- Home

- »

- Plastics, Polymers & Resins

- »

-

Aromatic Polyesters Market Size, Industry Report, 2033GVR Report cover

![Aromatic Polyesters Market Size, Share & Trends Report]()

Aromatic Polyesters Market (2025 - 2033) Size, Share & Trends Analysis Report By Resin Type (PET, PBT, PEN), By Application (Packaging, Electrical & Electronics, Automotive, Textiles & Technical Fibres), By Region And Segment Forecasts

- Report ID: GVR-4-68040-830-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Aromatic Polyesters Market Summary

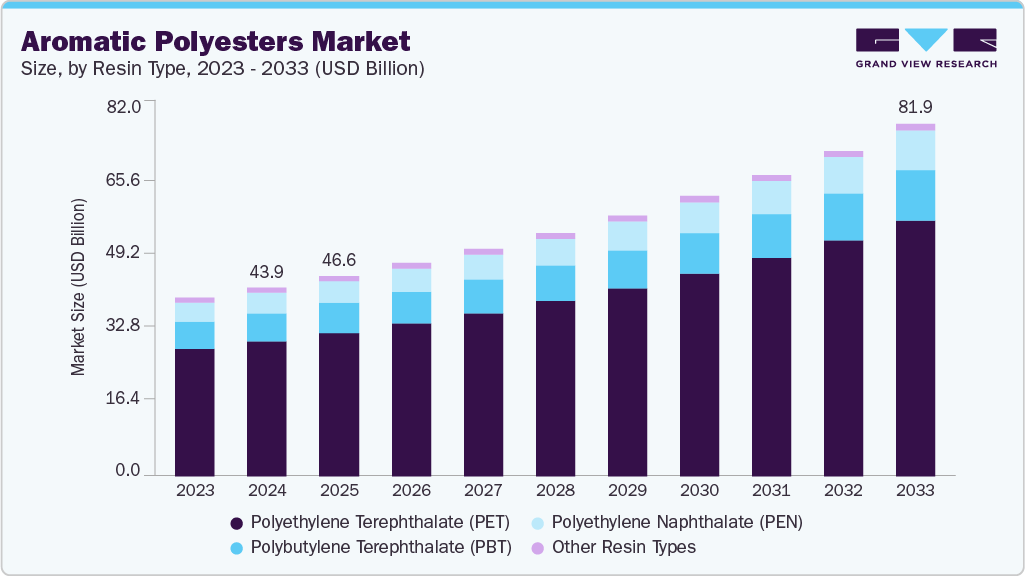

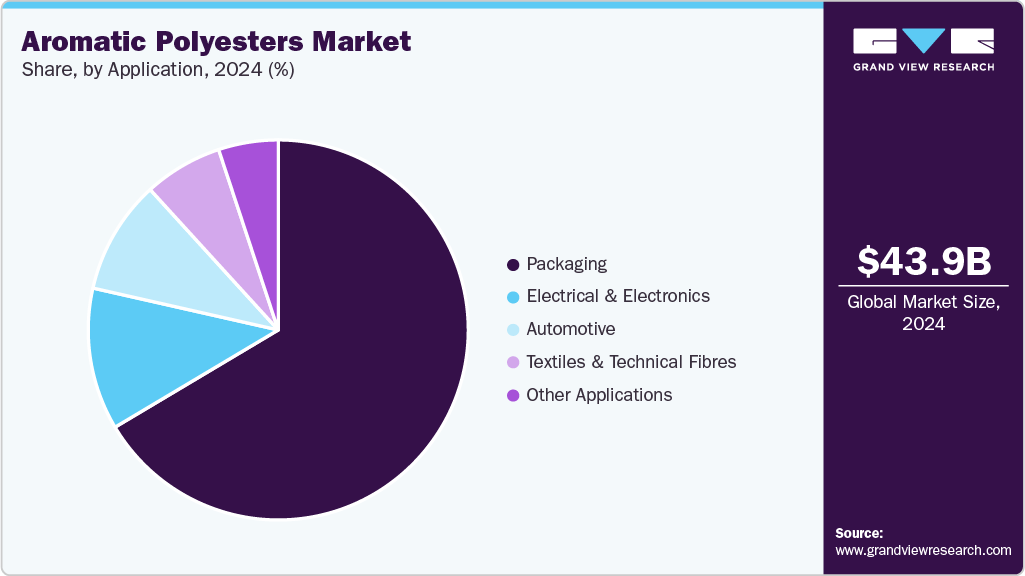

The global aromatic polyesters market size was estimated at USD 43.91 billion in 2024 and is projected to reach USD 81.87 billion by 2033, growing at a CAGR of 7.3% from 2025 to 2033. The growing demand for lightweight materials in the automotive and electronics industries is driving manufacturers to utilize aromatic polyesters, as they offer high strength and improved thermal stability.

Key Market Trends & Insights

- Asia Pacific dominated the aromatic polyesters market with the largest revenue share of 49.23% in 2024.

- The aromatic polyesters market in Canada is expected to grow at a substantial CAGR of 8.4% from 2025 to 2033.

- By resin type, the polyethylene naphthalate (PEN) segment is expected to grow at the fastest CAGR of 7.8% from 2025 to 2033.

- By application, the textiles & technical fibres segment is expected to grow at the fastest CAGR of 7.6% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 43.91 Billion

- 2033 Projected Market Size: USD 81.87 Billion

- CAGR (2025-2033): 7.3%

- Asia Pacific: Largest market in 2024

The demand for aromatic polyesters is shifting from commodity uses to engineered applications. Automotive and electrical connectors now absorb larger volumes because of the materials’ thermal and dimensional stability. At the same time, brand-driven packaging and rigid containers are adopting higher-performance PET/PBT variants. This dual pull is compressing volumes into higher-value product segments and lifting average selling prices.

Drivers, Opportunities & Restraints

Corporate sustainability targets and extended producer responsibility rules are forcing resin buyers to source recycled or lower-carbon feedstocks. Producers of aromatic polyester polyols report growth in rPET-based formulations and bio-attributed feedstocks as buyers prefer circular inputs. This regulatory and buyer-led pressure creates predictable demand for grades that can incorporate recycled terephthalate streams without performance loss.

Advances in chemical recycling and the development of biomass-derived polyester precursors create a clear commercial pathway to decouple the growth of aromatic polyesters from the cost cycles of crude oil. The successful scale-up of depolymerization and repolymerization processes will enable a closed-loop supply for high-value segments, such as automotive interiors and specialty foams. Early movers who secure feedstock partnerships and consistently demonstrate high-quality products stand to capture premium contracts.

Feedstock price volatility and the capital intensity of recycling infrastructure remain the primary constraints. Petrochemical feedstock swings compress margins for undifferentiated grades. At the same time, translating sustainability ambitions into certified, high-quality recycled inputs requires investment in sorting, purification, and qualification. Smaller producers face a disproportionate risk when raw material cycles turn against them.

Market Concentration & Characteristics

The market growth stage of the aromatic polyesters industry is medium, and the pace is accelerating. The market exhibits fragmentation, with key players dominating the industry landscape. Major companies, including Indorama Ventures, Toray Industries, Teijin Group, Reliance Industries, Far Eastern New Century, Celanese Corporation, Kolon Industries, DuPont de Nemours, Inc., and others, play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet the evolving demands of the industry.

Innovation in aromatic polyesters is currently driven by two converging technical trajectories: advanced chemical recycling and the use of bio-based monomers. Chemical depolymerization methods now recover terephthalic and naphthalic building blocks, improving yields and enabling near-virgin performance from post-consumer streams. At the same time, renewable monomers such as isosorbide are being incorporated to raise glass transition and environmental credentials while retaining mechanical properties. Early lab breakthroughs that convert PET back to TPA using low-energy routes indicate faster industrial adoption if scale and costs can be addressed.

Aromatic polyesters are often substituted by several engineering polymers, depending on the application. Polybutylene terephthalate and high-performance polyamides compete in electrical and automotive parts where heat and abrasion are significant factors. Polycarbonate replaces aromatic polyesters when impact resistance and optical clarity are priorities. For low-cost or single-use packaging, polylactic acid and other bioplastics are gaining traction due to their perceived sustainability. Emerging recyclable or high-performance copolymers and novel aromatic esters also act as near-drop-in alternatives in niche segments.

Resin Type Insights

The polyethylene terephthalate (PET) segment led the market with the largest revenue share of 71.41% in 2024. Regulatory pressure and consumer-facing brand commitments are forcing rapid adoption of recycled PET in bottle and tray supply chains. Food and beverage companies now set binding targets for post-consumer content, creating steady off-take for certified rPET. This makes investment in bottle-to-bottle processes commercially attractive for large resin producers and converters.

The polyethylene naphthalate (PEN) segment is anticipated to grow at the fastest CAGR of 7.8% through the forecast period. PEN demand is rising because its superior dimensional stability and high temperature tolerance meet the needs of flexible electronics, high-frequency circuits, and battery separator applications. Developers of next-generation displays and electric vehicle systems prefer PEN where PET cannot sustain thermal or barrier requirements. This technical advantage is driving targeted, higher-margin adoption.

Application Insights

The packaging segment led the market with the largest revenue share of 66.45% in 2024. Brands are paying premiums for packaging that extends shelf life and reduces waste. High-barrier polyester films and oriented PET structures improve oxygen and moisture protection while enabling lighter, mono-material formats that simplify recycling. Packaging buyers equate longer shelf life with lower logistics loss, which justifies switching to higher-performance aromatic polyester grades.

The textiles & technical fibres segment is expected to expand at the fastest CAGR of 7.6% through the forecast period. Technical textile buyers prefer polyester fibres that combine mechanical strength with a verified recycled content profile. Performance applications such as industrial filters, automotive textiles, and protective garments demand controlled dimensional behavior and consistent filament quality. Recycled bottle-to-fibre routes and branded sustainable fibres are therefore expanding market share against incumbent natural and specialty fibres.

Regional Insights

The aromatic polyesters market in North America is anticipated to grow at a significant CAGR during the forecast period. North American buyers are prioritizing certifiable recycled content to meet corporate sustainability targets. Large food and beverage customers are canalizing demand toward bottle-to-bottle rPET, which creates predictable demand for high-quality post-consumer streams. Investment in regional sorting and mechanical recycling capacity is improving feedstock availability. This regulatory and commercial alignment accelerates the adoption of premium aromatic polyester grades.

U.S. Aromatic Polyesters Market Trends

The aromatic polyesters market in the U.S held the significant share in North America in 2024. U.S. OEMs are increasing the use of engineering aromatic polyesters to cut vehicle mass while meeting higher under-the-hood temperature requirements. Growth in electric vehicle production and the demand for EV component suppliers is increasing the need for thermally stable, dimensionally precise resins. Procurement teams reward consistent performance and local supply, which advantages domestic resin producers able to offer validated recycled blends.

Asia Pacific Aromatic Polyesters Market Trends

Asia Pacific dominated the aromatic polyesters market with the largest revenue share of 49.23% in 2024 and is expected to grow at the fastest CAGR of 7.7% over the forecast period. Rapid urbanization and the expansion of consumer goods manufacturing are driving increased demand for bulk aromatic polyesters across the region. Producers in Asia benefit from lower capital and operating costs, which support the addition of large-scale PET and PEN capacity. Downstream converters leverage this scale to trial higher-performance resin blends, lifting regional sophistication in packaging and industrial applications.

The aromatic polyesters market in China combines the greatest domestic demand for polyester with deep upstream integration across feedstock, polymer, and recycling sectors. Government incentives and private investment are accelerating chemical and mechanical recycling projects that target closed-loop bottle and fibre markets. This vertical integration shortens qualification cycles for recycled aromatic polyester grades, enabling faster commercial adoption in the packaging and textiles industries.

Europe Aromatic Polyesters Market Trends

The aromatic polyesters market in Europe is growing at a rapid pace as the European policy requires minimum recycled content and tighter waste management, forcing upstream buyers to secure certified rPET and invest in material qualification. At the same time, elevated energy and compliance costs push producers to consolidate and invest selectively in higher-value aromatic polyester grades. The net effect is to tighten the supply of competitively priced virgin resin and accelerate the shift to circular feedstocks for premium applications.

Key Aromatic Polyesters Company Insights

The aromatic polyesters industry is highly competitive, with several key players dominating the landscape. Major companies include Indorama Ventures, Toray Industries, Teijin Group, Reliance Industries, Far Eastern New Century, Celanese Corporation, Kolon Industries, and DuPont de Nemours, Inc. The aromatic polyesters industry is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Aromatic Polyesters Companies:

The following are the leading companies in the aromatic polyesters market. These companies collectively hold the largest market share and dictate industry trends.

- Indorama Ventures

- Toray Industries

- Teijin Group

- Reliance Industries

- Far Eastern New Century

- Celanese Corporation

- Kolon Industries

- DuPont de Nemours, Inc.

Recent Developments

-

In May 2024, Loop Industries entered into a strategic partnership with Ester to build a full-scale “Infinite Loop” manufacturing facility in India for low-carbon rDMT/rMEG and specialty polymers, enabling large-scale production of recycled-content aromatic polyester feedstocks.

-

In November 2024, Amcor plc and Kolon Industries announced a collaboration to co-develop more sustainable polyester materials, including chemically recycled PET and alternative polyesters, for Amcor’s flexible packaging applications.

Aromatic Polyesters Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 46.62 billion

Revenue forecast in 2033

USD 81.87 billion

Growth rate

CAGR of 7.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, Volume in Tons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segment covered

Resin type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Spain; Italy; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Indorama Ventures; Toray Industries; Teijin Group; Reliance Industries; Far Eastern New Century; Celanese Corporation; Kolon Industries; DuPont de Nemours, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aromatic Polyesters Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global aromatic polyesters market report based on the resin type, application, and region:

-

Resin Type Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Polyethylene Terephthalate (PET)

-

Polybutylene Terephthalate (PBT)

-

Polyethylene Naphthalate (PEN)

-

Other Resin Types

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Packaging

-

Electrical & Electronics

-

Automotive

-

Textiles & Technical Fibres

-

Other Applications

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global aromatic polyesters market size was estimated at USD 43.91 billion in 2024 and is expected to reach USD 46.62 billion in 2025.

b. The global aromatic polyesters market is expected to grow at a compound annual growth rate of 7.3% from 2025 to 2033 to reach USD 81.87 billion by 2033.

b. Polyethylene terephthalate (PET) dominated the aromatic polyesters market across the resin type segmentation in terms of revenue, accounting for a market share of 71.41% in 2024 and is forecasted to grow at 7.5% CAGR from 2025 to 2033.

b. Some key players operating in the aromatic polyesters market include Indorama Ventures, Toray Industries, Teijin Group, Reliance Industries, Far Eastern New Century, Celanese Corporation, Kolon Industries, and DuPont de Nemours, Inc.

b. Growing demand for lightweight materials in automotive and electronics is pushing manufacturers to use aromatic polyesters because they offer high strength and better thermal stability. This shift helps OEMs reduce component weight while maintaining performance, which directly increases resin consumption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.