- Home

- »

- Next Generation Technologies

- »

-

Agriculture IoT Market Size, Share, Industry Report, 2030GVR Report cover

![Agriculture IoT Market Size, Share & Trends Report]()

Agriculture IoT Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Deployment, By Connectivity, By Farm Type, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-501-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Agriculture IoT Market Summary

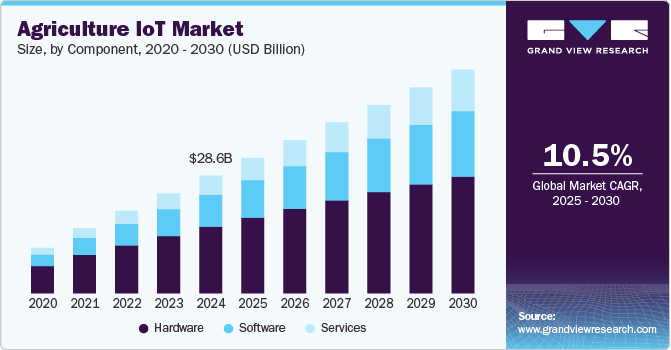

The global agriculture iot market size was estimated at USD 28.65 billion in 2024 and is projected to reach USD 54.38 billion by 2030, growing at a CAGR of 10.5% from 2025 to 2030. The market growth is primarily driven by the increasing demand for automation, the need for operational efficiency, and the rise in smart farming technologies that enable precise monitoring and management of crops.

Key Market Trends & Insights

- The agriculture IoT market in Asia Pacific dominated the market with a share of over 35% in 2024.

- Japan agriculture IoT market is expected to grow rapidly in the coming years.

- By component, the hardware segment recorded the largest revenue share of over 56% in 2024.

- By deployment, the on-premises segment accounted for the largest revenue share in 2024.

- By connectivity, cellular segment accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 28.65 Billion

- 2030 Projected Market Size: USD 54.38 Billion

- CAGR (2025-2030): 10.5%

- Asia Pacific: Largest market in 2024

In addition, the growing integration of artificial intelligence (AI) and machine learning with IoT systems is anticipated to enhance predictive analytics capabilities, allowing for more informed decision-making in farming operations, which is expected to present lucrative opportunities for the agriculture IoT industry in the coming years.

Integrating artificial intelligence (AI) and machine learning (ML) with IoT technologies is one of the most important emerging trends in the agriculture IoT industry. AI and ML algorithms can analyze the vast amounts of data IoT devices collect, offering predictive insights and automated decision-making capabilities. This combination allows farmers to identify problems before they arise, optimize crop yields, and enhance operational efficiency. The increasing use of AI and ML in conjunction with IoT transforms traditional farming methods, making agriculture smarter, more precise, and more productive.

In addition, governments around the world are increasingly supporting the adoption of IoT technologies in agriculture as part of their efforts to improve food security, increase agricultural productivity, and promote sustainable farming. Various initiatives, subsidies, and research programs are designed to encourage farmers to adopt smart farming solutions, including precision farming, data-driven decision-making, and automated irrigation. This government backing helps accelerate the deployment of IoT technologies in agriculture, leading to industry growth.

Furthermore, the growing emphasis on sustainability and environmental conservation in agriculture is another key factor driving the market growth. Precision agriculture, which uses IoT to optimize the use of inputs like water, fertilizers, and pesticides, not only improves farm productivity but also reduces the environmental footprint of farming activities. By enabling farmers to apply resources more efficiently and monitor environmental factors more closely, IoT technologies support more sustainable and eco-friendly farming practices, thus driving the expansion of the agriculture IoT industry.

Moreover, rapid sensor technology and connectivity advancements have played a pivotal role in the agriculture IoT industry expansion. With the development of low-cost, high-performance sensors and improved connectivity networks (such as 5G and low-power wide-area networks), farmers can collect real-time data from their fields and livestock. This data can then be used to monitor soil health, weather conditions, irrigation levels, and crop growth, helping farmers make informed decisions. The continuous improvement of these technologies enhances efficiency, reduces operational costs, and improves farm management. This trend is expected to drive market growth in the coming years.

Component Insights

The hardware segment recorded the largest revenue share of over 56% in 2024. This growth is driven by the increasing demand for real-time data collection and monitoring solutions that enhance operational efficiency. Farmers are adopting various IoT devices, including sensors, drones, and automated machinery, to gather critical information on soil moisture, crop health, and environmental conditions. This real-time monitoring enables optimized decision-making, reduces resource wastage, and improves overall yields. As the trend towards precision farming grows, advanced IoT hardware becomes essential for farmers looking to enhance productivity and sustainability in their operations.

Services is projected to register the highest CAGR of 13.1% from 2025 to 2030. The segmental growth is propelled by the growing need for integrated solutions encompassing installation, maintenance, and data analytics. As farmers increasingly adopt IoT technologies, they require comprehensive services to ensure these systems operate effectively and deliver actionable insights. Service providers offer support in areas such as data management, software integration, and ongoing technical assistance, which are crucial for maximizing the benefits of IoT investments. Furthermore, as agricultural practices evolve and diversify, the demand for customized service offerings that cater to specific farming needs is rising, further driving growth in this segment.

Deployment Insights

The on-premises segment accounted for the largest revenue share in 2024, primarily driven by the need for reliable data management and operational continuity in areas with limited internet connectivity. Many rural and remote farms face challenges with unstable or slow internet access, making on-premises deployments essential for ensuring that agricultural operations can function without relying on external cloud services. These systems allow farmers to control their data completely, addressing data security and privacy concerns. Furthermore, on-premises solutions enable real-time processing and analysis of critical agricultural data, ensuring farmers can make timely decisions to optimize their operations even in connectivity-challenged environments.

Cloud is anticipated to record the highest CAGR from 2025 to 2030. The segment is gaining traction in the agriculture IoT market due to its ability to provide scalable data storage and advanced analytics capabilities. Cloud computing facilitates the integration of vast amounts of data collected from various IoT devices, enabling farmers to perform complex analyses and gain insights into crop health, soil conditions, and weather patterns. This real-time access to data allows for informed decision-making, optimizing resource usage, and enhancing productivity. In addition, cloud solutions support collaboration among stakeholders in the agricultural supply chain, fostering innovation and efficiency.

Connectivity Insights

The cellular segment accounted for the largest revenue share in 2024, primarily driven by its ability to provide reliable and wide-ranging communication for IoT devices deployed in remote farming areas. Cellular networks facilitate real-time data transmission from sensors and equipment, enabling farmers to monitor crop conditions, soil health, and weather patterns from anywhere. This connectivity is particularly important for large agricultural operations that require extensive coverage and consistent data flow to optimize resource management and enhance productivity.

Bluetooth is anticipated to record the highest CAGR from 2025 to 2030. This segment is driven by providing a cost-effective, energy-efficient solution for short-range communication between devices. Bluetooth-enabled sensors and devices allow farmers to monitor equipment and livestock health without extensive infrastructure. This technology is particularly beneficial for small—to medium-sized farms where budget constraints may limit the adoption of more expensive connectivity solutions. Bluetooth's ability to connect multiple devices seamlessly enhances operational efficiency, allowing farmers to gather critical data on-site and immediately adjust their practices.

Application Insights

The precision farming segment accounted for the largest revenue share in 2024, driven by the need for optimal resource utilization and real-time monitoring of crops. As global food demand continues to rise, farmers increasingly adopt IoT technologies such as sensors and drones to gather critical data on soil conditions, moisture levels, and crop health. This data enables them to make informed decisions, apply inputs more accurately, and enhance productivity. In addition, advancements in AI and machine learning facilitate predictive analytics, allowing farmers to anticipate issues before they escalate, thus further boosting efficiency and yield in precision farming practices.

Aquaculture is anticipated to record the highest CAGR from 2025 to 2030. is propelled by the growing requirement for real-time tracking and monitoring of aquatic environments. As the demand for seafood increases, aquaculture operations are leveraging IoT technologies to optimize feeding practices, monitor water quality, and track fish health. Government initiatives supporting sustainable aquaculture practices and investments in research and innovation are also contributing to this growth. By utilizing IoT solutions, aquaculture farmers can enhance operational efficiency, reduce waste, and improve yield quality, ensuring they meet both market demands and environmental sustainability goals.

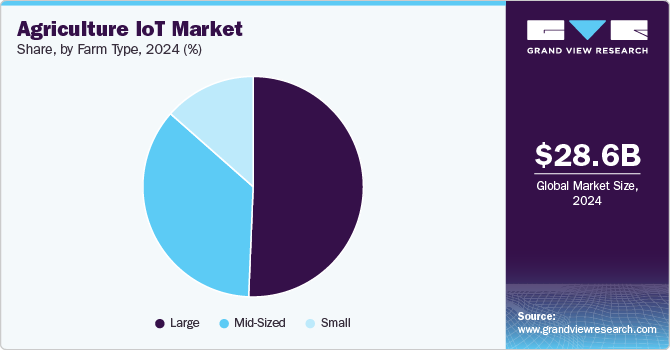

Farm Type Insights

The large segment accounted for the largest revenue share in 2024, primarily driven by the need for enhanced efficiency and productivity to meet the demands of a growing global population. Large-scale farms are increasingly adopting precision farming technologies that utilize IoT devices like sensors and drones to collect and analyze data on soil health, crop conditions, and resource usage. This data-driven approach allows for optimized input application, improved yield management, and reduced operational costs. Furthermore, government support through subsidies and grants encourages large farms to invest in advanced technologies, further propelling the adoption of IoT solutions in their operations.

The small segment is anticipated to record a significant CAGR from 2025 to 2030. The small segment is driven by the increasing availability of affordable IoT solutions tailored to meet the specific needs of smallholder farmers. As these farmers face challenges such as limited resources and labor shortages, IoT technologies provide them with tools to monitor crops and livestock efficiently, automate irrigation systems, and make informed decisions based on real-time data. Initiatives aimed at making technology accessible and affordable for small farmers, along with training programs to enhance digital literacy, are crucial in promoting the adoption of IoT solutions.

Regional Insights

North America's agriculture IoT market is expected to grow at a CAGR of over 13% from 2025 to 2030, driven by a rising demand for precision agriculture, which leverages IoT technologies to enhance farming efficiency and productivity in response to growing global food needs. Moreover, continuous advancements in IoT technology, including more affordable sensors and data analytics tools, make it easier for farmers to adopt these solutions, thereby propelling market growth as technology becomes increasingly accessible.

U.S. Agriculture IoT Market Trends

The agriculture IoT market in the U.S. held a dominant position in 2024, driven by government support and initiatives that promote the adoption of advanced agricultural technologies, creating a favorable environment for innovation and investment. Labor shortages and increasing input costs further necessitate integrating IoT solutions, as these technologies automate various tasks and streamline operations, helping farmers manage challenges effectively.

Europe Agriculture IoT Market Trends

The agriculture IoT market in Europe is expected to grow at a CAGR of over 8% from 2025 to 2030, primarily driven by the increasing adoption of precision agriculture technologies. These technologies enable farmers to optimize resource usage and enhance productivity through real-time data analytics. Furthermore, the rollout of 5G technology across Europe is enhancing connectivity in rural areas, facilitating the seamless integration of IoT devices, and improving the efficiency of agricultural operations.

The UK agriculture IoT market is expected to grow rapidly in the coming years. The increasing adoption of precision agriculture technologies is a primary driver in the UK. Farmers are leveraging IoT solutions to enhance productivity and sustainability by utilizing real-time data for crop monitoring, irrigation management, and pest control. The rise of agritech startups, which develop innovative IoT applications, has also contributed to this trend, providing farmers with advanced tools that facilitate data-driven decision-making. In addition, government initiatives promoting digital farming further accelerate the integration of IoT technologies in the agricultural sector.

The agriculture IoT market in Germany held a substantial market share in 2024. Germany's emphasis on sustainability and environmental conservation is a major market driver. German farmers are increasingly adopting smart farming solutions to optimize resource usage and minimize environmental impact. Integrating IoT devices allows for precise soil conditions and crop health monitoring, leading to more efficient farming practices.

Asia Pacific Agriculture IoT Market Trends

The agriculture IoT market in Asia Pacific dominated the market with a share of over 35% in 2024. The market is propelled by rapid technological advancements and a growing emphasis on food security due to increasing population pressures. Integrating AI and big data analytics into agricultural practices enables farmers to monitor resources effectively, automate processes, and make data-driven decisions. Furthermore, supportive government policies aimed at promoting modern agricultural techniques are fostering the adoption of IoT solutions across the region, addressing challenges such as labor shortages and climate change impacts.

Japan agriculture IoT market is expected to grow rapidly in the coming years. The market is primarily driven by government initiatives to modernize the agricultural sector and address labor shortages due to an aging farmer population. The Japanese government has implemented the Smart Agriculture Policy, which supports adopting digital technologies such as autonomous tractors and AI-powered monitoring systems, providing subsidies that cover a significant portion of equipment costs.

The agriculture IoT market in China is significantly influenced by the need for increased food production to meet the demands of its large population. The Chinese government has prioritized agricultural modernization through its policies, promoting smart farming technologies that utilize IoT solutions for real-time monitoring of crops and livestock.

Key Agriculture IoT Company Insights

Some key players operating in the market include John & Deere and Trimble, Inc..

-

Deere & Company is a leading innovator in precision agriculture technology, providing farmers with advanced tools to enhance their farm operations across all production stages. The company’s offerings include solutions for machine performance, field management, and data analysis, enabling farmers to monitor and optimize their activities effectively. With technologies such as JDLink for connectivity and the John Deere Operations Center for cloud-based farm management, farmers can access real-time agronomic data to improve efficiency and productivity.

-

Trimble Inc. is renowned for its innovative positioning technologies and solutions that enhance precision agriculture. The company provides a comprehensive suite of IoT applications designed to improve farm management, enabling farmers to make data-driven decisions. The company’s products include GPS-guided equipment, telematics systems, and software platforms that facilitate real-time monitoring of field conditions and machine performance.

Some of the emerging market players in the agriculture IoT market include Blue River Technology and Farmwise.

-

Blue River Technology, a subsidiary of John Deere, specializes in applying machine learning and computer vision to agriculture through innovative products like See & Spray. This technology allows farmers to precisely target weeds while minimizing herbicide use, promoting sustainable farming practices. Blue River's solutions utilize IoT devices to collect data on crop health and field conditions, enabling farmers to make informed decisions that enhance productivity and reduce environmental impact. Blue River Technology is at the forefront of transforming traditional farming methods into more efficient and eco-friendly practices as an emerging player in the IoT market for agriculture.

-

Farmwise is an emerging player focused on automating agricultural processes using advanced robotics and AI technologies. The company develops autonomous weeding machines that utilize computer vision and machine learning to identify and remove weeds without harming crops. By integrating IoT capabilities into its systems, Farmwise aims to enhance efficiency in labor-intensive tasks while reducing the reliance on chemical herbicides.

Key Agriculture IoT Companies:

The following are the leading companies in the agriculture IoT market. These companies collectively hold the largest market share and dictate industry trends.

- Deere & Company

- Trimble Inc.

- Raven Industries, Inc.

- AGCO Corporation

- Topcon Positioning Systems, Inc.

- Blue River Technology

- Valmont Industries, Inc.

- FarmWise Labs

- Cropin

- Agrostar

Recent Developments

-

In January 2025, John Deere unveiled new autonomous machines at CES 2025 to enhance agriculture, construction, and commercial landscaping productivity. This second-generation autonomy kit integrates advanced technologies such as computer vision and AI, addressing these industries' critical labor shortages.

-

In July 2024, Taranis announced the launch of its innovative Ag Assistant, a generative AI-powered tool designed to revolutionize crop management for agricultural retailers and producers. This advanced platform integrates diverse data sources, including images, text, and audio, to provide detailed insights and actionable recommendations tailored to specific fields.

-

In July 2024, Cropin Technology launched Sage, the world's first real-time agri-intelligence solution powered by Google Gemini, at an event in Bengaluru. This innovative platform creates a grid-based map of the global agricultural landscape, offering data with unprecedented accuracy and speed to help stakeholders in the food system make informed decisions regarding crop cultivation, irrigation, and climate impacts.

Agriculture IoT Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 32.95 billion

Revenue forecast in 2030

USD 54.38 billion

Growth rate

CAGR of 10.5% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, connectivity, application, farm type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; UAE

Key companies profiled

Deere & Company; Trimble Inc.; Raven Industries, Inc.; AGCO Corporation; Topcon Positioning Systems, Inc.; Blue River Technology; Valmont Industries, Inc.; FarmWise Labs; Cropin, Agrostar

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Agriculture IoT Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global agriculture IoT market report based on component, deployment, connectivity, application, farm type, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Connectivity Outlook (Revenue, USD Billion, 2018 - 2030)

-

Wi-Fi

-

Bluetooth

-

Cellular

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Precision Farming

-

Livestock Monitoring

-

Smart Greenhouse

-

Aquaculture

-

Others

-

-

Farm Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large

-

Mid-sized

-

Small

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global agriculture IoT market size was estimated at USD 28.65 billion in 2024 and is expected to reach USD 32.95 billion in 2025.

b. The global agriculture IoT market is expected to grow at a compound annual growth rate of 10.5% from 2025 to 2030, to reach USD 54.38 billion by 2030.

b. Asia Pacific dominated the agriculture IoT market with a share of over 35% in 2024, propelled by rapid technological advancements and a growing emphasis on food security due to increasing population pressures.

b. Some key players operating in the agriculture IoT market include Deere & Company, Trimble Inc., Raven Industries, Inc., AGCO Corporation, Topcon Positioning Systems, Inc., Blue River Technology, Valmont Industries, Inc., FarmWise Labs, Cropin, Agrostar.

b. Key factors that are driving the agriculture IoT market growth include the increasing demand for automation, the need for operational efficiency, and the rise in smart farming technologies that enable precise monitoring and management of crops.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.