards efficient, future-ready digital workplaces.

Key Workplace Transformation Companies:

The following are the leading companies in the workplace transformation market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture PLC

- NTT Data Corporation

- Cisco Systems, Inc.

- Atos SE

- Hewlett Packard Enterprise Development LP (HPE)

- Capgemini

- Cognizant Technology Solutions Corporation

- HCL Technologies Ltd.

- Citrix Systems

- Wipro Ltd.

- IBM Corporation

- Tata Consultancy Services

- Infosys

- Intel Corporation.

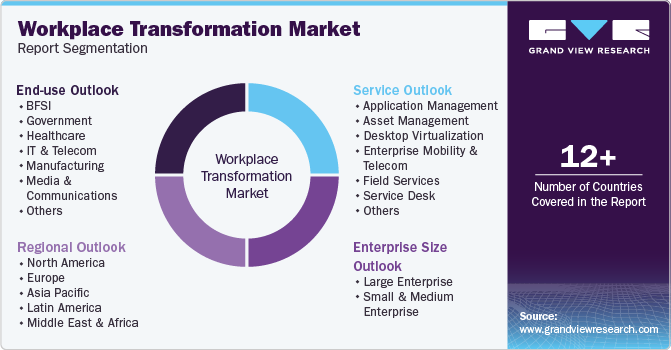

Workplace Transformation Market Report Scope

Report Attribute

Details

Market size in 2025

USD 29.67 billion

Market Size forecast in 2030

USD 69.89 billion

Growth rate

CAGR of 18.7% from 2025 to 2030

Actual data

2018 - 2023

Base Year

2024

Forecast period

2025 - 2030

Quantitative units

Market Size in USD million and CAGR from 2025 to 2030

Report coverage

Market Size forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Service, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Accenture PLC; NTT Data Corporation; Cisco Systems, Inc.,;Atos, Hewlett Packard Enterprise Development LP (HPE); Capgemini; Cognizant Technology Solutions Corporation; HCL Technologies Ltd.; Citrix Systems; Wipro Ltd.; IBM Corporation; Tata Consultancy Services; Infosys; Intel Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Workplace Transformation Market Report Segmentation

This report forecasts Market Size growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the workplace transformation market report based on service, enterprise size, end-use and region.

-

Service Outlook (Market Size, USD Million, 2018 - 2030)

-

Application Management

-

Asset Management

-

Desktop Virtualization

-

Enterprise Mobility & Telecom

-

Field Services

-

Service Desk

-

Unified Communication & Collaboration

-

Workplace Automation

-

Workplace Upgradation & Migration

-

Others

-

-

Enterprise Size Outlook (Market Size, USD Million, 2018 - 2030)

-

Large Enterprise

-

Small & Medium Enterprise

-

-

End-use Outlook (Market Size, USD Million, 2018 - 2030)

-

BFSI

-

Government

-

Healthcare

-

IT & Telecom

-

Manufacturing

-

Media & Communications

-

Retail

-

Others

-

-

Regional Outlook (Market Size, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global workplace transformation market size was estimated at USD 25.47 billion in 2024 and is expected to reach USD 29.67 billion in 2025.

b. The global workplace transformation market is expected to grow at a compound annual growth rate of 18.7% from 2025 to 2030 to reach USD 69.89 billion by 2030.

b. Large enterprises held the largest share of over 57% in 2024. Large enterprises are increasingly adopting digital tools and technologies to enhance operational efficiency, communication, and collaboration. Cloud computing allows for scalable, on-demand access to resources, reducing infrastructure costs and improving flexibility. AI-powered solutions automate routine tasks, optimize decision-making, and provide predictive analytics for better outcomes. Collaboration platforms, like Microsoft Teams and Slack, facilitate real-time communication, file sharing, and remote collaboration, supporting hybrid and distributed work models.

b. The key market players in the global workplace transformation market include Accenture PLC, NTT Data Corporation, Cisco Systems, Inc., Atos, Hewlett Packard Enterprise Development LP (HPE), Capgemini, Cognizant Technology Solutions Corporation, HCL Technologies Ltd., Citrix Systems, Wipro Ltd., IBM Corporation, Tata Consultancy Services, Infosys, and Intel Corporation

b. The transition in workforce demographics and increasing adoption of enterprise mobility services, which help enhance workforce productivity and reduce operational expenses, are the major factors contributing to the growth of the workplace transformation market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.