- Home

- »

- Clinical Diagnostics

- »

-

Acute Respiratory Disease Diagnostics Market Report, 2033GVR Report cover

![Acute Respiratory Disease Diagnostics Market Size, Share & Trends Report]()

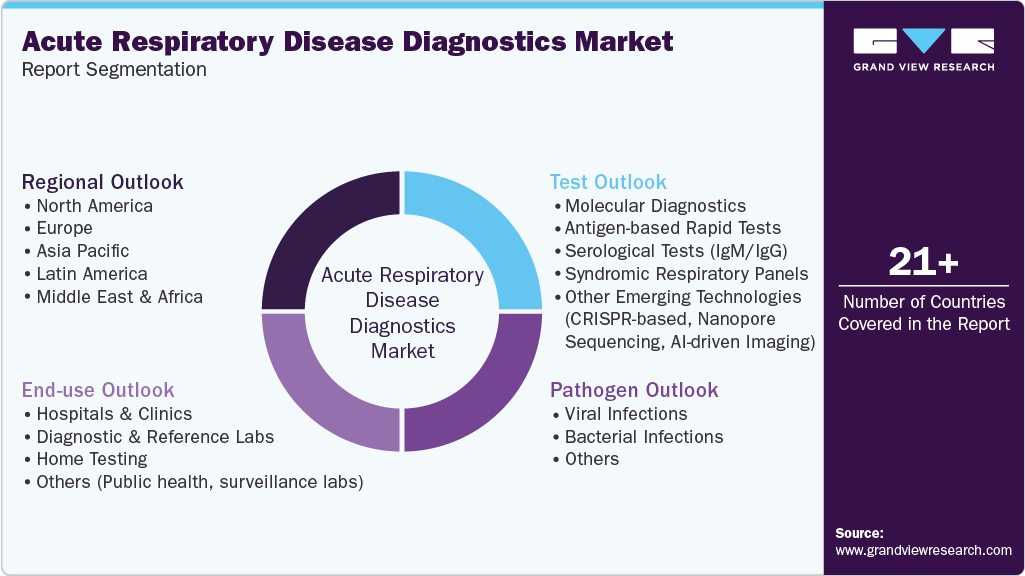

Acute Respiratory Disease Diagnostics Market (2025 - 2033) Size, Share & Trends Analysis Report By Test (Molecular Diagnostics, Antigen-based Rapid Tests), By Pathogen (Viral Infections, Bacterial Infections), By End-use (Hospitals & Clinics, Home Testing), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-812-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Acute Respiratory Disease Diagnostics Market Summary

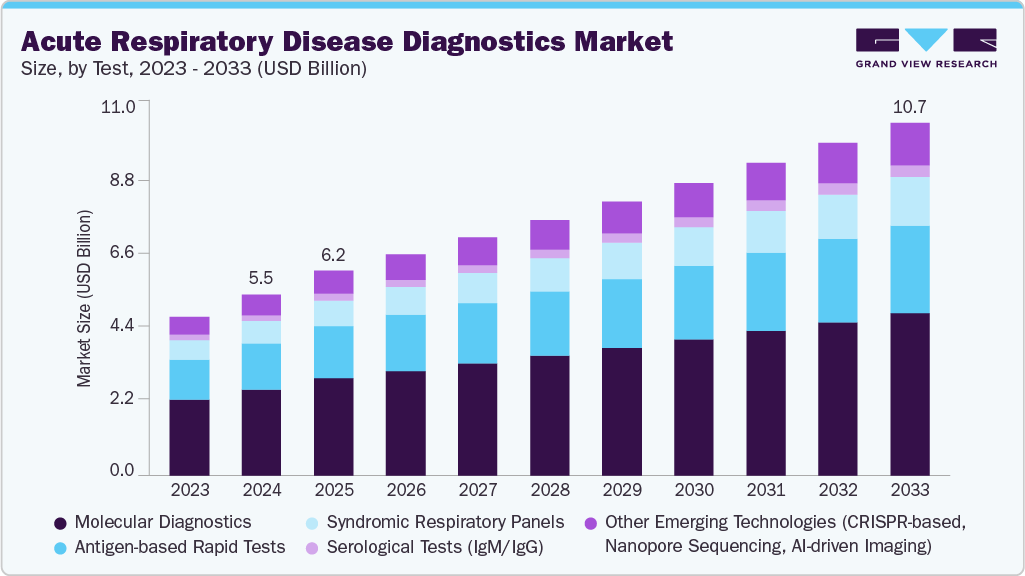

The global acute respiratory disease diagnostics market size was estimated at USD 5.49 billion in 2024 and is projected to reach USD 10.71 billion by 2033, growing at a CAGR of 7.01% from 2025 to 2033. Some of the major factors driving the market are rising disease burden of respiratory conditions, advancements in diagnostic technologies, and increasing demand for early detection & decentralized testing.

Key Market Trends & Insights

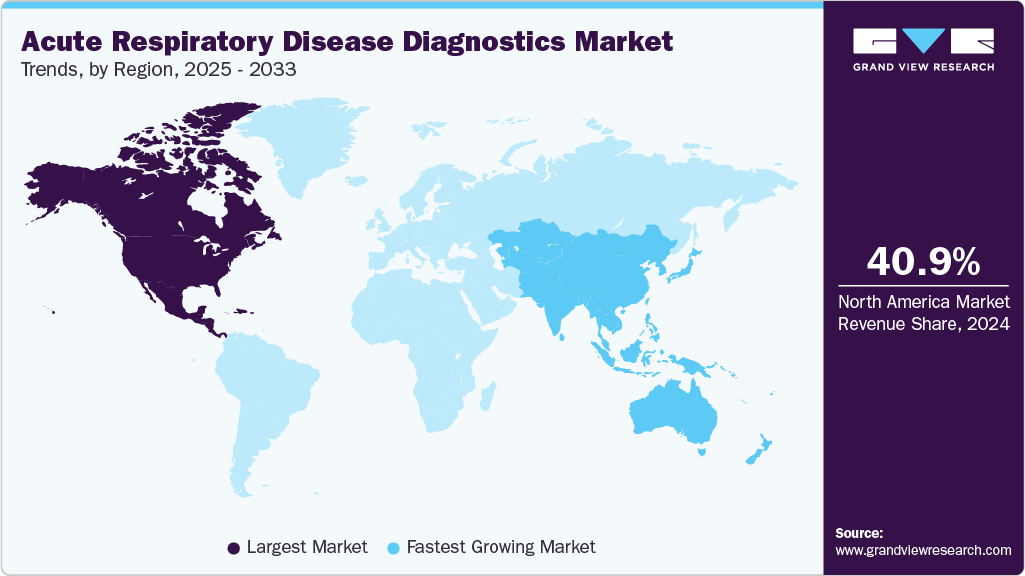

- The North America acute respiratory disease diagnostics market dominated the global market and accounted for the largest revenue share of 40.95% in 2024.

- The U.S. led the North American market and held the largest revenue share in 2024.

- Based on test, molecular diagnostics segment dominated the global market with a share of 47.63% in 2024.

- Based on pathogen, the viral infection segment held the largest revenue share of 67.90% in 2024.

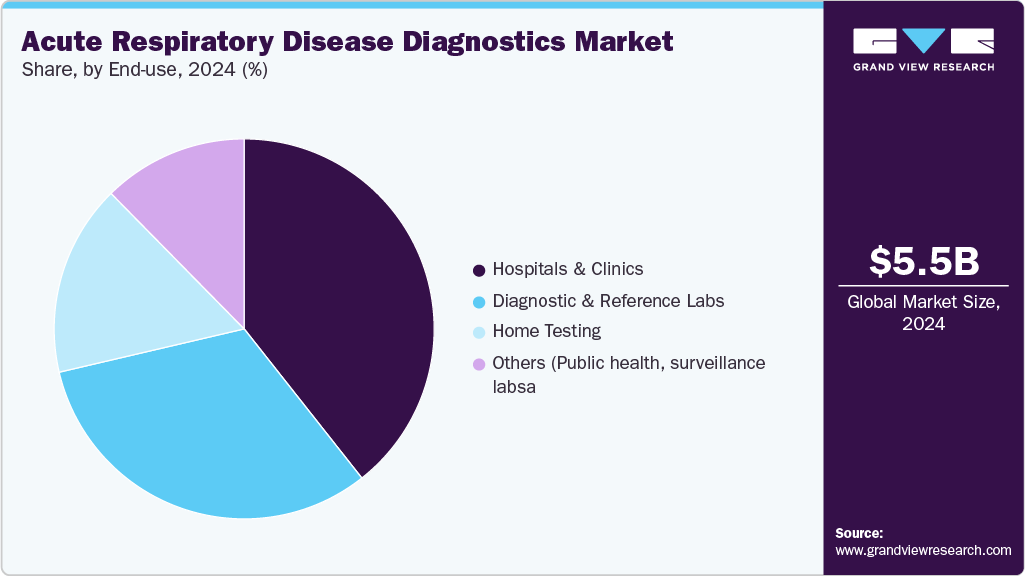

- Based on end-use, the hospital segment held the largest revenue share of 39.37% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.49 Billion

- 2033 Projected Market Size: USD 10.71 Billion

- CAGR (2025-2033): 7.01%

- North America: Largest Market in 2024

- Asia Pacific: Fastest growing market

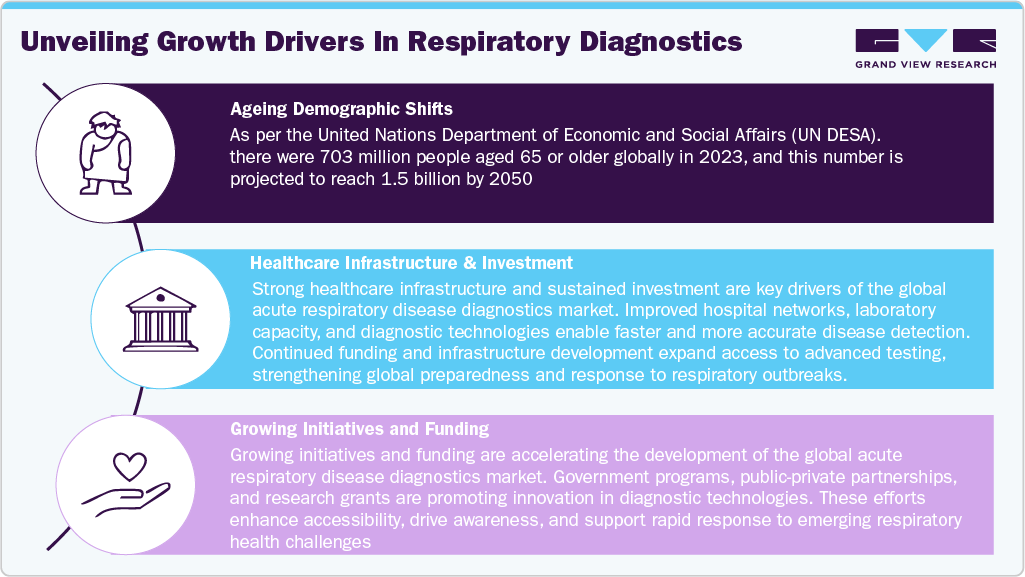

According to the Institute for Health Metrics and Evaluation (IHME) in April 2023, chronic respiratory diseases (CRDs) are the third leading cause of death globally. Furthermore, the market growth is driven by the ageing demographic shift, increased healthcare infrastructure & investment in developing markets, government initiatives, public health programs & funding. The rise in the proportion of older people globally has led to an increase in cases of respiratory disorders, as older age is often associated with decreased lung capacity and decreased immune functioning. This demographic shift introduces significant risk for the development of chronic and acute infections with co-morbidities, including pneumonia, chronic obstructive pulmonary disease (COPD), and influenza. As a result, there is an increasing demand for rapid and accurate diagnostic tools for early detection, timely intervention, and improved clinical outcomes among the aging demographic.

Simultaneously, the healthcare infrastructure in emerging economies is rapidly expanding, providing a solid base for the adoption of new diagnostic techniques. Countries in the Asia-Pacific, Latin America, and Middle East regions are seeing significant investments in the modernization of healthcare, laboratory automation, and the development of innovative devices. Governments and private healthcare providers are collaborating to enhance diagnostic capacity through public-private partnerships, the establishment of specialized respiratory testing centers, and the implementation of point-of-care testing. These efforts will lead to increased access to diagnostic services, shorter turnaround times, and enhanced disease management in both urban and rural areas.

In addition, government programs and international public health initiatives play a crucial role in supporting the global diagnostic ecosystem. Existing efforts by the WHO, the Global Fund, and the Ministries of Health of various countries to enhance surveillance of respiratory diseases, fund research, and provide equitable access to critical diagnostic supplies indicate that the global diagnostic community is working collaboratively to strengthen diagnostic capabilities worldwide and improve public health. Changes in reimbursement environments, public awareness campaigns, global strategic funding for innovations, and collaborative research efforts are reshaping global adherence to molecular and digital diagnostics. Overall, these aims aim to provide an ecosystem and ultimately improve public health by reducing the burden of acute respiratory disease through early, accurate, and accessible diagnostics.

Market Concentration & Characteristics

The global acute respiratory disease diagnostics industry is highly innovative, largely due to the continuous development of molecular diagnostics, real-time PCR technologies, point-of-care testing, AI-powered imaging solutions, and product expansion. For instance, in July 2025, PHASE Scientific entered into an exclusive U.S. distribution agreement with Lumos Diagnostics for FebriDx, a rapid point-of-care (POC) test that aids in the diagnosis of bacterial acute respiratory infection and differentiation from non-bacterial etiology in approximately 10 minutes using a single drop of blood. Moreover, FebriDx, with its strong product differentiation, FDA 510(k) clearance, and an expected CLIA waiver application within the next three months, is poised to transform how clinicians diagnose and manage respiratory infections. Companies are focusing on rapid, accurate, and multiplexed diagnostics that will enable efficient detection of a wide range of respiratory pathogens. This level of innovation enables earlier disease detection, improved patient outcomes, and ongoing advancements in decentralized testing solutions.

The M&A activities in the global acute respiratory disease diagnostics industry are observed to be moderate. Companies specialized in manufacturing respiratory devices and solutions focus on acquiring or collaborating with niche players. For instance, in September 2024, Vitalograph acquired Morgan Scientific, with the aim of strengthening its presence in the U.S. and enabling it to meet the global demand for respiratory diagnostics solutions.

The market faces a significant regulatory burden due to the rigorous adherence to regional and global standards that govern product approval, safety, and market access. Regulatory authorities (such as the FDA, EMA, and national health authorities) monitor diagnostic devices, require solid clinical validation, and quality assurance. Regulatory frameworks influence key elements, including the timing of innovation, pricing, and uptake into practice, making compliance crucial to successful adoption.

The number of products available in the market is high, with companies launching new products, including PCR kits, rapid antigen tests, multiplex assays, and integrated diagnostic solutions. The increased demand for early detection, combined with the need for comprehensive testing of respiratory pathogens, is driving the development of new products designed for use in clinics, hospitals, diagnostic laboratories, or at the point of care. The market continues to differentiate products to leverage newly emerging needs and stay competitive.

Expansion into new regions is perceived as medium because substantial growth opportunities exist within emerging markets, such as the Asia-Pacific, Latin America, and the Middle East, driven by increasing disease prevalence, improved healthcare infrastructure, and increased investments. Meanwhile, mature markets such as North America and Europe are benefiting from steady, incremental growth as a result of already entrenched healthcare systems and sufficient market penetration.

Test Insights

Based on test, the molecular diagnostics segment dominated the market with a share of 47.63% in 2024 due to its high accuracy, quick turnaround time, and ability to detect multiple pathogens simultaneously. Even at low viral loads, molecular techniques, particularly real-time PCR, can accurately identify viral and bacterial infections such as influenza, RSV, and SARS-CoV-2. The growing demand for early and reliable detection, combined with the global prevalence of respiratory diseases, has led to the widespread use of molecular diagnostics in hospitals, diagnostic laboratories, and point-of-care settings. Furthermore, technological advancements such as multiplex assays, automated platforms, and integration with digital reporting systems improve efficiency and throughput, reinforcing the molecular diagnostics segment's market leadership.

The syndromic respiratory panels segment is expected to be the fastest-growing market segment over the forecast period, owing to its ability to detect multiple pathogens from a single sample, saving time and improving diagnostic accuracy. These panels are especially useful for distinguishing between bacterial and viral infections, which aids in targeted treatment decisions and reduces unnecessary antibiotic use. For instance, in May 2024, QIAGEN N.V. received approval from the U.S. Food and Drug Administration (FDA) for the QIAstat-Dx Respiratory Panel Plus syndromic test for clinical use. Furthermore, the QIAstat-Dx Respiratory Panel Plus is designed to support clinical decision-making in diagnosing upper respiratory infections, encompassing 21 viral and bacterial targets. The QIAstat-Dx Respiratory SARS-CoV-2 Panel was previously authorized under an Emergency Use Authorization (EUA) from the USFDA. The panel leverages QIAstat-Dx's capability to simultaneously amplify multiple genetic targets using real-time PCR technology, yielding results in approximately one hour and requiring less than one minute of hands-on time. Cycle threshold (Ct) values and amplification curves are easily visible, providing healthcare professionals with additional clinical data. The rising prevalence of complex respiratory infections, combined with the need for rapid, comprehensive, and point-of-care testing in hospitals and clinical laboratories, is propelling adoption. Furthermore, advances in multiplex PCR technology, automation, and integration with digital reporting platforms are increasing the efficiency and throughput of syndromic panels, making them the preferred choice for healthcare providers treating acute respiratory illnesses.

Pathogen Insights

Based on the pathogen, viral infection is expected to account for the majority of market revenueshare of 67.90% in 2024, primarily due to the high prevalence of viral respiratory illnesses such as influenza, respiratory syncytial virus (RSV), and SARS-CoV-2 worldwide. The growing frequency of seasonal outbreaks, coupled with increased awareness of the importance of early detection, has led healthcare providers and diagnostic laboratories to prioritize viral testing. Advanced molecular diagnostics, including real-time PCR and multiplex syndromic panels, enable the rapid and accurate identification of viral pathogens, thereby improving patient management and reducing the risk of disease spread. In addition, government initiatives, vaccination programs, and public health surveillance efforts are further driving demand for viral diagnostics, thereby contributing significantly to the segment’s revenue dominance.

Conversely, bacterial infections represent the fastest-growing market segment, driven by the increasing incidence of bacterial respiratory infections, such as pneumonia, caused by pathogens like Streptococcus pneumoniae and Haemophilus influenzae, particularly in vulnerable populations, including children and the elderly. For instance, according to a meta‑analysis published in 2023, the overall prevalence of bacterial pneumonia in Ethiopia was estimated at 37.17 % (95 % CI 25.72-48.62 %). In a Chinese paediatric study covering January 2023 to July 2024, bacterial pathogens were detected in 40.7 % (2050/5037) of culture‑positive respiratory specimens from children. Rising antimicrobial resistance has also heightened the need for accurate bacterial diagnostics to ensure appropriate treatment and reduce misuse of antibiotics. Innovations in multiplex panels and rapid bacterial detection technologies are enabling faster identification of bacterial pathogens, supporting timely intervention and improved patient outcomes.

End-use Insights

On the basis of end-use, hospitals accounted for the largest market share of 39.37% in 2024, owing to the high volume of patients seeking treatment for acute respiratory conditions, the availability of advanced laboratory infrastructure, and the presence of trained healthcare professionals capable of performing complex diagnostic tests. Hospitals are primary centers for disease diagnosis and management, treating both routine and critical cases. Furthermore, government funding, reimbursement support, and hospital-based screening programs are driving adoption of molecular diagnostics, PCR assays, and syndromic panels in hospitals, cementing their position as the market's largest revenue-generating segment.

Home testing is expected to be the fastest-growing segment from 2025 to 2033, driven by rising demand for convenient, rapid, and point-of-care diagnostic solutions, particularly in the wake of the COVID-19 pandemic and seasonal outbreaks. Advances in user-friendly test kits, such as self-administered antigen and molecular tests, combined with digital reporting and telemedicine integration, enable patients to monitor their respiratory health from the comfort of their own homes. Strengthening consumer perception of the benefits and convenience of home testing, along with favorable regulatory approvals for home-use diagnostic kits, is accelerating growth in this segment, positioning home testing as a key driver of market expansion in the near future.

Regional Insights

North America acute respiratory disease diagnostics market is the leading region, holding a revenue share of 40.95% in 2024. The region benefits from a well-established healthcare infrastructure, widespread use of advanced diagnostic technologies, and strong government support for respiratory disease surveillance & prevention initiatives. Furthermore, the presence of major market players, significant R&D investments, and favorable reimbursement policies helps to accelerate the adoption of molecular diagnostics, syndromic panels, and point-of-care testing. The rising importance of early detection of infections such as influenza, RSV, and SARS-CoV-2 amongst healthcare professionals and patients is expected to fuel market growth.

U.S. Acute Respiratory Disease Diagnostics Market Trends

The acute respiratory disease diagnostics market in the U.S. is growing due to the high prevalence of respiratory infections and the quick adoption of cutting-edge diagnostic technologies. For instance, the CDC and related data indicate a high prevalence of respiratory diseases in the US in late 2023 and early 2024. During the 2023-2024 flu season, seasonal influenza, COVID-19, and Respiratory Syncytial Virus (RSV) caused approximately 41 million illnesses, 490,000 hospitalizations, and 25,000 deaths. The country's hospitals and diagnostic laboratories are increasingly relying on molecular diagnostics, PCR-based testing, and multiplex syndromic panels to identify pathogens like influenza, RSV, and SARS-CoV-2 quickly and accurately. Furthermore, government initiatives such as the CDC's National Respiratory and Enteric Virus Surveillance System (NREVSS) enhance disease monitoring and increase the demand for reliable diagnostic tools. Improved consumer knowledge, combined with strong reimbursement policies and public health funding, drives market growth. The presence of major market players, ongoing R&D investments, and strategic collaborations with biotech firms all contribute to innovation and expansion, establishing the U.S. as a leader in the global market.

Europe Acute Respiratory Disease Diagnostics Market Trends

The acute respiratory disease diagnostics market in Europe has been identified as a profitable region mainly due to stronger growth in the molecular and multiplex PoC segments. Countries such as Germany, the UK, and France have made significant investments in modernizing diagnostic laboratories and implementing molecular testing for pathogens such as influenza, RSV, and bacterial respiratory infections. Moreover, the European Centre for Disease Prevention and Control (ECDC) supports public health initiatives that promote surveillance and early detection, resulting in increased demand for multiplex PCR panels and rapid testing. The market also benefits from a robust R&D infrastructure and a favorable regulatory environment, which facilitates product approvals and launches. In addition, while the major markets/countries in the region are mature, there lies an opportunity for product expansion in the emerging markets within Eastern Europe.

The UK acute respiratory disease diagnostics market is drivenby the high prevalence of viral and bacterial respiratory infections and government-funded public health programs. National Health Service (NHS) initiatives promote widespread diagnostic testing, particularly in hospitals and primary care settings, to detect pathogens such as influenza, RSV, and Streptococcus pneumoniae. Rapid molecular testing and multiplex syndromic panels are gaining popularity as demand for early diagnosis and outbreak management increases. For instance, in October 2025, F. Hoffmann-La Roche obtained CE certification inthe UK for a diagnostic test for acute dengue virus infection. Furthermore, studies found that the assay was 94.90% sensitive in polymerase chain reaction-confirmed positive samples. Moreover, the assay detects the virus's non-structural protein 1 (NS1) antigen in human serum and plasma, which is an important indicator of acute infection in the early stages of illness. Furthermore, investments in laboratory automation, digital reporting platforms, and home testing kits have increased testing capacity and accessibility.

The acute respiratory disease diagnostics market in Germany is growing due to the high prevalence of respiratory infections and increased use of molecular and rapid diagnostic technologies. For infectious respiratory diagnostics, rapid turnaround, multiplex testing (influenza + RSV + SARS-CoV-2) is increasingly important given the co-circulation of pathogens. Germany has made significant investments in hospital and diagnostic laboratory modernization, allowing the widespread use of PCR-based and multiplex respiratory pathogen panels. Government-led programs, such as disease surveillance and vaccination campaigns, have increased the need for early detection of influenza, RSV, and bacterial respiratory infections. The presence of leading diagnostic companies that conduct R&D in molecular testing and syndromic panels has fueled product innovation, benefiting both hospital and outpatient diagnostics. Strategic collaborations between diagnostic manufacturers and healthcare providers, combined with supportive reimbursement policies, have helped position Germany as a key market in the European landscape of acute respiratory disease diagnostics.

Asia Pacific Acute Respiratory Disease Diagnostics Market Trends

The acute respiratory disease diagnostics market in the Asia Pacific is growing at the highest CAGR over the forecast period. Countries such as China, Japan, India, and South Korea are witnessing an increase in investment in molecular diagnostics, multiplex PCR panels, and point-of-care testing to manage viral and bacterial respiratory infections. Government initiatives to improve disease surveillance, expand healthcare access in rural areas, and fund diagnostic research are also driving market growth. Rising urbanization, increased hospital capacity, and strategic partnerships between key players all contribute to increasing market potential. The Asia Pacific region is a rapidly growing market for acute respiratory disease diagnostics, driven by a combination of unmet healthcare needs, technological advancements, and supportive policies.

Japan acute respiratory disease diagnostics market is expected to demonstrate high growth, primarily due to the aging population and a high disease burden. Furthermore, Japanese hospitals and laboratories have widely adopted molecular diagnostics, including real-time PCR and multiplex syndromic panels, to ensure rapid and accurate detection of pathogens. For instance, in April 2023, QIAGEN N.V. launched the QIAstat-Dx syndromic testing solution in Japan, featuring a SARS-CoV-2 Respiratory Panel that can detect more than 20 pathogens from a single patient sample. The availability of this product is expected in mid-2023, following decisions on reimbursement levels, and will come as the next step after the recent granting of IVD approval for the test. The Ministry of Health, Labour, and Welfare's public health initiatives, combined with robust disease surveillance programs, help support early detection and the prevention of outbreaks. Furthermore, as clinicians and patients become increasingly aware of the importance of timely testing, demand for point-of-care and home testing solutions is growing. Domestic diagnostic companies' R&D investments, combined with collaborations with international firms, have resulted in continuous product innovation.

The acute respiratory disease diagnostics market in China is growing due to technological advancement and broader adoption of PoC and syndromic panels. The Chinese government and regulatory agencies have emphasized the development of diagnostics, infectious disease surveillance, primary care, and POC testing. Initiatives, such as the Healthy China 2030 strategy and nationwide disease surveillance programs, promote early detection and public awareness of respiratory illnesses. Although large hospital infrastructure has been the foundation, there is increasing attention to outpatient, clinic, and POC settings in China, enabling broader access and volume growth. In addition, China has a large population, significant urbanization, high exposure to air pollution, and a sizable older demographic - all of which contribute to a higher prevalence of respiratory infectious diseases (e.g., influenza, RSV, pneumonia).

Latin America Acute Respiratory Disease Diagnostics Market Trends

The acute respiratory disease diagnostics market in Latin America is growing steadily. Brazil, Mexico, and Argentina are investing in hospital modernization, laboratory automation, and point-of-care testing to improve patients' access to accurate and timely respiratory diagnostics. Public health initiatives aimed at disease surveillance, vaccination, and outbreak management have also increased demand. Strategic partnerships between international diagnostic companies and local healthcare providers improve the availability of advanced diagnostic tools. These factors combine to position Latin America as a high-potential market for acute respiratory disease diagnostics during the forecast period.

Middle East and Africa Acute Respiratory Disease Diagnostics Market Trends

The acute respiratory disease diagnostics market in the MEA is expected to grow lucratively over the forecast period. Rapid testing for respiratory infections (influenza, RSV, MERS-CoV, pneumonia) is a priority in MEA, especially in Gulf states and in programs in Africa. GCC countries (e.g., Saudi Arabia, UAE) are investing in diagnostic infrastructure, digital health/connected diagnostics, as well as outbreak readiness, which supports the adoption of advanced testing. Countries such as South Africa have advanced laboratory networks in urban centers, making it a more mature market with major players focusing on launching products to achieve a higher market share.

Key Acute Respiratory Disease Diagnostics Company Insights

The market is highly competitive, with market players engaging in activities such as strategic collaborations, new product launches, acquisitions, technological advancements, and regional expansions.

Key Acute Respiratory Disease Diagnostics Companies:

The following are the leading companies in the acute respiratory disease diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- F. Hoffmann La-Roche

- Abbott Laboratories

- Quidel Corporation

- Becton, Dickinson and Company (BD)

- Thermo Fisher Scientific, Inc.

- Siemens Healthineers

- Bio-Rad Laboratories

- Luminex Corporation

- BioMérieux

- Meridian Bioscience

- Fujirebio Diagnostics

- Cepheid

- Lumos Diagnostics

Recent Development

-

In June 2024, F. Hoffmann La-Roche received approval from the U.S. Food and Drug Administration (FDA) for Emergency Use Authorization (EUA) for its cobas liat SARS-CoV-2, Influenza A/B & RSV nucleic acid test, an automated multiplex real-time polymerase chain reaction (RT-PCR) assay on the cobas liat system. Producing results in just 20 minutes on a compact analyzer suitable for most healthcare settings, the test uses either a single nasopharyngeal or anterior nasal-swab sample to confirm or rule out infection with SARS-CoV-2, influenza A virus, influenza B virus, and respiratory syncytial virus (RSV).

-

In July 2023, Lumos Diagnostics (Australia) received U.S. Food and Drug Administration (FDA) marketing clearance for FebriDX, a disposable point-of-care immunoassay designed to aid diagnosis of acute bacterial respiratory infections, which can now be marketed in the U.S. for use by healthcare providers in urgent care and emergency care settings. The tests, which differentiate between bacterial-and viral-associated host immune responses and are intended to be used in conjunction with clinical signs and symptoms, could help improve antibiotic prescribing for acute respiratory infections.

Acute Respiratory Disease Diagnostics Market Report Scope

Report Attribute

Details

Market size in 2025

USD 6.23 billion

Revenue forecast in 2033

USD 10.71 billion

Growth rate

CAGR of 7.01% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Test, pathogen, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark, Sweden, Norway, China; Japan; India; Australia; Thailand, South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

F. Hoffmann La-Roche; Abbott Laboratories; Quidel Corporation; Becton, Dickinson and Company (BD); Thermo Fisher Scientific, Inc.; Siemens Healthineers; Bio-Rad Laboratories; Luminex Corporation; BioMérieux; Meridian Bioscience; Fujirebio Diagnostics; Cepheid; Lumos Diagnostics

Customization scope

Free report customization (equivalent to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Acute Respiratory Disease Diagnostics Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global acute respiratory disease diagnostics market based on test, pathogen, end-use, and region:

-

Test Outlook (Revenue, USD Million, 2021 - 2033)

-

Molecular Diagnostics

-

PCR

-

INAAT

-

-

Antigen-based Rapid Tests

-

Serological Tests (IgM/IgG)

-

Syndromic Respiratory Panels

-

Other Emerging Technologies (CRISPR-based, Nanopore Sequencing, AI-driven Imaging)

-

-

Pathogen Outlook (Revenue, USD Million, 2021 - 2033)

-

Viral Infections

-

Influenza A & B

-

Respiratory Syncytial Virus (RSV)

-

SARS-CoV-2

-

Others

-

-

Bacterial Infections

-

Streptococcus pneumoniae

-

Haemophilus influenzae

-

Mycoplasma pneumoniae

-

Bordetella pertussis

-

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals & Clinics

-

Diagnostic and Reference Labs

-

Home Testing

-

Others (Public health, surveillance labs)

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.