- Home

- »

- Automotive & Transportation

- »

-

Aircraft Cabin Interior Market Size, Industry Report, 2030GVR Report cover

![Aircraft Cabin Interior Market Size, Share & Trends Report]()

Aircraft Cabin Interior Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Alloy, Composites), By Aircraft (Narrow Body, Wide Body), By Type, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-985-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Aircraft Cabin Interior Market Summary

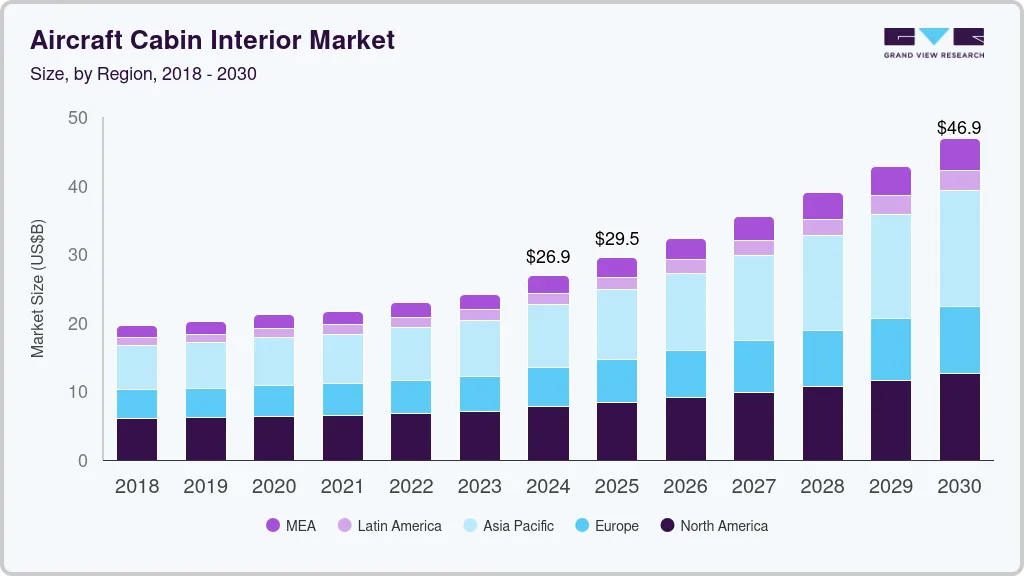

The global aircraft cabin interior market size was estimated at USD 26.88 billion in 2024 and is projected to reach USD 46.87 billion by 2030, growing at a CAGR of 9.7% from 2025 to 2030. The market is experiencing significant growth driven by rising air travel demand, increasing fleet expansion, and the need for enhanced passenger experience.

Key Market Trends & Insights

- The North America aircraft cabin interior market generated the highest revenue share, accounting for over 28% in 2024.

- The aircraft cabin interior market in U.S. held a dominant position in 2024.

- By material, the alloys segment captured the largest market share of over 64% in 2024.

- By type, the entertainment & connectivity segment held the largest revenue share in 2024.

- By aircraft, the narrow body aircraft segment accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 26.88 Billion

- 2030 Projected Market Size: USD 46.87 Billion

- CAGR (2025-2030): 9.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Airlines are investing heavily in modernizing cabin interiors with lightweight, durable materials like advanced composites to improve fuel efficiency and reduce operational costs. Passenger expectations for comfort, convenience, and connectivity are pushing the adoption of smart cabin technologies, including high-speed Wi-Fi, advanced in-flight entertainment systems, and personalized seating configurations. The trend toward premium travel experiences is also boosting demand for spacious cabin layouts, lie-flat seats, and mood lighting systems in both wide-body and narrow-body aircraft. In addition, the aftermarket segment is growing as airlines refurbish aging fleets to maintain competitive standards and enhance in-flight service quality. Sustainability initiatives are further shaping the industry, with a strong focus on eco-friendly materials and energy-efficient designs. As innovation and competition intensify, the aircraft cabin interior industry remains pivotal in shaping the future of air travel comfort and efficiency.The aircraft cabin interior industry is seeing a strong push toward premium passenger experience, driven by rising expectations for comfort and personalized services. Airlines are investing in advanced seating solutions, mood lighting, and high-speed in-flight entertainment to stand out in a competitive market. The demand for spacious cabin designs and ergonomic seating is shaping product innovations in the industry. Enhanced connectivity and digitalization play a crucial role in elevating in-flight experiences. This focus on passenger-centric design is a key trend driving the growth of the aircraft cabin interior industry.

Sustainability is becoming a major driver in the aircraft cabin interior industry, with airlines prioritizing lightweight materials to improve fuel efficiency and reduce carbon emissions. Advanced composites, recycled fabrics, and eco-friendly components are gaining popularity in cabin interior design. This shift not only aligns with global environmental standards but also lowers operational costs for airlines. Lightweight materials help optimize aircraft performance without compromising passenger comfort. The industry’s focus on sustainability is shaping next-generation cabin interior innovations.

The rapid growth of low-cost carriers is boosting demand in the aircraft cabin interior industry, especially for efficient and budget-friendly cabin designs. LCCs focus on maximizing seating capacity while maintaining passenger comfort, driving the need for slimline seats and modular interior components. Cost-effective yet durable materials are in high demand to support frequent flight operations. The expansion of LCCs in emerging markets like Asia Pacific and Latin America is further fueling market growth. This trend is pushing interior suppliers to innovate for both affordability and quality.

The aircraft cabin interior industry is embracing advanced technology with the rise of smart cabin systems and IoT-enabled devices. Touchless controls, wireless charging, and real-time connectivity are becoming standard features in modern aircraft interiors. Airlines are investing in smart lighting, climate control, and seat customization to enhance the in-flight experience. These innovations not only boost passenger satisfaction but also streamline airline operations and maintenance. Technology-driven interiors are shaping the future of the aircraft cabin interior industry.

The aircraft cabin interior industry is witnessing increased investment in luxury and premium class segments as airlines cater to high-end travelers. Enhanced privacy, lie-flat seating, and personalized entertainment options are key features driving this trend. Premium-class interiors focus on maximizing passenger comfort while offering exclusive amenities. This demand for superior design and high-end materials boosts the industry’s growth, particularly on long-haul international routes. The push for premium travel experiences continues to shape cabin interior innovations.

The booming aviation sector in the Asia Pacific is driving substantial demand in the aircraft cabin interior industry. Rapid fleet expansion and increasing air travel demand in countries like China and India fuel the need for modern and efficient cabin designs. Airlines in the region prioritize cost-effective solutions without compromising on passenger comfort and safety. Local manufacturing and technological adoption further support market growth. The Asia Pacific region remains a key contributor to the industry’s global expansion.

Airlines are increasingly offering personalized experiences, driving customization trends in the aircraft cabin interior industry. Adjustable seating, individualized entertainment systems, and tailored lighting options cater to diverse passenger preferences. Premium cabins focus on delivering unique and personalized travel experiences. Customizable interiors also help airlines strengthen brand identity and loyalty. This trend highlights the industry’s shift toward passenger-centric design solutions.

Material Insights

The alloys segment captured the largest market share of over 64% in 2024. The alloys segment is gaining traction due to its balance of strength, durability, and lightweight properties. Airlines are increasingly adopting advanced titanium and aluminum alloys to reduce aircraft weight, which enhances fuel efficiency and lowers operational costs. The demand for corrosion-resistant and high-strength materials is driving innovation in alloy composition for cabin components like seating frames, overhead bins, and structural panels. With growing pressure to meet sustainability goals, the use of recyclable and eco-friendly alloys is also rising. This trend positions the alloys segment as a key contributor to the evolution of modern, efficient, and comfortable aircraft interiors.

The composites segment is expected to witness a significant CAGR of 9.2% from 2025 to 2030. The composites segment is witnessing significant growth due to the rising demand for lightweight, durable, and fuel-efficient materials. Airlines are increasingly adopting advanced composite materials like carbon fiber and reinforced plastics to reduce aircraft weight, improve fuel efficiency, and lower operational costs. Composites also offer enhanced strength and flexibility, enabling innovative cabin designs without compromising safety or comfort. The push for sustainability further drives the use of eco-friendly composite materials, aligning with global environmental standards. As technological advancements improve the production and performance of composites, this segment continues to shape the future of modern aircraft interiors.

Type Insights

The entertainment & connectivity segment held the largest revenue share in 2024. The entertainment and connectivity segment is experiencing rapid growth, driven by increasing passenger demand for a seamless digital experience. Airlines are investing in high-speed Wi-Fi, in-flight streaming services, and personalized entertainment systems to enhance customer satisfaction and differentiate their services. Advanced seatback screens, wireless content access, and BYOD (Bring Your Own Device) solutions are becoming standard features across both premium and economy cabins. The integration of smart cabin technologies and IoT-enabled devices further boosts real-time connectivity and convenience. As digitalization continues to reshape air travel, the entertainment and connectivity segment remains a key driver of innovation and passenger engagement.

The galley segment is expected to record the fastest CAGR over the forecast period. The galley segment is evolving with a focus on efficiency, space optimization, and advanced technology integration. Airlines are adopting lightweight galley systems made from advanced composites to reduce overall aircraft weight and improve fuel efficiency. Modular and customizable galley designs are gaining popularity, allowing airlines to optimize space while accommodating diverse service requirements. Innovations like smart storage, touchless controls, and energy-efficient appliances enhance crew productivity and passenger service quality. As airlines prioritize both operational efficiency and in-flight experience, the galley segment remains a vital area for ongoing development and modernization.

Aircraft Insights

The narrow body aircraft segment accounted for the largest revenue share in 2024. The narrow-body aircraft segment is witnessing strong growth driven by the rising demand for short and medium-haul flights. Airlines are focusing on optimizing cabin space with lightweight seating, slimline designs, and modular interiors to maximize passenger capacity without sacrificing comfort. Enhanced in-flight entertainment, high-speed connectivity, and modern lighting systems are becoming standard in narrow-body cabins to meet evolving passenger expectations. The push for fuel efficiency and lower operational costs also leads to the adoption of advanced materials and compact galley designs. As air travel demand surges, particularly in emerging markets, the narrow-body aircraft segment remains a key focus for innovation and investment.

The wide body aircraft segment is expected to record a significant CAGR from 2025 to 2030. The wide-body aircraft segment growth is driven by the increasing demand for long-haul international travel and premium passenger experiences. Airlines are investing in spacious cabin layouts, advanced seating systems like lie-flat business class seats, and high-end entertainment solutions to enhance comfort on extended flights. The use of lightweight composite materials and energy-efficient systems helps reduce fuel consumption and operational costs while maintaining luxurious interiors. Innovations like customizable mood lighting, enhanced connectivity, and noise-reduction technologies further elevate the in-flight experience. As global air travel recovers and expands, the wide-body aircraft segment remains crucial for delivering both capacity and comfort on long-distance routes.

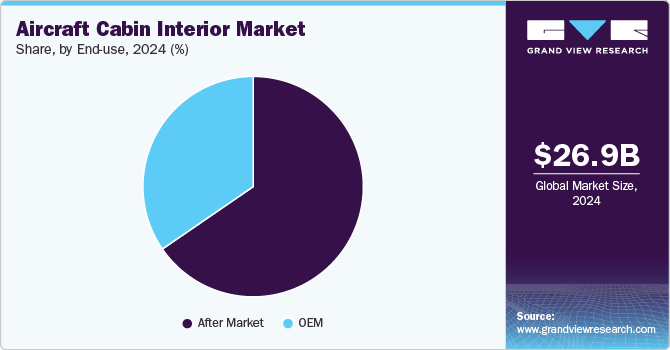

End-use Insights

The aftermarket segment held the largest revenue share in 2024. The aftermarket segment is gaining momentum due to the rising need for cabin refurbishments, upgrades, and maintenance services. Airlines are increasingly modernizing aging fleets with advanced seating, updated entertainment systems, and enhanced cabin aesthetics to stay competitive and improve passenger experience. Demand for lightweight, durable, and customizable interior components is driving growth in this segment, especially as carriers focus on fuel efficiency and cost management. The surge in air travel, coupled with extended aircraft lifespans, boosts the need for periodic cabin overhauls and part replacements. As innovation in interior design and technology continues, the aftermarket segment remains essential for sustaining high-quality cabin environments.

The OEM segment is expected to record the fastest CAGR from 2025 to 2030. The OEM (original equipment manufacturer) segment is thriving due to increasing aircraft production and fleet expansion worldwide. Airlines are demanding advanced, lightweight, and customizable interior solutions directly integrated during aircraft assembly to enhance passenger comfort and operational efficiency. OEMs are focusing on innovative designs, such as modular seating, next-generation entertainment systems, and smart cabin technologies, to meet evolving customer expectations. The push for fuel efficiency and sustainability also drives the adoption of eco-friendly materials and energy-efficient systems in cabin interiors. As global air travel demand rises, the OEM segment remains a vital driver of cutting-edge interior development and aircraft modernization.

Regional Insights

The North America aircraft cabin interior market generated the highest revenue share, accounting for over 28% in 2024. The North America market is driven by rising demand for enhanced passenger experience and the adoption of advanced in-flight entertainment and connectivity systems. Airlines are investing heavily in lightweight, fuel-efficient cabin components to reduce operational costs and carbon emissions. The region’s strong presence of key market players and technological innovation keeps it at the forefront of cabin interior advancements.

U.S. Aircraft Cabin Interior Market Trends

The aircraft cabin interior market in U.S. held a dominant position in 2024. The U.S. leads the North American market with a focus on premium cabin design and cutting-edge in-flight amenities. Airlines are increasingly upgrading their fleets with ergonomic seating, advanced lighting systems, and personalized entertainment options. The country’s strong aviation infrastructure and high air travel demand drive continuous investment in innovative cabin interior solutions.

Europe Aircraft Cabin Interior Market Trends

The aircraft cabin interior market in Europe was identified as a lucrative region in 2024. Europe’s market thrives on a strong focus on luxury and innovation, with leading airlines enhancing their premium and business class offerings. Advanced seating configurations, high-speed connectivity, and mood lighting systems are gaining traction across the region. The push for sustainability drives the adoption of eco-friendly materials and energy-efficient cabin systems.

The UK aircraft cabin interior industry emphasizes personalized passenger experience and innovative design, particularly in long-haul and business-class segments. Airlines are integrating high-end amenities like lie-flat seats, touchscreen controls, and advanced entertainment systems. The growing demand for aircraft refurbishments and cabin retrofits is also shaping market growth.

Germany aircraft cabin interior market stands out for its engineering excellence, with a focus on smart technology integration and comfort. Airlines are investing in advanced seating solutions, noise-reduction systems, and enhanced storage options. The country’s strong aerospace manufacturing base supports innovation and high-quality cabin interior products.

Asia Pacific Aircraft Cabin Interior Market Trends

The aircraft cabin interior industry in the Asia Pacific region is expected to grow at the fastest CAGR of over 22.0% from 2025 to 2030. The Asia Pacific region is experiencing rapid growth due to increasing air travel demand and fleet expansion. Airlines are focusing on cost-efficient yet comfortable cabin designs, driving demand for lightweight materials and modular components. Advanced in-flight entertainment and connectivity solutions are also becoming a key differentiator in the region.

China aircraft cabin interior market growth is fueled by the booming aviation sector and the high demand for modern and aesthetically appealing cabin interiors. Airlines are enhancing passenger experience through smart seating, personalized entertainment, and upgraded lighting systems. Domestic carriers are also investing in sustainable materials and energy-efficient designs to align with global environmental standards.

India aircraft cabin interior industry growth is driven by the rapid rise of low-cost carriers and increasing passenger expectations. Airlines are focusing on optimizing cabin space while ensuring comfort, leading to increased adoption of slimline seats and smart storage solutions. The push for digitalization sees a growing demand for advanced in-flight entertainment and connectivity systems.

Key Aircraft Cabin Interior Company Insights

Some of the key players operating in the market include Collins Aerospace and Honeywell International Inc.

-

Honeywell International Inc. is a well-established leader in aviation cloud solutions, offering cutting-edge flight operations, safety, and connectivity systems. The company’s strong R&D capabilities and advanced analytics tools help optimize flight efficiency and reduce operational costs. With a robust global presence, Honeywell remains at the forefront of smart aviation technologies. Long-standing partnerships with major airlines and aircraft manufacturers reinforce its mature market position.

-

Collins Aerospace is a key player in aerospace systems, providing integrated solutions for flight operations, avionics, and connectivity. The company’s innovations in cloud-based flight management and real-time data analytics are driving industry-wide digital transformation. Collins’ extensive product portfolio and technical expertise ensure its competitive edge in the aviation cloud market. Its established relationships with airlines and defense sectors further strengthen its market leadership.

Gogo, Inc. and JCB Aero are some of the emerging participants in the aircraft cabin interior industry.

-

Gogo has been gaining traction in the aviation connectivity and in-flight entertainment market, offering advanced satellite-based broadband solutions. The company is investing heavily in 5G air-to-ground networks to enhance connectivity speed and reliability for airlines. Its innovative approach to delivering seamless internet service positions it as a key player in the evolving aviation cloud market. Gogo’s growth reflects rising demand for digital transformation and enhanced passenger experiences on board.

-

JCB Aero specializes in aircraft interior design and refurbishment, focusing on custom cabin solutions for commercial and private jets. The company has been expanding its footprint through partnerships and advanced manufacturing techniques like composite material usage. As demand for premium passenger experience grows, JCB Aero’s tailored solutions gain popularity. Their emphasis on innovation and craftsmanship positions them among emerging leaders in aviation interiors.

Key Aircraft Cabin Interior Companies:

The following are the leading companies in the aircraft cabin interior market. These companies collectively hold the largest market share and dictate industry trends.

- Astronics Corporation

- Cobham PLC

- Collins Aerospace

- Gogo, Inc

- Honeywell International Inc.

- Hong Kong Aircraft Engineering Company Limited

- JCB Aero

- Panasonic Corporation

- Thales Group

- The Boeing Company.

Recent Developments

-

In March 2025, Delta Air Lines partnered with JetZero to develop a groundbreaking blended-wing-body aircraft aimed at enhancing fuel efficiency by 50% and reducing carbon emissions. This innovative design will serve both domestic and international routes, marking a significant step toward sustainable aviation. The first test flight of this next-generation aircraft is scheduled for 2027.

-

In December 2024, Air France introduced new onboard comfort kits tailored for La Première, Business, and Premium cabins, focusing on passenger comfort and sustainability. The kits feature high-end skincare products, eco-friendly materials, and practical amenities like bamboo toothbrushes and recycled fabric accessories. This initiative reflects Air France's commitment to enhancing the travel experience while prioritizing environmental responsibility.

-

In July 2024, Turkish Airlines unveiled its new Crystal Business Class suite, designed to elevate luxury and comfort for long-haul passengers. The suite features sliding privacy doors, wireless charging stations, personal reading lamps, and 22-inch entertainment screens. This launch aligns with the airline’s strategy to enhance its premium cabin offerings and passenger experience.

Aircraft Cabin Interior Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 29.49 billion

Revenue forecast in 2030

USD 46.87 billion

Growth rate

CAGR of 9.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, type, aircraft, end-use, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; India; Japan; Indonesia; Brazil; Mexico; Saudi Arabia; UAE

Key companies profiled

Astronics Corporation; Cobham PLC; Collins Aerospace; Gogo, Inc; Honeywell International Inc.; Hong Kong Aircraft Engineering Company Limited; JCB Aero; Panasonic Corporation; Thales Group; The Boeing Company

Pricing and purchase options

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aircraft Cabin Interior Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels and analyzes the latest market trends in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global aircraft cabin interior market report based on material, type, aircraft, end-use, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Alloys

-

Aluminum Alloy

-

Steel Alloy

-

Others

-

-

Composites

-

Carbon

-

Glass

-

ARAMID (Kevlar)

-

Others

-

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Aircraft Seating

-

Passenger Seating

-

Business Class

-

Economy Class

-

Premium Economy Class

-

First Class

-

-

Crew Rest Seating

-

-

Entertainment & Connectivity

-

Hardware

-

Connectivity

-

Content

-

-

Cabin Lighting

-

Signage Lights

-

Ceiling & Wall Lights

-

Floor Path Lighting Strips

-

Reading Lights

-

Lavatory Lights

-

-

Galley

-

Electric

-

Non-electric

-

-

Lavatory

-

Reusable Liquid Flush

-

Vacuum Flush Type

-

-

Windows & Windshields

-

Cabin Windows

-

Windshields

-

-

Stowage Bins

-

Shelf Bins

-

Pivot Bins

-

Translating Bins

-

-

Interior Panels

-

Floor Panels

-

Ceiling Panels

-

Side Panels

-

Cabin Dividers

-

-

-

Aircraft Outlook (Revenue, USD Million, 2018 - 2030)

-

Narrow Body Aircraft

-

Wide Body Aircraft

-

Business Jets

-

Regional Transport Aircraft

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Original Equipment Manufacturer (OEM)

-

After Market

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Rest of Europe

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Indonesia

-

Rest of Asia

-

-

Latin America

-

Brazil

-

Mexico

-

Rest of Latin America

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

Rest of Middle East & Africa

-

-

Frequently Asked Questions About This Report

b. The global aircraft cabin interior market size was estimated at USD 26.88 billion in 2024 and is expected to reach USD 29.49 billion in 2025.

b. The global aircraft cabin interior market is expected to grow at a compound annual growth rate of 9.7% from 2025 to 2030 to reach USD 46.87 billion by 2030.

b. The Asia Pacific dominated the aircraft cabin interior market with a share of over 34% in 2024 due to increasing air travel demand and fleet expansion. Airlines are focusing on cost-efficient yet comfortable cabin designs, driving demand for lightweight materials and modular components.

b. Some key players operating in the aircraft cabin interior market include Astronics Corporation; Cobham PLC; Collins Aerospace; Gogo, Inc.; Honeywell International Inc.; Hong Kong Aircraft Engineering Company Limited; JCB Aero; Panasonic Corporation; Thales Group; The Boeing Company.

b. Key factors that are driving the aircraft cabin interior market growth include growing preference, for short-haul and domestic flights, an increase in advancements and upgradation of cabin interiors, and a rise in penetration of Inflight entertainment and connectivity for enhancing passenger convenience.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.