- Home

- »

- Medical Devices

- »

-

Artificial Hip And Knee Joints Market Size Report, 2030GVR Report cover

![Artificial Hip And Knee Joints Market Size, Share & Trends Report]()

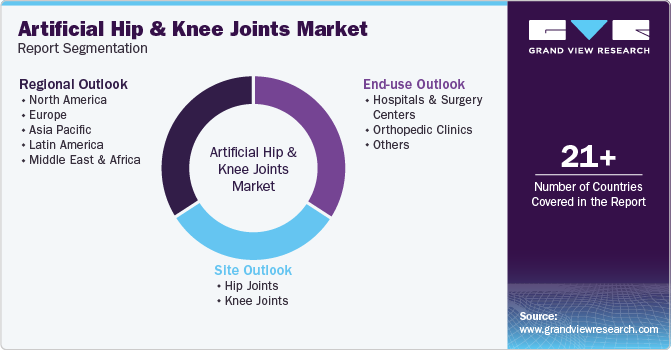

Artificial Hip And Knee Joints Market (2024 - 2030) Size, Share & Trends Analysis Report By Site (Hip Joints, Knee Joints), By End-Use (Hospitals & Surgery Centers, Orthopedic Clinics, Others), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-478-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Artificial Hip And Knee Joints Market Trends

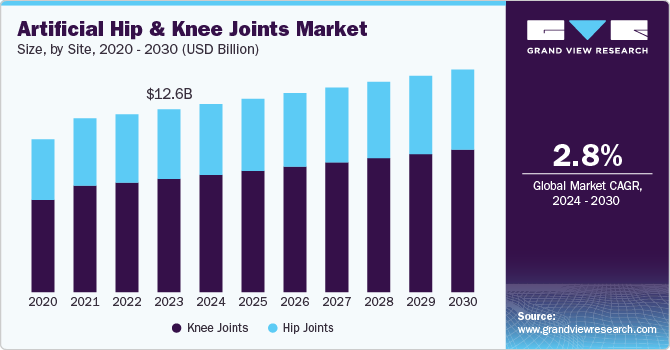

The global artificial hip and knee joints market size was estimated at USD 12.57 billion in 2023 and is projected to grow at a CAGR of 2.85% from 2024 to 2030. The rising cases of orthopedic diseases such as osteoarthritis and rheumatoid arthritis are expected to boost market growth. For instance, as per the 2021 Global RA Network report, more than 350 million individuals worldwide suffer from arthritis. Moreover, study published in Lancet Rheumatology in 2023 stated, almost one billion people are expected to have osteoarthritis, the most prevalent form of arthritis by 2050. Such diseases increase the demand for artificial hip & knee joints, boosting market growth.

Factors such as the rising prevalence of hip fractures and the growing geriatric population are expected to drive market growth over the forecast period. For instance, the 2023 National Hip Fracture Database (NHFD) 2022 reported that more than 7,000 people had a hip fracture in December 2022, higher than the average of 5,500 per month in 2022. In 2022, NHFD recorded 72,160 hip fractures, contrasting with under 66,000 in 2021 and 2020 and 67,000 before the pandemic.

An article published by the American Orthopaedic Foot & Ankle Society states that the most common sports injuries are in the lower extremities of the body, with children being more susceptible than young adults. This research presented findings from 27 high schools in the U.S. for three years, showing that the maximum number of lower leg injuries occurred due to soccer, indoor track races, and cross-country races. A significant surge in treatment adoption rates in developed & emerging countries and growing participation in sports are expected to fuel market growth during the forecast period, consequently driving the adoption of artificial hip & knee joints.

Furthermore, market participants are concentrating on bolstering R&D efforts to introduce advanced products and are focusing on various strategies to maintain their market position. For instance, in March 2023, at the AAOS Annual Meeting in Las Vegas, Stryker unveiled the Mako Total Knee 2.0. This advanced system includes a digital tensioner, a new feature that allows surgeons to evaluate the knee's stability during total knee arthroplasty procedures without the need for additional instruments.

Moreover, favorable government initiatives and reimbursement policies fuel the market growth. For example, Medicaid is a joint program between federal and state governments in the U.S. that provides health insurance to qualifying low-income individuals and families. Each state administers its Medicaid program; hence, reimbursement policies for orthopedic joints and implants may vary depending on the state. States often follow federal guidelines set by the Centers for Medicare & Medicaid Services. However, they may have their own rules and fee schedules for reimbursing orthopedic procedures.

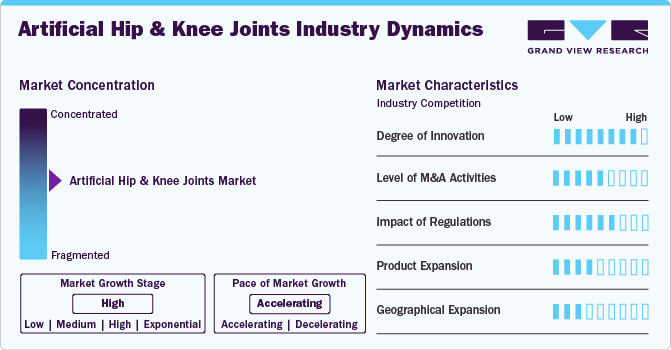

Market Concentration & Characteristics

The market is characterized by a high degree of innovation driven by advancements in biomechanics, surgical techniques, and materials science. For example, the Department of Electrical and Computer Engineering at The Ohio State University employs vibrometry to detect hip implant loosening, integrating wireless piezoresistive strain sensors for knee implants and load measuring electronics for bone healing assessment.

The market is characterized by a medium level of merger and acquisition (M&A) activity. These M&A facilitate access to complementary distribution channels, technologies, and expertise, enabling market players to improve operational efficiency, accelerate product development, and capture a larger market share. For instance, in May 2023, Zimmer Biomet acquired Ossisa, a medical device company specializing in 3D hip replacement implants. This acquisition helps Zimmer Biomet bring innovation in the medical technology industry and strengthens its position in the MedTech sector.

Regulations play an important role in shaping the market, ensuring the safety, quality, and efficacy of implants and joints available to patients.

Aspect

Details

Regulatory Body

Food and Drug Administration (FDA)

Applicable Regulations

Title 21 of the Code of Federal Regulations (CFR), Part 888

Legislation

Medical Device Amendments (MDA) of 1976, Safe Medical Devices Act (SMDA) of 1990

Product Marking

Unique Device Identification (UDI) system, FDA Registration

Standardization Body

American Society for Testing and Materials (ASTM), International Organization for Standardization (ISO)

Postmarket Surveillance

Conducted by FDA through Medical Device Reporting (MDR) system, inspections, and audits

The threat of substitutes in the market is significantly low. While alternative treatments such as pain medication and physical therapy may temporarily relieve patients with joint issues, they do not offer a permanent solution such as joint replacement surgery. The demand for hip and knee replacements continues to rise, with over 137,000 surgeries and estimated inpatient costs of more than USD 1.4 billion annually in Canada.

Several companies are expanding their business by entering new geographical regions to strengthen their market position. Increasing product launches create more opportunities for market players to enter new regions. For instance, in August 2023, Smith+Nephew, a UK-based MedTech company, launched its OR3O Dual Mobility System in India for primary and revision hip arthroplasty.

Site Insights

The knee joints segment dominated the market and accounted for the largest revenue share of 62.0% in 2023. Growing cases of knee injuries and the prevalence of knee disorders, especially osteoarthritis, fuel the market growth. For instance, according to data published by the Aspen Institute for Humanistic Studies in November 2023, serious knee injuries among teen athletes grew by 26% in the U.S. Moreover, according to the Arthritis Society Canada, around 6 million individuals in Canada (1 in 5 adults) have arthritis. Furthermore, rising disposable income allows more patients to afford these procedures while technological advancements enhance implant designs and surgical outcomes.

The hip joints segment in artificial hip and knee joints market is anticipated to witness the fastest CAGR from 2024 to 2030. The growing investments and funding for R&D and the launch of new technological products in the field of hip joints have significantly contributed to market growth. For instance, in September 2024, the National Institute for Health and Care Research (NIHR) awarded USD 1.55 to support innovative research on testing new surgical techniques to improve outcomes for patients undergoing hip replacement surgery. This funding plays a crucial role in driving research and development efforts, leading to advancements in materials, technology, and procedures used in hip replacement surgeries.

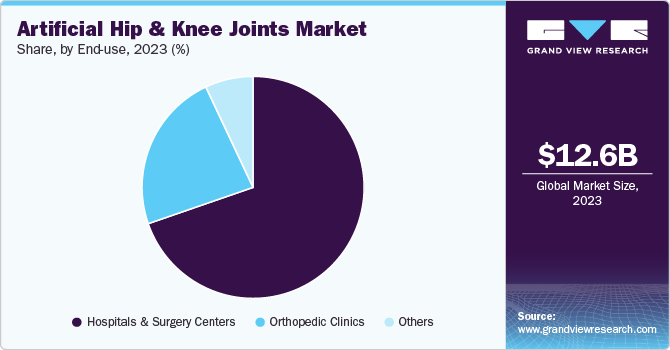

End Use Insights

The hospitals & surgery centers segment dominated the market with a revenue share of 69.7% in 2023. These facilities have advanced surgical technologies and trained healthcare staff specializing in joint replacement procedures, ensuring high-quality care and enhanced patient outcomes. Moreover, supportive reimbursement policies for hospital patients and the widespread availability of hospitals and surgery centers play an important role in propelling the demand for hospital services. For instance, according to the Australian Institute of Health and Welfare, there were 700 public hospitals in Australia in 2023, and the number varied in size, location, and services provided. Of these public hospitals, 400 were in outer and inner regions, 189 were in Major cities, and 111 were in remote areas.

The orthopedic clinics segment is anticipated to register a significant CAGR from 2024 to 2030. Orthopedic clinics offer convenient and accessible services with shorter wait times, streamlined processes, and personalized attention from healthcare practitioners. Moreover, the number of orthopedic clinics continues to expand their surgical capacity, and the rise in the number of training programs for orthopedic surgeons is expected to register significant growth over the forecast period. For example, the Canadian Orthopaedic Association, in collaboration with the Royal College of Physicians and Surgeons of Canada, offers 17 orthopedic training programs in Canada.

Regional Insights

North America artificial hip and knee joints market in 2023 and accounted for the largest revenue share of 46.0% in 2023, owing to a rise in the prevalence of musculoskeletal disorders, such as rheumatoid arthritis and osteoarthritis. For instance, according to the CDC, 53 million individuals in the U.S. have rheumatoid arthritis. Moreover, the market is expected to grow due to rapid technological advancements and well-established healthcare facilities.

U.S. Artificial Hip And Knee Joints Market Trends

The artificial hip and knee joints market in the U.S. held the largest revenue share of 92.6% in 2023. The increasing adoption of expansion strategies, such as product launches, mergers, acquisitions, partnerships, and collaborations by companies, drives the market. For instance, in August 2022, Exactech, a manufacturer of orthopedic implants and instrumentation, launched the Logical Cup System and Spartan Stem for total hip arthroplasty.

Europe Artificial Hip And Knee Joints Market Trends

Europe artificial hip and knee joints market is anticipated to grow significantly during the forecast period. The region's strong focus on R&D fosters continuous innovation in implant technologies, enhancing product efficacy and patient outcomes. Moreover, robust regulatory frameworks and favorable healthcare policies ensure the quality and safety of artificial hip and knee joints, thereby raising their demand among the population.

The artificial hip and knee joints market in Germany is expected to grow considerably during the forecast period. The increase in road accidents in the country led to increased demand for artificial hip and knee joints. For instance, according to the Statistisches Bundesamt (Destatis) report, 2,519,525 road accidents were recorded in Germany, and 366,557 individuals were injured due to these accidents.

The UK artificial hip and knee joints market is anticipated to register a considerable growth rate during the forecast period. The UK's National Health Service (NHS) offers universal healthcare coverage and ensures access to orthopedic procedures for all citizens, which promotes market growth. Furthermore, a rise in the number of hospitals offering orthopedic procedures boosts market growth. For instance, as of August 2023, there are 1148 hospitals in the UK, 218 private and 930 NHS hospitals.

Asia Pacific Artificial Hip And Knee Joints Market Trends

The artificial hip and knee joints market in Asia Pacific is expected to witness the fastest CAGR growth over the forecast period. Due to the growth in sports accidents, the number of fractures and joint replacement cases is anticipated to increase the market growth. Moreover, the market is driven by technological developments, such as 3D printing and smart sensors, and growing R&D efforts.

China artificial hip and knee joints market is anticipated to register a considerable growth rate during the forecast period. Medical tourism is booming, the healthcare infrastructure is constantly being improved, and patients are becoming more aware of the commercial availability of artificial hip and knee joints. All of these factors contribute to the country's market growth.

Latin America Artificial Hip And Knee Joints Market Trends

The artificial hip and knee joints market in Latin America is anticipated to register a considerable growth rate during the forecast period. An increase in sports injuries is one of the key factors expected to propel the artificial hip and knee joints market in Latin America. Football is highly popular in Latin America, leading to increased knee injuries. Moreover, technological advancements, increasing government spending, and the presence of skilled healthcare professionals are expected to drive the market over the forecast period.

Brazil artificial hip and knee joints market is anticipated to register a considerable growth rate during the forecast period. A key factor anticipated to drive the market is the growing prevalence of osteoporosis in the country. According to an article published in The Scientific Electronic Library Online (SciELO) recently, osteoporosis and associated fractures are very common in Brazil, owing to an active youth population attracted toward high-intensity sports and an increasing geriatric population affected with musculoskeletal disorders.

Middle East And Africa Artificial Hip And Knee Joints Market Trends

The artificial hip and knee joint market in the Middle East and Africa region is experiencing lucrative growth. The rising prevalence of orthopedic conditions such as osteoporosis and osteoarthritis due to factors such as obesity, sedentary lifestyles, and an aging population is boosting the market growth. In addition, the region's expanding medical tourism sector and the presence of skilled healthcare professionals are expected to foster market growth.

South Africa artificial hip and knee joints market is anticipated to register a considerable growth rate during the forecast period. The growing number of sports-related injuries and road accidents that require orthopedic procedures further propels the market growth. In addition, the availability of favorable reimbursement policies and government initiatives aimed at improving healthcare infrastructure & accessibility are important drivers for the artificial hip and knee joints market in South Africa.

Key Artificial Hip And Knee Joints Company Insights

Key participants in the market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Artificial Hip And Knee Joints Companies:

The following are the leading companies in the artificial hip and knee joints market. These companies collectively hold the largest market share and dictate industry trends.

- Exactech, Inc.

- CORENTEC Co., Ltd.

- Smith+Nephew

- Zimmer Biomet

- Enovis Corporation

- Johnson & Johnson (DePuy Synthes)

- Medacta International

- MicroPort Orthopedics, Inc.

- Stryker

- CONMED Corporation.

Recent Developments

-

In February 2024, Corentec, a producer of artificial joints, received U.S. Food and Drug Administration (FDA) clearance to market BENCOX Mirabo Z Cup Continuum, the hip artificial cup.

-

In October 2023, Medacta Group S.A., a Swiss company, introduced GMK SpheriKA, a femoral component optimized for Kinematic Alignment in total knee replacements.

Artificial Hip And Knee Joints Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 12.93 billion

Revenue forecast in 2030

USD 15.31 billion

Growth rate

CAGR of 2.85% from 2024 to 2030

Actual data

2018 - 2023

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Site, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa;Saudi Arabia; UAE; Kuwait

Key companies profiled

Exactech, Inc.; CORENTEC Co., Ltd.; Smith+Nephew; Zimmer Biomet; Enovis Corporation; Johnson & Johnson (DePuy Synthes); Medacta International; MicroPort Orthopedics, Inc.; Stryker; CONMED Corporation

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Artificial Hip And Knee Joints Market Report Segmentation

This report forecasts revenue growth at global, regional, and country level and provides an analysis on industry trends in each of the sub segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global artificial hip and knee joints market report based on the site, end use and region:

-

Site Outlook (Revenue USD Million, 2018 - 2030)

-

Hip Joints

-

By Hip Product

-

Total Hip

-

Partial Femoral Head

-

Hip Resurfacing

-

Revision Hip

-

-

-

Knee Joints

-

By Knee Product

-

Fixed-bearing Implants

-

Mobile-bearing Implants

-

-

By Knee Procedure

-

Total Knee Replacement

-

Partial Knee Replacement

-

Revision Knee Replacement

-

-

-

-

End Use Outlook (Revenue USD Million, 2018 - 2030)

-

Hospitals & Surgery Centers

-

Orthopedic Clinics

-

Others

-

-

Regional Outlook Revenue USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global artificial hip and knee joints market size was estimated at USD 12.57 billion in 2023 and is expected to reach USD 12.93 billion in 2024.

b. The global artificial hip and knee joints market is expected to grow at a compound annual growth rate of 2.85% from 2024 to 2030 to reach USD 15.31 billion by 2027.

b. By site, the knee joints segment dominated the artificial hip and knee joints market in 2023 and accounted for the largest revenue share of 62.0%. Growing cases of knee injuries and the prevalence of knee disorders, especially osteoarthritis, fuel the market growth.

b. Some key players operating in the market include Exactech, Inc., CORENTEC Co., Ltd., Smith+Nephew, Zimmer Biomet, Enovis Corporation, Johnson & Johnson (DePuy Synthes), Medacta International, MicroPort Orthopedics, Inc., Stryker, CONMED Corporation

b. The rising cases of orthopedic diseases such as osteoarthritis and rheumatoid arthritis are expected to boost market growth. For instance, as per the 2021 Global RA Network report, more than 350 million individuals worldwide suffer from arthritis.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.