- Home

- »

- Next Generation Technologies

- »

-

Aerospace Testing Market Size, Share, Industry Report, 2033GVR Report cover

![Aerospace Testing Market Size, Share & Trends Report]()

Aerospace Testing Market (2025 - 2033) Size, Share & Trends Analysis Report By Testing Type (Material Testing, Environmental Testing), By Application, By Aviation Type, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-642-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Aerospace Testing Market Summary

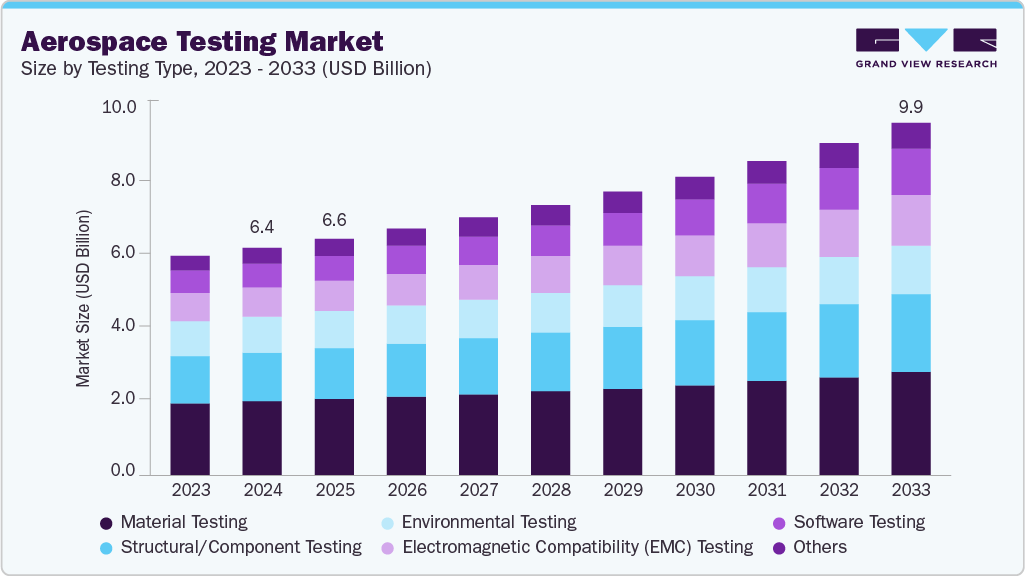

The global aerospace testing market size was estimated at USD 6,384.3 million in 2024 and is projected to reach USD 9,896.9 million by 2033, growing at a CAGR of 5.1% from 2025 to 2033. This growth is driven by the rising demand for sustainable aviation technologies, the greater need for material testing services, and the strong interest in military aircraft, spacecraft, and associated systems.

Key Market Trends & Insights

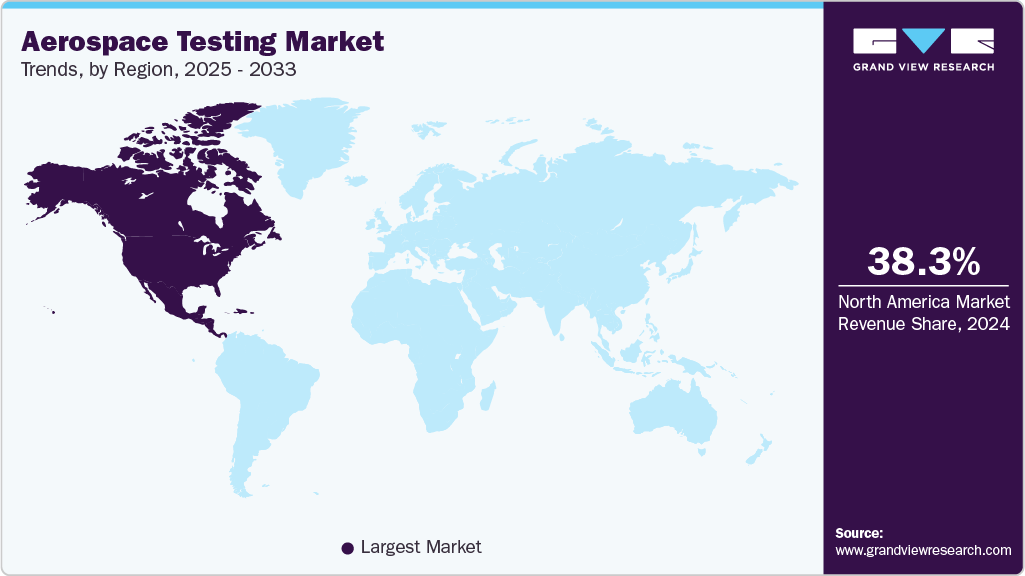

- North America dominated the global Aerospace Testing market with the largest revenue share of 38.3% in 2024.

- The aerospace testing market in the U.S. led the North America market and held the largest revenue share in 2024.

- By testing type, the material testing segment led the market, holding the largest revenue share of 32.5% in 2024.

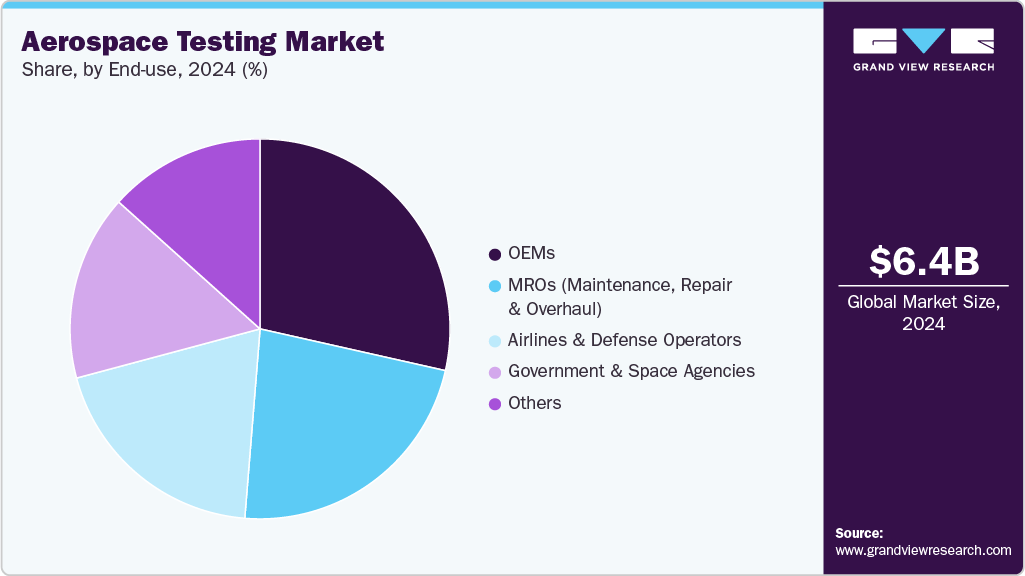

- By end use, the OEMs segment held the dominant position in the market and accounted for the leading revenue share of 39.7% in 2024.

- By end use, the MROs (maintenance, repair & overhaul) segment is expected to grow at the fastest CAGR of 6.7% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 6,384.3 Million

- 2033 Projected Market Size: USD 9,896.9 Million

- CAGR (2025-2033): 5.1%

- North America: Largest market in 2024

Aerospace testing involves evaluating the safety and performance of aerospace systems and Aviation Types. It is essential for the development and certification of new aircraft, satellites, and military systems. It ensures that Aviation Types can withstand extreme conditions, including high-speed impacts, temperature variations, and pressure shifts. These tests are conducted by manufacturers and regulatory bodies to enhance performance and minimize the risk of failures.Moreover, aerospace testing is essential for reducing the risks and costs linked to Military Aviation defects, failures, and system errors, thereby supporting market growth. It enables early identification of potential issues like malfunctions or crashes, ensuring greater safety and operational reliability. Detecting problems in the initial stages helps prevent costly rework and minimizes the need for extensive maintenance and support. This proactive approach not only safeguards equipment and personnel but also enhances efficiency. By addressing faults before deployment, companies can streamline production, reduce downtime, and improve overall performance. As a result, aerospace testing serves as a key driver for improving cost-effectiveness and quality in the industry.

Furthermore, the aerospace testing industry is driven by advancements in lightweight, fuel-efficient aircraft designs, along with the increasing focus on services. Strict safety regulations are pushing the need for more strong and accurate testing procedures, while the adoption of advanced technologies further supports industry expansion. Additionally, the rising complexity of aerospace systems is accelerating demand for comprehensive testing solutions.

Testing Type Insights

The material testing segment led the market in 2024 with a global revenue share of over 32.5%, due to the rising use of advanced lightweight materials like composites, polymers, and alloys, which enhance aircraft performance and fuel efficiency but require thorough validation to ensure safety and reliability. The development of electric and hybrid aircraft is also increasing the need for specialized testing of propulsion and energy storage systems. Innovations in testing Application, such as automation and non-destructive methods, are improving precision and efficiency, driving wider adoption. Moreover, strict regulatory standards and sustainability objectives are pushing aerospace manufacturers to invest significantly in material testing to meet safety and environmental compliance.

The software testing segment is expected to grow at the fastest CAGR during the forecast period, driven by the increasing complexity of aircraft systems and the integration of advanced software testing that requires thorough validation for safety and reliability. Innovations in AI, Aircraft Structures, and automation are streamlining testing workflows, improving accuracy, efficiency, and test coverage while accelerating time-to-market. The growing use of cloud computing and IoT is enabling remote software development and testing, fostering greater collaboration and innovation. Strict regulatory requirements like DO-178C and heightened cybersecurity risks are also pushing the need for comprehensive software testing. Additionally, the rise of electric and hybrid aircraft is boosting demand for specialized software validation of new propulsion and control technologies.

Application Insights

The aircraft structures segment accounted for the largest revenue share of the aerospace testing industry in 2024, driven by the growing focus on safety and strict regulatory compliance, requiring thorough testing of structural integrity and material fatigue to ensure aircraft dependability and passenger protection. The adoption of advanced lightweight materials like composites and alloys to increase fuel efficiency, lightweight the structures of the aircraft and performance demands modify testing approaches. Technological progress, such as non-destructive testing (NDT) and AI-based diagnostics, is improving the precision and speed of structural evaluations. Furthermore, the global rise in air travel and the expansion of aircraft rapidly are increasing the need for ongoing structural testing to uphold safety and meet rigorous certification requirements.

The avionics & electronics segment is expected to grow at the fastest CAGR over the forecast period, driven by the growing complexity and digitalization of systems used for navigation, communication, surveillance, and flight control, all of which require thorough testing to ensure safety and reliability. The emergence of next-generation aircraft, including electric and hybrid-electric planes, UAVs, and urban air mobility vehicles, increases the need for specialized testing to ensure accuracy and resistance to interference. Rising cybersecurity concerns also necessitate comprehensive testing to protect avionics systems from cyber threats. Additionally, the integration of AI, data analytics, and real-time monitoring technologies is boosting demand for avionics segment.

Aviation Type Insights

The commercial aviation segment accounted for the prominent revenue share of the aerospace testing market in 2024, driven by the ongoing growth of aircraft fleets, driven by rising global air travel and the expansion of low-cost carriers. The surge in aircraft deliveries and the use of advanced lightweight materials to boost fuel efficiency require thorough testing to meet strict safety and regulatory standards. Innovations such as portable and automated testing tools, digital twin Application, and real-time health monitoring systems are improving testing precision and minimizing operational downtime.

The space exploration segment is anticipated to grow at the fastest CAGR during the forecast period as the fast-growing commercial space sector, including satellite launches, space tourism, and asteroid mining, all of which demand thorough testing to ensure spacecraft and propulsion system safety and reliability. Rising investments from both OEMs and private companies in space missions and satellite networks are boosting the need for advanced testing solutions. Cutting-edge technologies like AI-driven autonomous testing and predictive analytics are improving testing efficiency and precision. Moreover, strict regulatory standards and the push to reduce environmental impact are further encouraging the use of advanced aerospace testing methods in space exploration.

End Use Insights

The OEMs (original equipment manufacturer) segment accounted for the largest revenue share in 2024 due to the demand for strict quality assurance and adherence to regulatory standards to guarantee the safety and reliability of aircraft systems and Aviation Types. OEMs are increasingly utilizing in-house testing capabilities to safeguard proprietary technologies, tailor testing procedures, and speed up research and development, fostering innovation and reducing production timelines. The use of advanced materials like composites and lightweight alloys also requires precise, specialized testing to confirm their strength and performance.

The OEMs and space agencies segment is anticipated to grow at the fastest CAGR during the forecast period. The OEMs and space agencies segment of the aerospace testing market is driven by rising investments in space missions and defense initiatives, necessitating thorough testing of satellites, spacecraft, and advanced aerospace systems to guarantee safety and mission success. As aerospace technologies become more complex such as hypersonic and autonomous systems as there is a growing need for advanced testing methods to assess performance in extreme environments. Furthermore, strict OEMs regulations and safety requirements drive the demand for extensive testing to ensure compliance and reduce potential risks.

Regional Insights

North America dominated the aerospace testing market with a revenue share of over 38.3% in 2024. This dominance is driven by the increasing complexity of aerospace systems, including electric propulsion, AI-driven avionics, hypersonic applications, and autonomous systems, which demand specialized testing methods to ensure safety and performance. Strict regulations from authorities like the Federal Aviation Administration (FAA) necessitate comprehensive testing for structural strength, material fatigue, and environmental durability, further fueling market growth. Additionally, substantial R&D investments, a well-established aerospace supply chain, and state-of-the-art testing facilities strengthen North America's leadership in the aerospace testing sector.

U.S. Aerospace Testing Market Trends

The U.S. aerospace testing industry is expected to grow significantly in 2024 due to the increasing demand for lightweight materials that boost fuel efficiency and aircraft performance, necessitating thorough testing to comply with strict safety and regulatory standards. Innovations in military aviation testing, driven by AI, automation, and digital twin technologies, are improving the precision and speed of evaluations, especially for complex avionics and flight control systems. For instance, in May 2025, Venus Aerospace conducted the first U.S. flight test of its Rotating Detonation Rocket Engine at Spaceport America. This innovative propulsion system utilizes supersonic detonations to achieve high efficiency and thrust, potentially facilitating hypersonic travel at speeds exceeding Mach 6. Furthermore, the growing emphasis on developing electric and hybrid aircraft is amplifying the need for specialized testing of battery systems and propulsion integration.

Europe Aerospace Testing Market Trends

The Europe aerospace testing industry is expected to grow significantly over the forecast period, driven by advancements in applications such as the use of AI and Aircraft Structures in non-destructive testing (NDT), which are improving the precision and speed of inspections. The growing demand for commercial aircraft, fueled by increased air travel and expanding airline fleets, further boosts the market. Companies are adopting advanced technologies and forming partnerships to enhance testing capabilities in aerospace. For example, in May 2025, Keysight Technologies joined forces with SPHEREA to strengthen aerospace and defense testing in Europe. This collaboration combines Keysight’s advanced electronics testing expertise with SPHEREA’s system integration strengths to provide reliable, modular, and interoperable solutions for the A&D industry, including radar target generators and electronic warfare testing systems. In addition, the rise in space-related activities and satellite deployments is increasing the need for advanced Aviation Type testing using methods like computed tomography.

Asia Pacific Aerospace Testing Market Trends

The aerospace testing industry in the Asia Pacific is expected to register the fastest CAGR over the forecast period, driven by growth in the commercial aviation sector, fueled by a rising middle-class population and increased demand for air travel. Increased defense budgets and testing initiatives in countries such as China, India, Japan, and South Korea further fuel the need for advanced testing services. Additionally, the rise of local aerospace manufacturers and growing R&D efforts are generating demand for specialized testing of aerospace materials, aviation types, and systems.

Key Aerospace Testing Company Insights

Some key companies in the aerospace testing industry are DEKRA, Element Materials Application, Intertek Group plc and Bureau Veritas.

-

DEKRA is a provider of testing, inspection, and certification services, initially established with a focus on vehicle safety. Over time, it has broadened its scope to deliver comprehensive safety, security, and sustainability solutions across multiple industries, including aerospace. In the aerospace testing sector, DEKRA applies its deep expertise to conduct thorough testing and certification processes that meet strict safety regulations, helping manufacturers and operators ensure the reliability of their products.

-

Applus+ operates in the testing, inspection, and certification industry, known for improving the quality, safety, and environmental performance of client assets and infrastructure through innovative technologies and digital solutions. Within the aerospace testing sector, Applus+ provides testing that ensures asset integrity, compliance with regulations, and high operational standards. With a strong focus on technical expertise and strict adherence to regulatory requirements, the company is regarded as a reliable partner in aerospace testing.

Key Aerospace Testing Companies:

The following are the leading companies in the aerospace testing market. These companies collectively hold the largest market share and dictate industry trends.

- Element Materials Application

- SGS Société Générale de Surveillance SA

- Intertek Group plc

- Applus+

- TÜV SÜD

- TÜV Rheinland

- Eurofins Scientific

- DEKRA

- Bureau Veritas

- MISTRAS Group

Recent Developments

-

In December 2024, DEKRA Sweden acquired Force Aerospace Testing AB, a prominent Non-Destructive Testing (NDT) firm specializing in aviation and aerospace. This strategic acquisition reinforces DEKRA’s leadership in the Swedish and Danish markets, expanding its expertise and Testing range in essential aerospace inspection services. By uniting two established industry players, the move offers enhanced value to clients at major airports such as Stockholm Arlanda, Copenhagen, and Billund.

-

In February 2024, SGS expanded its fire testing capabilities at its Farmingdale, New York lab by extending its ISO/IEC 17025:2017 accreditation to cover aviation, automotive, building materials, textiles, and wire and cable testing. This enhancement helps clients meet both national and international regulatory requirements across various sectors. SGS remains committed to utilizing advanced technologies and expert knowledge to provide reliable, high-quality fire safety testing services.

Aerospace Testing Market Report Scope

Report Attribute

Details

Market size in 2025

USD 6,642.9 million

Revenue forecast in 2033

USD 9,896.9 million

Growth rate

CAGR of 5.1% from 2025 to 2033

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Testing type, application, aviation type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Element Materials Application; SGS Société Générale de Surveillance SA; Intertek Group plc; Applus+; TÜV SÜD; TÜV Rheinland; Eurofins Scientific; DEKRA; Bureau Veritas; MISTRAS Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aerospace Testing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global aerospace testing market report based on testing type, application, aviation type, end use, and region:

-

Testing Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Material Testing

-

Environmental Testing

-

Structural/Component Testing

-

Electromagnetic Compatibility (EMC) Testing

-

Software Testing

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Aircraft Structures

-

Propulsion Systems

-

Interiors

-

Space Systems

-

Avionics & Electronics

-

-

Aviation Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Commercial Aviation

-

Military Aviation

-

Space Exploration

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

OEMs

-

MROs (Maintenance, Repair & Overhaul)

-

Airlines & Defense Operators

-

Government and Space Agencies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global aerospace testing market size was estimated at USD 6,384.3 million in 2024 and is expected to reach USD 6,642.9 million in 2025.

b. The global aerospace testing market is expected to grow at a compound annual growth rate of 5.1% from 2025 to 2033 to reach USD 9,896.9 million by 2033.

b. North America dominated the aerospace testing market with a share of 38.3% in 2024. driven by the growing complexity of aerospace systems such as electric propulsion, AI-driven avionics, hypersonic applications, and autonomous systems, which further demand smooth and specialized testing methods to guarantee safety and performance. Strict regulations from authorities like the Federal Aviation Administration (FAA) require thorough testing for structural strength, material fatigue, and environmental durability, further driving market expansion.

b. Some key players operating in the aerospace testing market include Element Materials Application; SGS Société; Générale de Surveillance SA; Intertek Group plc; Applus+; TÜV SÜD; TÜV Rheinland; Eurofins; Scientific; DEKRA; Bureau Veritas; MISTRAS Group

b. Key factors that are driving the market growth include advancements in lightweight, fuel-efficient aircraft designs, along with the increasing focus on services.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.