- Home

- »

- Advanced Interior Materials

- »

-

Anti-counterfeit Packaging Market, Industry Report, 2033GVR Report cover

![Anti-counterfeit Packaging Market Size, Share & Trends Report]()

Anti-counterfeit Packaging Market (2026 - 2033) Size, Share & Trends Analysis Report By Technology (Covert (Security Labels, Invisible Printing), Overt, Forensic), By Application (Pharmaceutical, Food & Beverage), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-387-4

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Anti-counterfeit Packaging Market Summary

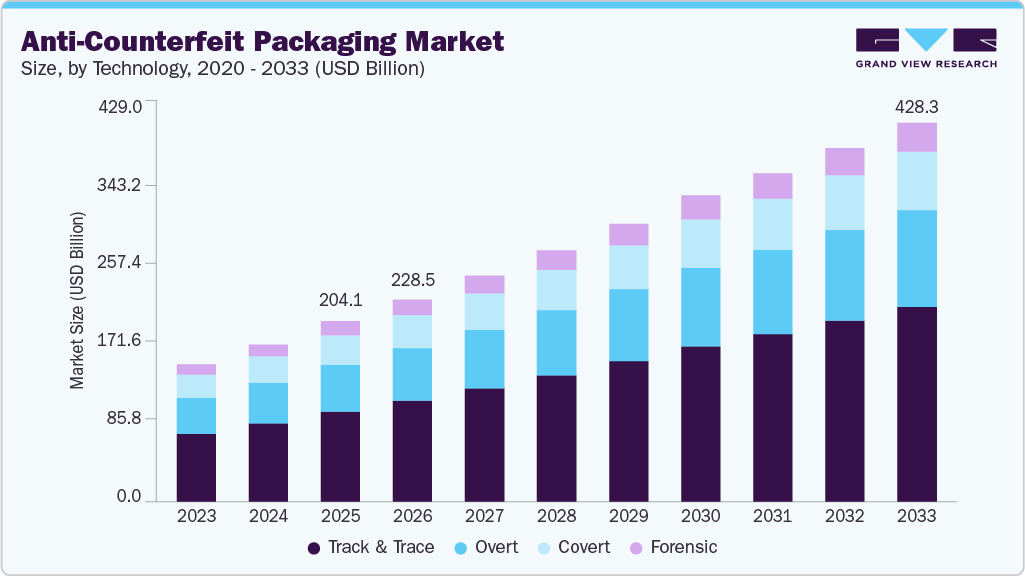

The global anti-counterfeit packaging market size was estimated at USD 204.08 billion in 2025 and is projected to reach USD 428.28 billion by 2033, growing at a CAGR of 9.4% from 2026 to 2033. The market is expected to register significant growth on account of rise in the demand for brand protection solutions for protection of pharmaceutical products.

Key Market Trends & Insights

- North America dominated the anti-counterfeit packaging industry with the largest revenue share of over 43.21% in 2025.

- The anti-counterfeit packaging industry in the U.S is expected to grow at a substantial CAGR of 10.1%% from 2026 to 2033.

- By technology, the track & trace segment accounted for the largest revenue share of 49.75% in 2025, and is forecasted to grow at a significant CAGR from 2026 to 2033 in terms of revenue.

- By application, the pharmaceutical & nutraceutical segment is expected to grow at the fastest CAGR of 10.3% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 204.08 Billion

- 2033 Projected Market Size: USD 428.28 Billion

- CAGR (2026-2033): 9.4%

- North America: Largest market

- Asia Pacific: Fastest growing market

In addition, ease in product monitoring through the supply chain is expected to drive the market growth over the next seven years. Moreover, the market is expected to be driven by rising technological development enabling increased functioning of the technology.

The primary driver of the market for anti-counterfeit packaging is the rising global concern over product counterfeiting, particularly in pharmaceuticals, luxury goods, and consumer electronics. For instance, according to the data provided by the US Customs and Border Protection, over USD 2.0 billion worth of goods and over USD 20.0 million worth counterfeit drugs were seized on the country’s border in 2022. Thus, increasing spending by the drug manufacturing companies and the U.S. government to resolve issues related to goods counterfeiting is expected to drive industry growth over the forecast period.

The rapid growth of e-commerce has significantly amplified the need for anti-counterfeit packaging solutions. With online marketplaces making it easier for counterfeiters to reach consumers, brands are investing in advanced authentication features such as QR codes and near-field communication (NFC) tags that allow customers to verify product authenticity through their smartphones. Companies such as Louis Vuitton and Nike have implemented these technologies to combat the sale of fake products on digital platforms, enabling consumers to scan and authenticate products before purchase.

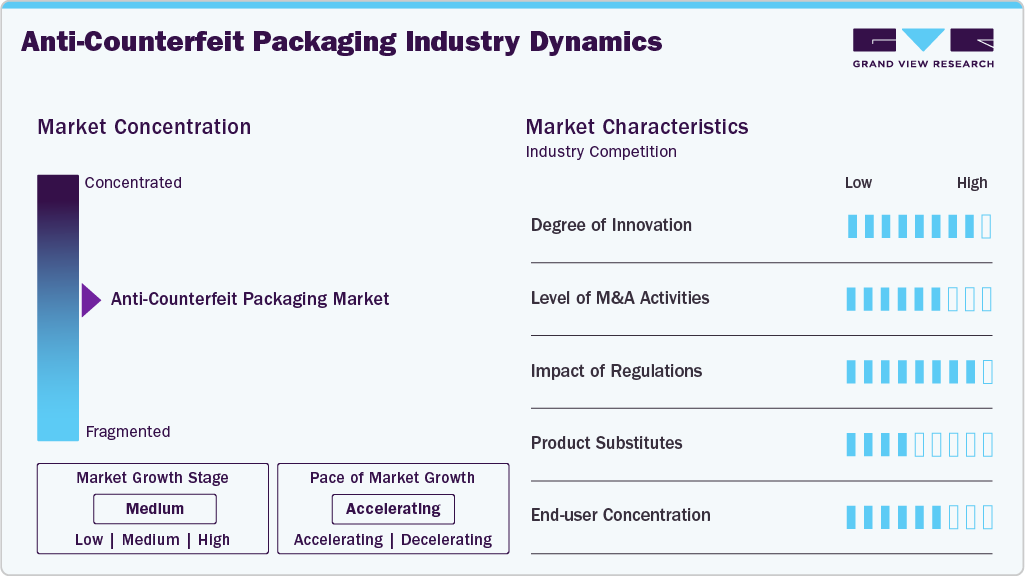

Market Concentration & Characteristics

The global anti-counterfeit packaging industry is characterized by high regulatory dependence and application-driven demand, with adoption closely tied to industries where product authenticity, brand protection, and consumer safety are critical. Pharmaceuticals, food & beverages, cosmetics, electronics, and luxury goods represent the core demand base, as these sectors face significant risks from counterfeit products, including revenue loss, reputational damage, and safety concerns. Demand is not discretionary but largely compliance- and risk-driven, making the market structurally resilient even during economic slowdowns. As a result, growth is linked more to regulatory enforcement, supply chain complexity, and brand protection strategies than to general packaging volume trends.

From a manufacturing and technology standpoint, the market is innovation-intensive rather than volume-driven, with differentiation centered on security complexity rather than physical scale. Anti-counterfeit packaging solutions, such as holograms, tamper-evident features, track-and-trace codes, RFID, NFC, and digital authentication technologies, require specialized materials, proprietary designs, and secure production environments. Production processes often involve multi-layer integration of overt, covert, and forensic security elements, increasing technical barriers to entry. Unlike conventional packaging, customization and solution-specific development are common, as security features must be tailored to product type, distribution geography, and threat level, resulting in shorter product development cycles but longer qualification and validation phases.

The industry is also defined by strong integration with brand owners, regulators, and digital infrastructure, creating high switching costs and long-term supplier relationships. Anti-counterfeit packaging solutions must align with existing filling lines, IT systems, and supply chain workflows while meeting country-specific regulations related to serialization, traceability, and labeling. Changes in solution providers often require regulatory reapproval, system integration, and distributor retraining, discouraging frequent supplier changes. Consequently, established players with proven compliance expertise, global service networks, and the ability to provide end-to-end solutions, combining physical packaging with digital authentication platforms, hold a competitive advantage.

Regulatory and policy frameworks strongly shape industry structure, particularly in pharmaceuticals and food applications. Government mandates for serialization, traceability, and tamper evidence have transformed anti-counterfeit packaging from a value-added option into a mandatory compliance component in many markets. At the same time, rising sustainability expectations are influencing material selection and design, pushing suppliers to integrate security features without compromising recyclability or increasing material usage. These regulatory and sustainability pressures raise technical and cost barriers but do not suppress demand; instead, they favor technologically advanced suppliers capable of delivering compliant, scalable, and sustainable anti-counterfeit packaging solutions across multiple regions.

Technology Insights

Based on technology, the market is segmented into covert, overt, forensic and track & trace. Track & trace dominated the overall market with a revenue share of over 49.75% in 2025 and is expected to witness robust growth with a CAGR of 9.8% over the forecast period. Track & trace technologies enable real-time monitoring of products throughout the supply chain. This can be achieved through serialization, barcodes, RFID tags, or QR codes that provide unique identifiers for each product. This segment growth is driven by the increasing demand for supply chain transparency and traceability, especially in industries where product safety and regulatory compliance are critical.

Overt technologies are easily visible security features that allow consumers and authorities to verify the authenticity of a product without specialized equipment. Common overt techniques include holograms, color-shifting inks, security labels, and tamper-evident seals. These features are often used in industries such as consumer goods, electronics, and tobacco to allow quick visual verification of a product’s authenticity, enhancing consumer trust and brand protection.

Covert technologies in anti-counterfeit packaging are hidden security features that are not visible to the naked eye, requiring specialized tools or knowledge for verification. These technologies often include security labels, invisible printings, microtext, or embedded markers that can be detected using UV light, special readers, or magnification. Covert solutions are widely used in industries such as pharmaceuticals, electronics, and luxury goods to provide discreet yet robust protection against counterfeiting without alerting counterfeiters to the presence of the security feature.

Forensic technology is expected to be one of the most secure anti-counterfeit services owing to the high technologies and high security against copying. DNA, biological and chemical taggants and isotope ratios are the key examples for forensic anti-counterfeit market.

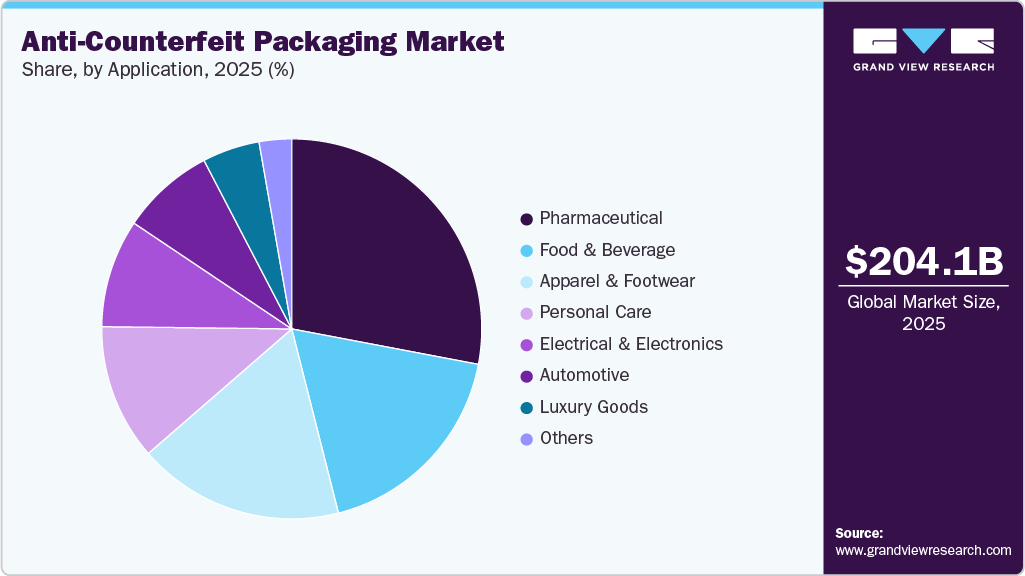

Application Insights

Based on application, the market is segmented into pharmaceutical, food & beverage, apparel & footwear, automotive, personal care, electrical & electronics, luxury goods, and other applications. The pharmaceutical segment accounted for the major revenue share of over 27.99% in 2025 and is expected to witness robust growth with a CAGR of 10.3% over the forecast period. Anti-counterfeit packaging in the pharmaceutical industry ensures the authenticity of medicines, helping to prevent the circulation of fake drugs that could harm patients.

In the food and beverage sector, anti-counterfeit packaging helps ensure product safety and quality. Techniques such as tamper-evident seals, QR codes, and holographic labels protect consumers from fraudulent products while maintaining brand trust. Additionally, the rise in online food purchases and global trade has created new vulnerabilities, leading to higher demand for secure packaging solutions in this sector.

The apparel and footwear industry is highly susceptible to counterfeit products. Growing global e-commerce sales, particularly in luxury and branded apparel, and the increasing presence of counterfeit goods are major drivers for anti-counterfeit packaging in this industry. Brand protection and maintaining consumer trust are key reasons for implementing anti-counterfeit packaging in this sector.

Moreover, the electrical and electronics industry uses anti-counterfeit packaging to ensure the authenticity of products such as gadgets, components, and devices. The growing demand for branded electronic products and the rising risk of counterfeit items in global electronics markets are major drivers for anti-counterfeit packaging in this industry. Consumer safety concerns, product warranty issues, and protection against gray market sales also contribute to the adoption of secure packaging solutions.

Regional Insights

North America anti-counterfeit packaging industry dominated the global market with the largest revenue share of over 43.21% in 2025. This dominance is attributed primarily due to North America’s robust regulatory framework and stringent enforcement measures. The FDA's Drug Supply Chain Security Act (DSCSA) and the Food Safety Modernization Act (FSMA) have mandated sophisticated tracking and authentication systems for pharmaceuticals and food products. These regulations have compelled companies to invest heavily in advanced anti-counterfeit technologies such as RFID tags, security holograms, and blockchain-based tracing systems.

U.S. Anti-counterfeit Packaging Market Trends

U.S. anti-counterfeit packaging industry is primarily driven by the large consumer goods market. Companies such as Nike, Inc. and Apple Inc. have faced considerable challenges with counterfeit products, leading them to invest heavily in advanced packaging solutions. Moreover, the presence of leading technology companies and packaging innovators in the U.S. further strengthens its position in the global anti-counterfeit packaging industry. Companies such as 3M and DuPont have developed cutting-edge anti-counterfeit solutions such as color-shifting films, microscopic taggants, and blockchain-based tracking systems. The food and beverage industry has also adopted these technologies extensively, with companies such as The Coca-Cola Company implementing tamper-evident seals and unique bottle designs to prevent counterfeiting.

Europe Anti-counterfeit Packaging Market Trends

The Europe anti-counterfeit packaging industry is driven by the region's strong focus on protecting intellectual property rights and brand value, which has led to significant investments in innovative anti-counterfeit packaging solutions. For example, major luxury brands such as LVMH and Gucci have implemented holographic labels, RFID tags, and blockchain-based verification systems to combat counterfeiting. The wine and spirits industry in Europe has been particularly proactive, with companies such as Pernod Ricard using NFC-enabled bottles and tamper-evident closures to ensure authenticity and protect their premium beverage brands.

The anti-counterfeit packaging industry in the UK is primarily driven by its strict regulatory framework and robust intellectual property protection laws. The UK Intellectual Property Office (IPO) works closely with industries to combat counterfeiting, while legislation like the Trademarks Act 1994 and the Fraud Act 2006 provide strong legal foundations for anti-counterfeiting measures. These regulations have compelled businesses across various sectors to invest heavily in sophisticated packaging solutions, from pharmaceutical companies to luxury goods manufacturers.

Asia Pacific Anti-counterfeit Packaging Market Trends

Asia Pacific anti-counterfeit packaging industry is driven by the large population base and growing middle class have created a substantial market for branded products, particularly in sectors such as cosmetics, wines & spirits, and fashion. This has simultaneously attracted counterfeiters while pushing legitimate manufacturers to invest in advanced anti-counterfeit packaging solutions. For example, companies such as Samsung and LG have implemented sophisticated track-and-trace systems and tamper-evident packaging for their electronics products.

China anti-counterfeit packaging industry has faced significant challenges with counterfeit products across multiple industries, from luxury goods to pharmaceuticals and electronics. This has led to increased pressure from both domestic consumers and international trading partners for better authentication and security measures. Major Chinese e-commerce platforms such as Alibaba and JD.com have invested heavily in anti-counterfeit technologies, including blockchain-based tracking systems and smart packaging solutions, to protect their reputation and maintain consumer trust.

Central & South America Anti-counterfeit Packaging Market Trends

The Central & South America anti-counterfeit packaging industry is driven by the regional economic integration and trade agreements that have necessitated stronger anti-counterfeit measures to protect intellectual property rights and ensure product safety across borders. The Pacific Alliance, comprising Chile, Colombia, Mexico, and Peru, has implemented standardized packaging security requirements, driving the adoption of advanced anti-counterfeit technologies.

Middle East & Africa Anti-counterfeit Packaging Market Trends

The anti-counterfeit packaging industry in MEA is driven by the rapid growth of e-commerce and cross-border trade in the region, which has contributed to the growth of the anti-counterfeit packaging industry. Major economic hubs such as Dubai, Abu Dhabi, and Saudi Arabia have become significant transit points for global trade, necessitating stronger anti-counterfeit measures. These countries have implemented strict regulations requiring businesses to adopt sophisticated packaging solutions to protect brand integrity and consumer safety. For example, the Saudi Food and Drug Authority (SFDA) has mandated track-and-trace systems for pharmaceutical products, driving the adoption of serialization and authentication technologies.

Key Anti-counterfeit Packaging Company Insights

The anti-counterfeit packaging industry is fragmented across the globe as many small manufacturers are trying to enter the market with new production technology. Competition between companies is completely based on the technology offered and the innovation implemented. Companies are investing huge amounts in merger & acquisitions and R&D activities and innovation to gain competitive advantage.

-

In November 2022, Holostik India launched Optashield, an advanced anti-counterfeiting security product, during the Label India Expo 2022. This innovative technology utilizes custom holographic methods to display two distinct colors when viewed from different angles, making it one of the most secure and convenient authentication devices in the anti-counterfeit industry.

-

In September 2022, UbiQD, Inc., a nanotechnology company based in New Mexico, and SICPA HOLDING SA, a Swiss company in security inks, announced an expansion of their partnership focused on developing anti-counterfeit security inks utilizing UbiQD's advanced quantum dot technology. This collaboration aims to enhance security applications by leveraging the unique optical properties of quantum dots (QDs), which are semiconductor nanoparticles known for their high efficiency in photoluminescence across a broad spectrum of colors.

-

In June 2022, Exxon Mobil Corporation launched a new line of lubricants under the "Mobil Super" brand, featuring enhanced packaging that incorporates a QR-code-based anti-counterfeit system. This initiative aims to provide consumers with a reliable method for verifying the authenticity of the products they purchase, thereby combating counterfeiting in the lubricant market.

Key Anti-counterfeit Packaging Companies:

The following are the leading companies in the anti-counterfeit packaging market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- AVERY DENNISON CORPORATION

- CCL Industries

- DuPont

- Zebra Technologies Corp.

- ITL Group

- SML Group

- SATO Holdings Corporation

- SICPA HOLDING SA

- Systech International

- Applied DNA Sciences

- AlpVision SA

- Authentix

- Atlantic Zeiser GmbH

Anti-counterfeit Packaging Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 228.49 billion

Revenue forecast in 2033

USD 428.28 billion

Growth rate

CAGR of 9.4% from 2026 to 2033

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

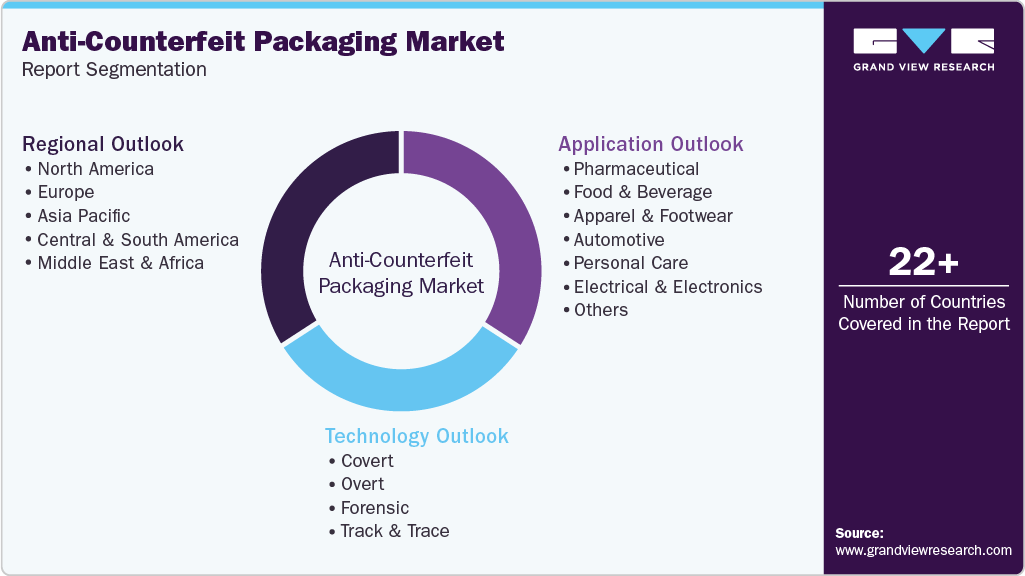

Segments covered

Technology, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Taiwan; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

3M; AVERY DENNISON CORPORATION; CCL Industries; DuPont; Zebra Technologies Corp.; ITL Group; SML Group; SATO Holdings Corporation; SICPA HOLDING SA; Systech International; Applied DNA Sciences; AlpVision SA; Authentix; Atlantic Zeiser GmbH

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Anti-counterfeit Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the anti-counterfeit packaging market report based on technology, application, and region:

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Covert

-

Security Labels

-

Invisible Printing

-

Others

-

-

Overt

-

Holograms

-

Color Shifting Inks

-

Others

-

-

Forensic

-

Track & Trace

-

Machine Readable Data

-

RFID

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical

-

Food & Beverage

-

Apparel & Footwear

-

Automotive

-

Personal Care

-

Electrical & Electronics

-

Luxury Goods

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Taiwan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the anti-counterfeit packaging market include Avery Dennison Corporation, CCL Industries Inc., Zebra Technologies, Sicpa Holding S.A., Alp Vision S.A., and Authentix Inc.

b. Key factors driving market growth include rising technological innovation in the production of highly secure packaging for use in application industries and the growing focus of product manufacturers on maintaining brand image.

b. The global anti-counterfeit packaging market size was estimated at USD 204.08 billion in 2025 and is expected to reach USD 228.49 billion in 2026.

b. The global anti-counterfeit packaging market is expected to grow at a compound annual growth rate of 9.4% from 2026 to 2033, reaching USD 428.28 billion by 2033.

b. North America dominated the anti-counterfeit packaging market, with a share of over 43.21% in 2025. This is attributable to the growing number of counterfeit goods seized by government agencies and the increased penetration of counterfeit products in the food and beverage, apparel and footwear, and pharmaceutical industries, which leads to loss of sales.

b. The pharmaceutical segment dominated the anti-counterfeit packaging market, accounting for a share of over 27.99% in 2025. This is attributed to the growing counterfeiting of drugs globally, leading to increased demand for anti-counterfeiting technologies-based packaging.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.