- Home

- »

- Renewable Energy

- »

-

Air Pollution Control Systems Market, Industry Report, 2033GVR Report cover

![Air Pollution Control Systems Market Size, Share & Trends Report]()

Air Pollution Control Systems Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Scrubbers, Thermal Oxidizers, Catalytic Converters, Electrostatic Precipitators), By Application (Iron & Steel, Power Generation, Cement, Chemical), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-439-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Air Pollution Control Systems Market Summary

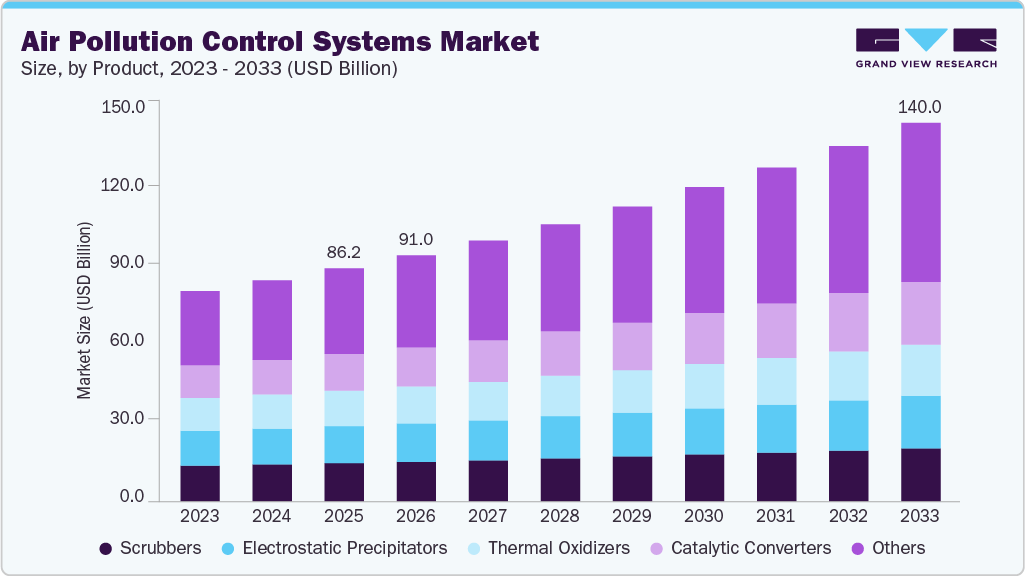

The global air pollution control systems market size was valued at USD 86.18 billion in 2025 and is projected to reach USD 140.03 billion by 2033, growing at a CAGR of 6.3% from 2026 to 2033. Rising emissions from vehicles, industries, and power plants are severely degrading urban air quality.

Key Market Trends & Insights

- Asia Pacific dominated the air pollution control systems market with the largest revenue share of 37.2% in 2025.

- The air pollution control systems market in the U.S. is expected to grow at a substantial CAGR of 5.2% from 2026 to 2033.

- By product, the catalytic converters segment is expected to grow at a considerable CAGR of 7.0% from 2026 to 2033 in terms of revenue.

- By application, the power generation segment is expected to grow at a considerable CAGR of 7.1% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 86.18 Billion

- 2033 Projected Market Size: USD 140.03 Billion

- CAGR (2026-2033): 6.3%

- Asia Pacific: Largest market in 2025

- Latin America: Fastest growing market

Increasing respiratory and cardiovascular health issues are prompting greater adoption of pollution control solutions. Governments and environmental bodies are investing in clean-air initiatives. Industries are shifting toward energy-efficient and low-emission processes to minimize environmental impact. Modern filtration, scrubbing, and catalytic technologies are being integrated into manufacturing facilities. This transition supports sustainability and helps companies meet emission-reduction targets. As a result, the market for air pollution control equipment continues to expand rapidly.

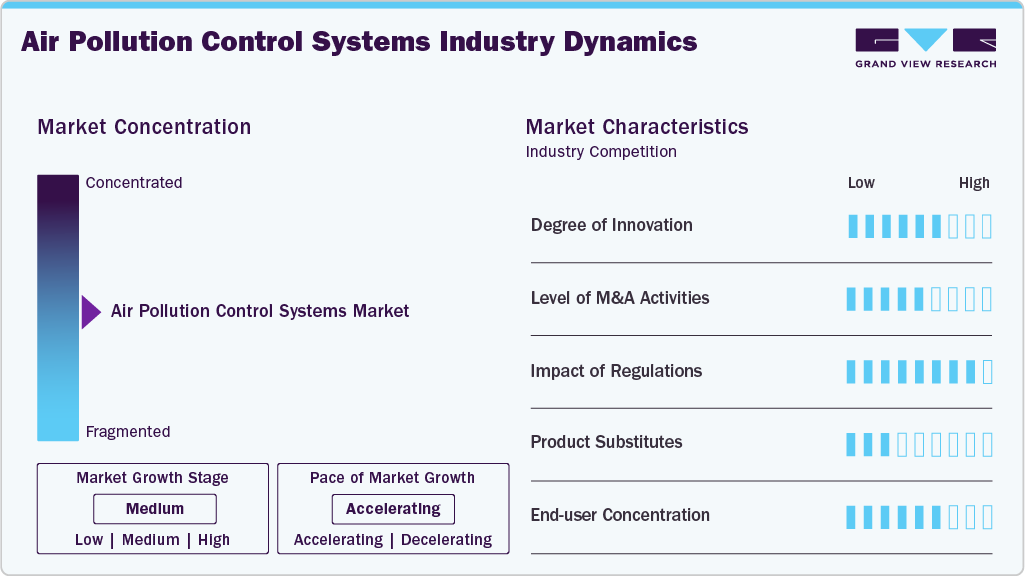

Market Concentration & Characteristics

The industry is moderately concentrated, with a few global players holding notable technological and project execution advantages. However, regional manufacturers and specialized solution providers continue to compete strongly, especially in emerging economies. This mix of established brands and local firms creates a dynamic competitive landscape. Ongoing innovation in filtration efficiency and digital emission monitoring keeps market leadership constantly evolving.

Innovation in the industry is driven by the need for higher efficiency and lower operational costs. Companies are introducing smart monitoring, IoT-enabled controls, and advanced materials for better pollutant capture. Breakthroughs in catalytic and electrostatic technologies are improving performance in heavy industries. This innovation cycle is crucial to staying ahead of evolving emission standards.

Environmental regulations have a strong influence on technology adoption and investment decisions in this market. Compliance mandates push industries to upgrade outdated equipment and adopt cleaner processes. Nations implementing net-zero policies further accelerate system deployment across sectors. Regulatory pressure remains the primary driver of sustained market demand.

Demand is highly concentrated in major polluting sectors such as power generation, metals, cement, and chemicals. These industries rely heavily on emission control technologies to operate within legal frameworks. As industrial output expands, these core end users account for a significant share of market revenue. Growth in manufacturing hubs continues to strengthen this concentration pattern.

Drivers, Opportunities & Restraints

Strict environmental compliance requirements and rising health concerns are pushing industries to adopt efficient emission control solutions. Rapid industrialization, especially in emerging economies, is expanding demand for dust collectors, scrubbers, and ESPs. Adoption of cleaner production processes supports long-term investments in advanced technology. Together, these factors strengthen market growth across major industrial hubs.

Growing focus on sustainability and net-zero targets creates scope for innovative air pollution control technologies. Integration of automation, remote monitoring, and smart sensors enhances operational reliability and energy savings. Retrofitting existing plants presents strong aftermarket potential for service providers. Expanding green infrastructure also boosts future deployment in urban and industrial areas.

High installation and maintenance costs limit adoption among small and medium manufacturing units. Complex upgrading procedures often require production downtime, discouraging frequent system improvements. In some regions, weak regulatory enforcement slows investment decisions. Additionally, fluctuations in raw material prices increase overall project expenses, challenging market profitability.

Product Insights

The Catalytic Converters segment is expected to grow at a considerable CAGR of 7.0% from 2026 to 2033 in terms of revenue. Scrubbers held the dominant share, accounting for 16.4% share in 2025, as they efficiently remove acidic gases, particulate matter, and hazardous pollutants across multiple industries. Their adaptability to power plants, chemical facilities, and marine applications drives widespread adoption. Increasing regulatory pressure on SOx and NOx emissions supports continued market reliance on wet and dry scrubbing systems. Strong retrofitting demand in aging industrial plants further sustains their leadership.

Catalytic converters are witnessing rapid growth driven by the shift toward cleaner industrial and vehicular emissions. Advancements in catalyst materials are improving conversion efficiency while reducing operational costs. Stricter emission norms for transportation and manufacturing are accelerating new installations. Their expanding role in meeting future low-carbon mobility goals positions them as a fast-rising segment in the market.

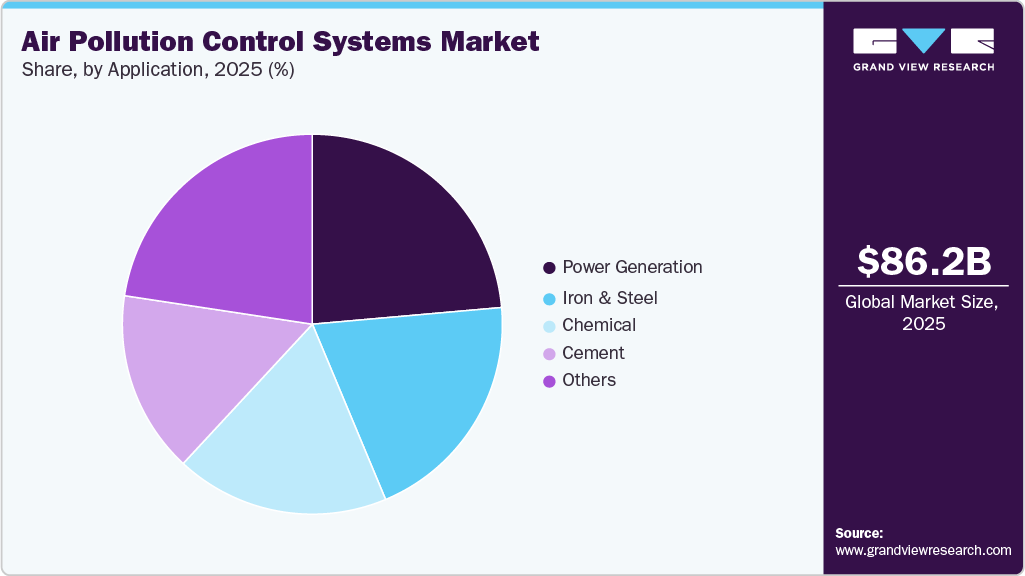

Application Insights

The Iron & Steel segment is expected to grow at a significant CAGR of 6.5% from 2026 to 2033 in terms of revenue. Power generation plants remain the primary adopters of air pollution control systems and accounted for a 23.6% share in 2025, due to their high emissions of SOx, NOx, and particulate matter. Upgrades in coal-based facilities and stricter national clean-air mandates continue to drive system installations. Scrubbers, ESPs, and catalytic technologies are widely deployed to maintain compliance. This essential role in energy infrastructure keeps power generation at the forefront of market demand.

The iron and steel sector is expanding its use of emission control technologies as production levels rise globally. Dust, fumes, and toxic gases from furnaces and processing units require efficient abatement systems. Investments in modernization and greener steel initiatives are accelerating adoption. As major producers target sustainability goals, this segment shows strong and increasing growth momentum.

Regional Insights

North America air pollution control systems market is seeing steady growth, supported by stringent environmental regulations and the modernization of industrial facilities. Focus on reducing carbon emissions in the power and oil & gas sectors, and fuel system upgrades. Investments in smart monitoring technologies improve compliance efficiency. Growing sustainability commitments from corporates enhance market penetration.

U.S. Air Pollution Control Systems Market Trends

The air pollution control systems market in the U.S. leads the regional market due to the strict enforcement of air emission standards from the EPA and state-level agencies. Upgrades in power, oil & gas, and chemical facilities drive strong adoption of advanced pollution control systems. Industrial sustainability programs are accelerating retrofits in aging infrastructure. High investment capacity and supportive clean-energy policies maintain U.S. market dominance.

Canada air pollution control systems market shows steady growth as provinces implement initiatives to improve industrial and urban air quality. Expansion of mining, metal processing, and energy projects is creating consistent demand for emission control technologies. Government incentives for low-carbon operations support technology adoption. Increasing focus on environmental performance positions Canada as a rising contributor to market growth.

Europe Air Pollution Control Systems Market Trends

The air pollution control systems market in Europe is driven by ambitious climate policies and aggressive decarbonization goals. The region prioritizes energy-efficient and low-emission industrial solutions. Strong presence of leading technology providers supports innovation in pollution control. Circular economy initiatives are creating new opportunities in industrial pollution management.

Germany air pollution control systems market leads the European region due to its strong industrial base in automobiles, chemicals, and metal processing. Stringent EU emission regulations drive continuous upgrades of air pollution control technologies. High adoption of energy-efficient and low-emission systems boosts market penetration. Ongoing investment in clean manufacturing keeps Germany at the forefront of demand.

The air pollution control systems market in the UK is experiencing growth as industries transition toward cleaner production and carbon-reduction objectives. Increased focus on air quality in urban centers encourages deployment of advanced filtration and gas treatment solutions. Industrial decarbonization programs are accelerating technology upgrades across key sectors. Supportive environmental policies strengthen the UK’s expanding market share.

Asia Pacific Air Pollution Control Systems Market Trends

The air pollution control systems market in Asia Pacific led and accounted for a 37.2% share in 2025, due to fast industrial expansion in China, India, and Southeast Asia. Rapid urbanization and high pollution levels are driving large-scale deployment of emission control technologies. Government initiatives promoting cleaner industries further strengthen market growth. The region’s strong manufacturing base ensures sustained long-term demand.

China air pollution control systems market dominates the Asia Pacific market due to its large industrial base in power, steel, and chemicals. Strict air quality regulations under national clean-air programs continue to drive major system installations. Rapid retrofitting of coal plants and manufacturing facilities boosts equipment demand. Strong government-backed sustainability targets reinforce China’s leadership position.

The air pollution control systems market in India is witnessing strong growth as industrial expansion and urban pollution push the adoption of emission control systems. Policies like the National Clean Air Programme are accelerating investment in cleaner technologies. Rising infrastructure development across cement, metals, and energy sectors supports the market. Increasing regulatory compliance and public health focus enhance long-term growth potential.

Latin America Air Pollution Control Systems Market Trends

The air pollution control systems market in Latin America is expected to witness the fastest CAGR of 8.4%, supported by expanding industrial activities in Brazil. Environmental enforcement is gradually tightening, pushing companies to deploy compliant filtration and gas treatment systems. Infrastructure expansion in the mining, power, and cement industries boosts demand. International collaboration is helping accelerate the adoption of modern clean-air technologies.

Brazil is driving market growth in Latin America, supported by expanding industrial activities in mining, cement, and manufacturing sectors. Strengthening environmental regulations is pushing companies to adopt efficient emission control systems. Investments in new power and infrastructure projects increase equipment installation needs. Growing awareness of air pollution impacts further enhances Brazil’s demand potential.

Middle East & Africa Air Pollution Control Systems Market Trends

The air pollution control systems market in the Middle East & Africa is experiencing progress as major oil, gas, and petrochemical facilities invest in emission control upgrades. Rising urban pollution concerns encourage new environmental standards across key economies. Industrial diversification under long-term development visions expands target applications. Growing awareness of air quality issues improves market prospects in the region.

The UAE air pollution control systems market is experiencing strong growth driven by industrial diversification and expansion in petrochemicals, metals, and construction sectors. National sustainability initiatives are encouraging the adoption of advanced pollution control technologies. Major investment in clean energy and air quality monitoring strengthens regulatory compliance. As environmental standards tighten, the UAE continues to emerge as a key growth market in the region.

Key Air Pollution Control Systems Companies Insights

Key players operating in the air pollution control systems market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth. Some of the key players operating in the market include MITSUBISHI HEAVY INDUSTRIES, LTD, Hitachi, and Alstom SA.

-

Mitsubishi Heavy Industries offers a broad suite of air-pollution control systems designed for large industrial and power-generation facilities. Its solutions include high-efficiency ESPs, advanced desulfurization and denitrification units, and full flue-gas treatment setups. The company emphasizes long-term operational reliability and compliance with strict global emission norms. It also delivers complete project support, from engineering and fabrication to installation and maintenance. Strong technological expertise enables Mitsubishi to help industries transition toward cleaner and more sustainable operations.

-

Hitachi integrates environmental technologies into industrial systems to improve energy efficiency and emission performance. The company focuses on reducing air pollutants by combining smart controls with resource-efficient equipment. Its solutions support industries in modernizing older facilities to meet tightening environmental standards. Hitachi’s technology strategy highlights reduced carbon footprint, lower operating costs, and sustainable production methods. This approach positions the company as a key contributor to clean-air advancements across manufacturing and infrastructure sectors.

Key Air Pollution Control Systems Companies:

The following are the leading companies in the air pollution control systems market. These companies collectively hold the largest market share and dictate industry trends.

- MITSUBISHI HEAVY INDUSTRIES, LTD

- Hitachi

- Alstom SA

- Thermax Limited

- Ducon Technologies

- Hamon Corporation

- Siemens Ag

- Babcock & Wilcox Enterprises, Inc

- Fujian Longking Co., Ltd.

- Testo SE & Co. KGaA

- MANN+HUMMEL

- Tri-Mer Corporation

- Doosan

- Donaldson Company, Inc.

- Essar Enviro Air Systems

Recent Developments

-

In November 2024, MANN+HUMMEL introduced a new MANN-FILTER cabin air filter that uses a nanofiber layer to improve protection against ultra-fine particles and airborne pollutants. The technology helps maintain cleaner air in vehicle interiors and supports passenger health. It is designed to stay effective throughout the filter’s service life without performance loss. This launch strengthens the company’s focus on advanced air-filtration solutions for the automotive sector.

-

In April 2024, Donaldson introduced the DFPRE 2, a compact dust-collection system built for quick installation and dependable air-filtration performance. It offers configuration flexibility with options to manage combustible dust and optimize airflow. Smart monitoring through iCue technology helps reduce maintenance issues and improve operational uptime. This solution is targeted at industries needing efficient, space-saving dust control.

Air Pollution Control Systems Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 91.03 billion

Revenue forecast in 2033

USD 140.03 billion

Growth rate

CAGR of 6.3% from 2026 to 2033

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; Russia; Italy; Spain; UK; China; Japan; India; Australia; South Korea; Brazil; Saudi Arabia; UAE

Key companies profiled

MITSUBISHI HEAVY INDUSTRIES, LTD; Hitachi; Alstom SA; Thermax Limited; Ducon Technologies; Hamon Corporation; Siemens AG; Babcock & Wilcox Enterprises, Inc.; Fujian Longking Co., Ltd.; Testo SE & Co. KGaA; MANN+HUMMEL; Tri-Mer Corporation; Doosan; Donaldson Company, Inc.; Essar Enviro Air Systems.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Air Pollution Control Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global air pollution control systems market report based on product, application, and region.

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Scrubbers

-

Thermal Oxidizers

-

Catalytic Converters

-

Electrostatic Precipitators

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Iron & Steel

-

Power Generation

-

Cement

-

Chemical

-

Others

-

-

Region Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Russia

-

Germany

-

Italy

-

UK

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global air pollution control systems market size was estimated at USD 86.18 billion in 2025 and is expected to be USD 91.03 billion in 2026.

b. The global air pollution control systems market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.3% from 2026 to 2033 to reach USD 140.03 billion by 2033

b. Asia Pacific leads the market and accounting for 37.2% share in 2025, due to fast industrial expansion in China, India, and Southeast Asia. Rapid urbanization and high pollution levels are driving large-scale deployment of emission control technologies. Government initiatives promoting cleaner industries further strengthen market growth.

b. Some of the key players operating in the air pollution control systems market include MITSUBISHI HEAVY INDUSTRIES, LTD; Hitachi; Alstom SA; Thermax Limited; Ducon Technologies; Hamon Corporation; Siemens AG; Babcock & Wilcox Enterprises, Inc.; Fujian Longking Co., Ltd.; Testo SE & Co. KGaA; MANN+HUMMEL; Tri-Mer Corporation; Doosan; Donaldson Company, Inc.; Essar Enviro Air Systems.

b. Stringent environmental regulations and rising health concerns are compelling industries to adopt advanced emission control technologies. Rapid growth in industrial activities, particularly in developing economies, is boosting system installations. Additionally, sustainability goals and cleaner production initiatives are accelerating upgrades across major polluting sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.