- Home

- »

- Next Generation Technologies

- »

-

5G Network Slicing Market Growth And Trends Report, 2030GVR Report cover

![5G Network Slicing Market Size, Share & Trends Report]()

5G Network Slicing Market (2023 - 2030) Size, Share & Trends Analysis Report By Component, By Type (RAN Slicing, Edge Slicing, End-to-End Network Slicing), By Network Architecture, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-048-1

- Number of Report Pages: 114

- Format: PDF

- Historical Range: 2020 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global 5G network slicing market size was valued at USD 208.2 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 43.0% from 2023 to 2030. 5G network slicing is a technology that allows mobile network operators to create multiple virtual networks within a single physical 5G network infrastructure. 5G network slicing provides several benefits such as increased network flexibility, better resource utilization, improved network efficiency, and enhanced user experiences. It enables mobile network operators to support a wide range of use cases and industries with different performance requirements, while also allowing them to differentiate their services and create new revenue streams. The demand for 5G network slicing is driven by the need for customized and flexible 5G networks that can meet the diverse requirements of various industries and use cases.

The growing adoption of the Internet of Things (IoT) to enable communication between sensors and connected devices is anticipated to increase the demand for 5G network slicing. By creating dedicated network slices for IoT devices, service providers can ensure that these devices have the necessary resources and QoS to operate efficiently and effectively.

Moreover, as the number of IoT devices continues to grow, service providers will need to scale their networks accordingly. 5G network slicing allows them to do so flexibly and cost-effectively creating new network slices as needed and allocating resources as required. This can help service providers to keep pace with the rapidly evolving IoT market and remain competitive. The growing demand for IoT devices and applications is driving the need for 5G network slicing, and this is expected to fuel the growth of the 5G network slicing market in the coming years.

Artificial Intelligence (AI) and Machine Learning (ML) are playing an important role in 5G network slicing. By analyzing network data in real-time, AI and ML algorithms can help to optimize network resource allocation, improve network efficiency, and enhance network security. Moreover, the growing demand for Augmented Reality (AR) and Virtual Reality (VR) in gaming applications is anticipated to increase the demand for 5G network slicing owing to the ability of the network slicing technology to provide a specialized and dedicated logical network.

Several players are collaborating to develop 5G network slicing for AR/VR applications, thereby supporting market growth. For instance, in June 2021, Telefonaktiebolaget LM Ericsson, Samsung Electronics Co. Ltd., and Deutsche Telekom AG announced the world’s first implementation of a 5G end-to-end network slicing for cloud VR streaming game application.

Network slicing is a rapidly evolving technology that enables service providers to offer customized connectivity services to their customers based on their specific needs. However, the lack of standardization for 5G standalone network slicing is a challenge that can limit interoperability between different vendors' products and hinder the market’s growth. Moreover, delivering high-quality services to each slice can be challenging, especially when the network is congested or the number of devices in a particular slice increases. Thus, the complexity of designing the 5G network slices is also expected to pose a challenge to market growth.

COVID-19 Impact

The COVID-19 pandemic has had a significant impact on the global economy. While the pandemic has presented many challenges for businesses, it has also created new opportunities for growth and innovation in the telecommunications industry. COVID-19 has accelerated the adoption of IoT devices and applications in various industries. As businesses looked for ways to operate more efficiently and remotely, they shifted to IoT devices to monitor and control their operations.

This created a greater demand for network slicing solutions that can support the diverse requirements of IoT applications. However, the pandemic has also presented challenges for the 5G network slicing market. With many businesses facing economic uncertainty, they hesitated to invest in new technologies like 5G network slicing.

Additionally, disruptions to global supply chains and manufacturing processes delayed the rollout of 5G networks and hindered the growth of the market. Overall, while COVID-19 has created both challenges and opportunities for the 5G network slicing market, it is expected to continue to grow during the forecast period as businesses and consumers demand faster and more reliable connectivity.

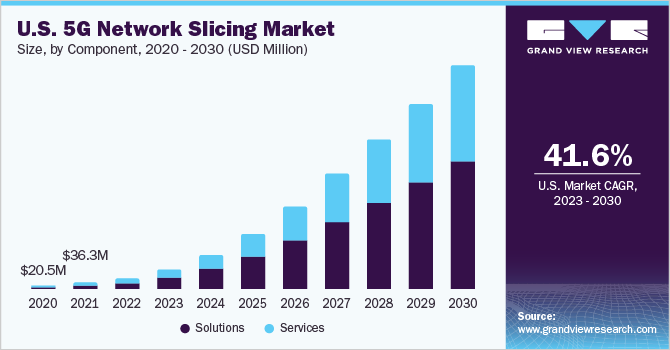

Component Insights

The solutions segment dominated the market in 2022 and accounted for a revenue share of more than 59.0%. The growth is driven by the rising need for 5G network slicing solutions to support diverse use cases with different requirements, such as ultra-reliable low-latency communication (URLLC), massive machine-type communication (mMTC), and enhanced mobile broadband (eMBB). Moreover, the rising demand for 5G network slicing solutions by various industries such as manufacturing, transportation, energy, and others to boost productivity by leveraging network slicing capabilities to boost productivity is expected to fuel the segment’s growth.

The services segment is anticipated to register the fastest growth over the forecast period. The segment is further split into professional and managed services. The managed services include services such as design, deployment, monitoring, optimization, and troubleshooting. The managed services segment is anticipated to be the fastest-growing segment throughout the projection period. The growth can be attributed to the ability of managed services providers to offer advanced analytics and automation capabilities to optimize network slicing performance and provide real-time insights into network traffic and usage patterns.

This can enable operators to better understand their customers' needs and preferences and tailor their services accordingly. In addition, the professional services include network planning, consulting, network management, and others. The professional services segment is predicted to witness substantial growth during the forecast period due to increasing demand for dedicated 5G networks from various industries and businesses.

Type Insights

The end-to-end slicing segment dominated the market in 2022 and accounted for a revenue share of more than 48.0%. The segment is estimated to grow at the highest CAGR during the forecast period. The end-to-end network slice is a logical network that covers both the 3rd Generation Partnership Project (3GPP) and non-3GPP domains and offers guaranteed Quality of Service (QoS). The growing adoption of 5G end-to-end network slicing is due to rising demand for uniform connectivity characteristics to serve several applications in different end-use sectors such as automotive, broadcasting, and others.

The edge slicing segment is anticipated to witness significant growth through the forecast period. 5G edge slicing allows for the creation of customized and optimized 5G network services and applications closer to the end-users, reducing latency and improving the user experience. It enables the creation of distributed network functions that can be placed at different points in the network, depending on the specific requirements of the application or service.

The ability of edge slicing to improve network security by enabling the deployment of customized security functions closer to the end-users, reducing the attack surface, and improving the overall security posture of the network is anticipated to support the growth of the segment.

Network Architecture Insights

The non-standalone segment dominated the market in 2022 and accounted for a revenue share of more than 70.0%. The growth of the segment is due to the increasing adoption of 5g network services from existing network infrastructure to reduce the initial costs of deploying the 5G network. Non-standalone architecture is a transitional 5G network deployment that relies on existing 4G/LTE infrastructure to deliver 5G services. However, as the market matures and the demand for 5G services grows, standalone 5G network architecture is expected to gain traction.

The standalone segment is expected to witness significant growth during the forecast period. Standalone 5G architecture is a pure 5G network deployment that does not rely on existing 4G/LTE infrastructure, providing better performance and greater flexibility compared to non-standalone architecture. The network slices created on a 5G standalone network offer higher speeds, lower latency, and better reliability, thereby driving the growth of the segment.

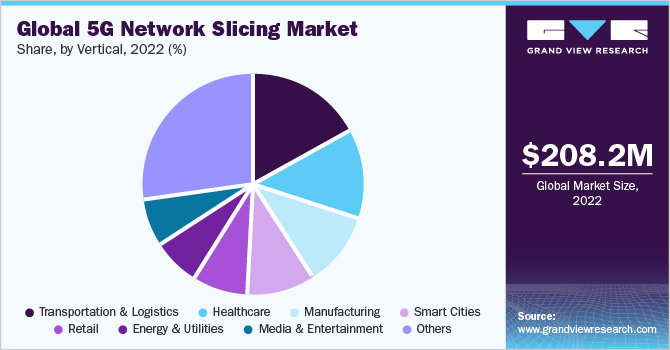

Vertical Insights

The transportation and logistics segment dominated the market in 2022 and accounted for a revenue share of more than 17.0%. The dominance of the segment is due to the increasing demand for the creation of customized and optimized network services for applications such as fleet management, logistics optimization, autonomous vehicles, traffic management, and others. Moreover, several market players are focused on the development of 5G network slicing solutions for various use cases, which is anticipated to aid segment growth.

The other segment includes several end-use industries such as financial services, mining, public safety, IT & telecom, and others. The 5G network slicing is being highly adopted in the aforementioned industries as more devices require high-speed connectivity owing to the increasing integration of the Internet of Things (IoT) and deployment of connected devices. In addition, the 5G network slicing introduces new levels of functionality and performance to cellular networks, thus, boosting segment growth.

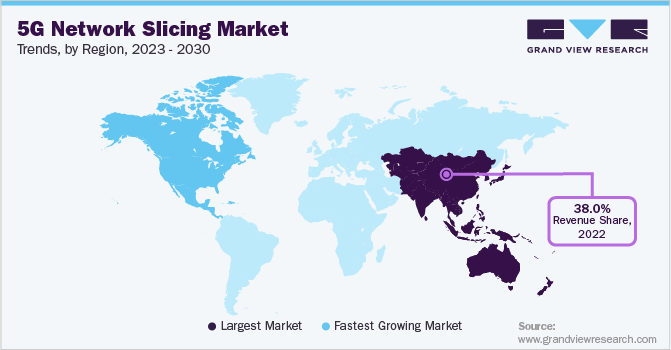

Regional Insights

Asia Pacific dominated the 5G network slicing market in 2022 and accounted for a revenue share of over 38.0%. The dominance can be attributed to the early adoption of 5G technology by Asian countries such as China, Japan, and South Korea. The countries have invested heavily in building 5G infrastructure, which has led to the development and deployment of 5G network slicing services in these countries. Moreover, Asia Pacific has the highest number of mobile subscribers in the world. The high mobile subscriber base is driving the demand for 5G network slicing to support the increasing number of devices and services connected to the network.

North America is anticipated to register significant growth over the forecast period. The growth can be attributed to the presence of the major market players in the region such as AT&T Inc., Verizon Communications, Inc., and others. The network operators and vendors in the region are partnering to develop and deploy 5G network slicing services.

Moreover, the players are developing innovative solutions for 5G network slicing. For instance, in February 2020, Amdocs, Inc. a leading software and service provider, launched a 5G slice manager solution. The solution is designed to assist the service providers in accelerating their 5G journey, providing a complete set of abilities to monetize and manage 5G network slices.

Key Companies & Market Share Insights

The market is slightly fragmented with a presence of established mobile network operators, technology providers, and startups, each with their strengths and capabilities. The companies are collaborating and entering into strategic partnerships to develop innovative 5G network slicing solutions. For instance, in February 2023, major players such as Telefonaktiebolaget LM Ericsson, Intel Corporation, and Microsoft Corporation partnered to demonstrate end-to-end slicing capabilities of a 5G standalone network on a Windows laptop. This will allow new business segments to create a variety of use cases for enterprises and consumers.

Mobile network operators are investing heavily in 5G network slicing technology and infrastructure to capitalize on the growing demand for specialized network services. They are partnering with technology providers and industry players to develop new business models and use cases that can leverage the capabilities of 5G network slicing. For instance, in March 2022, Vodafone Group plc and Telefonaktiebolaget LM Ericsson partnered to create an on-demand 5G network slice for a Virtual Reality (VR) use case which offered a guaranteed latency of 12.4 milliseconds and download speed of 260 Mbps. Some prominent players in the global 5G network slicing market include:

-

AT&T, Inc.

-

Telefonaktiebolaget LM Ericsson

-

Nokia Corporation

-

Huawei Technologies Co., Ltd.

-

Cisco Systems, Inc.

-

Deutsche Telekom AG

-

Amdocs, Inc.

-

Vodafone Group plc

-

ZTE Corporation

5G Network Slicing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 394.6 million

Revenue forecast in 2030

USD 4,829.3 million

Growth rate

CAGR of 43.0% from 2023 to 2030

Base year of estimation

2022

Historical data

2020 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, type, network architecture, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; China; India; Japan; Australia; South Korea; Brazil; Mexico; Kingdom of Saudi Arabia; UAE; South Africa

Key companies profiled

AT&T, Inc.; Telefonaktiebolaget LM Ericsson; Nokia Corporation; Huawei Technologies Co., Ltd.; Cisco Systems, Inc.; Deutsche Telekom AG; Amdocs, Inc.; Vodafone Group plc; ZTE Corporation

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 5G Network Slicing Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2020 to 2030. For this study, Grand View Research has segmented the global 5G network slicing market report based on component, type, network architecture, vertical, and region:

-

Component Outlook (Revenue, USD Million, 2020 - 2030)

-

Solutions

-

Services

-

Managed Services

-

Professional Services

-

-

-

Type Outlook (Revenue, USD Million, 2020 - 2030)

-

RAN Slicing

-

Edge Slicing

-

End-to-End Network Slicing

-

-

Network Architecture Outlook (Revenue, USD Million, 2020 - 2030)

-

Standalone

-

Non-standalone

-

-

Vertical Outlook (Revenue, USD Million, 2020 - 2030)

-

Manufacturing

-

Healthcare

-

Smart Cities

-

Transportation & Logistics

-

Energy & Utilities

-

Media & Entertainment

-

Retail

-

Others (Financial Services, Public Safety, IT & Telecom, Others)

-

-

Regional Outlook (Revenue, USD Million, 2020 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global 5G network slicing market size was estimated at USD 208.2 million in 2022 and is expected to reach USD 394.6 million in 2023.

b. The global 5G network slicing market is expected to grow at a compound annual growth rate of 43.0% from 2023 to 2030 to reach USD 4,829.3 million by 2030.

b. Asia Pacific dominated the 5G network slicing market with a share of 38.70%% in 2022. The dominance can be attributed to the early adoption of 5G technology by Asian countries such as China, Japan, and South Korea. The countries have invested heavily in building 5G infrastructure, which has led to the development and deployment of 5G network slicing services in these countries.

b. Some key players operating in the 5G network slicing market include AT&T, Inc., Telefonaktiebolaget LM Ericsson, Nokia Corporation, Huawei Technologies Co., Ltd., Cisco Systems, Inc., Deutsche Telekom AG, Amdocs, Inc., Vodafone Group plc, ZTE Corporation.

b. Key factors that are driving the 5G network slicing market growth include Growing adoption of IoT devices and applications and Increasing demand for high-bandwidth, low-latency, and reliable connectivity in various industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.