- Home

- »

- Next Generation Technologies

- »

-

Smart Shelves Market Size, Share & Growth Report, 2030GVR Report cover

![Smart Shelves Market Size, Share & Trends Report]()

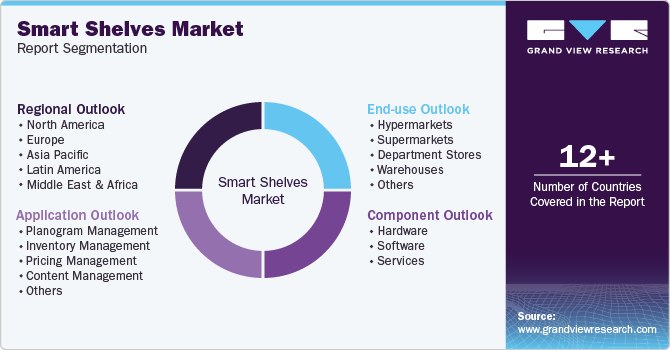

Smart Shelves Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software), By Application (Planogram Management, Inventory Management), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-438-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Shelves Market Summary

The global smart shelves market size was estimated at USD 3.31 billion in 2023 and is projected to reach USD 14.69 billion by 2030, growing at a CAGR of 24.2% from 2024 to 2030. This growth can be attributed to the rising adoption of automation in retail and the need for enhanced inventory management systems.

Key Market Trends & Insights

- The smart shelves market in North America is expected to grow at a notable CAGR of 23.7% from 2024 to 2030.

- The smart shelves market in Europedominated globally in 2023 with a revenue share of over 35.0%.

- The smart shelves market in Asia Pacific is expected to grow at the fastest CAGR of 26.4% from 2024 to 2030.

- Based on component, the hardware segment dominated the market in 2023 and accounted for more than 47.0% share of global revenue.

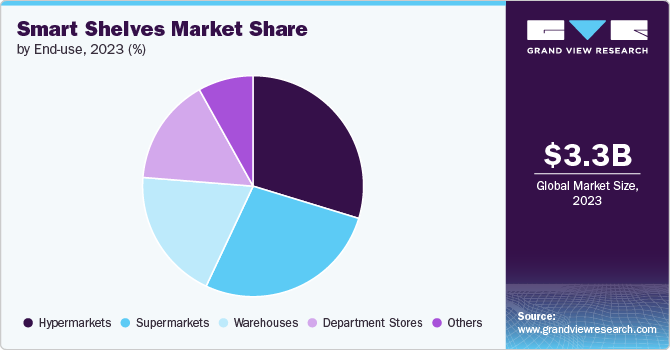

- In terms of end use, the hypermarkets segment dominated the market in 2023 and accounted for more than 29.72% of global revenue.

Market Size & Forecast

- 2023 Market Size: USD 3.31 Billion

- 2030 Projected Market Size: USD 14.69 Billion

- CAGR (2024-2030): 24.2%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

One of the most significant trends in the market is the rapid digital transformation and automation of retail operations. As e-commerce continues to challenge traditional brick-and-mortar stores, retailers are increasingly adopting smart technologies to stay competitive. Smart shelves play a critical role in this transformation by providing real-time inventory data, reducing stockouts, and improving customer engagement through interactive displays.Effective inventory management is a critical factor driving the adoption of smart shelves. Traditional inventory systems often rely on manual processes, which are prone to errors and inefficiencies. Smart shelves provide real-time visibility into inventory levels, allowing retailers to automate replenishment processes and reduce the risk of stockouts or overstocking. This leads to significant cost savings and improved customer satisfaction.

In today’s competitive retail environment, providing superior customer experience is paramount. Smart shelves enhance the shopping experience by offering personalized promotions, interactive displays, and real-time product information. These features not only attract customers but also encourage them to spend more time in the store, increasing the likelihood of purchases. Retailers are increasingly adopting smart shelves to differentiate themselves and build customer loyalty.

Advancements in IoT technology have been a major driving factor behind the growth of the smart shelves industry. The proliferation of connected devices and the increasing affordability of sensors, RFID tags, and digital displays have made smart shelves more accessible to retailers of all sizes. The integration of IoT technology enables retailers to collect and analyze vast amounts of data, leading to more informed decision-making and improved operational efficiency. Furthermore, the integration of AI and machine learning into smart shelves has opened new possibilities for retailers. AI algorithms can analyze vast amounts of data collected by smart shelves to identify patterns and trends, enabling retailers to make data-driven decisions.

Regulatory compliance and product safety are critical concerns for retailers, particularly in sectors such as food and pharmaceuticals. Smart shelves help retailers meet regulatory requirements by providing real-time monitoring of product conditions, such as temperature and humidity. This ensures that products are stored in optimal conditions, reducing the risk of spoilage and ensuring compliance with safety standards. The rise of e-commerce has significantly impacted traditional retail, forcing brick-and-mortar stores to innovate. Smart shelves are a response to this challenge, enabling physical stores to offer a seamless shopping experience that integrates with online platforms.

Component Insights

In terms of component, the market is classified into hardware, software, and services segments. The hardware segment dominated the market in 2023 and accounted for more than 47.0% share of global revenue. Retailers and warehouse owners are investing in hardware to reduce shrinkage, optimize stock levels, and ensure product availability. One of the notable trends is the miniaturization and integration of sensors and RFID tags, allowing for more seamless deployment and less intrusive designs. In addition, a growing shift towards battery-less RFID tags that harness ambient energy reduces the overall operational costs for retailers.

The software segment is projected to witness the fastest CAGR of 24.8% from 2024 to 2030. The growing demand for personalized shopping experiences is driving the adoption of software solutions that can track customer behavior and preferences. These platforms enable retailers to deliver targeted promotions and recommendations, enhancing customer loyalty and increasing sales. Moreover, cloud-based solutions are gaining traction due to their scalability, cost-effectiveness, and ease of integration with existing systems.

Application Insights

In terms of application, the market is classified into planogram management, inventory management, pricing management, content management, and others segments. The inventory management segment dominated the market in 2023 and accounted for more than 35.0% share of global revenue. The demand for real-time visibility into stock levels is a major driver of smart shelf adoption in inventory management. As consumer expectations for product availability rise, retailers must ensure that their shelves are always stocked with the right products. Moreover, the emergence of just-in-time inventory practices aimed at reducing waste and improving efficiency has increased the need for advanced inventory management systems.

The pricing management segment is projected to register a notable growth rate from 2024 to 2030. A notable trend in this segment is the adoption of electronic shelf labels (ESLs), which display real-time pricing information that can be updated remotely based on data from smart shelves. Smart shelves play a crucial role in dynamic pricing strategies by providing real-time data on sales and inventory levels, allowing retailers to adjust prices automatically and in real-time. In addition, AI and machine learning algorithms are increasingly being used to analyze data from smart shelves and recommend optimal pricing strategies. This includes discounting strategies for perishable goods approaching their sell-by dates or premium pricing for high-demand items.

End-use Insights

In terms of end use, the market is classified into hypermarkets, supermarkets, department stores, warehouses, and others. The hypermarkets segment dominated the market in 2023 and accounted for more than 29.72% of global revenue. The growing need for efficient inventory management is paramount in these large-scale retail environments. Smart shelves help to reduce the instances of stockouts and overstocking, thereby optimizing inventory levels. Furthermore, hypermarkets are increasingly focused on enhancing customer experience to differentiate themselves in a competitive market.

The department stores segment is projected to register a notable CAGR from 2024 to 2030. The adoption of smart shelves in department stores is driven by the need to innovate and stay relevant in the face of growing competition from e-commerce. Furthermore, smart shelves help department stores manage their diverse inventory more effectively, ensuring that popular items are always in stock. The ability to gather detailed customer insights through smart shelf interactions is also a significant driver, enabling department stores to tailor their offerings to meet evolving consumer preferences.

Regional Insights

The smart shelves market in North America is expected to grow at a notable CAGR of 23.7% from 2024 to 2030. The rapid growth of IoT and AI technologies in the region is a significant factor driving the growth of the regional market. Furthermore, growing consumer demand for more personalized and convenient shopping experiences, smart shelves enable retailers to meet these expectations by providing real-time product information and personalized promotions.

U.S. Smart Shelves Market Trends

The smart shelves market in the U.S. is expected to grow at a CAGR of 22.9% from 2024 to 2030. Retailers are increasingly focusing on improving operational efficiency and customer satisfaction. The use of smart shelves has expanded beyond inventory management to include features like dynamic pricing and personalized marketing driven by data analytics.

Europe Smart Shelves Market Trends

The smart shelves market in Europedominated globally in 2023 with a revenue share of over 35.0%. The consumers and government in Europe are increasingly prioritizing sustainability. Smart shelves contribute to this by enabling efficient inventory management, reducing waste, and supporting sustainable retail practices.

Asia Pacific Smart Shelves Market Trends

The smart shelves market in Asia Pacific is expected to grow at the fastest CAGR of 26.4% from 2024 to 2030. Retailers in countries such as China, Japan, and South Korea are increasingly adopting smart shelves as a part of their broader digital transformation strategies. Furthermore, the rapid urbanization in the Asia Pacific, coupled with the expansion of retail chains, particularly in China and India, drives the demand for smart shelves.

Key Smart Shelves Company Insights

Some of the key companies operating in the smart shelves industry include Honeywell International Inc., Huawei Technologies Co. Ltd, Trax Retail, Lenovo PCCW Solutions Limited, Samsung Electronics Co. Ltd, AWM Smart Shelf, Happiest Minds Technologies Limited, E Ink Holdings Inc., Avery Dennison Corporation, and Intel Corporation.

-

Avery Dennison Corporation is a U.S.-based company that manufactures labeling and packaging materials. The company’s broad product portfolio allows it to serve a wide range of retail segments, from fashion to food. This diversity helps the company capture a larger share of the market by addressing the specific needs of different retailers.

Trax Retail, Pensa Systems, and Zebra Technologies are some of the emerging companies in the target market.

-

Trax Retail, a provider of retail computer vision solutions. The company offers advanced image recognition technology, which global retailers use to monitor store performance and optimize merchandising strategies. The company focuses on using AI and big data to enhance retail operations position in the market. The company’s technology helps retailers ensure compliance with planograms, optimize product placement, and track inventory more effectively.

Key Smart Shelves Companies:

The following are the leading companies in the smart shelves market. These companies collectively hold the largest market share and dictate industry trends.

- Avery Dennison Corporation

- AWM Smart Shelf

- E Ink Holdings Inc

- Happiest Minds Technologies Limited

- Honeywell International Inc.

- Huawei Technologies Co. Ltd

- Intel Corporation

- Lenovo PCCW Solutions Limited

- Samsung Electronics Co. Ltd

- Trax Retail

Recent Developments

-

In April 2024, Inc. entered a strategic partnership with AUO Corporation, a display manufacturer in Taiwan, to develop ePaper displays. Through the collaboration, the former company focuses on advancing offerings in smart retail solutions through energy-efficient and low-power display technology.

-

In March 2024, Huawei Technologies Co. Ltd. launched the Smart Retail Solution for stores, retail campuses, and multi-branch interconnection. The solution focuses on intelligent warehousing, smart stores, digital marketing, and energy efficiency. It would help retail companies reduce operational costs, increase efficiency, and improve customer experience.

Smart Shelves Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.00 billion

Revenue forecast in 2030

USD 14.69 billion

Growth Rate

CAGR of 24.2% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; India; China; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Honeywell International Inc., Huawei Technologies Co. Ltd, Trax Retail, Lenovo PCCW Solutions Limited, Samsung Electronics Co. Ltd, AWM Smart Shelf, Happiest Minds Technologies Limited, E Ink Holdings Inc., Avery Dennison Corporation, Intel Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Shelves Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global smart shelves market report based on component, application, end-use, and region.

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Services

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Planogram Management

-

Inventory Management

-

Pricing Management

-

Content Management

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Hypermarkets

-

Supermarkets

-

Department Stores

-

Warehouses

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global smart shelves market size was estimated at USD 3.31 billion in 2023 and is expected to reach USD 4.00 billion in 2024.

b. The global smart shelves market is expected to grow at a compound annual growth rate of 24.2% from 2024 to 2030 to reach USD 14.69 billion by 2030.

b. The hardware segment dominated the market in 2023 and accounted for more than 47.0% share of global revenue. Retailers and warehouse owners are investing in hardware to reduce shrinkage, optimize stock levels, and ensure product availability.

b. Some of the players operating in the smart shelves market include Honeywell International Inc., Huawei Technologies Co. Ltd, Trax Retail, Lenovo PCCW Solutions Limited, Samsung Electronics Co. Ltd, AWM Smart Shelf, Happiest Minds Technologies Limited, E Ink Holdings Inc, Avery Dennison Corporation, and Intel Corporation.

b. The market growth can be attributed to the rising adoption of automation in retail and the need for enhanced inventory management systems. One of the most significant trends in the smart shelves market is the rapid digital transformation and automation of retail operations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.