- Home

- »

- Next Generation Technologies

- »

-

AI Training Dataset Market Size, Share, Industry Report 2033GVR Report cover

![AI Training Dataset Market Size, Share & Trends Report]()

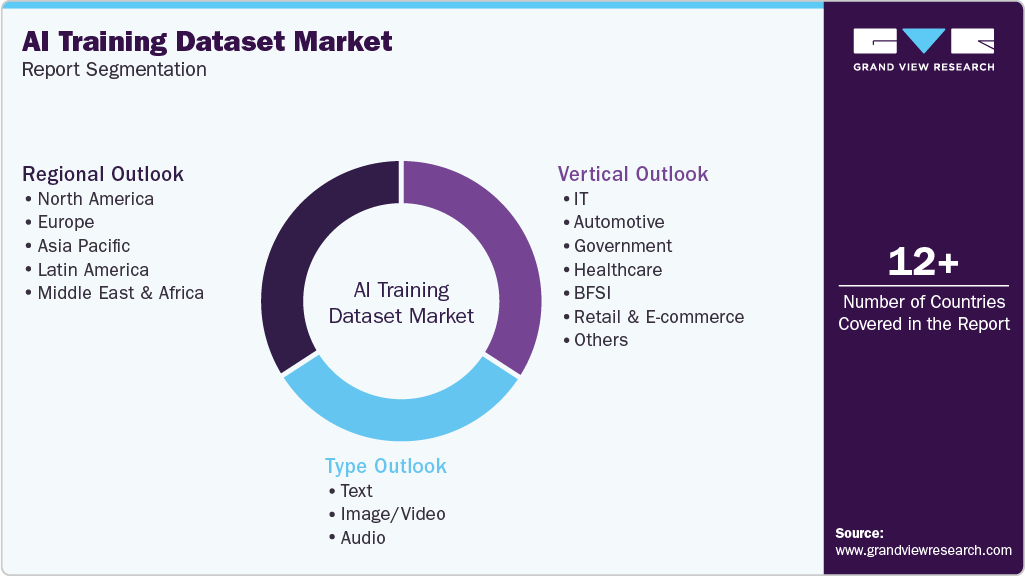

AI Training Dataset Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (Text, Image/Video, Audio), By Vertical (IT, Automotive, Healthcare, Retail & E-commerce, Government, BFSI), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-517-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

AI Training Dataset Market Summary

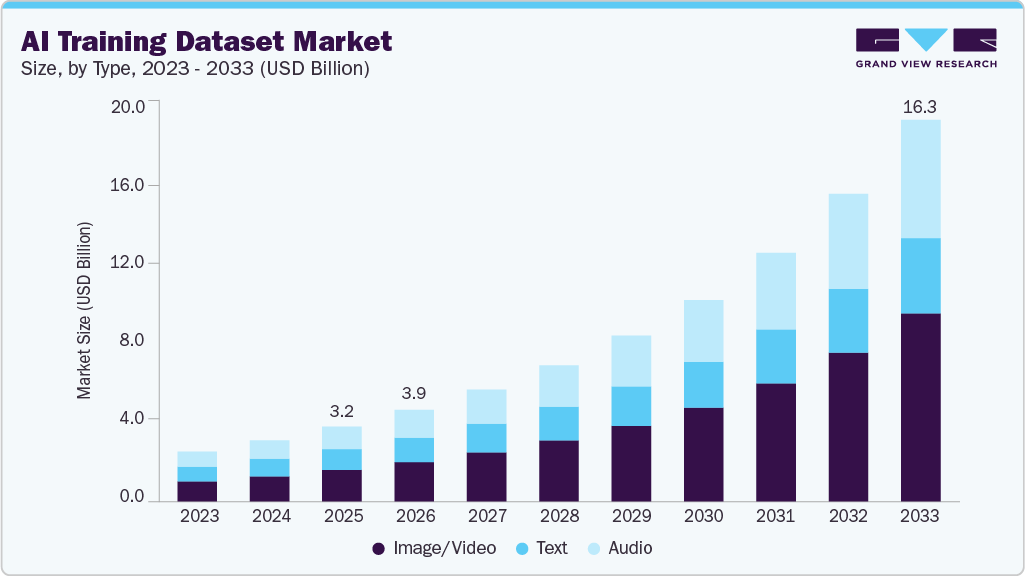

The global AI training dataset market size was estimated at USD 3,195.1 million in 2025 and is projected to reach USD 16,320 million by 2033, growing at a CAGR of 22.6% from 2026 to 2033. The market is expanding rapidly, driven by the increasing demand for high-quality data to train machine learning models.

Key Market Trends & Insights

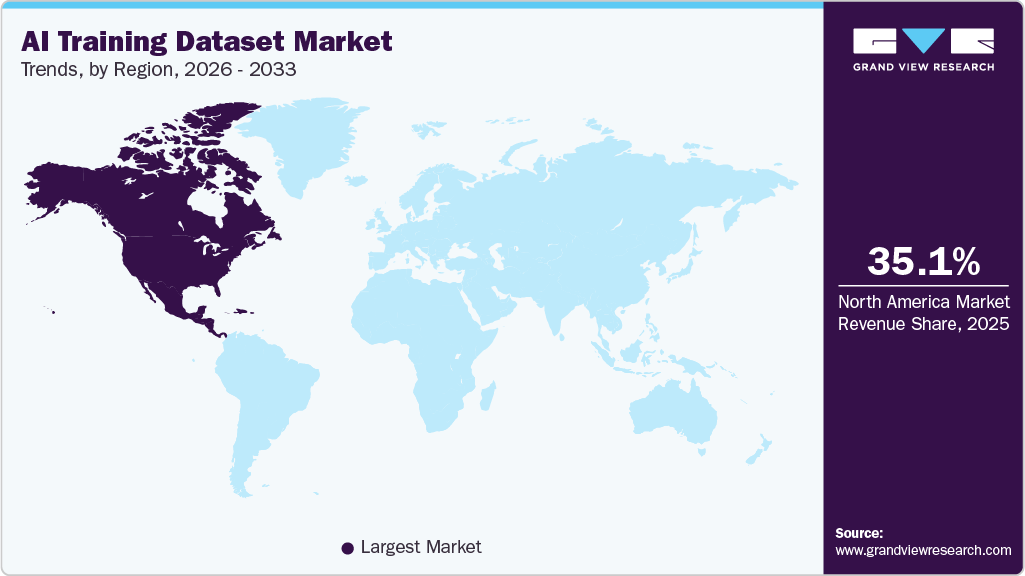

- North America led the global AI training dataset market, accounting for the leading revenue share of 35.1% in 2025

- In the U.S., the AI training dataset industry benefits from a strong emphasis on AI research, with academic institutions and private enterprises pushing the boundaries of machine learning.

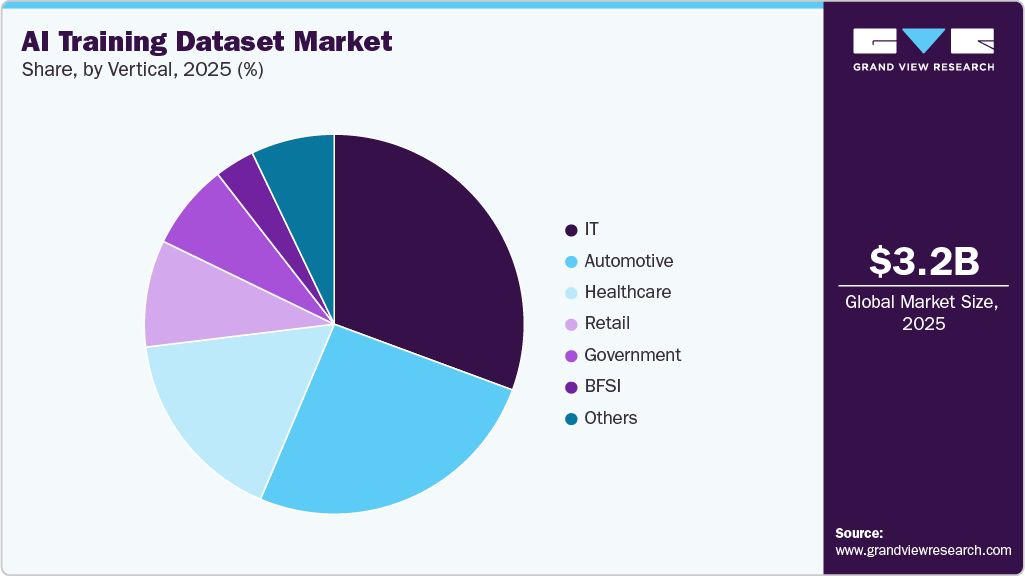

- By type, the image/video segment dominated the AI training dataset market in 2025 with a revenue share of 41.9%.

- By vertical, the automotive sector is experiencing significant growth in the AI training dataset market.

Market Size & Forecast

- 2024 Market Size: USD 3,195.1 Million

- 2033 Projected Market Size: USD 16,320 Million

- CAGR (2026-2033): 22.6%

- North America: Largest market in 2024

Companies across various industries are recognizing the importance of well-curated datasets in enhancing the performance and accuracy of their AI models. The need for diverse and representative data is pushing the growth of this market; Organizations are utilizing both public and proprietary datasets to enhance their AI capabilities. The AI training dataset industry is witnessing significant investments in data collection, annotation, and management platforms. Data providers are adopting advanced technologies, such as crowdsourcing, automated data labeling, and synthetic data generation, to meet the growing demand. Machine learning algorithms require vast amounts of accurate, labeled data to train effectively, creating a thriving ecosystem of data vendors and annotators. With the increasing reliance on AI in various sectors, securing high-quality datasets has become a priority for businesses. As a result, AI training datasets are being curated for more specialized use cases, including niche domains and languages. These efforts ensure that models are not only accurate but also ethical and unbiased.

The regulatory landscape is also evolving in response to the growing reliance on AI. Governments are introducing policies to ensure the transparency and fairness of datasets used for training AI models. These regulations focus on privacy, data security, and reducing bias, all of which are essential for the adoption of AI across various industries. As the market expands, businesses must navigate these regulatory challenges while striking a balance between the need for diverse data. With the global expansion of AI technologies, the demand for both local and international datasets is increasing. Companies are seeking to collaborate with data providers worldwide to meet the diverse requirements of various markets and jurisdictions.

Type Insights

The image/video segment dominated the AI training dataset market in 2025 with a revenue share of 41.9%. Image and video data dominate the market due to their extensive use in computer vision applications. The need for labeled image and video datasets is high in industries such as retail, security, and entertainment. These datasets are essential for training models to recognize objects, faces, and movements in various settings. With the rise of augmented reality and autonomous vehicles, the demand for visual data has surged. As a result, image and video data have become central to AI model development, leading to their dominance in the market.

Audio data is gaining importance as speech recognition and natural language processing (NLP) technologies continue to advance. With the increasing use of virtual assistants and voice-controlled devices, the need for large and diverse audio datasets is rising. These datasets are crucial for training models to comprehend and produce human speech across diverse languages and accents. The expansion of the audio data market is also driven by innovations in healthcare and customer service, where voice-based AI applications are becoming more common. As businesses seek to enhance their AI capabilities, audio data is expected to continue growing in the coming years.

Vertical Insights

The IT sector led the AI training dataset industry in 2025, due to its widespread integration of artificial intelligence across various applications. Data from IT systems, such as network traffic, cybersecurity logs, and customer interactions, is used to train models for tasks like anomaly detection, automation, and predictive maintenance. The sheer volume of data generated by IT systems makes it an essential source for training AI models, driving its dominance. With the continuous advancement of IT infrastructure and the increasing use of AI for data analysis, this sector is poised to remain a major contributor. Moreover, IT companies are investing heavily in acquiring and refining datasets to improve machine learning algorithms. This dominance is likely to continue as more industries digitize their operations and utilize AI technologies.

The automotive sector is experiencing significant growth in the AI training dataset market. With the rise of autonomous vehicles, there is a growing need for datasets that help train AI models to detect road signs, obstacles, and other vehicles. The automotive industry's push for smarter, safer vehicles is driving the demand for diverse datasets in areas like traffic prediction, driver assistance systems, and sensor fusion. Automotive companies are increasingly collaborating with data providers to ensure their models are trained with high-quality data for real-world scenarios. As electric and autonomous vehicles become more common, the automotive sector is expected to continue growing its footprint in the market. This growth is fostering innovation and enhancing the development of AI-powered technologies in the automotive industry.

Regional Insights

North America led the global AI training dataset market, accounting for the leading revenue share of 35.1% in 2025. In North America, the market is experiencing robust growth, fueled by extensive investments in AI technologies and research. Companies across industries, such as healthcare, finance, and retail, are increasingly relying on high-quality datasets to develop machine learning models. Moreover, the presence of tech giants and AI-focused startups is driving demand for diverse and large-scale datasets. The region's strong infrastructure and advanced data processing capabilities further support the market's expansion.

U.S. AI Training Dataset Market Trends

In the U.S., the AI training dataset industry benefits from a strong emphasis on AI research, with academic institutions and private enterprises pushing the boundaries of machine learning. The demand for high-quality datasets is driven by AI applications in sectors like finance, healthcare, and security. Data privacy concerns and regulatory frameworks are also influencing how datasets are collected and utilized, with a focus on the development of ethical AI.

Europe AI Training Dataset Market Trends

In Europe, the AI training dataset industry is influenced by strict data privacy regulations, such as the GDPR, which shape how datasets are collected and used. Companies are focusing on ensuring that their datasets comply with these regulations while addressing ethical concerns, including reducing bias and promoting transparency. As AI adoption increases across industries, European companies are looking to collaborate on data-sharing initiatives to enhance their AI models.

Asia Pacific AI Training Dataset Market Trends

The Asia Pacific AI training dataset industry is the fastest-growing due to the region's technological advancements and large-scale digital transformation efforts. Countries such as China, Japan, and India are experiencing an increasing demand for AI models across various sectors, including manufacturing, finance, and healthcare. The rise of smart cities, IoT devices, and autonomous vehicles is further accelerating the need for diverse and high-quality datasets. Moreover, the region's growing focus on AI research and development is creating new opportunities for data providers and AI companies.

Key AI Training Dataset Company Insights

Some of the key companies in the market include Google, LLC (Kaggle); Appen Limited; Cogito Tech LLC; Lionbridge Technologies, Inc.; and Amazon Web Services, Inc. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, including mergers and acquisitions, as well as partnerships with other major companies.

-

Amazon Web Services (AWS), Inc. offers a range of cloud-based solutions that support data collection, processing, and management. AWS provides tools like SageMaker for machine learning, which includes features for labeling datasets, training models, and deploying AI solutions. Their vast infrastructure and global reach enable the processing of large volumes of diverse data, catering to industries such as healthcare, finance, and retail.

-

Google LLC has been a key player in the AI training dataset market with its robust ecosystem of tools and platforms, including TensorFlow and Google Cloud AI. Google’s Kaggle platform facilitates the sharing of datasets and models, enabling collaboration across a global community of data scientists. The company is also deeply involved in creating and curating high-quality datasets for specific AI applications, from natural language processing to computer vision.

Key AI Training Dataset Companies:

The following are the leading companies in the AI training dataset market. These companies collectively hold the largest Market share and dictate industry trends.

- Alegion

- Amazon Web Services, Inc.

- Appen Limited

- Cogito Tech LLC

- Deep Vision Data

- Google, LLC (Kaggle)

- Lionbridge Technologies, Inc.

- Microsoft Corporation

- Samasource Inc.

- Scale AI Inc.

Recent Developments

-

In August 2025, Scale AI partnered with the U.S. Department of Defense to advance AI research and development for the Army, focusing on data operations, generative AI dataset creation, model improvement, and engineering support. This partnership builds on Scale AI’s ongoing collaborations with the DoD to integrate AI into defense missions and strengthen national security.

-

In February 2025, the Ministry of Communications and Information Technology (MCIT) of Qatar collaborated with Scale AI, Inc. to enhance government services in Qatar, including the development of over 50 AI-driven use cases by 2029, as well as the introduction of specialized AI training programs. The collaboration focuses on AI-powered process optimization, workforce upskilling, and improving operational efficiency across government entities.

-

In September 2024, SCALE AI announced a $21 million investment in nine artificial intelligence (AI) projects to enhance healthcare across Canada, focusing on optimizing resource management, patient care, and reducing wait times. This initiative, part of the Pan-Canadian Artificial Intelligence Strategy, promotes collaboration between hospitals and AI solution providers to drive innovation and ensure the ethical handling of data in the Canadian healthcare system.

-

In August 2024, Lionbridge Technologies, Inc. launched Aurora AI Studio, a platform designed to help companies train data sets for advanced AI solutions, addressing the increasing demand for high-quality training data. Lionbridge aims to leverage its expertise in data curation and annotation to empower AI developers and drive improved commercial outcomes.

-

In August 2024, Accenture, an IT company in Ireland, and Google Cloud are accelerating generative AI adoption and enhancing cybersecurity for enterprise clients, with 45% of projects moving to production. Their Generative AI Center of Excellence offers training, expertise, and tools to securely scale AI across various industries.

-

In July 2024, Microsoft Research introduced AgentInstruct. This multi-agent workflow framework automates the generation of high-quality synthetic data for AI model training, significantly reducing the need for human curation. The framework's effectiveness was demonstrated by the Orca-3 model, which showed substantial improvements across multiple benchmarks.

AI Training Dataset Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 3,910.8 million

Revenue forecast in 2033

USD 16,320 million

Growth rate

CAGR of 22.6% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segment scope

Type, vertical, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; KSA; UAE; South Africa

Key companies profiled

Alegion; Amazon Web Services, Inc.; Appen Limited; Cogito Tech LLC; Deep Vision Data; Google, LLC (Kaggle); Lionbridge Technologies, Inc.; Microsoft Corporation; Samasource Inc.; Scale AI Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AI Training Dataset Market Report Segmentation

This report offers revenue growth forecasts at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2026 to 2033. For this study, Grand View Research has segmented the global AI training dataset market report based on type, vertical, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Text

-

Image/Video

-

Audio

-

-

Vertical (Revenue, USD Million, 2021 - 2033)

-

IT

-

Automotive

-

Government

-

Healthcare

-

BFSI

-

Retail & E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global AI training dataset market size was estimated at USD 3,195.1 million in 2025 and is expected to reach USD 3,910.8 million in 2026.

b. The global AI training dataset market is expected to grow at a compound annual growth rate of 22.6% from 2026 to 2033 to reach USD 16,320 million by 2033.

b. North America dominated the AI training dataset market with a share of 35.1% in 2025. This is attributable to the rising adoption of technologies including artificial intelligence, machine learning, LiDAR, and autonomous vehicles.

b. Some key players operating in the AI training dataset market include Alegion, Amazon Web Services, Inc., Appen Limited, Cogito Tech LLC, Deep Vision Data, Google, LLC (Kaggle), Lionbridge Technologies, Inc., Microsoft Corporation, Samasource Inc., Scale AI Inc.

b. Key factors that are driving the AI training dataset market growth include the rapid growth of AI and machine learning and growing applications of training datasets across diversified industry verticals.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.