- Home

- »

- Advanced Interior Materials

- »

-

Africa Dewatering Pump Market Size & Share Report, 2030GVR Report cover

![Africa Dewatering Pump Market Size, Share & Trends Report]()

Africa Dewatering Pump Market (2023 - 2030) Size, Share & Trends Analysis Report By Technology (Positive Displacement, Centrifugal), By Product Type, By End-use, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-059-3

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

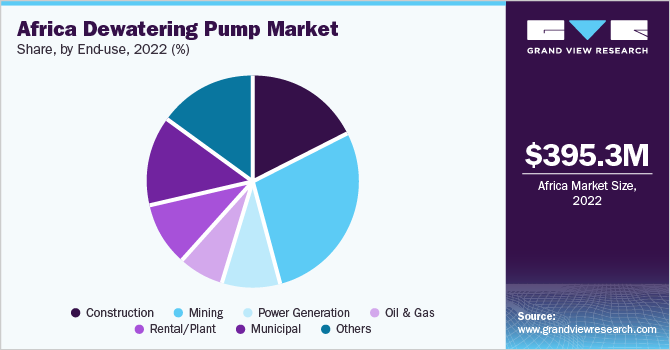

The Africa dewatering pump market size estimated was at USD 395.3 million in 2022 and is expected to grow at a compounded annual growth rate (CAGR) of 3.8% from 2023 to 2030. The growth in demand for dewatering pumps is boosted by rising industrialization and urbanization. Population in the African continent is rapidly increasing. According to the United Nations statistics, in 2023; the current population of the continent is 1.45 billion, registering a 2.8% increase from the previous year. By 2050, the population is likely to grow to 2.50 billion exhibiting a significant increase. This population growth is driving the real estate and housing sector, creating opportunities for new construction projects. This in turn is expected to increase the demand for dewatering pumps for construction sites.

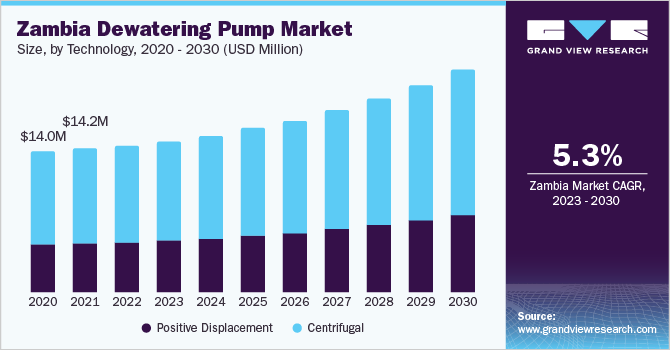

The Zambia dewatering pump market is projected to grow at a CAGR of 5.3% over the forecast period. The growth in the construction sector, mining activities, oil & gas industry, etc. are likely to facilitate the demand for the dewatering pump including submersible pumps. For instance, in May 2022, First Quantum Minerals, headquartered in Canada, announced USD 1.25 billion foreign investment in the Kansanshi copper mine over a period of a decade.

Moreover, a government initiative to attract FDI in the mining sector is expected to boost the mining sector output and increasingly demand more dewatering pumps. In November 2021, the Zambian government introduced tax breaks to the mining sector. The new tax rule as a part of the 2022 budget is expected to create a more business-friendly environment and encourage more companies to invest in the mining sector.

Additionally, increasing oil & gas exploration activities in the region are expected to augment the growth of the African dewatering pump market. Dewatering pumps are used to separate the suspended solids from the water used and produced water at these oil & gas exploration sites. For instance, total oil & gas exploration in Africa amounted to USD 5.1 billion in 2022, rising from USD 3.4 billion in 2020.

Key players in the dewatering pump market are actively investing in innovative products launched to introduce high-performance, automated, and highly efficient products. For instance,in November 2020, Weir Group launched a new mobile dewatering pump offering trailer and skid-mounted specificity.

Technology Insights

The centrifugal pump segment by technology held the largest share in the Africa dewatering pump market, accounting for 74.0% of the revenue share in 2022.The vast majority of the applications of the centrifugal type of dewatering pump in mining, construction, oil & gas, wastewater treatment, and other industries are credited to the large demand.

In the construction industry, centrifugal dewatering pumps are used in a crucial process of construction. These centrifugal dewatering pumps are used to remove the groundwater for the construction process to commence.

The positive displacement segment is anticipated to grow at a CAGR of 4.1% over the forecast period. These types of pumps are usually diesel-driven pumps which are used in the general manufacturing industry. These types of pumps are known for their self-priming capacity and are an excellent choice for transporting viscous liquids. Industries such as power stations, and waste treatment plants. The suction height offered by the positive displacement pump is above 7 meters.

Increasing power generation facilities in the region are expected to have a positive impact on the positive displacement dewatering pump. For instance, in July 2021, to reduce the gap between the available electricity and growing demand, the Zambian government inaugurated a new USD 2.3 billion power plant with having capacity of 750 megawatts. The growth in the region’s power generation capacity is anticipated to drive the growth of the Africa dewatering pump market.

Product Type Insights

The slurry pump segment of product type held the largest share of the Africa dewatering pump industry. In 2022, the segment accounted for 30.5% of the revenue share. Slurry pumps are used in dewatering applications in various end-use industries including construction, mining, oil & gas, etc. The extensive mining activities in the region are credited for the large market share of the slurry pumps.

The slurry pump segment is expected to grow at the highest CAGR of 4.2% over the forecast period. The expansion of industrial output in the region is likely to have a positive impact on the growth of the segment. FDI, government initiatives, and market entry of global companies are likely to facilitate the growth of the segment over the forecast period.

The sludge pump is anticipated to witness a significant growth rate, growing at the second-highest CAGR over the forecast period. The sludge pump is utilized for the dewatering application at the construction and mining sites. These pumps are excellent at pumping water mixed with high content of suspended solids and other dirty components.

Other industrial application of sludge pump includes the oil & gas industry and wastewater treatment facilities. The increasing FDI flows and exploration in the oil & gas industry are anticipated to drive the growth of the sludge pumps for dewatering purposes. Moreover, these pumps are also capable of handling high abrasion resistance, and high wear resistance, along with low energy consumption and long durability.

End-use Insights

The mining segment accounted for the largest revenue share of 29.1% in 2022. The mining industry is one of the largest sectors in Africa. In Sub-Saharan Africa mining sector accounts for almost 10% of the GDP, according to the International Monetary Fund. It also exports key mineral commodities across the world, with an abundance of reserves of gold, diamond, coal, iron ore, copper, bauxite, etc.

The growing investment from foreign governments and companies in the regional mining sector is likely to drive segmental growth. This is expected to drive the demand for dewatering pumps over the forecast period. Dewatering pumps used at the mining sites include a submersible slurry pump, which removes water from the abrasive material such as suspended solids.

The power generation segment is expected to grow at the highest growth rate with a CAGR of 5.2% over the forecast period. The rising government initiative to cater to the increasing demand for electricity for the industrial sectors, manufacturing facilities, and residential areas is likely to drive the growth of the segment over the forecast period.

For instance, in March 2023, Eskom Hld SOC Ltd. announced the construction of a new power generation facility. This power station is situated at Kusile and is expected to become one of the largest coal-fired power plants delivering 4.8 gigawatt power generation. Dewatering pumps, which are employed at the power stations to remove the spent cooling water, are expected to experience growing demand over the forecast period.

Country Insights

Zambia accounted for a revenue share of around 3.7% in 2022. The industrially developing country is essentially based on privatization. Its mining sector provides an abundance of gold, copper, cobalt, and other natural resources, which are largely exported outside the country. The growth in the dewatering pump market is increasingly facilitated by the growth in mining and other industries.

Mining companies in South Africa are focusing on setting up new mining sites in the country’s mining plateau. For instance, in August 2022, Theta Gold Mines announced an underground project in South Africa at Transvaal Gold Mining Estate (TGME), which aims to develop up to 40 gold mines in the region. This is expected to boost the growth of the Africa dewatering pump industry over the forecast period.

Congo DRC is expected to register a strong CAGR of 5.5% over the forecast period. The increasing rate of industrialization in the country is likely to catapult the demand for the dewatering pump over the forecast period. Various industries are in boom including, mining, oil & gas exploration, construction sector, etc. are actively improving in terms of technology and infrastructure. This is anticipated to create a positive impact on the African dewatering pump market growth over the forecast period.

According to the United Nations Conference on Trade and Development’s 2022 World Investment Report, foreign direct investment in the Congo DRC in 2021 was USD 1.8 billion, increasing from USD 1.6 billion in 2020. The FDI flow is also expected to increase over the forecast period. This increasing FDI flow is expected to drive industrial growth and demand for dewatering pumps is expected to rise over the forecast period.

Key Companies & Market Share Insights

To increase market penetration and meet the shifting technological demands from various applications, including power generation, mining, construction, oil & gas, and others, the manufacturers employ a variety of strategies, including acquisitions, mergers, joint ventures, new product developments, and geographic expansions.

For instance, In November 2022, Atlas Copco announced about the agreement with IPR (Integrated Pump Rental) for dewatering pump distribution in the region. The company now rents and sells Atlas Copco submersible and diesel-based dewatering pumps. Some prominent players in the Africa dewatering pump market include:

-

Atlas Copco

-

Doosan

-

Elgi

-

Kirloskar

-

Sullair

-

Ingersoll Rand

-

Xylem, Inc.

-

Grundfos

-

The Weir Group

-

Sulzer

Africa Dewatering Pump Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 401.4 million

Revenue forecast in 2030

USD 530.8 million

Growth rate

CAGR of 3.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Technology, product type, end-use, country

Country Scope

South Africa; Nigeria; Zambia; Malawi; Congo DRC

Key companies profiled

Atlas copco; Doosan; Elgi; Kirloskar; Sullair; Ingersollrand; Xylem; Grundfos; The Weir Group plc.; Sulzer

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Africa Dewatering Pump Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Africa dewatering pump market report based on technology, product type, end-use, and country:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Positive Displacement

-

Centrifugal

-

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Sludge Pump

-

Slurry Pump

-

Drainage Pump

-

Hybrid Pump

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Construction

-

Mining

-

Power Generation

-

Oil & Gas

-

Rental/Plant

-

Municipal

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

South Africa

-

Nigeria

-

Zambia

-

Malawi

-

Congo DRC

-

Frequently Asked Questions About This Report

b. The Africa dewatering pump market size was estimated at USD 395.3 million in 2022 and is expected to reach USD 401.4 million in 2023.

b. The Africa dewatering pump market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.8% from 2023 to 2030 to reach USD 530.8 million by 2030.

b. Centrifugal segment dominated the Africa dewatering pump market with a revenue share of 74.0% in 2022. The high demand for centrifugal pump and pump services in dewatering application in construction, mining, oil & gas, etc. industry credited for the large market share.

b. Some of the key players operating in the Africa dewatering pump market include, Atlas copco, Doosan, Elgi, Kirloskar, Sullair, Ingersoll, Xylem, Grundfoss, The Weir Group, Sulzer, and among others.

b. The key factors that are driving the Africa dewatering pump market include the increasing construction activities, mining sector expansion, growing water infrastructure, and flourishing oil & gas industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.