- Home

- »

- Advanced Interior Materials

- »

-

Alloy Wheels Market Size & Share, Industry Report, 2033GVR Report cover

![Alloy Wheels Market Size, Share & Trends Report]()

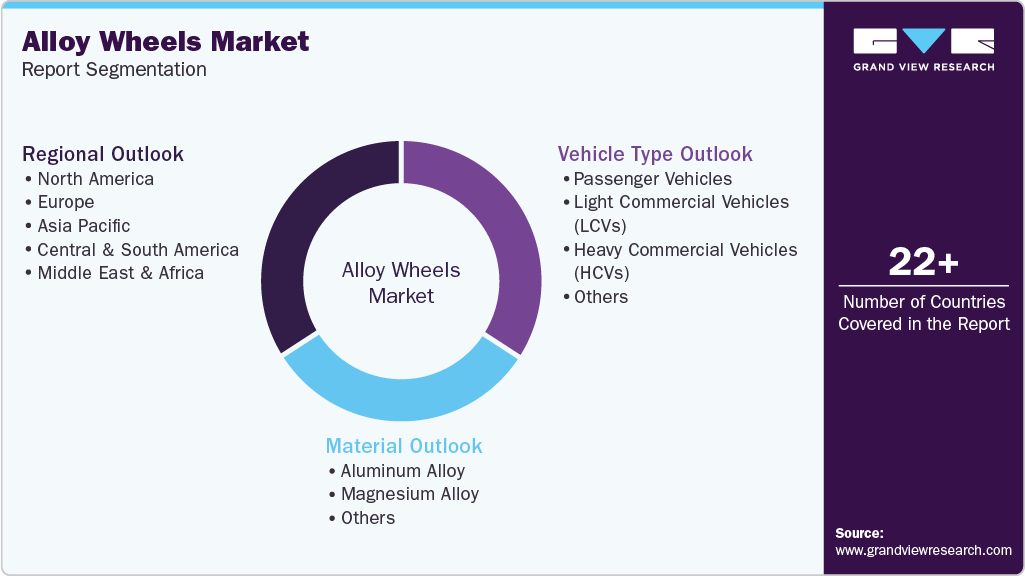

Alloy Wheels Market (2025 - 2033) Size, Share & Trends Analysis Report By Vehicle Type (Passenger Vehicles, Light Commercial Vehicles (LCVs)), By Material, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-811-5

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Alloy Wheels Market Summary

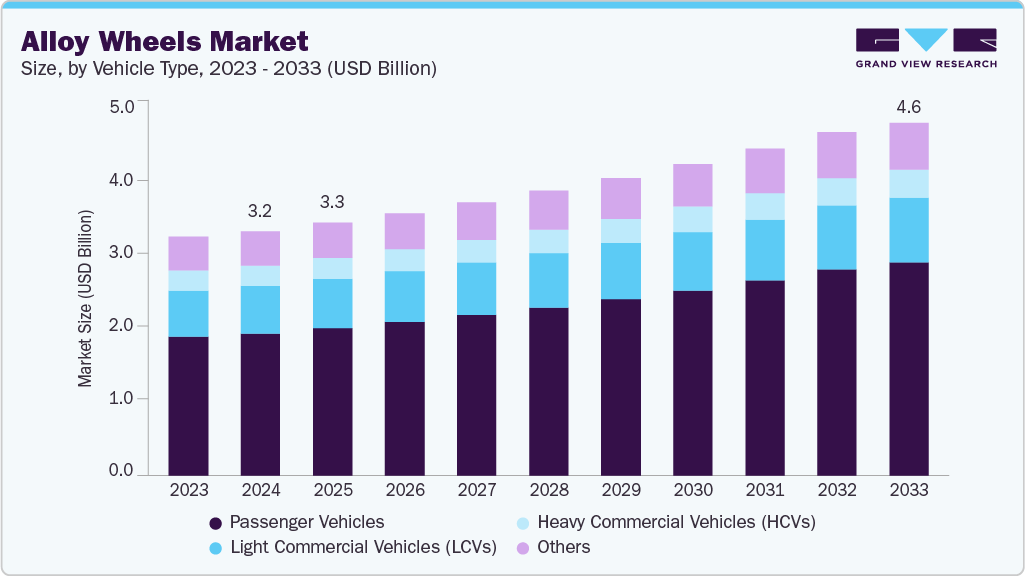

The global alloy wheels market size was estimated at USD 3.17 billion in 2024 and is projected to reach USD 4.58 billion by 2033, growing at a CAGR of 4.2% from 2025 to 2033, driven by the automotive industry's continuous expansion, with increasing vehicle production and sales fueling demand. Alloy wheels, known for their lightweight and durable properties, contribute to reduced vehicle weight, which directly improves fuel efficiency and vehicle performance.

Key Market Trends & Insights

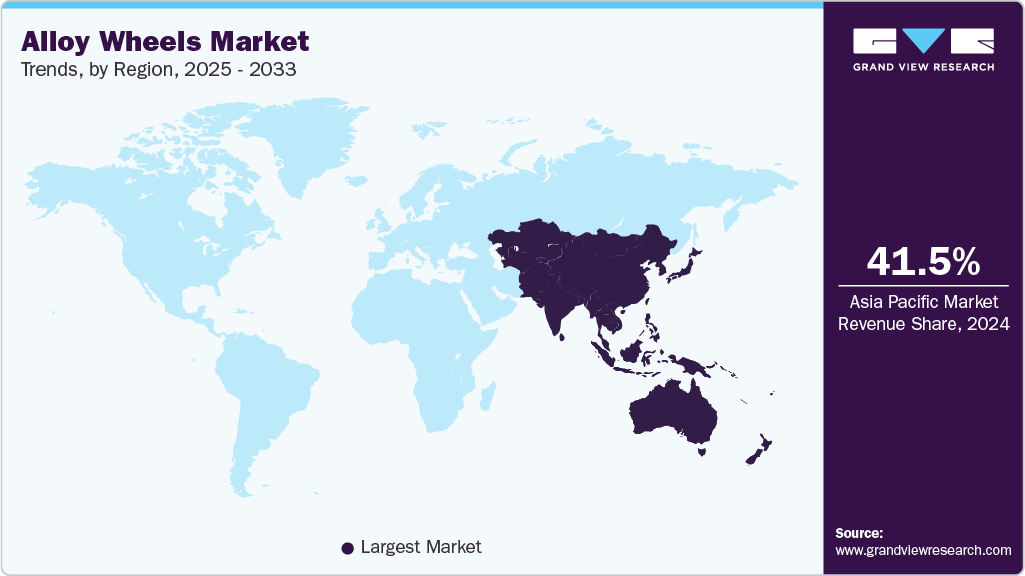

- Asia Pacific dominated the alloy wheels market with the largest revenue share of 41.5% in 2024.

- By vehicle type, the passenger vehicle segment is expected to grow at fastest CAGR of 4.7% over the forecast period.

- By material, the aluminum alloy segment is expected to grow at fastest CAGR of 4.3% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 3.17 Billion

- 2033 Projected Market Size: USD 4.58 Billion

- CAGR (2025-2033): 4.2%

- Asia Pacific: Largest market in 2024

This characteristic is especially critical as automobile manufacturers focus on meeting stringent fuel economy and emission standards worldwide. As a result, the adoption of alloy wheels is expanding across passenger vehicles, enhancing overall demand in the market. Urbanization and changing consumer preferences also play a pivotal role. The shift towards modern, stylish vehicles in increasingly urbanized areas encourages the demand for aesthetically appealing alloy wheels. Consumers are drawn to alloy wheels not just for their functional benefits but also as a means of personalizing and upgrading their vehicles. This trend is prominent in emerging markets in Asia-Pacific and parts of Europe, where rising disposable incomes and luxury vehicle ownership fuel growth in the alloy wheels segment.

Another significant driver is the rising trend of electric vehicle (EV) adoption, which impacts alloy wheel requirements. EV manufacturers prioritize lightweight components to enhance battery efficiency and overall vehicle range. Alloy wheels, being lighter than traditional steel wheels, support this need, leading to increased demand in regions with growing EV markets such as Europe, China, and North America. Additionally, advancements in wheel design and manufacturing technologies, including forged and flow-formed wheels, cater to the high-performance standards required by EVs, further stimulating market growth.

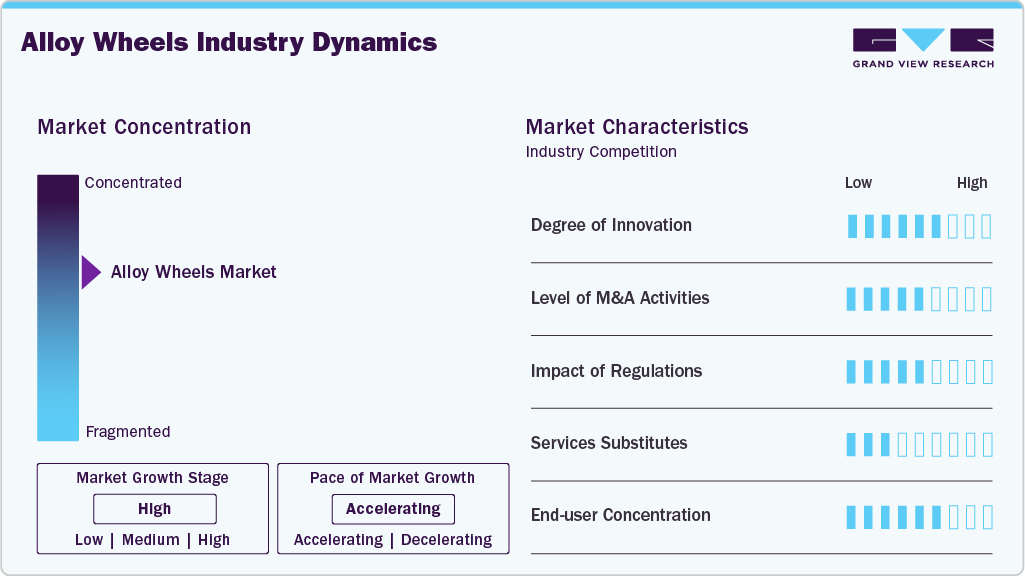

Market Concentration & Characteristics

The global alloy wheels market exhibits a moderate to high degree of innovation, driven by ongoing technological advancements in lightweight materials and manufacturing processes. Innovations such as forged and flow-formed alloy wheels enhance performance, durability, and aesthetic appeal. The industry also increasingly integrates smart technologies and sustainable materials to meet environmental standards and customer preferences. Continuous research and development efforts by leading manufacturers foster product differentiation and customization, contributing to the competitive landscape’s dynamism. Market concentration in the alloy wheels segment is shaped by several significant mergers and acquisitions, where key players consolidate their positions to expand technological capabilities, production capacities, and geographic presence. This consolidation enhances economies of scale while fostering innovation.

Regulatory frameworks, particularly stringent emission and safety regulations globally, significantly impact product development, steering manufacturers toward lighter, more environmentally friendly wheel designs. Furthermore, substitute products such as steel wheels still exist but are declining due to inferior performance characteristics. The end user concentration largely revolves around the automotive sector-especially passenger and luxury vehicles-where OEMs and aftermarket consumers exhibit growing preferences for alloy wheels, driven by factors such as fuel efficiency, customization, and performance requirements.

Vehicle Type Insights

Passenger vehicle segment led the market and accounted for the largest revenue share of 58.1% in 2024, driven by the rising demand for lightweight, high-performance wheels that enhance fuel efficiency and vehicle aesthetics. Increasing production and sales of mid-range and premium passenger cars globally, as well as a growing trend towards electric vehicles (EVs), contribute significantly to this growth. Consumers’ growing preference for personalized and stylish wheel designs, combined with advanced manufacturing technologies, further boosts demand in this segment.

Light commercial vehicles (LCVs) segment is expected to grow significantly at CAGR of 3.6% over the forecast period, driven by increased demand for durable yet lightweight alloy wheels that improve fuel efficiency and load capacity. Growing logistics and delivery services worldwide have heightened LCV usage, emphasizing the need for wheels that endure heavy usage while contributing to overall vehicle efficiency. Technological advancements aimed at enhancing the strength and resilience of alloy wheels for commercial purposes also drive this segment's growth.

Material Insights

Aluminum alloy segment dominated the market and accounted for the largest revenue share of 81.6% in 2024, driven by its superior corrosion resistance, lightweight nature, and affordability compared to other materials. Aluminum alloy wheels offer durability and contribute to fuel savings, making them highly preferred across passenger vehicles and commercial vehicles alike. Continuous innovation in aluminum alloy formulations and manufacturing processes, such as forging and flow forming, also supports the segment’s expansion.

Magnesium alloy segment is expected to grow significantly at CAGR of 3.1% over the forecast period, driven by its ultralight weight properties, which are essential for high-performance and electric vehicles seeking maximum efficiency and extended range. Despite higher costs and manufacturing complexities, magnesium alloys provide excellent strength-to-weight ratios, improving vehicle dynamics and reducing emissions. Research into enhancing the durability and production scalability of magnesium alloy wheels is expected to further fuel growth in this niche segment.

Regional Insights

Asia Pacific held the largest revenue market share of 41.5% in the global alloy wheels market in 2024, driven by rapid automotive production growth, especially in countries like China, India, Japan, and South Korea. Rising demand for electric and premium vehicles drives this market significantly, as alloy wheels contribute to vehicle light weighting, which improves fuel efficiency and battery range in EVs. Consumer preferences are shifting towards customized, stylish wheels supported by urbanization and higher disposable incomes. Regulatory push for emission reduction and safety standards further accelerates the substitution of steel wheels with alloys.

China Alloy Wheels Market Trends

China, as the largest market within the Asia Pacific, holds a significant share driven by its booming automotive production and rapid EV expansion. The country’s alloy wheel demand reflects growth in passenger vehicles, especially in the electric vehicle segment, incentivized by government policies. Rising consumer preference for upgraded vehicle styling and performance, combined with increased OEM adoption of alloy wheels, propels market growth. The aftermarket also benefits from growing car ownership and the expansion of urban centers.

North America Alloy Wheels Market Trends

North America’s alloy wheels market is driven primarily by increasing demand for lightweight materials among vehicle manufacturers, propelled by rising adoption of electric and premium vehicles. The region’s market also benefits from a strong aftermarket with growing preferences for aesthetic customization among consumers. Additionally, advancements in alloy materials and manufacturing techniques enhance performance and style, while expanding e-commerce platforms and urban mobility trends further boost market growth. The U.S. dominates this market with substantial OEM investments and rising consumer inclination toward high-performance, fuel-efficient wheels.

The U.S. alloy wheel market is strongly influenced by the adoption of electric and premium vehicles. Consumers show a preference for lightweight, durable, and visually appealing alloy wheels, fueling aftermarket customization trends. The expanding retail and e-commerce channels facilitate convenient access to diverse alloy wheel options. Furthermore, favorable economic conditions and automotive industry growth contribute to increasing demand for alloy wheels as replacements for traditional steel wheels, allowing sustained market expansion.

Europe Alloy Wheels Market Trends

Europe’s alloy wheels market is shaped by stringent government regulations targeting vehicle emissions and fuel economy improvements, pushing OEMs to adopt lightweight materials. High demand for premium and luxury vehicles sustaining alloy wheel use is evident across the region, with Germany as a major contributor due to its strong automotive industry base. The European market emphasizes environmentally friendly production processes and sustainability, incorporating recycled materials and reducing VOC emissions in manufacturing. Consumer trends favoring vehicle customization and high performance positively influence aftermarket sales.

The alloy wheels market in Germany benefits from leading automotive brands emphasizing performance, safety, and design excellence, which contribute to alloy wheel adoption. Germany’s regulatory environment is among the strictest globally, particularly regarding emissions and safety, and strongly influences industry standards. Investments in R&D for lightweight alloys and enhanced durability align with both OEM and aftermarket demands.

Latin America Alloy Wheels Market Trends

Latin America’s alloy wheels market is experiencing steady growth driven by increasing vehicle production and expanding automotive aftermarket services. Rising disposable incomes and consumer preference for lightweight, high-performance, and stylish wheels are fueling demand in key markets such as Brazil, Mexico, and Argentina. The region is witnessing innovations in advanced alloys and wheel designs tailored to enhance fuel efficiency and vehicle aesthetics. Additionally, growing electric vehicle adoption is encouraging demand for alloy wheels optimized for EV performance.

Middle East & Africa Alloy Wheels Market Trends

In the Middle East & Africa (MEA), alloy wheels market growth is fueled by rapid urbanization, infrastructure development, and increasing demand for premium and luxury vehicles. The region’s expanding vehicle fleet, particularly in Gulf Cooperation Council (GCC) countries, drives demand for performance-oriented and customized alloy wheels. Heightened consumer awareness regarding the benefits of alloy wheels such as improved fuel efficiency, durability, and aesthetics contributes to rising adoption.

Key Alloy Wheels Company Insights

Some of the key players operating in market include Borbet GmbH, Ronal Group

-

Borbet GmbH specializes in the design and manufacturing of light-alloy wheels with a strong emphasis on quality, safety and innovation. Headquartered in Germany with production across Europe and beyond, Borbet supplies OEMs and aftermarket customers with cast and flow-forming alloy wheel technologies.

-

Ronal Group is a major global supplier of aluminum alloy wheels, catering to both passenger cars and commercial vehicles. It operates multiple production sites across continents and offers cast and forged wheel solutions aimed at OEMs and aftermarket segments.

Enkei Corporation, Maxion Wheels are some of the emerging market participants in alloy wheels market.

-

Enkei Corporation is a Japanese wheel manufacturer founded in 1950, known for its lightweight aluminum wheels used in performance, motorsport and mainstream vehicle applications. It serves OEM and aftermarket customers worldwide.

-

Maxion Wheels is a global leader in wheel manufacturing, producing steel and aluminum wheels for passengers, commercial and specialty vehicles. With over 50 million wheels produced annually, the company emphasizes global scale, innovation and sustainability in wheel solutions.

Key Alloy Wheels Companies:

The following are the leading companies in the alloy wheels market. These companies collectively hold the largest market share and dictate industry trends.

- Borbet GmbH

- Ronal Group

- Enkei Corporation

- Maxion Wheels

- CITIC Dicastal Co., Ltd.

- Alcoa® Wheels

- Topy Industries Ltd.

- BBS Kraftfahrzeugtechnik AG

- Superior Industries International, Inc.

Recent Developments

-

In September 2023, Uno Minda introduced a premium series of alloy wheels for the Indian aftermarket in partnership with Kosei Aluminum Co. Ltd. The range, sold under the brand name Uno Minda Wheelz, includes multiple size options and contemporary designs suited for both radial and conventional tubeless tires. This launch aims to improve vehicle safety while offering enhanced visual appeal.

Alloy Wheels Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.28 billion

Revenue forecast in 2033

USD 4.58 billion

Growth rate

CAGR of 4.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD Million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, vehicle type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan, South Korea; Australia; Brazil; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Borbet GmbH; Ronal Group; Enkei Corporation; Maxion Wheels; CITIC Dicastal Co., Ltd.; Alcoa® Wheels; Topy Industries Ltd.; BBS Kraftfahrzeugtechnik AG; Superior Industries International, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Alloy Wheels Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global alloy wheels market report based on vehicle type, material, and region.

-

Vehicle Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Passenger Vehicles

-

Light Commercial Vehicles (LCVs)

-

Heavy Commercial Vehicles (HCVs)

-

Others

-

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Aluminum Alloy

-

Magnesium Alloy

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global alloy wheels market size was estimated at USD 3.17 billion in 2024 and is expected to reach USD 3.28 billion in 2025.

b. The global alloy wheels market is expected to grow at a compound annual growth rate of 4.2% from 2025 to 2033 to reach USD 4.58 billion by 2033.

b. Aluminum alloy segment dominated the market and accounted for the largest revenue share of 81.6% in 2024, driven by its superior corrosion resistance, lightweight nature, and affordability compared to other materials.

b. Some of key players in the alloy wheels market are Borbet GmbH, Ronal Group, Enkei Corporation, Maxion Wheels, CITIC Dicastal Co., Ltd., Alcoa® Wheels, Topy Industries Ltd., BBS Kraftfahrzeugtechnik AG, Superior Industries International, Inc.

b. The key factors driving the alloy wheels market include increasing demand for lightweight, fuel-efficient vehicles, growing adoption of electric and premium cars, rising consumer preference for stylish and customizable wheels, and advancements in alloy manufacturing technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.