- Home

- »

- Medical Imaging

- »

-

3D Imaging Distance Service Market, Industry Report, 2030GVR Report cover

![3D Imaging Distance Service Market Size, Share & Trends Report]()

3D Imaging Distance Service Market (2025 - 2030) Size, Share & Trends Analysis Report By Service Model (Per-case Image Processing, Subscription-based 3D Planning), By Application (Urological Surgery, Neurosurgery), By Sales Method, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-609-7

- Number of Report Pages: 170

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

3D Imaging Distance Service Market Summary

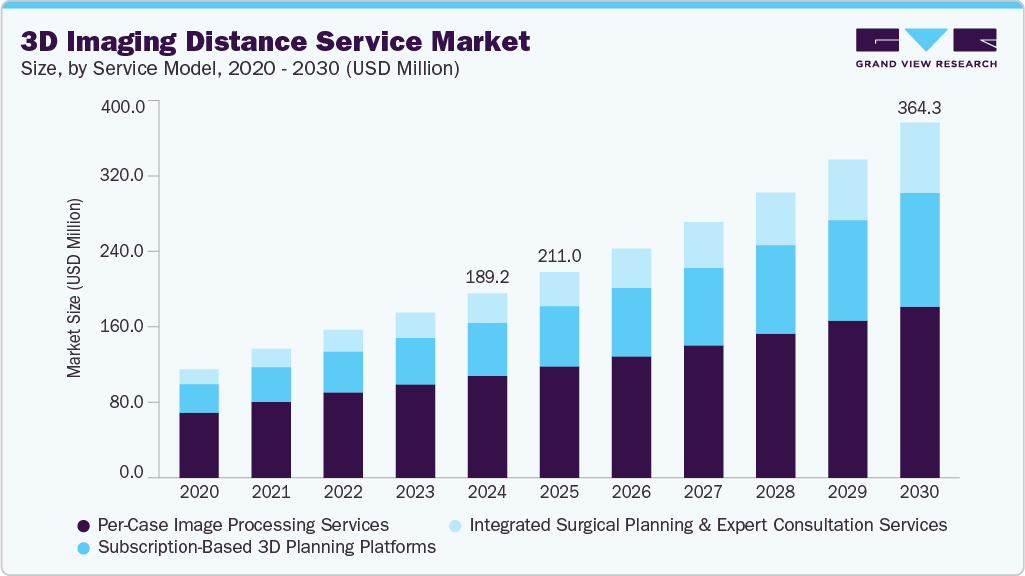

The global 3D imaging distance service market size was estimated at USD 189.2 million in 2024 and is projected to reach USD 364.3 million by 2030, growing at a CAGR of 11.5% from 2025 to 2030. The growth is driven by rising demand for improved diagnostic precision, minimally invasive procedures, and telehealth integration.

Key Market Trends & Insights

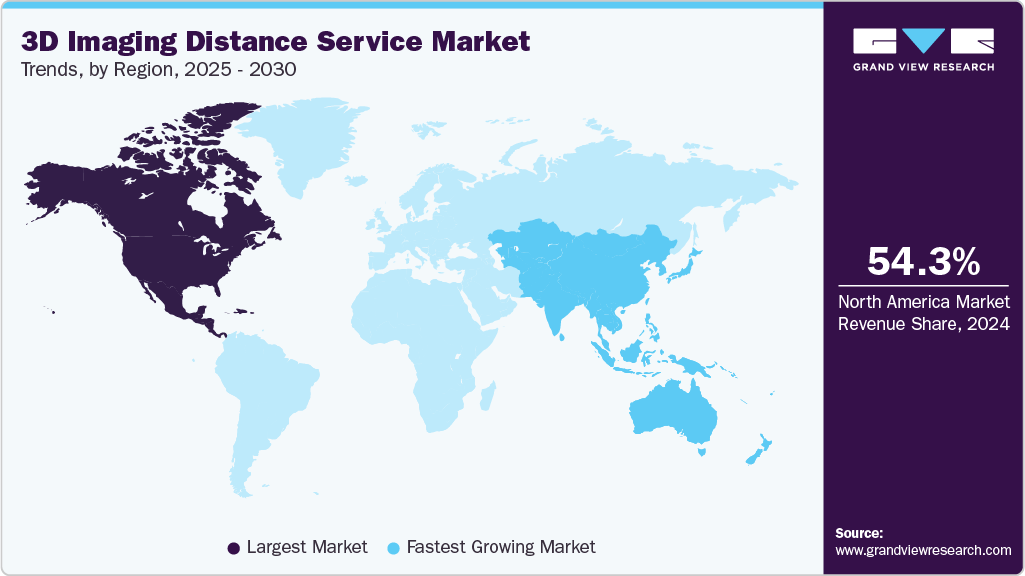

- North America 3D imaging distance service market dominated the global industry and accounted for a 54.3% revenue share in 2024.

- By service model, the per-case segment led the market with a 55.3% share in 2024.

- By application, the general surgery segment led the market with a 32.5% share in 2024.

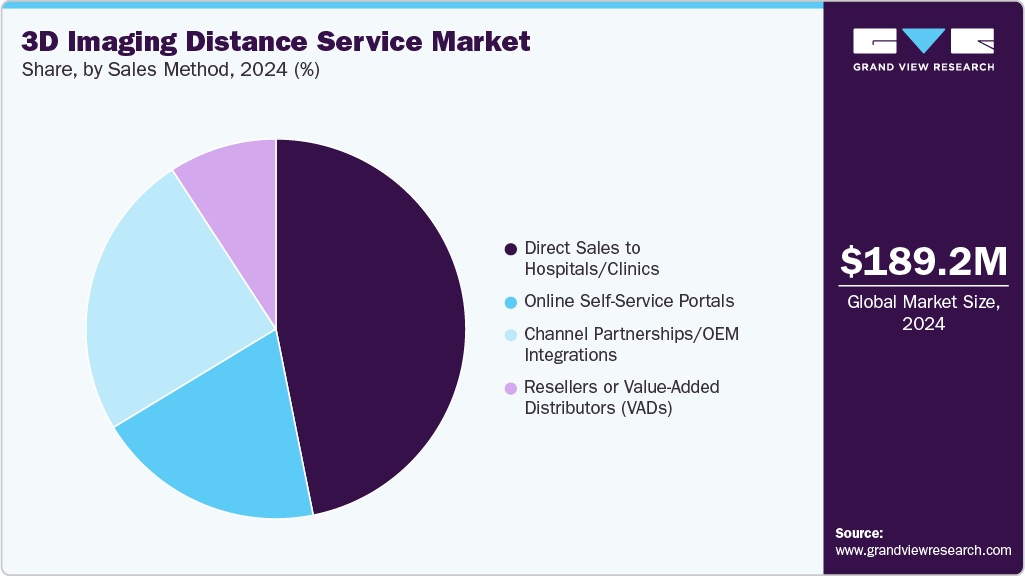

- By sales method, direct sales to hospitals/clinics segment accounted for the largest market share at 46.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 189.2 Million

- 2030 Projected Market Size: USD 364.3 Million

- CAGR (2025-2030): 11.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Advanced imaging technologies enable real-time collaboration, preoperative planning, and medical education. In 2025, the U.S. is projected to report approximately 2.04 million new cancer cases and 618,120 cancer-related deaths, with lung, colorectal, and pancreatic cancers being the leading causes of mortality.The industry is expanding as healthcare providers increasingly utilize advanced imaging to refine surgical planning, particularly for high-risk cancers. The demand for personalized and minimally invasive procedures fuels the use of 3D technologies that improve tumor targeting and reduce surgical trauma. Surgeons now rely more on 3D models for tailored interventions, especially in complex fields like colorectal and gynecologic oncology. Innovations in AI-driven 3D imaging and real-time visualization are revolutionizing surgery by enhancing outcomes, minimizing complications, and improving efficiency. Endometrial (or uterine) cancer-currently the sixth most common cancer in women globally-poses a growing clinical burden.

In 2025, the U.S. is projected to report 69,120 new uterine cancer cases and 13,860 related deaths. In 2022, China, the U.S., and Russia recorded the highest incidence of endometrial cancer. Integrating 3D imaging services enables more precise, less invasive treatments, supporting healthcare goals of improved quality of life and cost-effective, value-based care, further accelerating market growth.

The table below highlights the 10 countries with the highest number of endometrial cancer cases, along with their age-standardized rates (ASRs), illustrating the global impact of this disease.

Global Burden of Endometrial Cancer

Rank

Country

New cases 2022

ASR/100,000

-

World

420,368

8.4

1

China

77,722

6.8

2

United States

66,055

22.5

3

Russia

29,852

20.6

4

Japan

18,338

14.8

5

India

17,240

2.5

6

Brazil

12,616

8.2

7

Germany

11,767

10.8

8

United Kingdom

10,440

14.8

9

Italy

10,202

14.4

10

France (metropolitan)

9,760

12.1

Source: World Cancer Research Fund, Grand View Research

Technological Influence on Surgical Precision

3D imaging platforms from providers like Materialise and Visible Patient enable the creation of lifelike anatomical reconstructions for surgeries such as:

-

Spinal fusion

-

Cranial tumor resections

-

Liver resections

-

Aortic valve replacements

These models are especially valuable in minimal invasive surgery (MIS), where visualization is limited. 3D images help identify anatomical anomalies, guide robotic tools, and ensure safer access with less trauma to surrounding tissues. As a result, surgeons can reduce complication rates and operative time.

Impact of AR/VR + AI on Surgical Metrics

Metric

Traditional Planning

With AR/VR + AI

Improvement

Planning Time

3-6 hours

1-2 hours

60-70% faster

Surgical Accuracy

Moderate

High (millimeter-level)

~35% improvement

Patient Outcomes (Recovery Time)

5-10 days

3-7 days

~25% faster recovery

Repeat Surgeries

Higher

Significantly Lower

~30% reduction

Source: GVR

VR-Enhanced Surgical Planning

The June 2023 study in Urology Video Journal highlights the transformative role of 3D virtual reality (VR) models-specifically Ceevra-in robotic urologic surgery. By converting standard CT and MRI scans into immersive 3D models, Ceevra enhances preoperative planning and intraoperative decision-making. This technology improves outcomes such as reduced blood loss, shorter hospital stays, and optimized clamp times during partial nephrectomy procedures. It also enables surgeons to modify surgical plans in nearly a third of cases and enhances anatomical understanding, critical for accurate resection and preserving healthy tissue.

Beyond surgery, the technology supports resident training and patient education, reducing preoperative anxiety and improving patient comprehension. Scenarios presented in the paper demonstrate the value of 3D VR in selecting surgical approaches, performing selective clamping, and enhancing depth assessment of tumors.

As this technology gains adoption, it is fueling growth in the U.S. 3D imaging distance services industry by increasing demand for advanced imaging reconstructions, remote surgical planning, and VR integration in preoperative workflows. This trend also opens new avenues for AI and machine learning integration in future surgical models, supporting continued market expansion.

The industry is witnessing a shift in distribution preferences, driven by digital transformation and diverse healthcare facility needs. Cloud-based platforms are becoming the dominant choice due to their scalability, ease of deployment, and lower upfront costs-ideal for mid-sized hospitals and remote centers. Standalone installations remain prevalent in large hospitals with robust IT infrastructure and in-house expertise. Meanwhile, PACS/EMR-integrated solutions are increasingly adopted in developed markets, enabling seamless data flow and enhancing clinical workflow efficiency.

Flow Alignment with Distribution Channels and Systems (with Company Examples)

Adoption Type

Distribution Channel

Company Examples

Explanation

Cloud-Based Platforms

Online Portals, Direct Sales, Channel Partners

Materialise (Mimics Cloud), Ceevra, Precision Image Analysis, Innersight Labs

Materialise's Mimics 2024 integrates cloud-based segmentation and case sharing-ideal for remote collaboration. Ceevra’s 3D imaging for surgery runs fully on the cloud.

Standalone Installations

Direct Sales to Large Hospitals

3D Systems (D2P), MeVis Medical Solutions, EDDA Technology

Large hospitals prefer on-premises installations for full control and data security. 3D Systems’ D2P allows localized surgical planning; MeVis provides tailored radiology tools.

PACS/EMR Integration

OEM Partnerships, VADs

Visible Patient, 3DR Labs, Medannot

Visible Patient integrates 3D modeling into EMRs for preoperative planning. 3DR Labs supports PACS-based teleradiology services. Medannot offers structured reporting integration.

Market Concentration & Characteristics

The industry is moderately concentrated, with a mix of established imaging firms and emerging tech startups driving innovation. Key players focus on cloud-based platforms, AI integration, and telehealth compatibility to meet the rising demand for remote diagnostics and surgical planning.

The industry is characterized by rapid technological advancements, increasing applications in oncology and complex surgeries, and growing emphasis on personalized, minimally invasive care. Strategic collaborations with healthcare providers and regulatory support for digital health solutions shape market dynamics. Precision-focused 3D imaging services are becoming essential for improving clinical outcomes and operational efficiency as value-based care gains traction.

The industry is characterized by high innovation, driven by rapid tech advancements and rising clinical needs. MeVis Medical Solutions, a Varex Imaging subsidiary, highlighted innovations at RSNA 2023, including AI-powered Veolity LungCAD and LungRead for lung nodule detection and CT scan analysis. Their MeVis Distant Services (MDS) suite enables 3D visualizations from CT/MRI data for surgical planning in liver, kidney, and pancreas procedures. It also supports vascular analysis and secure remote collaboration through shared 3D models. The MeVis Liver Suite enhances hepatobiliary surgical planning, combining detailed imaging with user-friendly tools for clinical teams.

The industry is significantly shaped by evolving regulatory frameworks to ensure patient safety, data security, and clinical efficacy. Regulatory bodies like the FDA, EMA, and regional health authorities mandate rigorous compliance for software-as-a-medical-device (SaMD) solutions. Data protection laws such as HIPAA and GDPR further influence how patient imaging data is stored, transmitted, and shared, especially across borders. Certification standards for AI integration and interoperability with hospital information systems also affect product development and deployment timelines. Adherence to these regulations ensures quality and trust, but present hurdles that require substantial investment in compliance infrastructure.

Mergers and acquisitions influence the industry, reshaping competitive dynamics. A key example is KARL STORZ's January 2024 acquisition of Innersight Labs Ltd., a UK-based AI innovator known for its Innersight3D software. This platform converts CT and MRI scans into interactive, web-accessible 3D models tailored to patients. The acquisition strengthens KARL STORZ’s offerings by integrating AI-enhanced 3D imaging tools, enabling more precise preoperative planning, shorter surgeries, and fewer complications. Such strategic moves highlight how companies leverage M&A to boost innovation, expand capabilities, and respond to growing demand for advanced surgical visualization technologies.

Product substitutes in the industry include traditional 2D imaging techniques, in-person diagnostic imaging services, and standard radiology consultations. While these alternatives may offer lower costs or easier access in some regions, they lack the precision, depth, and real-time collaboration features provided by 3D imaging. Emerging technologies like augmented reality and virtual reality-based visualization tools pose substitution threats but often serve complementary roles. However, the growing demand for minimally invasive procedures, personalized care, and remote diagnostics continues to strengthen the position of 3D imaging services, limiting the appeal of substitutes and reinforcing their value in clinical workflows.

The industry is expanding regionally, with companies like Ethicon growing their digital surgery offerings. The Ethicon Visible Patient solution is now available in Italy, the UK, Germany, Spain, Switzerland, Belgium, Luxembourg, the Netherlands, Saudi Arabia, and Kuwait. It helps surgeons plan and reference surgeries using interactive 3D organ models generated from existing CT or MRI scans through advanced software algorithms and expert medical analysis. This expansion supports improved surgical precision and broader global access to 3D imaging technologies in clinical practice. Supporting this perspective, the Global Head of Digital Solutions emphasizes,

“Ethicon Visible Patient aims to provide our surgeon customers with insights on patient-specific anatomy, available at their fingertips both pre-operatively and inside the OR. By providing 3D models of structures such as suspected tumors, vascular anatomy, and anatomical variation, we give surgeons a valuable new tool for planning their surgical approach.

Service Model Insights

The per-case segment led the market with a 55.3% share in 2024. Technological advancements and increasing demand for personalized imaging solutions fuel the segment's growth. This service model allows healthcare providers to access high-quality imaging on a case-by-case basis, which is beneficial for facilities that may not have the resources to maintain extensive imaging capabilities in-house. For instance, in March 2025, ConcertAI’s TeraRecon and 3DR Labs expanded their partnership to enhance AI-enabled image post-processing clinical services for US healthcare providers. The collaboration leverages TeraRecon’s TR Subscription, providing 3DR Labs access to advanced visualization tools, AI-powered applications, and cloud services. This integration aims to improve imaging diagnostics and surgical planning, streamline 3DR’s clinical operations via cloud migration, and scale services while maintaining quality and security. Such initiatives by image processing service providers in the country are expected to increase the preference of healthcare providers towards per-case image processing services over the forecast period.

The Integrated Surgical Planning & Expert Consultation Services segment is projected to grow steadily during the forecast period with a CAGR of 15.4%. As healthcare providers adopt 3D imaging tools, such as cone-beam CT, MRI, and intraoperative imaging, the need for interpretive and planning support is growing rapidly, especially in smaller practices and community hospitals that lack in-house specialists. As hospitals and surgical centers face challenges related to imaging accuracy and patient outcomes, integrated services that combine advanced imaging technologies with expert consultations can address these issues effectively, as these services can enable providers to reduce diagnostic uncertainty, minimize pre-surgical planning errors, and enhance patient outcomes.

Application Insights

The general surgery segment led the market with a 32.5% share in 2024, driven by the rising demand for advanced surgical technologies in a wide range of general surgery applications such as liver, pancreas, esophagus, stomach, rectal & colorectal, gynecology, and others. Through modalities like 3D CT, MRI, and ultrasound, surgeons can visualize complex anatomical structures in detail, aiding in planning procedures such as hernia repairs, gallbladder removals, bowel resections, and bariatric surgeries. These high-resolution images can be remotely transmitted to tertiary care centers, where surgical specialists interpret them to guide local teams or provide second opinions. This is especially beneficial for hospitals in rural or underserved areas lacking on-site radiology or surgical subspecialists.

The cardiovascular & thoracic surgery segment is projected to expand significantly during the forecast period. 3D imaging distance services have become essential to cardiovascular and thoracic surgery, improving diagnostic precision and surgical planning. Techniques like 3D CT angiography, MRI, and echocardiography provide intricate views of the heart, lungs, and vascular systems. Furthermore, these services promote collaboration among cardiac surgeons, pulmonologists, and radiologists, regardless of location. This connectivity is particularly beneficial for patients in rural or underserved regions who may not have direct access to specialized cardiovascular care. Additionally, remotely examining and manipulating 3D models enhances intraoperative navigation and postoperative monitoring, guaranteeing ongoing care throughout treatment.

Sales Method Insights

Direct Sales to Hospitals/Clinics accounted for the largest market share at 46.9% in 2024, owing to healthcare facilities' increasing preference for vendor-managed, customized imaging solutions. This method eliminates third-party distributors, allowing providers of 3D imaging services to establish relationships with medical institutions. For instance, Materialise NV offers its Mimics Innovation Suite through direct enterprise sales to U.S. hospitals and institutions. These installations allow hospitals to manage their 3D modeling in-house, giving them greater control over case volume, model turnaround time, and integration with existing imaging and PACS systems. Several leading institutions, including the Cleveland Clinic and the Hospital for Special Surgery, have adopted direct installations of planning software to support orthopedic, cardiovascular, and craniofacial surgery units.

The Resellers or Value-Added Distributors (VADs) segment is anticipated to grow at a CAGR of 14.8%. The VADs' sales method is gaining popularity in the market, owing to the complexity of advanced technology and the specialized needs of healthcare providers adopting remote imaging solutions. Vendors recognize that direct sales models can be inefficient for penetrating a diverse and geographically dispersed market with a nascent understanding of distance service benefits.

Regional Insights

North America 3D imaging distance service market dominated the global industry and accounted for a 54.3% revenue share in 2024. This growth is largely driven by the rising adoption of advanced imaging technologies in surgical planning, cancer diagnostics, and minimally invasive procedures. Increased healthcare spending, a strong presence of leading imaging companies, and robust infrastructure support rapid technology integration. The growing prevalence of cancer, especially lung, colorectal, and uterine cancers, has heightened the demand for precision-guided surgeries. Moreover, favorable regulatory frameworks and high awareness among healthcare providers have accelerated the use of 3D imaging solutions across hospitals and specialty clinics.

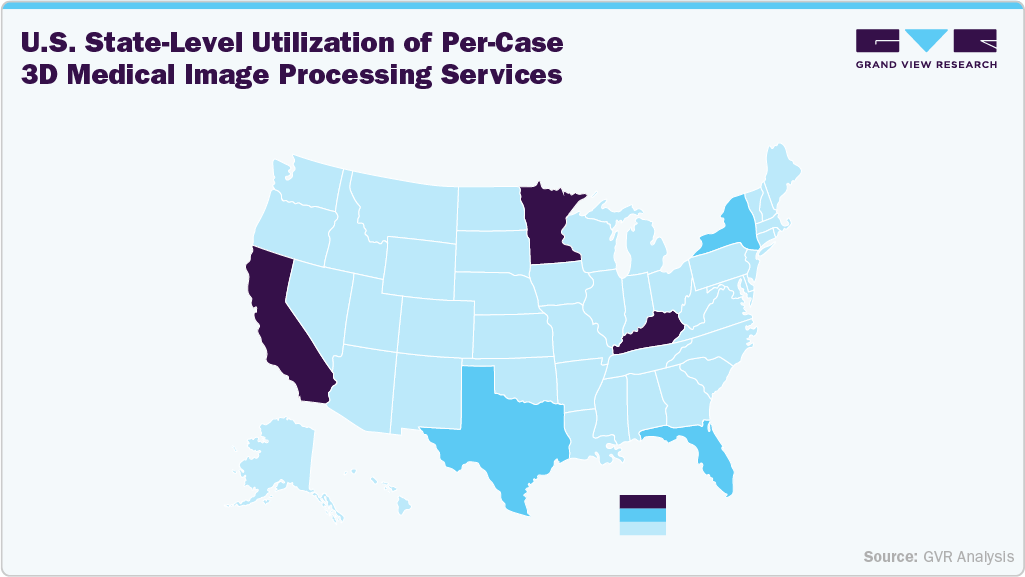

U.S. 3D Imaging Distance Service Market Trends

The 3D imaging distance service market in the U.S. held a significant share of the North American region in 2024, driven by advances in urology and oncology. According to the American Urological Association (AUA) in 2023, oncology (12.3%), pediatrics (6.7%), and endourology/stone disease (5.1%) were the top subspecialties. Kidney stone disease benefits greatly from 3D imaging, as non-contrast CT scans remain essential for detecting and characterizing stones. 3D reconstructions aid urologists in selecting treatments like lithotripsy or surgery. Remote imaging interpretation enables quick triage and monitoring, especially where radiology expertise is limited. In complex urological reconstruction, 3D imaging supports precise preoperative planning. Programs like NYU Langone Health’s use of 3D augmented reality models highlight the value of these services for remote collaboration and improved surgical outcomes.

High Utilization States:

-

California: Home to institutions like Pomona Valley Hospital, which utilizes advanced diagnostic imaging per-case pay services, which include 3D mammography and CT scans.

-

Minnesota: The University of Minnesota's Visible Heart Laboratories specializes in creating 3D-printed heart models for educational and surgical planning purposes.

-

Headquarters of 3DR Labs, the largest 3D medical image post-processing lab in the U.S., serving numerous healthcare facilities nationwide.

Moderate Utilization States:

-

New York: Academic and tertiary hospitals have engaged with providers for 3D modeling services.

-

Texas: Several community health systems use remote 3D modeling services for cardiovascular and neuroimaging cases.

-

Florida: Utilization is growing, particularly in orthopedic surgery centers.

Europe 3D Imaging Distance Service Market Trends

The 3D imaging distance service market in Europe is experiencing robust growth, fueled by technological advancements and rising healthcare demands. A pivotal moment for this sector dates back to the 1990s, when an EU-funded research project, PHIDIAS, pioneered 3D printing in medicine. Sparked by Fried Vancraen’s discovery of a 3D printer at a German trade show in 1990, the Belgian start-up Materialise emerged as a medical innovator. With funding from the EU, Materialise collaborated with Siemens, KU Leuven, and UK-based Imperial Chemical Industries to create accurate 3D models from CT scans, aiding complex surgeries in January 2025. This marked a significant shift in pre-surgical planning, replacing error-prone “salami slice” scanning with spiral CT imaging for precision.

Materialise also benefited from new biocompatible polymers developed by Zeneca, which later merged into AstraZeneca, enabling patient-specific implants. Today, 3D printing plays a key role in surgical care across Europe, from prosthetics to personalized implants. Backed by initiatives like the EU4Health program (2021 - 2027), with USD 5.3 billion in funding, and strong healthcare investment from countries like Germany and France, Europe continues to lead innovation in medical imaging and 3D technologies.

The UK 3D imaging distance service market is growing rapidly, driven by the NHS rollout of AI-powered 3D heart scans, which speed up diagnosis and reduce invasive testing. Available in 56 hospitals, HeartFlow technology creates personalized 3D models from CT scans, enabling faster, more accurate diagnoses of coronary heart disease. This approach has helped over 24,000 patients, saving the NHS an estimated £9.5 million. It reduced unnecessary invasive angiograms by 16% and second heart tests by 12%. The tool also helps identify optimal stent placement. This innovation supports the NHS's digital transformation and improves cardiac care outcomes.

The 3D imaging distance service market in France is poised for substantial growth, driven by the increasing demand for advanced diagnostic tools and surgical planning solutions. In 2023, France reported approximately 433,136 new cancer cases, with incidence rates of 354.9 per 100,000 men and 274.0 per 100,000 women. Breast cancer was the most prevalent among women, accounting for 61,214 cases, while prostate cancer was the most prevalent among men, with 59,885 cases. The rising cancer burden underscores the need for precise imaging technologies. 3D imaging distance services enable clinicians to visualize complex anatomies remotely, enhancing preoperative planning and patient outcomes. As France continues to invest in healthcare innovation, adopting these services is expected to accelerate.

Germany 3D imaging distance service market is witnessing consistent growth, driven by increased healthcare investments and advancements in imaging technology. In 2023, the country’s healthcare expenditure rose to approximately 11.7% of GDP, up from 11.2%, underscoring its commitment to enhancing medical infrastructure and embracing cutting-edge diagnostic and surgical tools.

Asia Pacific 3D Imaging Distance Service Market Trends

The 3D imaging distance service market in Asia Pacificis expanding significantly, fueled by swift technological progress, growing healthcare investments, and increasing use of advanced imaging solutions. Leading nations such as China, India, and Japan are actively adopting 3D imaging, especially in healthcare for diagnostics and surgical planning, resulting in better clinical outcomes. Moreover, its application in manufacturing boosts product development and quality assurance. Government support and regional innovation are vital in accelerating this growth, positioning Asia Pacific as a key hub for the future development and deployment of 3D imaging distance services across various sectors.

Japan 3D imaging distance service market is experiencing consistent growth, driven by its advanced healthcare infrastructure, ongoing technological innovation, and proactive government support. A key example is Holoeyes Edu, which offers immersive 3D anatomical models and enhances medical training. This tool significantly improves nursing education and surgical training by enabling learners to visualize and interact with anatomical structures, overcoming the limitations of traditional 2D methods. Holoeyes, in collaboration with Jameel Health, aims to expand this platform globally. The initiative reflects Japan’s broader strategy to integrate advanced visualization technologies for medical education and improve patient outcomes through precision learning.

The 3D imaging distance service market in China is projected to grow significantly during the forecast period, driven by the country's rapid adoption of advanced imaging technologies across various sectors, including healthcare. In healthcare, increasing investments are enhancing diagnostic capabilities and surgical planning. The manufacturing sector benefits from 3D imaging through improved quality control and product design. Additionally, the entertainment industry leverages these technologies for immersive experiences. The convergence of these factors underscores China's commitment to integrating 3D imaging solutions, positioning the country as a significant player in the global 3D imaging landscape.

India 3D imaging distance service market is advancing due to the growing demand for advanced diagnostic tools and the presence of global innovators. Innersight Labs Ltd., a spin-off from King’s College London founded by Oxford graduates Lorenz Berger and Eoin Hyde, has expanded into India following its acquisition by medtech giant KARL STORZ. The company’s office in India marks a strategic move to tap into the country's rising healthcare needs and support remote 3D imaging services. This expansion enhances access to AI-driven surgical planning tools, enabling improved preoperative assessment and fostering innovation within India’s evolving medical imaging ecosystem.

Latin America 3D Imaging Distance Service Market Trends

The 3D imaging distance service market in Latin America is experiencing significant growth, driven by the increasing cancer burden in Brazil and Argentina. In Brazil, the National Cancer Institute estimates approximately 704,000 new cancer cases annually between 2023 and 2025, with breast and prostate cancers being the most prevalent. Similarly, Argentina reports an age-standardized cancer incidence rate of 215.8 per 100,000 population, with breast cancer being the most common among women and prostate cancer among men. These statistics underscore the critical need for advanced diagnostic and treatment planning solutions, such as 3D imaging distance services, to enhance patient outcomes and address the growing healthcare demands in the region.

Middle East & Africa 3D Imaging Distance Service Market Trends

The 3D imaging distance service market in the Middle East & Africa is experiencing significant growth, driven by a mix of healthcare modernization efforts, expanding telemedicine infrastructure, and rising demand for precision surgical planning. In wealthier Gulf states like the UAE and Saudi Arabia, government-backed digital health initiatives, such as Saudi Vision 2030 and Dubai Health Strategy, actively promote the integration of advanced technologies, including 3D imaging and printing, into mainstream clinical workflows. The region's increasing investment in high-acuity care centers and medical tourism also fuels demand for sophisticated imaging tools to support complex cardiology, oncology, orthopedics, and neurosurgery procedures.

Saudi Arabia3D imaging distance service marketis experiencing significant growth, driven by advancements in medical imaging and the country's Vision 2030 initiative. This initiative aims to enhance healthcare infrastructure and integrate digital health technologies, including 3D imaging, into clinical practices.

Key 3D Imaging Distance Service Company Insights

Key players operating in the 3D imaging distance service market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key 3D Imaging Distance Service Companies:

The following are the leading companies in the 3D imaging distance service market. These companies collectively hold the largest market share and dictate industry trends.

- Medannot

- Ceevra, Inc.

- Visible Patient (VP)

- EDDA Technology, Inc.

- Materialise NV

- MeVis Medical Solutions AG

- 3D Systems, Inc.

- Innersight Labs Ltd.

- Precision Image Analysis, Inc.

- 3DR Labs, LLC.

Recent Developments

-

In June 2024, Ceevra received EU MDR Class IIa certification for its AI-based 3D digital imaging platform, which is used for surgical planning and visualization. This approval confirms its safety and efficacy, enabling its use across the EU. The platform improves outcomes by reducing surgery time and is already widely used in U.S. cancer care.

-

In September 2024, Medannot secured funding from Zero One Hundred to expand its no-code AI platform for radiology. The cloud-based tool enables clinicians to create and deploy AI models without coding, streamlining diagnostics and 3D imaging. The platform supports collaboration, regulatory approval, and monetization, aiming to transform radiology workflows with accessible automation

3D Imaging Distance Service Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 211.0 million

Revenue forecast in 2030

USD 364.3 million

Growth rate

CAGR of 11.5% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service model, application, sales method, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Medannot; Ceevra, Inc.; Visible Patient (VP); EDDA Technology, Inc.; Materialise NV; MeVis Medical Solutions AG; 3D Systems, Inc.; Innersight Labs Ltd.; Precision Image Analysis, Inc.; 3DR Labs, LLC.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 3D Imaging Distance Service Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global 3D imaging distance service market report on the basis of service model, application, sales method, and region:

-

Service Model Outlook (Revenue, USD Million, 2018 - 2030)

-

Per-Case Image Processing Services

-

Subscription-Based 3D Planning Platforms

-

Integrated Surgical Planning & Expert Consultation Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Urological Surgery

-

Oncological (e.g., prostate, kidney, bladder cancer)

-

Non-Oncological (e.g., reconstructions, stones)

-

-

Neurosurgery

-

Oncological (e.g., brain/spinal tumors)

-

Non-Oncological (e.g., epilepsy, vascular corrections)

-

-

Cardiovascular & Thoracic Surgery

-

Oncological (e.g., lung tumors)

-

Non-Oncological (e.g., valve repair, congenital defects)

-

-

General Surgery

-

Liver

-

Pancreas

-

Esophagus

-

Stomach

-

Rectal & Colorectal

-

Gynecology

-

Other (e.g., bariatric, hernia, etc.)

-

-

Other Applications

-

-

Sales Method Outlook (Revenue, USD Million, 2018 - 2030)

-

Direct Sales To Hospitals/Clinics

-

Online Self-Service Portals

-

Channel Partnerships / OEM Integrations

-

Reseller Or Value-Added Distributors (VADs)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global 3D imaging distance service market size was estimated at USD 189.2 mllion in 2024 and is expected to reach USD 211.0 million in 2025.

b. The global 3D imaging distance service market is expected to grow at a compound annual growth rate of 11.5% from 2025 to 2030 to reach USD 364.3 million by 2030.

b. In 2024, the general surgery segment led the 3D imaging distance service market with a 32.5% share, driven by the rising demand for advanced surgical technologies in a wide range of general surgery applications such as liver, pancreas, esophagus, stomach, rectal & colorectal, gynecology, and others.

b. Some key players operating in the 3D imaging distance service market include Medannot; Ceevra, Inc.; Visible Patient (VP); EDDA Technology, Inc.; Materialise NV; MeVis Medical Solutions AG; 3D Systems, Inc.; Innersight Labs Ltd.; Precision Image Analysis, Inc.; and 3DR Labs, LLC.

b. Key factors driving market growth include the rising demand for improved diagnostic precision, minimally invasive procedures, and telehealth integration. Moreover, the growing integration of AR/VR and AI in pre-surgical 3D planning and the rising use of personalized surgical simulation in oncology and urology further drive market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.