- Home

- »

- Market Trend Reports

- »

-

Oncology Clinical Trials: Current Dynamics And Pipeline Outlook

Report Overview

The rising global prevalence of cancer is significantly shaping the oncology clinical trials landscape. According to the data published by WHO in February 2024, there were approximately 20 million new cancer cases reported globally in 2022. This upward trend is attributed to factors such as population aging, lifestyle changes, and increased exposure to risk factors like tobacco use, alcohol consumption, obesity, and environmental pollutants. Projections indicate a staggering 77% increase in new cancer cases by 2050, reaching over 35 million annually. This upsurge highlights a growing demand for innovative therapeutic options, stimulating a significant expansion in oncology-focused clinical trials. Furthermore, oncology accounts for over 30% of the global clinical trial pipeline, indicating heightened investment by biopharmaceutical companies aiming to address unmet medical needs and improve patient outcomes. Advancements in targeted therapies, immuno-oncology agents, and precision medicine approaches, including biomarker-driven and adaptive trial designs, are reshaping the treatment landscape. Regulatory agencies are also facilitating faster approvals through expedited pathways, encouraging collaborations among sponsors, contract research organizations, and academic institutions.

Oncology Clinical Trials: Current Dynamics And Pipeline Outlook Report Coverage

Oncology Clinical Trials: Current Dynamics and Pipeline Outlook Report Coverage

Market Outlook

Prevalence Trends Analysis

R&D Investment Analysis

Industry Ecosystem Analysis

Market Dynamics

Regulatory Framework

List of Top 100 Active Trials by Phase, Sponsor, and Indication

Emerging Clinical Trial Model Analysis

Global Oncology Clinical Trials, by Phase & Study Design

Global Oncology Clinical Trials, by key Indications, By Region

Furthermore,growing adoption of precision oncology, which emphasizes therapies specific to the genetic profile of individual tumours is also driving the oncology specific clinical trials. This shift has prompted a move toward more flexible and targeted trial models that allow for the immediate evaluation of treatments across multiple cancer types sharing a common mutation, or multiple therapies within one cancer type based on specific molecular markers. These adaptive designs significantly enhance operational efficiency, reduce time-to-market, and improve the relevance of outcomes. Moreover, the integration of real-world data (RWD) and real-world evidence (RWE) is enabling trial sponsors to generate deeper insights into patient subgroups, improve treatment predictions, and supplement traditional clinical endpoints. The deployment of digital health technologies such as electronic patient-reported outcomes (ePROs), wearable biosensors, and remote monitoring platforms is further assisting the rise of decentralized and hybrid trial models. These innovations are improving patient accessibility, especially in underserved regions, while also enabling more continuous and significant data collection throughout the course of treatment.

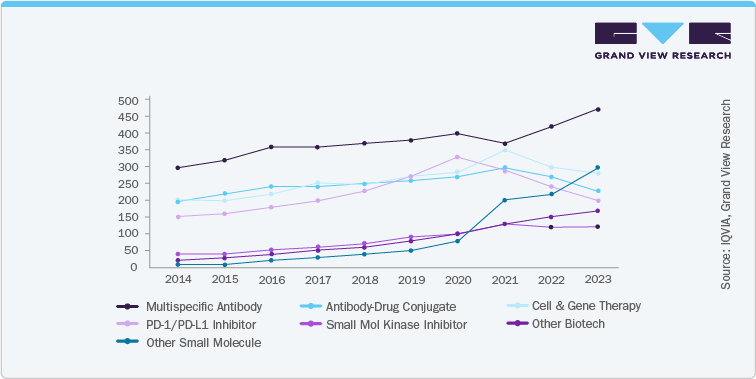

In addition, growing emphasis on novel immunotherapies and cell and gene therapies (CGTs) is a key driver of market expansion. Clinical trials exploring immune checkpoint inhibitors such as PD-1/PD-L1 and CTLA-4 blockers have rapidly extended beyond traditional indications like melanoma and non-small cell lung cancer to include bladder, head and neck, and gastric cancers. From 2014 to 2023, the number of clinical trial initiations for solid tumours surged rapidly, driven by a shift toward innovative treatments including Mult specific antibodies, antibody-drug conjugates, and CGTs. Among these, Mult specific antibodies saw the most significant growth, emerging as the leading therapeutic class by 2023, while traditional approaches like small molecules and PD-1/PD-L1 inhibitors held steady or declined slightly in market share. Similarly, clinical trials in hematologic cancers remained lower in volume and more stable over time, with only moderate growth across therapy classes and a slower adoption of next-generation therapies. This divergence highlights a robust wave of innovation in solid tumour research, contrasting with the more gradual evolution within hematologic oncology trials. The below figure signifies the growth of clinical trials in the solid tumour cancers.

R&D Investment And Funding Analysis

The oncology R&D landscape is experiencing unprecedented growth, with global spending on cancer medicines reaching USD 223 billion in 2023, marking a USD 25 billion increase from 2022. This upward trajectory is projected to continue, with expenditures expected to hit USD 409 billion by 2028. This surge is fueled by the initiation of over 2,000 new oncology clinical trials in 2023, focusing on innovative modalities such as cell and gene therapies, antibody-drug conjugates, antibodies, and radioligand therapies.

Furthermore, venture capital investment in biotech has also seen a significant uptick, with USD 26 billion raised in 2024, surpassing the USD 23.3 billion from the previous year, despite a decrease in the number of funding rounds. For instance, Avammune Therapeutics, a Bengaluru-based startup, secured USD 12 million in Series A funding to advance its cancer therapies. In addition, AstraZeneca acquired Belgian biotech EsoBiotec for approximately USD 1 billion, aiming to enhance its cell therapy capabilities. These investments highlight the robust confidence in the oncology sector and its potential for transformative breakthroughs.

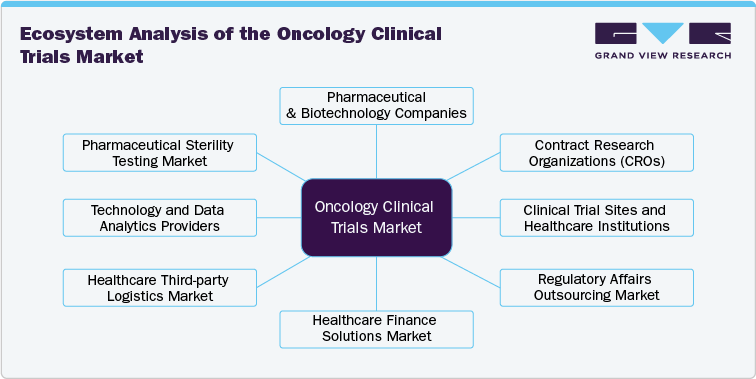

The oncology clinical trials ecosystem comprises numerous stakeholders, including pharmaceutical & biotechnological companies, CROs, regulatory bodies, research institutions, healthcare providers, technology vendors, investors & funding institutions, and patients & advocacy groups. Pharmaceutical organizations and biotech firms are at the forefront of clinical trial sponsorship, investing heavily in research to develop innovative therapies for age-related eye diseases, retinal disorders, and gene therapies.

CROs, acting as intermediaries between sponsors and clinical trial sites, play a critical role in ensuring trial efficiency, regulatory compliance, and data management. Research institutions and universities often collaborate with industry players to advance novel treatment approaches, particularly in niche areas like gene editing and stem cell therapy.

Regulatory bodies like the U.S. FDA and EMA establish the framework within which clinical trials operate, influencing study design, recruitment strategies, and approval processes. The ecosystem also includes technology vendors providing clinical trial management solutions, data analytics tools, and advanced diagnostic technologies like OCT and AI-driven imaging. The convergence of these entities is fostering innovation, making the oncology clinical trials market highly collaborative and competitive.

Emerging Clinical Trial Design Analysis

Emerging clinical trial models are transforming the way oncology trials are designed and conducted. With the advent of decentralized trials, remote patient monitoring, and telemedicine, clinical trials are becoming more patient-centric, reducing geographic and logistical barriers. Virtual visits, wearables, and mobile health apps enable real-time data collection, making it easier for patients to participate from their homes, especially in rare or geographically dispersed conditions. Adaptive trial designs are also gaining traction, allowing modifications to the trial protocol based on interim results, thereby improving efficiency and reducing costs. Moreover, artificial intelligence (AI) and machine learning (ML) enhance recruitment, predictive modeling, and the identification of patient population that are most likely to benefit from specific therapies. These advancements are making clinical trials more efficient and allowing the collection of more granular data, thus providing deeper insights into treatment efficacy and safety. This report explores these emerging trial models, offering key insights into how these innovative approaches are reshaping oncology research.

U.S. Oncology Active Clinical Trials, by Phase (2024)

Phase

Number of Trials

Key Sponsors

Top Indications

Phase I

2,316

Pfizer, AbbVie

Non-Small Cell Lung Cancer, Hematologic Cancer

Phase II

3,465

Bristol-Myers Squibb, AstraZeneca

Breast Neoplasms, Chronic Lymphocytic Leukemia

Phase III

1,014

AstraZeneca, Eli Lilly and Company, Celgene

Follicular Lymphoma, Hepatocellular Carcinoma, Carcinoma, Non-Small-Cell Lung

Phase IV

112

Eli Lilly and Company, AstraZeneca, Takeda

Chronic Lymphocytic Leukemia, Chronic Lymphocytic Leukemia

Source: Clinicaltrials.gov, Grand View Research

This report’s detailed analysis of active clinical trials across phases provides stakeholders with a global view of ongoing research, helping identify trends, key players, and the most promising areas for investment. By offering insights into the number of trials, sponsors, and indications at each phase, this table serves as a vital resource for those looking to track the progress of the oncology pipeline and make informed decisions about future investments and trial strategies.

List of Major Active Trials by Phase, Sponsor, and Indication, A Key Example:

Clinical Trial Study Title

Study for AZD4360 in Participants With Advanced Solid Tumours

Study Status

Not Yet Recruiting

Phase

Phase I/ Phase II

Study Type

Interventional

Study Design

- Allocation: NA

- Intervention Model: Sequential

- Masking: None

- Primary Purpose: Treatment

Conditions

- Gastric Cancer

- Gastroesophageal Junction Cancer

- Biliary Tract Cancer

- Pancreatic Ductal Adenocarcinoma

Interventions

DRUG: AZD4360

Sponsor

AstraZeneca

Number of Patients (Enrollment)

117

Start Date

23-05-2025

Primary Completion Date

31-07-2027

Completion Date

14-12-2027

Locations

- Research Site, Los Angeles, California, 90095, United States

- Research Site, Providence, Rhode Island, 02906, United States

- Research Site, Houston, Texas, 77030, United States

- Research Site, Chengdu, 610041, China

- Research Site, Shanghai, 201318, China

- Research Site, Wuhan, 430040, China

Other aspects that shall be analyzed will include the market overview, clinical trials by study design, by key indications, by region, and list of key clinical trials, sponsors, among several other factors.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified