Artificial Intelligence Market (2025 - 2033) Size, Share & Trends Analysis Report By Solution, By Technology (Deep Learning, Machine Learning, NLP, Machine Vision, Generative AI), By Function, By End-use, By Region, And Segment Forecasts

Artificial Intelligence Market Summary

The global artificial intelligence market size was estimated at USD 279.22 billion in 2024 and is projected to reach USD 3,497.26 billion in 2033, expanding at a CAGR of 31.5% from 2025 to 2033. The continuous research and innovation directed by tech giants are driving adoption of advanced technologies in industry verticals, such as automotive, healthcare, retail, finance, and manufacturing.

Key Market Trends & Insights

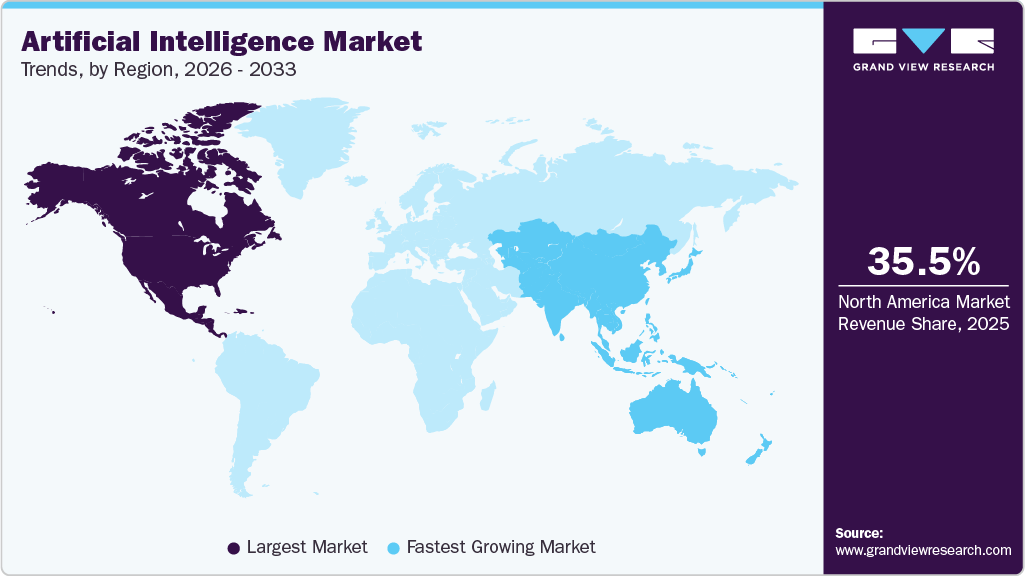

- North America dominated the global Artificial intelligence (AI) market with the largest revenue share of 36.3% in 2024.

- The Artificial intelligence market in the U.S. led the North America Market and held the largest revenue share in 2024.

- By solution, the software segment led the market and held the largest revenue share of 35.0% in 2024.

- By technology, the deep learning segment held the dominant position in the market and accounted for the leading revenue share of 26.0% in 2024.

- By function, operations segment accounted for around largest market share of global revenue in 2024.

Market Size & Forecast

- 2024 Market Size: USD 279.22 billion

- 2033 Projected Market Size: USD 3,497.26 billion

- CAGR (2025-2033): 31.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The integration of artificial intelligence into wearable consumer devices is driving the AI market forward by creating new applications for everyday use. Increasing consumer adoption of these devices encourages further investment in AI research and development. Innovations such as gesture-based controls and intuitive interfaces improve user experience and interaction with AI systems. Industry-specific wearables, including those for athletes, open new revenue streams and demonstrate targeted AI solutions. Together, these factors strengthen the overall AI ecosystem and support sustained growth in the market. For instance, in September 2025, Meta, a U.S.-based technology company, launched its consumer-ready smart glasses with a built-in display, featuring a wristband controller for gesture-based commands and to advance AI-powered personal superintelligence. The launch aims to enhance real-time user interaction, improve communication and memory, and demonstrate the practical applications of artificial intelligence in everyday life.

AI has proven to be a significant revolutionary element of the upcoming digital era. Tech giants like Amazon.com, Inc.; Google LLC; Apple Inc.; Facebook; International Business Machines Corporation; and Microsoft are investing significantly in research and development of AI, thus increasing the artificial intelligence market cap. These companies are working to make AI more accessible for enterprise use cases. Moreover, various companies adopt AI technology to provide better customer experience and improve their presence in the artificial intelligence industry 4.0.

The essential fact accelerating the rate of innovation in AI is accessibility to historical datasets. Since data storage and recovery have become more economical, healthcare institutions and government agencies build unstructured data accessible to the research domain. Researchers are getting access to rich datasets, from historic rain trends to clinical imaging. The next-generation computing architectures, with access to rich datasets, are encouraging information scientists and researchers to innovate faster.

Furthermore, progress in profound learning and ANN (Artificial Neural Networks) has also fueled the adoption of AI in several industries, such as aerospace, healthcare, manufacturing, and automotive. ANN works in recognizing similar patterns and helps in providing modified solutions. Tech companies like Google Maps have been adopting ANN to improve their route and work on feedback received using ANN. ANN is substituting conventional machine learning systems to evolve precise and accurate versions. For instance, recent advancements in computer vision technology, such as GAN (Generative Adversarial Networks) and SSD (Single Shot MultiBox Detector), have led to digital image processing techniques. For instance, images and videos taken in low light, or low resolution, can be transformed into HD quality by employing these techniques. Continuous research in computer vision has built the foundation for digital image processing in security & surveillance, healthcare, and transportation, among other sectors. Such emerging methods in machine learning are anticipated to alter the manner AI versions are trained and deployed.

Solution Insights

Software solutions led the market and accounted for 35.0% of the global revenue in 2024. This leading share can be attributed to prudent advances in information storage capacity, high computing power, and parallel processing capabilities to deliver high-end services. Furthermore, the ability to extract data, provide real-time insight, and aid decision-making has positioned this segment to capture a significant portion of the market. AI software solutions include libraries for designing and deploying artificial intelligence applications, such as primitives, linear algebra, inference, sparse matrices, video analytics, and multiple hardware communication capabilities. The need for enterprises to understand and analyze visual content to gain meaningful insights is expected to spur the adoption of artificial intelligence software over the forecast period.

The services segment is anticipated to exhibit the highest CAGR over the forecast period. This growth is driven by the increasing adoption of AI-driven consulting, integration, and support services as businesses seek to optimize AI implementation. Organizations require expert guidance to integrate AI solutions into existing infrastructures, leading to a surge in demand for managed and professional services. Additionally, continuous AI advancements necessitate regular updates, maintenance, and training, further boosting the services market. The expansion of AI-as-a-Service (AIaaS) offerings by cloud providers also contributes to the segment’s rapid growth, making AI more accessible to businesses of all sizes.

Technology Insights

Deep learning segment led the market and accounted for around largest share of global revenue in 2024 owing to growing prominence of its complicated data-driven applications, including text/content or speech recognition. Deep learning offers lucrative investment opportunities as it helps overcome the challenges of high data volumes. Rising investments in research and development by leading players will also play a crucial role in increasing the uptake of artificial intelligence technologies.

The machine vision segment is anticipated to exhibit the highest CAGR over the forecast period.The machine vision industry has seen a rise in 3D imaging technologies, including stereo vision and structured lighting. For performing robotic tasks like path planning and navigation, 3D structured light technologies are preferred. Most established vendors, such as Keyence Corporation, have developed their structured light technology systems.

The technology is also experiencing widespread adoption in industrial operations, significantly replacing manual inspection and measurement processes. The growing need for efficient and reliable inspection and measurement solutions drives this shift. Machine vision systems deploy smart cameras and image processing to perform measurements and inspections.

Function Insights

Operations segment accounted for around largest market share of global revenue in 2024. The operations segment is the engine room of a business, encompassing all day-to-day activities that deliver products or services to customers. Implementation of AI can automate repetitive tasks, such as data entry and order processing, improving efficiency and reducing errors. Further, by using AI for predictive maintenance, process automation, and supply chain optimization, businesses can streamline workflows, reduce costs, and ensure smooth delivery of their offerings.

The sales and marketing segment is projected to expand with the highest growth rate during the forecast period of 2025 to 2033. It leverages AI to transform how businesses attract and convert customers. AI can analyze vast amounts of customer data to identify high-potential leads, prioritize sales efforts, and personalize marketing campaigns. Chatbots powered by AI can answer customer inquiries, qualify leads, and even schedule appointments, freeing up sales reps for more complex interactions. Additionally, AI can personalize marketing messages and recommendations based on a customer's demographics, purchase history, and online behavior, leading to more targeted and effective marketing campaigns that drive sales.

End Use Insights

The healthcare sector led the AI market in 2024, securing the highest revenue share among all industries. The adoption of AI was fueled by the need to enhance diagnostics, patient care, and operational efficiency. Machine learning and deep learning technologies enabled sophisticated analysis of large datasets for personalized treatment plans. AI applications in medical imaging, drug discovery, and predictive analytics drove significant advancements. Integration of AI helped reduce errors, streamline clinical workflows, and support better decision-making. Hospitals and research institutions increasingly relied on AI to improve outcomes and efficiency. This widespread adoption established healthcare as the dominant sector in the Artificial Intelligence market.

The Automotive and Transportation sector is experiencing rapid growth in the artificial intelligence market. Increasing demand for autonomous vehicles and advanced driver-assistance systems (ADAS) is driving AI adoption. AI technologies enhance traffic management, route optimization, and predictive maintenance, improving overall efficiency. Machine learning and computer vision are being utilized for real-time object detection and safety monitoring. Connected vehicle ecosystems rely on AI to process massive amounts of data from sensors and cameras. The integration of AI supports smart logistics, fleet management, and mobility-as-a-service solutions. The sector is emerging as a key growth area within the broader Artificial Intelligence market.

Other verticals for artificial intelligence systems include retail, law, agriculture, and others. Increasing government regulations play a crucial role in driving the growth of the automotive artificial intelligence market. Governments worldwide are becoming increasingly concerned about road safety and enacting strict safety measures. Moreover, conversational AI platform is also one of the most used artificial intelligence applications in every vertical. Retail segment is anticipated to witness a substantial rise owing to the increasing focus on providing an enhanced shopping experience. An increasing amount of digital data in text, sound, and images from different social media sources is driving the need for data mining and analytics. In the entertainment and advertising industry, AI has been creating a positive impact, and companies are using AI techniques to promote their products and connect to the customer base.

Regional Insights

North America holds the largest share in the artificial intelligence market, accounting for 36.3% in 2024. It is attributed to favorable government initiatives to encourage the adoption of artificial intelligence (AI) across various industries. Governments in North America are investing in AI research and development, establishing specialized research institutes and centers, and funding AI-related projects. They also utilize AI in many fields, such as enhancing public safety and transportation, and promoting healthcare innovation.

U.S. Artificial Intelligence Market Trends

The U.S. holds the largest share in the artificial intelligence market in North America, driven by extensive research and development and advanced technological infrastructure. Widespread adoption of AI across industries such as healthcare, finance, manufacturing, and consumer technology is accelerating growth. Strong investments from both private and public sectors are fueling innovation and the deployment of AI solutions.

Europe Artificial Intelligence Market Trends

The Europe artificial intelligence market is witnessing steady growth, supported by government initiatives and policies promoting AI adoption. Increasing investments in research and development are driving innovation across industries such as healthcare, automotive, and manufacturing. Emphasis on data privacy and ethical AI is shaping technology deployment and market strategies. Key players in the region are focusing on collaborations and partnerships to enhance AI capabilities.

Asia Pacific Artificial Intelligence Market Trends

The Asia Pacific region is the fastest-growing market for Artificial Intelligence. In the Asia-Pacific region, the financial industry is increasingly utilizing AI for tasks such as customer service, credit scoring, risk assessment, and fraud detection. AI-powered chatbots are becoming more common, enhancing customer interactions and providing more seamless banking experiences. As AI technology continues to evolve, the financial sector in Asia-Pacific is expected to explore more advanced applications, which will further transform how financial services are delivered and perceived.

Key Artificial Intelligence Company Insights

Some of the key companies in the artificial intelligence industry include Ayasdi AI LLC, Baidu, Inc., Clarifai, Inc, Cyrcadia Health, Enlitic, Inc., Google LLC, H2O.ai, HyperVerge, Inc., International Business Machines Corporation, and others. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

AiCure is a company focused on developing clinically validated artificial intelligence technologies aimed at improving medication adherence and patient behavior. It offers a software-as-a-service (SaaS) model that includes motion-sensing and facial recognition technologies. AiCure is creating a mobile technology platform that integrates recent advancements in AI, such as machine learning, predictive analytics, deep learning, and computer vision. This platform uses AI on mobile devices to verify medication ingestion in high-risk populations and clinical trials.

-

Clarifai, Inc. is an artificial intelligence company specializing in visual recognition solutions and advanced image recognition systems. Its technology identifies objects, tags, and categories in images and searches for similar images, detecting visual search results and near duplicates. Clarifai, Inc. provides visual recognition and computer vision AI for enterprises and developers. Their products support various applications, including custom face recognition, demographic analysis, and content moderation.

-

Enlitic, Inc. provides artificial intelligence solutions for the healthcare industry. The company develops software that offers insights into treatment planning, early detection, and disease monitoring. Enlitic creates tools that help physicians use medical data effectively and also produces clinical decision-support solutions. The company collaborates with academic institutions, healthcare providers, and pharmaceutical companies to advance its AI technologies.

Key Artificial Intelligence Companies:

The following are the leading companies in the artificial intelligence market. These companies collectively hold the largest market share and dictate industry trends.

- Advanced Micro Devices

- AiCure

- Arm Limited

- Atomwise, Inc.

- Ayasdi AI LLC

- Baidu, Inc.

- Clarifai, Inc

- Cyrcadia Health

- Enlitic, Inc.

- Google LLC

- H2O.ai.

- HyperVerge, Inc.

- International Business Machines Corporation

- IBM Watson Health

- Intel Corporation

- Iris.ai AS.

- Lifegraph

- Microsoft

- NVIDIA Corporation

- Sensely, Inc.

- Zebra Medical Vision, Inc.

Recent Developments

-

In September 2025, Google LLC integrated its Gemini AI into the Chrome browser, adding features for searching, researching, and answering questions with AI, along with upcoming agentic cursor-controlling tools. This development highlights the increasing role of AI in mainstream software, enhancing user interaction and productivity across web applications.

-

In May 2025, H2O.ai introduced agentic AI features for its enterprise platform h2oGPTe at Dell Technologies World, enhancing secure, production-ready deployment of AI across banking, telecom, and government use cases. The updates include integration with Dell AI Factory and Amazon Bedrock, hybrid deployment support, and improved automation and user experience.

-

In March 2025, ServiceNow launched a suite of AI-powered products to enhance enterprise workflow automation. The offerings include AI Agent Studio, a no-code tool for custom AI agent creation; AI Agent Orchestrator, a control tower for seamless AI agent coordination; and thousands of pre-built AI agents to optimize operations and reduce mean-time-to-resolution.

-

In March 2025, the Commonwealth Bank of Australia expanded its partnership and investment in Anthropic PBC to accelerate AI adoption. The collaboration aims to enhance customer experiences, support bank personnel, and provide Commonwealth Bank of Australia technologists with direct access to Anthropic PBC's AI expertise, advancing safe and responsible AI development.

-

In March 2025, EthicalWeb.Ai launched AI Vault, a generative AI-powered enterprise security SaaS solution for AWS customers. Built on the company's AI intellectual property, including three US patents, AI Vault enhances threat detection, response, and prevention with real-time data redaction. It is a key component of a scalable Gen Artificial Intelligence marketplace enterprise offering.

-

In March 2025, NTT DATA Group Corporation and CrowdStrike, Inc. announced an expanded partnership to enhance NTT DATA Group Corporation's managed cybersecurity services using the AI-native CrowdStrike, Inc.'s Falcon platform. This collaboration combines NTT DATA Group Corporation's world-class managed services with Falcon's advanced cybersecurity capabilities, enabling clients to strengthen threat detection, response, and prevention, ensuring robust protection against breaches.

Artificial Intelligence Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 390.91 billion |

|

Revenue forecast in 2033 |

USD 3,497.26 billion |

|

Growth rate |

CAGR of 31.5% from 2025 to 2033 |

|

Historical data |

2021 - 2024 |

|

Forecast period |

2025 - 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Solution, technology, end use, function, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA |

|

Key companies profiled |

Advanced Micro Devices; AiCure; Arm Limited; Atomwise, Inc.; Ayasdi AI LLC; Baidu, Inc.; Clarifai, Inc; Cyrcadia Health; Enlitic, Inc.; Google LLC; H2O.ai.; HyperVerge, Inc.; International Business Machines Corporation; IBM Watson Health; Intel Corporation; Iris.ai AS.; Lifegraph; Microsoft; NVIDIA Corporation; Sensely, Inc.; Zebra Medical Vision, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Artificial Intelligence Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global artificial intelligence market report based on solution, technology, function, end use, and region:

-

Solution Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hardware

-

Accelerators

-

Processors

-

Memory

-

Network

-

-

Software

-

Services

-

Professional

-

Managed

-

-

-

Technology Outlook (Revenue, USD Billion, 2021 - 2033)

-

Deep Learning

-

Machine Learning

-

Natural Language Processing (NLP)

-

Machine Vision

-

Generative AI

-

-

Function Outlook (Revenue, USD Billion, 2021 - 2033)

-

Cybersecurity

-

Finance and Accounting

-

Human Resource Management

-

Legal and Compliance

-

Operations

-

Sales and Marketing

-

Supply Chain Management

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Healthcare

-

Robot Assisted Surgery

-

Virtual Nursing Assistants

-

Hospital Workflow Management

-

Dosage Error Reduction

-

Clinical Trial Participant Identifier

-

Preliminary Diagnosis

-

Automated Image Diagnosis

-

-

BFSI

-

Risk Assessment

-

Financial Analysis/Research

-

Investment/Portfolio Management

-

Others

-

-

Law

-

Retail

-

Advertising & Media

-

Automotive & Transportation

-

Agriculture

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global artificial intelligence market size was estimated at USD 279.22 billion in 2024 and is expected to reach USD 390.91 billion in 2025.

b. The global artificial intelligence market is expected to grow at a compound annual growth rate of 31.5% from 2025 to 2033 to reach USD 3,497.26 billion by 2033.

b. North America dominated the AI market and accounted for over 36.3% share of global revenue in 2024, owing to favorable government initiatives to encourage the adoption of artificial intelligence (AI) across various industries.

b. Some key players operating in the AI market include Atomwise, Inc.; Lifegraph; Sense.ly, Inc.; Zebra Medical Vision, Inc.; Baidu, Inc.; H2O ai; IBM Watson Health; NVIDIA; Enlitic, Inc.; Google LLC; Intel Corporation; and Microsoft Corporation.

b. Key factors that are driving the artificial intelligence market growth include a rise in the adoption of big data, analytics, and the increasing potential of R&D in developing AI systems and technological innovations across the globe.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."