- Home

- »

- Next Generation Technologies

- »

-

AI In Education Market Size & Share, Industry Report, 2030GVR Report cover

![AI In Education Market Size, Share & Trends Report]()

AI In Education Market (2025 - 2030) Size, Share & Trends Analysis Report By Component, By Deployment, By Technology (NLP, ML), By Application (Intelligent Tutoring System, Learning Platform & Virtual Facilitators), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-948-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

AI In Education Market Summary

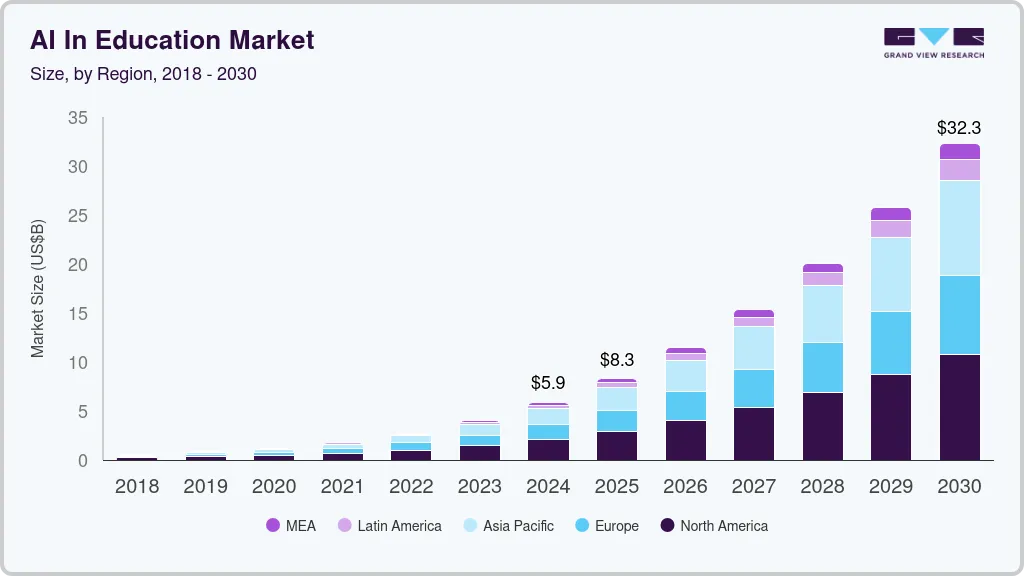

The global AI in education market size was estimated at USD 5.88 billion in 2024 and is projected to reach USD 32.27 billion by 2030, growing at a CAGR of 31.2% from 2025 to 2030. driven by the increasing demand for personalized learning experiences. Schools and institutions are leveraging AI-powered tools such as Intelligent Tutoring Systems (ITS), chatbots, and learning analytics to enhance student engagement and optimize teaching methods.

Key Market Trends & Insights

- North America AI in education market dominated the market with the largest revenue share of 38.0% in 2024.

- The U.S. AI in education market is expected to grow at the fastest CAGR during the forecast period.

- Based on component, the solutions segment led the market with the largest revenue share of 70.3% in 2024.

- Based on deployment, the cloud segment led the market with the largest revenue share of 60.1% in 2024.

- Based on technology, the machine learning segment led the market with the largest revenue share of 64.7% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.88 Billion

- 2030 Projected Market Size: USD 32.27 Billion

- CAGR (2025-2030): 31.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The integration of AI in the education industry is further propelled by the shift towards e-learning platforms, accelerated by the COVID-19 pandemic, and growing investments in EdTech startups. In addition, advancements in Natural Language Processing (NLP) and computer vision are expanding AI applications for automated assessments, content delivery, and adaptive learning solutions. The need for data-driven decision-making in institutions drives the growing adoption of AI in education industry. Educational institutions are utilizing AI-based analytics to monitor student performance, predict dropout rates, and design intervention strategies for at-risk students. The increasing role of AI in skill development and workforce training, mainly through online courses and certifications, is also contributing to market growth. Governments across various countries are supporting artificial intelligence (AI) initiatives in education through funding programs and policy frameworks, further accelerating adoption.

The rapid expansion of virtual learning environments, which rely heavily on AI for customization and scalability, is driving the market growth. AI-integrated platforms are improving accessibility by offering language translation, speech recognition, and assistive technologies for students with disabilities. The proliferation of 5G networks and smart devices is enabling seamless access to AI-powered educational solutions, increasing adoption globally. Furthermore, the shift towards hybrid learning models is creating long-term opportunities for AI-based solutions as institutions increasingly blend in-person and online education.

Component Insights

Based on component, the solutions segment led the market with the largest revenue share of 70.3% in 2024, due to the widespread adoption of AI-powered Learning Management Systems (LMS) and ITS. These solutions enable personalized learning paths, automate grading processes, and provide real-time analytics to educators, enhancing teaching efficiency. The demand for adaptive learning software, virtual classrooms, and AI chatbots has surged as they offer flexible, student-centric learning experiences. In addition, the increasing need for automated administrative tools, such as attendance tracking and performance monitoring systems, has driven institutions to invest in comprehensive AI-based solutions.

The services segment is predicted to foresee at a significant CAGR during the forecast period, due to the increasing demand for implementation, integration, and consulting services in the AI education industry. As institutions adopt AI-powered solutions, they require technical support to customize platforms, ensure seamless integration with existing systems, and train staff to use these tools effectively. Managed services, including regular software updates, system monitoring, and data security, are becoming essential to maintain the smooth operation of AI-based platforms. In addition, educational institutions are relying on consulting services to develop strategies for artificial intelligence (AI) adoption and to stay aligned with evolving industry standards and best practices.

Deployment Insights

Based on deployment, the cloud segment led the market with the largest revenue share of 60.1% in 2024, due to the growing adoption of cloud-based platforms for seamless access to learning resources anytime, anywhere. Cloud solutions enable faster deployment of AI-powered tools, such as virtual classrooms, ITS, and LMS, enhancing operational efficiency. In addition, cloud-based platforms support real-time data analytics and remote monitoring, helping educators personalize learning experiences and track student performance more effectively. With increasing hybrid and remote learning models, the reliance on cloud technology has surged, offering institutions flexibility, data security, and cost optimization.

The on-premises segment is expected to showcase at a significant CAGR over the forecast period, as institutions with stringent data privacy requirements prefer local infrastructure over cloud-based solutions. Educational institutions, mainly in regions with strict data protection laws or concerns over cybersecurity, are investing in on-premises AI systems to maintain full control over sensitive student and administrative data. In addition, on-premises setups offer greater customization, allowing institutions to tailor AI solutions according to their specific operational needs without relying on third-party cloud providers. Schools and universities with large budgets are also prioritizing on-premises deployments to ensure minimal downtime, better performance, and high-speed data processing.

Technology Insights

Based on technology, the machine learning segment led the market with the largest revenue share of 64.7% in 2024, driven by its ability to power personalized learning experiences and adaptive education platforms. ML algorithms help analyze student behavior, learning patterns, and performance data, enabling educators to tailor content and interventions based on individual needs. This technology is widely adopted in ITS, automated assessments, and predictive analytics, enhancing both teaching efficiency and student outcomes. Educational institutions and EdTech companies are leveraging Machine Learning (ML) for tasks such as content recommendation, chatbot assistance, and performance forecasting, further expanding its scope.

The Natural Language Processing (NLP) segment is anticipated to witness at a significant CAGR during the forecast period, due to its ability to enhance interaction between students and AI-driven systems. NLP-powered chatbots and virtual assistants are increasingly used in educational platforms to provide instant responses to student queries, easing the burden on educators. Technology also plays a vital role in language translation, making learning materials accessible to non-native speakers and promoting inclusive education. In addition, NLP enables automated grading of essays and assessments, saving time and ensuring consistency in evaluations.

Application Insights

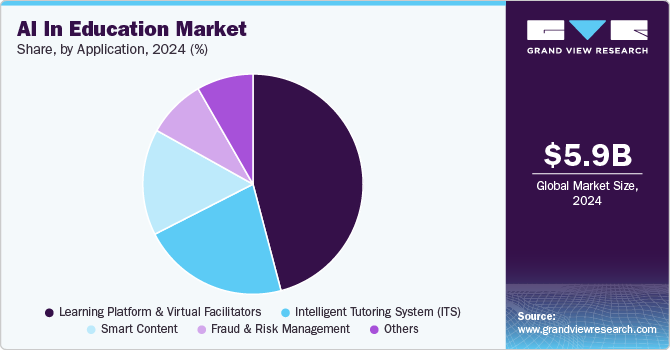

Based on application, the learning platform & virtual facilitators segment led the market with the largest revenue share of 45.9% in 2024, due to the rising demand for digital learning environments and personalized education. Virtual facilitators, such as AI-powered tutors and teaching assistants, enable real-time student interaction and support, improving engagement and learning outcomes. Educational institutions and corporations are increasingly adopting these platforms to offer flexible, self-paced courses and certifications, catering to diverse learner needs. The COVID-19 pandemic accelerated the shift towards e-learning, driving investments in virtual classrooms and AI-enhanced platforms for remote and hybrid education models.

The smart content segment is poised for significant CAGR during the forecast period, as educational institutions increasingly prioritize personalized learning experiences tailored to individual student needs. Smart content utilizes AI algorithms to curate, generate, and adapt learning materials, ensuring relevance and engagement for diverse learners. The rise of digital textbooks, interactive simulations, and multimedia resources has fueled demand for content that is not only informative but also engaging and interactive. In addition, the integration of adaptive learning technologies allows for real-time adjustments to content based on student performance, promoting mastery of subjects at a personalized pace.

End-use Insights

Based on end use, the higher education segment led the market with the largest revenue share of 44.3% in 2024, primarily driven by the increasing demand for innovative teaching methods and advanced learning technologies among colleges and universities. Higher education institutions are rapidly adopting AI-powered solutions to enhance student engagement, improve retention rates, and personalize learning experiences for diverse student populations. The rise of online degree programs and blended learning models has further accelerated the integration of AI tools in curriculum design, assessment, and student support services. In addition, institutions are leveraging data analytics and machine learning to inform strategic decision-making and optimize resource allocation, enhancing overall operational efficiency.

The corporate training & learning segment is anticipated to exhibit at the fastest CAGR over the forecast period, driven by the growing recognition of continuous skill development in an evolving job market. Organizations are increasingly adopting AI-powered training solutions to deliver personalized learning experiences that cater to employees' specific skill gaps and career aspirations. The shift towards remote and hybrid work models has accelerated the demand for flexible, on-demand training programs that can be accessed anytime, anywhere. In addition, AI technologies are enabling companies to track employee progress and engagement, allowing for data-driven adjustments to training programs for maximum effectiveness.

Regional Insights

North America AI in education market dominated the market with the largest revenue share of 38.0% in 2024, driven by the region's advanced technological infrastructure and high investment in education technology. The presence of leading EdTech companies and AI solution providers in the U.S. fosters innovation and accelerates the adoption of AI tools across educational institutions. The presence of leading EdTech companies and AI solution providers in the U.S. fosters innovation and accelerates the adoption of AI tools across educational institutions.

U.S. AI In Education Market Trends

The U.S. AI in education market is expected to grow at the fastest CAGR during the forecast period, driven by substantial investments in educational technology and a focus on personalized learning solutions. The rising demand for personalized learning experiences is driving educational institutions to adopt AI-powered solutions that cater to individual student needs and learning styles. Furthermore, the shift to online and hybrid learning environments, accelerated by the COVID-19 pandemic, has prompted a surge in the use of AI tools to enhance student engagement and accessibility.

Europe AI In Education Market Trends

The Europe AI in education market is expected to witness at a significant CAGR over the forecast period. This growth is primarily driven by the increasing adoption of digital learning solutions and the push for personalized education across various European countries. Government initiatives, such as the European Commission's Digital Education Action Plan, are promoting the integration of AI technologies in schools and universities to enhance teaching and learning processes. In addition, the rising demand for intelligent tutoring systems and virtual learning environments is propelling investments in AI-driven educational tools.

Asia Pacific AI In Education Market Trends

The AI in education market in the Asia Pacific is anticipated to register at the fastest CAGR over the forecast period. This growth is driven by the increasing adoption of digital learning platforms and AI technologies in countries such as China, India, and Japan, where there is a strong emphasis on enhancing educational quality and accessibility. The rapid expansion of e-learning solutions in response to the COVID-19 pandemic has significantly boosted the demand for AI-driven educational tools. Government initiatives aimed at integrating technology into education and fostering innovation are further supporting market growth in this region.

Key AI In Education Company Insights

Some key players in the AI in education industry, such as Pearson, Anthology Inc.,IBM Corporation, Microsoft, are actively working to expand their customer base and gain a competitive advantage. To achieve this, they are pursuing various strategic initiatives, including partnerships, mergers and acquisitions, collaborations, and the development of new products and technologies. This proactive approach allows them to enhance their market presence and innovate in response to evolving security needs.

-

Pearson is a global education company known for its innovative use of technology in the learning space, particularly through its AI-driven solutions. The company has evolved from traditional publishing to becoming a pioneer in digital learning platforms, offering a wide range of educational resources, assessments, and services for K-12 and higher education. Pearson's AI initiatives focus on personalized learning experiences, utilizing data analytics to tailor content and improve student outcomes.

-

Anthology Inc. is a prominent provider of education technology solutions specializing in enhancing the student experience through innovative AI-driven platforms. The company's products encompass a range of functionalities, such as learning management systems (LMS), data analytics, and student information systems, all designed to empower institutions to leverage data for improved decision-making.

Key AI In Education Companies:

The following are the leading companies in the AI in education market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services, Inc.

- IBM Corporation

- Microsoft

- Google LLC

- Pearson

- BridgeU

- DreamBox Learning, Inc.

- Carnegie Learning, Inc.

- Fishtree Inc.

- Anthology Inc.

Recent Developments

-

In September 2024, PowerSchool, a provider of cloud-based software for K-12 education, announced the launch of its new PowerBuddy AI products: PowerBuddy for College and Career and PowerBuddy for Custom AI. These tools are designed to enhance connectivity among school staff, teachers, counselors, students, families, and the community while also assisting students in exploring and taking steps toward achieving success in college, careers, and life.

-

In July 2024, Pearson announced the launch of new generative AI-powered tools to enhance teaching and learning across various age levels through Pearson+ Channels. These tools include the ability for students to upload their syllabus, to create personalized learning experiences and an AI tutor embedded in videos to answer concept-related questions. Pearson’s full-time online K-12 public school program, Connections Academy, is incorporating these AI tools into its high school curriculum for specific subjects, enabling teachers to design assessments using AI-based tools.

-

In February 2024, India launched an AI-powered education tablet designed to enhance digital learning, featuring the BharatGPT virtual assistant for the first time. This innovative tablet incorporates AI and machine learning for inter-lingual translation, supporting India's diverse languages and promoting inclusivity for differently-abled individuals.

AI In Education Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.30 billion

Revenue forecast in 2030

USD 32.27 billion

Growth rate

CAGR of 31.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2017 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, technology, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Amazon Web Services, Inc.; IBM Corporation; Microsoft; Google LLC; Pearson; BridgeU; DreamBox Learning, Inc.; Carnegie Learning, Inc.; Fishtree Inc.; Anthology Inc.

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AI In Education Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global AI in education market report based on component, deployment, technology, application, end-use and region.

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Solutions

-

Services

-

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cloud

-

On-Premises

-

-

Technology Outlook (Revenue, USD Billion, 2017 - 2030)

-

Natural Language Processing (NLP)

-

Machine Learning

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Learning Platform & Virtual Facilitators

-

Intelligent Tutoring System (ITS)

-

Smart Content

-

Fraud and Risk Management

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

K-12 Education

-

Higher Education

-

Corporate Training & Learning

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global AI in education market size was estimated at USD 5.88 billion in 2024 and is expected to reach USD 8.30 billion in 2025.

b. The global AI in education market is expected to grow at a compound annual growth rate of 31.2% from 2025 to 2030 to reach USD 32.27 billion by 2030

b. North America dominated the AI in education market with a market share of 36% in 2024 driven by the region's advanced technological infrastructure and high investment in education technology. The presence of leading EdTech companies and AI solution providers in the U.S. fosters innovation and accelerates the adoption of AI tools across educational institutions.

b. Some key players operating in the AI in education market include Amazon Web Services, Inc.; IBM Corporation; Microsoft; Google LLC; Pearson; BridgeU; DreamBox Learning, Inc.; Carnegie Learning, Inc.; Fishtree Inc.; Anthology Inc.

b. Key factors driving the market growth include the increasing investments in AI and EdTech by private as well as public sector and the increasing penetration of edutainment

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.