- Home

- »

- Next Generation Technologies

- »

-

AI In Food & Beverages Market Size & Share Report, 2030GVR Report cover

![AI In Food & Beverages Market Size, Share & Trends Report]()

AI In Food & Beverages Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (Machine Learning, Robotics & Automation), By Application, By End-use, By Deployment, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-429-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

AI In Food & Beverages Market Summary

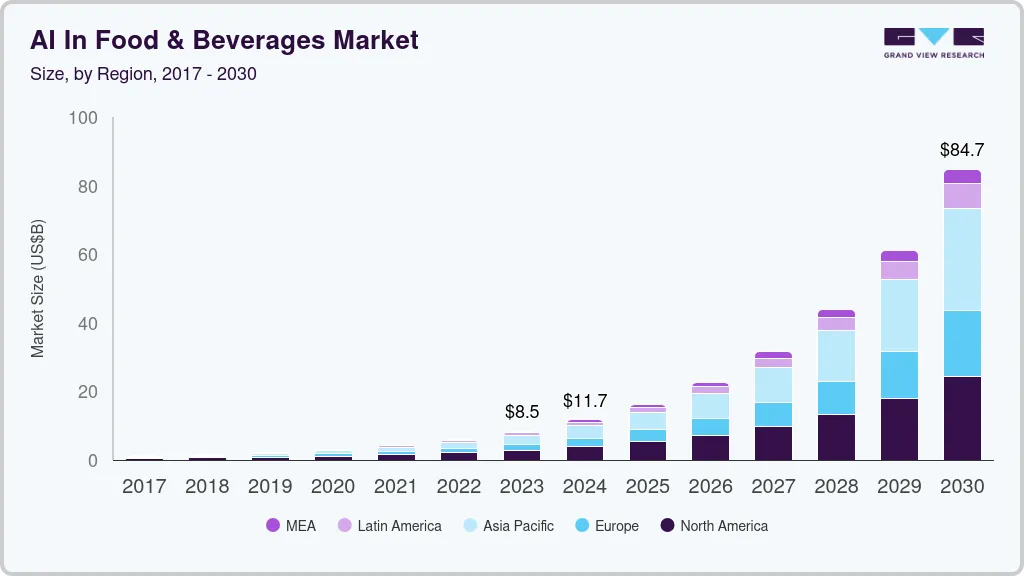

The global AI in food & beverages market size was valued at USD 8.45 billion in 2023 and is anticipated to reach USD 84.75 billion by 2030, growing at a CAGR of 39.1% from 2024 to 2030. AI is revolutionizing the food and beverages industry by enhancing efficiency and automation in processing, sorting, and packaging, thereby reducing errors and meeting global food demands.

Key Market Trends & Insights

- North America AI in food & beverages market represented a significant market share of over 32.0% in 2023.

- AI in food & beverages market in the U.S. is expected to grow significantly over the forecast period.

- By deployment, the cloud segment led the AI in the food & beverages industry in 2023.

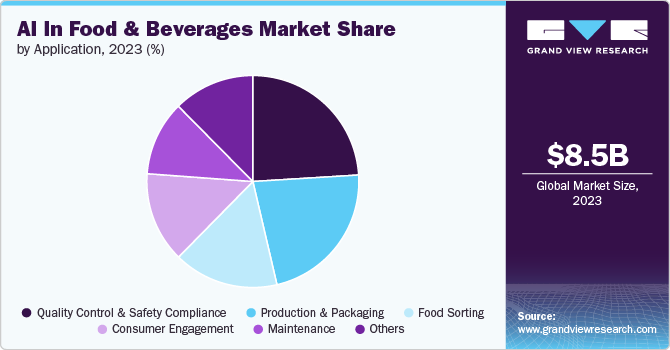

- By application, the quality control and safety compliance segment accounted for the largest market revenue share in 2023.

- By end-use, the food processing segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 8.45 Billion

- 2030 Projected Market Size: USD 84.75 Billion

- CAGR (2024-2030): 39.1%

- North America: Largest market in 2023

Its role in stringent quality control and safety compliance is becoming increasingly crucial due to heightened consumer awareness and regulatory pressures. AI also drives personalized consumer engagement and marketing while optimizing supply chains to minimize waste and manage inventory efficiently. The ongoing technological advancements, especially the integration of AI with IoT and big data, are broadening its applications and impact across the sector.

AI is transforming the food and beverage industry by enabling personalized food products tailored to individual preferences and dietary needs, which is appealing to health-conscious consumers. Predictive analytics powered by AI helps companies forecast demand more accurately, reducing overproduction and waste, especially for perishable goods. Sustainability initiatives are being enhanced through AI's ability to optimize resource usage, reduce food waste, and improve energy efficiency, aligning with global environmental goals. Additionally, AI-driven technologies such as blockchain are enhancing food traceability, ensuring safety standards, and boosting consumer trust through greater transparency.

The industry is also addressing labor shortages and rising costs by automating repetitive tasks with AI, reducing reliance on human labor, and controlling operational expenses. AI is accelerating new product development by analyzing large datasets to predict trends and optimize ingredient combinations, speeding up the time-to-market for innovative products. Regulatory compliance is streamlined with AI, which automates reporting, conducts real-time monitoring, and predicts potential issues, ensuring adherence to food safety standards. Moreover, AI is enhancing consumer experiences in retail, both in-store and online, through smart shelves, automated checkouts, and personalized promotions, leading to increased convenience and satisfaction.

Technology Insights

The machine learning segment led the market and accounted for over 29.0% of the global revenue in 2023 due to its powerful capabilities in data analysis and insight generation. Machine learning excels at uncovering patterns from vast datasets, optimizing food production processes, and enhancing supply chain management. It drives personalization through advanced recommendation systems, ensuring tailored food product suggestions that boost consumer engagement and satisfaction. Additionally, machine learning improves quality control by detecting defects and contamination more accurately, predicts demand to manage inventory efficiently, and automates tasks such as sorting and packaging, thereby enhancing efficiency and reducing labor costs.

The robotics & automation segment within the AI in the food and beverages market significantly enhances production efficiency by streamlining processing, packaging, and handling tasks, leading to higher output and consistency. These systems, which operate continuously without breaks, improve precision and quality control by performing tasks with high accuracy, which is essential for maintaining product standards. Automation also reduces operational costs by replacing labor-intensive tasks and addressing labor shortages. Modern robotic systems offer flexibility and adaptability to handle various products and respond to market changes, while integration with AI enables advanced functionalities such as machine vision, predictive maintenance, and real-time data analysis, enhancing overall safety and process optimization.

Deployment Insights

The cloud segment led the AI in the food & beverages industry in 2023 due to its scalability, cost efficiency, and ability to handle large volumes of data generated by AI systems. Cloud computing offers a flexible, pay-as-you-go model that reduces capital expenses and supports extensive data integration from various sources, enhancing AI analytics and decision-making. It also fosters better collaboration across departments and locations by providing accessible, real-time data. Additionally, cloud platforms offer advanced AI tools and services while ensuring robust security and compliance with industry regulations, protecting sensitive data effectively.

The on-premises segment is experiencing significant growth due to its advantages in data security, customization, and performance. On-premises solutions provide enhanced control over sensitive information, allowing for tailored AI integration with existing systems and processes, which ensures higher precision and compliance with regulatory requirements. They offer lower latency and faster processing speeds, essential for real-time applications in automated production and quality control. Additionally, on-premises systems can seamlessly integrate with legacy technologies and provide operational independence from external cloud providers, helping companies maintain control and avoid potential disruptions.

End-use Insights

The food processing segment accounted for the largest market revenue share in 2023 due to AI technologies that enhance efficiency by automating tasks such as sorting, grading, and blending, which speeds up production cycles and reduces manual labor. AI-driven quality control systems ensure product consistency and safety by detecting defects and deviations with high precision and adhering to stringent regulations. It also optimizes operations by analyzing data to improve recipes, streamline workflows, and reduce waste. Predictive maintenance minimizes downtime by forecasting equipment issues, while AI supports innovation by analyzing consumer trends and customizing products.

The supply chain management segment is expected to grow significantly due to AI's role in enhancing efficiency and accuracy. AI automates tasks such as inventory management and demand forecasting, reducing manual labor and minimizing errors, which leads to smoother operations and quicker response times. Predictive analytics helps anticipate disruptions and optimize procurement, while real-time tracking via IoT and machine learning improves visibility and traceability throughout the supply chain. AI also reduces costs by improving demand forecasting and inventory management, supports better decision-making with actionable insights, and strengthens risk management by identifying potential vulnerabilities.

Application Insights

The quality control and safety compliance segment accounted for the largest market revenue share in 2023. AI technologies, such as machine learning and computer vision, offer highly accurate and consistent quality control by detecting defects, contaminants, and deviations more precisely than manual methods. These solutions help companies meet stringent regulatory standards by automating monitoring and reporting, ensuring adherence to safety protocols. Real-time monitoring and predictive maintenance capabilities further enhance product safety and operational efficiency. Additionally, AI reduces labor costs, minimizes waste, and boosts consumer trust by maintaining high quality and safety standards, which are essential for brand reputation.

The production and packaging segment is poised for significant growth due to AI-driven automation, which enhances efficiency and consistency by streamlining tasks like sorting, filling, and labeling. AI optimizes production schedules and reduces downtime through predictive maintenance and real-time adjustments, leading to faster time-to-market and better resource utilization. It also ensures high-quality standards and compliance with safety regulations by detecting defects and deviations in real time, reducing the risk of recalls. By minimizing manual labor and waste, AI helps lower operational costs and supports precise control over ingredients and packaging.

Regional Insights

North America AI in food & beverages market represented a significant market share of over 32.0% in 2023 due to its advanced technological infrastructure, including robust IT systems, high-speed internet, and data centers that support AI adoption. The region's significant investment in R&D fosters continuous innovation in AI solutions, mainly in the food and beverages sector. North America's strong consumer market and early adoption of cutting-edge technologies drive growth by improving product quality and customer experiences. The presence of leading technology companies and stringent regulatory standards further support the widespread implementation of AI, ensuring compliance and enhancing operational efficiency.

U.S. AI in Food & Beverages Market Trends

AI in food & beverages market in the U.S. is expected to grow significantly over the forecast period, driven by the country's technological leadership and substantial investments in AI research and infrastructure. U.S. technology companies and startups are leading innovation in AI applications, enhancing efficiency, quality, and customer experience in the food and beverages industry. Consumer demand for personalized and convenient products fuels the adoption of AI for customized recommendations and optimized production processes. AI technologies also help reduce operational costs through automation and predictive maintenance while advancing food safety and quality through real-time monitoring and compliance tools.

Europe AI in Food & Beverages Market Trends

AI in food & beverages market in Europe is gaining significant traction due to significant investment in innovation and R&D by European companies and research institutions. The region's stringent food safety regulations are well-supported by AI technologies that ensure compliance through advanced monitoring and quality control. Additionally, Europe's focus on sustainability drives the adoption of AI for optimizing production, reducing waste, and improving resource efficiency. With consumers increasingly demanding personalized and high-quality food products, AI helps companies meet these preferences and enhance customer satisfaction.

Asia Pacific AI in Food & Beverages Market Trends

AI in food & beverages market in Asia Pacific is poised for significant growth. The expansion of e-commerce and online food delivery services across APAC, including China, India, and Southeast Asia, drives AI adoption for personalized recommendations and efficient order management. The rise of smart agriculture, utilizing AI-driven drones and sensors, addresses productivity challenges and optimizes crop yields. AI also enhances food quality and safety compliance by enabling real-time detection of contaminants.

Key AI in Food & Beverages Company Insights

Key players in the industry have strengthened their market presence through a strategic mix of product launches, expansions, mergers and acquisitions, contracts, partnerships, and collaborations. These initiatives serve as vital tools for enhancing market penetration and strengthening their competitive edge within the industry. For instance, in January 2024, ITC Limited adopted AI technologies for improved quality control in dairy and beverage manufacturing. It used visual inspection systems and real-time monitoring to ensure high product quality, which aligns with the growing use of AI across food industries.

Key AI in Food & Beverages Companies:

The following are the leading companies in the AI in food & beverages market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Honeywell International Inc.

- IBM Corporation

- Key Technology

- NVIDIA Corporation

- Rockwell Automation

- Sesotec GmbH

- Sight Machine

- Siemens

- TOMRA Systems ASA

Recent Developments

-

In July 2024, Mattson, a food and beverage innovation firm, appointed Steve Gundrum as its first Chief Artificial Intelligence Officer and introduced AI-enhanced product innovation services. Their new ProtoThink AI platform enables rapid idea exploration with specialized AI models, while the AI-powered Food Studio Ideation service boosts idea generation. Additionally, Mattson's advanced AI models provide deep consumer insights by analyzing billions of data points, offering faster and more cost-effective market understanding.

-

In July 2024, Chef Robotics, Inc. introduced an AI-powered robot designed to enhance industrial food production and tackle labor shortages. The robot, powered by ChefOS software, aims to boost efficiency and reduce waste in large-scale food manufacturing. It can partially automate operations in a compact space, requiring minimal resources, and allows staff to work alongside it, reducing the need for production area personnel.

-

In March 2024, Ai Palette, an AI-driven product development solutions company operating in the Consumer Packaged Goods (CPG) and food sectors, raised USD 5.7 million in a Series A1 funding round, bringing its total funding to USD 11.2 million. The funds will help expand its AI-powered platform, which helps food companies de-risk and accelerate the product innovation process.

AI in Food & Beverages Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.72 billion

Revenue forecast in 2030

USD 84.75 billion

Growth Rate

CAGR of 39.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, deployment, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; Japan; India; Australia; South Korea; Brazil; UAE; KSA; South Africa

Key companies profiled

ABB; Honeywell International Inc; IBM Corporation; Key Technology.; NVIDIA Corporation; Rockwell Automation; Sesotec GmbH; Sight Machine; Siemens; TOMRA Systems ASA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AI in Food & Beverages Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global AI in food & beverages market report based on technology, application, deployment, end-use and region:

-

Technology Outlook (Revenue, USD Billion, 2017 - 2030)

-

Machine Learning

-

Computer Vision

-

Natural Language Processing

-

Robotics & Automation

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Food Sorting

-

Consumer Engagement

-

Quality Control and Safety Compliance

-

Production and Packaging

-

Maintenance

-

Others

-

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cloud

-

On-premises

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Food Processing

-

Supply Chain Management

-

Hotel & Restaurant

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global AI in food & beverages market size was estimated at USD 8.45 billion in 2023 and is expected to reach USD 11.72 billion in 2024.

b. The global AI in food & beverages market is expected to grow at a compound annual growth rate of 39.1% from 2024 to 2030 to reach USD 84.75 billion by 2030.

b. North America dominated the market in 2023, accounting for over 32.0% share of the global revenue due to its advanced technological infrastructure, including robust IT systems, high-speed internet, and data centers that support AI adoption.

b. Some key players operating in the AI in food & beverages market include ABB; Honeywell International Inc; IBM Corporation; Key Technology.; NVIDIA Corporation; Rockwell Automation; Sesotec GmbH; Sight Machine; Siemens; TOMRA Systems ASA

b. Key factors driving the AI in food & beverages market growth include the surge in automation and robotics for streamlined operations and the growing adoption of predictive analytics for optimized supply chain

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.