- Home

- »

- IT Services & Applications

- »

-

Workspace As A Service Market Size, Industry Report, 2030GVR Report cover

![Workspace As A Service Market Size, Share, & Trends Report]()

Workspace As A Service Market (2025 - 2030) Size, Share, & Trends Analysis Report By Type (System Integrated Services, DaaS, AaaS), By Deployment, By Enterprise Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-502-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Workspace As A Service Market Trends

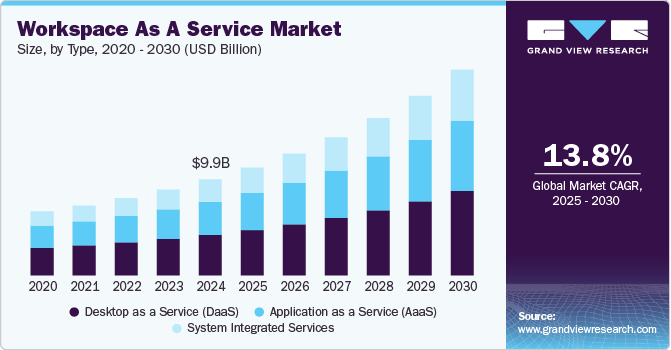

The workspace as a service market size was estimated at USD 9.94 billion in 2024 and is anticipated to grow at a CAGR of 13.8% from 2025 to 2030. The increasing demand for remote work and hybrid work models is a significant driver of the workspace as a service (WaaS) market. With the global shift towards flexible work arrangements, businesses are adopting WaaS solutions to provide employees with secure access to their work environments from any location. This ensures productivity and collaboration, even when employees are geographically dispersed. The COVID-19 pandemic further accelerated this trend, highlighting the need for scalable, secure workspace solutions.

Cost efficiency and scalability are also critical factors fueling the market's growth. Workspace as a service (WaaS) eliminates the need for heavy investments in physical infrastructure, such as on-premises servers and office setups, enabling organizations to reduce operational costs. Businesses can easily scale their workspace requirements up or down based on workforce size or project needs, offering flexibility and cost savings.

The rise in Bring Your Own Device (BYOD) policies and the proliferation of mobile devices have also contributed to the growth of the WaaS market. Employees increasingly prefer using their personal devices for work purposes, necessitating secure and seamless access to enterprise applications and data. WaaS provides an effective solution by enabling secure access to virtual workspaces without compromising security or performance.

In addition, integrating advanced technologies such as cloud computing, virtualization, and AI is driving workspace expansion as a service industry. These technologies enhance the performance, reliability, and security of WaaS solutions, making them more attractive to businesses across various industries. Cloud-based WaaS solutions allow easy deployment and management, while AI-driven tools enable predictive maintenance and personalized workspace experiences.

Type Insights

The desktop as a service (DaaS) segment dominated the market and accounted for a revenue share of over 42.0% in 2024. Small and medium-sized businesses (SMBs) are increasingly adopting DaaS solutions due to their affordability and ease of implementation. SMBs often lack the resources to build and maintain extensive IT infrastructure, making DaaS an attractive option. These solutions provide SMBs with enterprise-grade capabilities at a fraction of the cost, allowing them to compete with larger organizations while maintaining operational efficiency.

The system-integrated services segment is expected to grow at a significant CAGR of 15.0% over the forecast period. As organizations adopt diverse technologies such as cloud computing, virtualization, and advanced networking solutions, the complexity of IT ecosystems has grown exponentially. System-integrated services help businesses unify disparate IT components into a cohesive infrastructure. These services ensure that applications, databases, communication systems, and hardware components work harmoniously, enabling efficient workflows and reducing operational bottlenecks.

Deployment Insights

The hybrid segment accounted for the largest revenue share of over 47.0% in 2024. Advancements in edge computing and the Internet of Things (IoT) augment the hybrid segment. These technologies enable real-time data processing closer to the source, enhancing performance and reducing latency for workspace solutions. The hybrid model's compatibility with edge computing ensures businesses can harness these innovations without overhauling their infrastructure.

The public segment is expected to grow at a significant CAGR over the forecast period owing to enterprises' increasing adoption of cloud-first strategies. Businesses across industries prioritize cloud-based solutions to enhance agility, support innovation, and reduce time to market. Public WaaS solutions enable organizations to quickly deploy virtual workspaces with minimal setup time, which is particularly beneficial for dynamic industries such as retail, technology, and media.

Enterprise Size Insights

The large enterprise segment accounted for the largest revenue share of over 61.0% in 2024. Cost optimization and operational efficiency are major drivers for WaaS adoption in large enterprises. These organizations are constantly looking to reduce their IT infrastructure's total cost of ownership (TCO) while enhancing performance. By shifting to WaaS, enterprises can offload the management and maintenance of physical workstations, reduce energy costs, and focus IT resources on strategic initiatives.

The SME segment is expected to grow significantly over the forecast period. The rise of industry-specific solutions tailored to SMEs contributes to this segment's growth. WaaS providers are increasingly offering customized solutions designed to address the unique challenges of industries such as retail, healthcare, and education, making WaaS adoption more appealing to small businesses within these sectors.

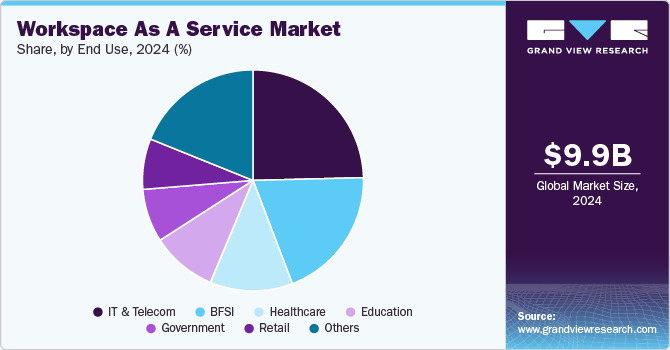

End Use Insights

The IT & telecom segment dominated the market in 2024 and accounted for a revenue share of over 24.0%. Data security and compliance are significant growth drivers for WaaS adoption in the IT & telecom sectors. With stringent data protection regulations and the increasing sophistication of cyber threats, WaaS solutions offer built-in security measures, including encryption, identity management, and multi-factor authentication. This ensures that sensitive data and intellectual property are safeguarded while meeting global compliance standards.

The healthcare segment is expected to grow significantly over the forecast period. The rise of telehealth and remote patient care is a critical factor driving WaaS adoption in healthcare. With the increasing demand for virtual consultations and remote monitoring, WaaS solutions enable healthcare professionals to securely access patient records, diagnostic tools, and communication platforms from any location. This capability enhances patient care and ensures continuity of services, even in geographically dispersed areas.

Regional Insights

The workspace as a service market in North America held the largest share of over 35.0% in 2024. Technological advancements and a strong focus on innovation contribute significantly to WaaS market growth. North America is home to several leading technology companies and cloud service providers that are driving the development and adoption of advanced WaaS solutions. Technologies such as cloud computing, virtualization, and artificial intelligence enhance these solutions' performance, scalability, and security, making them increasingly attractive to businesses.

U.S. Workspace As A Service Market Trends

The workspace as a service market in the U.S. is expected to grow significantly at a CAGR of 11.1% from 2025 to 2030. The widespread adoption of remote and hybrid work models in the U.S. is a primary driver of the WaaS market. From startups to large enterprises, American companies embrace flexible work arrangements to meet employee preferences and enhance productivity. WaaS solutions enable organizations to provide secure and seamless access to work environments, ensuring business continuity even as workforce dynamics evolve.

Europe Workspace As A Service Market Trends

The workspace as a service market in Europe is anticipated to register considerable growth from 2025 to 2030. Rising government regulations and compliance requirements in Europe also fuel the growth of WaaS. With strict data protection laws such as the General Data Protection Regulation (GDPR), businesses must adopt solutions offering robust security and compliance features. WaaS platforms are designed to address these regulatory needs by providing centralized control, encrypted data access, and other security measures, making them an attractive choice for businesses operating in regulated industries like finance and healthcare.

The UK workspace as a service industry is expected to grow rapidly in the coming years. Cost-saving opportunities and operational flexibility appeal to small and medium-sized enterprises (SMEs) in the UK, which form a substantial part of the country’s economy. WaaS solutions reduce the need for expensive physical infrastructure and allow businesses to scale up or down based on workforce requirements or project demands. This affordability and adaptability make WaaS an attractive solution for SMEs looking to optimize their operations.

The workspace as a service market in Germany held a substantial market share in 2024. Another important driver is the push for digital transformation within Germany’s industrial and business sectors. Germany has long been known for its advanced manufacturing sector and the Industry 4.0" principles, and now more organizations across various industries are modernizing their IT infrastructure. WaaS solutions fit seamlessly into this transformation, offering flexible, scalable, and cloud-based workspaces that align with businesses’ digitalization goals. Integrating WaaS with other cloud technologies enhances operational efficiency and drives innovation across industries.

Asia Pacific Workspace As A Service Market Trends

The workspace as a service market in Asia Pacific is growing significantly at a CAGR of 15.6% from 2025 to 2030. The growing adoption of Bring Your Own Device (BYOD) and mobile-first strategies is gaining traction in the region. With a young and tech-savvy workforce in many countries, employees increasingly prefer to use their personal devices for work. WaaS solutions facilitate this by providing secure virtual workspaces accessible from any device, allowing businesses to support BYOD initiatives while maintaining data security and control. This trend is particularly prominent in fast-growing markets like India, where mobile devices are central to everyday business operations.

Japan workspace as a service market is expected to grow rapidly in the coming years. Japan’s focus on innovation and digital transformation plays a significant role in adopting WaaS. The Japanese government has implemented several initiatives to support the digital transformation of businesses, including the "Society 5.0" vision, which aims to create a highly advanced digital society. WaaS aligns with these goals by offering businesses a way to modernize their IT infrastructure and improve collaboration, productivity, and business agility.

The workspace as a service market in China held a substantial market share in 2024. China’s emphasis on digital transformation and innovation fosters WaaS solutions' growth. The Chinese government has introduced several initiatives, such as "Made in China 2025" and "Digital China," to boost innovation and digitalization across industries. WaaS platforms support this national push by offering businesses the tools they need to modernize their IT infrastructure, improve collaboration, and enhance overall productivity.

Key Workspace As A Service Company Insights

Amazon Web Services, Inc., Microsoft, Broadcom, Cloud Software Group, Inc. (Citrix), and Dell Inc. are key players in the workspace as a service industry. The companies are focusing on various strategic initiatives, including new product development, partnerships and collaborations, and agreements, to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In November 2024, Citrix, a Cloud Software Group, Inc. division, officially introduced Citrix DaaS for Amazon WorkSpaces Core, which is generally available. This collaboration integrates the capabilities of Citrix’s Desktop as a Service (DaaS) solution with Amazon WorkSpaces Core, AWS’s virtual desktop infrastructure (VDI) platform. The offering aims to provide organizations with a secure, efficient, cost-effective approach to delivering virtual desktops and applications. It also includes compatibility with Microsoft 365 Apps for enterprise, ensuring seamless user experiences across diverse locations and devices.

-

In May 2024, Colt Technology Services Group Limited announced the expansion of its Unified Communications as a Service (UCaaS) platform and Colt Intelligent Communications (CIC). The service is now available in seven additional European countries: the Czech Republic, Finland, Luxembourg, Norway, Poland, Romania, and Slovakia. This expansion increases the reach of Colt’s fully compliant cloud voice services to 20 countries across Europe, along with Japan. Businesses in these new regions can now access Colt’s high-quality, secure, and flexible communication solutions designed to meet the demands of modern enterprises.

Key Workspace As A Service Companies:

The following are the leading companies in the workspace as a service market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services, Inc.

- Broadcom (VMware Inc.)

- Cloud Software Group, Inc. (Citrix)

- Colt Technology Services Group Limited

- Dell Inc.

- Econocom Group SE

- Microsoft

- Tech Mahindra Limited

- Unisys Corporation

- Evolve IP, LLC

Workspace As A Service Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.17 billion

Revenue forecast in 2030

USD 21.31 billion

Growth rate

CAGR of 13.8% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report services

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Type, deployment, enterprise size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Amazon Web Services, Inc.; Broadcom (VMware Inc.); Cloud Software Group, Inc. (Citrix); Colt Technology Services Group Limited; Dell Inc.; Econocom Group SE; Microsoft; Tech Mahindra Limited; Unisys Corporation; Evolve IP, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Workspace As A Service Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the workspace as a service market report based on type, deployment, enterprise size, end use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

System Integrated Services

-

Desktop as a Service (DaaS)

-

Application as a Service (AaaS)

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Public

-

Private

-

Hybrid

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprise

-

SME

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Education

-

Retail

-

Government

-

IT & Telecom

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global workspace as a service market size was estimated at USD 9.94 billion in 2024 and is expected to reach USD 11.17 billion in 2025

b. The global workspace as a service market is expected to grow at a compound annual growth rate of 13.8% from 2025 to 2030 to reach USD 21.31 billion by 2030

b. The workspace as a service market in North America held a largest share of over 35.0% in 2024. Technological advancements and a strong focus on innovation contribute significantly to WaaS market growth. North America is home to several leading technology companies and cloud service providers that are driving the development and adoption of advanced WaaS solutions.

b. Some key players operating in the workspace as a service market include Amazon Web Services, Inc., Broadcom (VMware Inc.), Cloud Software Group, Inc. (Citrix), Colt Technology Services Group Limited, Dell Inc., Econocom Group SE, Microsoft, Tech Mahindra Limited, Unisys Corporation

b. The increasing demand for remote work and hybrid work models is a significant driver of the Workspace as a Service (WaaS) market. With the global shift towards flexible work arrangements, businesses are adopting WaaS solutions to provide employees with secure access to their work environments from any location.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.