- Home

- »

- Next Generation Technologies

- »

-

AI Productivity Tools Market Size, Industry Report, 2033GVR Report cover

![AI Productivity Tools Market Size, Share & Trend Report]()

AI Productivity Tools Market (2025 - 2033) Size, Share & Trend Analysis Report By Offering (Virtual Assistants, RPA), By Deployment (Cloud, On-premise), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-315-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

AI Productivity Tools Market Summary

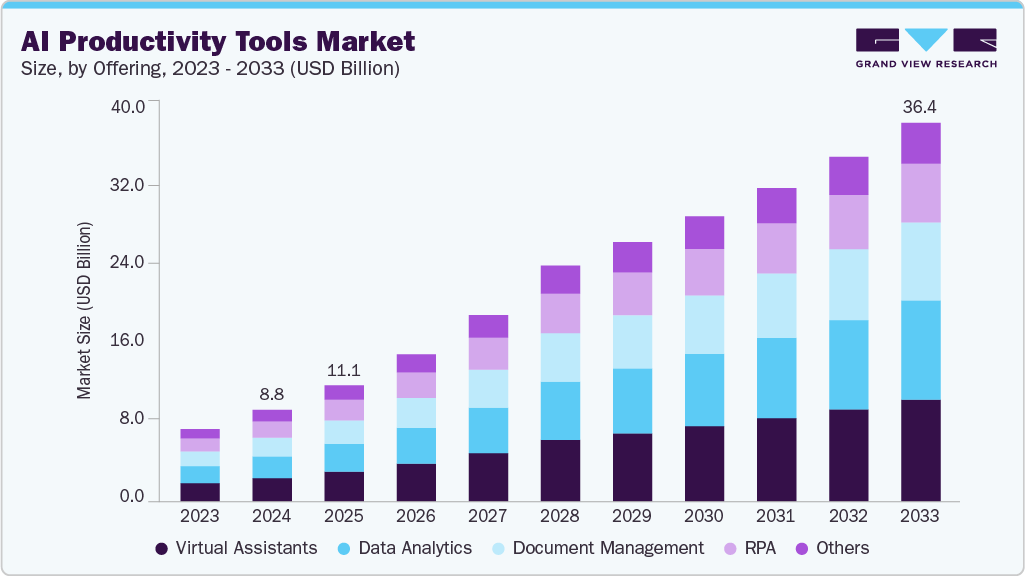

The global AI productivity tools market size was estimated at USD 8,801.2 million in 2024 and is projected to reach USD 36,377.8 million by 2033, growing at a CAGR of 15.9% from 2025 to 2033. The global AI productivity tools industry is expanding as enterprises automate routine tasks and accelerate workflow efficiency across digital operations.

Key Market Trends & Insights

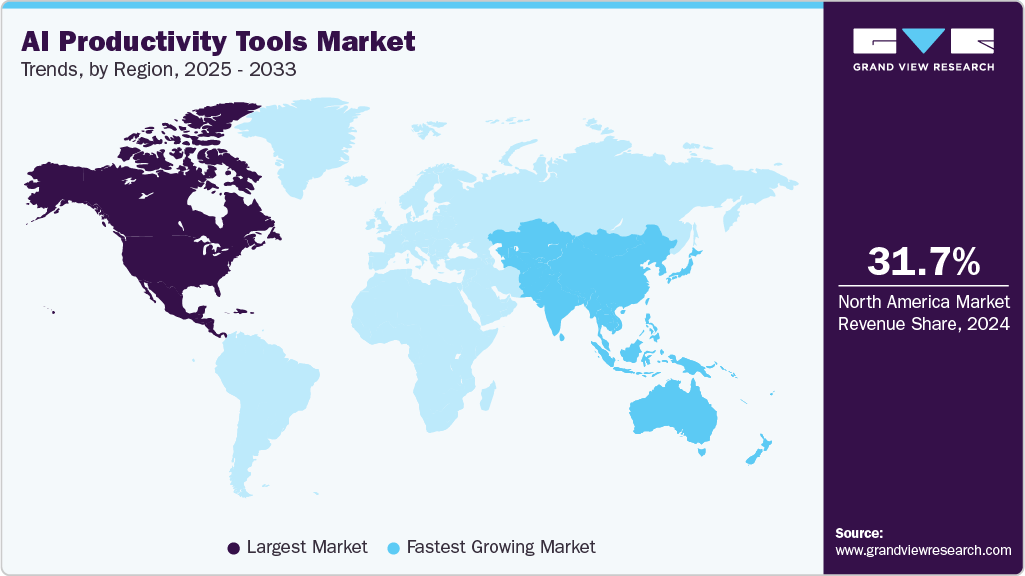

- North America dominated the global AI productivity tools market with the largest revenue share of 31.7% in 2024.

- The AI productivity tools industry in the U.S. accounted for the largest market revenue share in North America in 2024.

- By offering, the virtual assistants segment led the market with the largest revenue share of 25.4% in 2024.

- By deployment, the on-premises segment led the market with the largest revenue share of 60.7% in 2024.

- By end use, the IT and telecom segment is expected to grow at the fastest CAGR of 15.8% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 8,801.2 Million

- 2033 Projected Market Size: USD 36,377.8 Million

- CAGR (2025-2033): 15.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest market in 2024

Demand is rising due to wider adoption of generative AI, smarter workflow orchestration, and integration of AI assistants into business platforms. Vendors are enhancing multimodal capabilities to improve accuracy and reduce operational effort across functions.The growing focus on connecting enterprise workflows with cloud-based AI capabilities is propelling the AI productivity tools industry. Organizations are automating complex processes to save time and reduce errors. Real-time insights from AI are enhancing decision-making across functions. Unified platforms that combine data, AI models, and operational tools are driving efficiency and increasing the adoption of AI productivity solutions. For instance, in January 2025, ServiceNow, a U.S.-based software company, and Google Cloud expanded their partnership to bring the Now Platform and workflows to Google Cloud Marketplace. This partnership integrates ServiceNow data with Google’s AI tools to enhance automation and improve enterprise productivity.

The adoption of interoperable, multi-agent AI ecosystems across enterprise platforms is driving the growth of the AI productivity tools industry. Organizations are deploying AI agents that can work seamlessly across different systems and applications. This enables automated workflows, reduces manual effort, and improves overall efficiency. Real-time insights from these AI agents enhance decision-making across functions. Enterprises are increasingly prioritizing scalable and flexible AI tools that integrate smoothly with existing cloud and workflow platforms.

For instance, in April 2025, Deloitte, a UK-based multinational professional services company, expanded its collaboration with Google Cloud and ServiceNow to launch over 100 ready-to-deploy AI agents and establish an open interoperability protocol for multi-agent ecosystems. This initiative enables enterprises to scale agentic AI across platforms, enhancing productivity, automation, and cross-system collaboration.

Advancements in Natural Language Processing (NLP) are significantly enhancing AI productivity tools by enabling them to understand and generate human language effectively. This capability improves communication and supports content creation across various enterprise functions. In email management, NLP allows tools to categorize, prioritize, and autonomously compose responses, streamlining the handling of high volumes of messages. AI-driven document summarization leverages NLP to extract key information efficiently, saving users considerable time. Virtual assistants benefit from NLP by facilitating more natural and intuitive interactions, which enhances user experience and adoption. Across workflows, NLP automates language-related tasks, reducing manual effort and accelerating decision-making. By providing intelligent insights, these tools enable organizations to optimize their operations and resource allocation.

Offering Insights

The virtual assistant segment led the market with the largest revenue share of 25.4% in 2024. Its expansion was driven by wider deployment across customer-facing workflows. Enterprises adopted these systems to manage queries, reduce support load, and improve response quality. Advancements in NLP improved accuracy and enabled more nuanced dialogue handling. These improvements made virtual assistants more dependable for high-volume interactions. Integration with CRM and automation platforms strengthened adoption momentum. Organizations viewed these integrations as a way to streamline operational processes. These factors helped the virtual assistant segment maintain a strong position during the year.

The data analytics segment is anticipated to grow at the fastest CAGR during the forecast period. The data analytics segment is poised for robust growth within AI productivity tools due to its ability to empower actionable insights. With advanced predictive analytics capabilities, these tools enable businesses to anticipate future trends and optimize operations proactively. Moreover, AI-powered data analytics tools streamline processes, automate tasks, and extract insights from large datasets, boosting efficiency and productivity. Businesses gain a competitive advantage by harnessing data analytics, enabling them to adapt quickly, innovate, and meet market demands effectively.

Deployment Insights

The on-premises segment accounted for the largest market revenue share of 60.7% in 2024. Many enterprises selected this deployment approach to maintain direct control over sensitive operational data. Security considerations remained a priority for organizations operating in regulated environments. Internally managed infrastructure offered predictable system behavior for intensive workloads. Companies valued the stability and customization options available with this setup, as it allowed them to fine-tune performance, integrate legacy systems, and configure environments according to specific operational requirements.

The cloud segment is anticipated to grow at the fastest CAGR during the forecast period, due to increasing demand for scalable and flexible deployment models. Organizations prefer cloud solutions as they reduce infrastructure costs and eliminate the need for extensive on-site management. Cloud-based platforms enable faster integration with existing systems and allow seamless updates to AI models and tools. They also support distributed teams by providing easy access to applications and data from multiple locations. Enhanced collaboration, real-time analytics, and remote accessibility have strengthened adoption across enterprises of all sizes.

End Use Insights

The IT and telecom segment accounted for the largest market revenue share in 2024, due to high adoption of digital transformation initiatives. Enterprises invested heavily in AI productivity tools to enhance network management and customer service operations. The sector leveraged automation and analytics to optimize workflows and reduce operational costs. The growing demand for real-time communication and data-driven decision-making has reinforced the segment’s market position. The increasing reliance on cloud-based and AI-driven solutions has further strengthened the presence of IT and telecom in the market. These factors enabled IT and telecom to maintain a strong share within the overall market.

The BFSI sector is anticipated to grow at the fastest CAGR during the forecast period, due to increasing demand for automation and data-driven decision-making. Financial institutions are adopting AI tools to streamline operations, enhance customer experience, and improve compliance management. Advanced analytics help banks and insurers predict trends, assess risks, and optimize product offerings more effectively. AI-powered chatbots and virtual assistants are being widely deployed to manage customer queries and reduce operational workload. The integration of these tools with existing financial systems has strengthened efficiency and operational agility. These factors are driving the BFSI sector forward and establishing it as a rapidly expanding contributor to the overall market.

Regional Insights

North America dominated the AI productivity tools market with the largest revenue share of 31.7% in 2024, due to early adoption of advanced technologies. Enterprises in the region have invested heavily in AI solutions to enhance operational efficiency and improve customer engagement. The presence of major technology providers and innovation hubs accelerated market growth. Strong digital infrastructure and supportive regulatory frameworks encouraged faster deployment of AI tools. These factors enabled North America to maintain its leading position in the global market.

U.S. AI Productivity Tools Market Trends

The AI productivity tools market in the U.S. accounted for the largest market revenue share in North America in 2024.The U.S. market is witnessing continuous advancements in AI technologies, including machine learning, natural language processing, and computer vision, which are driving the development of more sophisticated productivity tools.

Europe AI Productivity Tools Market Trends

The AI productivity tools market in Europe is anticipated to grow at a significant CAGR during the forecast period. In Europe, businesses are embracing automation as a means to enhance employee satisfaction and focus on higher-value tasks. Consequently, the adoption of AI productivity tools is on the rise across various industries, contributing to increased efficiency and innovation in the European workplace.

Asia Pacific AI Productivity Tools Market Trends

The AI productivity tools market in the Asia Pacific is anticipated to register at the fastest CAGR over the forecast period, driven by rising digital adoption and increased technology investments. Rapid growth in SMEs and enterprises is driving demand for AI productivity solutions across various industries. The increasing deployment of cloud infrastructure, combined with a focus on automation, is supporting market expansion. Governments and private organizations are promoting AI initiatives to enhance operational efficiency and innovation.

Key AI Productivity Tools Company Insights

Some of the key companies in the AI productivity tools industry include Automation Anywhere, Inc., Blue Prism Limited, Cisco Systems, Inc., Dropbox Inc., and others. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, including mergers and acquisitions, as well as partnerships with other major companies.

-

Cisco Systems, Inc. has focused on integrating AI capabilities into its collaboration and networking solutions to enhance productivity. The company leverages AI-driven analytics to optimize enterprise network performance and support decision-making. Its platforms include virtual assistants and automation tools to streamline workflows for IT and business teams. Cisco’s investments in AI-powered security and communication tools strengthen its market presence.

-

Dropbox Inc. has enhanced its cloud storage and collaboration platform with AI-powered productivity features. The company utilizes AI to automate file organization, enhance search functionality, and facilitate content recommendations. Integration with virtual assistants and workflow automation tools helps users manage tasks more efficiently. Dropbox’s continuous development of AI-driven collaborative features strengthens user engagement and platform adoption.

Key AI Productivity Tools Companies:

The following are the leading companies in the AI productivity tools market. These companies collectively hold the largest Market share and dictate industry trends.

- Automation Anywhere, Inc.

- Blue Prism Limited

- Cisco Systems, Inc.

- Dropbox Inc.

- Grammarly Inc.

- Google LLC

- International Business Machines Corporation

- Microsoft

- UiPath

- Workato

Recent Developments

-

In November 2025, Google LLC launched Antigravity, an AI coding tool that acts like a junior developer by planning, executing, and testing code autonomously, alongside Gemini 3 for agent-first software development. The tool aims to boost productivity, automate routine coding tasks, and assist developers without fully replacing junior roles.

-

In September 2025, UiPath, a U.S.-based enterprise software company, launched new agentic AI capabilities, including UiPath Maestro for orchestrating AI agents, robots, and workflows, along with integrated solutions for financial services, healthcare, and retail to accelerate automation ROI. The company also launched Test Cloud, Agent Builder, ScreenPlay, API workflows, and intelligent document processing to boost efficiency, governance, and enterprise automation.

-

In April 2024, Microsoft partnered with Cloud Software Group, Inc., a U.S.-based software company, to deepen collaboration on cloud solutions and generative AI capabilities, aiming to empower over 100 million users with enhanced productivity and innovation. Through initiatives such as deploying GitHub Copilot and embedding Copilot assistant within Spotfire, the partnership focuses on using AI to drive efficiency and accelerate R&D efforts.

-

In March 2024, Microsoft and NVIDIA Corporation collaborated to integrate AI into healthcare and life sciences, focusing on enhancing patient care and expediting medical research and drug discovery. Their collaboration aims to use advanced technologies to transform the healthcare industry and drive innovation in patient treatment and outcomes.

-

In March 2024, Ciscoadded new AI features to its Webex platform, such as burnout detection for contact center agents, as part of its efforts to enhance productivity across remote and hybrid work environments. Moreover, Cisco introduced new hardware devices, such as the Cisco Desk Phone 9800 and Cisco Board Pro G2, customized to the evolving needs of enterprises transitioning back to office settings.

-

In February 2024, Google LLC launched Gemini for Google Workspace, alongside two plans, Gemini Business and Gemini Enterprise, empowering businesses to utilize AI for growth. Gemini Business provides access to generative AI features, while Gemini Enterprise offers additional capabilities, including AI-powered meetings and enterprise-grade data protection.

AI Productivity Tools Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11,148.2 million

Revenue forecast in 2033

USD 36,377.8 million

Growth rate

CAGR of 15.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

offering, deployment, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Automation Anywhere, Inc.; Blue Prism Limited; Cisco Systems, Inc.; Dropbox Inc.; Grammarly Inc.; Google LLC; International Business Machines Corporation; Microsoft; UiPath; Workato

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

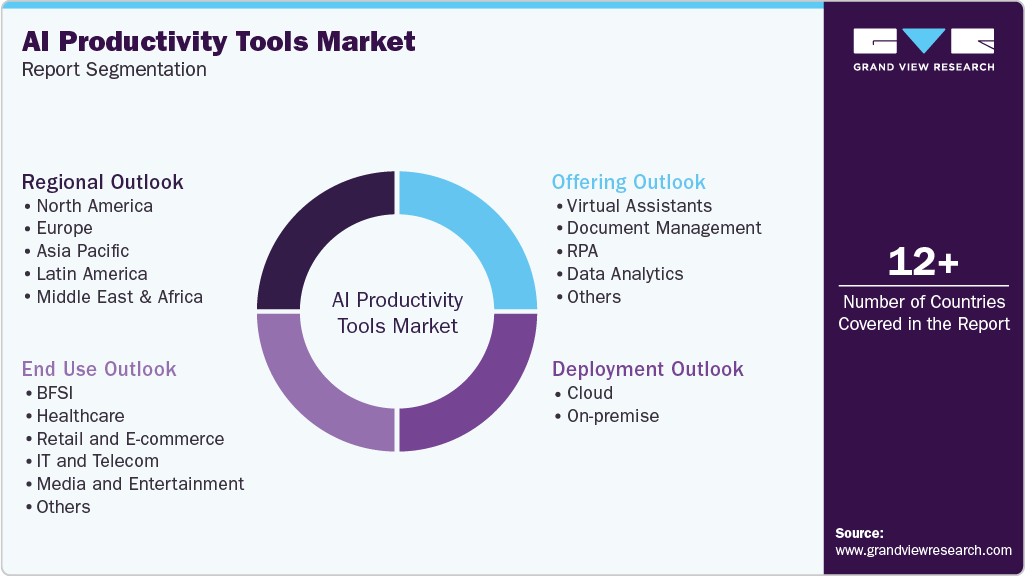

Global AI Productivity Tools Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global AI productivity tools market report based on offering, deployment, end use, and region.

-

Offering Outlook (Revenue, USD Million, 2021 - 2033)

-

Virtual Assistants

-

Document Management

-

RPA

-

Data Analytics

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

Cloud

-

On-premise

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

BFSI

-

Healthcare

-

Retail and E-commerce

-

IT and Telecom

-

Media and Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global AI productivity tools market size was estimated at USD 8,801.2 million in 2024 and is expected to reach USD 11,148.2 million in 2025.

b. The global AI productivity tools market is expected to grow at a compound annual growth rate of 15.9% from 2025 to 2033 to reach USD 36,377.8 million by 2033.

b. North America dominated the AI productivity tools market with a share of 31.7% in 2024. This is attributable to the drive for innovation that has led to the adoption of advanced technologies such as AI, which offer the potential to revolutionize various aspects of operations.

b. Some key players operating in the AI productivity tools market include Automation Anywhere, Inc., Blue Prism Limited, Cisco Systems, Inc., Dropbox Inc., Grammarly Inc., Google LLC, International Business Machines Corporation, Microsoft, UiPath, and Workato.

b. Key factors that are driving the market growth include increasing need to manage workflow and tasks, advancements in AI and ML, and integration with emerging technologies

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.