- Home

- »

- Power Generation & Storage

- »

-

Alternative Fuels Market Size & Share, Industry Report 2030GVR Report cover

![Alternative Fuels Market Size, Share & Trends Report]()

Alternative Fuels Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Natural Gas, Biodiesel, Ethanol, Hydrogen), By Vehicle Type (Light Commercial Vehicle), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-504-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Alternative Fuels Market Summary

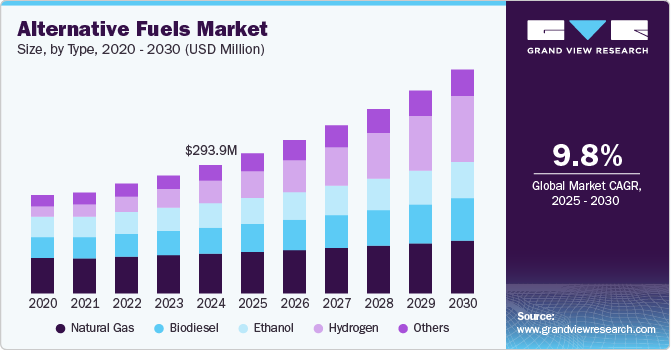

The global alternative fuels market size was estimated at USD 294.0 Million in 2024 and is projected to reach USD 512.4 Million by 2030, growing at a CAGR of 9.8% from 2025 to 2030. This growth is driven by the increasing demand for cleaner and more sustainable energy sources.

Key Market Trends & Insights

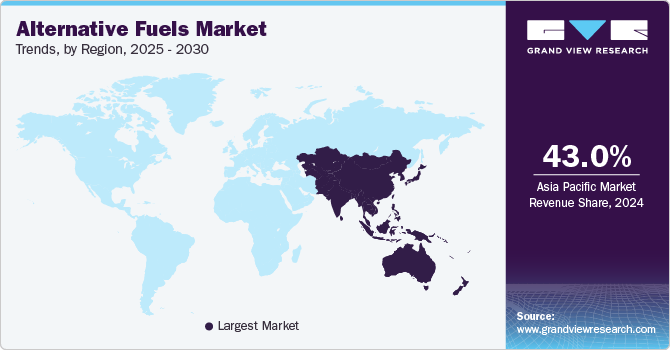

- Asia Pacific dominated the market in 2024, accounting for the largest revenue share of over 43.0%.

- The alternative fuels market in the U.S. is experiencing significant growth.

- Based on type, the natural gas emerged as the largest type segment, holding a significant market share of over 31.04% in 2024.

- Based on end-use, the transportation segment capturing over 53.0% of the market share in 2024.

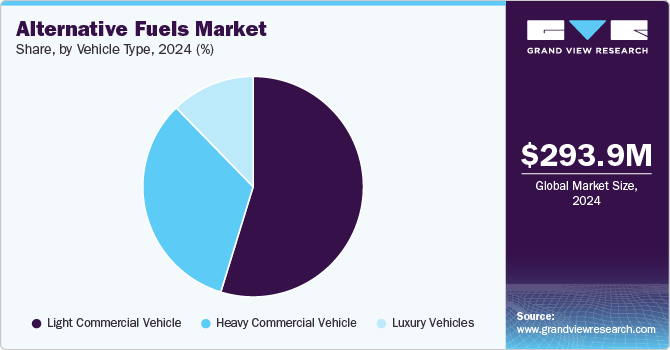

- Based on vehicle type, the light commercial vehicle segment capturing over 54.0 % of the market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 294.0 Million

- 2030 Projected Market Size: USD 512.4 Million

- CAGR (2025-2030): 9.8%

- Asia Pacific: Largest market in 2024

Governments worldwide are implementing stringent environmental regulations and setting ambitious carbon reduction targets, which are pushing industries and consumers to adopt alternative fuels. This shift is particularly important as governments seek to reduce greenhouse gas emissions and lessen their dependence on fossil fuels. As a result, investments in research and development of alternative fuels such as biofuels, hydrogen, and electric fuels are expected to rise substantially over the coming years.

Another key factor contributing to the growth of the industry is the rapid advancement of technology in fuel production and infrastructure. New technologies are making alternative fuel options more efficient, accessible, and cost-competitive with traditional fuels. For example, advancements in battery technology are helping to increase the efficiency and range of electric vehicles, making them a more viable option for consumers. Similarly, breakthroughs in biofuel production are improving the sustainability of biofuels by utilizing waste materials and agricultural by-products, which reduces the environmental impact and the cost of production.

The growing awareness of environmental issues and the need for sustainable development also play a pivotal role in driving the demand for alternative fuels. Consumers are increasingly concerned about their carbon footprints, and many are opting for alternative fuel-powered vehicles and technologies to reduce their impact on the environment. Additionally, the global shift towards cleaner energy sources is fostering a stronger push toward renewable energy adoption. As more industries and sectors make the transition to using alternative fuels in their operations, the market will continue to expand, positioning itself as a crucial part of the global effort to combat climate change and ensure energy security.

Type Insights

Based on type, the industry is segmented into natural gas, biodiesel, ethanol, hydrogen, and others. Natural gas emerged as the largest type segment, holding a significant market share of over 31.04% in 2024. This dominance is attributed to its affordability and lower environmental impact compared to traditional fossil fuels. As a cleaner-burning alternative, natural gas generates fewer carbon emissions, sulfur oxides, and particulate matter, making it a more environmentally friendly option. This makes it an attractive choice for industries and governments striving to reduce air pollution and meet carbon reduction targets. Its widespread use in transportation, power generation, and industrial applications has further cemented its position as the leading alternative fuel, especially in sectors where cost-effectiveness and energy efficiency are prioritized.

Moreover, the infrastructure supporting natural gas, including refueling stations and distribution networks, is more developed compared to other alternative fuels, making it more accessible and convenient for consumers and businesses. In addition, natural gas is readily available in many regions globally, with vast reserves ensuring its long-term supply. Government incentives and policies supporting natural gas adoption have also played a significant role in its growth, as they encourage the transition from more polluting fuels to cleaner alternatives. As a result, natural gas continues to dominate the alternative fuels market, with its market share expected to remain strong in the coming years.

End Use Insights

Based on end-use, the industry is segmented into transportation, chemical, agricultural, industrial, and others. The transportation segment emerged as the largest end-use in the global alternative fuels market, capturing over 53.0% of the market share in 2024. This dominance is largely driven by the increasing demand for cleaner, more sustainable fuel options in the automotive and transportation sectors. With growing concerns about climate change and air pollution, governments worldwide have been implementing stricter emission regulations, pushing the transportation sector to adopt alternative fuels such as biofuels, natural gas, hydrogen, and electricity. These fuels offer a viable solution for reducing carbon emissions from vehicles and improving air quality, especially in densely populated urban areas. The rising adoption of electric vehicles and alternative fuel-powered trucks for freight and logistics has further accelerated this trend.

Moreover, the transportation sector accounts for a significant portion of global energy consumption, which has made it a primary focus for alternative fuel adoption. The shift towards alternative fuels is not only driven by environmental concerns but also by the growing economic pressure on businesses to reduce fuel costs and enhance energy efficiency. As electric vehicles (EVs) and alternative fuel-powered vehicles become more accessible and cost-competitive, they are becoming increasingly popular for both personal and commercial use. This, along with government incentives and expanding infrastructure for refueling and charging stations, has solidified the transportation segment's dominance in the alternative fuels market. The increasing penetration of electric cars, public transportation, and freight vehicles powered by alternative fuels is expected to continue driving the segment’s growth in the coming years.

Vehicle Type Insights

Based on vehicle type, the industry is segmented into light commercial vehicles, heavy commercial vehicles, and luxury vehicles. The light commercial vehicle segment has emerged as the largest vehicle type in the global alternative fuels market, capturing over 54.0 % of the market share in 2024. This segment's dominance is attributed to the growing demand for more fuel-efficient and environmentally friendly options in the transportation sector. LCVs are widely used across various industries for goods and services delivery, logistics, and transportation, which has led to a high adoption rate of alternative fuels. The need for cost-effective solutions to reduce operational costs, along with the increasing push for lower carbon emissions, has prompted businesses to opt for cleaner alternatives such as natural gas, electric power, and biofuels. This demand is particularly significant in urban environments, where environmental regulations are becoming stricter, further driving the growth of the LCV segment.

Additionally, the infrastructure supporting alternative fuels for LCVs is more developed compared to other vehicle types, such as heavy commercial vehicles or luxury vehicles. With more refueling stations and charging points for alternative fuels, LCVs are able to transition more smoothly to cleaner energy options, making them an attractive option for fleet operators and small businesses alike. Moreover, the regulatory incentives and government policies supporting the adoption of alternative fuels in LCVs, such as tax breaks and subsidies, have fueled their growth. As a result, the LCV segment is expected to maintain its dominant share in the alternative fuels market due to its widespread application and the increasing emphasis on sustainability in the transportation industry.

Regional Insights

North America alternative fuels market is expanding rapidly, driven by technological advancements, supportive government policies, and increasing consumer demand for cleaner energy solutions. In the U.S., the adoption of alternative fuels is being accelerated by federal and state-level incentives for electric vehicles, biofuels, and natural gas. Companies like Tesla and General Motors are investing heavily in alternative fuel technologies, especially in electric vehicles and hydrogen fuel cells. Canada, too, is focusing on reducing emissions and promoting green energy solutions through tax credits and sustainable infrastructure investments. Together, these efforts are propelling the alternative fuels market forward in North America, positioning the region as a hub for clean energy innovation.

U.S. Alternative Fuels Market Trends

The alternative fuels market in the U.S. is experiencing significant growth, largely driven by government initiatives and incentives aimed at reducing carbon emissions. The Biden administration’s focus on clean energy, including tax credits for electric vehicles and funding for renewable energy projects, has provided a substantial boost to the adoption of alternative fuels. The U.S. is witnessing increased investments in electric vehicles, biofuels, and hydrogen infrastructure, as both private and public sectors push for greater sustainability. These efforts are positioning the U.S. as a leader in the global alternative fuels market, with further market growth expected as the country transitions to a low-carbon economy.

Asia Pacific Alternative Fuels Market Trends

Asia Pacific dominated the global alternative fuels market in 2024, accounting for the largest revenue share of over 43.0%. This dominance is largely driven by the region's rapid economic growth, increasing industrialization, and rising demand for cleaner energy sources. The region has some of the world's largest and most densely populated countries, including China, India, and Japan, where the transportation sector is a major contributor to pollution and greenhouse gas emissions. Governments in these countries are increasingly focusing on reducing their environmental impact by promoting the adoption of alternative fuels such as biofuels, natural gas, and electric power. Additionally, strong policy support, such as subsidies for electric vehicles, infrastructure development for alternative fuel stations, and regulatory mandates for cleaner emissions, has further accelerated the market’s growth. The combination of growing awareness of climate change, urbanization, and favorable government policies has made Asia Pacific a key region for the expansion of the alternative fuels market.

China alternative fuels market is thriving, driven by the country’s large-scale industrial sector and aggressive push toward sustainability. The Chinese government’s policies, such as subsidies for electric vehicles (EVs), infrastructure development for alternative fuel stations, and stringent environmental regulations, have significantly accelerated the adoption of alternative fuels. The increasing demand for EVs, along with the push for hydrogen and natural gas as cleaner energy sources, is fostering growth in the alternative fuels market. The development of domestic production and innovations in alternative fuel technologies have further strengthened China’s position, making it a global leader in the transition to cleaner fuels.

Europe Alternative Fuels Market Trends

The alternative fuels market in Europe is witnessing strong growth, supported by the region’s commitment to reducing greenhouse gas emissions and promoting sustainable energy solutions. Leading countries like Germany, France, and the UK are investing heavily in alternative fuel technologies, such as electric vehicles, biofuels, and hydrogen. Europe’s stringent regulatory framework, including the European Green Deal, has created a favorable environment for the adoption of alternative fuels in both the transportation and industrial sectors. The growing demand for electric vehicles, supported by subsidies and expanded charging infrastructure, is driving market growth. Additionally, Europe’s investments in renewable energy sources and green hydrogen are positioning the region as a key player in the global alternative fuels market.

The UK alternative fuels market is expanding rapidly, fueled by government policies and technological advancements. The UK’s commitment to reaching net-zero emissions by 2050 and banning petrol and diesel car sales by 2030 has significantly boosted the demand for alternative fuels, especially in the automotive sector. Investments in electric vehicles, hydrogen, and biofuels are growing, with major manufacturers such as Nissan and Jaguar Land Rover leading the way. The UK government’s support for clean energy initiatives, including funding for EV infrastructure and green hydrogen production, is further accelerating the market’s growth. These developments are positioning the UK as a key player in Europe’s transition to alternative fuels.

Middle East & Africa Alternative Fuels Market Trends

The alternative fuels market in the Middle East and Africa is gaining traction as countries diversify their economies and focus on sustainability. The UAE and Saudi Arabia are leading the way with ambitious clean energy initiatives, including investments in renewable energy and hydrogen production. The UAE’s National Energy Strategy 2050 and Saudi Arabia’s Vision 2030 are pushing the region toward a future powered by alternative fuels. In Africa, the demand for reliable and affordable energy sources, particularly in the transportation and industrial sectors, is driving the adoption of alternative fuels such as natural gas and biofuels. This growing demand for cleaner energy solutions is positioning the region as a key player in the industry.

Key Alternative Fuels Company Insights

The competitive landscape of the alternative fuels market is rapidly evolving, driven by the growing global demand for sustainable energy solutions across sectors such as transportation, industrial, and agriculture. Key players range from well-established energy corporations to emerging startups, all competing to capitalize on the increasing shift toward cleaner fuels like biofuels, hydrogen, natural gas, and electric vehicles (EVs). Market dynamics are shaped by government policies and incentives promoting renewable energy technologies, which stimulate innovation and investment in alternative fuel solutions. Asia Pacific companies, particularly in China and Japan, are leading the development and adoption of alternative fuels, while North America and Europe focus on expanding domestic production capabilities and reducing reliance on foreign alternatives. Strategic partnerships with automotive manufacturers, energy providers, and infrastructure developers are becoming crucial in strengthening market positions while price competition, technological advancements, and regulatory compliance continue to drive the competitiveness of the market.

-

In April 2023, Iwatani Corporation signed an agreement with the New Energy and Industrial Technology Development Organization (NEDO). The agreement pertains to a project focused on the technical development of hydrogen systems and the construction of a business model for energy reuse.

-

In April 2023, Linde plc announced its long-term agreement to distribute and supply green hydrogen in Singapore with Evonik, a manufacturer of specialty chemicals. With this agreement, Linde plc is expected to expand its footprint in Asia Pacific market to meet the growing hydrogen demand in the region.

Key Alternative Fuels Companies:

The following are the leading companies in the alternative fuels market. These companies collectively hold the largest market share and dictate industry trends.

- BP Plc

- Sasol Ltd.

- General Electric Company

- EI DuPont

- ExxonMobil Corporation.

- Cosan

- Gushan Environmental Energy

- Archer Daniel Midland

- Neste

- INEOS Enterprises

Alternative Fuels Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 320.82 million

Revenue forecast in 2030

USD 512.45 million

Growth rate

CAGR of 9.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue Forecast, competitive landscape, growth factors and trends

Segments covered

Type, vehicle type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S., Canada, Mexico, Germany, UK, Italy, Spain, France, Russia, China, India, Japan, Australia, Brazil, Argentina, Saudi Arabia, South Africa, UAE

Key companies profiled

BP Plc, Sasol Ltd., General Electric Company, EI DuPont, ExxonMobil Corporation., Cosan, Gushan Environmental Energy, Archer Daniel Midland, Neste, INEOS Enterprises

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

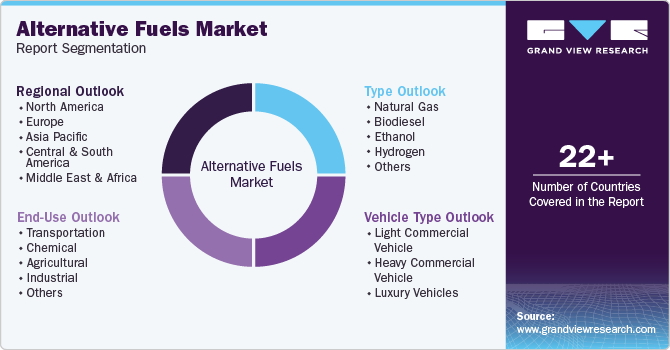

Global Alternative Fuels Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global alternative fuels market report on the basis of type, vehicle type, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Natural Gas

-

Biodiesel

-

Ethanol

-

Hydrogen

-

Others

-

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Light Commercial Vehicle

-

Heavy Commercial Vehicle

-

Luxury Vehicles

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Transportation

-

Chemical

-

Agricultural

-

Industrial

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.