- Home

- »

- Medical Devices

- »

-

Wound Gel Market Size And Share, Industry Report, 2033GVR Report cover

![Wound Gel Market Size, Share & Trends Report]()

Wound Gel Market (2025 - 2033) Size, Share & Trends Analysis By Product (Dressings, Gels), By Antimicrobial Properties (Silver, Non Silver), By Application, By End Use, By Mode Of Purchase, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-616-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Wound Gel Market Summary

The global wound gel market size was valued at USD 6.05 billion in 2024 and is projected to reach USD 9.68 billion by 2033, growing at a CAGR of 5.37% from 2025 to 2033. The demand for wound gel is rising owing to the increasing number of surgical cases and the growing burden of wounds.

Key Market Trends & Insights

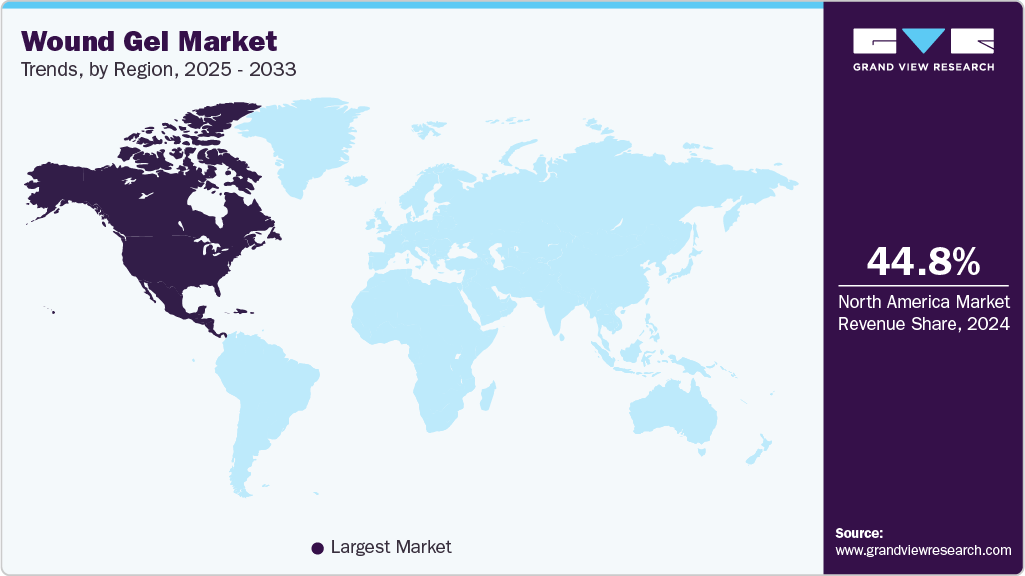

- North America dominated the wound gel market with the largest revenue share of 44.79% in 2024.

- In 2024, the wound gel market in the U.S. had the largest market revenue share, 77.79%, in North America.

- By product, the dressings segment led the market with the largest revenue share of 58.74% in 2024.

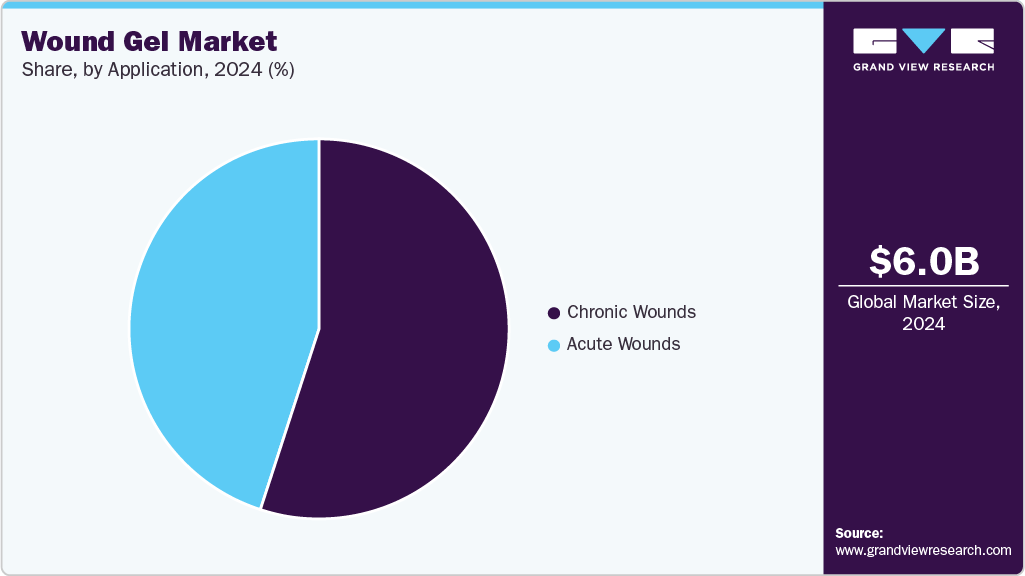

- Based on application, the chronic wounds segment led the market with the largest revenue share of 55.29% in 2024.

- By end use, the hospitals segment led the market with the largest revenue share of 41.52% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.05 Billion

- 2033 Projected Market Size: USD 9.68 Billion

- CAGR (2025-2033): 5.37%

- North America: Fastest growing market

According to the data published by the University of Hawaiʻi in February 2025, chronic wounds affect about 6.5 million individuals in the U.S. each year, contributing to an estimated USD 25 billion in healthcare costs. Such a high burden of wounds and growing healthcare expenditure globally is anticipated to drive the demand for wound gel in the coming years.The rising number of surgical procedures worldwide is a significant driver for expanding the wound gels market. Surgical interventions often result in acute wounds that require effective post-operative care to minimize infection risk and promote faster healing. Advanced wound care products, particularly wound gels, are increasingly preferred due to their ability to maintain a moist wound environment, support autolytic debridement, and accelerate tissue regeneration. According to data published in the BMC Surgery journal in 2025, approximately 313 million surgical procedures are performed globally annually. This substantial volume underscores the growing demand for reliable and effective wound care solutions, reinforcing the critical role of wound gels in the post-surgical healing process.

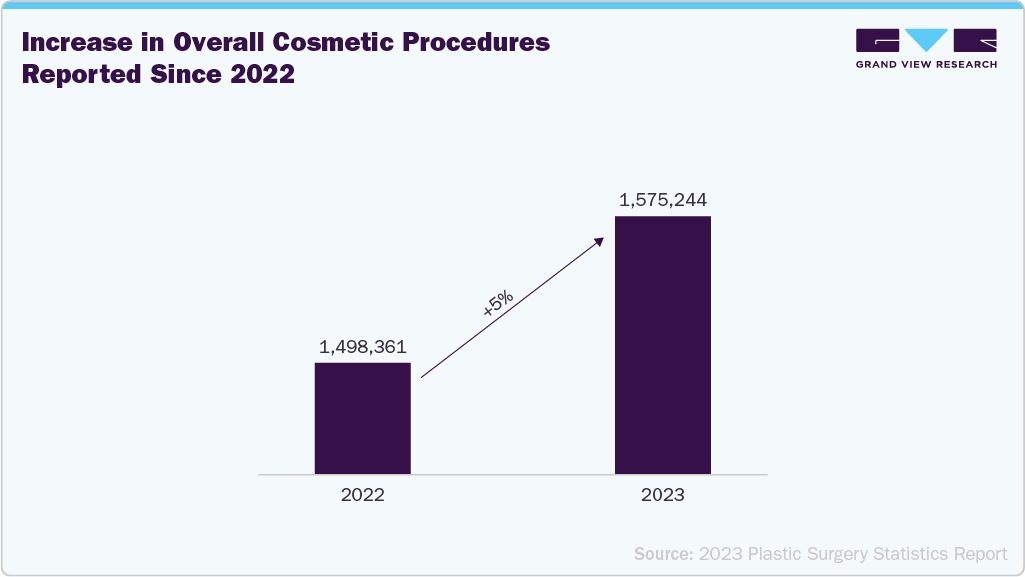

In addition to traditional medical surgeries, the growing demand for cosmetic and plastic surgeries is expected to contribute significantly to the market's expansion.According to the 2023 Plastic Surgery Statistics Report by the American Society of Plastic Surgeons, there was a 5% increase in overall cosmetic procedures from 2022 to 2023, as illustrated in the graph below:

Wound gels play a vital role in post-operative care following cosmetic procedures. These gels are designed to manage incisions and minor surgical wounds by promoting moist wound healing, which helps reduce the risk of scarring, minimizes the chance of infection, and accelerates tissue regeneration. As a result, wound gels are becoming essential in both in-clinic post-surgical protocols and at-home aftercare routines within aesthetic medicine. With the high volume of cosmetic surgeries, the demand for wound gels is expected to rise accordingly.

Key Opinion Leaders

Company Name

KOLs

Growth Opportunities

SolasCure

“This trial is pivotal for fully demonstrating proof-of-concept of efficacy for Aurase Wound Gel with a stronger concentration of the enzyme Tarumase. This will help us establish that the product can achieve complete debridement in 6-9 applications aligned with the standard of care and positively influence the healing rate. This is what the market has been waiting for, bringing Aurase Wound Gel a step closer to providing relief to those suffering from chronic wounds worldwide."

- Clinical endorsement potential

- Facilitate regulatory approval and faster market entry

BioStem Technologies Inc.

ProgenaCare represents a significant opportunity for us in our portfolio expansion initiatives. The products align perfectly with our goal to provide wound-care solutions across the entire continuum of care. The addition of ProgenaCare’s 510(k) cleared products will enhance our position in the hospital-based segments of the market. In contrast, ProgenaCare’s proprietary technology platforms and product pipeline offer significant opportunities[4] for us to help drive future growth. With Revyve, we could address wounds early in the treatment continuum, greatly broadening the patient population BioStem supports and offering multiple opportunities for channel expansion. We believe this acquisition will strengthen our existing commercial activities and position ProgenaCare for accelerated growth and operational efficiency. This partnership will enable both of our organizations to unlock new potential, fostering talent and innovation to deliver meaningful wound care solutions.”

- Hospital market expansion

- Broader patient reach

- Channel diversification

Source: Grand View Research Analysis

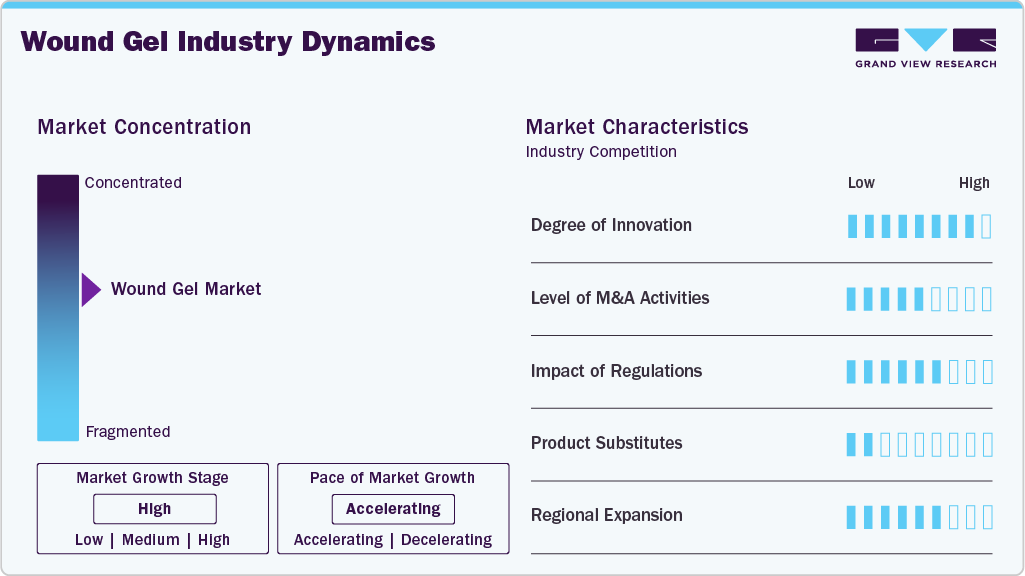

Market Concentration & Characteristics

The market growth stage is high, and the pace of growth is accelerating. The wound gel industry is characterized by high growth due to the rising burden of chronic wounds, the growing launches of novel products, and an increasing number of surgical procedures.

Industry players and researchers are increasingly focusing on developing advanced wound gels. Several clinical trials are ongoing to create such innovative products. For instance, in March 2025, SOLASCURE Ltd enrolled the first patient in the phase II trial to advance Aurase Wound Gel. This gel is a hydrogel-releasing Tarumase that promotes healing through wound bed preparation and debridement.

Regulatory approvals accelerate innovation and market growth in the wound gel industry, enhancing access to advanced therapies. For instance, in December 2023, the FDA approved FILSUVEZ, a topical gel for treating partial thickness wounds in patients 6 months and older with Junctional and Dystrophic Epidermolysis Bullosa. This marked a significant milestone for rare wound care treatment.

Mergers and acquisitions are actively employed in the wound gel industry, enabling companies to expand their portfolios, accelerate innovation, and strengthen market presence. For instance, in November 2024, BioStem Technologies signed a Letter of Intent (LOI) to acquire ProgenaMatrix and revyve Antimicrobial Wound Gel, enhancing its placental-derived biologics offerings by strategically acquiring ProgenaCare Global’s assets.

Wound gel companies are increasingly pursuing regional expansion to broaden market access and meet rising demand for advanced therapies. For instance, in 2024 and 2025, the distribution of Revyve Antimicrobial Wound Gel is expanded across the U.S. and Canada, strengthening BioStem’s North American footprint and enhancing access to early-stage wound treatment options across key healthcare systems.

Product Insights

The dressings segment dominated the wound gel industry in 2024, driven by continuous innovation in advanced materials such as hydrogel, gelling fiber, and specialty formulations like honey and silicone gel dressings. Growing demand for effective wound management solutions and rising product launches further fueled this growth. For instance, in December 2022, NEXGEL introduced a new hydrogel dressing specifically designed to treat turf burns and protect athletic wounds, highlighting the expanding application of dressings across sports medicine and acute care settings.

The gel segment is expected to be the fastest-growing segment in the wound gels market due to its versatility, ease of use, and effectiveness in managing both acute and chronic wounds. Ongoing research and the development of new products are anticipated to support this segment's growth. For example, in February 2024, a CSIR-Central Leather Research Institute (CLRI) research team developed a novel PASCH hydrogel made from silk fibroin and collagen-like proteins, specifically designed to enhance healing in diabetic and burn wounds. This innovation underscores the potential advancements in wound gel technology.

Antimicrobial Properties Insights

The silver (Ag+) segment held the largest market share in 2024 within the antimicrobial properties segment, demonstrating its leading role in advanced wound care. It is also anticipated to grow fastest over the forecast period. Its broad-spectrum antimicrobial properties are particularly effective against infection-causing pathogens, especially in chronic wounds such as diabetic foot ulcers and pressure ulcers. Furthermore, the increasing preference for silver gels in hospitals and home care settings reinforces this segment's strong market presence and ongoing growth.

The non-silver segment is projected to grow significantly from 2025 to 2033, driven by increasing demand for safer, biocompatible alternatives to metal-based formulations. Rising awareness of allergic reactions and cytotoxicity risks associated with silver, coupled with the growing use of natural agents like honey, iodine, and collagen, is fueling adoption. This trend aligns with the broader move toward personalized, gentler wound care solutions across chronic and acute wound management.

Application Insights

The chronic wounds segment dominated the market in 2024, capturing the largest share of 55.29%. This dominance is attributed to the high prevalence and significant healthcare burden associated with chronic wounds. According to the data published by Springer Nature Limited in December 2024, chronic wounds affect around 4% of the world population, with conditions such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers being prevalent. These wounds often require advanced wound care products for effective management and healing. The increasing incidence of chronic diseases, an aging population, and the need for specialized wound care have contributed to the substantial market share of the chronic wound segment in 2024.

The acute wounds segment is projected to be the fastest-growing market from 2025 to 2033, driven by a rising number of surgical procedures, burn injuries, and trauma cases worldwide. According to the data published by the Ministry of Health & Family Welfare in November 2024, burns are a global public health problem, accounting for an estimated 265,000 casualties yearly.

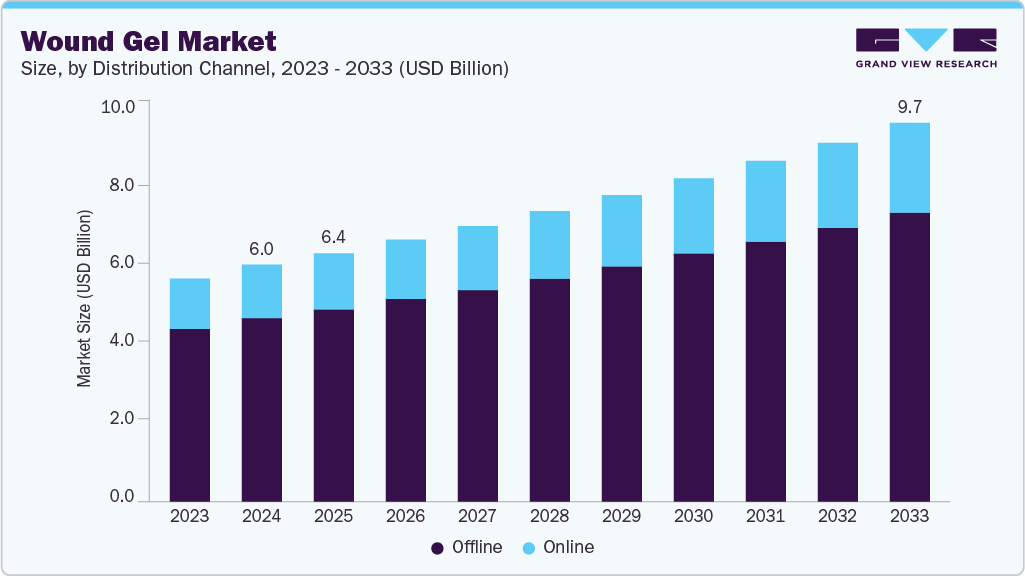

Distribution Channel Insights

The offline segment held the largest market share in 2024. This dominance is primarily attributed to the widespread availability of wound gel products through hospitals, pharmacies, and medical supply stores, where healthcare professionals often guide product selection. The offline channel continues to be preferred, particularly for clinical-grade products, due to the trust in in-person consultations and the immediate accessibility of treatment solutions.

The online segment is expected to experience substantial growth between 2025 and 2033, registering the highest CAGR of 6.1% during this period. This projected surge is driven by increasing consumer preference for the convenience of e-commerce platforms, wider product availability, and the growing adoption of digital health solutions. In addition, the rise of telemedicine and direct-to-consumer sales channels encourages patients and caregivers to purchase wound care products, including gels, through online retailers. Enhanced logistics, secure payment systems, and competitive pricing further support the rapid expansion of the online segment in the market.

End Use Insights

The hospital segment dominated the market in 2024, accounting for the largest share of 41.52%. This dominance is due to the high volume of patients requiring advanced wound care for acute and chronic conditions. Hospitals serve as primary treatment centers for surgical incisions, burns, diabetic foot ulcers, and pressure ulcers, necessitating effective wound gel products. The presence of skilled healthcare professionals, access to advanced technologies, and a growing number of surgical interventions further reinforce hospitals’ leading role in wound management globally.

The home care settings segment is expected to register the highest CAGR in the market from 2025 to 2033. This growth is driven by the rising preference for at-home treatment, especially among elderly and chronically ill patients. The availability of user-friendly wound gel products, advancements in telehealth, and increasing healthcare cost awareness encourage a shift from institutional care to home-based management. This trend also reflects the growing demand for convenience, personalized care, and reduced hospital visits.

Mode of Purchase Insights

The prescription segment held the largest market share in 2024 the wound gel industry. This dominance is mainly due to the reliance on physician-recommended or hospital-administered wound care treatments, particularly for chronic, post-surgical, and severe wounds. Prescription gels often contain advanced formulations with antimicrobial, enzymatic, or healing-promoting properties, making them essential for controlled and effective treatment under medical supervision. The growing incidence of diabetes-related ulcers, pressure sores, and surgical incisions has increased the demand for prescription products.

The non-prescription segment is projected to witness the fastest growth in the market between 2025 and 2033. This anticipated surge is driven by rising consumer awareness of basic wound care, increased preference for self-treatment of minor injuries, and the easy availability of over-the-counter (OTC) wound gel products. As more individuals seek convenient and cost-effective options for managing everyday cuts, burns, and abrasions, demand for non-prescription wound gels is expected to rise significantly.

Regional Insights

In 2024, North America held the largest revenue share in the wound gel market. In addition, the region is also anticipated to grow fastest over the forecast period, driven by the presence of major companies such as 3M, Smith & Nephew, and ConvaTec, alongside ongoing product innovation. In addition, the region’s aging population and increasing number of surgical procedures are key factors fueling demand for advanced gels. For example, a study published by the National Library of Medicine in May 2023 reported that over two million surgeries are performed annually in Canada, highlighting the market’s growth potential.

U.S. Wound Gel Market Trends

The U.S. wound gel market is set for strong growth, driven by key industry players and strategic collaborations. For instance, in February 2025, the Medical University of South Carolina (MUSC’s) Burn Center, the Zucker Institute, and Chitozan Health partnered to develop advanced antimicrobial gels using Glucosil technology-a fusion of silver chitosan and novel compounds-to enhance infection control and wound healing outcomes.

Europe Wound Gel Market Trends

The wound gel market in Europe is poised for notable growth in the coming years, fueled by a growing elderly population, a higher incidence of chronic wounds like diabetic foot ulcers and pressure ulcers, and continuous advancements in wound care technology. In January 2024, the EU population stood at approximately 449.3 million , with over 21.6% aged 65 and older, underscoring rising demand for advanced solutions.

The UK wound gel market is expected to see substantial growth in the coming years, fueled by an aging population, a surge in chronic health conditions, and rising investments in surgical infrastructure. For instance, NHS England reported in October 2024 a USD 17.62 million investment in a surgical hub at Kendal’s Westmorland General Hospital. These developments are set to improve surgical capacity and access, thereby driving demand for advanced solutions nationwide.

Asia Pacific Wound Gel Market Trends

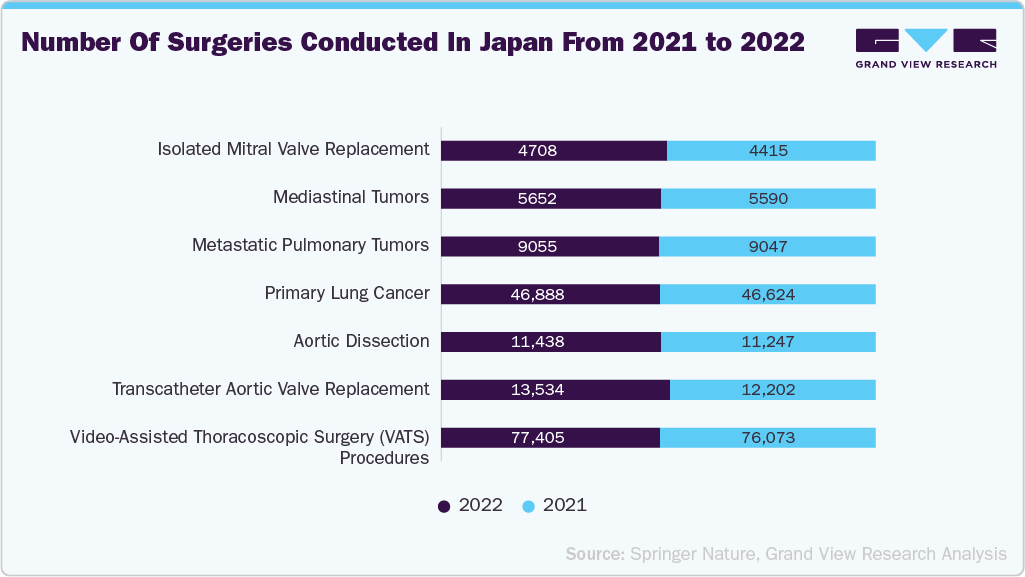

The Asia Pacific market is expected to grow significantly during the forecast period, driven by critical factors. These include a rising incidence of chronic conditions like diabetes, a rapidly aging population, and a growing volume of surgical procedures. Countries like Japan are witnessing a significant increase in surgeries, further boosting the demand for advanced wound gels to support effective post-operative and chronic care management.

The wound gel market in India is anticipated to witness significant growth during the forecast period. Ongoing research for wound gels is expected to grow the country's market. For instance, in January 2025, researchers at NITK Surathkal developed an innovative pH-sensitive hydrogel to treat slow-healing wounds, marking a significant advancement in India's market. This development reflects the growing focus on affordable and effective wound management solutions in the country.

Latin America Wound Gel Market Trends

The wound gel market in Latin America is witnessing steady growth, driven by an increasing prevalence of chronic conditions such as diabetes and vascular diseases, along with a growing elderly population. Improvements in healthcare infrastructure and expanding access to advanced products in countries like Brazil and Mexico also contribute to market expansion.

Middle East and Africa Wound Gel Market Trends

The Middle East and Africa (MEA) market is witnessing significant growth, fueled by a high prevalence of chronic diseases like diabetes, an increasing aging population, and rising road traffic injuries. These factors drive the demand for advanced wound care solutions, including innovative products, to improve healing outcomes and address the growing healthcare challenges in the region.

The Saudi Arabia wound gel market is expected to experience significant market growth, driven by increasing road traffic accidents, rising awareness about advanced wound care, and improvements in healthcare infrastructure. The growing demand for effective and convenient wound management solutions, especially among drivers and accident victims, is fueling this market expansion. Additionally, government initiatives such as Saudi Vision 2030 focused on healthcare development further support the country's rising adoption of wound gels.

Key Wound Gel Company Insights

Medline Industries, LP, Coloplast Ltd, Mölnlycke Health Care AB, Solventum, Convatec Inc., Smith+Nephew, B. Braun SE, DermaRite Industries, LLC.,Integra LifeSciences Corporation, Axio Biosolutions Private Limited, and Sanara MedTech Inc. are some of the major players in the wound gel market. Companies are expanding their portfolios of wound gel and increasing their production capacities to meet the growing demand. Moreover, industry players are also launching antimicrobial and innovative products to gain a competitive advantage.

Key Wound Gel Companies:

The following are the leading companies in the wound gel market. These companies collectively hold the largest market share and dictate industry trends.

- Medline Industries, LP.

- Coloplast Ltd

- Mölnlycke Health Care AB

- Solventum

- Convatec Inc.

- Smith+Nephew

- B. Braun SE

- DermaRite Industries, LLC.

- Integra LifeSciences Corporation

- Axio Biosolutions Private Limited

- Sanara MedTech Inc

Recent Developments

-

In March 2025, SolasCure announced the enrollment of the first patient in its upcoming Phase II clinical trial to advance the development of the Aurase Wound Gel. This marks a significant milestone in the company’s efforts to evaluate the safety and efficacy of the gel in promoting wound healing. The trial is designed to gather critical data supporting further clinical development and potential regulatory approval of this innovative treatment.

-

In March 2025, Mölnlycke Health Care completed the acquisition of the manufacturer of Granudacyn. Granudacyn includes solutions and gels designed explicitly for wound cleansing, irrigation, and moisturizing across various wound types. This strategic acquisition strengthens Mölnlycke’s portfolio, enhancing its capabilities to deliver comprehensive and effective solutions for wound care and infection prevention.

Wound Gel Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.36 billion

Revenue forecast in 2033

USD 9.68 billion

Growth rate

CAGR of 5.37% from 2025 to 2033

Base year for estimation

2024

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD Million/Billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, antimicrobial properties, application, mode of purchase, distribution channel, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medline Industries, LP; Coloplast Ltd; Mölnlycke Health Care AB; Solventum; Convatec Inc.; Smith+Nephew; B. Braun SE; DermaRite Industries, LLC.; Integra LifeSciences Corporation; Axio Biosolutions Private Limited; Sanara MedTech Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wound Gel Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global wound gel market report based on product, antimicrobial properties, application, mode of purchase, distribution channel, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Dressings

-

Hydrogel dressing

-

Gelling fiber dressings

-

Others

-

-

Gels

-

-

Antimicrobial Properties Outlook (Revenue, USD Million, 2021 - 2033)

-

Silver (Ag+)

-

Non-Silver

-

-

Mode of Purchase Outlook (Revenue, USD Million, 2021 - 2033)

-

Prescription

-

Non-prescription

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline

-

Online

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Chronic Wounds

-

Diabetic Foot Ulcers (DFUs)

-

Pressure Ulcers

-

Stage 1

-

Stage 2

-

Stage 3

-

Stage 4

-

-

Leg Ulcers

-

-

Acute Wounds

-

Surgical Incisions

-

Burns

-

1st Degree

-

2nd Degree

-

3rd Degree

-

-

Lacerations, Abrasions

-

-

-

End Use Outlook (Revenue, USD Million, 2021-2033)

-

Hospitals

-

Specialty Clinics

-

Ambulatory Surgery Centers

-

Homecare Settings

-

Long-Term Care Facilities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021-2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global wound gel market size was estimated at USD 6.05 billion in 2024 and is expected to reach USD 6.36 billion in 2025.

b. The global wound gel market is expected to grow at a compound annual growth rate of 5.37% from 2025 to 2033 to reach USD 9.68 billion by 2033.

b. North America dominated the wound gel market with a revenue share of 44.79% in 2024. This dominance is due to the presence of major companies such as 3M, Smith & Nephew, and ConvaTec, alongside ongoing product innovation.

b. Some key players operating in the wound gel market include Medline Industries, LP., Coloplast Ltd, Mölnlycke Health Care AB, Solventum, Convatec Inc., Smith+Nephew, B. Braun SE, DermaRite Industries, LLC., Integra LifeSciences Corporation, Axio Biosolutions Private Limited, Sanara MedTech Inc.

b. Key factors driving the market's growth include the increasing number of surgical cases and the growing burden of wounds.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.