- Home

- »

- Plastics, Polymers & Resins

- »

-

Zero Waste Packaging Market Size, Industry Report, 2033GVR Report cover

![Zero Waste Packaging Market Size, Share & Trends Report]()

Zero Waste Packaging Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Biopolymer, Paper And Cardboard), By Type (Reusable/Recyclable Packaging, Compostable Packaging), By Distribution Channel, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-015-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Zero Waste Packaging Market Summary

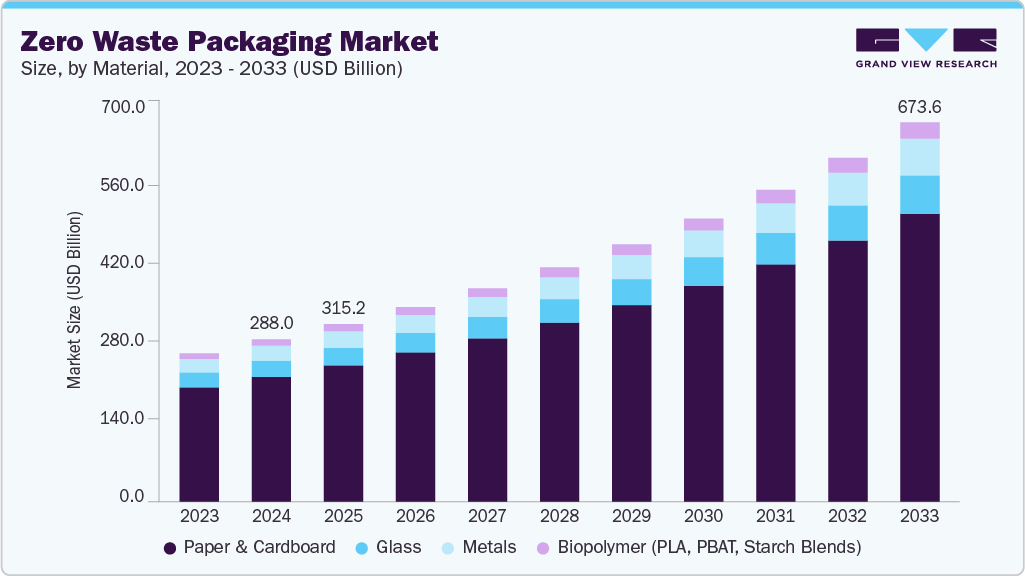

The global zero waste packaging market size was estimated at USD 288.03 billion in 2024, and is projected to reach USD 673.57 billion by 2033, growing at a CAGR of 10.0% from 2025 to 2033. The market growth can be attributed to the continuously rising focus on sustainable packaging solutions and awareness about the circular economy, which can increase the efficiency of the manufacturers as well as support environment-friendly developments by decreasing carbon footprints across the globe.

Key Market Trends & Insights

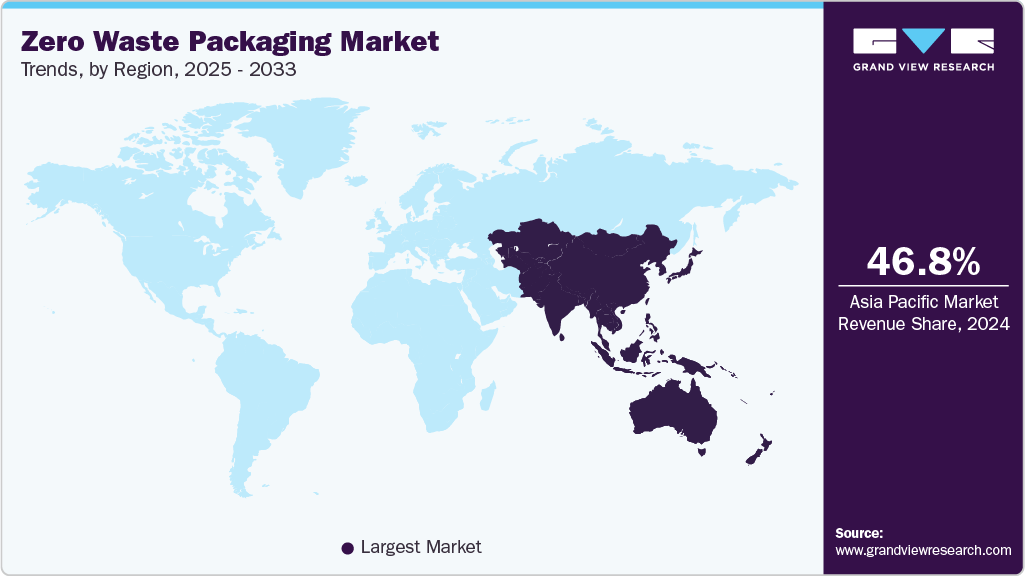

- In terms of region, Asia Pacific dominated the market with the largest revenue share of 46.85% in 2024.

- Country-wise, India is expected to grow at a substantial CAGR of 10.9% from 2025 to 2033.

- By material, the biopolymer (PLA, PBAT, starch blends) segment is expected to grow at a considerable CAGR of 11.1% from 2025 to 2033 in terms of revenue.

- By type, the edible packaging segment is expected to grow at a considerable CAGR of 19.2% from 2025 to 2033 in terms of revenue.

- By distribution channel, the online segment is expected to grow at a considerable CAGR of 10.2% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 288.03 Billion

- 2033 Projected Market Size: USD 673.57 Billion

- CAGR (2025-2033): 10.0%

- Asia Pacific: Largest market in 2024

The rising environmental concerns owing to the increasing amount of packaging waste across the globe, especially across developing economies, are driving the demand for zero waste packaging. Zero waste packaging refers to packaging solutions, where the discarded packaging product either can be utilized for further processes, such as recycling/reuse, or is decomposed in the natural environment by microorganisms. In other words, packaging waste should not end up in a landfill or pollute the environment in any way. Such packaging solutions are considered under zero waste packaging.The U.S. economy is highly developed and is continuously involved in developing proper infrastructure for the recycling and collection of discarded packaging materials. Thus, the country is supporting the growth of the market. Moreover, the presence of global entities, such as the World Wide Fund For Nature (WWF) and Zero Waste International Alliance (ZWIA), for spreading awareness about environment-friendly packaging solutions and controlling the production activities of packaging manufacturers, is supporting the growth.

The rising awareness among consumers about the proper segregation and disposal of packaging waste is contributing to the growth. In addition, the increasing efforts of governments and respective municipalities for the proper segregation of waste and effective waste management of packaging products are expected to support the growth. There is an increasing awareness about environment-friendly packaging among end users through the means of electronic media or social media, where concerned authorities are spreading awareness regarding the pros and cons of packaging waste.

Market Concentration & Characteristics

The market growth stage is high, with an accelerating pace. The market exhibits slight fragmentation, with key players dominating the industry landscape. Major companies like Ecovative LLC, DS Smith plc, Avani Eco, Biome Bioplastics Limited, BIOPLA, Loliware Inc., Evoware, Sulapac Oy, TIPA, World Centric, Notpla Limited, Regeno, Hero Packaging, and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and end uses to meet evolving industry demands.

Despite growing consumer and corporate emphasis on sustainability, conventional plastics remain a formidable substitute for zero‑waste packaging thanks to their 30-50% lower production costs, a compelling advantage for budget‑constrained SMEs and high‑volume users seeking to control operating expenses. Meanwhile, a wave of biocomposite innovations-from barley‑based polymers that fully decompose within two months to seaweed‑ and mushroom‑derived foams-is reshaping the substitution landscape by offering 100% biodegradable performance with minimal supply‑chain disruption.

Legislative frameworks worldwide are accelerating the shift toward zero‑waste solutions by imposing stringent end‑of‑life responsibilities on producers and retailers. The EU’s Packaging and Packaging Waste Directive, Canada’s outright ban on certain single‑use plastics, and India’s Extended Producer Responsibility (EPR) mandates collectively force companies to invest in compostable, reusable, and fully recyclable packaging systems to remain compliant.

Material Insights

The paper and cardboard segment held the largest revenue share of 76.90% in 2024, and it is projected to maintain its dominance throughout the forecast period. The developed infrastructure for the recycling of cardboard packaging for further use of recycled material in the packaging industry for application products is supporting segment growth. According to the U.S. Environmental Protection Agency, paper and paperboard containers and packaging have around 80% of recycling.

The biopolymer segment, including polylactic acid (PLA), polybutylene adipate terephthalate (PBAT), and starch blends combined, is projected to exhibit the fastest CAGR of 11.1% over the forecast period. The material is gaining growth in the packaging segment because it can provide potential substitutes for plastic that are environmentally friendly and are increasingly preferred in the end use market.

Furthermore, the rising concerns associated with plastic packaging waste, including soil pollution and water pollution, especially in rivers and oceans, are generating demand for alternative products and solutions to this existing problem. Ocean life, including plants, animals, and dependent organisms in salt water, is majorly suffering from the disposal of plastic packaging, and some of these may become extinct on the planet in the near future. According to National Geographic, over one million marine animals die because of the tons of plastic disposed of into the oceans every year.

According to the ocean literacy portal of UNESCO, currently, there are about 50-75 trillion pieces of plastic and microplastics in the ocean. Approximately 80 percent of marine pollution is caused by plastic waste, and around 8 to 10 million metric tons of plastic end up in the ocean each year. According to the Center for Biological Diversity, fish in the North Pacific ingest 12,000 to 24,000 tons of plastic each year. This causes intestinal injury and death and transfers plastic up the food chain to bigger fish, marine mammals, and human seafood eaters. As a result, the demand for zero waste packaging is projected to witness growth over the forecast period.

Type Insights

Reusable/recyclable packaging captured the largest revenue share of 94.96% in 2024. The segment is also projected to maintain its dominance throughout the forecast period. Reusable/recyclable packaging is typically composed of materials including paper and cardboard, glass, and metal, which are generally preferred. The developing infrastructure for proper waste management and the use of packaging material in the circular economy concept is projected to support the growth of the segment over the forecast period.

The increasing demand for compostable packaging, which is manufactured from biopolymers, is anticipated to support the growth of the segment over the forecast period. The increasing penetration of home compostable bins, which can convert biodegradable waste into nutrient-rich soil in a certain period to be used for gardening purposes, is a key growth factor. Thus, compostable packaging can be managed at home through these systematic arrangements and can have a lesser impact on the environment and dependent bodies. For instance, Ecovative LLC provides mushroom packaging made with hemp hurd and mycelium. It is an eco-friendly alternative to Styrofoam and can easily be converted into compost by breaking it into smaller pieces and distributing them into compost bins or straight into gardening soil.

Distribution Channel Insights

The offline segment accounted for the largest revenue share of 53.60% in 2024 and is projected to maintain its dominance throughout the forecast period. The high penetration of the offline system in the end use market is the major factor supporting its dominance in the global market.

The online segment is projected to exhibit the fastest CAGR of 10.2% over the forecast period. This can be credited to the increasing penetration of online sales in the global market, especially after the coronavirus pandemic, which has boosted awareness regarding online sales platforms. The pandemic has created the need for online transaction platforms to avoid physical gatherings, which is also a major factor supporting the growth.

Moreover, the increasing internet penetration in developing economies at affordable prices is supporting the growth of the segment. The increasing penetration of social media vendors in the global market, along with their wider portfolio to select from, is another factor supporting industry growth.

Application Insights

The food and beverages segment held the largest revenue share of 34.22% in 2024, as the wholesale food market has a significant penetration of corrugated packaging, which is contributing to growth. In addition, the beverages market is making significant use of glass and metal packaging, which are in a closed system of reuse or recycling; therefore, the segment is leading the market.

The e-commerce segment is projected to exhibit the fastest CAGR of 10.6% over the forecast period. The convenience of shopping at home and various coupons and offers provided by e-shopping platforms to their customers are major factors boosting the segment growth. In addition, the affordability and easy penetration of internet connectivity and mobile phones, especially in developing economies, are further supporting segment growth over the forecast period.

Regional Insights

North America’s zero waste packaging industry is propelled by the rapid rollout of Extended Producer Responsibility (EPR) schemes and deposit-return systems (DRS) across the U.S. and Canada, which shift end‑of‑life costs back onto brand owners and drive investment in reusable and compostable formats. Simultaneously, major retailers and CPG companies have pledged to adopt 100% recyclable or refillable packaging, spurring material‑recovery‑facility upgrades and AI‑enabled sortation technologies that strengthen the circular supply chain while meeting sustainability commitments.

U.S. Zero Waste Packaging Market Trends

The zero‑waste packaging industry in the U.S. is anticipated to grow at a significant rate over the coming years. In the U.S., aggressive state‑level mandates-most notably California’s SB 54, which requires a 25% reduction in single‑use plastics by 2032-are forcing consumer‑goods manufacturers to reformulate packaging with high‑compostability biopolymers and recyclable paper‑based substrates. This regulatory pressure is amplified by the EPA’s Sustainable Materials Management initiatives and rising shareholder advocacy, which together incentivize national brands to integrate closed‑loop design principles and transparent lifecycle labeling into their packaging portfolios.

Europe Zero Waste Packaging Market Trends

Europe zero‑waste packaging industry accounted for the second-largest share in 2024, and the region is projected to maintain its position throughout the forecast timeframe. The high awareness about environmental protection and respective measures for combating the environment’s degrading condition is further supporting regional growth. In addition, the presence of organizations such as the European Union, TUV AUSTRIA, and Swiss Federal Laboratories for Materials Science (Empa) is supporting the demand for zero-waste packaging in the regional market. The presence of manufacturers such as DS Smith plc, Biome Bioplastics Limited, BIOPLA, and Sulapac Oy is contributing to the growth of the market.

Asia Pacific Zero Waste Packaging Market Trends

Asia Pacific zero‑waste packaging industry held the maximum revenue share of 46.85% in 2024, and the region is projected to maintain its dominance throughout the forecast timeframe. China is majorly contributing to the high growth of the regional market. The presence of numerous small and medium players in the country, which are involved in the manufacturing of paper and cardboard packaging and the recycling of discarded packaging materials, is supporting the industry's growth.

China’s zero-waste packaging industry is being shaped by the fallout from Operation National Sword-Beijing’s crackdown on contaminated waste imports, which has compelled local processors to scale high‑purity recyclate production and catalyzed domestic R&D in biopolymer alternatives. Concurrently, government subsidies and pilot programs for plant‑based films and paper‑fiber composites are boosting commercial-scale deployment, aligning with China’s broader circular‑economy targets and driving revenue growth projections above a 9.8% CAGR through 2030

Key Zero Waste Packaging Company Insights

The market for zero waste packaging is highly competitive, with several key players dominating the landscape. Major companies include Ecovative LLC, DS Smith plc, Avani Eco, Biome Bioplastics Limited, BIOPLA, Loliware Inc., Evoware, Sulapac Oy, TIPA, World Centric, Notpla Limited, Regeno, and Hero Packaging. The market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key Zero Waste Packaging Companies:

The following are the leading companies in the zero waste packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Ecovative LLC

- DS Smith plc

- Avani Eco

- Biome Bioplastics Limited

- BIOPLA

- Loliware Inc.

- Evoware

- Sulapac Oy

- TIPA

- World Centric

- Notpla Limited

- Regeno

- Hero Packaging

Recent Developments

-

In October 2024, UPM Specialty Papers and Eastman jointly launched a new paper-based food packaging solution that featured a compostable, biobased coating designed to provide grease and oxygen barriers for food products. The solution combined Eastman’s Solus performance additives with BioPBS polymer, applied as a thin layer on UPM’s recyclable barrier base papers, enabling the packaging to be recycled within existing fiber recycling streams

-

In September 2024, Danimer Scientific and Ningbo Homelink Eco-iTech announced the commercial launch of a home-compostable extrusion coating biopolymer based on Danimer's Nodax polyhydroxyalkanoate (PHA). Homelink's disposable cups coated with this PHA biopolymer provide a fully repulpable, home and industrially compostable alternative to traditional paper cups, replacing polyethylene as a liquid barrier coating.

Zero Waste Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 315.19 billion

Revenue forecast in 2033

USD 673.57 billion

Growth rate

CAGR of 10.0% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, type, distribution channel, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Ecovative LLC; DS Smith plc; Avani Eco; Biome Bioplastics Limited; BIOPLA; Loliware Inc.; Evoware; Sulapac Oy; TIPA; World Centric; Notpla Limited; Regeno; Hero Packaging

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Zero Waste Packaging Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global zero waste packaging market report based on material, type, distribution channel, applications, and region:

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Biopolymer

-

Paper and Cardboard

-

Glass Packaging

-

Metal Packaging

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Reusable/Recyclable Packaging

-

Compostable Packaging

-

Edible Packaging

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Online

-

Offline

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Food & Beverages

-

Healthcare

-

Cosmetics & Personal Care

-

Electrical & Electronics

-

eCommerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global zero waste packaging market size was estimated at USD 288.03 billion in 2024 and is expected to reach USD 315.19 billion in 2025.

b. The global zero waste packaging market is expected to grow at a compound annual growth rate of 10.0% from 2025 to 2033 to reach USD 673.57 billion by 2033.

b. The paper and cardboard segment held the largest revenue share of 76.90% in 2024 and it is projected to maintain its dominance throughout the forecast period. The developed infrastructure for the recycling of cardboard packaging for further use of recycled material in the packaging industry for application products is supporting segment growth.

b. Some key players operating in the zero waste packaging market include include Ecovative LLC, DS Smith plc, Avani Eco, Biome Bioplastics Limited, BIOPLA, Loliware Inc., Evoware, Sulapac Oy, TIPA, World Centric, Notpla Limited, Regeno, and Hero Packaging.

b. The market growth can be attributed to the continuously rising focus on sustainable packaging solutions and awareness about the circular economy, which can increase the efficiency of the manufacturers as well as support environment-friendly developments by decreasing carbon footprints across the globe

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.