- Home

- »

- Next Generation Technologies

- »

-

AI In Interior Design Market Size, Industry Report, 2033GVR Report cover

![AI In Interior Design Market Size, Share & Trends Report]()

AI In Interior Design Market (2026 - 2033) Size, Share & Trends Analysis Report By Component, By Deployment, By Application (Digital Design & Visualization, Space Planning & Layout Optimization, 3D Rendering), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-849-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

AI in Interior Design Market Summary

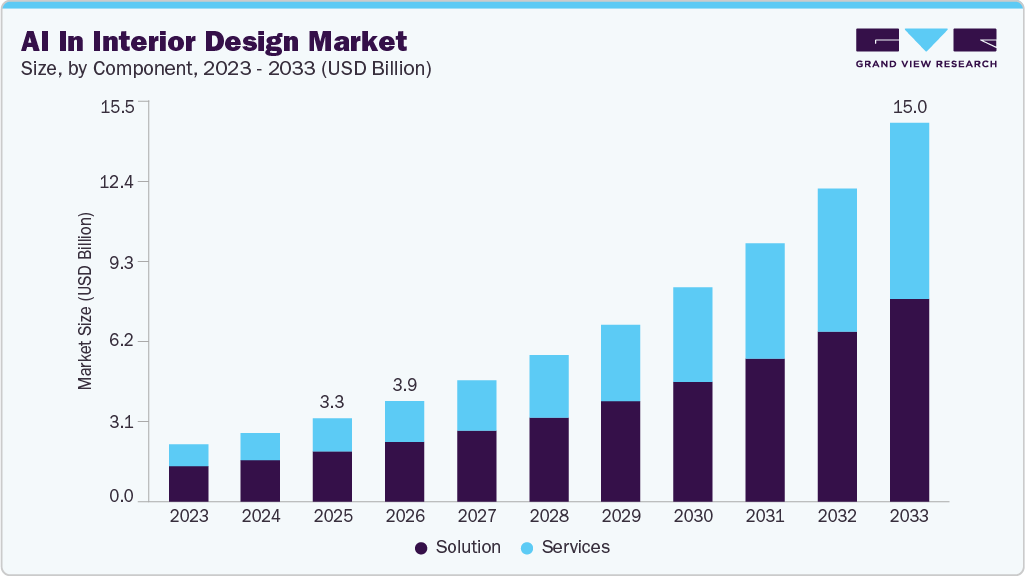

The global AI in interior design market size was estimated at USD 3,282.3 million in 2025 and is projected to reach USD 15,004.5 million by 2033, growing at a CAGR of 20.9% from 2026 to 2033. The market is driven by the advanced capabilities in integration of AI with sustainability-focused design practices support energy efficiency, material optimization, and compliance with green building standards.

Key Market Trends & Insights

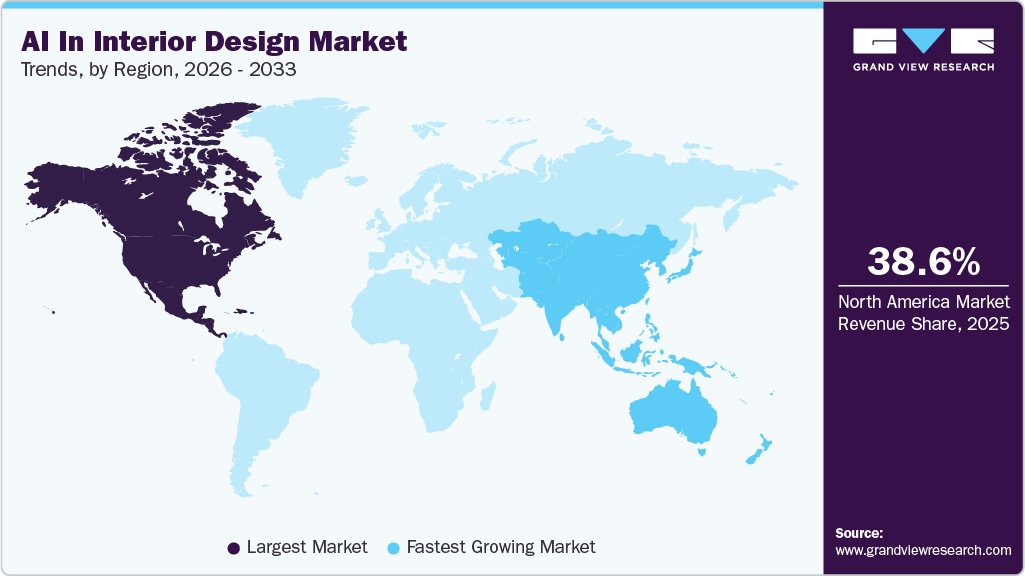

- North America dominated the global AI in interior design market with the largest revenue share of 38.6% in 2025.

- The AI in interior design market in the U.S. led the North America market and held the largest revenue share in 2025.

- By component, the solution segment led the market and held the largest revenue share of 60.1% in 2025.

- By deployment, the cloud segment held the dominant position in the market and accounted for the leading revenue share of 69.5% in 2025.

- By end-use, the residential segment is expected to grow at the fastest CAGR of 22.0% from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 3,282.3 Million

- 2033 Projected Market Size: USD 15,004.5 Million

- CAGR (2026-2033): 20.9%

- North America: Largest Market in 2025

- Asia Pacific: Fastest growing market

The AI in interior design market is rising by the increasing demand for data-driven design efficiency across residential and commercial projects. Design firms and real estate companies are adopting AI tools to reduce manual effort in space planning, visualization, and layout optimization as advanced algorithms enable accurate room measurements, zoning, and furniture placement based on user preferences and spatial constraints. AI-enabled platforms also support cost estimation and material optimization, addressing budget sensitivity in large-scale projects. Growing dependence on digital systems further supports the adoption of AI-powered design solutions.

The AI in Interior Design market is being influenced by the growing adoption of immersive visualization technologies, including 3D rendering, augmented reality, and virtual walkthroughs, which improve real-time visualization through enhanced lighting, textures, and layout accuracy. Clients increasingly expect interactive design previews prior to execution, particularly in high-value residential and commercial developments. AI-based visualization reduces design revisions by aligning investor expectations early in the project lifecycle. Cloud-based AI platforms enable scalable access to these visualization tools without heavy infrastructure requirements. This shift supports broader participation from small and mid-sized design firms. As a result, visualization-centric AI applications represent a significant demand driver.

Furthermore, the expansion of e-design and remote interior design services enables personalized design recommendations based on user behavior, lifestyle data, and aesthetic preferences. Online design platforms use AI to deliver standardized yet customizable solutions at lower costs, which supports higher adoption among price-sensitive consumers and emerging markets. AI also facilitates continuous design modification through feedback loops and usage data analysis. The merging of AI with e-commerce platforms strengthens end-to-end digital design ecosystems. These developments support consistent growth across both residential and commercial end use segments.

Component Insights

The solution segment led the market and accounted for 60.1% of the global revenue in 2025. The solution segment is driven by the increasing need for standardized, scalable AI platforms that support end-to-end interior design workflows and design software fixed with AI enables automated layout generation, real-time visualization, and data-backed design validation. For instance, in February 2026, Story Renovations launched the Story AI Design Studio, a free online tool that enables homeowners to ideate, refine, and visualize design concepts for renovations and custom homes.

The service segment is predicted to foresee significant growth in the forecast period. The services segment is supported by demand for customization, system integration, and advisory expertise tailored to complex design requirements. Managed services reduce operational burden by handling platform maintenance and performance optimization. For instance, in February 2024, Venus Williams launched Palazzo, an AI-powered interior design service platform where users upload room photos and engage with the AI chatbot Vinci to generate customized renderings based on specified styles, colors, and preferences

Deployment Insights

The cloud segment accounted for the largest market revenue share in 2025, driven by the need for scalable computing resources to support AI-intensive design applications such as real-time rendering and collaborative visualization. Centralized data storage enables seamless access to design libraries, client preferences, and project files across distributed teams. Frequent platform updates and centralized maintenance support continuous feature enhancements without operational disruption and integration with third-party design, ordering, and project management tools further strengthens cloud adoption.

The on-premises segment is characterized by strict data control requirements, particularly in high-value commercial and government-related interior design projects. Organizations with proprietary design methodologies favor internal deployment to protect intellectual property and confidential client information. On-premises systems allow customization of AI models to align with internal workflows and legacy infrastructure, supporting operational continuity. This deployment model also enables compliance with region-specific data residency and security regulations.

Application Insights

The digital design & visualization segment holds the highest market share of the global revenue in 2025. The segment is driven by the need for rapid concept development and early-stage design validation as it enhances consistency across design iterations and improves standardization for large portfolios. This segment also supports efficient client approvals by presenting multiple design scenarios within shorter timelines. For instance, in February 2025, Hover launched Instant Design, an AI-powered platform that enables construction professionals and homeowners to generate photo-realistic visualizations of home exteriors and interiors from single photos in seconds.

The 3D rendering, AR/VR walkthroughs segment is predicted to foresee significant growth in the forecast period. The market is supported by demand for experiential design communication across real estate and commercial projects. AI improves rendering accuracy by simulating lighting behavior, depth, and spatial perception in near-real conditions. AR and VR walkthroughs enable stakeholders to evaluate usability and scale prior to construction execution which reduces design misalignment and downstream modification costs. The segment benefits from rising adoption of immersive presentation formats in high-value developments.

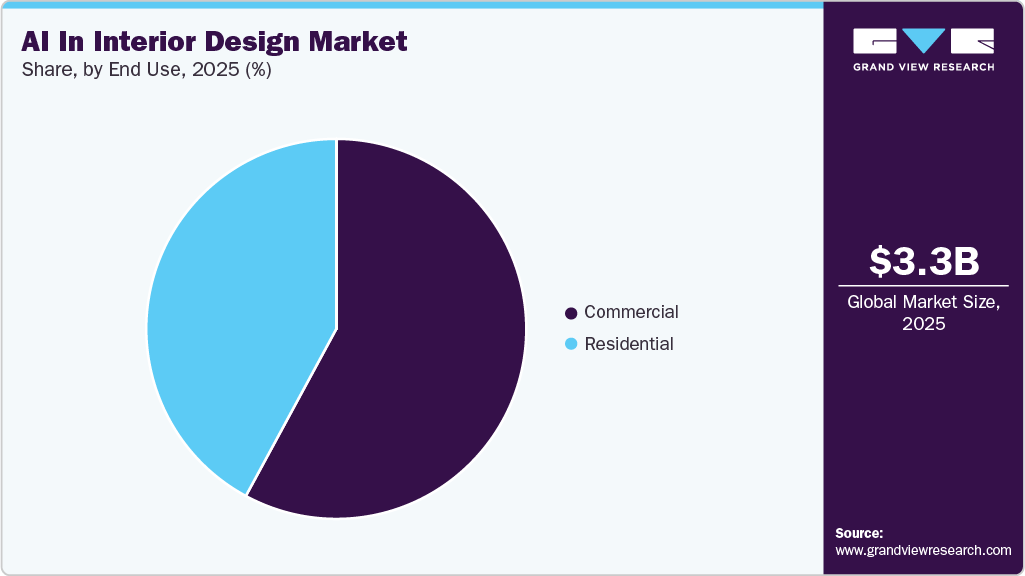

End-use Insights

The commercial segment accounted for the largest market revenue share in 2025. The commercial segment is shaped by the need for operational standardization across offices, retail spaces, hospitality, and mixed-use developments. AI enables consistent design replication across multiple locations while preserving brand identity and functional requirements. Demand for space utilization analytics supports data-driven layout optimization and occupancy planning. Faster design validation cycles help minimize project delays and improve coordination among architects, contractors, and property owners.

The residential segment is projected to grow significantly over the forecast period. The residential segment is driven by rising consumer preference for personalized interior solutions aligned with lifestyle and budget constraints due to increased digital adoption among homeowners strengthening demand for self-guided and assisted design tools. AI-driven visualization improves purchase confidence in furniture and décor selection. For instance, in July 2023, Wayfair launched Decorify, a generative AI-powered virtual room styler service that enables consumers to upload photos of their living spaces and generate shoppable, photorealistic redesigns in styles such as bohemian, mid-century modern, or industrial.

Regional Insights

North America AI in interior design market dominated the global industry by 38.6% revenue share in 2025. North America is driven by high adoption of AI-enabled design platforms across professional design firms and real estate developers and, the strong penetration of cloud infrastructure supports advanced rendering, simulation, and collaborative design workflows. Moreover, the demand for productivity enhancement tools encourages the use of AI for automating repetitive design and documentation tasks.

U.S. AI in Interior Design Market Trends

The U.S. market is driven by early adoption of AI across architecture, engineering, and construction value chains as demand for advanced data analytics supports AI-based space utilization and performance modeling. Integration of AI with real estate technology platforms enhances design decision-making for developers and investors. Strong innovation activity among software vendors accelerates commercialization of specialized AI interior design applications.

Europe AI in Interior Design Market Trends

Europe is driven by regulatory importance on sustainable construction and energy-efficient interior spaces. AI-supported material selection and lighting optimization align with strict environmental compliance requirements and, because of public and private investments in smart buildings strengthen demand for intelligent interior planning solutions. The region’s focus on renovation of old building stock increases adoption of AI-based redesign and space optimization tools.

Asia Pacific AI in Interior Design Market Trends

Asia Pacific has the highest CAGR for the forecasted period as the market expansion is due to rapid urbanization and large-scale residential and commercial construction activity as there is high project volumes create demand for scalable and cost-efficient AI design solutions. Growing acceptance of mobile-first and cloud-based platforms supports widespread use among small and mid-sized design firms. Rising digital engagement among consumers strengthens adoption of AI-powered visualization and remote design services.

Key AI in Interior Design Market Company Insights

Some key companies in the AI in interior design industry are Autodesk Inc., Planner 5D, RoomGPT, Interior AI

-

Autodesk Inc. provides advanced software solutions that support AI-enabled workflows across architecture, engineering, and interior design applications. The company’s platforms integrate AI-driven automation, generative design, and data analytics to enhance spatial planning and design accuracy. AI capabilities assist in optimizing layouts, materials, and design documentation efficiency. The company also supports cloud-based deployment models that improve scalability and remote collaboration.

-

Interior AI operates as a digital platform focused on AI-powered interior visualization and concept generation. The company enables users to generate multiple design styles and layout variations through image-based and prompt-driven workflows. The platform supports residential-focused use cases, including room redesign, furniture visualization, and style exploration. AI models streamline early-stage design decisions by reducing manual input requirements.

Key AI in Interior Design Companies:

The following key companies have been profiled for this study on the AI in interior design market.

- Autodesk Inc.

- Coohom, Inc.

- Foyr

- Infurnia Technologies Pvt Ltd

- Interior AI

- Planner 5D

- REimagine Home

- RoomGPT

- RoomSketcher

- Vectorworks, Inc.

Recent Developments

-

In June 2025, Vectorworks, Inc., part of the Nemetschek Group, announced the availability of its AI Assistant. The AI Assistant (Preview) initiates Vectorworks' integration of AI learning technology to deliver intelligent, personalized solutions for designers across architecture, landscape, and entertainment workflows. It includes features such as confidence scores, language localization, built-in feedback mechanisms, and direct links to Vectorworks Help and University resources to support learning and productivity.

-

In June 2024, Coohom Cloud introduced its 2D and 3D interior dataset products. As a data service provider for the AI industry, the company highlighted solutions for embodied intelligence, computer vision, machine learning, and robotics. These datasets help with physical simulation, environment changes using different models and materials, and provide labels for both meaning and space. The solutions support AI training in computer vision, embodied intelligence, indoor navigation, and robotics through physical enhancement, environment augmentation, and precise annotation capabilities.

-

In November 2023, Autodesk introduced Autodesk AI, a technology built which is available into its products and the Design and Make Platform. It aims to boost creativity, solve problems, and reduce non-productive work in design and manufacturing. Autodesk AI offers smart assistance and generative tools to help achieve accurate and creative results in architecture, engineering, construction, product design, and media.

AI In Interior Design Market Report Scope

Report Attribute

Details

Market size in 2026

USD 3,965.7 million

Revenue forecast in 2033

USD 15,004.5 million

Growth rate

CAGR of 20.9% from 2026 to 2033

Base year for estimation

2025

Actual data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion/million and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, application, end-use, regional

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Europe; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Autodesk Inc.; Coohom, Inc.; Foyr; Infurnia Technologies Pvt Ltd; Interior AI; Planner 5D; REimagine Home; RoomGPT; RoomSketcher; Vectorworks, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AI In Interior Design Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global AI in interior design market report based on component, deployment, application, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Solution

-

Service

-

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

On-premises

-

Cloud

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Digital Design & Visualization

-

Space Planning & Layout Optimization

-

3D Rendering, AR/VR Walkthroughs

-

Design Decision Support

-

E-Design / Remote Design Services

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Commercial

-

Residential

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global AI in interior design market size was estimated at USD 3,282.3 million in 2025 and is expected to reach USD 3,965.7 million in 2026.

b. The global AI in interior design market is expected to grow at a compound annual growth rate of 20.9% from 2026 to 2033 to reach USD 15,004.5 million by 2033.

b. North America dominated the AI in interior design market with a share of 38.6% in 2025. This is driven by high adoption of AI-enabled design platforms across professional design firms and real estate developers and the strong penetration of cloud infrastructure supports advanced rendering, simulation, and collaborative design workflows.

b. Some key players operating in the AI in interior design market include Autodesk Inc.; Coohom, Inc.; Foyr; Infurnia Technologies Pvt Ltd; Interior AI; Planner 5D; REimagine Home; RoomGPT; RoomSketcher; Vectorworks, Inc.

b. The market is driven by the advanced capabilities in integration of AI with sustainability-focused design practices supports energy efficiency, material optimization, and compliance with green building standards.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.