- Home

- »

- Medical Devices

- »

-

Hip Replacement Implants Market Size & Share Report, 2030GVR Report cover

![Hip Replacement Implants Market Size, Share & Trends Report]()

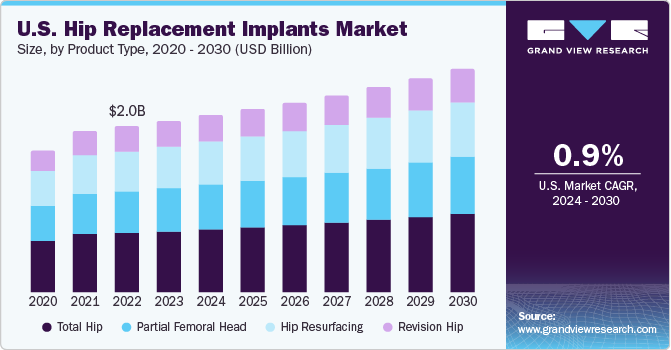

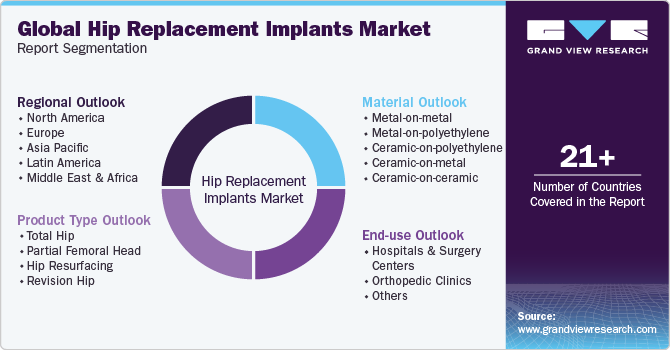

Hip Replacement Implants Market (2024 - 2030) Size, Share & Trends Analysis Report By Product Type (Total Hip), By Material (Metal-on-Metal), By End-use (Orthopedic Clinics), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-487-1

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hip Replacement Implants Market Summary

The global hip replacement implants market size was estimated at USD 4.8 billion in 2023 and is projected to reach USD 5.5 billion by 2030, growing at a CAGR of 2.1% from 2024 to 2030. The rising incidence of obesity, hip injuries, and osteoarthritis drive the market growth.

Key Market Trends & Insights

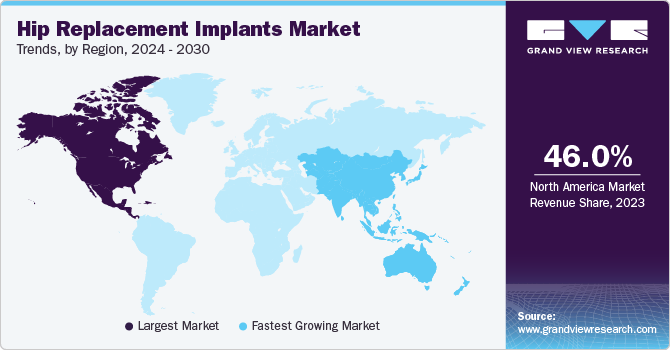

- North America dominated the global market for hip replacement implant sand accounted for a revenue share of 46.0% in 2023.

- The Asia Pacific hip replacement implants market is expected to grow at the fastest CAGR from 2024 to 2030.

- By product type, the total hip replacement implants segment held the highest revenue share of 37.6% in 2023.

- By material, the metal-on-PE segment accounted for the largest share of 30.8% in 2023.

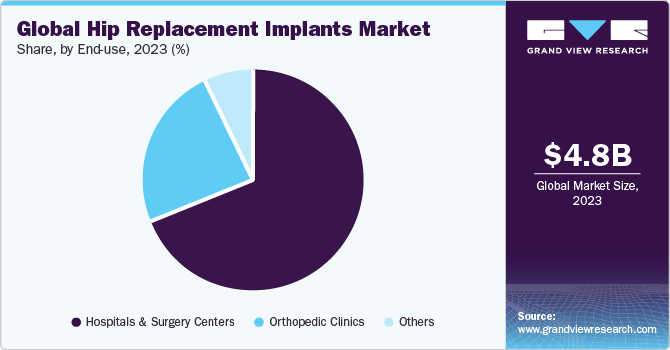

- By end-use, the hospitals & surgery centers segment accounted for the largest revenue share of 69.2% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 4.8 Billion

- 2030 Projected Market Size: USD 5.5 Billion

- CAGR (2024-2030): 2.1%

- North America: Largest market in 2023

- Asia Pacific: Fastest-growing market

According to the World Obesity Atlas 2023, by 2035, the number of individuals potentially impacted is projected to surpass 4 billion, a significant rise from the over 2.5 billion estimated in 2020. This represents an escalation from over 35% of the global population in 2020 to exceeding 50% by 2035, excluding children under the age of five years. In addition, it is projected that the prevalence of obesity, defined as having a Body Mass Index (BMI) equal to or greater than 30kg/m², may increase from 14% to 25% of the population by 2035.

This rise in obesity rates is expected to impact nearly 2 billion adults, children, and adolescents. Similarly, the WHO estimates that by the year 2050, there might be 130 million osteoarthritis patients worldwide and 40 million people who are disabled due to the same. Since the cases of osteoarthritis have increased, there is likely to be an increased demand for hip replacement surgeries and the need for hip replacement implants, which is expected to contribute to market growth. Factors, such as a growing geriatric population and rising prevalence of hip fractures, are expected to drive market growth over the forecast period. For instance, as per the WHO, by 2030, the proportion of individuals aged 60 years or older in the global population is expected to be 1 in every 6 individuals, increasing from 1 billion in 2020 to nearly 1.5 billion.

By 2050, the number of people aged 60 years and above worldwide is projected to double to 2.0 billion. In addition, the population of individuals aged 80 years or older is anticipated to triple from 2020 to 2050, reaching over 425 million. The growing incidence of osteoarthritis in elderly people is also anticipated to impact market growth positively. Growing awareness and increasing accessibility of hip implant solutions are boosting the procedural volume. The average age of Americans undergoing hip replacements is also increasing, thereby, recording a surge in procedural volumes.

As per a national study by the American Academy of Orthopedic Surgeons, the average age of patients undergoing hip replacements has decreased to just under 65 years, owing to new joint replacement techniques & technologies, such as direct anterior approach for hip replacement, image-guided surgery, and cement-less technology for hip replacement. With an increasing prevalence of diabetes and obesity in the U.S., there is also an increased need for surgery at younger ages. Furthermore, the increased number of young people suffering from degenerative diseases is anticipated to continue to boost product demand over the forecast period. Moreover, favorable reimbursement policies also contribute to market growth.

For instance, as per the Patient Protection and Affordable Care Act (PPACA), the range of coverage provided by insurance companies in orthopedic devices is growing, thus enabling more patient access. In recent years, both the public sector (such as the CMS) and commercial insurance providers have adequately covered orthotics and prosthetics. The rising procedures of hip replacement are anticipated to propel market growth in the coming years. For instance, according to the National Center of Biotechnology Information study, approximately 572,000 total hip arthroplasty cases are expected to be registered by 2030. Also, as per the American Joint Replacement Registry study published in 2022, between 2012 and 2021 in the U.S., there were approximately 2,550,530 hip and knee arthroplasty procedures, encompassing both primary and revision surgeries, of which around 37.3% were primary hip surgeries.

The increasing investments and funding in the field of hip replacement have significantly contributed to the growth of the overall market. For instance, in February 2023, a fund exceeding USD 957.8 million was awarded by the National Institute for Health and Care Research (NIHR) to support innovative research focusing on testing new surgical techniques to improve outcomes for patients undergoing hip replacement surgery. This funding plays a crucial role in driving research and development efforts, leading to advancements in technology, materials, and techniques used in hip replacement surgeries. It also enables the expansion of clinical trials and studies to ensure the safety, efficacy, and long-term success of hip replacement procedures.

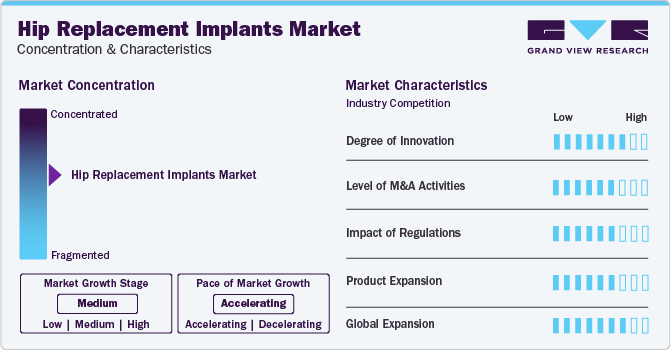

Market Concentration & Characteristics

The hip replacement implants industry exhibits a moderate level of concentration. Characteristics include rapid technological advancements, such as real-time imaging and 3D visualization, enhancing surgical precision and outcomes. The market growth is driven by increasing demand for minimally invasive procedures, particularly in developed regions. The industry showcases continuous innovation and expansion fueled by rising healthcare expenditure and the high prevalence of chronic diseases requiring surgical interventions.

The market is characterized by a high degree and rapidly evolving innovation, with companies consistently developing products that enhance efficiency and safety. For instance, in August 2023, Smith+Nephew introduced the OR3O Dual Mobility System for primary and revision hip arthroplasty in India, which features a unique design that sets it apart from traditional solutions. This system incorporates a smaller femoral head that securely fits into a larger polyethylene insert through which it enhances stability, reduces the risk of dislocation, and provides an improved range of motion compared to conventional implants

Advancements in technology have revolutionized total hip arthroplasty (THA) procedures, leading to improved outcomes, reduced complications, and enhanced implant survival rates. Innovations such as robotic-assisted surgery, patient-specific instrumentation (PSI) using 3D printing technology, dual mobility bearings, and virtual reality surgical simulations have transformed the landscape of hip replacement surgery

The impact of regulations in this market has been significant. The Food and Drug Administration (FDA) regulates the approval, marketing, and post-market surveillance of medical devices, including hip implants, to ensure their safety and effectiveness. For instance, in January 2023, Hip Innovation Technology, LLC (HIT) successfully performed the inaugural implantation of the HIT Reverse Hip Replacement System (Reverse HRS) in the U.S. authorized under an FDA-approved Investigational Device Exemption (IDE). The IDE Study aims to investigate the safety and efficacy of the HIT Reverse HRS in Primary Total Hip Arthroplasty (THA

Mergers and acquisitions in the industry are rising due to the need for R&D, reflecting the industry's dynamic nature. Companies are leveraging M&A activities to innovate & offer advanced solutions that meet the evolving needs of healthcare professionals and the desire to capitalize on the growing demand for hip replacement implants globally. For instance, in March 2024, Stryker announced the acquisition of SERF SAS, a joint replacement company based in France. This strategic move by Stryker aligns with its focus on expanding its presence and offerings in the orthopedic sector, particularly in joint replacement solutions, and is aimed at enhancing its product portfolio. One notable example of product expansion is the introduction of customized hip prostheses. With each patient having a unique anatomy, manufacturers are increasingly focusing on utilizing 3D printing technology to create patient-specific implants

Product expansion in the industry plays a crucial role in meeting the evolving needs of patients and healthcare providers. The Personalized Arthroplasty Society’s Scientific Session & Annual Meeting 2023 was conducted for personalized hip replacement. The purpose of this gathering was to support the Society’s objective of uniting the most innovative surgeons and engineers globally with progressive companies to enhance personalized hip and knee arthroplasty for all patients. This event aims to foster the advancement of arthroplasty through educational initiatives and constructive discussions

The industry is experiencing robust global expansion due to increasing strategic growth of companies into new regions to capitalize on emerging opportunities and meet the increasing demand for hip replacement surgeries and implants. For instance, in February 2024, Zeda, Inc., a company based in California, U.S., acquired the Orthopaedic Implant Company (OIC) located in Reno, Nevada. This acquisition enabled Zeda to manufacture OIC’s implant designs to strengthen and expedite its mission to provide cost-effective trauma implants to patients globally

Product Type Insights

The total hip replacement implants segment held the highest revenue share of 37.6% in 2023 due to the high volume of total hip replacement surgeries across the globe. Since total hip replacement is the most frequent type of hip replacement surgery, the demand for total hip replacement implants is also greater. For instance, the Agency for Healthcare Research and Quality estimates that more than 450,000 total hip replacements are carried out annually in the U.S. Revision hip replacement implants are expected to experience the fastest growth rate from 2024 to 2030.

The growth can be attributed to the advancements in medical technology and implant design that have enhanced the durability and longevity of hip implants, resulting in a larger pool of patients who may require revision surgery after their initial procedure. For instance, dual mobility total hip arthroplasty consists of a small metal or ceramic head that is mobile within a larger polyethylene (PE) head and has been increasingly adopted for primary total hip arthroplasty. Many national joint registries have reported an increased use of dual mobility articulations, with the American Joint Replacement Registry reporting a rise in all total hip arthroplasties. These implants provide improved hip stability and reduced dislocation rates.

Material Insights

The metal-on-PE segment accounted for the largest share of 30.8% in 2023 since it is among the most affordable implants and offers advantages including fewer complications and fewer wear particles. In addition, the industry is experiencing considerable expansion potential due to ongoing breakthroughs in metal-on-polyethylene mixture materials.For instance, the development of highly cross-linked polyethylene (HXLPE). This advanced form of PE has shown promise in reducing wear rates compared to conventional PE, thereby potentially extending the lifespan of joint replacements. In addition, metal-on-PE implants are widely accessible and have a track record of clinical success.

The ceramic-on-PE segment is anticipated to experience the highest CAGR from 2024 to 2030 due to its low wear rate and reduced complications. Ceramic-on-PE hip replacement implants offer superior wear resistance than their metal-on-PE counterparts and are less likely to cause hindrances, such as metal toxicity and implant corrosion. Due to these factors, they are anticipated to gain popularity over the forecast period. Major players in this segment include DePuy Synthes, Stryker, and Zimmer Biomet.

End-use Insights

The hospitals & surgery centers segment accounted for the largest revenue share of 69.2% in 2023. The segment growth is driven by a rise in hip implant surgeries performed in these facilities. These facilities have the most recent & up-to-date technology and qualified medical staff, further accelerating segment growth. In addition, partnerships between hospitals and key players to develop cutting-edge surgical techniques support segment growth.

The orthopedic clinics segment is expected to experience the highest CAGR from 2024 to 2030 due to the growing number of orthopedic surgeons & orthopedic clinics and the favorable affordability of outpatient replacement surgeries. The availability of qualified surgeons and the development of an advanced infrastructure are also positively influencing this growth.

Regional Insights

The hip replacement implants market in North America dominated the global market for hip replacement implantsand accounted for a revenue share of 46.0% in 2023. This can be attributed to the high prevalence of osteoarthritis and the rise in the volume of hip replacement surgeries in North America. Moreover, increased R&D activity for advancements in hip replacement surgeries and product approvals contribute to market growth. For instance, in May 2022, The FDA accelerated access to cutting-edge technologies that could enhance hip replacement procedures by designating JointMedica’s Polymotion hip resurfacing system as a Breakthrough Device.

U.S. Hip Replacement Implants Market Trends

The U.S. hip replacement implants marketheld a significant share of the North America market in 2023, driven by factors, such as advancing technologies, changing patient care strategies, and growing cases of hip replacement. For instance, as reported by the American Joint Replacement Registry in 2022, approximately 6,805 revision hip arthroplasty or hip replacement procedures were conducted in the U.S. Moreover, the growing prevalence of arthritis in the U.S. is boosting the demand for hip replacement. As per the SingleCare updates 2024, in the U.S., 1 in 4 adults register arthritis issues. In addition, over 5 million adults in the U.S. are projected to have arthritis by 2040.

Europe Hip Replacement Implants Market Trends

The hip replacement implants market in Europe is witnessing growth fueled by increased investments in R&D from the public and private sectors. The high demand for partial replacement operations and rising cases of hip joint pain-related conditions are also expected to boost the regional market expansion. Moreover, organizations in the region are adopting robotic surgeries, which is further propelling the market growth. For instance, in August 2023, Nuffield Health Warwickshire Hospital announced its plans to offer Mako robot, a robot-assisted surgery facility, to its patients requiring hip replacements.

The France hip replacement implants market is expected to grow over the forecast period. The French government is undertaking initiatives to improve the healthcare structure in France. The government recently announced a fund of USD 1.63 billion (EUR 1.5 billion) over 3 years for staffing services, which is expected to improve the country’s healthcare industry. Furthermore, the number of hip procedures in France is expected to increase considerably over the next 50 years, which is expected to boost market growth in the country.

Thehip replacement implants market in Germany is projected to expand considerably over the forecast period owing to a rapidly aging population, growing prevalence of hip joint pain and injuries, the presence of a sophisticated healthcare system, a highly qualified workforce, and high healthcare spending. Germany has a lucrative environment for technologically innovative startups. Around 80% of the surgical & implant device manufacturers, including companies of hip replacement and implant devices in the country are SMEs. The presence of major market players, such as Johnson & Johnson, Stryker Corp., and Smith & Nephew Plc, is anticipated to create lucrative opportunities in Germany.

Asia Pacific Hip Replacement Implants Market Trends

The Asia Pacific hip replacement implants marketis expected to grow at the fastest CAGR from 2024 to 2030 due to the rapid growth of the population and increased R&D activities in this region. Moreover, the increasing strategic initiatives by companies are driving the regional market growth. For instance, in July 2023, Zimmer acquired OSSIS to gain access to clinical experience & engineering proficiency and to offer innovative med-tech technologies to its patients across various regions including Asia Pacific.

The hip replacement implants market in Japan is expected to grow at a steady rate from 2024 to 2030 due to the growing geriatric population and the ongoing need for advanced medical technologies in Japan. Moreover, the government’s initiatives to support the healthcare industry are anticipated to sustain market growth.

The China hip replacement implants market is expected to have significant growth in the coming years. Companies interested in entering the market in China must overcome existing barriers in an ambiguous and changing regulatory environment. The country also offers momentous potential for U.S. companies interested in expanding and entering the Chinese market. Moreover, the rising prevalence of age-related orthopedic conditions highlights China’s substantial market influence, as the necessity for joint replacements escalates with an aging populace. This trend solidifies China’s position as a pivotal influencer in shaping the course of the market in Asia Pacific.

Latin America Hip Replacement Implants Market Trends

The hip replacement implants market in Latin America is experiencing significant growth due to various factors, such as the increasing obese & geriatric population and a rise in the cases of hip injuries. For instance, according to the International Osteoporosis Foundation, approximately 655,645 cases of hip fractures are expected to be registered in Latin America by 2050.

The Kuwait hip replacement implants market is expected to grow over the forecast period due to a favorable investment outlook, with the country focusing on investments in the private sector. Moreover, the country offers hip implants at subsidized rates in the public sector, owing to the plans of Kuwait’s Ministry of Health. This is expected to drive the market demand and provide significant growth opportunities for players in the country.

Key Hip Replacement Implants Company Insights

The global market is highly competitive, with key players, such as Johnson & Johnson and Smith & Nephew Plc, holding significant positions. Major companies are undertaking various organic as well as inorganic strategies, such as new product development, collaborations, acquisitions, mergers, and regional expansions, to serve the unmet needs of their customers.

Key Hip Replacement Implants Companies:

The following are the leading companies in the hip replacement implants market. These companies collectively hold the largest market share and dictate industry trends.

- Zimmer Biomet

- Johnson & Johnson

- Stryker Corporation

- Smith & Nephew Plc

- MicroPort Scientific Corporation

- Exactech, Inc.

- OMNIlife Science, Inc.

- B. Braun Melsungen AG

- DJO Global, Inc.

- Aesculap Implant Systems, LLC

- ConMed Corporation

Recent Developments

-

In February 2024, Hip Innovation Technology, LLC (HIT) unveiled its flagship product, the Reverse Hip Replacement System (Reverse HRS) at the 2024 American Academy of Orthopaedic Surgeons (AAOS) annual meeting in San Francisco

-

In August 2023, Stryker introduced a nationwide marketing campaign called “Scan. Plan. Mako Can.” This initiative aims to raise awareness among patients about Mako SmartRobotics, an advanced solution for individuals in need of hip joint replacement surgery due to arthritis

-

In August 2023, Smith+Nephew introduced the OR3O Dual Mobility System for primary and revision hip arthroplasty in India. The new launch features a unique design where a smaller femoral head securely fits into a larger polyethylene insert. This innovative configuration enhances stability, reduces the risk of dislocation, and provides an improved range of motion compared to traditional hip implant solutions. The Managing Director, South Asia, Smith+Nephew stated, “Smith+Nephew’s OR3O Dual Mobility System is a groundbreaking introduction for India that offers technology not available in other systems”.

-

In January 2023, Exactech revealed that the first hip resurfacing surgery was effectively completed employing the novel JointMedica Polymotion hip implant, which is built on a metal-on-polyethylene formulation

Hip Replacement Implants Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.9 billion

Revenue forecast in 2030

USD 5.5 billion

Growth rate

CAGR of 2.1% from 2024 to 2030

Actual Data

2018 - 2023

Forecast Data

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, material, end- use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Zimmer Biomet; Johnson & Johnson; Stryker Corp.; Smith & Nephew Plc; MicroPort Scientific Corp.; Exactech, Inc.; OMNIlife Science, Inc.; B. Braun Melsungen AG; DJO Global, Inc.; Aesculap Implant Systems, LLC; ConMed Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hip Replacement Implants Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the hip replacement implants market report on the basis of product type, material, end-use, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Total Hip

-

Partial Femoral Head

-

Hip Resurfacing

-

Revision Hip

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Metal-on-metal

-

Metal-on-polyethylene

-

Ceramic-on-polyethylene

-

Ceramic-on-metal

-

Ceramic-on-ceramic

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Surgery Centers

-

Orthopedic Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hip replacement implants market size was estimated at USD 4.8 billion in 2023 and is expected to reach USD 4.9 billion in 2024.

b. The global hip replacement implants market is expected to grow at a compound annual growth rate of 2.1% from 2024 to 2030 to reach USD 5.5 billion by 2030.

b. North America dominated the hip replacement implants market with a share of 46.0% in 2023. This is attributable due to the increase in demand for hip arthroplasty/replacement surgical procedures, and the high prevalence of lower extremity conditions such as osteoarthritis and osteoporosis.

b. Some key players operating in the hip replacement implants market include ConMed Corporation; Aesculap Implant Systems, LLC; DJO Global, Inc.; B. Braun Melsungen AG; OMNIlife Science, Inc.; Exactech, Inc.; MicroPort Scientific Corporation; Smith & Nephew plc; Stryker Corporation; Johnson & Johnson; and Zimmer Biomet.

b. Key factors that are driving the market growth include presence of affordable healthcare facilities in developed countries and technological advancements in non-invasive surgeries, growing number of younger individuals suffering from degenerative diseases, and growing number of robot-assisted surgeries have increased the success rate of minimally invasive hip replacement implant surgeries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.