- Home

- »

- Electronic Devices

- »

-

3D Metrology Market Size, Share & Trends Report, 2030GVR Report cover

![3D Metrology Market Size, Share & Trends Report]()

3D Metrology Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Hardware (CMM, VMM), By Application (Quality Control & Inspection, 3D Scanning), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-053-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

3D Metrology Market Summary

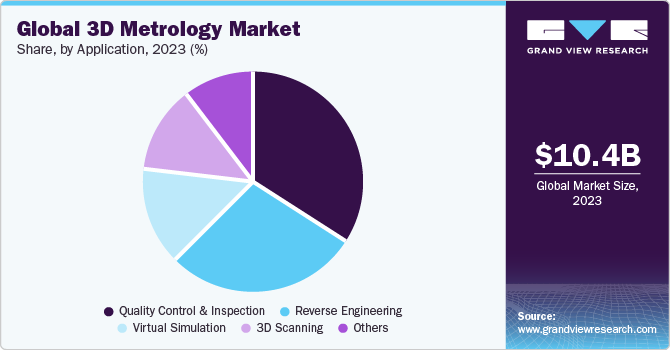

The global 3d metrology market size was estimated at USD 10,350.9 million in 2023 and is projected to reach USD 19,513.8 million by 2030, growing at a CAGR of 9.2% from 2024 to 2030. There is a growing trend of increased demand for quality control and inspection applications across a wide range of industries, including heavy machinery, automotive, energy, power, aerospace, construction, engineering, and medical, to ensure the quality of their goods, which is propelling the market's expansion.

Key Market Trends & Insights

- North America accounted for the largest revenue share of 34.5% of the global market in 2023.

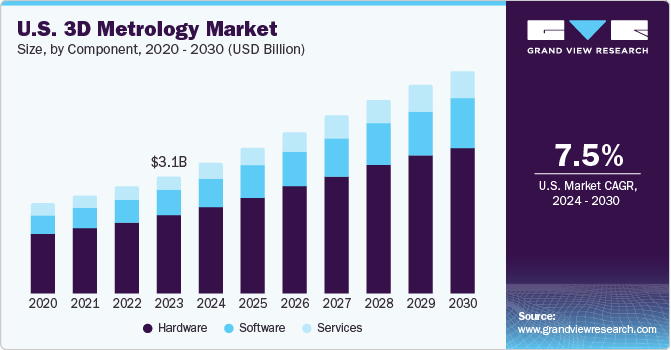

- The 3D metrology market in the U.S. is anticipated to grow at a CAGR of over 7% from 2024 to 2030.

- By component, the hardware segment recorded the largest revenue share of 66.7% in 2023.

- By hardware, the coordinate measuring machine (CMM) segment accounted for the largest market share in 2023.

- By application, the quality control & inspection segment accounted for the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 10,350.9 Million

- 2030 Projected Market Size: USD 19,513.8 Million

- CAGR (2024-2030): 9.2%

- North America: Largest market in 2023

Continuous technological advancements in the field of 3D metrology are fueling the market growth. Companies are developing innovative solutions that offer faster and more effective 3D measuring capabilities. The introduction of new scanning technologies with improved precision and productivity is a key focus area for industry players. For instance, in September 2023, 3DMakerpro introduced the SEAL and SEAL Lite next-generation scanners. The scanners redefined the cost of consumer-grade scanners and set a new benchmark for 3D scanning with their innovative optical technologies.

Government initiatives focused on promoting the adoption of 3D metrology have significantly contributed to market expansion. For instance, in various countries, medical devices are required to undergo metrological safety assessments and control tests, ensuring precision in implants, prostheses, dental applications, and critical components of medical devices like CT scanners and X-ray machines that require access to challenging areas. Furthermore, global governments are emphasizing advanced manufacturing programs that highlight the importance of 3D metrology, thereby fostering growth opportunities in the market.

The rise of Industry 4.0, characterized by interconnected systems, machine learning, and real-time data processing, is accelerating the demand for advanced technologies like 3D metrology systems. Companies are investing in cutting-edge solutions to enhance connectivity and efficiency across their operations. The development of intelligent metrology systems that leverage artificial intelligence (AI) algorithms to analyze data, detect anomalies, and make automated adjustments is one of the instances of how companies are embracing cutting-edge solutions to enhance their operations.

Additionally, a significant trend influencing the market is the integration of metrology directly into production lines for ultra-fast, highly precise, and detailed part scanning. Furthermore, the market is impacted by the industry's integration of robotics and automation, which promotes increased automation and efficiency in metrology procedures. For instance, industrial robots play a crucial role in enhancing the quality and reliability of measurement data, reducing errors, increasing efficiency, and providing high levels of repeatability in metrology processes.

Market Concentration & Characteristics

The degree of innovation in the market is anticipated to be high. The rise of Industry 4.0, characterized by interconnected systems, machine learning, and real-time data, is propelling innovation in the market. Businesses across various industries are adopting cutting-edge technologies, including sophisticated 3D metrology systems, to enhance connectivity and access to real-time information throughout the supply chain. Furthermore, companies are constantly investing in research and development to create novel technologies that offer faster, more accurate, and more efficient 3D measuring solutions. For instance, in March 2022, Shining 3D introduced advanced products like the FreeScan UE Pro, which combines photogrammetry and laser technology for enhanced productivity and precision in large-scale 3D inspection and reverse engineering.

The level of merger and acquisition activities in the market is expected to be moderate to high. The competitive nature of the industry and the importance of strategic partnerships and collaborations are driving growth and market expansion. The strategic moves are being made by key players to strengthen their positions, expand their product portfolios, and enhance their technological capabilities. Companies are actively engaging in mergers and acquisitions to gain a competitive edge, access new markets, and drive innovation. For instance, Ricoh, a leading provider of 3D-printed medical devices, entered a partnership with North Carolina State University to advance additive manufacturing in medical device manufacturing and surgery planning.

The impact of regulations on the market is expected to be moderate to high. Market players have to adhere to government policies, regulations, and incentives such as subsidiaries for renewable energy projects, and carbon pricing mechanisms, which impact the market dynamics and shape the industry landscape in terms of compliance, standards, and technological advancements.

The competition from product substitutes in the market is expected to be relatively low. While there are alternative tools and technologies, such as 2D metrology systems, traditional measurement tools, or non-contact measurement methods, these substitutes offer different capabilities, cost structures, or levels of precision compared to 3D metrology systems, influencing the choice of technology for specific applications and industries.

The end-user concentration in the market is anticipated to be high. 3D metrology finds applications across a broad spectrum of industries, including aerospace and defense, automotive, medical, construction, heavy machinery, and electronics. This necessitates the need for specialized 3D metrology solutions to meet the specific demands of different industries, contributing to the market dynamics and the need for customized offerings.

Component Insights

The hardware segment recorded the largest revenue share of 66.7% in 2023. The rising demand for high-precision measurement for quality control in the automotive, aerospace, and electronics industries is fueling the growth of this segment. The demand for high-precision measurement solutions in these sectors underscores the critical role of hardware in meeting stringent quality standards and enhancing overall product performance.

The services segment is projected to register the fastest CAGR of 10.0% over the forecast period. This segment includes consulting, integration, support, and maintenance services that are offered to end users. The integration services in 3D metrology systems ensure efficient operation of both hardware (such as scanners, probes, and sensors) and software (for data analysis and visualization) components. As industries are increasingly adopting these systems, it necessitates maintenance and calibration services as well as training and onboarding services, which are contributing to segmental growth.

Hardware Insights

The coordinate measuring machine (CMM) segment accounted for the largest market share in 2023. The growth of this segment is driven by the increasing demand for accurate measurements in industries like heavy machinery, automotive, aerospace, and electronics. These machines offer advanced measurement capabilities that are crucial for ensuring quality and compliance with industry standards.

The 3D automated optical inspection system (AoI) segment is expected to register a considerable CAGR from 2024 to 2030. The continuous evolution and advancement in technology, particularly in the field of electronics manufacturing, are driving the demand for more sophisticated inspection systems. The introduction of 3D AOI technology allows for more precise inspection and measurement of components on PCBs, enhancing defect detection capabilities.

End-use Insights

The aerospace and defense segment accounted for the largest revenue share in 2023. 3D metrology is used for designing, manufacturing, and maintaining various aircraft components and systems. Moreover, it is crucial for precision measurement as even the smallest imperfections can lead to significant reductions in the performance of the aircraft operating in extreme conditions. Technological developments in 3D metrology allow engineers to measure surface imperfections as small as nanometers, ensuring optimal performance for aerospace components. This is anticipated to increase demand for these solutions and support the segment's growth.

The medical segment is expected to register the fastest CAGR from 2024 to 2030. The growth is attributed to the crucial role played by metrology solutions in the development of medical devices to ensure safety and precision. The Medical Devices Act mandates that safety assessment tests and metrological controls be performed on certain devices. This makes it easier to achieve high levels of accuracy in dental applications, prosthetics, implants, and crucial assembly of medical devices like CT and X-ray machines which require access to difficult-to-reach places. The growing need to adhere to stringent international quality standards is expected to drive the demand for 3D metrology systems, which will favor segmental growth in the upcoming years.

Application Insights

The quality control & inspection segment accounted for the largest revenue share in 2023. This is attributed to the increasing importance of accuracy in quality control processes, the need to maintain certification standards, and the significant benefits of automated quality control systems in industries like automotive, metal, electronics, and others. In addition, to meet the demands of clients, manufacturers are implementing globally recognized quality standards including Six Sigma, ISO-9001, and QS-9000 in effect. The high usability of 3D metrology solutions in ensuring quality and reliability is expected to drive the segment growth over the coming years.

The 3D scanning segment is anticipated to record the fastest CAGR from 2024 to 2030. The growth is attributed to the increasing demand for 3D scanning solutions as they play a crucial role in metrology, ensuring precise measurements and accurate digital representations of physical objects. They capture millions of data points within seconds, creating high-resolution digital models. In aerospace and automotive sectors, 3D scanning aids in reverse engineering, rapid prototyping, and quality control processes. In healthcare, it supports applications like face and body scanning for medical purposes. Overall, the growth of the 3D scanning segment can be attributed to its ability to enhance efficiency, accuracy, and quality across diverse industry verticals through advanced metrology capabilities.

Regional Insights

North America accounted for the largest revenue share of 34.5% of the global market in 2023, owing to the ongoing trend of manufacturers pursuing automation and Industry 4.0 initiatives. In addition, the need for 3D metrology equipment is rising due to the significant presence of multiple manufacturers such as General Motors and Ford Motors, academic institutions, and prominent semiconductor companies. Furthermore, a major factor in the growing popularity of the 3D metrology industry in North America is the strong presence of U.S. manufacturers of pharmaceutical and aerospace components.

U.S. 3D Metrology Market Trends

The 3D metrology market in the U.S. is anticipated to grow at a CAGR of over 7% from 2024 to 2030, owing to the ongoing development of the manufacturing industry driven by the adoption of state-of-the-art technology in the country. Capabilities such as sheet metal fabrication, plastic injection molding, and precision machining all require increasingly intelligent metrology machines and equipment, which offers significant opportunities for the market.

Asia Pacific 3D Metrology Market Trends

The 3D metrology market in Asia Pacific is projected to be the fastest-growing market, anticipating a remarkable CAGR of 10.9% from 2024 to 2030. Asia Pacific is recognized as a significant industrial products manufacturing and engineering hub, with countries like China being prominent in manufacturing output across various industries. This industrial activity drives the need for 3D metrology in power generation and diverse industrial applications. In addition, the region has become a global manufacturing powerhouse in the automotive, electronics, and aerospace industries, creating lucrative growth opportunities for the market.

The China 3D metrology market is projected to grow at a CAGR of over 10.0% from 2024 to 2030. This is attributed to the nation's emphasis on accuracy, its prominence as a hub for global manufacturing, and a surge in demand for precise engineering, industrial applications, and power generation.

The Japan 3D metrology market accounted for over 19% of the revenue share in 2023. There is a rising trend in the use of portable and handheld 3D metrology devices in Japan, particularly in sectors like construction which is fueling the market growth.

The 3D metrology market in India is expected to grow at a CAGR of 13.8% from 2024 to 2030. Growing adoption of non-contact 3D metrology solutions, rising demand for high-end product quality, and automation of production processes are all key factors contributing to the market expansion.

Europe 3D Metrology Market Trends

The 3D metrology market in Europe is anticipated to grow at a CAGR of over 8.4% from 2024 to 2030. Europe’s strong focus on quality assurance and automation technologies, and the advancements in 3D metrology tools to align with innovative operational processes contribute to market growth.

The UK 3D metrology market accounted for over 20% revenue share of Europe in 2023. Innovation in additive manufacturing and the country's strong presence in the automotive and aerospace sectors are fueling the market expansion.

The 3D metrology market in Germany is expected to grow at a CAGR of 7.9% from 2024 to 2030. The influence of Industry 4.0 initiatives, industry-specific requirements, and automation integration, contribute to the market growth.

The France 3D metrology market is projected to grow at a CAGR of over 8.8% from 2024 to 2030, owing to significant investments in additive manufacturing for aviation improvement and the continuous technological advancements in 3D metrology solutions.

Middle East & Africa Market Trends

The 3D metrology market in Middle East and Africa is anticipated to grow at a CAGR of over 10% from 2024 to 2030. The utilization of 3D metrology in various industries such as manufacturing, automotive, aerospace, and logistics contributes to market growth.

The Saudi Arabia 3D metrology market accounted for a revenue share of over 25% in 2023. The increasing adoption of precise measurement and inspection systems across various industries, such as manufacturing and automotive, is contributing to market expansion.

Key 3D Metrology Company Insights

Some key players operating in the market include FARO Technologies, 3D Systems, and Hexagon AB.

-

FARO Technologies is a prominent player in the 3D Metrology industry, offering industry-leading solutions for 3D measurement, imaging, and digital realization. They provide a range of hardware solutions, including measurement arms and laser scanners, as well as software for processing scans and creating CAD-ready files. FARO Technologies also offers certified pre-owned industrial equipment, catering to various applications and budgets.

-

Hexagon AB is a significant player in the 3D Metrology industry, offering metrology-assisted manufacturing solutions that bring metrology-grade accuracy to industrial automation for more efficient manufacturing processes. The company's commitment to leveraging metrology data for greater automation in smart manufacturing underscores its role as a key player in advancing the industry with innovative solutions that enhance productivity and quality.

Some emerging players in the 3D Metrology industry include Heliotis AG, Metrologic Group, and Carmar Accuracy Co., Ltd

-

Heliotis AG is a Swiss company that specializes in developing, manufacturing, and distributing optical 3D measurement technology for industrial quality control. The company offers flexible laboratory systems that facilitate interactive examinations and fully automated batch measurements, allowing for the seamless transfer of research findings to production processes

-

Metrologic Group is a company specializing in 3D measurement technology, particularly in the field of quality control for industries like automotive, offering the Metrolog XG 3D measuring software. The company is known for developing innovative and universal 3D metrology solutions, working closely with manufacturers to achieve their quality control objectives.

Key 3D Metrology Companies:

The following are the leading companies in the 3D metrology market. These companies collectively hold the largest market share and dictate industry trends.

- 3D Systems Inc

- Carl Zeiss AG

- Carl Zeiss GOM Metrology

- Carmar Accuracy Co.Ltd

- Creaform

- FARO Technologies Inc

- Heliotis AG

- Hexagon AB

- Intertek Group Plc

- Keyence

- KLA Corporation

- Langley Holdings

- Metrologic Group

- Nikon Corporation

- Renishaw Group

- WENZEL Group

- Zygo Corporation

Recent Developments

-

In November 2023, Carl Zeiss AG launched the new Zeiss Inspect 3D metrology software, a cutting-edge solution designed for the inspection and evaluation of 3D measurement data. This software offers numerous new functions, enhancing data acquisition speed and improving evaluation capabilities for metrological tasks.

-

In October 2023, The HandySCAN 3D|MAX Series, a Truly Portable Metrology-Grade 3D Scanner for Large Parts, was introduced by Creaform. representing a significant advancement in 3D scanning technology. This innovative scanner offers a range of features that enhance its performance and usability in various industries, including aerospace, transportation, energy, mining, and heavy industries.

-

In April 2023, InnovMetric, a software development firm, launched PolyWorks 2023, a significant advancement that empowers manufacturers to digitally transform their 3D measurement processes.PolyWorks 2023 enhances the performance of 3D measurement teams through universal platform enhancements, reducing the cost of measuring in 3D in various ways.

3D metrology Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.5 billion

Revenue forecast in 2030

USD 19.51 billion

Growth rate

CAGR of 9.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, hardware, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; RoE; China; Japan; India; South Korea; RoAPAC; Brazil; Mexico; RoLATAM; Saudi Arabia; South Africa; RoMEA

Key companies profiled

3D Systems Inc; Carl Zeiss AG; Carl Zeiss GOM Metrology; Carmar Accuracy Co.Ltd; Creaform; FARO Technologies Inc; Heliotis AG; Hexagon AB; Intertek Group Plc; Keyence; KLA Corporation; Langley Holdings; Metrologic Group; Nikon Corporation; Renishaw Group; WENZEL Group; Zygo Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 3D Metrology Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global 3D metrology market report based on component, hardware, application, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Hardware Outlook (Revenue, USD Million, 2018 - 2030)

-

Coordinate Measuring Machine (CMM)

-

Optical Digitizer & Scanner (ODS)

-

Video Measuring Machine (VMM)

-

3D Automated Optical Inspection (AOI) System

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Quality Control & Inspection

-

Reverse Engineering

-

Virtual Simulation

-

3D Scanning

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Aerospace & Defense

-

Semiconductor & Electronics

-

Automotive

-

Medical

-

Construction & Engineering

-

Heavy Machinery

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

RoE

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

RoAPAC

-

-

Latin America

-

Brazil

-

Mexico

-

RoLATAM

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

RoMEA

-

-

Frequently Asked Questions About This Report

b. The global 3D metrology market size was estimated at USD 10.4 billion in 2023 and is expected to reach USD 11.5 billion in 2024.

b. The global 3D metrology market is expected to grow at a compound annual growth rate of 9.2% from 2024 to 2030 to reach USD 19.51 billion by 2030.

b. North America dominated the 3D metrology market with a share of 34% in 2023. The region is mainly driven by the strong presence of aerospace, automotive, and pharmaceutical equipment manufacturers in the U.S.

b. Some key players operating in the 3D metrology market include 3D Systems, Inc.; Zeiss International; FARO Technologies, Inc.; Hexagon AB; Intertek Group Plc; Nikon Corporation; KLA Corporation; Keyence Corporation; Perceptron, Inc.; Renishaw Plc; and Applied Materials.

b. Key factors that are driving the market growth include implementation of industry 4.0, coupled with an increase in R&D expenditure by metrology equipment manufacturers, and growing adoption of 3D metrology equipment by various industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.