- Home

- »

- Next Generation Technologies

- »

-

4D Imaging Radar Market Size, Share, Industry Report, 2033GVR Report cover

![4D Imaging Radar Market Size, Share & Trends Report]()

4D Imaging Radar Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (Short, Medium, Long), By Application (Automotive, Aerospace & Defense, Security & Surveillance, Traffic Monitoring & Management), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-475-3

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

4D Imaging Radar Market Summary

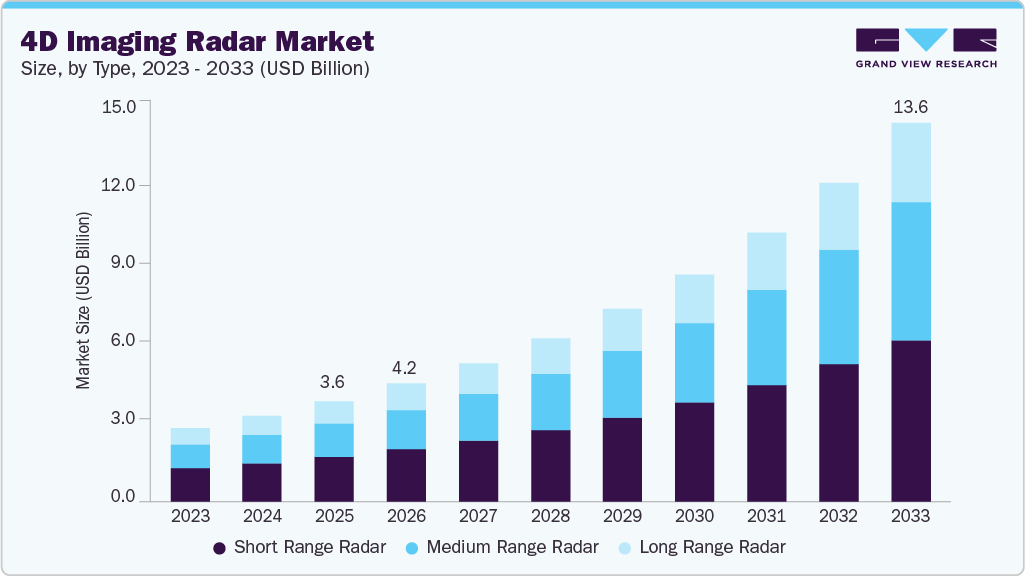

The global 4D imaging radar market size was estimated at USD 3.62 billion in 2025, and is projected to reach USD 13.61 billion by 2033, growing at a CAGR of 18.1% from 2026 to 2033. The market is gaining momentum, driven by rising demand for high-resolution sensing across autonomous vehicles and advanced driver assistance systems.

Key Market Trends & Insights

- The North America 4D imaging radar market accounted for a global revenue share of 35.0% in 2025.

- The 4D imaging radar industry in the U.S. held a dominant position in 2025.

- By type, the short range radar segment accounted for the largest revenue share of 44.9% in 2025.

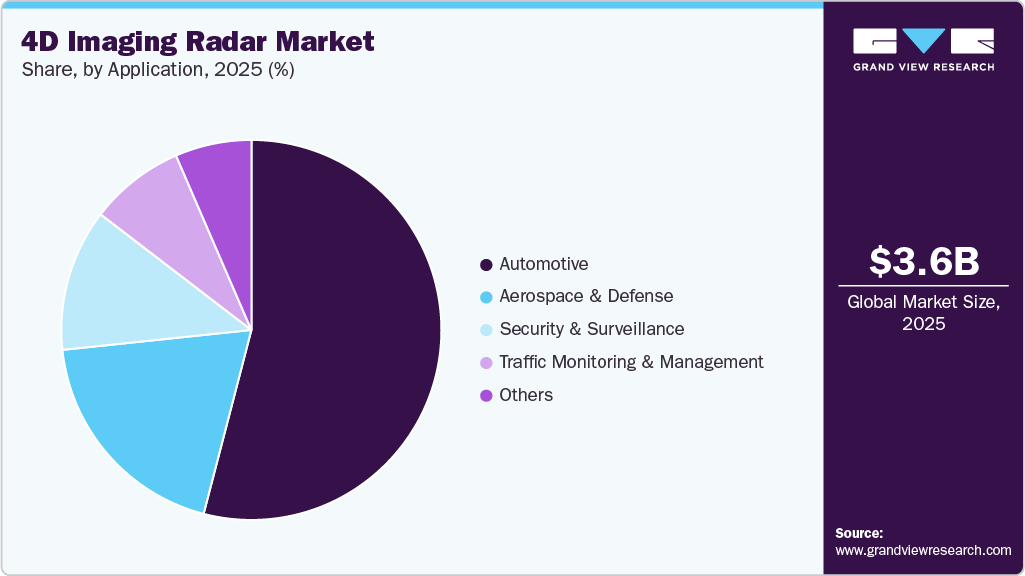

- By application, the automotive segment held the largest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 3.62 Billion

- 2033 Projected Market Size: USD 13.61 Billion

- CAGR (2026-2033): 18.1%

- North America: Largest Market in 2025

- Asia Pacific: Fastest Growing Market

The increasing use of radar for reliable object detection in poor visibility conditions is accelerating its adoption in automotive and mobility platforms. The growing applications in defense, security, and smart traffic systems are further driving market growth. Advancements in MIMO architectures, radar chipsets, and AI-based signal processing are enhancing imaging accuracy while reducing system costs, thereby supporting wider commercial deployment. However, high development costs and the need for precise calibration remain key challenges, particularly for large-scale commercial deployment.Rapid adoption of advanced driver assistance systems (ADAS) is driving demand for 4D imaging radar, as automakers prioritize technologies that enhance situational awareness and reduce collision risks. Core ADAS features such as automatic emergency braking (AEB), adaptive cruise control (ACC), blind spot detection (BSD), and traffic jam assist increasingly rely on high-resolution sensing to operate reliably in complex driving environments. Traditional radars provide range and speed, but they fall short in elevation mapping and object separation, capabilities essential for next-generation ADAS. This gap is being bridged by 4D imaging radar, which delivers precise point-cloud data, superior object classification, and robust detection in all weather and lighting conditions.

Rising ADAS penetration across vehicle segments is prompting OEMs to adopt 4D imaging radar as a foundational sensing modality. Also, the growing demand for high-precision sensing in commercial and industrial automation environments is supporting the market. Modern automated systems, whether in manufacturing, logistics, construction, or mining, require extremely accurate perception capabilities to detect objects, assess distances, and track movement in real time. 4D imaging radar offers centimeter-level accuracy, a wide field of view, and robust depth perception, making it well-suited to increasingly complex and data-driven automated operations.

Sensor-fusion integration in mobility and autonomous systems is creating a strong growth opportunity for the 4D imaging radar market, driven by the need for highly reliable and comprehensive environmental perception. Modern vehicles increasingly rely on a combination of cameras, LiDAR, radar, and ultrasonic sensors to generate a unified and accurate understanding of the driving environment. 4D imaging radar enhances this fusion stack by adding high-resolution elevation, velocity, and range data that traditional radar cannot provide. Its ability to maintain performance across adverse weather and lighting conditions makes it a critical component for building redundancy and reliability in sensor-fusion architectures.

The growing complexity of autonomous driving functions, particularly at Levels 2 and above, is further increasing the demand for advanced sensing systems that complement one another. Cameras offer rich visual detail, and LiDAR provides precise depth mapping, but both technologies face limitations in fog, heavy rain, glare, or low-light scenarios. 4D imaging radar fills these perception gaps while supporting long-range detection and robust object tracking. This complementary role strengthens the overall fusion layer by ensuring that autonomous decision-making systems receive consistent and dependable data, even in challenging environments.

High system complexity and integration challenges hinder the growth of the 4D imaging radar industry. These systems require sophisticated hardware architectures that combine multi-channel antennas, high-speed signal processors, advanced SoCs, and precise calibration models. Thus, product development cycles become longer, and engineering costs escalate, discouraging smaller OEMs and Tier 2 suppliers from entering the market. This level of complexity also creates dependency on specialized talent in RF engineering, signal processing, and AI-based perception algorithms, skills that remain scarce in many regions.

Type Insights

The short range radar segment led the 4D imaging radar market, accounting for the largest share of 44.9% in 2025. Factors such as the increasing adoption of advanced driver-assistance systems (ADAS), including parking assist, blind-spot detection, lane-change assistance, and collision avoidance, rely heavily on short-range radar for precise close-proximity sensing. Its compact size, lower cost, and ease of integration make it ideal for passenger vehicles and urban mobility platforms.Increasing demand for compact, cost-effective radar solutions in passenger vehicles and urban mobility applications further supports growth in this segment.

The medium range radar segment is expected to grow at the fastest CAGR from 2026 to 2033. Medium-range 4D imaging radar is positioned as the workhorse for surround-view and intersection/cross-traffic awareness, filling the gap between short-range proximity sensing and long-range forward perception.Rising deployment of Level 2 plus and Level 3 autonomy features is accelerating demand for radars that can deliver accurate mid-distance object classification, lane-change support, and side-rear collision avoidance. Increasing integration of medium-range radars within multi-sensor fusion architectures, supported by improvements in MIMO antenna design and high-resolution imaging algorithms, is further strengthening its adoption.

Application Insights

The automotive segment accounted for the largest share of the 4D imaging radar industry in 2025,driven by the rapid adoption of advanced driver-assistance systems (ADAS), increasing demand for autonomous and semi-autonomous vehicles, and stringent safety regulations that mandate collision avoidance and emergency braking systems. The growing integration of electric vehicles and smart mobility solutions further supports the deployment of high-resolution 4D radar in passenger and commercial vehicles.

The traffic monitoring & management segment is expected to grow at a significant CAGR during the forecast period. Traffic management authorities and smart-city programs are adopting 4D imaging radar to achieve more accurate, real-time visibility into vehicle flow, congestion, and safety risks across urban and highway environments.With its ability to detect vehicle type, speed, trajectory, and vulnerable road users, even in rain, fog, or at night, 4D radar offers far greater situational awareness than camera-only or inductive-loop systems.Growing investment in intelligent transportation systems, demand for automated incident detection, and the shift toward data-driven traffic optimization platforms are driving market growth in this segment.

Regional Insights

North America dominated the 4D imaging radar market, accounting for a 35.0% revenue share in 2025, and is expected to retain its dominance over the forecast period, driven by the rapid adoption of ADAS and autonomous vehicle initiatives. Strong regulatory support, including safety mandates for collision avoidance systems, encourages OEMs to integrate high-resolution radar solutions. The increasing adoption of electric vehicles, investment in smart traffic infrastructure, and growing demand for advanced perception systems further propel market growth.

U.S. 4D Imaging Radar Market Trends

The U.S. 4D imaging radar industry held a dominant position in 2025. The market is witnessing a significant transformation, driven by accelerating R&D activities in high-resolution radar chipsets and large-scale testing programs led by major technology companies and autonomous vehicle developers. Growing federal and state-level funding for intelligent transportation upgrades, including automated incident detection and congestion analytics, is strengthening demand for advanced radar-based sensing.Rising investments by semiconductor manufacturers in mmWave radar production, along with strong participation from leading Tier 1 suppliers, are also contributing to market expansion in the country.

The Canada 4D imaging radar market’s growth is supported by expanding investments in connected mobility pilots, smart-road infrastructure, and advanced safety technologies across commercial fleets. The rising emphasis on all-weather sensing performance, particularly in regions with heavy snow and low visibility conditions, is driving the stronger adoption of high-resolution radar solutions among OEMs and municipal authorities.

The 4D imaging radar market in Mexico is gaining momentum due to increasing automotive manufacturing activities, growing integration of ADAS features in mid-range vehicles, and rising demand for cost-effective perception technologies. Expanding production hubs for global OEMs and investments in next-generation vehicle platforms are further contributing to the country’s market growth.

Europe 4D Imaging Radar Market Trends

The Europe 4D imaging radar industry was identified as a lucrative region in 2025. The market is witnessing a significant transformation, driven by stringent automotive safety regulations, growing investments in ADAS-focused innovation, and heightened demand for resilient security and surveillance systems across critical infrastructure. Automakers in Germany, France, and the Nordics are integrating high-resolution radars to meet Euro NCAP’s evolving safety requirements and to support highway pilot initiatives.

The Germany 4D imaging radar market is being shaped by increasing integration of high-precision radar systems within premium automotive platforms, supported by Germany’s strong engineering base and leadership in advanced vehicle safety technologies. Growing investment in automated highway driving programs, coupled with rapid development of radar fusion architectures by major Tier 1 suppliers, is accelerating adoption.

The 4D imaging radar market in the UK is gaining momentum due to the increasing deployment of sensor technologies in autonomous public transport pilots, smart road corridors, and automated freight initiatives. Companies in the UK are actively developing compact 4D radar modules, advancing software-defined radar platforms, and partnering with mobility operators to trial high-resolution sensing systems across autonomous shuttles, logistics fleets, and smart-infrastructure testbeds. Growth in the country’s startup ecosystem, focusing on AI-driven radar processing and edge-based perception, is strengthening innovation and supporting wider commercial adoption.

Asia Pacific 4D Imaging Radar Market Trends

The Asia Pacific 4D imaging radar industry was identified as a lucrative region in 2025. The market is being driven by the rapid electrification of vehicles, the expansion of autonomous mobility pilots, and the rising security and surveillance needs in densely populated cities. Automakers in China, Japan, and South Korea are aggressively deploying imaging radars in next-generation EVs, leveraging the technology for improved safety, parking automation, and highway autonomy. Governments and industrial operators are utilizing 4D radar for smart city deployments, port automation, and infrastructure monitoring, where 24/7 environmental resilience is essential.

The China 4D imaging radar market held a substantial market share in 2025. Chinese automakers, such as BYD, Xpeng, and Geely, are integrating 4D radar into next-generation ADAS and highway assist systems to enhance perception accuracy in dense and complex traffic environments. Local radar manufacturers are focusing on cost-optimized 4D imaging radar modules, high-channel MIMO architectures, and multi-sensor fusion optimized for China’s urban road scenarios. The market is experiencing rapid growth, driven by large-scale deployment of autonomous driving test zones, expansion of EV manufacturing, and aggressive investments by domestic Tier 1 suppliers in high-resolution radar platforms.

The 4D imaging radar market in Japan held a significant share in 2025. The market is influenced by the steady push toward advanced safety technologies aligned with Japan NCAP standards and the country’s commitment to reducing traffic accidents involving pedestrians and elderly road users. Japanese OEMs such as Toyota, Nissan, and Honda are prioritizing compact, power-efficient 4D radar units that enhance low-speed urban perception, intersection monitoring, and nighttime object detection.Growing deployment of high-precision radars in rail systems, port automation projects, and robotics applications is also shaping the country’s market growth.

Key 4D Imaging Radar Company Insights

Some of the key players operating in the market include Robert Bosch GmbH, ZF Friedrichshafen AG, Arbe, and Aptiv.

-

Robert Bosch GmbH is a global technology leader recognized for its extensive capabilities in mobility solutions, industrial systems, consumer technologies, and energy-efficient products. The company has established a strong footprint in automotive electronics and sensor-based safety systems, consistently driving innovation across the ADAS ecosystem. In the radar domain, Bosch plays a pivotal role in advancing 4D imaging radar technologies that deliver precise measurements of elevation, angle, velocity, and long-range distance.

-

ZF Friedrichshafen AG is a major global provider of mobility solutions, integrating mechanical engineering excellence with electronics, software, and intelligent control systems. Its portfolio spans driveline, chassis, vehicle motion control, and advanced safety technologies used across passenger and commercial vehicles. Building on this foundation, ZF has emerged as a significant contributor to the next wave of radar-based perception. The company’s 4D imaging radar platforms provide detailed environmental mapping and elevation detection, along with a wide field of view and long-range sensing, making them well-suited for complex city scenarios and automated highway maneuvers.

Key 4D Imaging Radar Companies:

The following are the leading companies in the 4D imaging radar market. These companies collectively hold the largest market share and dictate industry trends.

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- Arbe

- Aptiv

- Renesas Electronics Corporation

- Zadar Labs, Inc.

- Huawei Technologies Co., Ltd.

- Continental AG

- RADSee Technologies Ltd.

- s.m.s, smart microwave sensors GmbH

Recent Developments

-

In November 2025, Zadar Labs, Inc. announced the launch of Zadar Saudi Solutions (ZSS), a new joint venture in the Kingdom of Saudi Arabia. The venture is established in partnership with Bidaya Holding, an investment firm focused on technology and financial ecosystems across the GCC, and SmartChips, a prominent player in IoT development. ZSS will spearhead the rollout of SDIR technology across Saudi Arabia and the wider GCC region, providing advanced radar perception solutions for automotive, mobility, and smart infrastructure applications.

-

In October 2025, Aptiv unveiled its Gen-8 radar lineup featuring significantly higher channel density, enhanced resolution, and advanced imaging-grade capabilities, effectively doubling the channel count compared to the previous generation.

-

In January 2024, HiRain (Arbe-based) introduced the LRR610 4D imaging radar module, built on Arbe’s chipset and designed to deliver high-resolution long-range perception.

-

In February 2023, s.m.s., smart microwave sensors GmbH, and NXP Semiconductors collaborated to create a 4D radar sensor built on NXP’s SAF85xx one-chip radar SoC, enabling high-performance radar capabilities for mainstream autonomous driving and ADAS applications.

4D Imaging Radar Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 4.25 billion

Revenue forecast in 2033

USD 13.61 billion

Growth rate

CAGR of 18.1% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report Coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments Covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

Robert Bosch GmbH; ZF Friedrichshafen AG; Arbe; Aptiv; Renesas Electronics Corporation; Continental AG; Zadar Labs, Inc.; Huawei Technologies Co., Ltd.; RadSee; s.m.s, smart microwave sensors GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 4D Imaging Radar Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global 4D imaging radar market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Short Range Radar

-

Medium Range Radar

-

Long Range Radar

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Automotive

-

Aerospace & Defense

-

Security & Surveillance

-

Traffic Monitoring & Management

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global 4D imaging radar market size was estimated at USD 3.62 billion in 2025, and is projected to reach USD 13.61 billion by 2033, growing at a CAGR of 18.1% from 2026 to 2033.

b. The global 4D imaging radar market is expected to grow at a compound annual growth rate of 18.1% from 2026 to 2033 to reach USD 13.61 billion by 2030.

b. North America dominated the 4D imaging radar market with a share of 34.7% in 2025. The growing adoption of autonomous vehicles, where 4D imaging radar plays a critical role in enhancing safety and navigation, is a major factor contributing to the growth of the market.

b. Some of the key players operating in the 4D imaging radar market include Robert Bosch GmbH., ZF Friedrichshafen AG, Arbe, Aptiv., Renesas Electronics Corporation., Continental AG, Zadar Labs, Inc., Huawei Technologies Co., Ltd., RadSee, and Smartmicro.

b. Key factors driving the 4D imaging radar market include the increasing demand for Advanced Driver Assistance Systems (ADAS), autonomous vehicles, and enhanced safety features in automotive applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.