- Home

- »

- Power Generation & Storage

- »

-

Air Electrode Battery Market Size And Share Report, 2030GVR Report cover

![Air Electrode Battery Market Size, Share & Trends Report]()

Air Electrode Battery Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Rechargeable, Fuel Cell, Non-rechargeable), By Application (Medical Devices, Transportation), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-120-4

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Air Electrode Battery Market Size & Trends

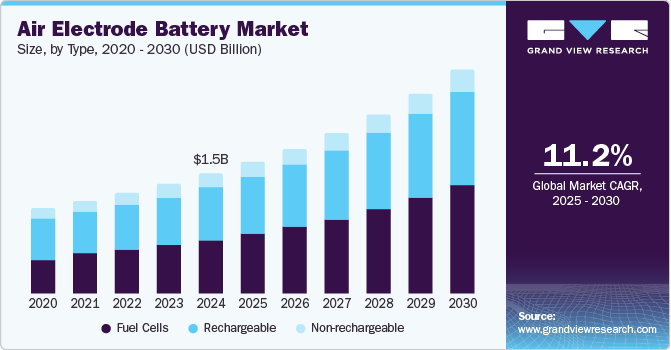

The global air electrode battery market size was valued at USD 1.51 billion in 2024 and is projected to grow at a CAGR of 11.2% from 2025 to 2030. This growth is driven by the increasing adoption of electric vehicles (EVs) is a major contributor, as these vehicles require high-performance batteries with long cycle life and high energy density. Additionally, the growing demand for energy storage systems, particularly for renewable energy sources such as solar and wind, is propelling market growth. Technological advancements in battery materials and design also enhance air electrode batteries' performance and cost-effectiveness. Furthermore, the focus on environmental sustainability and the implementation of supportive government policies and initiatives for clean energy are driving the market forward.

Government incentives and policies promoting clean energy and reduced carbon emissions significantly enhance the market outlook for air electrode batteries. Many countries have established renewable energy standards, such as the U.S. state-level Renewable Portfolio Standards, requiring utilities to incorporate a certain percentage of renewable sources. Tax incentives, such as the federal Electric Vehicle Tax Credit in the U.S. and various rebates in Europe, encourage consumers to adopt electric vehicles, driving demand for advanced battery technologies. Additionally, initiatives such as the European Union’s Horizon Europe program fund research and development in battery technologies, fostering innovation.

Stringent carbon emission reduction targets, such as the UK's goal of achieving net-zero emissions by 2050, push industries towards cleaner alternatives, while supportive policies for electric vehicles, including the U.S. Administration's aim for 50% of new vehicles to be electric by 2030, create a robust demand for high-performance batteries. Furthermore, programs like California's Self-Generation Incentive Program incentivize energy storage solutions, further promoting air electrode technologies. Finally, emerging regulations encouraging battery recycling, such as the European Battery Directive, enhance the sustainability and longevity of battery systems. Together, these factors create a conducive environment for the growth of air electrode batteries as part of a broader commitment to sustainable energy solutions.

Type Insights

The fuel cells segment accounted for the largest share of 45.2% in 2024 due to the increasing demand for clean and efficient energy solutions, particularly in the transportation and stationary power sectors. Fuel cells offer a reliable and sustainable alternative to traditional combustion engines, providing higher efficiency and lower emissions. The growing adoption of fuel cells in electric vehicles, backup power systems, and industrial applications has significantly contributed to this segment's market share.

The rechargeable segment is expected to grow at a CAGR of 10.3% from 2025 to 2030, driven by the rising demand for energy storage systems and the continuous advancements in rechargeable battery technologies. Rechargeable air electrode batteries, such as lithium-air and zinc-air batteries, offer high energy density, longer cycle life, and faster charging capabilities, making them ideal for applications in electric vehicles, portable electronics, and grid energy storage. The increasing focus on renewable energy integration and the need for efficient energy storage solutions further propel the growth of this segment.

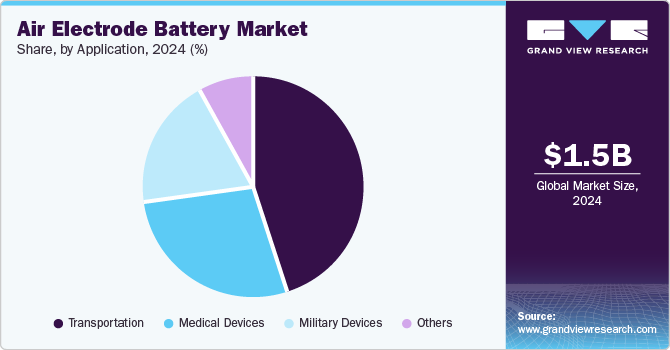

Application Insights

The transportation segment dominated the global air electrode battery market in 2024, primarily due to the increasing adoption of EVs and the need for high-performance batteries. Air electrode batteries, such as lithium-air and zinc-air batteries, offer high energy density and longer cycle life, making them ideal for electrical vehicles (EVs). The push for sustainable transportation and stringent emission regulations have further driven the demand for advanced battery technologies in the transportation sector.

The military devices segment is projected to grow at the fastest CAGR of 11.1% over the forecast period. The increasing defense spending and the need for reliable and high-energy-density power sources for military equipment drive this growth. Air electrode batteries are well-suited for military applications due to their lightweight, high energy density, and ability to operate in extreme conditions. The ongoing advancements in battery technology and the growing emphasis on energy-efficient military solutions are expected to fuel the growth of this segment.

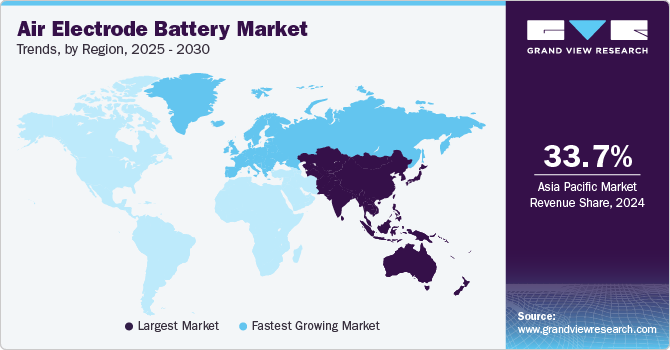

Regional Insights

North America held a significant share of the global air electrode battery market in 2024, driven by the robust demand for energy storage solutions and the adoption of advanced battery technologies. The region's focus on renewable energy integration and significant investments in electric vehicles (EVs) and grid storage solutions have fueled market growth. Additionally, supportive government policies and initiatives promoting clean energy and sustainability have further boosted the demand for air electrode batteries in North America.

U.S. Air Electrode Battery Market Trends

The U.S. held a dominant position in the North American air electrode battery market in 2024, primarily due to the country's advanced infrastructure and strong emphasis on technological innovation. The increasing adoption of electric vehicles and renewable energy systems has significantly driven the demand for high-performance batteries. Furthermore, government incentives and funding programs to promote clean energy and reduce carbon emissions have played a crucial role in the market's growth. The presence of leading battery manufacturers and extensive research and development activities also contribute to the U.S.'s dominant position in the market.

Europe Air Electrode Battery Market Trends

Europe air electrode battery market is projected to grow at a CAGR of 10.2% from 2025 to 2030. This growth is largely driven by the European Union's rigorous carbon emission regulations and the increasing penetration of electric vehicles. Furthermore, substantial investments in renewable energy infrastructure, particularly in wind and solar sectors, underscore the need for advanced energy storage solutions, thereby enhancing the demand for air electrode batteries. The region's commitment to innovation and technological progress fosters ongoing advancements and the adoption of cutting-edge battery technologies.

Asia Pacific Air Electrode Battery Market Trends

The Asia Pacific region dominated the air electrode battery market with a revenue share of 33.7% in 2024, owing to rapid industrialization, urbanization, and the burgeoning consumer electronics market. Countries like China, Japan, and South Korea are key players in this region, driven by their leadership in battery technology and manufacturing capabilities. The strong push for electric vehicles and renewable energy storage solutions has significantly increased the demand for air electrode batteries. Government policies and initiatives promoting clean energy and sustainable practices further support the market growth in this region.

Latin America Air Electrode Battery Market Trends

The Latin America air electrode battery market is expected to grow fastest over the forecast period, driven by the increasing adoption of renewable energy sources and the growing automotive sector. Countries such as Brazil and Mexico are investing heavily in solar and wind power projects, which require efficient energy storage solutions. The rising demand for electric vehicles and expanding the consumer electronics market also contribute to the growing need for advanced batteries in this region.

Key Air Electrode Battery Company Insights

Some of the key companies in the air electrode battery market include Phinergy, Mullen Technologies, Inc., Poly Plus Battery Company, Tesla Inc., Hitachi Maxell Ltd., Volkswagen Ag, and others.

-

Phinergy is a pioneering company in the air electrode battery market, known for its innovative aluminum-air technology. Its approach leverages the abundant availability of aluminum to create batteries that promise significantly higher energy densities than conventional lithium-ion batteries.

-

Poly Plus Battery Company is at the forefront of next-generation battery technology, specializing in lithium-air and lithium-sulfur batteries. It is dedicated to advancing rechargeable lithium-air batteries, which have the potential to revolutionize energy storage for electric vehicles and renewable energy systems.

Key Air Electrode Battery Companies:

The following are the leading companies in the air electrode battery market. These companies collectively hold the largest market share and dictate industry trends.

- Phinergy

- Mullen Technologies, Inc.

- Poly Plus Battery Company

- Tesla Inc.

- Hitachi Maxell Ltd.

- Volkswagen Ag

- Sanyo Electric Co., Ltd.

- BASF Global

- Panasonic Corporation

- LG Chem Ltd.

Recent Developments

-

In February 2024, Volvo Group successfully acquired Proterra's battery business for USD 210 million. This acquisition included a California-based development center and a South Carolina manufacturing facility, significantly bolstering the Group's electric vehicle battery capabilities.

Air Electrode Battery Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.66 billion

Revenue forecast in 2030

USD 2.82 billion

Growth rate

CAGR of 11.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Russia; Spain; Italy; China; Japan; India; South Korea; Australia; Brazil; Colombia; Paraguay; KSA; UAE; Egypt; South Africa

Key companies profiled

Phinergy, Mullen Technologies, Inc., Poly Plus Battery Company, Tesla Inc., Hitachi Maxell Ltd., Volkswagen Ag, Sanyo Electric Co., Ltd., BASF Global, Panasonic Corporation, LG Chem Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

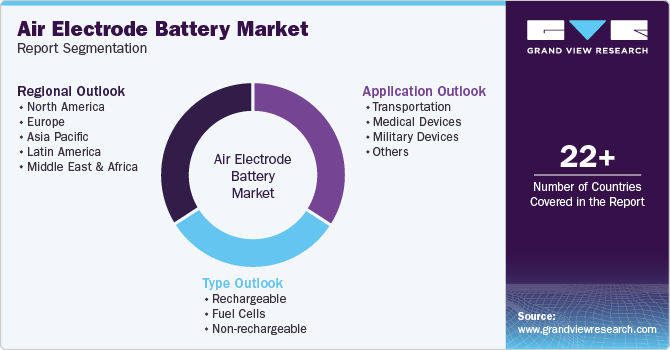

Global Air Electrode Battery Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global air electrode battery market report based on type, application, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Rechargeable

-

Fuel Cells

-

Non-rechargeable

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Transportation

-

Medical Devices

-

Military Devices

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Middle East and Africa (MEA)

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.