- Home

- »

- Digital Media

- »

-

Animation Software Market Size, Share, Growth Report, 2030GVR Report cover

![Animation Software Market Size, Share & Trends Report]()

Animation Software Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (2D Animation, 3D Animation, Flipbook Animation, Stop Motion), By Deployment, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-372-2

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Animation Software Market Summary

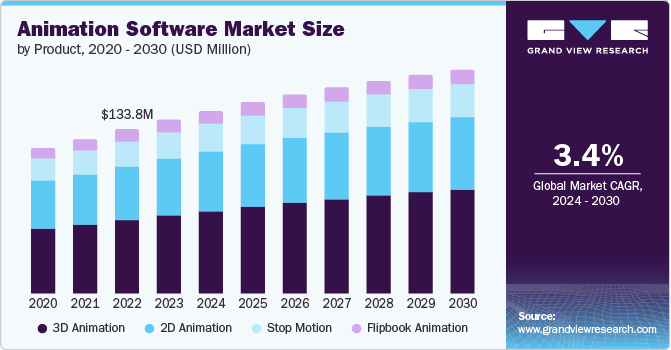

The global animation software market size was estimated at USD 141.63 billion in 2023 and is projected to reach USD 182.42 billion by 2030, growing at a CAGR of 3.4% from 2024 to 2030. The market growth is attributed to the growing prevalence of animation across various industries, including media & entertainment, construction, gaming, education, healthcare, etc.

Key Market Trends & Insights

- North America held the largest revenue share in 2023, accounting for 37.7%.

- The U.S. animation software market is estimated to witness a significant CAGR of over 2.1% from 2024 to 2030.

- By product, the 3D animation segment held the largest revenue share of around 45% in 2023.

- By end use, the healthcare & life sciences segment is anticipated to expand at the fastest CAGR from 2024 to 2030.

Market Size & Forecast

- 2023 Market Size: USD 141.63 Billion

- 2030 Projected Market Size: USD 182.42 Billion

- CAGR (2024-2030): 3.4%

- North America: Largest market in 2023

Moreover, ongoing technological developments, such as enhanced visual effects, projection mapping, and 3D printing, contribute to market growth. In addition, the proliferation of streaming platforms and digital media, which has stimulated the demand for enhanced visual effects, further enhances the outlook of the animation software market. The market growth is also driven by the expansion of the construction industry, coupled with rapid infrastructure development across the globe. Construction companies rely on 3D animation to create realistic visualizations of architectural designs, infrastructure projects, and manufacturing processes. These animations help market their services, showcase project concepts, and secure approvals.

Animation software continues to thrive with the popularity of online video platforms and the growth of virtual and augmented reality (VR/AR). As consumers seek immersive experiences, the demand for visually stunning content has surged. VFX empowers the creation of realistic and interactive videos, enhancing user engagement. VFX tools have evolved significantly. Real-time rendering techniques, advancements in ray tracing, and enhanced GPU capabilities contribute to the seamless integration of VFX-based scenes with live-action footage.

The increasing demand from the gaming sector is driving the market growth further. As video games become more intricate and visually appealing, the demand for high-quality animations rises. Gamers expect realistic characters, environments, and special effects, driving studios to use advanced animation tools. Innovations like 3D animations and 4K content cater to adult gamers seeking immersive experiences. These advancements enhance gameplay and storytelling, spurring the adoption of animation software.

Market Concentration & Characteristics

The animation software market growth stage is mature, and the pace of its growth is accelerating. This is primarily attributed to continuous technological advancements, software tools, and rendering techniques. The increasing demand for realism and creativity fuels a competitive environment, prompting studios and artists to explore innovative solutions. Moreover, integrating Artificial Intelligence (AI) and Machine Learning (ML) in animation processes further elevates the industry's innovative landscape.

The animation software market is also characterized by a high level of merger and acquisition (M&A) activities by the leading market players. Companies seek to leverage complementary strengths, expand their global footprint, and enhance technological capabilities. Key players are keen on acquiring innovative studios or technology firms to stay competitive and meet the growing demands of a diverse audience across various platforms, including film, gaming, and Virtual Reality (VR).

Regulations play a significant role in determining the animation software market, influencing its creative and commercial aspects. Compliance with industry standards ensures the production of high-quality content while safeguarding intellectual property rights. Moreover, regulatory frameworks impact accessibility, copyright issues, and ethical considerations within the industry. Adapting to evolving regulations becomes imperative for industry players to navigate challenges and capitalize on emerging opportunities.

The threat of direct substitutes in the animation software market is low, owing to the specialized skills and advanced technology required in this field. High-quality 3D animation necessitates expertise in complex software and artistic creativity, creating a barrier to entry for potential substitutes. Additionally, the unique capabilities of 3D animation in industries such as film, gaming, and VR make it challenging for alternative solutions to replicate its impact.

End-user concentration is a significant factor in the market, as several industry verticals, such as entertainment and gaming and architecture and construction, are increasingly adopting animation tools that offer various features, including modeling, rigging, texturing, animation, and rendering.

Product Insights

The 3D animation segment accounted for the largest revenue share of around 45% in 2023. The growth is attributed to the ability of 3D animation software to create visuals that appear realistic and tangible. Viewers' increasing expectation of realistic-looking images and films urges filmmakers to use advanced animation techniques. Moreover, 3D animation software is also increasingly adopted in mobile applications and games. In addition, 3D animation finds applications in the healthcare sector as it enables precise medicine production and innovative surgical planning, further stimulating segment growth.

The 2D animation segment is expected to record a notable CAGR of over 3% from 2024 to 2030. Several industries, such as marketing, advertising, public relations, and social media management, drive the demand for 2D animation software owing to its comprehensive visual effects and graphical capabilities. This technology offers advantages, such as enhanced visual perception, simulation of concepts through images, and the ability to create value-added content for clients, which drive its demand supporting segment growth.

Deployment Insights

The cloud-based segment is estimated to register a notable CAGR from 2024 to 2030 owing to increasing consumer demand for this deployment mode as it offers greater flexibility and scalability to the animators and studios. They can scale their computing resources according to the project requirements. Moreover, it enables team members to work and collaborate remotely and choose from various cloud service providers as per their preferences. Besides, users can control the accessibility and use encryption and backup features to ensure the privacy and safety of the work. The increasing demand for cloud-based deployment due to these benefits is expected to drive segment growth over the coming years.

The on-premise segment held a considerable revenue share in 2023. Several organizations still prefer this deployment mode, which offers greater data security and savings, as sensitive animation projects can be managed within their own infrastructure. Besides, some studios rely on legacy systems or have existing workflows that depend on on-premise tools, and transitioning to cloud-based solutions can be complex and costly. As a result, this deployment type is used by several organizations, contributing to segmental growth.

End-use Insights

The media & entertainment segment accounted for the largest revenue share in 2023. This is attributed to the increasing usage of animation, from hand-drawn animations to Computer Generated Imagery (CGI), to bring characters, worlds, and emotions into films. Animated content caters to diverse audiences, with availability in several genres, from comedy to action. Moreover, live-action films also use animation to add realistic creatures, mind-bending effects, and epic battles, creating significant demand for VFX software, such as Autodesk Maya, Houdini, and Cinema 4D. In addition, animation software creates realistic game characters, environments, and interactions, driving demand and creating lucrative growth prospects for the segment.

The healthcare & life sciences segment is anticipated to expand at the highest CAGR from 2024 to 2030 owing to the increasing adoption of animation to explain to patients their conditions, procedures, and treatments through visualization of anatomical structures and disease processes. These tools are highly useful in complicated cases that are difficult to explain through manuals. Moreover, animation tools also witness heightened demand for marketing patient care equipment, such as respirators, scanners, ventilators, blood purifiers, etc. In addition, animation tools are also used for medical training, driving their demand and further contributing to segment growth.

Regional Insights

The animation software market in North America held the largest revenue share and is expected to record a significant growth rate of nearly 2.4% from 2024 to 2030 due to the growing demand for animation technology in the region. The strong presence of various prominent animation studios, such as Fox Studio, Disney, and Nickelodeon, further contributes to market growth. Moreover, the thriving media & entertainment industry in the region is significantly driving the demand for animation technology. In addition, the rising use of visual effects in movies, mobile applications, and games contributes to the regional market growth.

U.S. Animation Software Market Trends

The U.S. animation software market is estimated to witness a significant growth rate of over 2.1% from 2024 to 2030. The growth is attributed to the rising demand for animation software solutions, including visual effects, 3D graphics, and artificial intelligence, across various industries such as media & entertainment, advertising, gaming, education, healthcare, etc.

Asia Pacific Animation Software Market Trends

The animation software market in Asia Pacific is expected to record the highest CAGR from 2024 to 2030. The growth is credited to the increasing adoption of animation technology across Japan, China, and South Korea, where the media & entertainment industry, including films, television series, merchandise, and events, is gaining wide prominence. In addition, the region is also witnessing rapid expansion of the manufacturing industry and infrastructure development, which is further contributing to the market growth.

The animation software market in India is estimated to record a notable growth rate of over 6.0% from 2024 to 2030. The growing demand for VFX, coupled with the increasing prominence of 3D animation software across sectors like healthcare, manufacturing, automotive, etc., is driving the market growth.

The animation software market in China accounted for the highest market share in 2023 owing to the booming economy, which created considerable demand for VFX. Moreover, the rising consumption of immersive content through platforms, such as ultra-high-definition TVs, smartphones, and tablets, enhances the market outlook.

The animation software market in Japan is expected to witness a significant CAGR from 2024 to 2030 owing to the expanding media sector, creating a demand for high-quality animation and VFX in the country.

Europe Animation Software Market Trends

The animation software market in Europe accounted for a notable revenue share in 2023 and is expected to witness notable growth over the coming years. This growth could be due to the growing demand for technology in the sports and entertainment sectors. The continued development of technology and the increasing popularity of cartoon content and graphics, especially in Germany, are driving the regional market growth.

The animation software market in the UK is expected to witness significant growth over the coming years with the increasing adoption of animation across various industries, such as entertainment, advertising, media, gaming, education, etc., in the country.

The animation software market in Germany is estimated to record a CAGR of around 4.0% from 2024 to 2030. The growth is attributed to the thriving automotive and engineering sector, wherein animation software solutions form the most crucial part of the design and manufacturing processes.

Middle East & Africa Animation Software Market Trends

The animation software market in the Middle East and Africa (MEA) region is anticipated to grow significantly from 2024 to 2030. Market growth is driven by the increasing demand for animation software solutions due to the increasing consumption of streaming video content, including animation and VFX, in the region. Besides, the rising demand for 3D animation software in the regional manufacturing industry further contributes to the market growth.

The animation software market in Saudi Arabia accounted for a considerable revenue share in 2023, owing to the ongoing expansion of the construction industry and rapid infrastructure development across the region.

Key Animation Software Company Insights

Some of the key players operating in the market include Adobe Inc., Autodesk Inc., Alludo, Pixar, and NVIDIA Corporation Airbus among others.

-

Adobe Inc. is a diversified multinational software solutions provider. The company’s solutions and services meet the needs of professionals, marketers, application developers, enterprises, and consumers for the purpose of creating, managing, delivering, and optimizing content and experiences across multiple devices

-

Autodesk Inc. is a software corporation that offers software solutions and services for designers, engineers, builders, and creators in various industries, including architecture, engineering, manufacturing, construction, automotive, media & entertainment, and education

-

NVIDIA Corporation operates as a technology company designing Application Programming Interface (APIs) and Graphic Processing Units (GPUs) for high-performance computing. It offers design and simulation solutions, such as NVIDIA RTX and NVIDIA Omniverse, that help professionals, developers, creators, and students enhance creative workflows while developing, operating, and connecting within metaverse applications

Toon Boom Animation Inc., The Foundry Visionmongers Ltd, and Planetside Software LLC are some of the emerging market participants in the animation software market.

-

Toon Boom Animation Inc. offers pre-production and 2D animation software across the globe. Some of the company's popular products include Storyboard Pro (storyboarding and layout) and Harmony (end-to-end animation), built on its high-performance tools. Harmony Gaming (drawing and animation tools for game development) and Producer (production management) are the most recent additions to its line-up

-

The Foundry Visionmongers Ltd. develops creative software for the media & entertainment sector. The company offers the art and technology for a visual experience for several prominent post-production houses and feature film studios, including ILM, Pitch Black, DNEG, Walt Disney Animation Studios, Pixar, Netflix, Marvel, etc.

Key Animation Software Companies:

The following are the leading companies in the animation software market. These companies collectively hold the largest market share and dictate industry trends.

- Adobe Inc.

- Autodesk Inc.

- Blender Foundation

- Alludo (Cascade Parent Limited)

- Corus Entertainment Inc.

- MAGIX Software GmbH

- Maxon Computer GmbH

- Vizrt

- NVIDIA Corporation

- Pixar (The Walt Disney Company)

- Planetside Software LLC

- SideFX

- The Foundry Visionmongers Ltd.

- Toon Boom Animation Inc.

- Xara GmbH

Recent Developments

-

In April 2024, Vizrt introduced a Free Graphics Packages library for its cloud-native HTML5 platform, Viz Flowics users. The SaaS platform has delivered live production workflows and seamless cloud live graphics across industries from esports to sports, broadcast, and corporate. This new feature is aimed at simplifying and expediting the production workflows while improving customer engagement

-

In March 2024, MAGIX Software GmbH launched the latest version of its iconic audio editing software, SOUND FORGE Pro 18. Developed with around three decades of innovation, SOUND FORGE Pro is the most chosen solution among audio engineers, producers, and content creators. The software is widely used for recording, audio restoration, in-depth waveform editing, and mastering

-

In March, Alludo launched new versions of its graphic design software, CorelDRAW Technical Suite, CorelDRAW Graphics Suite, CorelDRAW Standard, and CorelDRAW Essentials. These new updates are designed to help users unleash their creativity, whether they are professional designers or casual creatives

-

In February 2024, Autodesk, Inc. acquired the PIX business of X2X, a production management solution for content collaboration and secure review between creatives and executives in the media and entertainment sector. This strategic initiative is aimed at delivering both customer-driven outcomes by facilitating broader communication and collaboration while increasing the efficiency of the production process and saving customers time and money

Animation Software Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 149.00 billion

Revenue forecast in 2030

USD 182.42 Billion

Growth rate

CAGR of 3.4% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Report updated

July 2024

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, deployment, end-use, region

Regional scope

North America; Europe; Asia Pacific; South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Adobe Inc.; Autodesk Inc.; Blender Foundation; Alludo (Cascade Parent Limited); Corus Entertainment Inc.; MAGIX Software GmbH; Maxon Computer GmbH; Vizrt; NVIDIA Corporation; Pixar (The Walt Disney Company); Planetside Software LLC; SideFX; The Foundry Visionmongers Ltd; Toon Boom Animation Inc.; Xara GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Animation Software Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global animation software market report based on product, deployment, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

2D Animation

-

3D Animation

-

Flipbook Animation

-

Stop Motion

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Cloud-based

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Media & Entertainment

-

Architecture & Construction

-

Automotive

-

Healthcare & Life Sciences

-

Education & Academics

-

Government & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global animation software market size was estimated at USD 141.63 billion in 2023 and is expected to reach USD 149.00 billion in 2024.

b. The global animation software market is expected to grow at a compound annual growth rate of 3.4% from 2024 to 2030 to reach USD 182.42 billion by 2030.

b. The North America region dominated the industry with a revenue share of 37.7% in 2023. This can be attributed to the thriving media & entertainment industry in the region which is significantly driving the demand for animation technology.

b. Some key players operating in the animation software market include Adobe Inc., Autodesk Inc., Blender Foundation, Alludo (Cascade Parent Limited), Corus Entertainment Inc., MAGIX Software GmbH, Maxon Computer GmbH, Vizrt, NVIDIA Corporation, Pixar (The Walt Disney Company), Planetside Software LLC, SideFX, The Foundry Visionmongers Ltd, Toon Boom Animation Inc., and Xara GmbH

b. Key factors that are driving animation software market growth include the increased demand for animation in various industry verticals, proliferation of streaming platforms and digital media, and technological developments such as enhanced visual effects, projection mapping, and 3D printing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.