- Home

- »

- Animal Feed and Feed Additives

- »

-

Yeast Ingredients Market Size, Share & Growth Report, 2030GVR Report cover

![Yeast Ingredients Market Size, Share & Trends Report]()

Yeast Ingredients Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Yeast Extracts, Yeast Autolysates, Yeast Beta-Glucan Yeast Derivatives, Others), By Application (Food, Feed, Others), By Region, And Segment Forecasts

- Report ID: 978-1-68038-363-8

- Number of Report Pages: 75

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Yeast Ingredients Market Size & Trends

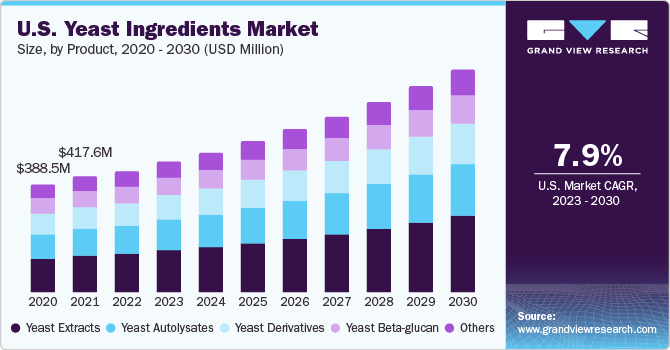

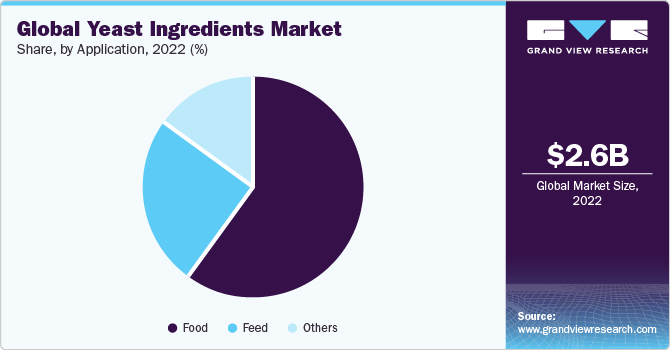

The global yeast ingredients market size was valued at USD 2.56 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 8.4% from 2023 to 2030. The growing importance of these ingredients as savory flavors and their large-scale application in fermentation processing has helped the market gain traction in the last few years. Furthermore, increasing consumption of processed and fast food, especially bakery items, is anticipated to stimulate the growth of the market. In terms of raw materials, the industry value chain consists of distribution channels, raw material suppliers, manufacturers, and applications. Yeast ingredients are used in various industries including food and feed.

Various food manufacturers are developing products that contain extracts rather than artificial flavors such as monosodium glutamate (MSG). This is estimated to boost the demand in the coming years. As these ingredients are natural, they are widely used across the food industry. Moreover, surging demand for food products with high nutritional value is expected to augment its use in various areas of the food and beverages industry.

Rising awareness regarding calorie reduction and healthier diets among consumers in major markets such as India, the U.S., and China is likely to promote the consumption of functional foods over the coming years, thereby escalating the growth of the market. Increasing awareness regarding the importance of appropriate protein intake is poised to provide an upthrust to the market over the forecast period.

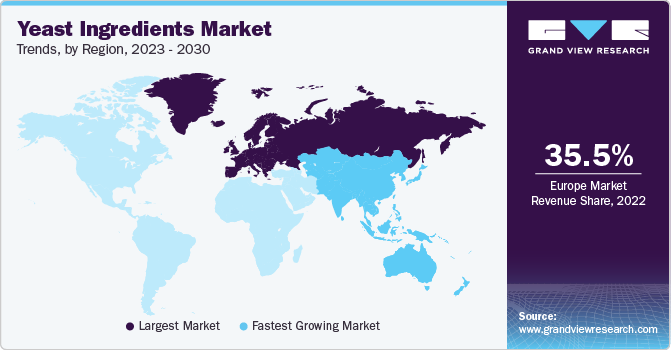

Asia Pacific is projected to be at the forefront of the market throughout the forecast period owing to increasing demand from different application segments in the region. Countries such as India and China are anticipated to be major manufacturing and exporting hubs for yeast, with a growing percentage share of sugarcane production.

Product Insights

The yeast extracts segment accounted for the largest revenue share of 37.7% in 2022 and is expected to expand at a CAGR of 9.2% during the forecast period. Yeast extract refers to beneficial components extracted by autolysis. It contains nucleotides, amino acids, vitamins, minerals, and others. It is used as a crucial ingredient in the food & beverage industry.

Key properties favoring the demand for extracts in the industry include high nutritional value, sodium content reaction, and taste and flavor enhancer. It is widely used in soups, savory mixes, dairy products, processed foods, and others. Companies are focusing on strategic technological developments and initiatives to expand their product portfolio.

Yeast autolysates are used to enhance the color, flavor, and nutritional value of food products. They are used in poultry and pork applications, in addition to their application as seasoning blend ingredients and flavor carriers for processed meat products. Autolysate products are rich in vitamins, proteins, micronutrients, and fiber, and thus, are added to food products. In addition, they are used as a pet food ingredient and as a nutrient for micro-organisms in fermentation processes.

Application Insights

The food segment held the largest revenue share of 60.4% in 2022 and is expected to expand at a CAGR of 8.8% over the forecast period. The demand for the product for food applications is anticipated to experience an upsurge over the coming years as consumers prefer balanced diets.

Rising awareness in major markets regarding calorie reduction, including the U.S., China, and Italy, is expected to promote the application of yeast ingredients in the health and wellness segment. This, in turn, is likely to spur the growth of the market during the forecast period. The burgeoning importance of adequate protein intake in emerging markets of China and India, on account of the growing focus on advertising campaigns by companies for brand promotions is poised to remain a driving force for the market over the forecast period.

Regional Insights

Europe dominated the yeast ingredients market and accounted for the largest revenue share of 35.5% in 2022. It is expected to witness substantial growth over the forecast period owing to developments in the bakery industry and expansion of business in target markets including Germany, the U.K., Italy, and France. Surging demand for bakery food products in European countries is likely to boost product demand in the region over the forecast period.

Asia Pacific is expected to expand at the fastest CAGR of 9.3% during the forecast period. China, India, and Japan are the key revenue contributors in the region, on account of high animal feed production and food consumption. In addition, increasing awareness regarding the consumption of nutritional food is poised to work in favor of the market.

Key Companies & Market Share Insights

The market is highly competitive, with a large number of manufacturers accounting for a majority of market share. Product launches, approvals, strategic acquisitions, and innovations are just a few of the important business strategies used by market participants to extend their global reach.

Key Yeast Ingredients Companies:

- AngelYeast Co., Ltd.

- ABF Ingredients

- AB Vista

- Lallemand Inc.

- Alltech

- BD

- ECPlaza Network Inc.

- Chr. Hansen Holding A/S

- Cangzhou YaTai Commercial & Trade Co., Ltd

- Foodchem International Corporation

- Kerry Group plc

- Lallemand, Inc.

- Leiber

- Lesaffre

- ORGANOTECHNIE

- DSM

- SUBONEYO Chemicals Pharmaceuticals P Limited.

- Synergy Biotechnologies

- Tangshan Top Bio-Technology Co., Ltd.

Recent Developments

-

In February 2023, AngelYeast Co., Ltd. announced its brand development strategy by delivering innovative offerings to the market. This brand development strategy also comprises the development of strategic partnerships and investments to expand its research and development capabilities and global supply chain. These initiatives are expected to improve the market reach of the company.

-

In February 2023, Lallemand Inc. expanded the utilization of Lalmin Vitamin D Yeast within the European Union. Having acquired permission in May 2020 for employing Lalmin Vitamin D Yeast in baked products and food supplements, the company obtained approval to incorporate Lalmin Vitamin D Yeast in 22 new categories. These categories encompass various products, including milk-based products and processed fruits & vegetables, in accordance with EU Regulation (EU) 2022/196.

Yeast Ingredients Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.77 billion

Revenue forecast in 2030

USD 4.90 billion

Growth rate

CAGR of 8.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Volume in Kilotons, Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central And South America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

AngelYeast Co., Ltd.; ABF Ingredients; AB Vista; Lallemand Inc.; Alltech; BD; ECPlaza Network Inc.; Chr. Hansen Holding A/S; Cangzhou YaTai Commercial & Trade Co., Ltd; Foodchem International Corporation; Kerry Group plc; Lallemand, Inc.; Leiber; Lesaffre; ORGANOTECHNIE; DSM; SUBONEYO Chemicals Pharmaceuticals P Limited; Synergy Biotechnologies; Tangshan Top Bio-Technology Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Yeast Ingredients Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global yeast ingredients market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

Yeast Extracts

-

Yeast Autolysates

-

Yeast Beta-glucan

-

Yeast Derivatives

-

Others

-

-

Application Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

Food

-

Feed

-

Others

-

-

Regional Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central And South America

-

Brazil

-

Argentina

-

-

Middle East And Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. Europe dominated the yeast ingredients market with a share of 35.5% in 2022. This is attributable to developments in the bakery industry and the expansion of business in target markets, including Germany, the U.K., Italy, and France.

b. Some key players operating in the yeast ingredients market include AngelYeast Co., Ltd., ABF Ingredients, Alltech, Inc., Chr. Hansen Holding A/S, Kerry Group; Cargill, Incorporated; Lesaffre Group; and Archer Daniels Midland Company.

b. Key factors that are driving the market growth include growing importance of these ingredients as savory flavors and their large-scale application in fermentation processing.

b. The global yeast ingredients market size was estimated at USD 2.56 billion in 2022 and is expected to reach USD 2.77 billion in 2023.

b. The global yeast ingredients market is expected to grow at a compound annual growth rate of 8.4% from 2023 to 2030 to reach USD 4.90 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.