- Home

- »

- Next Generation Technologies

- »

-

Algorithmic Trading Market Size, Share, Growth Report, 2030GVR Report cover

![Algorithmic Trading Market Size, Share & Trends Report]()

Algorithmic Trading Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Solution, Service), By Deployment (Cloud, On-premise), By Trading Types, By Type of Traders, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-004-8

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Algorithmic Trading Market Summary

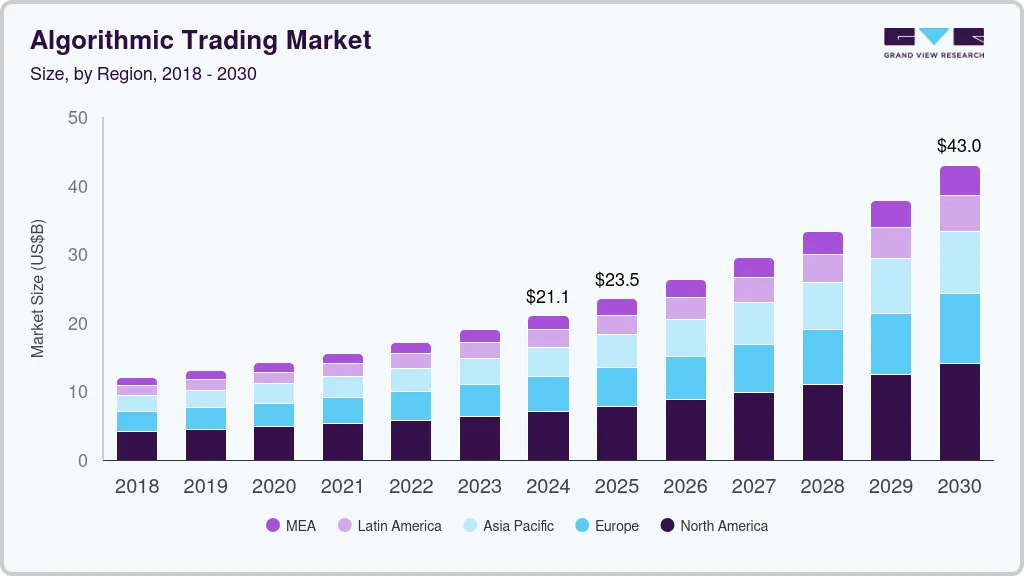

The global algorithmic trading market size was estimated at USD 21.06 billion in 2024 and is projected to reach USD 42.99 billion by 2030, growing at a CAGR of 12.9% from 2025 to 2030. The increasing integration of Machine Learning (ML) and Artificial Intelligence (AI) technologies in algorithmic trading solutions can be attributed to market growth.

Key Market Trends & Insights

- North America algorithmic trading market held the largest share with the revenue share of 33.6% in 2024.

- The algorithmic trading market in the U.S. held a dominant position in 2024.

- By component, the solutions segment accounted for the largest share of 85.83% in 2024.

- By deployment, the cloud segment held the largest market in 2024.

- By trading types, the stock market segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 21.06 Billion

- 2030 Projected Market Size: USD 42.99 Billion

- CAGR (2025-2030): 12.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

These technologies enable traders to develop more sophisticated algorithms to analyze massive amounts of data in real time, identifying patterns and making predictive decisions faster than traditional methods. AI and ML enhance trading strategies by allowing for adaptive learning, where algorithms improve over time based on historical performance and changing market conditions. High-frequency trading (HFT) is another key trend driving the market growth. HFT firms utilize complex algorithms to execute many orders at extremely high speeds, often within milliseconds. This approach benefits from small price discrepancies that exist briefly, allowing traders to make profits on minimal price changes. The growth of HFT is supported by advancements in technology, including faster networks and more powerful computing resources, which enable rapid trade execution. Several market participants are looking to take advantage of these benefits, and HFT is poised further to enhance its impact on the market.

The democratization of algorithmic trading tools has led to a surge in adoption among retail investors. Earlier, sophisticated trading algorithms were primarily accessible to institutional players due to their complexity and cost. However, the emergence of user-friendly platforms and educational resources has enabled individual traders to implement algorithmic strategies effectively. This trend is increasing greater participation in financial markets, as retail investors can now utilize algorithms for portfolio management and executing trades based on predefined criteria. The increased accessibility of these tools is expected to drive competition and innovation within the market.

Furthermore, regulatory support is crucial in transforming market growth. Governments and regulatory bodies are increasingly recognizing the importance of algorithmic trading in enhancing market efficiency and liquidity. As a result, ongoing efforts are to establish frameworks that promote transparency and accountability while ensuring investor protection. This supportive regulatory environment encourages financial institutions to adopt algorithmic trading strategies confidently, knowing they are operating within established guidelines. Moreover, as regulations evolve to accommodate technological advancements, firms are expected to invest more heavily in compliant algorithmic solutions, driving further market expansion.

However, algorithm inconsistency and lack of accuracy are anticipated to impede market growth during the forecast period. Insufficient risk valuation and monitoring capabilities are further expected to impact market expansion negatively. Since algorithmic trading operates as a fully automated process, traders cannot make discretionary decisions once an order is executed. Even if a trader realizes that the trading strategy may only provide favorable results after the order is completed, they need more ability to stop the program and intervene in the trade. These factors are expected to pose significant challenges to market growth.

Component Insights

The solutions segment accounted for the largest share of 85.83% in 2024. The segment is further bifurcated into platforms and software tools. The algorithmic trading platform offers a large collection of free futures and equities data and an efficient platform to back-test and study trading strategies. Increasing demand for supplement trading strategies globally is expected to propel the segment growth over the forecast period. Moreover, the increasing need to effectively manage an investment portfolio is further anticipated to create growth opportunities for the segment. On the other hand, increasing adoption of algorithmic trading software tools to effectively place the trades to generate profits and identify profitable opportunities is expected to propel the segment growth. Investment banks and proprietary trading firms widely adopt algorithmic trading software. The abundant resource availability owing to their large size enables these firms to build their private proprietary trading software tools, including large trading systems with dedicated support staff and data centers.

The services segment is expected to witness moderate growth during the forecast period. The services segment is further bifurcated into professional services and managed services. The increase can be attributed to the increasing adoption of professional services among end-users to ensure the effective functioning of trading solutions. Moreover, professional services enable trading businesses to automate or migrate an existing systematic trading strategy. Traders can accommodate any trading strategy using professional services, which can be defined via a set of rules. On the other hand, managed services provide traders and investors with support, maintenance, and infrastructure management for efficiently developing trading strategies. Moreover, traders widely use managed services to deploy and manage algorithmic trading solutions effectively. Furthermore, managed services are also used for real-time monitoring of trading data feed and order execution infrastructure.

Deployment Insights

The cloud segment held the largest market in 2024. Numerous global vendors are focusing on offering cloud-based algorithmic trading solutions to achieve maximum profits and efficiently automate the trading process. Moreover, the adoption of cloud-based solutions is anticipated to grow, mainly due to their benefits, such as cost-effectiveness, scalability, easy trade data maintenance, and effective management. Traditional traders can deploy cloud-based solutions to check new trading strategies, run time series analysis, and back-test while executing trades. The cloud-based solutions require minimum infrastructure and faster processing than their traditional on-premise counterpart. Also, increasing adoption of cloud-based solutions by financial institutions to enhance their efficiency and productivity is further expected to propel the cloud segment growth.

On-premise deployment is expected to register a moderate CAGR of 12.3% during the forecast period. An on-premises algorithmic trading solution is installed and runs on computers using the software on the businesses' premises. Many financial institutions prefer on-premise solutions due to enhanced control over their trading environments and data security, driving segment growth. In addition, this model allows firms to customize their algorithms and infrastructure according to specific trading strategies and regulatory requirements, ensuring compliance and minimizing risks associated with data breaches.

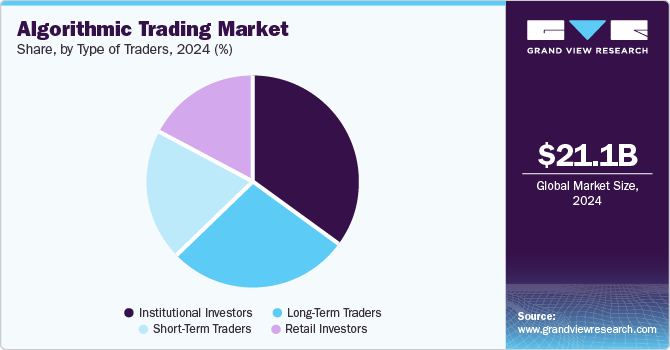

Type of Traders Insights

The institutional investors segment dominated the market in 2024. Institutional investors, such as banks, insurance companies, credit unions, hedge funds, mutual funds companies, and investment advisors, pool their money to purchase real estate, securities, or other investment assets. Moreover, institutional investors regularly use various computer-driven algorithmic strategies in the unpredictable trading marketplace, which succumb to the trade influence. Algorithmic trading techniques enable institutional investors to improve their profitability and effectively reduce trade costs.

The short-term traders segment is anticipated to grow rapidly during the forecast period. Short-term traders focus primarily on price action instead of an asset's long-term fundamentals. Algorithmic trading solutions enable short-term traders to earn quick profits from the market. Short-term traders are heavily influenced by investment strategies, thereby propelling the demand for algorithmic trading solutions in short-term trading.

Trading Types Insights

The stock market segment dominated the market in 2024. The stock market is considered one of the leading asset classes for trading numerous securities in a secured, managed, and controlled environment. Moreover, stock markets offer benefits, such as profit maximization and risk management, to financial and brokerage firms. These benefits pave the way for traders and investors to adopt algorithmic trading solutions.

The cryptocurrencies segment is expected to witness notable growth during the forecast period. This growth can be attributed to the increasing interest of trading professionals in cryptocurrency trading. Algorithmic trading solutions enable traders to process live market data from any of the supported cryptocurrency exchanges. These solutions also support margin and exchange trading. The factors above are expected to propel the segment’s growth.

Regional Insights

North America algorithmic trading market held the largest share with the revenue share of 33.6% in 2024 owing to a strong presence of financial institutions and technology companies that prioritize advanced trading solutions. Adopting AI and ML technologies has further enhanced trading efficiency and accuracy. Regulatory support, combined with a competitive landscape that encourages innovation, has made North America a major region for algorithmic trading. The increasing demand for low-latency trading and superior order execution is expected to contribute to market growth.

U.S. Algorithmic Trading Market Trends

The algorithmic trading market in the U.S. held a dominant position in 2024 due to the significant presence of institutional investors and hedge funds seeking to enhance their trading efficiency. In addition, increasing reliance on data analytics and machine learning in trading strategies further drives market growth.

Europe Algorithmic Trading Market Trends

The algorithmic trading market in Europe was identified as a lucrative region in 2024. The market's growth is driven by regulatory changes that promote transparency and efficiency in financial markets. Countries such as Germany and the UK are major contributors, with significant technological investments to enhance trading capabilities. The regional market is characterized by diverse participants, including institutional investors and retail traders, all seeking to leverage algorithmic solutions for better trading outcomes. Thus, increasing support from the government for technological advancements in trading practices is further expected to boost the market's growth.

The UK algorithmic trading market is expected to grow rapidly in the coming years due to its established financial services sector and regulatory framework. For instance, the Financial Conduct Authority (FCA) has implemented guidelines encouraging algorithmic trading while ensuring robust risk management practices among firms. This regulatory environment has attracted domestic and international players looking to capitalize on algorithmic strategies. Such initiatives are expected to contribute to market growth.

The algorithmic trading market in Germany held a substantial market share in 2024 owing to its strong economy and advanced technological infrastructure. The country has witnessed increased adoption of algorithmic solutions among institutional investors seeking to optimize their trading strategies. German regulators have also proactively established guidelines that facilitate safe and efficient algorithmic trading practices.

Asia Pacific Algorithmic Trading Market Trends

The algorithmic trading market in Asia Pacific is anticipated to grow at a CAGR of 13.6% during the forecast period. The rapid development of financial markets in countries such as China, Japan, and India has spurred significant technological investments to enhance trading efficiency. Institutional investors are increasingly adopting algorithmic strategies to capitalize on market opportunities presented by economic growth and increased liquidity. Furthermore, government initiatives promoting fintech innovations are expected to accelerate the region's adoption of algorithmic trading solutions.

Japan algorithmic trading market is expected to grow rapidly in the coming years due to its highly advanced technological infrastructure and early adoption of automated trading solutions. In addition, major financial institutions and high-frequency trading firms contribute to a competitive environment that drives the adoption of advanced algorithmic trading solutions.

The algorithmic trading market in China held a substantial market share in 2024 due to substantial investments from private and public sectors into fintech innovations. The Chinese government's encouraging policies regarding digital finance have created an environment that promotes rapid growth in algorithmic trading activities. Major tech companies are investing heavily in developing advanced algorithms capable of quickly processing vast amounts of data. This trend is expected to attract more institutional investors looking to leverage China's burgeoning financial markets through automated trading strategies, thereby contributing to market growth.

Key Algorithmic Trading Company Insights

Some of the key companies in the market include BNP Paribas Leasing Solutions, AlgoTrader, and Argo Software Engineering. Organizations are focusing on integrating advanced technologies into their offerings to maintain competitive advantages. Therefore, key players are taking several strategic initiatives, such as new product launches, mergers and acquisitions, and partnerships.

-

BNP Paribas Leasing Solutions has made significant developments in algorithmic trading, particularly within the foreign exchange (FX) market. The company focuses on a select number of highly advanced core algorithms to meet client needs by providing seamless, automated end-to-end services. This includes pre-trade workflow analysis, real-time trade monitoring, and post-trade analytics and reporting to ensure ease of service for users.

-

AlgoTrader employs a range of strategies in algorithmic trading to optimize performance and meet client needs. The company identifies lucrative trading opportunities across a range of assets, including stock indexes, bonds, currencies, international markets, and commodities. Its algorithmic trading system is designed for individuals seeking to boost their income. This all-in-one trading service enhances performance while minimizing portfolio volatility, enabling users to profit in both rising and falling stock markets.

Key Algorithmic Trading Companies:

The following are the leading companies in the algorithmic trading market. These companies collectively hold the largest market share and dictate industry trends.

- BNP Paribas Leasing Solutions

- AlgoTrader

- Argo Software Engineering

- InfoReach, Inc.

- Kuberre Systems, Inc.

- MetaQuotes Ltd.

- Symphony

- Tata Consultancy Services Limited

- VIRTU Finance Inc.

- AlgoBulls Technologies Private Limited

Recent Developments

-

In July 2023, MachineTrader launched a beta version of its software that enables traders to automate their investment strategies without hiring programmers or writing code for a custom trading platform. The MachineTrader platform features a visual development interface that lets users create flow-based processes, enhanced with Open AI, allowing them to design complex programs without any coding required.

-

In October 2022, Scotiabank launched its next-generation algorithmic trading platform in Canada. This platform, offered to clients through a strategic partnership with BestEx Research, is equipped with advanced technology tailored to meet the specific needs of the Canadian equities market.

Algorithmic Trading Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 23.48 billion

Revenue forecast in 2030

USD 42.99 billion

Growth rate

CAGR of 12.9% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, trading types, type of traders, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

BNP Paribas Leasing Solutions; AlgoTrader; Argo Software Engineering; InfoReach, Inc.; Kuberre Systems, Inc.; MetaQuotes Ltd.; Symphony; Tata Consultancy Services Limited; VIRTU Finance Inc.; AlgoBulls Technologies Private Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Algorithmic Trading Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global algorithmic trading market report based on component, deployment, trading types, type of traders, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Platforms

-

Software Tools

-

-

Service

-

Professional Services

-

Managed Services

-

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Trading Types Outlook (Revenue, USD Million, 2018 - 2030)

-

Foreign Exchange (FOREX)

-

Stock Markets

-

Exchange-Traded Fund (ETF)

-

Bonds

-

Cryptocurrencies

-

Others

-

-

Type of Traders Outlook (Revenue, USD Million, 2018 - 2030)

-

Institutional Investors

-

Long-Term Traders

-

Short-Term Traders

-

Retail Investors

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global algorithmic trading market size was estimated at USD 21.06 billion in 2024 and is expected to reach USD 23.48 billion in 2025.

b. The global algorithmic trading market is expected to grow at a compound annual growth rate of 12.9% from 2025 to 2030 to reach USD 42.99 billion by 2030.

b. North America dominated the algorithmic trading market with a share of 33.63% in 2024. The regional market growth can be attributed to the presence of numerous market players in the region. These vendors are also adopting numerous growth strategies to strengthen their foothold in the market.

b. Some key players operating in the algorithmic trading market include 63 moons technologies limited; AlgoTrader; Argo Software Engineering; InfoReach, Inc.; Kuberre Systems, Inc.; MetaQuotes Ltd.; Refinitiv; Symphony; Tata Consultancy Services Limited; VIRTU Finance Inc.

b. Key factors that are driving the market growth include Increasing demand for effective, fast, and reliable order execution and lowered transaction costs and the emergence of Artificial Intelligence (AI) and algorithms in the financial services sector.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.