- Home

- »

- Next Generation Technologies

- »

-

3D Printed Satellite Market Size, Share, Industry Report 2033GVR Report cover

![3D Printed Satellite Market Size, Share & Trends Report]()

3D Printed Satellite Market (2025 - 2033) Size, Share & Trends Analysis Report By Component, By Material (Polymers, Metals, Ceramics, Composites), By Satellite Type, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-755-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

3D Printed Satellite Market Summary

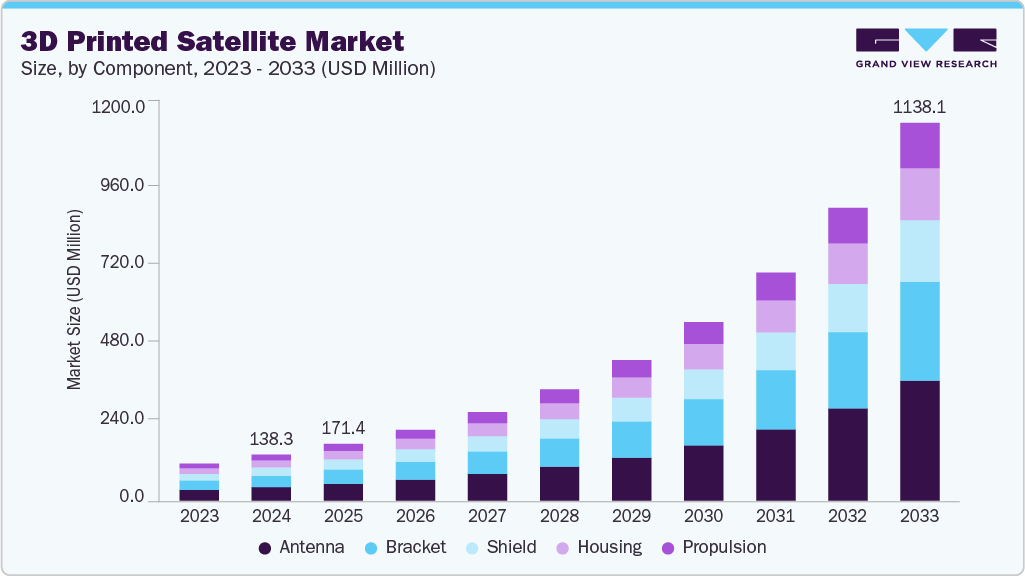

The global 3D printed satellite market size was estimated at USD 138.3 million in 2024 and is projected to reach USD 1,138.1 million by 2033, growing at a CAGR of 26.7% from 2025 to 2033. The market growth is primarily driven by the increasing demand for cost-effective, lightweight satellite components that can be rapidly manufactured and deployed.

Key Market Trends & Insights

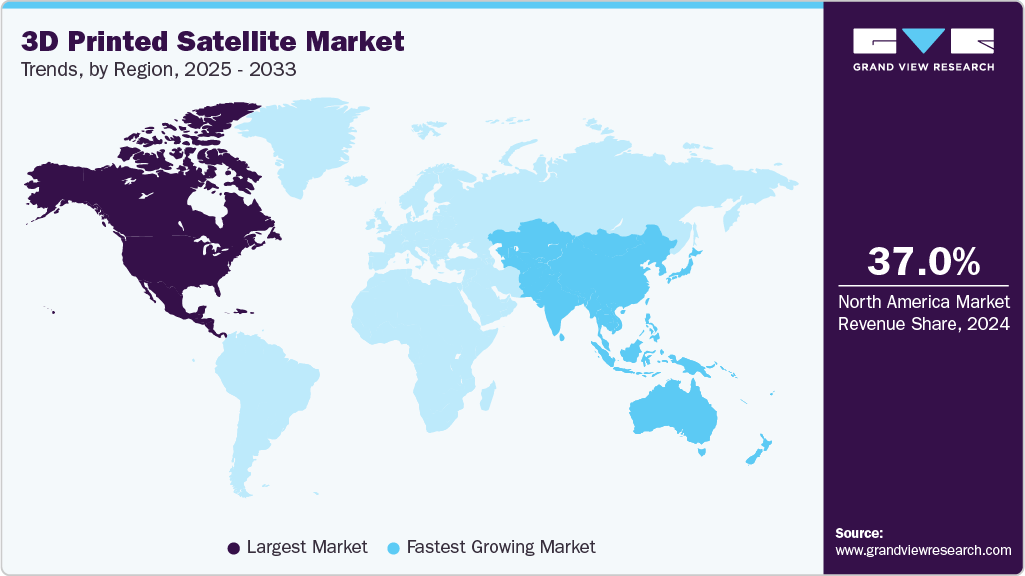

- North America dominated the global 3D printed satellite market with the largest revenue share of over 37% in 2024.

- The 3D printed satellite market in the U.S led the North America market and held the largest revenue share in 2024.

- By component, the antenna segment led the market and held the largest revenue share of over 29% in 2024.

- By satellite type, the nano and microsatellites segment dominates the market and holds the largest revenue share of over 40% in 2024.

- By application, the communication segment led the market and held the largest revenue share of over 31% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 138.3 Million

- 2033 Projected Market Size: USD 1,138.1 Million

- CAGR (2025-2033): 26.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The rising investments in space exploration, defense, and telecommunications sectors are expected to grow the 3D printed satellite market. The market growth is primarily driven by the increasing demand for lightweight and cost-efficient satellite components that enhance launch efficiency and reduce overall mission expenses. The rising need for rapid satellite deployment for communication, earth observation, and defense applications is prompting aerospace companies to adopt 3D printing technologies. Ongoing innovations in advanced metal alloys, polymer composites, and precision printing techniques are improving component reliability and design flexibility, which is expected to drive the 3D-printed satellite industry's expansion.

The increasing demand for cost-effective and lightweight satellite solutions is significantly fueling the growth of the 3D printed satellite industry. Traditional satellite manufacturing involves complex processes and high material waste, whereas 3D printing enables the creation of intricate geometries using less material, reducing production costs and lead times. This affordability allows startups, academic institutions, and emerging space agencies to access advanced satellite technology, thereby expanding market adoption. Lightweight components contribute to lower launch costs, making space missions more feasible and sustainable.

In addition, advancements in material science are becoming a key driver for the market’s expansion. High-performance alloys, composites, and radiation-resistant polymers used in 3D printing enhance the durability and reliability of satellite components in harsh space environments. These materials improve thermal resistance, structural integrity, and operational lifespan, crucial for deep-space exploration, communication constellations, and Earth observation missions. The ability to manufacture mission-specific designs quickly is positioning 3D printed satellites as a preferred solution.

Furthermore, the growing trend of small satellite constellations and low Earth orbit (LEO) deployments is accelerating the demand for 3D printed satellites. Miniaturized satellite systems allow faster deployment schedules and improved network redundancy, enabling high-speed data transmission and real-time global monitoring. Companies leverage 3D printing to rapidly prototype and deploy satellite batches, ensuring scalability and flexibility in meeting dynamic communication needs. These capabilities are essential in bridging digital divides and supporting remote sensing initiatives.

Moreover, the rise in space exploration missions and interplanetary research is propelling the demand for innovative satellite solutions. Missions targeting Mars, asteroids, and deep-space exploration require specialized payloads, radiation shielding, and thermal control systems. The flexibility to design custom satellite architectures suited for extreme environments supports scientific discovery and strategic defense initiatives. Global interest in space research intensifies, 3D printed satellites are increasingly seen as enablers of cutting-edge exploration, further propelling the growth of the 3D printed satellite industry.

Component Insights

The antenna segment dominated the market with a market share of over 29% in 2024, driven by its critical role in enabling reliable communication and data transmission for satellite networks. Their lightweight and high-strength designs, made possible through 3D printing, allow for rapid deployment and customization. The integration of advanced materials and additive manufacturing techniques allows antennas to withstand harsh space environments, further reinforcing the segment’s leadership in the 3D printed satellite industry.

The bracket segment is expected to witness a significant CAGR of over 27% from 2025 to 2033. This growth is attributed to the increasing deployment of modular satellite architectures that require lightweight yet durable support structures. The need for rapid satellite assembly and on-orbit servicing in Earth observation further drives the segment. Advancements in 3D printing using high-strength metals and composites allow for complex bracket designs that reduce weight while enhancing load-bearing capacity, thereby accelerating the adoption of 3D-printed brackets across the market.

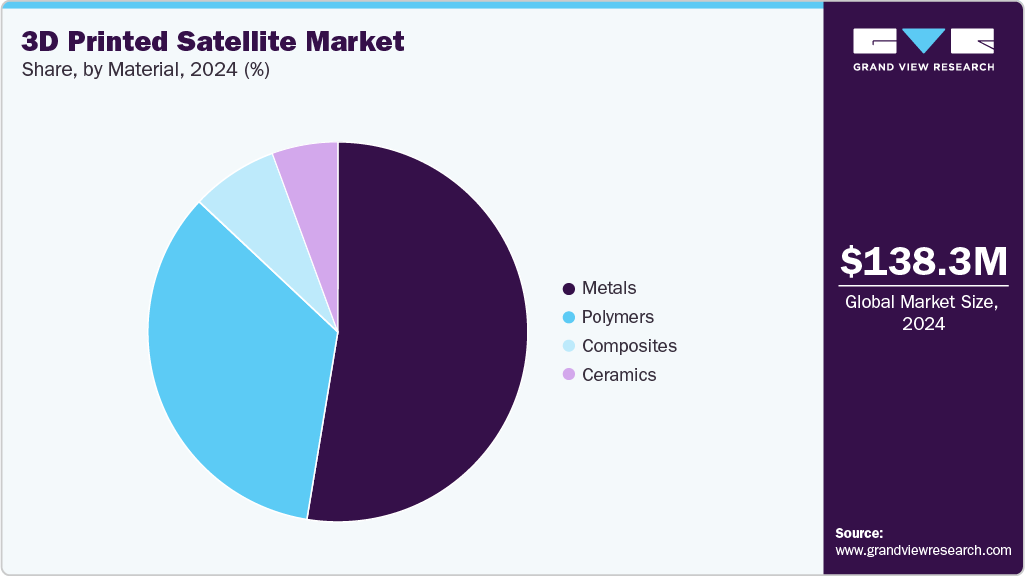

Material Insights

The metals segment accounted for the largest market share in 2024, owing to the rising demand for high-performance satellite components that require superior strength, durability, and thermal resistance. The increasing deployment of communication, Earth observation, and navigation satellites is driving the need for robust and reliable components that can withstand radiation, temperature extremes, and mechanical stress. These factors are prompting manufacturers and end-users to prioritize metal-based 3D printing solutions, reinforcing the segment’s leadership in the 3D printed satellite market.

The ceramics segment is expected to witness the highest CAGR from 2025 to 2033. The increasing demand for ceramic components, such as thermal protection tiles, waveguides, and antenna substrates, drives this growth. Advanced ceramics enable satellites to withstand harsh conditions while maintaining structural integrity and signal efficiency. These advantages enhance mission success rates, reduce maintenance requirements, and support the growing deployment of satellites, reinforcing the ceramics segment’s leadership in the 3D printed satellite industry.

Satellite Type Insights

The nano and microsatellites segment accounted for the largest market share in 2024, driven by growing demand, which is fueled by advancements in 3D printing technologies, the production of lightweight and durable satellite structures has become possible. These innovations significantly reduce launch costs while increasing payload efficiency, enabling more economical and efficient satellite missions. The versatility, affordability, and quick manufacturing timelines position the nano and microsatellites segment as the leading force in the 3D printed satellite industry.

The small satellites segment is expected to witness a significant CAGR from 2025 to 2033. This growth is driven by the increasing need for cost-effective, rapidly deployable 3D printed satellites. The ability of small satellites to carry advanced payloads such as hyperspectral sensors, communication relays, and Earth observation instruments makes them ideal for monitoring climate change and providing real-time disaster management data. Their lightweight structure allows for faster manufacturing and launch cycles, reducing overall mission costs, reinforcing their position as a key growth area in the 3D printed satellite market.

Application Insights

The communication segment accounted for the largest market share in 2024, driven by the increasing demand for seamless, high-speed data transmission across remote and urban areas. This growth is fueled by the rising deployment of 3D printed satellites integrated with advanced antenna systems, which offer lightweight, cost-effective, and highly efficient communication solutions. Government initiatives to enhance satellite-based broadband connectivity and the growing demand for real-time communication for defense and aviation sectors are further propelling the adoption of this segment.

The technology development segment is expected to witness a significant CAGR from 2025 to 2033. The growing need for next-generation space communication and advanced defense systems is driving this growth. Increasing investments in AI-driven data processing, autonomous navigation, and secure satellite networks make technology upgrades essential. These improvements are accelerating research initiatives and fostering innovation, thereby propelling the technology development segment's growth in the 3D-printed satellite market.

Regional Insights

The North America 3D printed satellite market accounted for the largest market share of over 37.0% in 2024, primarily driven by substantial government investments in space innovation and defense programs. The presence of key aerospace and technology companies is fostering rapid prototyping and commercialization of 3D printed satellite solutions. The availability of cutting-edge materials and high-performance computing infrastructure further enables the integration of AI-powered analytics and autonomous operations, reinforcing North America’s leadership in the 3D printed satellite market.

U.S. 3D Printed Satellite Market Trends

The U.S. 3D printed satellite market is expected to grow at a CAGR of over 23% from 2025 to 2033. The expanding commercial space sector in regions such as Silicon Valley and Florida, coupled with growing partnerships between aerospace startups and established manufacturers, accelerates the adoption of 3D printed satellites. These developments are enabling faster prototyping, reduced launch costs, and enhanced mission-specific designs, thereby strengthening the growth of the 3D printed satellite industry in the U.S.

Europe 3D Printed Satellite Market Trends

The Europe 3D printed satellite market is expected to grow at a CAGR of over 25% from 2025 to 2033. In Europe, the market is driven by increasing investments in space research and sustainable manufacturing technologies. The region’s focus on reducing space debris and enhancing supply chain resilience encourages the adoption of lightweight, efficient, and recyclable 3D printed satellite components. Collaborations between aerospace startups and defense agencies foster rapid prototyping of next-generation satellites, further strengthening the 3D printed satellite market growth.

The UK 3D printed satellite market is expected to grow at a significant rate in the coming years. The country’s strong aerospace sector, supported by organizations such as the UK Space Agency and the Satellite Applications Catapult, encourages innovation in lightweight and cost-effective satellite manufacturing using 3D printing. Defense initiatives, including secure communications and surveillance support, also fuel growth. These developments create a favorable environment for adopting the advanced 3D printed satellite industry in the UK

The Germany 3D printed satellite market is driven by the country’s strong aerospace engineering expertise and its strategic investments in space research and technology. Germany’s focus on promoting sustainable manufacturing practices and reducing carbon emissions has encouraged the use of lightweight, resource-efficient 3D printed components in satellite production. The growing demand for high-resolution Earth observation for agriculture, environmental monitoring, and climate research further propels the adoption of the advanced, cost-effective 3D printed satellite industry.

Asia Pacific 3D Printed Satellite Market Trends

The Asia Pacific 3D printed satellite market is expected to grow at the highest CAGR of over 30% from 2025 to 2033, fueled by the region’s increasing investments in space research, government initiatives promoting indigenous satellite manufacturing, and the rising demand for cost-efficient communication networks. Supportive regulatory frameworks encouraging sustainable space missions and advancements in lightweight materials and AI-powered payload systems are strengthening the adoption of the 3D printed satellite industry in the region.

The Japan 3D printed satellite market is gaining traction, fueled by the country’s focus on technological innovation, space exploration, and disaster resilience. Japan’s leadership in precision engineering and advanced materials, supported by collaborations between JAXA, leading universities, and private aerospace firms, is fostering the development of lightweight, high-performance satellite components through 3D printing. Strong government funding, tax incentives for space startups, and an emphasis on reducing space debris through sustainable manufacturing practices are also propelling the market’s growth across Japan.

The China 3D printed satellite market is rapidly expanding. China’s ambitious space exploration programs and investments in satellite communication infrastructure are driving demand for cost-efficient and high-performance 3D printed satellites. China’s presence in advanced manufacturing clusters, availability of skilled labor, and supportive policies for private aerospace startups are enabling local companies to scale production and develop customized satellite solutions, further accelerating the adoption of 3D printed satellites across civil, defense, and commercial sectors in China.

Key 3D Printed Satellite Company Insights

Some of the key players operating in the market include Maxar Technologies and Boeing among others.

- Maxar Technologies is a leading innovator in the 3D-printed satellite market, with a proven track record of launching over 2,500 additive-manufactured parts into orbit, including key components for NASA’s Psyche mission. Maxar’s strategic advancement in the performance and weight reduction of satellite structures through 3D-printed titanium components, solidifying its position in high-performance 3D printed satellite manufacturing.

- Boeing is a leading innovator in satellite manufacturing, driving advancements in 3D printing technology with a focus on solar arrays. Boeing’s proprietary 3D-printed solar arrays reduce production time by 50%, accelerating satellite deployment starting and reinforcing its position as a key player in next-in the 3D printed satellite industry.

WISSto12 and Relativity Space, Inc. are some of the emerging market participants in the 3D printed satellite market.

-

SWISSto12 is a key emerging player in the 3D-printed satellite communications market, specializing in radio frequency (RF) components including antennas, filters, and waveguides. The largest intellectual property portfolio for 3D-printed space RF products, SWISSto12 leads innovation in satellite communication technologies, strengthening its position as a fast-growing force in the global 3D printed satellite industry.

-

Relativity Space, Inc. is a rising star in aerospace manufacturing, pioneering the use of 3D printing to produce its rocket parts, including structural and propulsion components. Relativity’s Terran 1 and upcoming Terran R launch vehicles significantly reduce production timelines from months to weeks, enabling flexible and rapid satellite mission deployments and advancing the next generation of the 3D printed satellite industry.

Key 3D Printed Satellite Companies:

The following are the leading companies in the 3D printed satellite market. These companies collectively hold the largest market share and dictate industry trends.

- Maxar Technologies

- Boeing

- Northrop Grumman

- Lockheed Martin Corporation

- Fleet Space Technologies Pty Ltd

- Thales Alenia Space

- 3D Systems, Inc.

- SWISSto12

- Relativity Space, Inc.

- Rocket Lab

Recent Developments

-

In September 2025, Boeing unveiled 3D-printed solar array substrate technology that reduces composite build times by up to 50%. This innovative approach integrates additive manufacturing with high-efficiency solar cells and automated assembly, enabling faster, more efficient production of satellite solar arrays set, reinforcing Boeing's leadership in the 3D printed satellite industry.

-

In September 2025, Lockheed Martin Corporation partnered with NAMI, a joint venture between 3D Systems and Saudi Arabia’s DUSSUR, to qualify and manufacture aluminum 3D-printed aerospace components. Lockheed Martin’s commitment to the partnership marks a significant milestone in its localization efforts, aiming to boost economic growth in the 3D printed satellite market.

-

In June 2025, Maxar Technologies partnered with Array Labs to enhance its 3D Operational Terrain platform. This collaboration aims to provide rapid updates to Maxar's global 3D terrain, offering unparalleled insights for defense and commercial applications. This partnership further strengthens Maxar's leadership and innovation in the 3D-printed satellite market by integrating advanced terrain data with cutting-edge satellite manufacturing.

3D Printed Satellite Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 171.4 million

Revenue forecast in 2033

USD 1,138.1 million

Growth rate

CAGR of 26.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, material, satellite type, application, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

Maxar Technologies; Boeing; Northrop Grumman; Lockheed Martin Corporation; Fleet Space Technologies Pty Ltd; Thales Alenia Space; 3D Systems, Inc.; SWISSto12; Relativity Space, Inc.; Rocket Lab

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global 3D Printed Satellite Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the 3D printed satellitemarket report based on component, material, satellite type, application, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Antenna

-

Bracket

-

Shield

-

Housing

-

Propulsion

-

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Polymers

-

Metals

-

Ceramics

-

Composites

-

-

Satellite Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Nano and Microsatellites

-

Small Satellites

-

Medium and Large Satellites

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Communication

-

Earth Observation

-

Navigation

-

Technology Development

-

Scientific Research

-

Military Surveillance

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global 3D printed satellite market was estimated at USD 138.3 million in 2024 and is expected to reach USD 171.4 million in 2025.

b. The global 3D printed satellite market is expected to grow at a compound annual growth rate of 26.7% from 2025 to 2033 and to reach USD 1,138.1 million by 2033.

b. The North America 3D printed satellite market accounted for the largest market share of over 40% in 2024, primarily driven by substantial government investments in space innovation and defense programs. The presence of key aerospace and technology companies is fostering rapid prototyping and commercialization of 3D printed satellite solutions. The availability of cutting-edge materials and high-performance computing infrastructure further enables the integration of AI-powered analytics and autonomous operations, reinforcing North America’s leadership in the 3D printed satellite market.

b. The key players in the 3D printed satellite market are Maxar Technologies, Boeing, Northrop Grumman, Lockheed Martin Corporation, Fleet Space Technologies Pty Ltd, Thales Alenia Space, 3D Systems, Inc., SWISSto12, Relativity Space, Inc., Rocket Lab.

b. Key drivers of the 3D-printed satellite market include the increasing demand for cost-effective, lightweight satellite components that can be rapidly manufactured and deployed. Rising investments in space exploration, defense, and telecommunications sectors are expected to grow the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.