- Home

- »

- Next Generation Technologies

- »

-

Anti-drone Market Size, Share And Trends Report, 2030GVR Report cover

![Anti-drone Market Size, Share & Trends Report]()

Anti-drone Market Size, Share & Trends Analysis Report By Component (Hardware, Software), By Type, By Range, By Technology, By Mitigation Type, By Defense Type, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-241-9

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Anti-drone Market Size & Trends

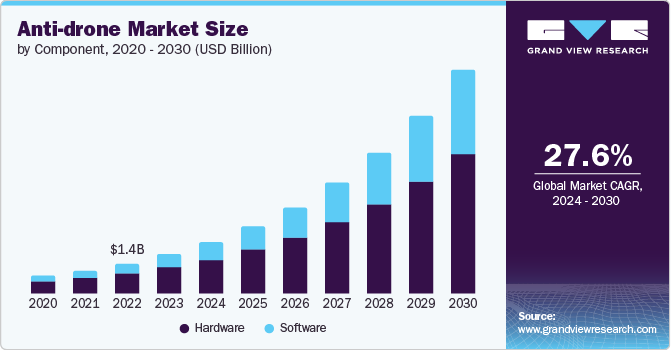

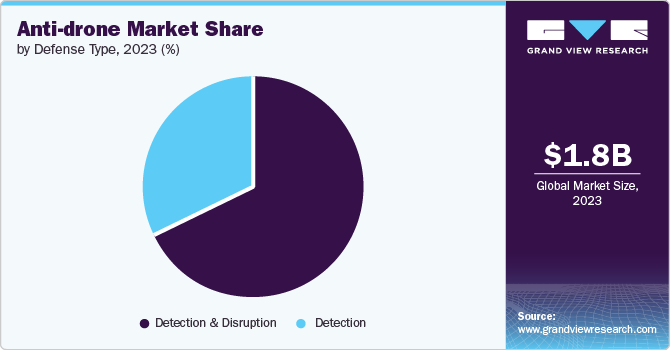

The global anti-drone market size was estimated at USD 1.87 billion in 2023 and is expected to grow at a CAGR of 27.6% from 2024 to 2030. The rising number of incidents involving drones breaching security in critical areas such as airports, government buildings, and public events is driving the demand for anti-drone solutions. In response, governments, military forces, and security agencies are investing heavily in the development and deployment of sophisticated anti-drone technologies, which is further fueling the market expansion.

The use of drones for illicit activities and growing drone-based terrorist activities is another major factor driving the adoption of anti-drone systems. Drones are increasingly used for illegal activities such as drug trafficking, human smuggling, and weapons smuggling owing to their ability to bypass traditional security measures and navigate difficult terrains. In response, anti-drone systems are deployed to secure borders and prevent these illicit activities. These systems include radar-based, RF-based, and electro-optical detection technologies to identify and track drones, and countermeasures such as jamming, interception, and laser systems to neutralize threats. Integration with existing security infrastructure, real-time data analytics, and supportive regulatory measures enhance the effectiveness of anti-drone solutions.

Governments worldwide are increasingly implementing regulations and guidelines to control unauthorized drone activities, significantly boosting the adoption of anti-drone systems. These regulations often mandate the registration of drones, enforce no-fly zones around sensitive areas such as airports and government buildings, and establish strict penalties for illegal drone operations. Additionally, guidelines are being developed to standardize the use of anti-drone technologies by law enforcement and security agencies, ensuring legal and ethical deployment, which is further driving the market expansion.

The integration of anti-drone systems with existing security infrastructure, such as CCTV cameras, access control systems, and perimeter security systems, is significantly enhancing the overall security framework. These systems are designed to detect, identify, and neutralize unauthorized drones, thereby adding an extra layer of protection to critical areas. By linking anti-drone systems to command and control centers, security personnel can achieve real-time monitoring and analysis of potential drone threats. This connectivity allows for a swift and coordinated response, ensuring that any unauthorized drone activity is promptly addressed. The comprehensive integration ensures that security measures are not only robust but also adaptable to the evolving nature of drone-related threats, ultimately providing a more secure and controlled environment.

Companies operating in the market have adopted various strategies to enhance their market presence. Companies operating in the anti-drone market have adopted various strategies to enhance their market presence, including technological innovation, strategic partnerships, and extensive research and development efforts. By focusing on advancements in detection and neutralization technologies, these companies are able to offer cutting-edge solutions that address emerging drone threats effectively.

For instance, in January 2024, Safran Electronics & Defense launched the Skyjacker counter-drone system at Eurosatory 2024. This system uses spoofing technology to alter drone trajectories by simulating GNSS signals, effectively neutralizing threats. Skyjacker is integrated with radar detection, optronic identification, and can counter isolated drones and swarms in land and naval environments. It features a modular design with command and control units and spoofing transmitters, and is compatible with various sensors and effectors. Additionally, companies are forming strategic alliances with security firms and government agencies to expanding their reach and credibility.

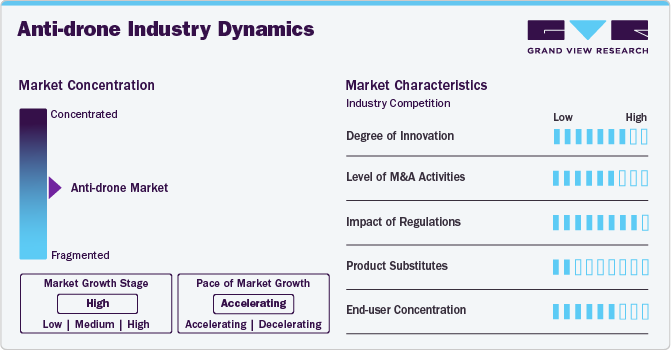

Market Concentration & Characteristics

The anti-drone market is characterized by a high degree of innovation. Military agencies across the world are investing heavily in advanced counter-drone technologies such as high-energy lasers, high-power microwave systems, and artificial intelligence-based systems. Companies are also integrating emerging technologies like blockchain to enhance the security and traceability of anti-drone operations. This focus on technological innovation is a key growth driver of the market.

The level of mergers & acquisition activities in the market is expected to be moderate. Companies operating in this sector are engaging in M&A activities to expand their product offerings, acquire new technologies and strengthen their competitive positions. There is an increasing number of start-ups and smaller players entering the market with new products and solutions. This has led to a moderate level of merger and acquisition (M&A) activities as larger players seek to acquire innovative technologies and expand their market presence.

The impact of regulations on the market is expected to be moderate to high. Governments and regulatory bodies are implementing stricter guidelines and policies to address the growing threat of unauthorized drone activities, particularly in sensitive areas like airports and critical infrastructure. Compliance with these regulations is a key consideration for companies operating in the anti-drone market.

The competition from product substitutes in the market is expected to be low owing to the unique features and benefits that anti-drone devices offer. There are no direct substitutes for anti-drone systems. The market faces competition from alternative solutions such as traditional physical security measures and other aerial defense systems. However, the unique capabilities of anti-drone technologies, such as their ability to detect, track, and neutralize small drones, make them an increasingly essential component of comprehensive security strategies.

The end user concentration in the market is expected to be high with the defense and homeland security sectors being the primary customers. Critical infrastructure operators, such as airports and energy facilities, are also significant End Users of anti-drone solutions. The high demand from these key sectors, coupled with the specialized nature of the technology, contributes to the overall concentration of the market.

Component Insights

The hardware segment registered the largest market shareof 68% in 2023. Hardware components such as sensors, radars, and jammers are essential for detecting, tracking, and neutralizing unauthorized drones effectively. These hardware solutions provide a tangible and immediate defense mechanism against rogue drones, making them a crucial aspect of anti-drone systems. Additionally, advancements in hardware technology have led to the development of more sophisticated and reliable anti-drone devices, further driving the demand for hardware-based solutions.

The software segment is expected to grow at the fastest CAGR of over 30% from 2024 to 2030. This rapid expansion is driven by the advancements in drone technology which have led to increased concerns regarding security and privacy breaches, especially in sensitive areas such as airports, government facilities, and public events. Additionally, the rising incidents of drone-related disruptions, including illegal surveillance, smuggling activities, and potential terrorist threats, have further propelled the need for robust anti-drone solutions.

Type Insights

The ground-based segment registered the largest market sharein 2023. The growth is attributable to the ability of ground-based systems to provide continuous surveillance and protection against drone threats makes them a popular choice for various applications such as critical infrastructure protection, event security, and military installations.

The UAV-based segment is expected to register the fastest CAGR from 2024 to 2030. This growth can be attributed to several factors such as technological advancements in UAVs, improved detection capabilities, cost-effectiveness, and autonomous operation enabled by AI integration. UAVs provide a cost-effective solution for monitoring airspace and detecting potential threats posed by rogue drones. Their ability to cover large areas quickly and efficiently makes them ideal for securing critical infrastructure and public spaces against unauthorized drone incursions.

Range Insights

The less than 5 km segment registered the largest revenue share in 2023, owing to the increasing demand for short-range anti-drone systems in urban areas, critical infrastructure sites, and events where close-proximity protection is essential. This segment’s dominance can be attributed to factors such as the rising incidents of unauthorized drone activities near sensitive locations, the need for rapid response capabilities, and the effectiveness of short-range solutions in countering low-altitude threats.

The more than 5 km segment is anticipated to witness significant growth from 2024 to 2030. This growth can be attributed increasing adoption of anti-drone technologies by critical infrastructure facilities, government agencies, and military organizations to protect against unauthorized drone activities. Additionally, advancements in detection and mitigation technologies, including radar systems, RF sensors, jamming devices, and drone capture mechanisms, are expected to drive the market growth in the more than 5 km segment.

Technology Insights

The anti-drone radar segment registered the largest revenue share in 2023, owing to the widespread adoption of anti-drone radars as it offers advanced features such as long-range detection, high accuracy, and the ability to differentiate between drones and other flying objects, which make them a preferred choice for organizations looking to enhance their airspace security. Additionally, advancements in radar technology, including the integration of artificial intelligence and machine learning algorithms for improved threat identification and mitigation, have further boosted the adoption of anti-drone radar systems in the market.

The thermal image segment is anticipated to record the fastest growth from 2024 to 2030, owing to the increasing demand for thermal imaging technology in drone detection. The rising adoption of thermal cameras and sensors in advanced anti-drone systems is further driven by their ability to detect the heat signatures of drones, enabling early warning and effective countermeasures against unauthorized UAV incursions.

Mitigation Type Insights

The destructive segment registered the largest revenue share in 2023, owing to the increasing demand for counter-drone technologies that can effectively neutralize unauthorized drones. This segment includes technologies such as jamming systems, laser systems, and kinetic impact solutions that are designed to physically disable or destroy rogue drones. With the rising incidents of drone-related security breaches and threats, governments, defense organizations, and critical infrastructure operators are investing significantly in advanced anti-drone systems capable of swiftly responding to potential risks which has further fueled the demand for destructive segment.

The non-destructive segment is anticipated to witness significant growth from 2024 to 2030. This growth can be attributed to the increasing incidents of unauthorized drone activities, security breaches, and privacy concerns across various sectors such as defense, government, critical infrastructure, and commercial facilities. In addition, innovations in anti-drone technologies, such as radio frequency (RF) sensors, radar systems, acoustic sensors, and optical cameras, are driving the growth of the non-destructive segment.

Defense Type Insights

The detection & disruption segment in the market registered the largest revenue share in 2023. This growth can be attributed to the growing emphasis on comprehensive anti-drone solutions that encompass both early detection capabilities and effective countermeasures to mitigate potential risks effectively.

The detection segment is anticipated to record the fastest growth from 2024 to 2030. This surge is primarily driven by the growing demand for advanced detection technologies to identify and neutralize rogue drones effectively. Furthermore, leading counter-drone technology providers and system manufacturers provide a wide range of tracking, diagnostic equipment, and professional detection solutions to meet this growing demand. These tools include acoustic sensors, perimeter detection and monitoring radars, video and infrared systems, and RF spectrum analyzers.

End-use Insights

The military & defense segment in the market registered the largest revenue share in 2023, owing to the increasing adoption of anti-drone technologies by defense organizations worldwide. With the rising threats posed by drones in military operations, governments are investing heavily in advanced anti-drone systems to protect critical infrastructure, military assets, and personnel. The military sector’s stringent security requirements and the need for cutting-edge counter-drone solutions have propelled the growth of this segment.

The commercial segment is anticipated to record the fastest growth from 2024 to 2030. The rise in unauthorized drone activities near sensitive areas like airports, stadiums, and government buildings has propelled the demand for advanced anti-drone technologies in the commercial sector. Additionally, advancements in anti-drone technology, including AI-powered detection systems, jamming devices, and drone capture mechanisms, are making these solutions more efficient and reliable for commercial applications.

Regional Insights

North America accounted for the highest revenue share of over 43% in 2023. This can be attributed to the region's advanced technological infrastructure, presence of major tech giants, and strong emphasis on research and innovation. The region's robust regulatory framework, significant investments in cybersecurity, and highly skilled workforce also contribute to its leading position. Additionally, the North American market benefits from its collaborative ecosystem, government support for Anti-drone initiatives, and widespread adoption of Anti-drone solutions across various sectors, including healthcare, automotive, and manufacturing.

U.S. Anti-drone Market Trends

The anti-drone market in U.S. is projected to grow at a CAGR of over 23% from 2024 to 2030. The companies in the U.S. are investing heavily in research and development to enhance their anti-drone technologies. This includes the development of cutting-edge solutions such as radar systems, radio frequency detection, jamming devices, and artificial intelligence for more effective drone detection, tracking, and neutralization.

Europe Anti-drone Market Trends

The anti-drone market in Europe is anticipated to grow at a CAGR of over 28% from 2024 to 2030. This growth is driven by the increasing use of consumer drones and the rising concerns over security threats posed by unauthorized drone operations.

UK anti-drone market is anticipated to grow at a CAGR of 27% from 2024 to 2030. The growth of the market in the UK can be attributed to the need to protect critical infrastructure, public events, and sensitive areas from potential drone-related risks.

The anti-drone market in Germany is expected to grow at a CAGR of 29% from 2024 to 2030. The country’s focus on security and defense technologies has led to an increased demand for anti-drone systems to counter the rising threats posed by unmanned aerial vehicles (UAVs) in various sectors. Additionally, the German government is actively promoting the development and deployment of anti-drone solutions to safeguard critical infrastructure, public events, and sensitive locations from drone-related risks.

France anti-drone market is projected to grow at a CAGR of over 29% from 2024 to 2030. The increasing adoption of drones for commercial, recreational, and illicit activities has spurred the demand for anti-drone systems in France. This growth is expected to continue as security concerns related to drone incursions persist across various industries including aviation industry, commercial enterprises, and others.

Asia Pacific Anti-drone Market Trends

The anti-drone market in the Asia-Pacific region is expected to account for the fastest growth of over 31% from 2024 to 2030. The market growth is primarily driven by the increasing incidents of security breaches by unauthorized drones, rise in terrorist activities, drone detection cases, and close encounters with commercial aircraft.

China anti-drone market is projected to grow at a CAGR of over 28% from 2024 to 2030. The Chinese government has been proactive in addressing security concerns related to drones. There have been initiatives to regulate drone usage and promote the development and deployment of anti-drone technologies to safeguard critical infrastructure and public safety.

The anti-drone market in Japan is expected to grow at a CAGR of 29% from 2024 to 2030. The increasing adoption of consumer drones globally has led to a surge in the demand for anti-drone systems to mitigate potential threats posed by unauthorized drone activities.

India anti-drone market is expected to grow at a CAGR of 35% from 2024 to 2030. The widespread availability and affordability of devices, combined with cloud computing, analytics, is driving the rapid growth of the market in India.

Middle East & Africa Anti-drone Market Trends

The anti-drone market in Middle East and Africa is expected to grow at the CAGR of over 30% from 2024 to 2030, owing to the escalating security concerns in the region due to geopolitical tensions, terrorist threats, and increasing drone-related incidents have necessitated the adoption of advanced anti-drone technologies.

Saudi Arabia anti-drone market is anticipated to grow at a CAGR of over 31% from 2024 to 2030. Saudi Arabia’s strategic geopolitical position and its efforts to enhance its defense capabilities further drive the need for advanced anti-drone systems. Additionally, the rising investments in defense and security infrastructure by the Saudi government contribute to the market growth.

Key Anti-drone Company Insights

Some of the key players operating in the market include Lockheed Martin Corporation, Thales Group, Raytheon Company.

-

Lockheed Martin Corporation is a global aerospace, defense, arms, security, and advanced technologies company and operates through four main business segments: Aeronautics, Missiles and Fire Control, Rotary and Mission Systems, and Space. Lockheed Martin is known for its advanced military aircraft such as the F-35 Lightning II fighter jet and the F-22 Raptor. The company also provides various defense and security solutions, including missile defense systems, naval systems, cybersecurity solutions, and space exploration technologies.

-

Thales Group is a multinational company based in France that operates in the aerospace, defense, transportation, and security markets. The company specializes in providing solutions for critical infrastructure protection, cybersecurity, air traffic management, satellite navigation systems, and communication networks. Thales has a strong focus on innovation and technology development to meet the evolving needs of its customers worldwide. The company’s diverse portfolio includes products such as avionics systems for aircraft, radar systems for defense applications, transportation systems for railways and urban mobility, as well as digital security solutions.

Blighter Surveillance Systems; Dedrone; and DeTect, Inc. are some of the emerging participants in the anti-drone market.

-

Blighter Surveillance Systems is a UK-based company specializing in the development and manufacturing of advanced electronic-scanning radars and surveillance solutions. The company’s anti-drone systems are designed to detect, track, and classify drones in various environments, providing real-time situational awareness to security forces and organizations. Blighter’s technology integrates radar, cameras, and software to offer a comprehensive solution for countering unauthorized drone activities.

-

Dedrone is a global leader in airspace security, offering a range of anti-drone solutions to protect critical infrastructure, government facilities, public events, and private properties from the threats posed by drones. Dedrone’s platform combines RF sensors, cameras, and AI-based software to detect and mitigate unauthorized drone incursions effectively. The company focuses on providing scalable and customizable anti-drone systems that can be tailored to meet the specific needs of different clients.

Key Anti-drone Companies:

The following are the leading companies in the anti-drone market. These companies collectively hold the largest market share and dictate industry trends.

- Advanced Radar Technologies S.A.

- Airbus Group SE

- Blighter Surveillance Systems

- Dedrone

- DeTect, Inc.

- Droneshield LLC

- Enterprise Control Systems

- Israel Aerospace Industries Ltd. (IAI)

- Liteye Systems, Inc.

- Lockheed Martin Corporation

- Orelia

- Prime Consulting and technologies

- Raytheon Company

- Saab Ab

- Selex Es Inc.

- Thales Group

- The Boeing Company

Recent Developments

-

In June 2024, Deddrone launched DedroneOnTheMove to enhance the fight against unauthorized and malicious drones. This new solution is designed to provide mobile protection against drone threats, enabling users to detect and mitigate potential risks posed by drones in various environments. DedroneOnTheMove aims to address the growing concerns related to drone misuse and security breaches by offering a portable and adaptable system that can be deployed quickly and effectively.

-

In May 2024, Droneshield announced the release of DroneSentry C2 Next-Gen v1.00, an advanced command-and-control system that enhances the capabilities of anti-drone systems by providing centralized monitoring and control functionalities. It allows users to efficiently manage multiple sensors and countermeasures to protect critical infrastructure, public events, military installations, and other sensitive areas from potential drone threats.

-

In Febraury 2022, Cisco Systems Inc, announced advancements to its Anti-drone portfolio to simplify data management at massive scale for low-cost, often-stationary devices. The enhanced Anti-drone SaaS platform, Cisco Anti-drone Control Center, manages nearly 200 million devices across all licensed cellular networks (LPWAN/4G/5G) and provides a single platform for service providers and enterprise customers to address a broad range of Anti-drone use cases, from low-to-high complexity.

Anti-drone Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.44 billion

Revenue forecast in 2030

USD 10.56 billion

Growth rate

CAGR of 27.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report Deployment

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, type, range, technology, mitigation type, defense type, end-use, regional

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; UAE

Key companies profiled

Advanced Radar Technologies S.A.; Airbus Group SE; Blighter Surveillance Systems; Dedrone; DeTech Inc.; Droneshield LLC; Enterprise Control Systems; Israel Aerospace Industries Ltd. (IAI); Liteye Systems, Inc.; Lockheed Martin Corporation; Orelia; Prime Consulting and technologies; Raytheon Company; Saab Ab; Selex Es Inc.; Thales Group; The Boeing Company

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Anti-drone Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global anti-drone market report based on component, type, range, technology, mitigation type, defense type, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Radars

-

Acoustic Sensors

-

Infrared and Video Surveillance Systems

-

RF Detectors

-

Jammers

-

Others

-

Software

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Ground Based

-

Fixed

-

Mobile

-

Handheld

-

UAV Based

-

-

Range Outlook (Revenue, USD Million, 2018 - 2030)

-

Less than 5 km

-

More than 5 km

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Anti-drone Radar

-

RF Scan

-

Thermal Image

-

Others

-

-

Mitigation Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Destructive System

-

Laser System

-

Missile Effector

-

Electronic Countermeasure

-

Non-destructive System

-

-

Defense Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Drone Detection & Disruption Systems

-

Drone Detection Systems

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Military & Defense

-

Commercial

-

Public Spaces

-

Critical Infrastructures

-

Energy & Utilities

-

Sports Stadiums

-

Airport

-

Data Centers

-

-

Others

-

Government

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Australia

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global anti-drone market size was estimated at USD 1.87 billion in 2023 and is expected to reach USD 2.44 billion in 2024.

b. The global anti-drone market is expected to grow at a compound annual growth rate of 27.6% from 2024 to 2030 to reach USD 10.56 billion by 2030.

b. North America dominated the anti-drone market with a share of 43% in 2022. This is attributable to the aerospace and defense sector, especially in U.S., which is witnessing a growing adoption of anti-drone systems and technologies.

b. Some key players operating in the anti-drone market include Dedrone GmbH, Advanced Radar Technologies, Droneshield, Thales Group, Blighter Surveillance Systems, Airbus Group SE, and The Boeing Company.

b. Key factors that are driving the anti-drone market growth include a significant rise in the adoption of unmanned aerial vehicles (UAVs) for commercial and recreational applications and an increase in the number of security breach incidents in public places and critical government infrastructure.

Table of Contents

Chapter 1 Anti-drone Market: Methodology and Scope

1.1 Market Segmentation & Scope

1.2 Market Definitions

1.3 Information Procurement

1.3.1 Information analysis

1.3.2 Market formulation & data visualization

1.3.3 Data validation & publishing

1.4 Research Scope and Assumptions

1.4.1 List to data sources

Chapter 2 Anti-drone Market: Executive Summary

2.1 Market Snapshot

2.2 Segment Snapshot

2.3 Competitive Landscape Snapshot

Chapter 3 Anti-drone Market: Industry Outlook

3.1 Market Lineage

3.2 Industry Value Chain Analysis

3.3 Market Dynamics

3.3.1 Market driver analysis

3.3.1.1 Rising use of drones in illicit activities

3.3.1.2 Increase in drone sightings and close encounters with aircrafts

3.3.1.3 Growth in drone-based terrorist activities

3.3.2 Market challenge analysis

3.3.2.1 Organizational challenges to regulatory enforcement and compliance

3.4 Industry Opportunities & Challenges

3.5 Industry Analysis Tools

3.5.1 Porter’s analysis

3.5.2 Macroeconomic analysis

Chapter 4 Anti-drone Market Component Outlook

4.1 Anti-drone Market Share By Component, 2018 - 2030 (USD Million)

4.2 Component Movement Analysis & Market Share, 2023 & 2030

4.3 Anti-drone Market Estimates & Forecast, By Component (USD Million)

4.3.1 Hardware

4.3.1.1 Radars

4.3.1.2 Acoustic sensors

4.3.1.3 Infrared and video surveillance systems

4.3.1.4 RF detectors

4.3.1.5 Jammers

4.3.1.6 Others

4.3.2 Software

Chapter 5 Anti-drone Market Type Outlook

5.1 Anti-drone Market Share By Type, 2018 - 2030 (USD Million)

5.2 Type Movement Analysis & Market Share, 2023 & 2030

5.3 Anti-drone Market Estimates & Forecast, By Type (USD Million)

5.3.1 Ground based

5.3.1.1 Fixed

5.3.1.2 Mobile

5.3.2 Handheld

5.3.3 UAV based

Chapter 6 Anti-drone Market Range Outlook

6.1 Anti-drone Market Share By Range, 2018 - 2030 (USD Million)

6.2 Range Movement Analysis & Market Share, 2023 & 2030

6.3 Anti-drone Market Estimates & Forecast, By Range (USD Million)

6.3.1 Less than 5 km

6.3.2 More than 5 km

Chapter 7 Anti-drone Market Technology Outlook

7.1 Anti-drone Market Share By Technology, 2018 - 2030 (USD Million)

7.2 Technology Movement Analysis & Market Share, 2023 & 2030

7.3 Anti-drone Market Estimates & Forecast, By Technology (USD Million)

7.3.1 Anti-drone radar

7.3.2 RF scan

7.3.3 Thermal image

7.3.4 Others

Chapter 8 Anti-drone Market Mitigation Type Outlook

8.1 Anti-drone Market Share By Mitigation Type, 2018 - 2030 (USD Million)

8.2 Mitigation Type Movement Analysis & Market Share, 2023 & 2030

8.3 Anti-drone Market Estimates & Forecast, By Mitigation Type (USD Million)

8.3.1 Destructive type

8.3.1.1 Laser Systems

8.3.1.2 Missile effector

8.3.1.3 Electronic countermeasure

8.3.2 Non-destructive type

Chapter 9 Anti-drone Market Defense Type Outlook

9.1 Anti-drone Market Share By Defense Type, 2018 - 2030 (USD Million)

9.2 Defense Type Movement Analysis & Market Share, 2023 & 2030

9.3 Anti-drone Market Estimates & Forecast, By Defense Type (USD Million)

9.3.1 Detection & disruption systems

9.3.2 Detection systems

Chapter 10 Anti-drone Market End Use Outlook

10.1 Anti-drone Market Share By End Use, 2018 - 2030 (USD Million)

10.2 End Use Movement Analysis & Market Share, 2023 & 2030

10.3 Anti-drone Market Estimates & Forecast, By End Use (USD Million)

10.3.1 Military & Defense

10.3.2 Commercial

10.3.2.1 Public Spaces

10.3.2.2 Critical Infrastructures

10.3.2.2.1 Energy & Utilities

10.3.2.2.2 Sports Stadiums

10.3.2.2.3 Airport

10.3.2.2.4 Data Centers

10.3.2.2.5 Others

10.3.3 Government

Chapter 11 Anti-drone Regional Outlook

11.1 Anti-drone Market Share By Region, 2023 & 2030

11.2 North America

11.2.1 North America Anti-drone Market Estimates & Forecasts, 2018 - 2030 (USD Million)

11.2.2 U.S.

11.2.3 Canada

11.3 Europe

11.3.1 Europe Anti-drone Market Estimates & Forecasts, 2018 - 2030 (USD Million)

11.3.2 UK

11.3.3 Germany

11.3.4 Italy

11.3.5 France

11.3.6 Spain

11.4 Asia Pacific

11.4.1 Asia Pacific Anti-drone Market Estimates & Forecasts, 2018 - 2030 (USD Million)

11.4.2 China

11.4.3 Japan

11.4.4 South Korea

11.4.5 India

11.4.6 Australia

11.5 Latin America

11.5.1 South America Anti-drone Market Estimates & Forecasts, 2018 - 2030 (USD Million)

11.5.2 Brazil

11.5.3 Mexico

11.6 MEA

11.6.1 MEA Anti-drone Market Estimates & Forecasts, 2018 - 2030 (USD Million)

11.6.2 Saudi Arabia

11.6.3 UAE

Chapter 12 Anti-drone Market - Competitive Landscape

12.1 Recent Developments & Impact Analysis, By Key Market Participants

12.2 Company Categorization

12.3 Participant’s Overview

12.4 Financial Performance

12.5 Product Benchmarking

12.6 Company Market Positioning

12.7 Company Market Share Analysis, 2023

12.8 Company Heat Map Analysis

12.9 Strategy Mapping

12.9.1 New Product Launches

12.9.2 Expansion

12.9.3 Mergers & Acquisitions

12.9.4 Collaborations

12.10 Company Profiles

12.10.1 Advanced Radar Technologies S.A

12.10.1.1 Participant’s Overview

12.10.1.2 Financial Performance

12.10.1.3 Product Benchmarking

12.10.1.4 Recent Developments

12.10.2 Airbus Group SE

12.10.2.1 Participant’s Overview

12.10.2.2 Financial Performance

12.10.2.3 Product Benchmarking

12.10.2.4 Recent Developments

12.10.3 Blighter Surveillance Systems

12.10.3.1 Participant’s Overview

12.10.3.2 Financial Performance

12.10.3.3 Product Benchmarking

12.10.3.4 Recent Developments

12.10.4 Dedrone

12.10.4.1 Participant’s Overview

12.10.4.2 Financial Performance

12.10.4.3 Product Benchmarking

12.10.4.4 Recent Developments

12.10.5 DeTech Inc

12.10.5.1 Participant’s Overview

12.10.5.2 Financial Performance

12.10.5.3 Product Benchmarking

12.10.5.4 Recent Developments

12.10.6 Droneshield LLC

12.10.6.1 Participant’s Overview

12.10.6.2 Financial Performance

12.10.6.3 Product Benchmarking

12.10.6.4 Recent Developments

12.10.7 Enterprise Control Systems

12.10.7.1 Participant’s Overview

12.10.7.2 Financial Performance

12.10.7.3 Product Benchmarking

12.10.7.4 Recent Developments

12.10.8 Israel Aerospace Industries Ltd

12.10.12.1 Participant’s Overview

12.10.12.2 Financial Performance

12.10.12.3 Product Benchmarking

12.10.12.4 Recent Developments

12.10.9 Liteye Systems, Inc

12.10.7.1 Participant’s Overview

12.10.7.2 Financial Performance

12.10.7.3 Product Benchmarking

12.10.7.4 Recent Developments

12.10.10 Lockheed Martin Corporation

12.10.12.1 Participant’s Overview

12.10.12.2 Financial Performance

12.10.12.3 Product Benchmarking

12.10.12.4 Recent Developments

12.10.11 Orelia

12.10.11.1 Participant’s Overview

12.10.11.2 Financial Performance

12.10.11.3 Product Benchmarking

12.10.11.4 Recent Developments

12.10.12 Prime Consulting and technologies

12.10.12.1 Participant’s Overview

12.10.12.2 Financial Performance

12.10.12.3 Product Benchmarking

12.10.12.4 Recent Developments

12.10.13 Raytheon Company

12.10.13.1 Participant’s Overview

12.10.13.2 Financial Performance

12.10.13.3 Product Benchmarking

12.10.13.4 Recent Developments

12.10.14 Saab Ab

12.10.14.1 Participant’s Overview

12.10.14.2 Financial Performance

12.10.14.3 Product Benchmarking

12.10.14.4 Recent Developments

12.10.15 Selex Es Inc

12.10.15.1 Participant’s Overview

12.10.15.2 Financial Performance

12.10.15.3 Product Benchmarking

12.10.15.4 Recent Developments

12.10.16 Thales Group

12.10.16.1 Participant’s Overview

12.10.16.2 Financial Performance

12.10.16.3 Product Benchmarking

12.10.16.4 Recent Developments

12.10.17 The Boeing Company

12.10.17.1 Participant’s Overview

12.10.17.2 Financial Performance

12.10.17.3 Product Benchmarking

12.10.17.4 Recent Developments

List of Tables

Table 1 Anti - drone Market - Key Market Driver Impact

Table 2 Global Anti - drone Market - Key Market Restraint Impact

Table 3 Global Anti - drone Market - Key Market Opportunities

Table 4 Global Anti - drone Market - Key Market Challenges

Table 5 Anti - drone Market Revenue Estimates and Forecast, By Component, 2018 - 2030 (USD Million )

Table 6 Anti - drone Market Revenue Estimates and Forecast, By Type, 2018 - 2030 (USD Million )

Table 7 Anti - drone Market Revenue Estimates and Forecast, By Range, 2018 - 2030 (USD Million )

Table 8 Anti - drone Market Revenue Estimates and Forecast, By Technology, 2018 - 2030 (USD Million )

Table 9 Anti - drone Market Revenue Estimates and Forecast, By Mitigation Type, 2018 - 2030 (USD Million )

Table 10 Anti - drone Market Revenue Estimates and Forecast, By Defense Type, 2018 - 2030 (USD Million )

Table 11 Anti - drone Market Revenue Estimates and Forecast, By End Use, 2018 - 2030 (USD Million )

Table 12 Recent Developments & Impact Analysis, By Key Market Participants

Table 13 Company Heat Map Analysis

Table 14 Key companies launching new products

Table 15 Key companies pursuing expansions

Table 16 Key companies pursuing mergers & acquisitions

Table 17 Key companies striking collaborations

List of Figures

Fig. 1 Market snapshot

Fig. 2 Information procurement

Fig. 3 Data analysis models

Fig. 4 Market formulation and validation

Fig. 5 Data validating & publishing

Fig. 6 Market snapshot

Fig. 7 Segment snapshot

Fig. 8 Competitive landscape snapshot

Fig. 9 Anti-drone market value, 2023 & 2030 (USD Million)

Fig. 10 Key opportunity analysis

Fig. 11 Industry value chain analysis

Fig. 12 Market dynamics

Fig. 13 Porter’s analysis

Fig. 14 PESTEL analysis

Fig. 15 Anti-drone market, by component, key takeaways

Fig. 16 Anti-drone market, by component, market share, 2023 & 2030

Fig. 17 Hardware market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 18 Radars market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 19 Acoustic Sensors market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 20 Infrared and Video Surveillance Systems market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 21 RF Detectors market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 22 Jammers market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 23 Others market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 24 Software market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 25 Anti-drone market, by type, key takeaways

Fig. 26 Anti-drone market, by type, market share, 2023 & 2030

Fig. 27 Ground based market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 28 Fixed market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 29 Mobile market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 30 Handheld market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 31 UAV based market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 32 Anti-drone market, by range, key takeaways

Fig. 33 Anti-drone market, by range, market share, 2023 & 2030

Fig. 34 Less than 5 km market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 35 More than 5 km market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 36 Anti-drone market, by technology, key takeaways

Fig. 37 Anti-drone market, by technology, market share, 2023 & 2030

Fig. 38 Anti-drone radar market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 39 RF scan market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 40 Thermal image market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 41 Others market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 42 Anti-drone market, by mitigation type, key takeaways

Fig. 43 Anti-drone market, by mitigation type, market share, 2023 & 2030

Fig. 44 Destructive system market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 45 Laser system market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 46 Missile Effector market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 47 Electronic Countermeasure market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 48 Non-destructive system market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 49 Anti-drone market, by defense type, key takeaways

Fig. 50 Anti-drone market, by defense type, market share, 2023 & 2030

Fig. 51 Detection & disruption systems market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 52 Detection systems market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 53 Anti-drone market, by End Use, key takeaways

Fig. 54 Anti-drone market, by End Use, market share, 2023 & 2030

Fig. 55 Military & defense market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 56 Commercial market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 57 Public Spaces market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 58 Critical Infrastructures market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 59 Government market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 60 Others market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 61 Anti-drone market revenue, by region, 2023 & 2030 (USD Million)

Fig. 62 North America anti-drone market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 63 U.S. anti-drone market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 64 Canada anti-drone market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 65 Europe anti-drone market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 66 UK anti-drone market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 67 Germany anti-drone market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 68 Italy anti-drone market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 69 France anti-drone market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 70 Spain anti-drone market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 71 Asia Pacific anti-drone market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 72 China anti-drone market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 73 Japan anti-drone market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 74 South Korea anti-drone market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 75 India anti-drone market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 76 Australia anti-drone market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 77 Latin America anti-drone market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 78 Brazil anti-drone market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 79 Mexico anti-drone market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 80 MEA anti-drone market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 81 Saudi Arabia anti-drone market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 82 UAE anti-drone market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 83 Strategic frameworkWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Anti-drone Component Outlook (Revenue, USD Million, 2018 - 2030)

- Hardware

- Radars

- Acoustic Sensors

- Infrared and Video Surveillance Systems

- RF Detectors

- Jammers

- Others

- Software

- Anti-drone Type Outlook (Revenue, USD Million, 2018 - 2030)

- Ground Based

- Fixed

- Mobile

- Handheld

- UAV Based

- Anti-drone Range Outlook (Revenue, USD Million, 2018 - 2030)

- Less than 5 km

- More than 5 km

- Anti-drone Technology Outlook (Revenue, USD Million, 2018 - 2030)

- Anti-drone Radar

- RF Scan

- Thermal Image

- Others

- Anti-drone Mitigation Type Outlook (Revenue, USD Million, 2018 - 2030)

- Destructive System

- Laser System

- Missile Effector

- Electronic Countermeasure

- Non-destructive System

- Anti-drone Defense Type Outlook (Revenue, USD Million, 2018 - 2030)

- Drone Detection & Disruption Systems

- Drone Detection Systems

- Anti-drone Defense End Use Outlook (Revenue, USD Million, 2018 - 2030)

- Military & Defense

- Commercial

- Public Spaces

- Critical Infrastructures

- Energy & Utilities

- Sports Stadiums

- Airport

- Data Centers

- Others

- Government

- Anti-drone Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America Anti-drone market, by Component

- Hardware

- Radars

- Acoustic Sensors

- Infrared and Video Surveillance Systems

- RF Detectors

- Jammers

- Others

- Software

- North America Anti-drone market, by Type

- Ground Based

- Fixed

- Mobile

- Handheld

- UAV Based

- North America Anti-drone market, by Range

- Less than 5 km

- More than 5 km

- North America Anti-drone market, by Technology

- Anti-drone Radar

- RF Scan

- Thermal Image

- Others

- North America Anti-drone market, by Defense Type

- Drone Detection & Disruption Systems

- Drone Detection Systems

- North America Anti-drone market, by End Use

- Military & Defense

- Commercial

- Public Spaces

- Critical Infrastructures

- Energy & Utilities

- Sports Stadiums

- Airport

- Data Centers

- Others

- Government

- U.S.

- U.S. Anti-drone market, by Component

- Hardware

- Radars

- Acoustic Sensors

- Infrared and Video Surveillance Systems

- RF Detectors

- Jammers

- Others

- Software

- U.S. Anti-drone market, by Type

- Ground Based

- Fixed

- Mobile

- Handheld

- UAV Based

- U.S. Anti-drone market, by Range

- Less than 5 km

- More than 5 km

- U.S. Anti-drone market, by Technology

- Anti-drone Radar

- RF Scan

- Thermal Image

- Others

- U.S. Anti-drone market, by Defense Type

- Drone Detection & Disruption Systems

- Drone Detection Systems

- U.S. Anti-drone market, by End Use

- Military & Defense

- Commercial

- Public Spaces

- Critical Infrastructures

- Energy & Utilities

- Sports Stadiums

- Airport

- Data Centers

- Others

- Government

- U.S. Anti-drone market, by Component

- Canada

- Canada Anti-drone market, by Component

- Hardware

- Radars

- Acoustic Sensors

- Infrared and Video Surveillance Systems

- RF Detectors

- Jammers

- Others

- Software

- Canada Anti-drone market, by Type

- Ground Based

- Fixed

- Mobile

- Handheld

- UAV Based

- Canada Anti-drone market, by Range

- Less than 5 km

- More than 5 km

- Canada Anti-drone market, by Technology

- Anti-drone Radar

- RF Scan

- Thermal Image

- Others

- Canada Anti-drone market, by Defense Type

- Drone Detection & Disruption Systems

- Drone Detection Systems

- Canada Anti-drone market, by End Use

- Military & Defense

- Commercial

- Public Spaces

- Critical Infrastructures

- Energy & Utilities

- Sports Stadiums

- Airport

- Data Centers

- Others

- Government

- Canada Anti-drone market, by Component

- Mexico

- Mexico Anti-drone market, by Component

- Hardware

- Radars

- Acoustic Sensors

- Infrared and Video Surveillance Systems

- RF Detectors

- Jammers

- Others

- Software

- Mexico Anti-drone market, by Type

- Ground Based

- Fixed

- Mobile

- Handheld

- UAV Based

- Mexico Anti-drone market, by Range

- Less than 5 km

- More than 5 km

- Mexico Anti-drone market, by Technology

- Anti-drone Radar

- RF Scan

- Thermal Image

- Others

- Mexico Anti-drone market, by Defense Type

- Drone Detection & Disruption Systems

- Drone Detection Systems

- Mexico Anti-drone market, by End Use

- Military & Defense

- Commercial

- Public Spaces

- Critical Infrastructures

- Energy & Utilities

- Sports Stadiums

- Airport

- Data Centers

- Others

- Government

- Mexico Anti-drone market, by Component

- North America Anti-drone market, by Component

- Europe

- Europe Anti-drone market, by Component

- Hardware

- Radars

- Acoustic Sensors

- Infrared and Video Surveillance Systems

- RF Detectors

- Jammers

- Others

- Software

- Europe Anti-drone market, by Type

- Ground Based

- Fixed

- Mobile

- Handheld

- UAV Based

- Europe Anti-drone market, by Range

- Less than 5 km

- More than 5 km

- Europe Anti-drone market, by Technology

- Anti-drone Radar

- RF Scan

- Thermal Image

- Others

- Europe Anti-drone market, by Defense Type

- Drone Detection & Disruption Systems

- Drone Detection Systems

- Europe Anti-drone market, by End Use

- Military & Defense

- Commercial

- Public Spaces

- Critical Infrastructures

- Energy & Utilities

- Sports Stadiums

- Airport

- Data Centers

- Others

- Government

- UK

- UK Anti-drone market, by Component

- Hardware

- Radars

- Acoustic Sensors

- Infrared and Video Surveillance Systems

- RF Detectors

- Jammers

- Others

- Software

- UK Anti-drone market, by Type

- Ground Based

- Fixed

- Mobile

- Handheld

- UAV Based

- UK Anti-drone market, by Range

- Less than 5 km

- More than 5 km

- UK Anti-drone market, by Technology

- Anti-drone Radar

- RF Scan

- Thermal Image

- Others

- UK Anti-drone market, by Defense Type

- Drone Detection & Disruption Systems

- Drone Detection Systems

- UK Anti-drone market, by End Use

- Military & Defense

- Commercial

- Public Spaces

- Critical Infrastructures

- Energy & Utilities

- Sports Stadiums

- Airport

- Data Centers

- Others

- Government

- UK Anti-drone market, by Component

- Germany

- Germany Anti-drone market, by Component

- Hardware

- Radars

- Acoustic Sensors

- Infrared and Video Surveillance Systems

- RF Detectors

- Jammers

- Others

- Software

- Germany Anti-drone market, by Type

- Ground Based

- Fixed

- Mobile

- Handheld

- UAV Based

- Germany Anti-drone market, by Range

- Less than 5 km

- More than 5 km

- Germany Anti-drone market, by Technology

- Anti-drone Radar

- RF Scan

- Thermal Image

- Others

- Germany Anti-drone market, by Defense Type

- Drone Detection & Disruption Systems

- Drone Detection Systems

- Germany Anti-drone market, by End Use

- Military & Defense

- Commercial

- Public Spaces

- Critical Infrastructures

- Energy & Utilities

- Sports Stadiums

- Airport

- Data Centers

- Others

- Government

- Germany Anti-drone market, by Component

- France

- France Anti-drone market, by Component

- Hardware

- Radars

- Acoustic Sensors

- Infrared and Video Surveillance Systems

- RF Detectors

- Jammers

- Others

- Software

- France Anti-drone market, by Type

- Ground Based

- Fixed

- Mobile

- Handheld

- UAV Based

- France Anti-drone market, by Range

- Less than 5 km

- More than 5 km

- France Anti-drone market, by Technology

- Anti-drone Radar

- RF Scan

- Thermal Image

- Others

- France Anti-drone market, by Defense Type

- Drone Detection & Disruption Systems

- Drone Detection Systems

- France Anti-drone market, by End Use

- Military & Defense

- Commercial

- Public Spaces

- Critical Infrastructures

- Energy & Utilities

- Sports Stadiums

- Airport

- Data Centers

- Others

- Government

- France Anti-drone market, by Component

- Europe Anti-drone market, by Component

- Asia Pacific

- Asia Pacific Anti-drone market, by Component

- Hardware

- Radars

- Acoustic Sensors

- Infrared and Video Surveillance Systems

- RF Detectors

- Jammers

- Others

- Software

- Asia Pacific Anti-drone market, by Type

- Ground Based

- Fixed

- Mobile

- Handheld

- UAV Based

- Asia Pacific Anti-drone market, by Range

- Less than 5 km

- More than 5 km

- Asia Pacific Anti-drone market, by Technology

- Anti-drone Radar

- RF Scan

- Thermal Image

- Others

- Asia Pacific Anti-drone market, by Defense Type

- Drone Detection & Disruption Systems

- Drone Detection Systems

- Asia Pacific Anti-drone market, by End Use

- Military & Defense

- Commercial

- Public Spaces

- Critical Infrastructures

- Energy & Utilities

- Sports Stadiums

- Airport

- Data Centers

- Others

- Government

- China

- China Anti-drone market, by Component

- Hardware

- Radars

- Acoustic Sensors

- Infrared and Video Surveillance Systems

- RF Detectors

- Jammers

- Others

- Software

- China Anti-drone market, by Type

- Ground Based

- Fixed

- Mobile

- Handheld

- UAV Based

- China Anti-drone market, by Range

- Less than 5 km

- More than 5 km

- China Anti-drone market, by Technology

- Anti-drone Radar

- RF Scan

- Thermal Image

- Others

- China Anti-drone market, by Defense Type

- Drone Detection & Disruption Systems

- Drone Detection Systems

- China Anti-drone market, by End Use

- Military & Defense

- Commercial

- Public Spaces

- Critical Infrastructures

- Energy & Utilities

- Sports Stadiums

- Airport

- Data Centers

- Others

- Government

- China Anti-drone market, by Component

- Australia

- Australia Anti-drone market, by Component

- Hardware

- Radars

- Acoustic Sensors

- Infrared and Video Surveillance Systems

- RF Detectors

- Jammers

- Others

- Software

- Australia Anti-drone market, by Type

- Ground Based

- Fixed

- Mobile

- Handheld

- UAV Based

- Australia Anti-drone market, by Range

- Less than 5 km

- More than 5 km

- Australia Anti-drone market, by Technology

- Anti-drone Radar

- RF Scan

- Thermal Image

- Others

- Australia Anti-drone market, by Defense Type

- Drone Detection & Disruption Systems

- Drone Detection Systems

- Australia Anti-drone market, by End Use

- Military & Defense

- Commercial

- Public Spaces

- Critical Infrastructures

- Energy & Utilities

- Sports Stadiums

- Airport

- Data Centers

- Others

- Government

- Australia Anti-drone market, by Component

- Japan

- Japan Anti-drone market, by Component

- Hardware

- Radars

- Acoustic Sensors

- Infrared and Video Surveillance Systems

- RF Detectors

- Jammers

- Others

- Software

- Japan Anti-drone market, by Type

- Ground Based

- Fixed

- Mobile

- Handheld

- UAV Based

- Japan Anti-drone market, by Range

- Less than 5 km

- More than 5 km

- Japan Anti-drone market, by Technology

- Anti-drone Radar

- RF Scan

- Thermal Image

- Others

- Japan Anti-drone market, by Defense Type

- Drone Detection & Disruption Systems

- Drone Detection Systems

- Japan Anti-drone market, by End Use

- Military & Defense

- Commercial

- Public Spaces

- Critical Infrastructures

- Energy & Utilities

- Sports Stadiums

- Airport

- Data Centers

- Others

- Government

- Japan Anti-drone market, by Component

- India

- India Anti-drone market, by Component

- Hardware

- Radars

- Acoustic Sensors

- Infrared and Video Surveillance Systems

- RF Detectors

- Jammers

- Others

- Software

- India Anti-drone market, by Type

- Ground Based

- Fixed

- Mobile

- Handheld

- UAV Based

- India Anti-drone market, by Range

- Less than 5 km

- More than 5 km

- India Anti-drone market, by Technology

- Anti-drone Radar

- RF Scan

- Thermal Image

- Others

- India Anti-drone market, by Defense Type

- Drone Detection & Disruption Systems

- Drone Detection Systems

- India Anti-drone market, by End Use

- Military & Defense

- Commercial

- Public Spaces

- Critical Infrastructures

- Energy & Utilities

- Sports Stadiums

- Airport

- Data Centers

- Others

- Government

- India Anti-drone market, by Component

- South Korea

- South Korea Anti-drone market, by Component

- Hardware

- Radars

- Acoustic Sensors

- Infrared and Video Surveillance Systems

- RF Detectors

- Jammers

- Others

- Software

- South Korea Anti-drone market, by Type

- Ground Based

- Fixed

- Mobile

- Handheld

- UAV Based

- South Korea Anti-drone market, by Range

- Less than 5 km

- More than 5 km

- South Korea Anti-drone market, by Technology

- Anti-drone Radar

- RF Scan

- Thermal Image

- Others

- South Korea Anti-drone market, by Defense Type

- Drone Detection & Disruption Systems

- Drone Detection Systems

- South Korea Anti-drone market, by End Use

- Military & Defense

- Commercial

- Public Spaces

- Critical Infrastructures

- Energy & Utilities

- Sports Stadiums

- Airport

- Data Centers

- Others

- Government

- South Korea Anti-drone market, by Component

- Asia Pacific Anti-drone market, by Component

- Latin America

- Latin America Anti-drone market, by Component

- Hardware

- Radars

- Acoustic Sensors

- Infrared and Video Surveillance Systems

- RF Detectors

- Jammers

- Others

- Software

- Latin America Anti-drone market, by Type

- Ground Based

- Fixed

- Mobile

- Handheld

- UAV Based

- Latin America Anti-drone market, by Range

- Less than 5 km

- More than 5 km

- Latin America Anti-drone market, by Technology

- Anti-drone Radar

- RF Scan

- Thermal Image

- Others

- Latin America Anti-drone market, by Defense Type

- Drone Detection & Disruption Systems

- Drone Detection Systems

- Latin America Anti-drone market, by End Use

- Military & Defense

- Commercial

- Public Spaces

- Critical Infrastructures

- Energy & Utilities

- Sports Stadiums

- Airport

- Data Centers

- Others

- Government

- Brazil

- Brazil Anti-drone market, by Component

- Hardware

- Radars

- Acoustic Sensors

- Infrared and Video Surveillance Systems

- RF Detectors

- Jammers

- Others

- Software

- Brazil Anti-drone market, by Type

- Ground Based

- Fixed

- Mobile

- Handheld

- UAV Based

- Brazil Anti-drone market, by Range

- Less than 5 km

- More than 5 km

- Brazil Anti-drone market, by Technology

- Anti-drone Radar

- RF Scan

- Thermal Image

- Others

- Brazil Anti-drone market, by Defense Type

- Drone Detection & Disruption Systems

- Drone Detection Systems

- Brazil Anti-drone market, by End Use

- Military & Defense

- Commercial

- Public Spaces

- Critical Infrastructures

- Energy & Utilities

- Sports Stadiums

- Airport

- Data Centers

- Others

- Government

- Brazil Anti-drone market, by Component

- Latin America Anti-drone market, by Component

- Middle East & Africa

- Middle East & Africa Anti-drone market, by Component

- Hardware

- Radars

- Acoustic Sensors

- Infrared and Video Surveillance Systems

- RF Detectors

- Jammers

- Others

- Software

- Middle East & Africa Anti-drone market, by Type

- Ground Based

- Fixed

- Mobile

- Handheld

- UAV Based

- Middle East & Africa Anti-drone market, by Range

- Less than 5 km

- More than 5 km

- Middle East & Africa Anti-drone market, by Technology

- Anti-drone Radar

- RF Scan

- Thermal Image

- Others

- Middle East & Africa Anti-drone market, by Defense Type

- Drone Detection & Disruption Systems

- Drone Detection Systems

- Middle East & Africa Anti-drone market, by End Use

- Military & Defense

- Commercial

- Public Spaces

- Critical Infrastructures

- Energy & Utilities

- Sports Stadiums

- Airport

- Data Centers

- Others

- Government

- South Africa

- South Africa Anti-drone market, by Component

- Hardware

- Radars

- Acoustic Sensors

- Infrared and Video Surveillance Systems

- RF Detectors

- Jammers

- Others

- Software

- South Africa Anti-drone market, by Type

- Ground Based

- Fixed

- Mobile

- Handheld

- UAV Based

- South Africa Anti-drone market, by Range

- Less than 5 km

- More than 5 km

- South Africa Anti-drone market, by Technology

- Anti-drone Radar

- RF Scan

- Thermal Image

- Others

- South Africa Anti-drone market, by Defense Type

- Drone Detection & Disruption Systems

- Drone Detection Systems

- South Africa Anti-drone market, by End Use

- Military & Defense

- Commercial

- Public Spaces

- Critical Infrastructures

- Energy & Utilities

- Sports Stadiums

- Airport

- Data Centers

- Others

- Government

- South Africa Anti-drone market, by Component

- Saudi Arabia

- Saudi Arabia Anti-drone market, by Component

- Hardware

- Radars

- Acoustic Sensors

- Infrared and Video Surveillance Systems

- RF Detectors

- Jammers

- Others

- Software

- Saudi Arabia Anti-drone market, by Type

- Ground Based

- Fixed

- Mobile

- Handheld

- UAV Based

- Saudi Arabia Anti-drone market, by Range

- Less than 5 km

- More than 5 km

- Saudi Arabia Anti-drone market, by Technology

- Anti-drone Radar

- RF Scan

- Thermal Image

- Others

- Saudi Arabia Anti-drone market, by Defense Type

- Drone Detection & Disruption Systems

- Drone Detection Systems

- Saudi Arabia Anti-drone market, by End Use

- Military & Defense

- Commercial

- Public Spaces

- Critical Infrastructures

- Energy & Utilities

- Sports Stadiums

- Airport

- Data Centers

- Others

- Government

- Saudi Arabia Anti-drone market, by Component

- UAE

- UAE Anti-drone market, by Component

- Hardware

- Radars

- Acoustic Sensors

- Infrared and Video Surveillance Systems

- RF Detectors

- Jammers

- Others

- Software

- UAE Anti-drone market, by Type

- Ground Based

- Fixed

- Mobile

- Handheld

- UAV Based

- UAE Anti-drone market, by Range

- Less than 5 km

- More than 5 km

- UAE Anti-drone market, by Technology

- Anti-drone Radar

- RF Scan

- Thermal Image

- Others

- UAE Anti-drone market, by Defense Type

- Drone Detection & Disruption Systems

- Drone Detection Systems

- UAE Anti-drone market, by End Use

- Military & Defense

- Commercial

- Public Spaces

- Critical Infrastructures

- Energy & Utilities

- Sports Stadiums

- Airport

- Data Centers

- Others

- Government

- UAE Anti-drone market, by Component

- Middle East & Africa Anti-drone market, by Component

- North America

Report content

Qualitative Analysis

- Industry overview

- Industry trends

- Market drivers and restraints

- Market size

- Growth prospects

- Porter’s analysis

- PESTEL analysis

- Key market opportunities prioritized

- Competitive landscape

- Company overview

- Financial performance

- Product benchmarking

- Latest strategic developments

Quantitative Analysis

- Market size, estimates, and forecast from 2018 to 2030

- Market estimates and forecast for product segments up to 2030

- Regional market size and forecast for product segments up to 2030

- Market estimates and forecast for application segments up to 2030

- Regional market size and forecast for application segments up to 2030

- Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

Grand View Research employs a comprehensive and iterative research methodology focused on minimizing deviance in order to provide the most accurate estimates and forecast possible. The company utilizes a combination of bottom-up and top-down approaches for segmenting and estimating quantitative aspects of the market. In Addition, a recurring theme prevalent across all our research reports is data triangulation that looks market from three different perspectives. Critical elements of the methodology employed for all our studies include:

Preliminary data mining

Raw market data is obtained and collated on a broad front. Data is continuously filtered to ensure that only validated and authenticated sources are considered. In addition, data is also mined from a host of reports in our repository, as well as a number of reputed paid databases. For a comprehensive understanding of the market, it is essential to understand the complete value chain, and in order to facilitate this; we collect data from raw material suppliers, distributors as well as buyers.

Technical issues and trends are obtained from surveys, technical symposia, and trade journals. Technical data is also gathered from an intellectual property perspective, focusing on white space and freedom of movement. Industry dynamics with respect to drivers, restraints, pricing trends are also gathered. As a result, the material developed contains a wide range of original data that is then further cross-validated and authenticated with published sources.

Statistical model

Our market estimates and forecasts are derived through simulation models. A unique model is created customized for each study. Gathered information for market dynamics, technology landscape, application development, and pricing trends are fed into the model and analyzed simultaneously. These factors are studied on a comparative basis, and their impact over the forecast period is quantified with the help of correlation, regression, and time series analysis. Market forecasting is performed via a combination of economic tools, technological analysis, industry experience, and domain expertise.

Econometric models are generally used for short-term forecasting, while technological market models are used for long-term forecasting. These are based on an amalgamation of the technology landscape, regulatory frameworks, economic outlook, and business principles. A bottom-up approach to market estimation is preferred, with key regional markets analyzed as separate entities and integration of data to obtain global estimates. This is critical for a deep understanding of the industry as well as ensuring minimal errors. Some of the parameters considered for forecasting include:

• Market drivers and restraints, along with their current and expected impact

• Raw material scenario and supply v/s price trends

• Regulatory scenario and expected developments

• Current capacity and expected capacity additions up to 2030We assign weights to these parameters and quantify their market impact using weighted average analysis, to derive an expected market growth rate.

Primary validation

This is the final step in estimating and forecasting for our reports. Exhaustive primary interviews are conducted, face to face as well as over the phone to validate our findings and assumptions used to obtain them. Interviewees are approached from leading companies across the value chain including suppliers, technology providers, domain experts, and buyers so as to ensure a holistic and unbiased picture of the market. These interviews are conducted across the globe, with language barriers overcome with the aid of local staff and interpreters. Primary interviews not only help in data validation but also provide critical insights into the market, current business scenario, and future expectations and enhance the quality of our reports. All our estimates and forecast are verified through exhaustive primary research with Key Industry Participants (KIPs) which typically include:

• Market-leading companies

• Raw material suppliers

• Product distributors

• BuyersThe key objectives of primary research are as follows:

• To validate our data in terms of accuracy and acceptability

• To gain an insight in to the current market and future expectationsData Collection Matrix

Perspective

Primary research

Secondary research

Supply-side

- Manufacturers

- Technology distributors and wholesalers

- Company reports and publications

- Government publications

- Independent investigations

- Economic and demographic data

Demand-side

- End-user surveys

- Consumer surveys

- Mystery shopping

- Case studies

- Reference customers

Industry Analysis MatrixQualitative analysis

Quantitative analysis

- Industry landscape and trends

- Market dynamics and key issues

- Technology landscape

- Market opportunities

- Porter’s analysis and PESTEL analysis

- Competitive landscape and component benchmarking

- Policy and regulatory scenario

- Market revenue estimates and forecast up to 2030

- Market revenue estimates and forecasts up to 2030, by technology

- Market revenue estimates and forecasts up to 2030, by application

- Market revenue estimates and forecasts up to 2030, by type

- Market revenue estimates and forecasts up to 2030, by component

- Regional market revenue forecasts, by technology

- Regional market revenue forecasts, by application

- Regional market revenue forecasts, by type

- Regional market revenue forecasts, by component

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationShare this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."