- Home

- »

- Specialty Polymers

- »

-

Alumina Trihydrate Market Size, Share, Growth Report, 2030GVR Report cover

![Alumina Trihydrate Market Size, Share & Trends Report]()

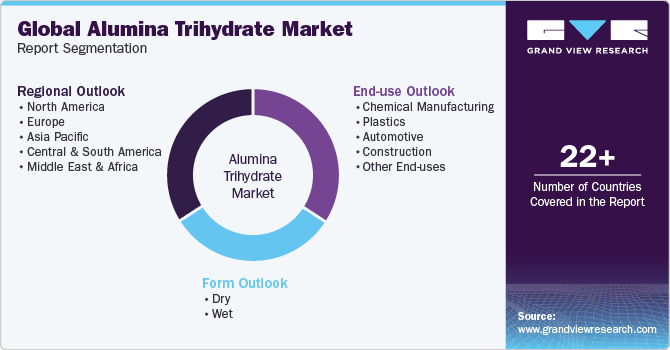

Alumina Trihydrate Market (2023 - 2030) Size, Share & Trends Analysis Report By Form (Dry, Wet), By End-use (Plastics, Automotive, Chemical Manufacturing), By Region (North America, Asia Pacific, Europe), And Segment Forecasts

- Report ID: GVR-4-68040-143-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Alumina Trihydrate Market Summary

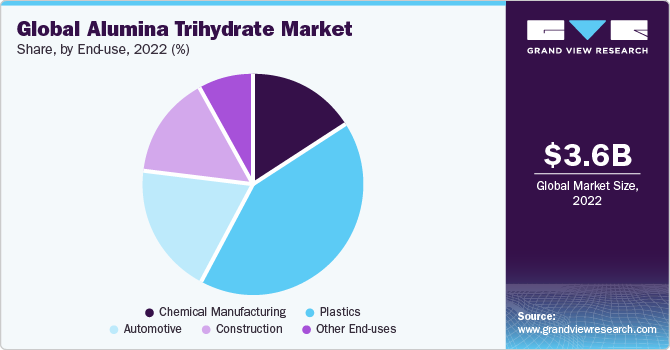

The global alumina trihydrate market size was estimated at USD 3.59 billion in 2022 and is projected to reach USD 5.64 billion by 2030, growing at a 5.6% from 2023 to 2030. The growth is majorly attributed to the rising product adoption from various end-use industries, such as plastics, automotive, construction, and chemical manufacturing.

Key Market Trends & Insights

- Asia Pacific dominated the global market with the largest revenue share of 37.25% in 2022.

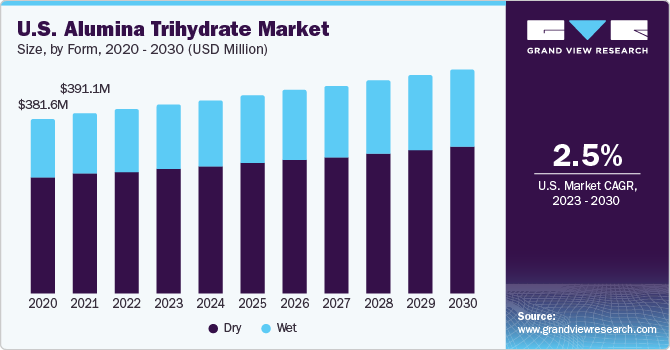

- By form, The dry form segment dominated the market with the largest revenue share of 66.70% in 2022.

- By End-use, The plastics segment dominated the market with a revenue share of 28.8% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 3.59 Billion

- 2030 Projected Market Size: USD 5.64 Billion

- CAGR (2023-2030): 5.6%

- Asia Pacific: Largest market in 2022

Alumina trihydrate is used as a flame retardant in plastics as well as construction industry for wires, cables, and building materials due to its excellent flame-retardant properties. Stringent environmental safety standards and environmental regulations have increased the demand for non-toxic, safer flame retardants.

Europe introduced the regulation on the registration, evaluation, authorization, and restriction of chemicals (REACH) regulation in 2007 to protect the environment and human health from the risks posed by chemicals. It places responsibility on companies to provide safety and manage risks from potentially harmful substances. This has led companies to look for eco-friendly alternatives, such as alumina trihydrate. Aluminum trihydrate is used in battery enclosures and for flame-resistant cable insulation in electric vehicles (EVs) to avoid fire hazards.

Regulations, such as AIS-156 Amendment 3, demand high levels of safety for battery packs. Its durability, low weight, and good thermal conductivity make it ideal to be used in battery casings. More than 10 million electric cars were sold in 2022 and the number is expected to grow by another 35% in 2023 to reach 14 million. The U.S., China, and Europe form the three biggest markets for electric cars with China alone accounting for 60% of global electric car sales in 2022. By 2030, these three markets are expected to have an average share of electric cars at around 60%. As the demand for EVs is on the rise globally, it is expected to have a positive impact on the product market as well.

Form Insights

The dry form segment dominated the market with the largest revenue share of 66.70% in 2022. The growing use of tablets where alumina trihydrate is used as an excipient is driving the consumption of dry products. Alumina trihydrate in its dry form is produced as a white, crystalline powder with a chemical formula of Al (OH)3. Bauxite ore is made to go through an elaborate set of processes to manufacture it in a usable form. The dry product is used in pharmaceuticals, water treatment, and ceramics production. Wet alumina trihydrates are used in a variety of applications, such as water treatment, aluminum manufacturing, and ceramics production. Ceramic materials are non-metallic, organic materials bonded with ionic or covalent bonds.

They are hard, brittle, strong in compression, and are used in different sectors from construction to heat-resistant micro parts used in space exploration vehicles. The increasing use of ceramics in power grids, batteries, and automobiles has led to an increase in the consumption of wet alumina trihydrates. Another major driver of segment growth is the rise in aluminum manufacturing around the globe. Aluminum being 3 times lighter than steel, aids in enhancing fuel efficiency and hence is an ideal choice for usage in aviation, automotive, and defense sectors. The overall consumption of aluminum has increased by approximately 20 times in the last sixty years, with a gradual shifting of production centers from west to east in countries such as India, China, and the Middle East.

End-use Insights

The plastics segment dominated the market with a revenue share of 28.8% in 2022. This is attributed to alumina trihydrate being used as a filler material in plastics, enhancing their impact resistance, stiffness, and dimensional ability. Its additional properties, such as increased thermal conductivity and excellent fire-retardant abilities, make it a crucial component in ensuring the fire safety of plastic products. In manufacturing industries’ hazardous environments, alumina trihydrate provides a viable option being chemically inert, halogen-free, and non-toxic. Increasing consciousness over eco-friendly products has, therefore, led to a rise in product demand.

Automotive also emerged as one of the largest end-use segments. In the automotive sector, it is used for a variety of applications, such as in dashboard components, wiring insulation, and seating materials, to provide a cover against possible incidents of fire. It is also used in the engine covers and battery enclosures of the car to enhance fire safety measures. Automotive is a giant industry in the world with over 60 million vehicles produced per year and contributing around 3% of the total GDP output in the world. A rise in the sector in developing economies, such as India and China, where the automotive industry accounts for over 7% of their GDPs, presents a major opportunity for the market.

Regional Insights

Asia Pacific dominated the global market with the largest revenue share of 37.25% in 2022. The strong economic advancement in the area has led to positive trends in key end-use industries, such as construction and manufacturing, indicating continuous market growth. Apart from China, the emerging economies of India, Malaysia, Indonesia, Thailand, and Australia played significant roles in driving market expansion in the Asia Pacific region. Europe has an established product market that is driven by large-scale automotive, plastics, and construction industries. Regulatory organizations in Europe are emphasizing product use that meets environmental specifications due to its qualities as an inert and nontoxic chemical.

One such regulation is the registration, evaluation, authorization, and restriction of chemicals (REACH), which was formed by the European Union to protect the environment and human health from the harmful side effects caused by chemicals. North America’s large-scale construction industry, which forms a ready end-user for alumina trihydrates. The construction industry in the U.S. grew 16.7% to USD 912 billion, while the Canadian construction industry was estimated at USD 65.41 billion in 2022. Along with this, the frequent cases of forest fires in North America, with 43,899 fires in the U.S. alone causing damage to 2.33 million acres of land have boosted the demand for fire retardants. This has increased product consumption, which forms a major component in fire retardants.

Key Companies & Market Share Insights

Developing cost-effective and environmentally sustainable products would offer significant growth opportunities for market players. In addition, companies are focusing on manufacturing biodegradable and less toxic products. Nabaltec AG, ALMATIS, TOR Minerals, and Akrochem Corp. are the key players in the global market. Major manufacturers dominate the market with various strategy initiatives, such as product launches, expansion, mergers & acquisitions, and certifications, for their products. For instance, in March 2023, Hindalco Industries Ltd. got certified with the ASI Performance Standard V2 certification, covering the segments of manufacturing and dispatch of alumina hydrates from its production facility in Belagavi, Karnataka. It became the first alumina refinery in India to be awarded the certification.

Key Alumina Trihydrate Companies:

- Nabaltec AG

- NALCO India

- ALMATIS

- Akrochem Corporation

- ALTEO

- TOR Minerals

- LKAB Minerals

- Hindalco Industries Ltd.

- The R.J. Marshall Company

- Huber Advanced Materials

- Sumitomo Chemical Co., Ltd.

- Southern Ionics Inc.

Alumina Trihydrate Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.85 billion

Revenue forecast in 2030

USD 5.64 billion

Growth rate

CAGR of 5.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; The Netherlands; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Nabaltec AG; NALCO India; ALMATIS; Akrochem Corp.; ALTEO; TOR Minerals; LKAB Minerals; Hindalco Industries Ltd.; The R.J. Marshall Company; Huber Advanced Materials; Sumitomo Chemical Co., Ltd.; Southern Ionics Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Alumina Trihydrate Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global alumina trihydrate market report on the basis of form, end-use, and region:

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Dry

-

Wet

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Chemical Manufacturing

-

Plastics

-

Automotive

-

Construction

-

Other End-uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

The Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global alumina trihydrate market size was estimated at USD 3.59 billion in 2022 and is expected to reach USD 3.85 billion in 2023.

b. The global alumina trihydrate market is expected to grow at a compound annual growth rate of 5.6% from 2023 to 2030 to reach USD 5.64 billion by 2030.

b. Asia Pacific dominated the alumina trihydrate market with a share of 37.25% in 2022. The strong economic advancement in the area has led to positive trends in key end-user industries such as construction and manufacturing, indicating continuous market growth. Apart from China, the emerging economies of India, Malaysia, Indonesia, Thailand, and Australia played significant roles in driving market expansion in the Asia Pacific region.

b. Some key players operating in the alumina trihydrate market include The strong economic advancement in the area has led to positive trends in key end-user industries such as construction and manufacturing, indicating continuous market growth. Apart from China, the emerging economies of India, Malaysia, Indonesia, Thailand, and Australia played significant roles in driving market expansion in the Asia Pacific region.

b. Key factors that are driving the market growth include rising adoption of product from various end-use industries such as plastics, automotive, construction, and chemical manufacturing. Increasing consciousness over environment-friendly products have hence led to an increase in product demand.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.