- Home

- »

- Market Trend Reports

- »

-

Top 20 Breast Cancer Drugs Market Analysis And Segment Forecasts To 2030

Report Overview

The global breast cancer drugs market continues to experience strong growth, driven by rising incidence rates, advancements in targeted therapies, and increased awareness and screening efforts worldwide. In 2024, the combined sales of the top 20 breast cancer drugs were estimated at USD 27.42 billion and is projected to grow at a CAGR of 8.42% from 2025 to 2030. These top-performing drugs span a wide range of therapeutic classes including CDK4/6 inhibitors, monoclonal antibodies, antibody-drug conjugates, immune checkpoint inhibitors, PARP inhibitors, mTOR inhibitors, RANK ligand inhibitors, and hormonal therapieshighlighting the diversity and complexity of modern breast cancer treatment approaches.

*Only the top 10 breast cancer drugs have been represented in this figure

While established blockbusters like Herceptin and Ibrance maintain a strong market presence, newer entrants such as Enhertu and Trodelvy are gaining momentum due to their clinical efficacy in hard-to-treat subtypes. The growing adoption of precision medicine, coupled with ongoing R&D and regulatory approvals, is expected to shape the competitive landscape from 2025 to 2030, despite challenges such as biosimilar erosion and access disparities in emerging markets.

The breast cancer drug market is undergoing dynamic evolution, shaped by a convergence of clinical, technological, and commercial forces. On one hand, rising global breast cancer incidence especially in aging populations and urbanizing regions continues to expand the patient pool. On the other, the increased molecular understanding of breast cancer subtypes has driven a wave of innovation in targeted therapies, antibody-drug conjugates (ADCs), and combination regimens. These developments have significantly improved treatment outcomes and redefined standards of care across early-stage and metastatic settings.

Top 20 Breast Cancer Drugs Market, 2024 (USD Million)

Drug Name (Generic Name)

Company

2024 Revenue (USD Billion)

2030 Revenue (USD Billion)

Date of First Regulatory Approval

Approved Indications

Approximate Annual Cost (USD)

Generics/Biosimilars Available

Verzenio (Abemaciclib)

Eli Lilly and Company

5.30

14.80

28-Sep-17 (U.S. FDA)

HR-positive, HER2-negative advanced or metastatic breast cancer

~$150,000

No

Ibrance (Palbociclib)

Pfizer Inc.

4.36

3.00

3-Feb-15 (U.S. FDA)

HR-positive, HER2-negative advanced or metastatic breast cancer

~$160,000

No

Perjeta (Pertuzumab)

*Similar analysis would be provided for key 20 drugs

Kisqali (Ribociclib)

Kadcyla (Ado-trastuzumab emtansine)

Phesgo (Pertuzumab, trastuzumab, and hyaluronidase-zzxf)

Herceptin (Trastuzumab)

Trodelvy (Sacituzumab govitecan)

Keytruda (Pembrolizumab)

Piqray (Alpelisib)

Lynparza (Olaparib)

Prolia (Denosumab)

Aromasin (Exemestane)

Faslodex (Fulvestrant)

XGEVA (Denosumab)

Tecentriq (Atezolizumab)

Afinitor (Everolimus)

Zometa (Zoledronic acid)

Arimidex (Anastrozole)

Enhertu (Trastuzumab deruxtecan)

Several strong drivers continue to propel growth in the breast cancer therapeutics market. The most prominent is the increasing global burden of breast cancer, now accounting for over 2.3 million new cases annually. Enhanced screening programs and growing public awareness have led to earlier detection, enabling timely and more effective interventions. Additionally, advancements in precision oncology through genomic profiling, biomarker-driven diagnosis, and companion diagnostics are fueling the adoption of targeted therapies like CDK4/6 inhibitors, PARP inhibitors, and ADCs.

Despite its strong momentum, the breast cancer drug market faces several hurdles. A key challenge is the growing impact of biosimilars and generics on established blockbuster drugs. With multiple first-generation agents now off-patent, originator brands are losing market share, forcing companies to justify premiums through incremental innovation or combination strategies. Furthermore, treatment resistance and safety concerns, such as cardiotoxicity from HER2-targeted therapies or immune-related adverse events from checkpoint inhibitors, present ongoing clinical challenges. Lastly, regulatory variability and slow approval timelines in certain regions can delay patient access and limit commercial potential. These factors underscore the need for balanced strategies that align innovation with affordability and global access.

Patent Expiry & Biosimilar Impact

Patent expirations continue to reshape the competitive landscape in the breast cancer drug market. Legacy blockbusters such as Herceptin (trastuzumab), Faslodex (fulvestrant), Zometa (zoledronic acid), and Afinitor (everolimus) have already faced biosimilar or generic erosion, significantly affecting revenue streams for their originators. The availability of biosimilars particularly for HER2-targeted agents like Herceptin and Perjeta has introduced more affordable options, improving access in price-sensitive markets but intensifying competition in mature ones.

Key Patent Expiries & Biosimilar Landscape

Drug

Originator

Indication

Patent Expiry

Biosimilar Status

Herceptin

Roche

HER2+ Breast Cancer

Expired (2014 EU, 2019 US)

Multiple biosimilars approved & marketed

Perjeta

Roche

HER2+ Breast Cancer

2023–2024 (varies)

Biosimilars in development

Faslodex

AstraZeneca

HR+ Breast Cancer

Expired

Generics available

Zometa

Novartis

Bone Metastases

Expired

Generics available

Afinitor

Novartis

HR+, HER2- Breast Cancer

Expired

Generics available

Ibrance

Pfizer

HR+/HER2- Metastatic

2027–2028

No biosimilar yet

Kadcyla

Roche

HER2+ Breast Cancer

~2027–2028

Patent protected (ADC class)

The biosimilar wave is not only reducing costs for healthcare systems but also pressuring branded manufacturers to differentiate through lifecycle management strategies, such as combination therapies, label expansions, or novel formulations (e.g., subcutaneous Phesgo). Over the next few years, additional biologics are expected to face LOE (loss of exclusivity), opening the door for further biosimilar launches. However, market penetration of biosimilars varies widely by region, depending on regulatory readiness, provider confidence, and payer incentives.

Pipeline & Innovation Spotlight

The breast cancer pipeline is rich with innovation, targeting both high-incidence subtypes and hard-to-treat populations. Recent years have seen the emergence of next-generation antibody-drug conjugates (ADCs), such as Enhertu (trastuzumab deruxtecan) and Trodelvy (sacituzumab govitecan), which are demonstrating strong clinical outcomes in HER2-low and triple-negative breast cancer (TNBC)-areas with historically limited treatment options. These therapies have redefined HER2 expression thresholds, offering hope for a broader patient population and opening up new commercial avenues.

Table: Selected Promising Pipeline Therapies in Breast Cancer

Drug (Code Name)

Developer

Target/Subtype

Class

Stage

Camizestrant

AstraZeneca

HR+ / HER2-

Oral SERD

Phase III

Dato-DXd (Datopotamab)

AstraZeneca / Daiichi

HER2-low / TNBC

ADC

Phase III

GDC-9545 (giredestrant)

Roche

HR+ Breast Cancer

Oral SERD

Phase II/III

ARV-471 (Vepdegestrant)

Pfizer / Arvinas

ER+ Breast Cancer

PROTAC / ER degrader

Phase III

Elacestrant

Menarini

HR+ / HER2-

Oral SERD

FDA Approved

LOXO-783

Eli Lilly

ESR1-mutant Breast Cancer

Mutant ESR1 inhibitor

Phase I/II

HLX11 (biosimilar to Perjeta)

Henlius

HER2+ Breast Cancer

Biosimilar (mAb)

Phase III

Beyond ADCs, the pipeline features novel small molecules, bispecific antibodies, immune-modulating agents, and targeted inhibitors aimed at overcoming resistance or enhancing response durability. Notably, several CDK2 and CDK7 inhibitors, PI3K pathway modulators, and oral selective estrogen receptor degraders (SERDs) are progressing through mid-to-late stage trials. Many of these investigational drugs are being explored in combination regimens, a trend driven by the need for multi-pronged strategies against tumor heterogeneity and adaptive resistance.

As precision oncology continues to drive the breast cancer R&D engine, these next-gen therapies are expected to transform future treatment pathways and potentially redefine the Top 20 drug rankings in the years ahead.

Regulatory & Policy Environment

The regulatory landscape for breast cancer therapies has become increasingly adaptive and innovation-friendly, particularly in the U.S., EU, and select Asia Pacific markets. Agencies like the U.S. FDA and European Medicines Agency (EMA) have embraced expedited pathways such as Breakthrough Therapy Designation, Fast Track, Accelerated Approval, and Priority Review to bring promising breast cancer treatments to patients faster-especially in areas of high unmet need like triple-negative breast cancer (TNBC) and HER2-low subtypes.

For example, Enhertu and Trodelvy both received accelerated approvals based on early-phase efficacy data, reflecting a growing reliance on surrogate endpoints such as objective response rate (ORR) and progression-free survival (PFS). Simultaneously, regulatory agencies are placing increased emphasis on companion diagnostics and biomarker-driven indications, aligning with the precision medicine movement. However, global disparities in regulatory efficiency remain a concern. While markets like Japan, South Korea, and Australia are aligning with Western standards, slower drug review cycles in regions like Latin America and parts of Africa continue to delay patient access. Overall, the regulatory ecosystem is evolving toward a balance of speed, safety, and science-based evaluation.

Pricing & Reimbursement Landscape

Pricing and reimbursement remain critical levers in determining drug accessibility and commercial success in the breast cancer market. High-cost therapies especially biologics and ADCs like Kadcyla, Enhertu, and Phesgo-are under increasing scrutiny from payers and health technology assessment (HTA) bodies. In high-income markets, reimbursement is often tied to clinical value demonstration through real-world evidence or cost-effectiveness models (e.g., QALY-based evaluations by organizations like NICE in the UK or ICER in the U.S.).

In contrast, price sensitivity in emerging economies poses challenges for high-cost innovator brands, prompting increased demand for biosimilars and generics. Governments in countries like India, Brazil, and South Africa are implementing price caps, centralized purchasing, or risk-sharing agreements to expand access while containing costs. Moreover, the rise of value-based pricing models and indication-specific pricing strategies is influencing how manufacturers launch and negotiate new therapies across different indications. To sustain market presence, pharmaceutical companies are adopting flexible pricing strategies, patient-assistance programs, and outcome-based reimbursement frameworks especially in markets where out-of-pocket spending remains high. As global pressure mounts for affordability without sacrificing innovation, pricing and reimbursement strategies will play a pivotal role in shaping both patient access and long-term market dynamics.

Product Insights

The breast cancer therapeutics market is dominated by CDK4/6 inhibitors, HER2-targeted biologics, and antibody-drug conjugates (ADCs), each playing a distinct role in the evolving treatment landscape. As of 2024, Ibrance (palbociclib) holds the largest market share of 17.76%, driven by its widespread adoption as a first-line therapy for HR+/HER2- metastatic breast cancer. The drug’s commercial success is attributed to its established efficacy, manageable safety profile, and long-standing integration into treatment guidelines. According to industry estimates, Ibrance generated USD 4,367.00 million in revenue in 2024, reflecting its entrenched position in standard-of-care regimens.

On the other hand, Enhertu (trastuzumab deruxtecan) emerged as the fastest-growing product within the breast cancer market, particularly for HER2-low and previously treated HER2-positive patients. Its differentiated mechanism of action as an ADC, with a high drug-to-antibody ratio (DAR), has demonstrated impressive efficacy even in patients who have progressed on other HER2-targeted therapies. Enhertu's sales are expected to grow at a CAGR exceeding 20% from 2025 to 2030, driven by label expansions, including the treatment of HER2-low breast cancer, a previously underserved population. Its rapid adoption is further supported by favorable regulatory designations such as Breakthrough Therapy Status from the FDA and Accelerated Approval in multiple regions.

Perjeta (pertuzumab) and Herceptin (trastuzumab) continue to be significant revenue contributors within the HER2-targeted segment, especially when used in combination with chemotherapy or as part of the Phesgo (pertuzumab, trastuzumab, and hyaluronidase-zzxf) subcutaneous formulation. Despite increasing biosimilar competition, the combination of Perjeta and Herceptin remains a cornerstone of HER2-positive breast cancer therapy due to its proven efficacy in both neoadjuvant and adjuvant settings.

Meanwhile, Trodelvy (sacituzumab govitecan) is gaining traction within the triple-negative breast cancer (TNBC) segment, offering a critical treatment option for heavily pretreated patients. Its antibody-drug conjugate mechanism is particularly beneficial for addressing the aggressive and difficult-to-treat nature of TNBC.

The PARP inhibitor class, represented by Lynparza (olaparib) and Piqray (alpelisib), continues to grow, primarily targeting patients with BRCA-mutated or PI3K-mutated breast cancers, respectively. Both drugs benefit from their oral formulations and have been integrated into combination regimens to enhance efficacy.

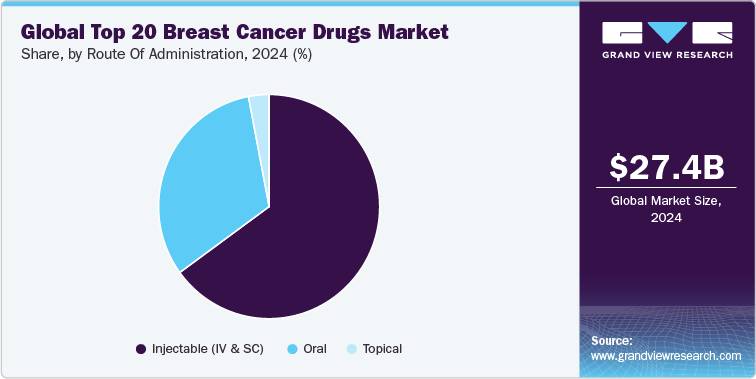

Route Of Administration Insights

The breast cancer therapeutics market is segmented into oral, intravenous (IV), and subcutaneous (SC) routes of administration, with each route serving specific clinical needs based on drug formulation, efficacy, patient convenience, and safety profiles. As of 2024, the intravenous (IV) route continues to dominate the market, particularly for monoclonal antibodies and antibody-drug conjugates (ADCs), which require precise dosage control and effective delivery into the bloodstream.

The majority of top-performing breast cancer drugs, including Herceptin, Perjeta, Kadcyla, Enhertu, and Trodelvy, are administered via IV infusion. This route accounted for majority of the market share in 2024, driven by the high efficacy of biologics and ADCs delivered directly into systemic circulation. Despite the growing availability of alternative formulations, IV administration remains preferred for drugs requiring precise dosing and controlled release, particularly in metastatic or aggressive breast cancer types.

However, the cumbersome nature of IV infusions, including the need for hospital visits or infusion centers, has prompted pharmaceutical companies to explore more convenient options to enhance patient compliance and quality of life.

Oral administration is the fastest-growing segment, projected to grow at a CAGR from 2025 to 2030. This growth is primarily driven by CDK4/6 inhibitors like Ibrance, Verzenio, and Kisqali, as well as PARP inhibitors like Lynparza and Piqray. The convenience of oral formulations offers significant advantages in terms of patient adherence, especially for chronic or maintenance therapy.

Drugs like Ibrance, which currently holds the largest market share among breast cancer treatments, have demonstrated high patient acceptance and preference due to their oral availability. Oral agents also simplify dosing regimens, reducing the need for frequent hospital visits and offering a substantial cost advantage over IV-administered biologics.

The subcutaneous route is gaining popularity as a convenient and effective alternative to IV infusions, particularly for HER2-targeted therapies. Roche’s Phesgo (pertuzumab, trastuzumab, and hyaluronidase-zzxf) an SC formulation approved for HER2-positive breast cancer has demonstrated comparable efficacy to IV administration with significantly reduced infusion time. This innovation addresses patient demand for more convenient, time-efficient treatments, especially in outpatient settings.

In addition to Phesgo, ongoing research aims to formulate other biologics and ADCs into subcutaneous options, potentially expanding the SC segment's share in the coming years. Industry experts anticipate that SC formulations could capture up to 20% of the market share by 2030, particularly as healthcare providers prioritize patient-centric care and efficiency.

Key Companies & Market Share Insights

The top 20 breast cancer drugs market is dominated by a select group of multinational pharmaceutical giants, many of whom have established leadership positions through their innovative therapies, extensive clinical research, and robust marketing strategies. The market remains highly competitive, with companies striving to enhance patient outcomes through targeted therapies, antibody-drug conjugates (ADCs), and hormone-based treatments.

Leading Companies by Market Share

Market Share Insights

-

F. Hoffmann-La Roche Ltd continues to lead the global breast cancer therapeutics market, particularly in the HER2-positive segment, driven by established blockbusters like Herceptin, Perjeta, Kadcyla, and the fast-growing Enhertu.

-

Pfizer remains a dominant player with Ibrance, the top-selling CDK4/6 inhibitor, while Novartis and Eli Lilly follow closely with Kisqali and Verzenio, respectively.

-

AstraZeneca is rapidly gaining market share through Enhertu (in collaboration with Daiichi Sankyo) and Lynparza, targeting HER2-low and BRCA-mutated breast cancer patients.

-

Merck & Co. and Bristol-Myers Squibb are actively expanding their presence in breast cancer with immunotherapy agents (Keytruda, Opdivo).

-

Amgen and Johnson & Johnson hold strong positions in bone metastasis management, with Xgeva and Prolia being widely adopted.

Key Top 20 Breast Cancer Drugs Market Companies:

The following are the leading companies in the Top 20 breast cancer drugs market. These companies collectively hold the largest market share and dictate industry trends.

- F. Hoffmann-La Roche Ltd

- Novartis AG

- Pfizer Inc.

- AstraZeneca

- Merck & Co., Inc.

- Johnson & Johnson

- Bristol-Myers Squibb Company

- Sanofi

- GSK plc.

- AbbVie Inc.

- Takeda Pharmaceutical Co.

- Biogen

- Eli Lilly and Company

- Novo Nordisk A/S

- Amgen Inc.

Recent Developments

-

In January 2025, AstraZeneca and Daiichi Sankyo received U.S. FDA approval for Datroway (datopotamab deruxtecan), an antibody-drug conjugate indicated for the treatment of advanced breast cancer in patients who have previously undergone treatment.

-

In October 2024, the U.S. Food and Drug Administration (FDA) approved a new combination therapy for estrogen receptor-positive (ER+), human epidermal growth factor receptor 2-negative (HER2-) breast cancer. This regimen combines inavolisib (Itovebi) with fulvestrant (Faslodex®) and palbociclib (Ibrance), offering a significant advancement for patients with this breast cancer subtype.

-

In January 2025, Roche received U.S. FDA approval for a label expansion of the PATHWAY anti-HER2/neu (4B5) Rabbit Monoclonal Primary Antibody, now authorized to identify patients with hormone receptor-positive, HER2-ultralow metastatic breast cancer who may be eligible for treatment with ENHERTU.

-

In October 2024, Roche received U.S. FDA approval for Itovebi (inavolisib), in combination with palbociclib and fulvestrant, for the treatment of adults with endocrine-resistant, PIK3CA-mutated, hormone receptor (HR)-positive, HER2-negative, locally advanced or metastatic breast cancer, following recurrence on or after completing adjuvant endocrine therapy.

Segments Covered In The Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global top 20 breast cancer drugs market report based on product, route of administration, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Verzenio

-

Ibrance

-

Perjeta

-

Kisqali

-

Kadcyla

-

Phesgo

-

Herceptin

-

Trodelvy

-

Keytruda

-

Piqray

-

Lynparza

-

Prolia

-

Aromasin

-

Faslodex

-

XGEVA

-

Tecentriq

-

Afinitor

-

Zometa

-

Arimidex

-

Enhertu

-

-

Route Of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Topical

-

Injectable

-

Oral

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Pricing & Purchase Options

Service Guarantee

-

Insured Buying

This report has a service guarantee. We stand by our report quality.

-

Confidentiality

We are in compliance with GDPR & CCPA norms. All interactions are confidential.

-

Custom research service

Design an exclusive study to serve your research needs.

-

24/5 Research support

Get your queries resolved from an industry expert.

-

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified