- Home

- »

- Animal Feed and Feed Additives

- »

-

Animal Feed Enzymes Market Size & Share Report, 2030GVR Report cover

![Animal Feed Enzymes Market Size, Share & Trends Report]()

Animal Feed Enzymes Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Phytases, Proteases) By Formulation, By Application (Poultry, Pigs), By Region And Segment Forecasts

- Report ID: GVR-1-68038-759-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Animal Feed Enzymes Market Summary

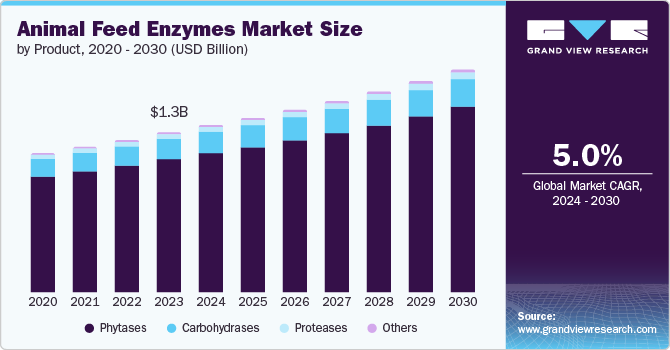

The global animal feed enzymes market size was estimated at USD 1.32 billion in 2023 and is projected to reach USD 1.84 billion by 2030, growing at a CAGR of 5.0% from 2024 to 2030. This is driven by the rapid expansion of the livestock sector, which propels the demand for nutritional enhancement and digestion efficiency.

Key Market Trends & Insights

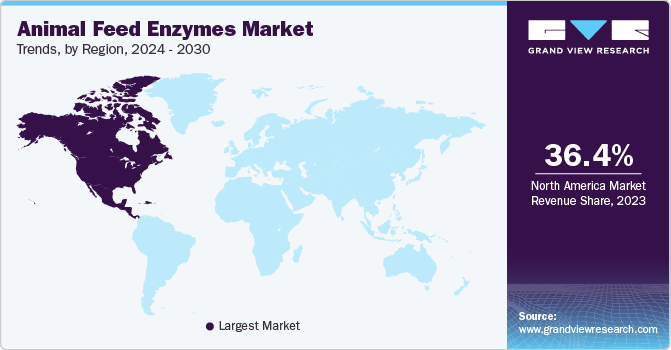

- North America dominated the global animal feed enzymes market with the largest revenue share of 36.4% in 2023.

- By product, the phytases segment led the market, holding the largest revenue share of 83.4% in 2023.

- By formulation, the dry animal feed enzymes segment held the dominant position in the market and accounted for the leading revenue share in 2023.

- By application, the pigs segment is expected to grow at a significant CAGR from 2024 to 2030.

Market Size & Forecast

- 2023 Market Size: USD 1.32 Billion

- 2030 Projected Market Size: USD 1.84 Billion

- CAGR (2024-2030): 5.0%

- North America: Largest market in 2023

With competent fodder becoming scarcer, livestock producers have increasingly used enzymes to help compensate for nutritional deficiencies, ensuring healthier livestock.

The market saw a major shift in preferences for synthetic and inorganic fertilizers. The excessive use of synthetic and inorganic fertilizers led crops to lose their nutritional qualities. As a result, harmful by-products are formed when these crops are ingested by livestock. Manufacturers have primarily applied enzymes for breaking down and absorbing naturally occurring elements such as fiber and phytate in animal feed ingredients. They used essential enzymes to aid livestock digestion, leading to improved feed efficiency and overall health.

In addition, cellulase enzymes facilitate the digestion of cellulose polysaccharides, breaking down fiber. Animal feed enzymes including proteases act on protein components, degrading them into amino acids — the building blocks for livestock. These enzymes enhance energy levels and metabolic rates in livestock, boosting their resistance to diseases.

The growing global population and urbanization have resulted in the increased demand for meat and dairy products. Enzymes contribute to better livestock health and productivity with optimized feed utilization, waste reduction, and environmental impact, meeting the rising demand and aligning with sustainability.

Product Insights

Phytases have registered the dominant market share with 83.4% in 2023 as an essential enzyme that enhances the digestibility of phytate-rich feed materials. These enzymes break down to release essential minerals including phosphorus for better absorption by livestock including metabolism and reproduction. This cost-effective approach reduces the need for expensive inorganic phosphates in animal diets. Furthermore, phytases optimize nutrient utilization and minimize phosphorus wastage, mitigating environmental impact. This has aligned with consumer preferences for healthier meat and dairy products.

Proteases are projected to emerge as the fastest-growing CAGR over the forecast period owing to the rising demand for eggs and meat with higher protein content. Proteases are protein-digesting enzymes that play a vital role in poultry and pig sectors by breaking down dietary proteins into amino acids for optimal growth, feed efficiency, waste reduction, and minimization of expensive protein sources. In addition, the growing industrialization in livestock farming in developing countries including Brazil, China, and India has driven the demand for proteases as these enhance metabolic rates in poultry, ruminants, pigs, and aquaculture.

Formulation Insights

Dry animal feed enzymes have exhibited the propellant share of the global revenue in 2023 owing to greater stability that enables longer shelf life. Dry formulations are manageable and spill-free. They require minimal handling effort during mixing into feed. Livestock rearers and feed manufacturers have increasingly preferred their stability during storage and transportation which ensures consistent enzyme activity, optimizing nutrient utilization in animal diets. In addition, dry enzymes sustain temperature during fodder processing and have greater thermal stability.

Liquid formulations are projected to grow substantially at a CAGR of 4.8% during the forecast period owing to cost-efficiency and ease of application. These offer practical advantages over dry forms. For instance, these are easier to mix into feed and readily absorbable, ensuring uniform distribution, bioavailability, and better nutrient utilization. In addition, these formulations allow precise dosing which helps livestock rearers to tailor diets based on specific enzyme requirements to optimize performance and minimize waste.

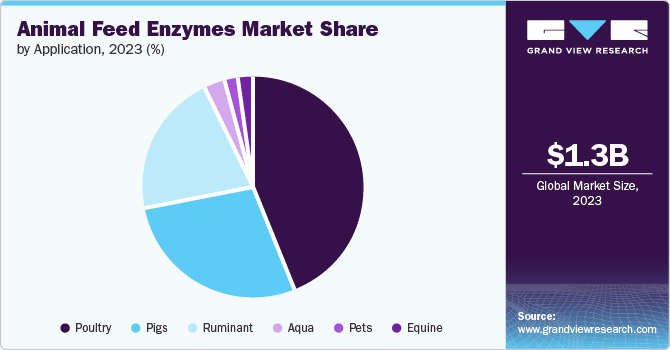

Application Insights

Poultry secured the largest share with 44.2% of the market in 2023 owing to the major shifts in consumer dietary preferences. Consumers have increasingly inclined toward leaner poultry products such as eggs and chicken which offer a versatile and affordable protein source. Enzymes help enhance the health and performance of livestock through digestion and nutrient absorption including proteins and fibers. Moreover, enzymes optimize nutrient utilization, reduce waste, and contribute to sustainable livestock production.

Pigs are projected to grow substantially during the forecast period. Pigs as monogastric animals, have limited ability to fully digest certain components of their diet. Livestock rearers use specific enzymes such as carbohydrases, proteases, and phytases to break down complex carbohydrates, proteins, and phytate. Improved digestibility ensures better nutrient absorption, leading to healthier pigs and efficient growth. For instance, proteases break down proteins into amino acids, essential for pig growth and muscle development and phytases release phosphorus from phytate, improving bone health and overall well-being.

Regional Insights

The North America animal feed enzymes market held 36.4% of the market share in 2023 as consumers increasingly sought high-quality meat products. With increased disposable incomes, consumers have prioritized healthier diets. Enzymes enhance livestock health, leading to better meat quality and nutritional value. These have increasingly served as alternatives to antibiotics in livestock production.

U.S. Animal Feed Enzymes Market Trends

The U.S. animal feed enzymes market was propelled by increasing consumer awareness about animal health and nutrition. Consumers have increasingly sought meat and dairy products with better nutritional profiles which significantly emphasized the role of enzymes in livestock diets. Furthermore, research and innovation in enzyme formulations to improve digestion, nutrient absorption, and livestock performance have contributed to their effectiveness, driving adoption.

Europe Animal Feed Enzyme Market Trends

The animal feed enzyme market in Europe secured 28.7% of the market share in 2023 owing to efficient feed processing and cost-effectiveness. European livestock producers prioritize efficient feed utilization and enzymes that break down complex nutrients improving digestion and overall animal health. Moreover, by enhancing nutrient absorption, enzymes reduce waste and minimize environmental impact, aligning with the eco-friendly preferences of European consumers.

Asia Pacific Animal Feed Enzymes Market Trends

The animal feed enzymes market in Asia Pacific (APAC) accounted for 22.2% in 2023 owing to the increased demand for protein-rich meat and dairy products. This has led to an increased adoption of enzymes that enhance livestock health and productivity. In addition, APAC countries including China, Japan, and India have increasingly emphasized sustainable agriculture and influenced the usage of enzymes for minimized waste and optimized feed efficiency.

Key Animal Feed Enzymes Company Insights

The animal feed enzymes market is fairly fragmented featuring key players such as AB Enzymes, BASF SE, Antozyme Biotech, and others. These companies have increasingly focused on research and development activities to extend their product lines, product capacity, and acquisitions and mergers to strengthen their market presence.

-

AB Enzymes is an industrial biotech company specializing in enzymes including pectinase enzymes, marketed as ROHAPECT. They offer enzyme products for food, animal feed, and technical applications. Their product portfolio includes enzymes for baking, beverages, grain, vegetable oil seeds processing, and more.

-

Antozyme Biotech is a well-integrated enzyme manufacturing and formulation organization. The company collaborates with innovative customers globally, helping them enhance product quality, and reduce costs. Antozyme Biotech caters to various industries, including food, starch, and juice clarification. Their eco-friendly enzymes are available in quantities ranging from small to large scale.

Key Animal Feed Enzymes Companies:

The following are the leading companies in the animal feed enzymes market. These companies collectively hold the largest market share and dictate industry trends.

- AB Enzymes

- BASF SE

- Archer Daniels Midland (ADM)

- Novus International

- DSM NV

- Cargill

- Elanco Animal Health

- Kerry Group

- Antozyme Biotech

- ABF Ingredients

Recent Development

-

In January 2023, BASF and Cargill expanded their collaboration, extending their existing feed enzyme development and distribution to U.S. Their joint commitment lies in introducing innovative enzyme-based solutions to the market, creating unique value for animal feed customers. By leveraging BASF’s expertise in enzyme research and development and combining it with Cargill’s application knowledge and extensive market presence, the two companies are set to establish a collaborative innovation pipeline for animal protein producers

Animal Feed Enzymes Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.38 billion

Revenue forecast in 2030

USD 1.84 billion

Growth Rate

CAGR of 5.0 % from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

September 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, formulation, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; China; Japan; India; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

AB Enzymes; BASF SE; Archer Daniels Midland (ADM); Novus International; DSM NV; Cargill; Elanco Animal Health; Kerry Group; Antozyme Biotech; ABF Ingredients

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Animal Feed Enzymes Market Report Segmentation

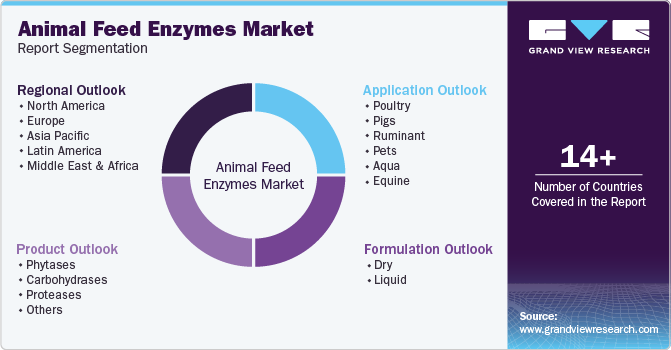

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global animal feed enzymes market report based on product, formulation, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Phytases

-

Carbohydrases

-

Proteases

-

Others

-

-

Formulation Outlook (Revenue, USD Million, 2018 - 2030)

-

Dry

-

Liquid

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Poultry

-

Pigs

-

Ruminant

-

Pets

-

Aqua

-

Equine

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.