- Home

- »

- Medical Devices

- »

-

Angiography Equipment Market Size, Industry Report, 2030GVR Report cover

![Angiography Equipment Market Size, Share & Trends Report]()

Angiography Equipment Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Angiography Systems, Catheters), By Technology (X-Ray, MRA, CT), By Procedure, By Application, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-065-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Angiography Equipment Market Summary

The global angiography equipment market size was estimated at USD 11,096.3 million in 2024 and is projected to reach USD 15,714.7 million by 2030, growing at a CAGR of 6.1% from 2025 to 2030. The increasing scope of applications and technological innovations are expected to be the key growth-driving factors for the market.

Key Market Trends & Insights

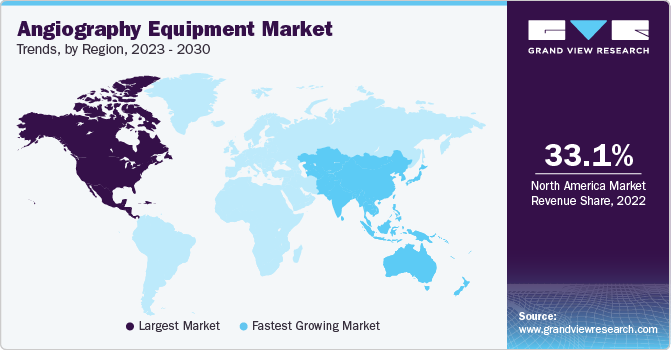

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, angiography systems accounted for a revenue of USD 3,198.7 million in 2024.

- Angiography Accessories is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 11,096.3 Million

- 2030 Projected Market Size: USD 15,714.7 Million

- CAGR (2025-2030): 6.1%

- North America: Largest market in 2024

Investments in the healthcare sector, the increasing geriatric population, and the rising prevalence of Cardiovascular Diseases (CVDs) are other prominent factors responsible for market growth. According to the World Health Organization (WHO), more than 75% of CVD deaths are caused in low-income and middle-income countries due to the lack of easy access to primary healthcare programs for early detection and treatment.

The rising prevalence of cardiovascular diseases (CVD) is a major driver for the growth of the healthcare market, particularly in the therapeutic and endovascular sectors. Factors such as unhealthy diets, sedentary lifestyles, smoking, and rising stress levels contribute to the global surge in conditions like hypertension, heart disease, and stroke. As cardiovascular diseases become more widespread, the demand for diagnostic tools, treatment options, and endovascular procedures like angioplasties, stent placements, and bypass surgeries continues to grow. In October 2024, the CDC reported that heart disease is the top cause of death among men, women, and a wide range of racial and ethnic groups. This illness results in a death every 33 seconds, with 702,880 lives lost to heart disease in 2022, representing about 20% of all deaths.

Technological advancements in healthcare are transforming medical treatments, driving efficiency, and improving patient outcomes. Innovations such as minimally invasive endovascular procedures, advanced imaging technologies, robotic surgeries, and AI-powered diagnostic tools enable quicker, more accurate treatments with less risk and shorter recovery times. In March 2024, Shimadzu Corporation introduced SHIMADZU Connected, a diagnostic X-ray imaging system component service initiative. This program includes various businesses aimed at generating recurring revenue through ongoing service contracts, parts, and software licenses for healthcare facilities that use Shimadzu products. The first offering is SMILE guard, which replaces X-ray tubes before they fail.

The aging population is one of the most significant factors driving the growth of the healthcare market. As life expectancy rises worldwide, particularly in developed countries, the elderly population increases, leading to higher demand for healthcare services, including those focused on cardiovascular health. In September 2024, the World Population Data Sheet indicates a global fertility rate of 2.2 births per woman and that 10% of the population is aged 65 and older, with some regions exceeding 20%. There are 800 million older adults, surpassing the entire population of Latin America and the Caribbean. This aging population is expected to lead to increased noncommunicable diseases and a rising demand for caregiving.

Market Concentration & Characteristics

The degree of innovation in the angiography equipment industry is high. Technological advancements such as 3D imaging, AI-based diagnostics, and enhanced fluoroscopy systems have revolutionized angiograms, improving diagnostic accuracy and procedural efficiency. These innovations cater to the growing demand for more precise and effective cardiovascular care.

The level of merger and acquisition activities is moderate in this market. While large players often pursue strategic alliances and collaborations to expand their product offerings, mergers and acquisitions are less frequent. Companies typically focus on strengthening their R&D and technology portfolios through partnerships rather than large-scale consolidation.

Regulation has a high impact, with stringent medical device regulations governing the development, approval, and commercialization of angiography equipment. Regulatory bodies, such as the FDA and EMA, enforce rigorous standards that ensure patient safety, which can significantly affect product timelines, costs, and market access. In August 2024, the US Centers for Medicare & Medicaid Services (CMS) announced a proposed increase in reimbursement rates for hospitals and outpatient clinics providing cardiac computed tomography angiography (CCTA), following years of declining payments. CMS reimburses approximately USD175 for CCTA, part of a class 1 recommendation for ruling out obstructive coronary disease according to the latest clinical guidelines for both stable and acute chest pain.

Product expansion is high in the market, driven by the demand for more advanced, compact, and cost-effective solutions. Companies continuously introduce new products like portable angiography systems and low-dose radiation technologies to meet diverse clinical needs, enabling broader adoption in both developed and emerging markets.

Regional expansion is moderate, as companies seek to enter emerging markets in Asia-Pacific and Latin America, with growing healthcare infrastructure and demand. However, challenges such as regulatory differences, market maturity, and economic factors in various regions often hampered expansion.

Product Insights

The angiography systems segment held the largest market share of 26.5% in 2024 due to continuous investments, technological advancements, and growing scope of applications. These systems have evolved from catheter-based minimally invasive procedures to digitalized procedures. In November 2024, Shimadzu Corporation won its first Red Dot Design Award in the Brands & Communication Design category for the "Trinias Series with SCORE Opera" angiography system. The company also received four awards in the Product Design category for its analytical and measuring instruments.

The contrast media segment is anticipated to grow at the fastest CAGR over the forecast period. These products are commonly utilized to improve the visibility of blood vessels in imaging methods like CT angiography, MRA, and X-ray. They are also employed in projectional radiography and fluoroscopy. Different radiocontrast agents include iodine, barium sulfate, and gadolinium. In July 2024, MEDTRON AG unveiled the MR syringe adapter CM Typ E, specifically crafted for Guerbet's pre-filled Elucirem syringe, which utilizes the contrast media gadopiclenol. Gaining approval in 2023, Elucirem significantly benefits patients and the environment thanks to its reduced gadolinium content. This new product was featured at the 2024 Radiology Congress, meeting the growing demand for specialized options in contrast media administration.

Technology Insights

In 2024, X-Ray held the largest market share of 36.0%. X-Ray dominated the angiography equipment industry. The market is segmented based on technology: X-ray, MRA, and CT. Companies are investing heavily in developing new technologies, which is expected to support market growth. The need for reduction of radiation dose, improvement in image quality, and emerging cath lab trends are expected to drive the market. In February 2024, Koninklijke Philips N.V. revealed enhancements to its Azurion Image Guided Therapy System with the launch of the new neuro biplane system. This system is tailored to improve neurovascular procedures, enabling faster decision-making, increased patient treatment, and better outcomes. It features advanced 2D and 3D imaging along with flexible X-ray detector positioning.

The MRA segment is anticipated to grow at the fastest CAGR over the forecast period due to its advantage of negligible exposure to radiation in the diagnosis of heart disease. MRA offers 3D capabilities to acquire images in any anatomical plane with excellent soft tissue contrast. The emergence of 3.0T MR imaging has significantly enhanced the diagnosis of coronary artery disease. These factors are also said to boost the segment growth. In October 2024, a study in Science Advances emphasized the vital role of magnetic resonance angiography (MRA) in diagnosing panvascular diseases. It noted the limitations of single-modality MRA and the need for contrast agents that combine T1 and T2 effects for multiparameter MRA. The research developed a highly sensitive MRA technique using dual-modality NaGdF4 nanoparticles.

Procedure Insights

The coronary segment dominated the market with a share of 45.8% in 2024 and is expected to grow at the fastest CAGR during the forecast period. The increasing rates of Coronary Artery Disease (CAD) are boosting the demand for coronary angiography in emerging countries like China and India. In October 2024, the CDC reported that approximately 1 in 20 adults aged 20 and older have coronary artery disease (CAD), which accounts for roughly 5%. Advances in imaging methods, notably the transition from single slice to multislice Computed Tomography (CT), have significantly improved diagnostic capabilities. Presently, diagnostic options include coronary Computed Tomography angiography, cardiac Magnetic Resonance Imaging (MRI), Single Photon Emission Computed Tomography (SPECT), and Positron Emission Tomography (PET).

The endovascular segment emerged as the second largest in 2024 due to the increasing preference for minimally invasive procedures that offer reduced recovery times, lower risk of complications, and improved patient outcomes. Endovascular procedures, such as stent placements, angioplasties, and embolization techniques, are increasingly used to treat vascular conditions like aneurysms, peripheral artery disease, and deep vein thrombosis, further driving the growth of this segment. In January 2024, Curatia Medical Inc announced that the XCESS Guiding Catheter has received formal MDR approval! These catheters are designed for the intravascular introduction of interventional or diagnostic devices within the coronary or peripheral vascular systems. The XCESS Guiding Catheter is a single-use, sterile Class III intravascular catheter with a validity period of three years.

Application Insights

The diagnostic segment dominated the market with a share of 59.0% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. Developments in CTA and MRA provide appropriate information in cardiology and neurology, such as cerebral aneurysms, acute stroke, brain arteriovenous malformation, dural arteriovenous fistula, suspected cerebral vasculitis, and occlusive diseases. The growing awareness of cardiovascular diseases (CVDs) and their risk factors is expected to drive market growth. In March 2024, Siemens Healthineers revealed that the CIARTIC Move, a mobile C-arm with autonomous driving capabilities, received clearance from the FDA. This innovative system enhances the efficiency and standardization of 2D fluoroscopic and 3D cone-beam CT imaging for surgical teams in hospitals and outpatient surgeries, leading to quicker imaging processes.

The therapeutic segment emerged as the second largest in 2024, due to the growing demand for advanced treatments across various medical conditions. This segment includes targeted therapies for cancer, cardiovascular disorders, and neurological diseases. The rise in chronic conditions, increasing aging populations, and the demand for personalized treatments have contributed to the expansion of this segment, making it a key focus for medical advancements and investments.

Regional Insights

In 2024, North America angiography equipment market held the predominant position with a share of 33.0%, due to its advanced healthcare infrastructure, high healthcare expenditures, and strong presence of leading medical device manufacturers and pharmaceutical companies. The region's emphasis on research and development and high adoption rate of innovative medical technologies further drive growth. In October 2024, the Society for Cardiovascular Angiography and Interventions (SCAI) released a new expert consensus statement on STEMI management for primary PCI, published in JSCAI. The statement provides practical guidance for physicians, addressing complex clinical scenarios like large thrombus burden and no-reflow phenomena. It emphasizes the need for specific equipment in cardiac catheterization labs and recommends advanced imaging tools and mechanical support for challenging cases.

U.S. Angiography Equipment Market Trends

In 2024, the U.S. accounted for North America's largest share of the angiography equipment industry. The U.S. leads in the medical and healthcare sectors because of its substantial investment in healthcare R&D, robust regulatory frameworks, and presence of major healthcare institutions. In January 2024, Summa Therapeutics, LLC announced that its Finesse Injectable balloon catheter was successfully used in first-in-human procedures for injectable angioplasty in patients with below-the-knee peripheral artery disease (PAD). This hybrid device combines diagnostic and therapeutic functions to improve treatment for patients at risk of limb loss while minimizing equipment and contract requirements.

Europe Angiography Equipment Market Trends

Europe angiography equipment market is anticipated to grow significantly over the forecast period. Europe dominates due to its well-established healthcare systems, government-funded healthcare models, and a strong emphasis on innovation in medical technology. Countries like Germany, France, and the UK invest heavily in healthcare infrastructure, supporting public and private growth.

The UK angiography equipment market is expected to grow over the forecast period. The UK benefits from a strong National Health Service (NHS) that ensures wide access to cutting-edge medical technologies. The country's focus on medical research and development, along with partnerships between public institutions and private companies, drives the adoption of innovative treatments. In November 2024, the Canadian Association of Radiologists Journal reported equipment failures in interventional radiology divisions at tertiary academic hospitals in the UK and Canada. It highlighted the importance of organizational resilience, emphasizing the stages of anticipation, coping, and adaptation.

The angiography equipment market in Germany is expected to grow over the forecast period. Germany is a leader in the European healthcare market due to its highly developed healthcare system, strong medical device manufacturing industry, and significant investments in healthcare research. In January 2024, a study in the European Heart Journal found that adhering to guidelines for coronary angiography (CA) use in stable coronary artery disease (SCAD) patients in Germany could reduce costs and major adverse cardiac events for most patients, benefiting the Statutory Health Insurance, although high pre-test probability patients may see slightly higher costs.

The angiography equipment market in France is expected to grow over the forecast period. France dominates due to its universal healthcare system, significant government funding, and a high standard of medical care. France's focus on innovation and its investment in medical technologies ensures continued growth in the healthcare and therapeutic segments.

Asia Pacific Angiography Equipment Market Trends

The Asia Pacific angiography equipment industryis expected to experience rapid growth, with a projected CAGR of 6.4% from 2025 to 2030. Asia-Pacific is a rapidly growing region in the healthcare sector, driven by a large and diverse population, improving healthcare infrastructure, and increasing healthcare expenditure. The rise in chronic diseases, the expanding middle class, and government initiatives to improve healthcare access contribute to the growth of the medical market, particularly in countries like China, Japan, and India. In November 2024, the Angiography Centre at the National University Heart Centre, Singapore (NUHCS) resumed operations with a revamped reception area that offers more seating. The improved facility features state-of-the-art imaging and diagnostic equipment and enhanced patient recovery space.

The China angiography equipment market is anticipated to grow over the forecast period. China dominates the Asia-Pacific region due to its massive population, expanding healthcare industry, and significant government investments in healthcare reforms. In November 2024, Beijing's municipal government unveiled a plan to expand the city's medical device industry to 50 billion yuan (around 7 billion U.S. dollars) by 2026. The strategy involves creating industrial clusters focused on high-end medical equipment, high-value consumables, and efficient diagnostic products through 2026.

The Japan angiography equipment market is expected to grow rapidly over the forecast period. Japan has one of the most advanced healthcare systems in the world, with cutting-edge medical technologies and a robust regulatory framework. In June 2024, JAMA Network Open published an article detailing a cohort study that analyzed 2,147 patients from the International Post-PCI FFR registry, incorporating data from Japan, Korea, and China. The findings indicated weak correlations between angiographic results and post-PCI fractional flow reserve (FFR).

The angiography equipment market in India is anticipated to grow rapidly over the forecast period. India is seeing rapid growth in its healthcare sector, driven by increasing healthcare needs due to a large aging population and a growing middle class. In March 2024, A J Hospital & Research Centre launched advanced cardiac facilities, including Optical Coherence Tomography (OCT), advanced Cardiac MRI & CT, and a 4D Echocardiogram machine. These technologies improve diagnostics and treatment options, making the hospital one of the region's most advanced cardiac care centers.

Latin America Angiography Equipment Market Trends

The angiography equipment industry in Latin America is witnessing a significant trend. Due to its expanding population and increasing demand for healthcare services, Latin America is growing as a key region in the healthcare sector. In November 2024, the IDB approved a loan to Buenos Aires for acquiring four angiography machines as part of a broader initiative to modernize the city’s public health system. This equipment will help improve diagnostic accuracy and reduce waiting times for over one million public health users, contributing to better healthcare service delivery in the city.

The angiography equipment market in Brazil is expected to grow over the forecast period. Brazil is the largest healthcare market in Latin America, and it is significantly focused on improving its healthcare infrastructure, including access to advanced medical treatments and devices. The country’s large population and growing demand for medical innovations make it a key player in the region’s healthcare market.

Middle East & Africa Angiography Equipment Market Trends

The angiography equipment market in the Middle East and Africais poised to grow in the near future. The Region is becoming increasingly important in the global healthcare landscape, with a rise in demand for healthcare services driven by an aging population and an increase in chronic diseases. In February 2024, Neusoft Medical Systems presented its state-of-the-art medical imaging solutions at Arab Health 2024, featuring technologies like CT, MRI, and more, all powered by AI. The standout exhibit was the NeuViz ACE UP CT, a groundbreaking system that improved healthcare efficiency and patient satisfaction, providing remarkable flexibility and precision that surpasses the typical 64-slice options.

The angiography equipment market in Saudi Arabia is expected to grow over the forecast period. Saudi Arabia leads the Middle East in healthcare development, with substantial investments in healthcare infrastructure, medical technology, and research. In July 2024, an article published in the Journal of Contemporary Medical Sciences stated that the incidence of contrast-induced acute kidney injury (CI-AKI) in patients undergoing coronary procedures was 8.1%, with higher rates in those over 70. The study suggests that while CI-AKI is a concern, its occurrence is lower than expected, and preventive measures can mitigate the risk.

The angiography equipment market in Kuwait is anticipated to grow over the forecast period. Kuwait invests heavily in its healthcare sector, improving medical services, expanding hospitals, and incorporating advanced medical technologies. The government’s efforts to provide high-quality healthcare to its citizens are driving growth in the region's therapeutic and endovascular sectors.

Key Angiography Equipment Company Insights

Some of the key players operating in the angiography equipment industry include Medtronic plc, Boston Scientific Corporation, Abbott, and ANGIODYNAMICS. These companies are making significant infrastructure investments, which enable them to develop, manufacture, and commercialize a high volume of drugs worldwide. In addition, to increase their presence globally, companies engage in several strategic partnerships with distributors and other companies.

Key Angiography Equipment Companies:

The following are the leading companies in the angiography equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic plc

- Boston Scientific Corporation

- Angiodynamics, Inc.

- Abbott

- Microport Scientific Corporation

- B. BRAUN SE

- KONINKLIJKE PHILIPS N.V.

- GE Healthcare

- Cardinal Health

- Siemens Healthineers AG

- SHIMADZU CORPORATION

Recent Developments

-

In October 2024, Shimadzu Corporation unveiled SMART Voice, a voice recognition feature for its Trinias angiography systems, aimed at improving efficiency and reducing the workload for healthcare professionals. The technology will be demonstrated at upcoming events in Kobe, Washington D.C., and the RSNA exhibition in Chicago, enhancing catheterization procedures without diverting attention from the affected area.

-

In June 2024, NIDEK CO., LTD. introduced the RS-1 Glauvas Optical Coherence Tomography (OCT). This cutting-edge system features a scanning speed of up to 250 kHz, enabling fast and accurate imaging. It is designed to enhance workflow efficiency and diagnostic confidence for glaucoma and retinal vascular diseases. It offers improved clarity in B-scan imaging and advanced AngioScan OCT-Angiography for better evaluation of chorioretinal microvasculature.

-

In February 2024, Koninklijke Philips N.V. unveiled the Philips CT 5300 system, which incorporates cutting-edge AI technology for diagnostics, interventional procedures, and screening applications. This versatile X-ray CT system enhances diagnostic accuracy, improves workflow efficiency, and maximizes equipment availability, ultimately benefiting patient outcomes. During #ECR2024, Philips works alongside healthcare providers to enhance productivity and promote more sustainable healthcare solutions.

Angiography Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.7 billion

Revenue forecast in 2030

USD 15.7 billion

Growth rate

CAGR of 6.1% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, procedure, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Medtronic plc; Boston Scientific Corporation; Angiodynamics, Inc.; Abbott; Microport Scientific Corporation; B. BRAUN SE; KONINKLIJKE PHILIPS N.V.: GE Healthcare; Cardinal Health; Siemens Healthineers AG; SHIMADZU CORPORATION

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Angiography Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global angiography equipment market report based on product, technology, procedure, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Angiography Systems

-

Catheters

-

Guidewire

-

Balloons

-

Contrast Media

-

Vascular Closure Devices

-

Angiography Accessories

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

X-Ray

-

MRA

-

CT

-

-

Procedure Outlook (Revenue, USD Million, 2018 - 2030)

-

Coronary

-

Endovascular

-

Neurovascular

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostic

-

Therapeutic

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global angiography equipment market size was estimated at USD 11.1 billion in 2024 and is expected to reach USD 11.7 billion in 2025.

b. The global angiography equipment market is expected to grow at a compound annual growth rate of 6.1% from 2025 to 2030.to reach USD 15.7 billion by 2030.

b. North America dominated the angiography equipment market with a share of 32.9% in 2024. This is attributable to increasing geriatric population and prevalence of CVDs. Presence of major companies in the U.S. attributes to the major share of the market.

b. Some of key industry participants are Medtronic, Inc.; Abbott Laboratories; GE Healthcare; Boston Scientific Corporation; Koninklijke Philips N.V.; AngioDynamics, Inc.; Shimadzu Corporation; Cordis Corporation; B. Braun Melsungen AG; and Siemens Healthcare Ltd.

b. Key factors that are driving the market growth include increasing scope of application and technological innovations. Investments in the healthcare sector, increasing geriatric population, and rising prevalence of cardiovascular diseases (CVDs) are several other prominent factors responsible for market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.