- Home

- »

- Digital Media

- »

-

AdTech Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![AdTech Market Size, Share & Trends Report]()

AdTech Market Size, Share & Trends Analysis Report By Offering, By Advertising Type, By Advertising Channel, By Advertising Format, By Platform, By Enterprise Size, By Industry Vertical, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-033-5

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2017 – 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

AdTech Market Size & Trends

The global AdTech market size was estimated at USD 845.33 billion in 2023 and is expected to expand at a CAGR of 22.4% from 2024 to 2030. AdTech (advertising technology) refers to the technology and software used to manage, deliver, and measure the effectiveness of online advertisements. The AdTech industry consists of a wide range of companies and products, such as demand-side platforms (DSPs), ad exchanges, data management platforms (DMPs), supply-side platforms (SSPs), and more. These products help advertisers target their ads to the right audiences, optimize their ad spending, and measure the performance of their campaigns.

The market is evolving at a significant pace with several key trends changing and shaping the industry. Some of the notable AdTech industry trends include connected TV (CTV), hyper-personalization, geotargeting, augmented reality and virtual reality, integrated consumer journeys, and vernacularization. Additionally, the use of programmatic advertising utilizes algorithms and data to target and deliver ads, allowing for more efficient and effective advertisement campaigns.

Native advertising is also gaining traction as it integrates sponsored content into a website's design and format. Since this approach is less intrusive than traditional banner advertisements, native advertising enables effective consumer engagement. AdTech companies use data and AI to improve targeting and personalization, allowing them to deliver more relevant messages to their customers, and increase the chances of conversion. Lastly, more and more companies are focusing on privacy-compliant and transparent advertisement practices to ensure their customers’ data is safe and protected.

The advertising technology market is anticipated to grow rapidly as it has experienced increasing investment in data, automation, artificial intelligence, and programmatic advertising. However, the industry faces various challenges, such as ad fraud, transparency, and privacy concerns. Overall, the market is constantly evolving and changing, with new products and companies emerging all the time. It's a complex and dynamic space, but it plays a critical role in the digital advertisement ecosystem. AdTech marketing agencies play a pivotal role in navigating the dynamic landscape of digital advertising since they use cutting-edge technologies to improve brand awareness and campaign performance.

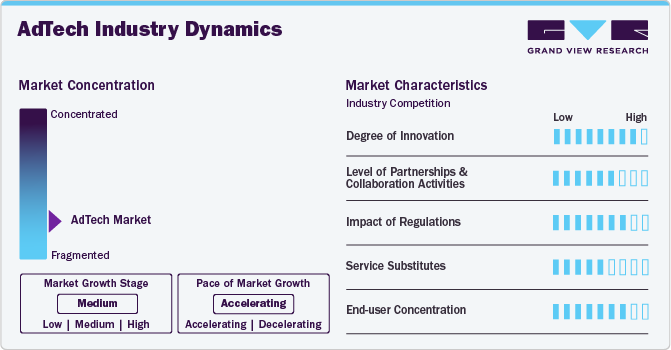

Market Concentration & Characteristics

Due to the ongoing advancements in data analytics and technology, the AdTech market has a remarkably high degree of innovation. Companies are continually pushing the boundaries to produce unique solutions, using artificial intelligence, machine learning, and improved targeting approaches. Personalized ad experiences, programmatic advertising, and real-time bidding are a few instances of cutting-edge techniques changing the market.

AdTech firms realize the importance of strategic alliances, which is evident by the considerate number of partnerships and collaboration activities in the industry. Ad agencies, tech businesses, and data providers frequently form partnerships that promote a cooperative ecosystem. These kinds of partnerships improve data capacities, expedite the advertising process, and produce more all-encompassing solutions. AdTech companies recognize the value of collaborating to address sector issues and capture new possibilities.

The impact of regulations in the market is increasingly significant.Regulations like the CCPA and GDPR have changed how businesses handle customer data as data privacy concerns gain traction. AdTech companies must emphasize compliance and adapt to stricter rules that affect data-driven targeting and advertising methods. Industry participants now prioritize navigating the regulatory environment to guarantee the ethical and compliant use of data.

In this industry, service substitutes are constantly evolving due to the introduction of fresh alternatives by developing technology. Innovative content distribution techniques and blockchain-based advertising platforms, for example, provide alternatives to conventional advertising structures. To challenge current service models, advertisers are looking into new ways to contact the audience. AdTech companies must be flexible to provide competitive solutions and manage the always changing landscape of service alternatives.

The market exhibits a diverse end-user concentration, encompassing a broad range of enterprises and industries that employ advertising technology. The need for AdTech services is widespread, ranging from small enterprises to the largest e-commerce companies. Nonetheless, several AdTech companies can discover that they are serving particular markets or sectors, necessitating focused approaches to meet the distinct requirements of various end-user groups. Understanding and adapting to the diverse needs of end-users is crucial for success in this dynamic market.

Offering Insights

The services segment dominated the market in 2023, gaining a revenue share of 33.4%, and is expected to grow at a faster CAGR of 22.9% from 2024 to 2030. This growth is fueled by the increasing demand for data-driven marketing strategies. Businesses are looking for ways to target audiences more effectively, and service providers offer solutions like campaign management, data analysis, and ad optimization. Additionally, the rise of new technologies like AR/VR creates opportunities for immersive ad formats, requiring specialized services for development and implementation. This surge in demand, coupled with the growing popularity of audio advertising and mobile optimization, is propelling the service segment forward as a key driver for the growth of the overall market.

The demand-side platforms (DSPs) segment dominated in 2023 with a revenue share of 33.7% and is anticipated to maintain its dominance from 2024 to 2030. DSPs ease the process of buying advertising inventory, making it efficient and effective. It also allows for advanced targeting capabilities, making them an attractive option for advertisers looking to reach specific audiences and optimize campaign performance. The rise of programmatic advertising has led to an increase in demand for DSPs, as they allow advertisers to purchase programmatic advertising inventory efficiently and effectively. DSPs offer advanced targeting capabilities, which allow advertisers to reach specific audiences and optimize campaign performance, making them more effective and efficient than traditional advertisement methods.

Advertising Type Insights

The programmatic advertising segment dominated the market with a share of 80.6%. It is expected to expand at a faster CAGR of 23.0% from 2024 to 2030. Programmatic advertising utilizes algorithms to streamline the buying and selling of ad placements, eliminating manual negotiations. This translates to advantages for both advertisers and publishers. Advertisers gain access to a wider range of targeted audiences at optimized costs, while publishers can fill ad inventory more effectively. The rise of mobile advertising and the increasing value of data further propel programmatic growth. As marketers prioritize data-driven targeting and campaign management, programmatic platforms offer a powerful solution, making it a dominant force in the rapidly evolving market.

The non-programmatic advertising segment is anticipated to progress at a CAGR of 20.1% from 2024 to 2030. Non-programmatic advertising relies on direct negotiation between advertisers and publishers to secure ad placements, often encompassing sponsorships, premium display locations, or long-term contracts. While conceding efficiency and automation to programmatic methods, non-programmatic advertising offers distinct advantages. Advertisers can secure coveted placements on prominent websites or within established programs, fostering brand recognition and achieving targeted audience reach. Additionally, direct deals cultivate stronger relationships between advertisers and publishers, enabling deeper collaboration and the potential for content integration. Non-programmatic advertising grants advertisers greater control over creative execution and ad placement, facilitating the development of tailored messaging for specific audiences.

Advertising Channel Insights

The digital out-of-home (DOOH) advertising channel market is expected to dominate from 2024 to 2030 and accounted for significant revenue share of over 31% in 2023. This expansion is driven by the ubiquitous deployment of digital displays in public spaces, coupled with advancements in programmatic buying techniques. DOOH advertising capitalizes on this by offering a distinct channel to reach consumers while they are outside their homes. Furthermore, the increasing availability of real-time data and analytics empowers advertisers with the ability to target audiences with heightened precision and assess campaign efficacy with greater accuracy. The potential for augmented reality (AR) integration presents an additional layer of potential, fostering a more immersive and engaging DOOH advertising experience.

The television advertising segment is anticipated to witness a notable CAGR of 23.1% from 2024 to 2030. While facing challenges from the rise of streaming services and cord-cutting, it also demonstrates potential for adaptation and growth. The emergence of connected TV (CTV) offers a bridge between traditional television and digital advertising. CTV allows for targeted advertising on smart TVs and streaming devices, leveraging data to reach specific audiences. Furthermore, programmatic buying platforms are streamlining ad placement within traditional television, increasing efficiency and offering advertisers more control. While the overall television viewership picture might be evolving, the segment is adapting through innovation and strategic integration with the broader AdTech landscape.

Advertising Format Insights

The text advertising format dominated the market with a significant revenue share of 30.7% in 2023. Search engine marketing (SEM), a cornerstone of text advertising, continues to grow as user dependence on search engines remains robust. Furthermore, advancements in programmatic buying techniques facilitate more precise audience targeting through the strategic utilization of keywords and contextually relevant placements. The burgeoning landscape of voice search necessitates the optimization of text content for spoken queries, ensuring continued relevance in this evolving landscape. Consequently, text advertising persists within the AdTech market, offering a compelling value proposition through its effectiveness in driving user acquisition and conversions.

The video advertising format segment is anticipated to witness a notable CAGR of 23.9% from 2024 to 2030. Consumers are increasingly shifting their attention towards video content, with platforms like YouTube, social media, and streaming services witnessing a surge in user engagement. This presents a lucrative opportunity for advertisers to reach audiences through captivating video ads. Additionally, advancements in programmatic buying and real-time bidding enable targeted ad placement and audience segmentation, maximizing campaign reach and effectiveness. Furthermore, the rise of video analytics tools empowers advertisers to measure ad performance with greater accuracy and optimize campaigns for better results.

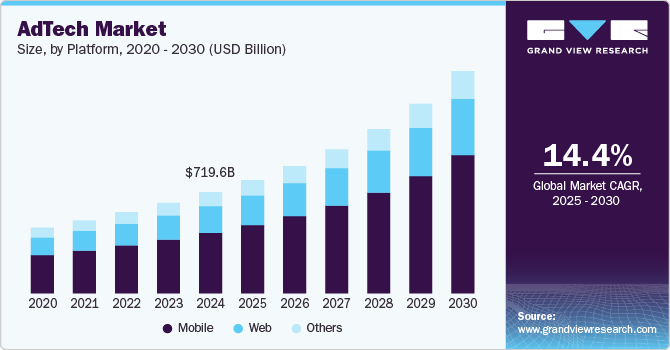

Platform Insights

The mobile segment dominated the market with a share of 55.0% in 2023 and is projected to witness the fastest CAGR of over 23.2% from 2024 to 2030. Mobile advertising offers a variety of ad formats, such as display ads, video ads, and in-app ads. These ads can be customized depending on specific devices and audiences. The rise of mobile advertisements has also led to the development of new technologies, allowing businesses to target consumers based on their geographic location. Additionally, mobile wallets, push notifications, and mobile apps have also gained traction in the AdTech industry, allowing businesses to engage with consumers in innovative ways. Mobile advertising has also driven the growth of mobile apps and in-app advertisement, therefore, reaching specific audiences and creating an immersive advertisement experience.

The web segment is anticipated to expand at a CAGR of 21.7% from 2024 to 2030. The web-based platform uses the internet and web-based technologies to create, deliver, and target online advertising campaigns. The web platform encompasses web browsers, websites, and web-based apps that deliver online advertisements to consumers. The web platform allows businesses to target a large and diverse audience as it has a wider reach than other platforms. Businesses can use tracking and web-based analytics tools to gauge respective target audiences and optimize advertisement campaigns. These tools collect and analyze data based on web and app usage, customer demographics, and behaviors, thereby designing personalized advertisement campaigns. Search advertising, coupled with other web-based advertisement formats, such as display and video ads, creates better and more comprehensive advertisement campaigns.

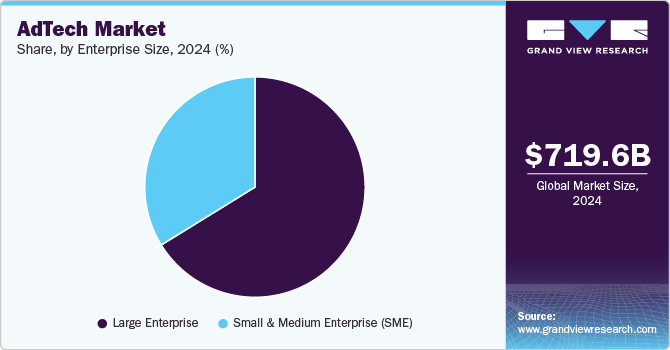

Enterprise Size Insights

The large enterprise segment dominated the market with a 65.4% share in 2023. It is anticipated to advance at a CAGR of around 21.7% from 2024 to 2030. Large enterprises typically are multinational corporations, large media companies, and major brands. These companies generally spend a specific number of resources on advertisements. Enterprises also use a combination of different ad formats and channels to reach their target audiences. Search, display, and video advertising are majorly preferred by large enterprises in the market. Large enterprises also use DSPs to buy and manage their digital advertising campaigns. Moreover, these enterprises use advanced technologies, such as DSPs, DMPs, AI, and ML, to gain insights, predict user behavior, and improve the performance of their ad campaigns.

The small and medium enterprises (SMEs) segment is expected to witness a faster CAGR of 23.8% from 2024 to 2030. Local businesses, small online retailers, and startups are generally considered SMEs. These companies generally have limited resources and budgets and are focused on cost-effective and targeted advertisement solutions. SMEs prefer self-serve platforms, such as search engines, social media, and online marketplaces, to reach the target audiences. Self-serve platforms enable SMEs to customize and manage their ad campaigns, with minimal costs and technical knowledge.

Industry Vertical Insights

The retail & consumer goods segment dominated the market with a share of 27.2% in 2023 and is expected to expand at a CAGR of 22.1% from 2024 to 2030. Companies operating in the retail and consumer goods segment use AdTech to advertise their products and services, build brand awareness, and thus, drive sales. Social media advertising in retail helps businesses engage with customers and promote new products. Similarly, influencer marketing includes the promotion of goods and services through social media influencers. Location-based advertisements use GPS and other location-detection technologies to target consumers based on their physical location. Retail companies use location-based advertising to promote nearby stores, products, and services.

The media & entertainment segment is anticipated to register the fastest CAGR of 24.8% from 2024 to 2030. AdTech in the media & entertainment industry helps businesses to promote content, build brand awareness, and drive viewership and engagement. Video advertising in the media & entertainment industry targets consumers who actively watch or stream video content. This often includes pre-roll, mid-roll, and post-roll ads. Video advertising is majorly used to promote specific movies, shows, or channels, and thus drive subscriptions and memberships. Similarly, media and entertainment companies use programmatic advertising to reach specific audiences and optimize their ad spending. Programmatic advertising uses automation and real-time bidding to target consumers based on their demographics, interests, and behaviors.

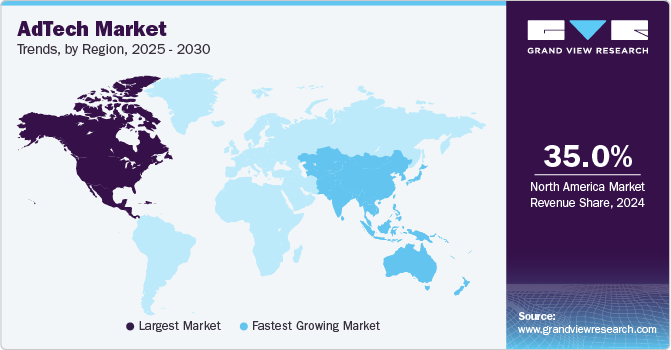

Regional Insights

North America AdTech market led the overall market in 2023 gaining a revenue share of 35.3%, with the U.S. being a major contributor to the industry. High penetration of digital advertising is one of the factors propelling regional market growth. Businesses are using data to better understand their audiences and optimize their ad spending. This has increased the growth of DMPs and marketing analytics platforms, allowing businesses to collect, analyze, and use data to generate advertising strategies.

U.S. AdTech Market Trends

The AdTech market in the U.S. accounted for over 71% share of the North American market in 2023. The U.S. has the largest digital advertising market in the world, and it continues to grow owing to a shift of consumers to online and mobile platforms. The U.S. is home to several technology companies and ad tech firms, including Google, Facebook, and Amazon, which have played a significant role in shaping the industry.Moreover, the competitive landscape in the U.S. AdTech sector fosters innovation and drives the continual evolution of advertising technologies and strategies.

Europe AdTech Market Trends

The Europe AdTech market is experiencing significant growth, driven by several key factors. One major driver is the rising adoption of programmatic advertising, which streamlines ad buying and placement through automation and data-driven targeting. This allows advertisers to reach specific audiences more effectively and publishers to monetize their inventory efficiently. Additionally, the burgeoning digital out-of-home (DOOH) sector is creating new advertising opportunities, with digital displays becoming increasingly prevalent in public spaces. Furthermore, the growing popularity of mobile internet usage and connected TV (CTV) is expanding the reach of video advertising, a powerful and engaging format.

The AdTech market in France gained a revenue share of 18% in 2023.The AdTech market in France exhibits robust growth potential fueled by a confluence of factors. France boasts a high rate of internet penetration, with a significant portion of the population actively engaging in e-commerce. Furthermore, the market is witnessing a surge in programmatic advertising, an automated and data-driven approach that benefits both advertisers seeking targeted reach and publishers aiming to optimize their ad inventory. Additionally, regulations like GDPR are fostering a privacy-conscious advertising environment, which is attractive to quality-focused advertisers. Moreover, the growth of the French DOOH market presents new avenues for advertisers to engage consumers beyond traditional online spaces. Consequently, France's AdTech market is well-positioned for continued expansion, driven by a combination of high internet adoption, programmatic adoption, evolving regulations, and a growing DOOH sector.

Asia Pacific AdTech Market Trends

The Asia Pacific AdTech market is expected to develop substantially by the projection period and progress at a CAGR of 23.7% during the forecast period. The increasing population and rising disposable income are anticipated to propel regional growth. China and Japan are technologically advanced countries in the region, resulting in higher penetration of internet consumption, and smartphone and mobile device penetration.

The AdTech market in China is projected to grow at a CAGR of 23.2% from 2024 to 2030. China dominates the Asia Pacific region in terms of revenue and is home to domestic tech giants such as Baidu, Alibaba, and Tencent. Rising inclination toward video platforms such as YouTube, TikTok, and Facebook has also resulted in an increase in the video advertising market in this region. Since the Asia Pacific region has a high penetration of social media users, social media advertising is growing rapidly in the region.

The Japan AdTech market is projected to grow at a CAGR of 23.5% from 2024 to 2030. The Japanese AdTech market is thriving due to several favorable factors, including the exponential growth of digital media consumption, high internet penetration exceeding 90%, and increasing smartphone usage. These trends create an attentive audience for advertisers, easily reached through digital platforms. As businesses recognize this opportunity, they're strategically investing in AdTech solutions to effectively engage with this captive market, paving the way for further innovation and market expansion fueled by data-driven targeting strategies. The Japanese AdTech market is dominated by domestic players like Dentsu, CyberAgent, and Yahoo Japan. However, global players like Google, Meta, and Amazon are also gaining traction.

The AdTech market in India is poised to witness a CAGR of 25.7% throughout the forecast period 2024 to 2030. The AdTech market in India is witnessing rapid growth, fueled by the nation's expanding internet penetration and embracing of digital technologies. Mobile internet usage, programmatic advertising, and data analytics stand as pivotal drivers behind the surge in India's AdTech sector expansion.

Key AdTech Company Insights

Some key players operating in the market include Meta and Alphabet among others.

-

Meta (formerly Facebook Inc) provides solutions for social networking, advertising, and business insights. Through its main products, including Messenger, Instagram, Facebook, Oculus, and WhatsApp, the company connects individuals across the globe, facilitating interactions between friends, family, and colleagues. While Meta boasts a massive user base and advanced targeting, giants like Google dominate search advertising and Amazon wields e-commerce data for powerful ads. Apple's privacy focus restricts Meta's data collection, and TikTok attracts younger audiences. Additionally, AdTech platforms offer alternative buying solutions outside Meta's ecosystem. However, Meta can capitalize on opportunities within the Metaverse and AR/VR, and by integrating e-commerce features more deeply. Ultimately, Meta's success hinges on navigating privacy regulations, adapting to user behavior shifts, and embracing new technologies in this ever-evolving landscape.

-

Alphabet Inc. has emerged as the leading player in the AdTech market. The company offers diverse products and platforms such as Google Ads, Google Maps, Search, Calendar, Gmail, Android, Chrome, Google Play, Google Cloud, and YouTube. The company provides online advertising services through the Google Network, including notable products such as AdSense, Google Ad Manager, and AdMob. In addition to these, the company offers an array of internet services and subscription-based products and engages in licensing, research, and development services. Alphabet remains a dominant force in search (through Google), online video (through YouTube), and other digital services. The company is constantly innovating and investing in areas like artificial intelligence, self-driving cars, and life sciences, solidifying its position at the forefront of technological advancement. Despite its immense success, Alphabet faces challenges, including navigating regulatory scrutiny and competition from other tech giants.

Magnite, Inc., and MediaMath are some emerging market participants in the market.

-

Magnite, Inc. is an advertising technology firm that delivers online advertising solutions to web publishers and ad networks. The company focuses on the programmatic buying and selling of advertising specifically for video content. They offer a comprehensive suite of tools for both sellers (publishers) and buyers (advertisers) to streamline ad transactions across Connected Television (CTV) and other digital video formats. Magnite leverages programmatic automation and data-driven targeting to ensure efficient ad placement and maximize yield for publishers, while also providing advertisers with access to valuable video audiences. Their focus on programmatic CTV advertising, a rapidly growing segment, positions Magnite as a key player to watch in the evolving AdTech landscape.

-

MediaMath is a technology company specializing in digital marketing solutions. Its comprehensive suite includes tools for ad-buying, data management, and other facets of digital marketing. This company positions itself as a challenger to the established giants, offering a comprehensive Demand-Side Platform (DSP) geared towards empowering advertisers. MediaMath's DSP goes beyond simply buying ad inventory; it provides advanced features for campaign management, data analysis, and audience targeting. By prioritizing transparency and control for advertisers, MediaMath carves out a niche for itself within the AdTech market. Their focus on innovation and a robust suite of tools positions MediaMath as a strong contender, particularly for advertisers seeking more control and flexibility within the programmatic advertising landscape.

Key AdTech Companies:

The following are the leading companies in the AdTech market. These companies collectively hold the largest market share and dictate industry trends.

- Adobe

- Alibaba Group Holding Limited

- Amazon.com, Inc.

- Criteo

- Facebook Incorporation

- Google Incorporation

- Microsoft Incorporation

- SpotX

- Twitter Incorporation

- Verizon

Recent Developments

-

In July 2023, Criteo S.A. announced its partnership with Integral Ad Science (IAS), a global media measurement platform. This collaboration aims to develop a product for measuring and optimizing retail media. By joining forces, both companies seek to enhance their offerings and provide advertisers with comprehensive solutions for effective and impactful retail advertising. Integral Ad Science (IAS) is known for delivering actionable data and insights, making it a valuable addition to Criteo's capabilities in the digital advertising space.

-

In June 2023, Alphabet Inc. announced the launch of two AI-powered advertising solutions, Demand Gen and Video View. These solutions are designed to help advertisers generate demand and drive engagement with their target audiences. These developments showcase Google's continued efforts to leverage AI technology in advertising.

-

In March 2023, Amazon.com, Inc. partnered with NVIDIA to construct an adaptable, on-demand Artificial Intelligence (AI) infrastructure suitable for generating generative AI applications and training complex Large Language Models (LLMs).

-

In July 2022, Microsoft announced partnership with the global streaming service provider Netflix as its AdTech partner for the upcoming ad-supported subscription service. This strategic collaboration would combine Netflix's renowned content offerings with Microsoft's advanced AdTech capabilities. Through this partnership, Netflix aims to enhance the user experience of its ad-supported subscription service by leveraging Microsoft's expertise in ad technology.

-

In June 2022, Magnite, Inc announced that it had extended its footprint in Australia's Connected TV (CTV) landscape. This strategic expansion highlights the company’s commitment to strengthening its presence and capabilities in the burgeoning CTV market. The company is poised to deliver innovative solutions and services in the CTV sector that cater to the evolving preferences of advertisers and audiences alike.

-

In March 2022, MediaMath and Hivestack entered into a strategic collaboration aimed at establishing a far-reaching programmatic Digital Out-Of-Home (DOOH) partnership on a global scale. This partnership seeks to harness the capabilities of both entities to enhance the programmatic DOOH landscape. As a result of this collaboration, Hivestack's expertise in programmatic DOOH technology will converge with MediaMath's proficiency in data-driven marketing solutions.

-

In December 2021, Microsoft announced the acquisition of Xandr from AT&T. Xandr is renowned for its data-driven technology platform, offering a comprehensive suite of tools that facilitate a dynamic ecosystem uniting marketers and media owners. This collaboration centers around first-party, data-powered advertising solutions that span Xandr's expansive network.

-

In August 2021, Adobe announced its plan to acquire Frame.io, a cloud-based video collaboration platform. This acquisition would allow Adobe to integrate Frame.io's capabilities into its Creative Cloud suite of products. Frame.io provides online video review and collaboration tools for creative professionals, and the acquisition aims to streamline digital collaboration among video editors and enhance Adobe's offerings in the video production space. This move reflects Adobe's commitment to expanding its capabilities in cloud-based production and post-production workflows.

AdTech Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 996.81 billion

Revenue forecast in 2030

USD 3,359.41 billion

Growth rate

CAGR of 22.4% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Offering, advertising type, advertising channel, advertising format, platform, enterprise size, industry vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; India; Japan; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Adobe; Alibaba Group Holding Limited; Amazon.com, Inc.; Criteo; Facebook Incorporation; Google Incorporation; Microsoft Incorporation; SpotX; Twitter Incorporation; Verizon

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AdTech Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global AdTech market report based on offering, advertising type, advertising channel, advertising format, platform, enterprise size, industry vertical, and region.

-

Offering Outlook (Revenue, USD Billion, 2017 - 2030)

-

Solution

-

Demand-Side Platforms (DSPs)

-

Supply-Side Platforms (SSPs)

-

Ad Networks

-

Data Management Platforms (DMPs)

-

Others

-

-

Services

-

Professional Services

-

Training & Consulting

-

Advertising Type & Integration

-

Support & Maintenance

-

-

Managed Services

-

-

-

Advertising Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Programmatic Advertising

-

Non-Programmatic Advertising

-

-

Advertising Channel Outlook (Revenue, USD Billion, 2017 - 2030)

-

Television Advertising

-

Radio Advertising

-

Digital Out-of-Home (DOOH) Advertising

-

Others (Mobile/Tablet Advertising)

-

-

Advertising Format Outlook (Revenue, USD Billion, 2017 - 2030)

-

Image

-

Video

-

Text

-

Others

-

-

Platform Outlook (Revenue, USD Billion, 2017 - 2030)

-

Mobile

-

Web

-

Others

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2017 - 2030)

-

Small and Medium Enterprise (SME)

-

Large Enterprise

-

-

Industry Vertical Outlook (Revenue, USD Billion, 2017 - 2030)

-

Retail & Consumer Goods

-

BFSI

-

Hospitality

-

Media & Entertainment

-

Transport & Logistics

-

Healthcare

-

IT & Telecom

-

Education

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

United Arab Emirates (UAE)

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global AdTech market size was estimated at USD 845.33 billion in 2023 and is expected to reach USD 996.81 billion in 2024.

b. The global AdTech market is expected to grow at a compound annual growth rate of 22.4% from 2024 to 2030, reaching USD 3,359.41 billion by 2030.

b. North America led the overall market in 2023, gaining a market share of 35.3%, with the U.S. being a major contributor to the industry. The high penetration of digital advertising is one factor propelling the growth of the North American adtech market.

b. Some key players operating in the AdTech market include Adobe, Alibaba Group Holding Limited, Amazon.com, Inc., Criteo, Facebook Incorporation, Google Incorporation, Microsoft Incorporation, SpotX, Twitter Incorporation, and Verizon.

b. The growth of AdTech market is anticipated to grow rapidly in recent years as the market has experienced increasing investment in data, automation, artificial intelligence, and programmatic advertising. The companies in the adtech space are providing solutions that help advertisers to target the right audiences, optimize their ad spending, and measure the performance of their campaigns.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."