- Home

- »

- Organic Chemicals

- »

-

Alpha-Amylase Baking Enzyme Market Size Report, 2030GVR Report cover

![Alpha-Amylase Baking Enzyme Market Size, Share & Trends Report]()

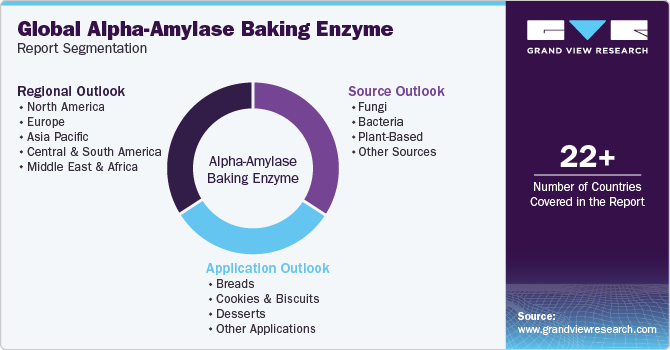

Alpha-Amylase Baking Enzyme Market (2024 - 2030) Size, Share & Trends Analysis Report By Source (Fungi, Plant-based), By Application (Bread, Cookies & Biscuits), By Region (North America, Europe), And Segment Forecasts

- Report ID: 978-1-68038-860-2

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Alpha-Amylase Baking Enzyme Market Summary

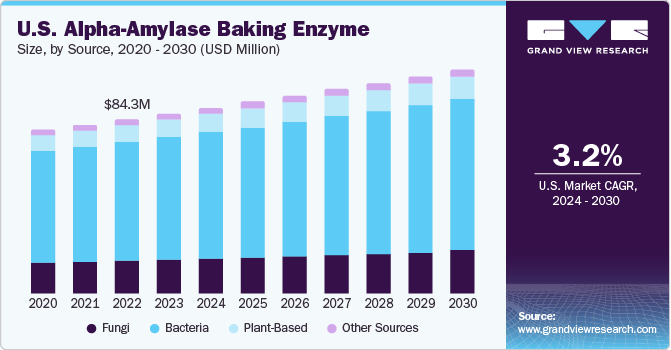

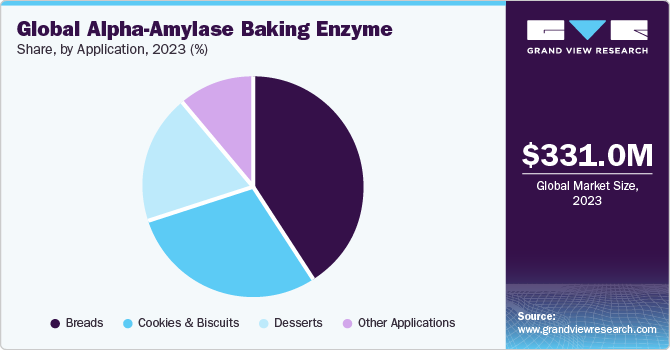

The global alpha-amylase baking enzyme market size was estimated at USD 331.01 million in 2023 and is projected to reach USD 422.94 million by 2030, growing at a CAGR of 3.6% from 2024 to 2030. As food supply chains become more globalized, bakers around the world are adopting standardized practices and ingredients.

Key Market Trends & Insights

- North America dominated the global market in 2023 with a revenue share of 37%.

- By source, bacteria-sourced alpha-amylase baking enzymes dominated the market in 2023, accounting for a 68.27% share.

- By application, the cookies & biscuits segment is projected to grow at the fastest CAGR during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 331.01 Million

- 2030 Projected Market Size: USD 422.94 Million

- CAGR (2024-2030): 3.6%

- North America: Largest market in 2023

Alpha-amylase enzymes offer a consistent and reliable way to achieve desired baking outcomes, making them attractive to large-scale commercial bakeries operating internationally. Additionally, these products can contribute to cost savings in the baking industry. By improving dough handling properties and increasing fermentation efficiency, these products can lead to better production yields and reduced waste. As a result, many bakeries are adopting alpha-amylase enzymes to optimize their processes and enhance profitability.

Enzyme production is a dynamic and evolving sector, driven by factors such as increased demand, advancements in enzyme technology, and a growing focus on sustainable and efficient manufacturing processes. Many companies in the enzyme industry, including those producing alpha-amylase baking enzymes, have been expanding their production capacities or establishing new facilities to meet the rising demand and improve operational efficiency.

Investments are being made not only in new production facilities but also in upgrading existing ones with state-of-the-art technologies. This includes advancements in fermentation processes, downstream processing, and purification methods to enhance overall efficiency and product quality. Sustainability is a key consideration in the modern enzyme industry. Companies are investing in eco-friendly and sustainable production processes, utilizing renewable resources, and implementing practices that reduce environmental impact.

Genetic engineering techniques are being employed to enhance microbial strains used in the production of alpha-amylase enzymes. This includes modifying the genetic makeup of bacteria or fungi to improve enzyme yields, stability, and performance. For example, according to the European Food Safety Authority (EFSA), AB Enzymes produces the food enzyme (α-amylase) using the genetically modified Bacillus subtilis strain AR-651. The genetic alterations made to the strain have been assessed and do not raise safety concerns. The food enzyme is confirmed to be devoid of viable cells from the production organism and its DNA. Its purpose is for use in baking processes.

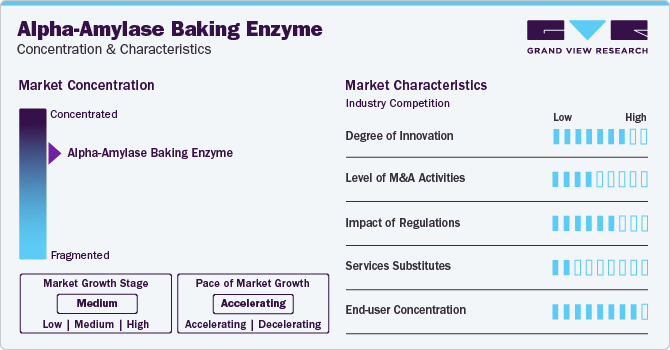

Market Concentration & Characteristics

Market growth stage is medium, and the pace of the market growth is accelerating. The alpha-amylase baking enzymes market is characterized by a high degree of innovation. Ongoing research and development activities in the field of enzymology drive innovations in alpha-amylase baking enzymes. Researchers and companies invest in understanding the complexities of enzyme function, leading to the discovery of novel enzyme variants with improved properties.

The market is also subject to increasing regulatory scrutiny. Various regulatory bodies such as Health Canada, OSHA, Codex Alimentarius, EU, and US FDA, among others, are governing the utilization of these products in numerous end-use applications globally. Regulatory approval is often a prerequisite for introducing alpha-amylase baking enzymes into the market. Stringent approval processes ensure that these products meet safety and quality standards. The time and effort required for regulatory clearance can impact the speed at which new products reach consumers. On the contrary, regulatory requirements can drive innovation in the development of alpha-amylase enzymes. Manufacturers may invest in research and development to create products that not only meet regulatory standards but also offer improved performance, thereby influencing consumption patterns.

End-user concentration is a significant factor in the global alpha-amylase baking enzymes market. Since there are several application areas that are increasingly utilizing these products in their product formulation, it often leads to larger volume purchases. This can lead to economies of scale for alpha-amylase suppliers, potentially resulting in cost efficiencies in production and distribution. High end-user concentration may lead to long-standing relationships between alpha-amylase suppliers and major players in the baking industry. This stability can foster collaboration, mutual understanding, and consistent business partnerships.

Source Insights

Bacteria-sourced alpha-amylase baking enzymes dominated the market and accounted for a share of 68.27% in 2023. Bacteria, especially strains of Bacillus subtilis, are known for their ability to produce alpha-amylase in large quantities. The fermentation process using bacterial cultures is efficient and cost-effective, making it a preferred source for industrial-scale enzyme production. Bacterial strains can be genetically modified more easily than other sources, allowing for the creation of engineered strains with enhanced enzyme production capabilities. This flexibility in genetic manipulation enables the development of strains optimized for specific industrial applications, including baking.

Fungal-derived alpha-amylase enzymes often exhibit a broad substrate specificity, meaning they can efficiently hydrolyze a variety of starch sources. This versatility makes them suitable for application in diverse baking processes where different types of flour or starches may be used.Some fungal alpha-amylases demonstrate good thermostability, allowing them to remain active at higher temperatures. This characteristic is advantageous in baking processes that involve elevated temperatures, such as bread baking, where the enzyme needs to withstand heat during the initial stages of dough preparation.

Enzymes obtained from plants are frequently regarded as free from allergens, making them a favored option for individuals with allergies or sensitivities. Plant-derived enzymes are less prone to elicit allergic responses in comparison to those sourced from fungal or microbial organisms. Moreover, plant-based alpha-amylase enzymes can be extracted from diverse plant sources, providing manufacturers with a variety of choices. Enzymes obtained from plants such as barley or wheat, for instance, offer alternatives that align seamlessly with the natural and plant-based narrative.

Application Insights

The bread application dominated the market in 2023. Alpha-amylase enzymes are starch-degrading enzymes that hydrolyze complex starch molecules into simpler sugars. In breadmaking, the primary source of starch is flour, and the enzymatic action of alpha-amylase breaks down starch into maltose, glucose, and other smaller sugar molecules. Additionally, the breakdown of starch by alpha-amylase produces fermentable sugars, such as maltose. During fermentation, yeast utilizes these sugars as a source of energy, leading to the production of carbon dioxide. The carbon dioxide is responsible for the leavening or rising of the dough, contributing to the volume and texture of the bread.

The cookies & biscuits segment is projected to grow at the fastest CAGR over the forecast period. In certain types of cookies, controlling the spread during baking is crucial for achieving the desired shape and texture. Alpha-amylase enzymes can influence the dough's viscosity, contributing to control spreading and maintaining the shape of cookies. The breakdown of starch into simple sugars during baking contributes to the Maillard reaction, a complex chemical reaction that enhances the color and flavor of baked goods. Alpha-amylase enzymes play a role in this process, contributing to the golden-brown color of cookies and biscuits. Such factors contribute to increasing demand for the product in the production of cookies & biscuits.

In the case of frozen desserts like ice cream, alpha-amylase enzymes can prevent the crystallization of ice crystals in the product. This results in a smoother and creamier texture, improving the overall quality of the frozen treat. Furthermore, in gel-based desserts like puddings and custards, these products can help control syneresis, which is the separation of liquid from the gel matrix. This contributes to the stability and consistency of the dessert. Such factors contribute to the increasing consumption of these products in the production of desserts.

Regional Insights

North America dominated the market and accounted for a 37% share in 2023. This high share is attributable to high bread and bakery consumption. North America has a high consumption of bread and bakery products. Alpha-amylase enzymes are extensively used in breadmaking processes to enhance dough handling, texture, and overall quality. The popularity of various bread types, including artisanal and specialty breads, contributes to the demand for alpha-amylase enzymes.

Asia Pacific is anticipated to witness significant growth in the global market. The Asia Pacific region has a large and growing population, contributing to increased consumption of baked goods. The demand for alpha-amylase enzymes rises correspondingly to meet the needs of the expanding market. The growth of bakery chains and the popularity of specialty bakeries in Asia Pacific contribute to the demand for these products. These enzymes are used to maintain consistency and quality across a wide range of baked products. The baking industry in the Asia Pacific is witnessing innovation in the development of unique and region-specific baked goods. The products play a role in optimizing the texture, shelf life, and overall quality of these innovative products.

Key Companies & Market Share Insights

Some of the key players operating in the market include Novozymes A/S, DuPont, DSM, Puratos N.V., Infinita Biotech, International Flavors & Fragrances Inc., Mianyang Habio Bioengineering Co., Ltd., Jiangsu Yiming Biological Technology Co., Ltd., Amano Enzyme, Antozyme Biotech, and AB Enzymes, among others.

-

Novozymes is a global leader in the production of industrial enzymes, including those used in the food and beverage sector. The company offers a range of enzyme solutions for various applications, and alpha-amylase enzymes are among the products developed for the baking industry. The company places a strong emphasis on innovation and invests significantly in research and development.

-

DSM operates in multiple sectors, including nutrition, health, and materials. Its portfolio encompasses a wide range of products and solutions, from vitamins and nutritional ingredients to advanced materials and bio-based products. The company is involved in the production and supply of enzymes for various applications, including those in the food and beverage industry.

Jiangsu Yiming Biological Technology Co., Ltd., Amano Enzyme, Antozyme Biotech, and Infinita Biotech, among others, are some of the emerging market participants in the alpha-amylase baking enzymes market.

-

Antozyme Biotech is a fully integrated organization specializing in enzyme manufacturing and formulation. Collaborating with forward-thinking clients worldwide, the company assists in maximizing productivity, enhancing product distinctiveness, and minimizing costs. It offers environmentally friendly enzymes in quantities ranging from small to large scale, catering to diverse industries including food, starch, distillery, brewery, wastewater treatment, agriculture, detergent, and pharmaceuticals

-

Infinita Biotech is involved in the production, promotion, and development of tailor-made enzyme formulations for distinct industries. The company has earned recognition from the Department of Scientific and Industrial Research under the Ministry of Science and Technology, Government of India. The company produces environmentally friendly enzymatic solutions tailored for various industries, including distillery, sugar, brewery, starch, food, animal feed, agriculture, biodiesel, pharmaceuticals, textile, and crude oil spill remediation

Key Alpha-Amylase Baking Enzyme Companies:

- Novozymes A/S

- DuPont

- DSM

- Puratos N.V.

- Infinita Biotech

- International Flavors & Fragrances Inc.

- Mianyang Habio Bioengineering Co., Ltd.

- Jiangsu Yiming Biological Technology Co., Ltd.

- Amano Enzyme

- Antozyme Biotech

- AB Enzymes

Recent Developments

- In December 2023, Kerry Group Plc entered a definitive agreement to acquire a segment of the global lactase enzyme business from Chr. Hansen Holding A/S ("Chr. Hansen") and Novozymes A/S ("Novozymes") are collectively referred to as the "Lactase Enzymes Business." This acquisition is contingent on the approval of Kerry as a buyer by the European Commission and is a component of the overall merger approval process involving Novozymes and Chr. Hansen

- In May 2023, International Flavors & Fragrances, Inc. launched the ENOVERATM 2000 range in Europe, the newest inclusion in its extensive collection of top-tier solutions for the bakery sector. Positioned as a next-generation enzyme dough strengthener, the ENOVERATM 2000 range is crafted for bakery producers seeking a viable substitute for vital gluten, particularly in demanding scenarios like whole wheat bread production.

- In February 2023, AB Enzymes announced the expansion of distribution agreement for bake and food enzymes across a significant portion of Europe with Barentz. The official signing ceremony occurred in Paris in December 2022. This 5-year agreement serves to reinforce AB Enzymes' aspirations and presence in the European markets

Alpha-Amylase Baking Enzyme Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 342.80 million

Revenue forecast in 2030

USD 422.94 million

Growth Rate

CAGR of 3.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Volume in Tons, Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Volume and Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; The Netherlands; China; India; Japan; South Korea; Singapore; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Novozymes A/S; DuPont; DSM; Puratos N.V.; Infinita Biotech; International Flavors & Fragrances Inc.; Mianyang Habio Bioengineering Co., Ltd.; Jiangsu Yiming Biological Technology Co., Ltd.; Amano Enzyme; Antozyme Biotech; AB Enzymes

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Alpha-Amylase Baking Enzyme Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global alpha-amylase baking enzymes market report based on source, application, and region.

-

Source Outlook (Volume, Tons; Revenue, USD Million; 2018 - 2030)

-

Fungi

-

Bacteria

-

Plant-Based

-

Other Sources

-

-

Application Outlook (Volume, Tons; Revenue, USD Million; 2018 - 2030)

-

Breads

-

Cookies & Biscuits

-

Desserts

-

Other Applications

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

The Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Singapore

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global alpha-amylase baking enzyme market size was estimated at USD 331.01 million in 2023 and is expected to reach USD 342.80 million in 2024.

b. The global alpha-amylase baking enzyme market is expected to grow at a compound annual growth rate of 3.6% from 2024 to 2030 to reach USD 422.94 million by 2030.

b. North America dominated the alpha-amylase baking enzyme market with a share of 37.0% in 2023. This is attributable to high breads and bakery consumption. North America has a high consumption of bread and bakery products.

b. Some key players operating in the alpha-amylase baking enzyme market include Advanced Micro Devices, Novozymes A/S, DuPont, DSM, Puratos N.V., Infinita Biotech, International Flavors & Fragrances Inc., Mianyang Habio Bioengineering Co., Ltd., Jiangsu Yiming Biological Technology Co., Ltd., Amano Enzyme, Antozyme Biotech.

b. Key factors that are driving the market growth include advancements in fermentation processes, downstream processing, and purification methods to enhance overall efficiency and product quality, along with high R&D activities in the field of enzymology.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.