- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Anti-Static Agents Market Size, Share & Growth Report, 2030GVR Report cover

![Anti-Static Agents Market Size, Share & Trends Report]()

Anti-Static Agents Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Glycerol Monostearate, Ethoxylated Fatty Acid Amines), By Form, By Polymer, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-461-8

- Number of Report Pages: 143

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Anti-Static Agents Market Summary

The global anti-static agents market size was estimated at USD 615.7 million in 2024 and is projected to reach USD 934.9 million by 2030, growing at a CAGR of 7.2% from 2025 to 2030. The growth of the market can be attributed to the product reducing the charges on the surface of polymers and increasing the conductivity of the products.

Key Market Trends & Insights

- The Asia Pacific accounted for the largest revenue share of 35.9% in 2023.

- Based on product, the ethoxylated fatty acid amines segment was valued at USD 183.8 million in 2023 and is projected to reach USD 313.7 million by 2030.

- Based on form, the liquid segment was estimated at USD 286.9 million in 2023 and is projected to reach USD 474.2 million by 2030.

- Based on polymer, the polypropylene segment accounted for the largest revenue share of 30.5% of the market in 2023.

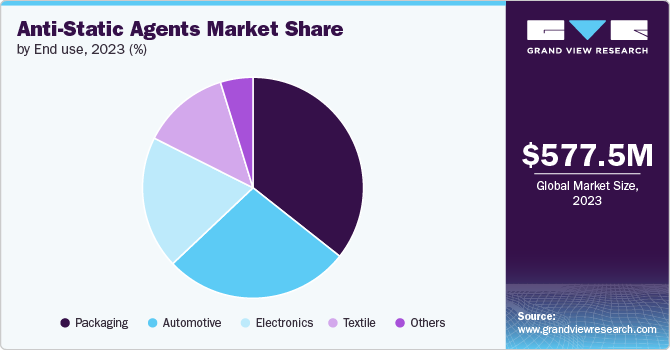

- Based on end use, the packaging segment accounted for the largest revenue share of 35.4% of the market in 2023.

Market Size & Forecast

- 2024 Market Size: USD 615.7 Million

- 2030 Projected Market Size: USD 934.9 Million

- CAGR (2025-2030): 7.2%

- Asia Pacific: Largest market in 2023

In the semiconductor industry, the demand for anti-static agent packaging is expected to rise due to strict requirements for component protection and the high sensitivity of semiconductor devices to electrostatic discharges (ESDs). Robust packaging solutions are crucial to prevent damage during transportation, manufacturing, and handling.

Antistatic agents are a specific type of plastic additive engineered to mitigate the accumulation of static electricity on plastic surfaces. Their application is widespread due to the potential issues associated with static electricity, such as dust attraction, product damage, and electrical discharge. Projections indicate that the product market is poised for growth in the forecast period. This anticipated expansion is linked to the increasing utilization of agents aimed at diminishing charges on polymer surfaces and enhancing product conductivity.

Drivers, Opportunities & Restraints

The global market is expected to experience significant growth, driven by advancements and innovations in the electronics industry. The emergence of smart and sustainable Electrostatic Discharge (ESD) packaging solutions, offering real-time static charge detection and neutralization, is anticipated to enhance product protection and efficiency. Nanotechnology is also revolutionizing ESD protection by utilizing nanomaterials to provide superior protection with a slim profile. The development of sustainable ESD with these agents further enhances the anti-static properties of ESD packaging solutions.

There is a rising product demand in the packaging industry to address the detrimental effects of static electricity on various packaging materials. Static electricity can lead to substantial issues, such as the attraction of dust particles to packaging surfaces and compromising product cleanliness and overall appearance. In addition, in industries dealing with sensitive electronic components, this discharge can potentially cause damage to these components during packaging, storage, or transportation. Therefore, manufacturers are increasingly incorporating these agents into their packaging materials to mitigate these risks.

The product market is heavily influenced by strict regulations governing the production, usage, and disposal of chemical additives due to environmental and health concerns. Regulatory bodies such as the ECHA and EPA have implemented guidelines for manufacturers to ensure product safety.

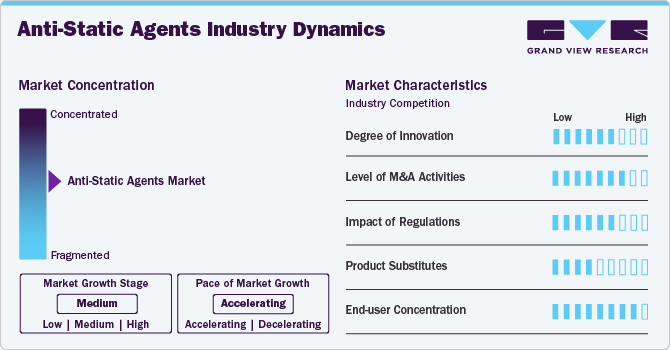

Market Concentration & Characteristics

The anti-static agents industry is moderately fragmented with strong competition among the tier-1 and tier-2 players.

Mature players often have extensive distribution channels. This enables efficient product delivery and broader market reach compared to newer entrants. They usually have high operational costs due to large workforces, facilities, and legacy systems. These factors make it difficult to compete with emerging players who can be more cost effective.

Product Insights

“Ethoxylated fatty acid amines segment is expected to witness growth at 8.0% CAGR”

The ethoxylated fatty acid amines segment of the market was valued at USD 183.8 million in 2023 and is projected to reach USD 313.7 million by 2030. Ethoxylated fatty acid amines are widely recognized for their efficacy in reducing static electricity across various applications. These compounds, derived through the ethoxylation of fatty acid amines, are primarily utilized in industries such as electronics and packaging. The mitigation of this charge accumulation is of paramount importance for enhancing operational efficiency and upholding product integrity within these sectors.

Glycerol monostearate (GMS) is a nonionic anti-static agent used in plastic applications, especially in polypropylene injection molding. It is one of three main types of antistats used in polypropylene, along with ethoxylated fatty acid amines and diethanolamides. The choice of agents depends on resin systems, FDA regulations, and intended applications.

Form Insights

“Liquid segment is expected to witness growth at 7.5% CAGR”

The liquid segment of the market was estimated at USD 286.9 million in 2023 and is projected to reach USD 474.2 million by 2030. Liquid-form product is mainly used in applications where easy application, uniform distribution, and efficient surface coverage are important. These agents help to reduce or eliminate static electricity that builds upon materials such as plastics, textiles, and electronic components. In addition, liquid anti-static agents are often the preferred choice in industries where high performance and consistent treatment are required, such as in the packaging, electronics, and automotive sectors.

Powder form is crucial in industries that require careful dry processing. They reduce static charges in materials such as polymers, textiles, and coatings. They can be easily mixed with solid materials, particularly in sectors like plastic and rubber manufacturing, where the presence of liquids may disrupt material properties or processing methods.

Polymer Insights

“Polypropylene segment is expected to witness highest growth at 7.6% CAGR”

The polypropylene segment accounted for the largest revenue share of 30.5% of the market in 2023. Polypropylene (PP) is increasingly used in packaging, consumer goods and automotive industries due to its high tensile strength, durability, and chemical resistance. However, these properties can lead to static electricity accumulation, posing risks during production, handling, and end use applications.

Polyethylene (PE) is commonly used for films, bags, and containers. Static buildup in PE products can attract dust, contaminate items, or cause packaging materials to stick together. In the food industry, the product is crucial to maintaining the quality and safety of packed products. Similarly, in the electronics industry, static charges in PE packaging can lead to damage during transportation and storage, making these agents essential.

End Use Insights

“Packaging segment is expected to witness highest growth at 7.5% CAGR”

The packaging segment accounted for the largest revenue share of 35.4% of the market in 2023. The segment is driven by the need for improved material handling and safety, especially in industries like food, pharmaceuticals, and electronics. These agents are used to reduce static charges in packaging materials, particularly plastics, to prevent damage to sensitive electronic components during transportation and handling.

The automotive segment is fueled by the demand for advanced materials that enhance vehicle performance and safety. These agents prevent static buildup in sensitive electronic components in automotive manufacturing, protecting critical vehicle systems, including safety features. As vehicles rely more on electronic systems, the need for effective anti-static agents has substantially increased in the automotive industry.

Regional Insights

The anti-static agents market in North America is anticipated to grow over the forecast period. The North American Semiconductor Corridor (NASC) was established in January 2023, encompassing the U.S., Mexico, and Canada. Its goal is to strengthen the semiconductor supply chain within the region by fostering collaboration among research centers, industry stakeholders, and government agencies. This is expected to drive the demand for electrostatic discharge (ESD) packaging and thereby, anti-static agents, which are used to protect semiconductor components from electricity damage in various industries.

Asia Pacific Anti-Static Agents Market Trends

“Asia Pacific. is expected to witness a market growth of CAGR 7.8%.”

The anti-static agents market in Asia Pacific accounted for the largest revenue share of 35.9% in 2023. The transportation sector in the region is experiencing significant growth due to increased transportation needs, rapid urbanization, and rising consumer spending. According to data published by the International Organization of Motor Vehicle Manufacturers (OICA) in 2023, Asia Pacific is the world's largest transportation market. This has led to a steady increase in automobile production in the region, supported by numerous automobile manufacturers.

The China anti-static agents market is anticipated to witness promising growth over the forecast period due to strong infrastructure development and surging power generation capacity. Also, rising product demand from key manufacturing industries, including packaging, electronics, automotive, textile, and aerospace, is expected to substantially contribute to the growing product demand in China.

Europe Anti-Static Agents Market Trends

The Europe anti-static agents market is expected to grow during the forecast period due to increasing demand from the electronics, textiles, packaging, and automotive industries. The semiconductor chip manufacturing industry in the region is becoming increasingly important owing to its strategic significance for key industrial value chains in Europe.

Key Anti-Static Agents Company Insights

Some of the key players operating in the market include 3M, BASF SE, Evonik Industries AG among others.

-

3M is a technology company that operates in various industries, including healthcare, consumer goods, electronics, and industrial markets. The company operates through four business segments: Safety and Industrial, Transportation and Electronics, Health Care, and Consumer. The Safety and Industrial segment provide personal protective equipment, safety products, and industrial adhesives.

-

BASF SE operates through six business segments: industrial solutions, materials, surface technologies, chemicals, nutrition and care, and agricultural solutions. The company's products are used in agriculture, construction, pharmaceuticals, energy and power, home care and nutrition, automotive and transportation, rubber and plastics, leather and textiles, and personal care and hygiene industries.

Anti-Static Agents Companies:

The following are the leading companies in the anti-static agents market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- BASF SE

- Evonik Industries AG

- Clariant

- CRODA INTERNATIONAL PLC

- ADEKA CORPORATION

- LyondellBasell Industries Holdings BV

- Ampacet Corporation

- Arkema

- Kao Corporation

- Mitsubishi Chemical Group Corporation

- Nouryon

Recent Developments

-

In December 2023, Arkema finalized its acquisition of a 54.0% stake in PI Advanced Materials (PIAM) for an enterprise value of approximately USD 798.0 million. This strategic move allowed Arkema to consolidate PIAM fully in its accounts and was expected to enhance its portfolio in high-performance polymers, particularly in the rapidly growing markets of mobile devices and electric vehicles.

-

In July 2023, Croda International Plc completed the acquisition of Solus Biotech, a major company in biotechnology-derived active ingredients for beauty care, after receiving approval from the South Korean regulatory authorities. The acquisition, valued at approximately USD 286.0 million, enhanced the company’s Beauty Actives portfolio by integrating Solus' advanced technologies in ceramides, phospholipids, and emerging natural retinol solutions.

Anti-Static Agents Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 659.2 million

Revenue forecast in 2030

USD 934.9 million

Growth rate

CAGR of 7.2% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

September 2024

Quantitative units

Revenue in USD million, Volume in Kilo Tons, and CAGR from 2025 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, form, polymer, end use, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa.

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, China, Japan, India, South Korea, Thailand, Indonesia, Australia, Brazil, Argentina, UAE, Saudi Arabia, South Africa

Key companies profiled

3M, BASF SE, Evonik Industries AG, Clariant, CRODA INTERNATIONAL PLC, ADEKA CORPORATION, LyondellBasell Industries Holdings BV, Ampacet Corporation, Arkema, Kao Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Anti-Static Agents Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global anti-static agents market report based on product, form, polymer, end use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Glycerol Monostearate

-

Ethoxylated Fatty Acid Amines

-

Diethanolamides

-

Others

-

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Liquid

-

Powder

-

Others

-

-

Polymer Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polypropylene (PP)

-

Polyethylene (PE)

-

Polyvinyl Chloride (PVC)

-

Acrylonitrile Butadiene Styrene (ABS)

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Automotive

-

Electronics

-

Textile

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

France

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Thailand

-

Indonesia

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global anti-static agents market size was estimated at USD 577.5 million in 2023 and is expected to reach USD 615.7 million in 2024.

b. The global anti-static agents market is expected to grow at a compound annual growth rate of 7.2% from 2024 to 2030 to reach USD 934.9 million by 2030.

b. Asia Pacific dominated the anti-static agents market with a share of 35.9% in 2023. The growth of the market can be attributed to the use of anti-static agents to reduce the charges on the surface of polymers and increase the conductivity of the products.

b. Some key players operating in the anti-static agents market include 3M, BASF SE, Evonik Industries AG, Clariant, Croda International Plc, LyondellBasell Industries Holdings B.V., ADEKA CORPORATION, Ampacet Corporation, Arkema, Kao Corporation, and Mitsubishi Chemical Group Corporation Nouryon

b. Key factors that are driving the market growth include significant advancements and innovations in the electronics industry. The emergence of smart, sustainable Electrostatic Discharge (ESD) packaging solutions, which offer real-time detection and neutralization of static charge, is expected to enhance protection and improve efficiency to the product.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.