- Home

- »

- Next Generation Technologies

- »

-

AI In Mining Market Size And Share, Industry Report, 2033GVR Report cover

![AI In Mining Market Size, Share & Trends Report]()

AI In Mining Market (2025 - 2033) Size, Share & Trends Analysis Report By Mining Type (Surface Mining, Underground Mining), By Technology (Machine Learning & Deep Learning), By Deployment (Cloud, On-premises, Hybrid), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-665-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

AI In Mining Market Summary

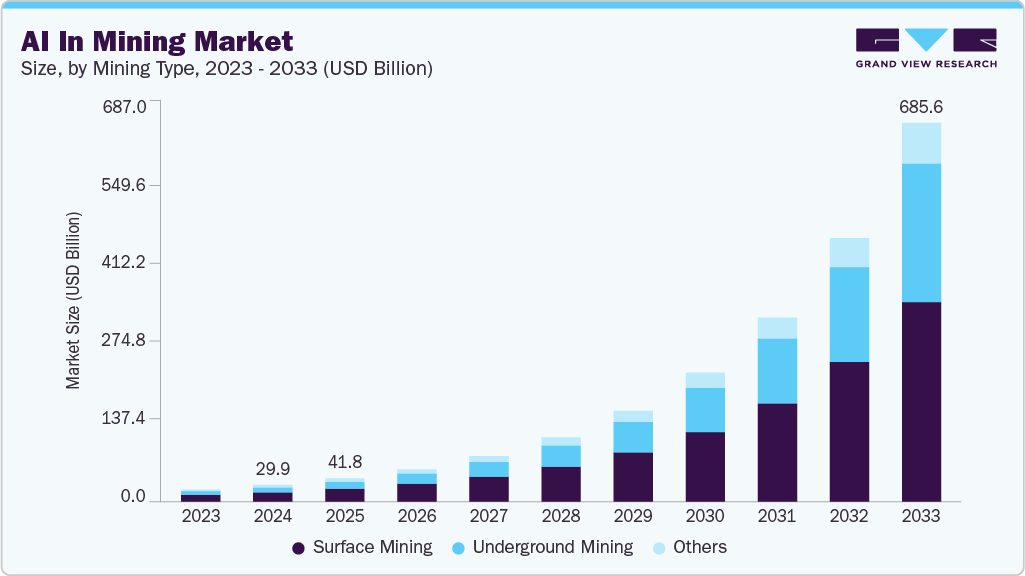

The global AI in mining market size was estimated at USD 29.94 billion in 2024 and is projected to reach USD 685.61 billion by 2033, growing at a CAGR of 41.87% from 2025 to 2033. Artificial intelligence (AI) in mining market growth is significantly accelerated by the growing need for AI technologies that enhance the accuracy of data management, decision making, productivity, and optimize operations with environmental sustainability by technology innovation in the mining sector, which further improves the sorting and accuracy by reducing the consumption of energy and waste.

Key Market Trends & Insights

- North America dominated the global AI in mining market with the largest revenue share of 34.98% in 2024.

- The AI in mining market in the U.S. led the North America market and held the largest revenue share in 2024.

- By mining type, the surface mining segment led the market, holding the largest revenue share of 56.3% in 2024.

- By technology, the machine learning and deep learning segment held the dominant position in the market and accounted for the leading revenue share of 39.2% in 2024.

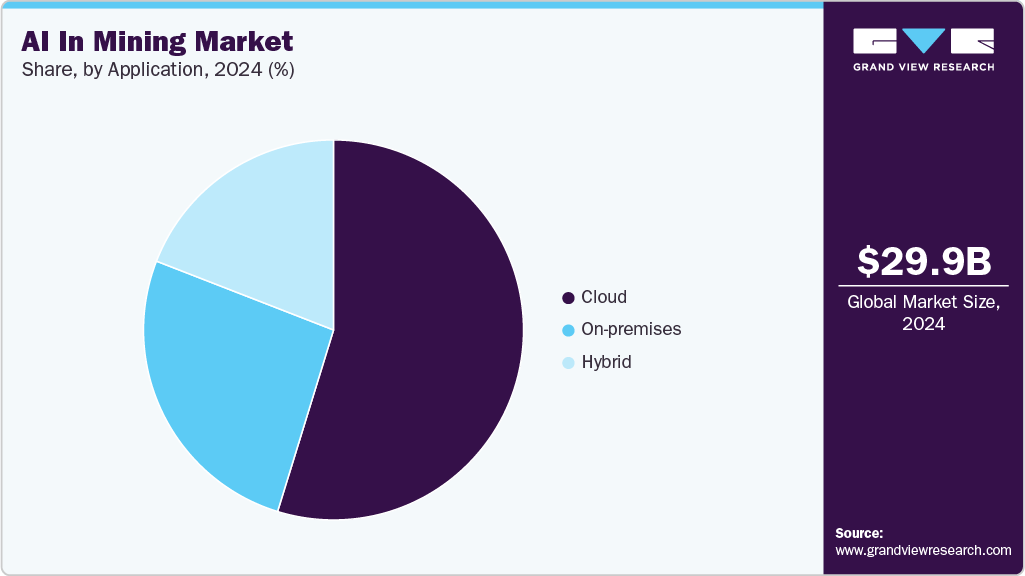

- By deployment, the cloud segment is expected to grow at the fastest CAGR of 42.9% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 29.94 Billion

- 2033 Projected Market Size: USD 685.61 Billion

- CAGR (2025-2033): 41.87%

- North America: Largest market in 2024

The AI in mining market is mainly driven due to its capability to reduce carbon footprints, waste with efficient engineering cycles, and increase compliance with ESG targets to make better use of the natural resources of the Earth. It provides mining workers the digital guidance and learning for remote, safe operations, and also ensures that the budget aligns with the project operations and ensures faster projects with smooth delivery of the product. It implements the predictive strategies for maintenance of the assets so that it extends the organization’s asset lifecycle with increased operational efficiency in the field of materials, energy, yields, and quality.

Furthermore, optimization in the organizations value chain and a rise in productivity by enhancing the coordination and enhanced the balance of supply and demand, which improves the forecasts from mine to processing plant for maximum recovery by leveraging data management and control methods. AI in mining is used to improve the process by analyzing the data from various sources such as surveys, sensors, and weather patterns, enhancing the resource extraction, reduces waste, and overall efficiency of the mining process.

Mining AI also has a unique role by offering safety in AI systems to detect potential hazards in environmental conditions such as landslides, structural failures, roof collapses, water rush-ins, and alert workers for such conditions to tackle such conditions and ensure safety. There are advanced AI wearables with IoT sensors equipped with AI that provide alerts for fatigue and other health issues that may be caused due to the mining process. AI can monitor the impact of mining activities on the environment, predict environmental risks and manage resource optimization, also helps to use renewable energy in mining operations for reducing carbon footprint and energy costs.

Mining Type Insights

The surface mining segment led the market with a revenue share of 56.3% of global market in 2024 due to the rising need for automation, digitalization in the AI tools that deliver improved efficiency and safety, which minimizes human interaction or exposure to risks while performing operations for enhancing fuel efficiency and productivity. Further, the increasing demand for electrification that usually reduces emissions of carbon and other harmful acids while supporting environmental goals. For instance, in December 2023, Epiroc launched its new digital solution tool for safe blasting, Blast Support, which enhances the awareness and safety for blasting activities at the mining sites that delivering alerts to workers in hazardous mine areas.

The underground mining segment is expected to grow at the highest CAGR during the forecast period driven by rising demand for safety of the workers by monitoring the real-time hazard while using the technology of autonomous machines which results in increasing efficiency with predictive analytics of the hazard activities and improving the resource extraction of geological data for better decision making. The use of AI in mining enables energy efficiency by following the regulatory compliance with lowering the costs and impact on the environment. For instance, in April 2025, the Ministry of Coal has introduced initiatives for underground coal mining in India, such as lowering the minimum revenue share and reducing financials. These policies are introduced to understand private investment, speed up project execution, and encourage the utilization of advanced, environmentally friendly mining technologies. This initiative aligns with India’s objectives of sustainable development, energy security, and the vision of Atmanirbhar Bharat by promoting a modern, efficient, and eco-conscious coal industry.

Technology Insights

The machine learning and deep learning segment accounted for the largest revenue share in 2024, due to its ability for the adoption of machine learning and deep learning and robotics & automation in mining include the increase in operational efficiency, lower costs, and enhance safety through automation and better data analysis which allows for the accurate exploration of mineral from the Earth by processing the geological data, which enhance the resource extraction optimization, and predict equipment failure to reduce the waste of time. AI-powered machinery and autonomous vehicles also minimize human exposure to dangerous conditions, improving safety. Furthermore, AI enhances environmental monitoring and promotes sustainable mining practices, offering safety and security.

The computer vision segment is expected to grow at the highest CAGR over the forecast period, driven by the need to reduce operational costs, mainly in energy and maintenance, and improving safety by reducing human presence in hazardous areas through automation and remote control. AI enhances efficiency and productivity by optimizing haulage routes, enabling predictive maintenance, and enhancing mineral processing, which collectively reduces downtime and minimize resource wastage. Moreover, the large volumes of data produced in mining operations further demand AI integration, as advanced analytics offer resource management and decision-making.

Deployment Insights

The cloud segment accounted for the largest revenue share in 2024, driven by its greater operational efficiency and real-time data insights, which support smarter decision-making and predictive maintenance across mining sites. The need to smoothly work with remote operations has raised the need for cloud models, which integrate local edge computing with centralized cloud analytics to address connectivity limitations across different mining sites where network connectivity may be limited. Moreover, cloud adoption enhances collaboration between mining sites and partners, lowers on-site labor costs through remote operations, and strengthens environmental compliance by ensuring transparent data for sustainability reporting.

The on-premises segment is anticipated to grow at the highest CAGR during the forecast period, driven by its ability to provide stronger data security and ease in regulatory compliance, as it lowers the risk of data breaches. This deployment method also delivers low latency and real-time processing, which is better for time-critical mining activities where fast decisions affect the safety and productivity of the workers at the sites. It provides more potential savings by eliminating cloud expenses and supporting better budget planning. For instance, in August 2023, Petrel introduced subsurface mining for geoscientists and engineers to analyze subsurface data from exploration to production, enabling the companies to standardize operations and make informed decisions with an understanding of risks and opportunities.

Regional Insights

North America AI in mining market dominated with a revenue share of 34.98% in 2024, driven by the need to enhance operational efficiency, safety, and sustainability in the mining sector. Mining companies are deploying AI across the entire value chain to improve productivity, cut costs, and meet the increasing need for safety standards. With decarbonization and environmental control high, AI is being used to optimize energy use, safety, and reduce emissions. AI-powered solutions, including predictive maintenance, automation, robotics, digital twins, and advanced analytics, are essential for real-time decision-making and strengthening operational safety. The strong network of mining companies, technology partners, and regulators is working together to create a safer, more efficient, and sustainable mining landscape in North America.

U.S. AI In Mining Market Trends

The U.S. AI in mining market is expected to grow significantly in 2024, driven by regulatory requirements that allow companies to meet strict environmental and safety standards, enabling them to use AI solutions. The large number of operating mines presents many opportunities for implementing automation and predictive maintenance. AI is also important in enhancing mineral exploration by enabling more precise analysis of geological data. Meanwhile, autonomous machinery and robotics increase productivity and lower risks to human workers.

Europe AI In Mining Market Trends

The Europe AI in mining market is witnessing steady growth over the forecast period,due to the region’s strong focus on sustainability and its strategic objective to achieve raw material independence by 2030. Environmental regulations encourage companies to adopt AI to cut or reduce emissions and make better use of resources. At the same time, Europe is working to narrow the AI adoption gap with other parts of the world by investing in technology and workforce skills. AI supports greater process efficiency, predictive maintenance, and improved safety, all essential for achieving operational excellence in mining.

Asia Pacific AI In Mining Market Trends

The AI in mining market in the Asia Pacific region is anticipated to register the highest CAGR over the forecast period led by the AI adoption within the mining sector, driven by investments from both governments and corporations in countries like Australia, China, and India which is in demand by a strong need of enhancing operational efficiency, safety, and sustainability through AI technologies, including autonomous machinery, predictive maintenance, and real-time risk management. The region’s growing human in AI talent and digital transformation initiatives further speed up this adoption. Additionally, national AI strategies and supportive innovation ecosystems are driving the growth and scalability.

Key AI In Mining Company Insights

Some key companies in the AI in mining industry are Sandvik, Microsoft, IBM, SAP, and ABB.

-

Sandvik is in high-tech engineering, is advancing innovation in mining with AI-driven solutions that boost productivity, safety, and sustainability. Among their AI efforts is the Remote Monitoring Service, which leverages advanced analytics and machine learning for predictive maintenance to minimize equipment failures and enhance operational efficiency. Sandvik is also investing in AI projects centered on mining and rock processing, harnessing cloud data and AI to make mining more efficient and environmentally sustainable. Additionally, their AI technologies, including image and speech recognition, promote greater automation and smarter decision-making across mining operations.

-

SAP is in enterprise software and business AI, helping mining companies enhance their operations through powerful data insights and AI-driven solutions. Their specialized mining software improves asset performance, predictive maintenance, supply chain efficiency, and sustainability reporting, fostering more resilient and streamlined mining operations. SAP’s AI tools enable the prediction of equipment failures, integrate ESG metrics into procurement, and optimize workforce management, all contributing to the digital transformation of the mining industry.

Key AI In Mining Companies:

The following are the leading companies in the ai in mining market. These companies collectively hold the largest market share and dictate industry trends.

- IBM

- SAP

- Microsoft

- Datarock

- Earth AI

- BHP

- ABB

- Sandvik

- Caterpillar

- Komatsu

Recent Developments

-

In May 2025, BHP has established its Industry AI Hub in Singapore to drive AI adoption and advance digital transformation within the mining and resources industry. This hub is dedicated to tackling enterprise-level challenges by applying AI to boost safety and productivity, focusing data-driven decision-making and automation into the heart of its operations.

-

In March 2025, ABB has launched out GMD Copilot, an AI-based digital assistant designed to enhance the performance and maintain gearless mill drives (GMDs), which is important in mineral extraction. The tool improves decision-making and helps cut downtime by providing real-time, and insights specifically to context through natural language. GMD Copilot enables mining operators to achieve greater efficiency and reliability due to security features and support of multiple languages, particularly in the copper sector where demand continues to grow.

-

In September 2024, Komatsu planned to acquire Octodots Analytics, a Chilean developer of mining optimization software, to strengthen its AI capabilities and assist customers in improving their mining operations. This acquisition will bolster Komatsu’s new modular ecosystem, which aims to unify data across mine sites and streamline workflows. Built on Komatsu’s dispatch fleet management system, the modular ecosystem enhances decision-making from individual machines to entire sites and organizations.

AI In Mining Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 41.77 billion

Revenue forecast in 2033

USD 685.61 billion

Growth rate

CAGR of 41.87% from 2025 to 2033

Base year for estimation

2024

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Market revenue in USD billion & CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Mining type, technology, deployment, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; KSA; UAE; South Africa

Key companies profiled

IBM; SAP; Microsoft; Datarock; ABB; BHP; Sandvik; Caterpillar; Komatsu; Earth AI

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AI In Mining Market Report Segmentation

This report forecasts revenue growth on global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global AI in mining market report based on the mining type, technology, deployment, and region:

-

Mining Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Surface Mining

-

Underground Mining

-

Others

-

-

Technology Outlook (Revenue, USD Billion, 2021 - 2033)

-

Machine Learning & Deep Learning

-

Robotics & Automation

-

Computer Vision

-

NLP

-

Others

-

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

Cloud

-

On-premises

-

Hybrid

-

-

Market Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global AI in mining market size was estimated at USD 29.94 billion in 2024 and is expected to reach USD 41.77 billion in 2025.

b. The global AI in mining market is expected to grow at a compound annual growth rate of 41.8% from 2025 to 2033 to reach USD 685.61 billion by 2033.

b. North America dominated the AI in mining market with a share of 35.0% in 2024. Driven by the need to enhance operational efficiency, safety, and sustainability in the mining sector. Mining companies are deploying AI across the entire value chain to improve productivity, cut costs, and meet increasing need for safety standards

b. Some key players operating in the AI in mining market include IBM; SAP; Microsoft; Datarock; ABB; BHP; Sandvik; Caterpillar; Komatsu; Earth AI

b. Key factors that are driving the market growth is mainly driven due to its capability to reduce carbon footprints, waste with efficient engineering cycles, and increase compliance with ESG targets to make better use of natural resources of Earth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.