- Home

- »

- Market Trend Reports

- »

-

Cardiovascular Clinical Trials: Current Dynamics And Pipeline Outlook

Report Overview

The cardiovascular clinical trials market is witnessing rapid growth, driven by the increasing prevalence of cardiovascular diseases, aging populations, poor dietary habits, rising rates of diabetes, obesity, hypertension, and sedentary lifestyles. Cardiovascular diseases include a range of disorders affecting the heart and blood vessels, including coronary heart disease, cerebrovascular disease, and rheumatic heart disease, among others. According to the Global Heart & Circulatory Diseases Factsheet published in January 2025, approximately 640 million people worldwide are affected by heart and circulatory diseases. Moreover, about 1 in 12 individuals experience such conditions globally. In addition, four out of five CVD deaths are due to heart attacks and strokes, and one third of these deaths occur prematurely in people under 70 years of age

This increasing burden of these diseases has led a shift in cardiovascular clinical trials toward earlier intervention strategies focusing on disease prevention and risk assessment. Besides, growing interest in innovative therapies such as RNA-based treatments, gene editing, and anti-inflammatory targets for atherosclerosis, along with advancements in early diagnosis and preventive care drive the market growth. In addition, current trials are making a concerted effort to include underrepresented populations to improve the outcomes. Thus, pharmaceutical and medical technology companies are increasingly emphasizing on cardiovascular drug and medical devices pipelines, while healthcare systems are concentrating on integrated, patient-centric models to effectively manage chronic conditions and mitigate long-term cardiovascular risks.

Cardiovascular Clinical Trials: Dynamics & Pipeline Outlook Report Coverage

Market Outlook

Prevalence Trends Analysis

R&D Investment Analysis

Industry Ecosystem Analysis

Market Dynamics

Regulatory Framework

List of Top 50 Active Trials by Phase, Sponsor, and Indication

Emerging Clinical Trial Design Analysis

Global Cardiovascular Clinical Trials, by Phase & Study Design

Global Cardiovascular Clinical Trials, by key Indications, By Region

Some other emerging trends such as advancements in technology, changing regulatory frameworks, and an increasing global disease burden contribute to growing focus on innovating drugs and devices propelling cardiovascular clinical trials.

In addition, pharmaceutical and medical device companies are focusing developing personalized medicine and advanced devices to address cardiovascular patient-specific needs. Innovations in genetics, biomarkers, and AI-driven cardiovascular diagnostics are enabling targeted therapies, while digital health innovations such as smart implants and wearables support real-time monitoring. This shift enhances treatment efficacy, safety, and patient engagement, trial efficiency and outcomes of trials addressing complex cardiovascular issues. For instance, in January 2025, Ncardia introduced the Ncyte Heart in a Box, a three-dimensional cardiac microtissue model aimed at advancing cardiovascular research and drug development. This model will provide a platform for studying heart development, the progression of diseases, and cellular interactions within the cardiac environment.

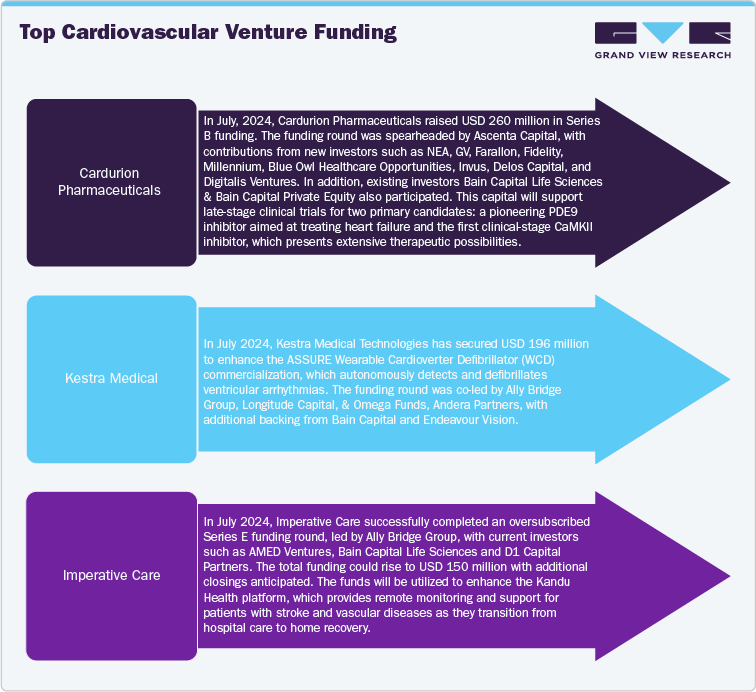

Furthermore, notable shift towards early-phase trials, particularly in areas such as heart failure, hypertrophic cardiomyopathy, and cardiometabolic conditions supports the market growth. Moreover, collaborations between biotech companies and pharmaceutical companies are driving the expansion of development pipelines, boosted by increased venture capital investments and strategic mergers and acquisitions. For instance, in January 2024, CardioSignal raised USD 10 million in a Series A funding round, increasing its total funding to USD 23 million. The round was led by DigiTx Partners, with participation from Sandwater and existing investor Maki.vc. This new funding will support the launch of their heart failure detection capability and the completion of clinical validation for aortic stenosis detection.

Besides, the flexibility offered by regulatory agencies for breakthrough designations and adaptive trial designs is streamlining the approval process. In addition, decentralized trials and AI-enhanced recruitment strategies are enhancing participant enrollment and data quality. This evolving landscape is expected to drive new innovations with increased investment, and a focus on precision outcomes.

R&D Investment and Funding Analysis

Investment in research and development for cardiovascular clinical trials across the globe is on the rise driven by significant clinical needs, an aging population, and technological advancements. Besides, established pharmaceutical and medical device companies are increasingly prioritizing resources to early-stage initiatives focusing on innovative mechanisms, gene therapies, and combinations of devices and drugs. In addition, academic institutions and startups are benefiting from public funding and strategic partnerships with industry sponsors. Non-profit organizations, such as the American Heart Association, play a crucial role in supporting investigator-led research.

Moreover, currently increasing availability of digital biomarkers and AI analytics is gaining attention in venture capital, further enhancing funding opportunities and expanding progress in cardiovascular research. Also, pharmaceutical players collaboration is focusing at next-generation therapies, including Lp(a) disruptors, cardiac myosin inhibitors, and RNA-based therapies. Mergers and acquisitions focused on advanced heart failure devices and structural heart technologies indicate a transition toward comprehensive cardiovascular care solutions among medical device companies. Similarly, venture capital has supported both clinical-stage and digital health enterprises, highlighting innovations in heart failure management and wearable defibrillators. These trends demonstrate a growing commitment to precision, accessibility, and scalability in cardiovascular therapeutics and diagnostics across the spectrum of research and commercialization.

Cardiovascular Drug Pipeline Updates

The cardiovascular drug pipeline is evolving rapidly, driven by breakthroughs in precision medicine, RNA therapeutics, and novel biologics. Current research focuses on increasing interest in therapies, increasing focus on conducting early-phase trials exploring innovative mechanisms, while late-stage candidates aiming to improve survival and quality of life in chronic cardiovascular conditions. Below are some of the examples for the current drug pipeline in cardiovascular disease.

Company Name

Drug

Class

Indication

Status

NewAmsterdam Pharma

Obicetrapib

Low dose cholesterol ester transfer protein

Treatment of adults with atherosclerotic cardiovascular disease and/or heterozygous familial hypercholesterolemia.

Phase 3 trial results

Corstasis Therapeutics

Bumetanide nasal spray

Loop diuretic

Treatment of edema is associated with congestive heart failure, as well as hepatic and renal disease.

NDA accepted for review

Merck

Sotatercept

Recombinant activin receptor type IIA-Fc fusion protein

Treatment of patients with pulmonary arterial hypertension (World Health Organization Group 1) functional class 2 or 3 at intermediate or high risk of disease progression.

Trial halted

Source: Press Release, Grand View Research

The ecosystem of cardiovascular clinical trials involves a diverse stakeholder, including pharmaceutical and biotechnology companies, contract research organizations (CROs), regulatory agencies, academic institutions, healthcare providers, technology providers, investors, and patient groups. Pharmaceutical and biotech companies further lead the charge in sponsoring clinical trials, dedicating substantial resources to the development of new therapies for cardiovascular diseases.

In addition, CROs serve as intermediaries between sponsors and clinical trial sites, ensuring efficient trial operations, adhering to regulatory standards, and managing data effectively. Collaboration between research institutions and industry partners is common, particularly in exploring innovative treatment techniques such as gene editing and stem cell therapies. Regulatory entities like the U.S. FDA establish the guidelines that govern clinical trials, impacting the design of studies, participant recruitment strategies, and the approval processes. Besides, technology vendors contribute by offering solutions for clinical trial management, data analytics, and advanced diagnostic technologies. The collaboration among these various entities is driving innovation, resulting in a highly collaborative and competitive landscape for cardiovascular clinical trials.

Emerging clinical trial models are transforming the way cardiovascular trials are designed and conducted. Cardiovascular clinical trials are experiencing a major evolution with the introduction of innovative models that emphasize flexibility, efficiency, and a focus on patient needs. Decentralized trials utilize telehealth, wearable technology, and remote monitoring to enhance access and increase participant engagement. Adaptive trial designs and platform trials allow for real-time adjustments to protocols and the simultaneous assessment of various therapies, thereby accelerating development processes. The incorporation of real-world evidence contributes to more comprehensive decision-making that goes beyond standard endpoints, while precision medicine trials concentrate on interventions driven by biomarkers. Hybrid trials merge in-person and virtual methods, providing added convenience while maintaining data integrity. Moreover, approaches such as synthetic control arms and N-of-1 trials present customized and resource-efficient solutions, which are particularly beneficial for niche or rare cardiovascular conditions.

U.S. Cardiovascular Clinical Trials, by Phase (2025)

Phase

Enrollment

Key Sponsors

Top Indications

Phase I

30

NYU Langone Health

Cardiac Arrest

Phase II

130

Merck Sharp & Dohme LLC

Hypertension, Pulmonary

Phase III

11,300

AstraZeneca

Heart Failure

Phase IV

200

Angiodynamics, Inc.

Peripheral Arterial Diseases

Source: Clinicaltrials.gov, Grand View Research

This report presents a comprehensive examination of active clinical trials across various phases, giving stakeholders a worldwide perspective on current research efforts. It highlights trends, major contributors, and the most promising investment opportunities. Through insights on the number of trials, sponsors, and indications at each stage, this table is an essential tool for tracking the advancement of the cardiovascular pipeline, enabling informed decisions regarding future investments and trial strategies.

List Of Major Active Trials By Phase, Sponsor, And Indication, A Key Example:

Clinical Trial Study Title

Packed Red Blood Cell Transfusion During Cardiac Arrest

Study Status

Recruiting

Phase

Early Phase I

Study Type

Interventional

Interventions

- Drug: Packed Red Blood Cells (1 unit)

- Drug: Packed Red Blood Cells (2 units)

- Other: Saline

Sponsor

NYU Langone Health

Number of Patients (Enrollment)

30

Start Date

25/3/2025

Primary Completion Date

1/4/2026

Completion Date

1/4/2026

Locations

NYU Langone Health, New York, New York, 10016, United States

Other aspects that shall be analyzed will include the market overview, clinical trials by study design, by key indications, by region, and list of key clinical trials, sponsors, among several other factors.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified