- Home

- »

- Petrochemicals

- »

-

America Lubricants Market Size & Share Report, 2022-2030GVR Report cover

![America Lubricants Market Size, Share & Trends Report]()

America Lubricants Market Size, Share & Trends Analysis Report By Vehicle Type (Motorcycle, Others), By End Use (Industrial, Automotive, Marine, Aerospace), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-984-8

- Number of Report Pages: 162

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Bulk Chemicals

Report Overview

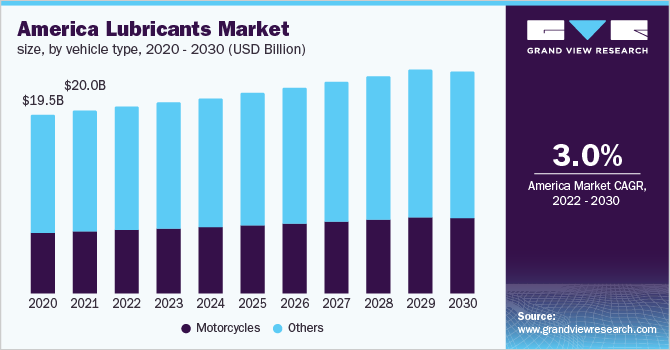

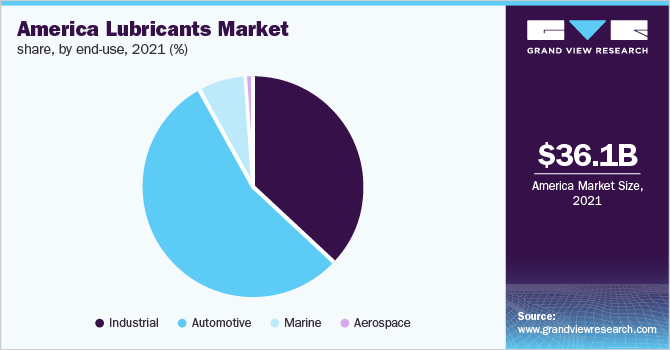

The America lubricants market size was valued at USD 36.1 billion in 2021 and is anticipated to expand at a compound annual growth rate (CAGR) of 3.0% from 2022 to 2030. Demand for the product is anticipated to be driven by an increase in requirement for automotive and end-use segments within the region.

Automotive and industrial are the major application accounting for 90% share of the market. Growth in automotive is expected to remain subdued due to the changing emission norms and introduction of the electric vehicles. Aerospace and marine are the high-margin application segments that are currently catered by top manufacturers in the market.

Companies are strategically divesting assets and investing in upstream facilities, making the market extremely competitive. Premium lubricants are projected to be the main driver of market growth in the future. Companies are also seeking strategic alliances and collaborations in order to enhance their brand image and invest in new product development

The primary items driving market expansion are industrial and automotive engine oils. Demand for high-value engine oils and synthetic formulations is likely to increase as new standards and regulations are implemented. Because of the vast number of market competitors, the automotive and industrial segments are likely to reach saturation. Despite being minor segments, aviation and marine are likely to grow significantly due to the strong margins given by the products.

Because of the growing demand for bio-based lubricants, the global lubricant industry dynamics are shifting in terms of raw ingredients. The expanding commerce in automobiles and their parts is expected to boost demand for automotive lubricants and grease even further. The need for bio-based lubricants is rapidly increasing. Because of strict environmental protection legislation and increased awareness among regional customers, North America has emerged as one of the main consumers of these lubricants.

Electric vehicles are projected to have a detrimental influence on lubricant after-sales in the near future. OEM components and after-sales services are now being developed by the manufacturers, which is expected to offer new growth opportunities in the future. Consumers' increasing focus on improving vehicle performance, combined with the introduction of novel and premium product choices, is driving lubricant growth in the region. The production of automobiles and the number of kilometers driven by each car will have a significant impact on future growth.

Vehicle Type Insights

Motorcycle segment dominated the market with 34.1% of the revenue share in 2021. The higher share is attributed because of increase in demand for motorcycles among the young population of the region. Motorcycles are available with engines ranging from 500cc to 250cc to 125cc. The lubricants used to boost performance are evolving in lockstep with the rapidly changing capabilities and technologies of internal combustion engines. Furthermore, four-stroke engine oils have recently gained popularity due to their ability to prevent leaks and reduce oil usage.

All across the world, synthetic engine oils have been in high demand. Because of their great temperature tolerance and excellent lubrication, synthetic engine oils are utilized in most high-performance motorcycles (>500cc). Engine oils accounted for about 85.0% of the two-wheeler lubricant market. This is due to a greater public awareness of the importance of proper bike maintenance, regular oil changes, and customer assistance in order to save and lengthen engine life.

Others segments is anticipated to witness a CAGR of 2.3% during the forecast period. The growth is attributed to the increase in demand for passenger vehicles, scooters, and commercial vehicles. In 2019, approximately 15.4 million light commercial vehicles were produced globally, compared to 11.8 million in 2020, a decrease of nearly 23.2%. As a result, there was a decrease in demand for engine oils, which hampered the growth of the automotive lubricant market.

The average age of automobiles has steadily increased throughout time. This issue creates an opportunity for the refill market. The rising average age of passenger cars and the growing urban population in developing countries is expected to increase the market for engine oils.

End-Use Insights

Automotive segment dominated the market with the highest revenue share of 55.4% in 2021. The growth is attributed to the increase in sales of passenger vehicles in America during the forecast period. Increased sales of commercial vehicles in the region, such as heavy-duty trucks and construction equipment like bulldozers, cranes, and concrete mixers, are likely to supplement the demand for heavy-duty automobile lubricants in the U.S.

Industrial segment dominated the end-use with 36.9% of the revenue share in 2021. The increase in demand can be witnessed due to the augment in need for industrial vehicles with the development in infrastructure of the region. Industrial lubricants are water- or petroleum-based liquids that reduce friction and protect metal-to-metal contact in dyes, tooling parts, and finished components, preventing metal-to-metal contact and corrosion. Gas engines, hydraulic systems, air compressors, auxiliary equipment, heat transfer systems, paper machines, turbines, metalworking systems, bearings, food machinery, and natural gas compressors all use these lubricants in various sectors.

Rising industrial production in Latin America's emerging markets is expected to drive demand for industrial lubricants in the area, during the forecast period. The mining, unconventional energy, and chemical industries are expected to require the most industrial lubricants. The need for industrial lubricants used in industrial engines, compressors, hydraulic systems, bearings, and centrifuges is predicted to increase as a result of this.

Marine segment is expected to expand at a CAGR of 3.4% during the forecast period. The growth is attributed to the rising demand for lubricants as it provides protection to hydraulic pumps used in ships and marine vessels. They include anti-wear additives, corrosion and oxidation inhibitors, foam along with aeration suppressants, and viscosity index improvers that are shear stable. Vane pumps, piston pumps, and gear pumps are the most important lubricated hydraulic components in ships and marine vessels. Lubricants are often offered in ISO 15, 22, 32, 46, 68, and 100 viscosity grades. Marine lubricants' multi-viscosity characteristic supports smooth power transmissions across a wide range with little shaking and maximum accuracy.

Aerospace sector in the U.S. is expected to increase significantly, during the forecast period. As a result, demand for aero-plane lubricants is likely to rise. Gas turbine engine lubricants, hydraulic fluids, piston engine oils, and other lubricants are essential for aviation. In 2017, the aerospace and defense sector in the U.S. had tremendous growth, generating sales of more than USD 865.0 billion. The commercial aerospace industry in the U.S. had a large growth in output in manufacturing activities, owing to rising demand for shipping civil space systems, general aviation aircraft, and commercial aircraft.

Regional Insights

North America region accounted for 67.3% of the revenue share in 2021. The growth is attributed to high demand within end-use industries that include textiles, industrial, medical textiles, and household manufacturing. Major factors driving market expansion in the area include the revival of the automobile industry in the U.S. and rising vehicle sales in Mexico. Slow but stable industrial output in the region, fueled mostly by the Mexican manufacturing sector is likely to support regional market growth.

The U.S. lubricant market is expected to witness a CAGR of 2.6% in terms of revenue during the forecast period. Because of its great efficiency, the U.S. has continued to evolve and employ higher-quality lubricants, resulting in minimal lubricant usage. Due to the strict regulatory system in the region addressing environmental degradation, the rise of the bio-based lubricants market in the United States is likely to increase industrial lubricant demand. Furthermore, the region has seen an increase in production activities as a result of augmented commerce across nations, which has boosted demand for these lubricants.

Latin America is one of the world's fastest developing geographies, thanks to the rapid growth of major industries in rising countries such as automotive, construction, food & beverage, electronics, and power, among others. The marine industry, on the other hand, is unprepared for the rapidly rising demand in the region. In the near future, the economic development and projected population growth rates are expected to produce a tremendous demand for port and transportation infrastructure improvements to support rising logistical and commerce demands.

Key Companies & Market Share Insights

The America lubricants market is highly competitive with the big international brands focusing on the development of long-term relationships with the end users. With further enlargement in the automotive, industrial, aerospace, and marine industries the competition is anticipated to increase in the coming years.

Companies such as BASF SE, BP p.l.c, Chevron Corporation, and Shell Plc have a high degree of integration across the value chain as they are also engaged in the production of lubricants. These companies have established themselves as key manufacturers and focus on research and development for novel uses of the product. Some prominent players in the America lubricants market include:

-

BASF SE

-

BP p.l.c

-

Chevron Corporation

-

Exxon Mobil Corporation

-

Petro China Company Limited

-

Petroliam Nasional Berhad (PETRONAS)

-

Shell Plc

-

Lukoil

-

Petro bras

America Lubricants Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 37.1 billion

Revenue forecast in 2030

USD 45.8 billion

Growth Rate

CAGR of 3.0% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD Million, Volume in Kilotons, CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Vehicle type, end-use, region

Regional scope

North America; Latin America

Country scope

U.S.; Mexico; Argentina; Brazil

Key companies profiled

BASF SE, BP p.l.c., Chevron Corporation, Exxon Mobil Corporation, Petro China Company Limited, Petroliam Nasional Berhad, (PETRONAS), Shell Plc, Lukoil, Petro bras, China Petrochemical Corporation, Total Energies

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

America Lubricants Market Segmentation

This report forecasts revenue growth at global, regional, & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For this study, Grand View Research has segmented the America lubricants market report based on the vehicle type, end-use, and region:

-

Vehicle Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Motorcycle

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Automotive

-

Marine

-

Aerospace

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Mexico

-

-

Latin America

-

Argentina

-

Brazil

-

-

Frequently Asked Questions About This Report

b. The America Lubricants Market is valued at USD 36.1 billion by 2020, is expected to reach to a market value of USD 37.1 billion by 2022

b. The America lubricants market is expected to grow at a compound annual growth rate of 3.0% from 2022 to 2030 to reach USD 45.8 billion by 2030.

b. The automotive segment with a market share of 57.3%, accounted for the largest market share

b. Companies such as Exxon Mobil, Chevron, Valvoline, and HollyFrontier Corporation are some of the key players present in the America Lubricants Market

b. The factors such as increasing automotive production, and an increase in oil and gas extraction activities in the region are one of the major contributors for growing America lubricants market

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."