- Home

- »

- Next Generation Technologies

- »

-

AI Workload Management Market Size, Industry Report 2033GVR Report cover

![AI Workload Management Market Size, Share & Trends Report]()

AI Workload Management Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Solution, Services), By Deployment (On-premises, Cloud), By Organization Size (Large Enterprises, SMEs), By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-714-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

AI Workload Management Market Summary

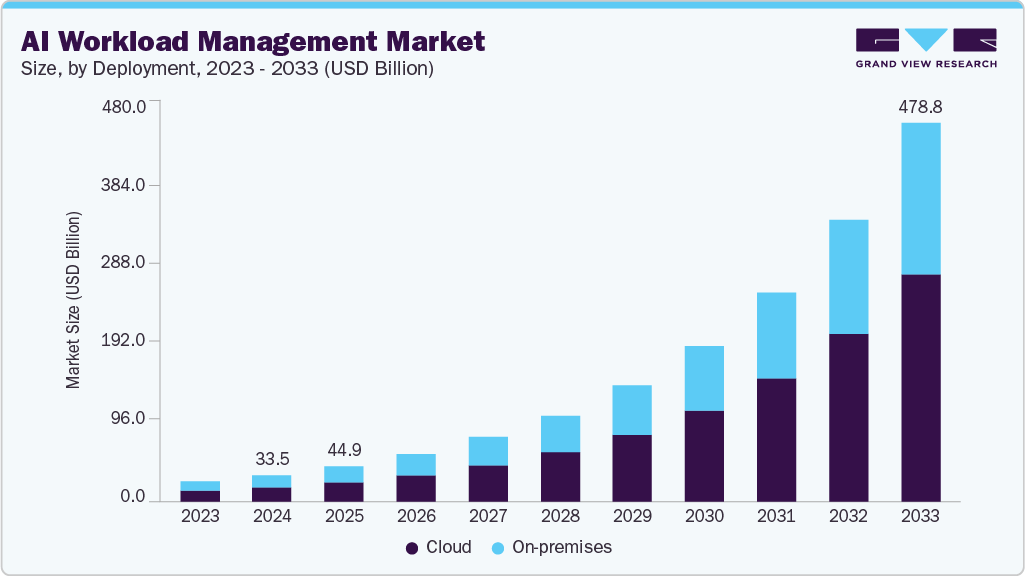

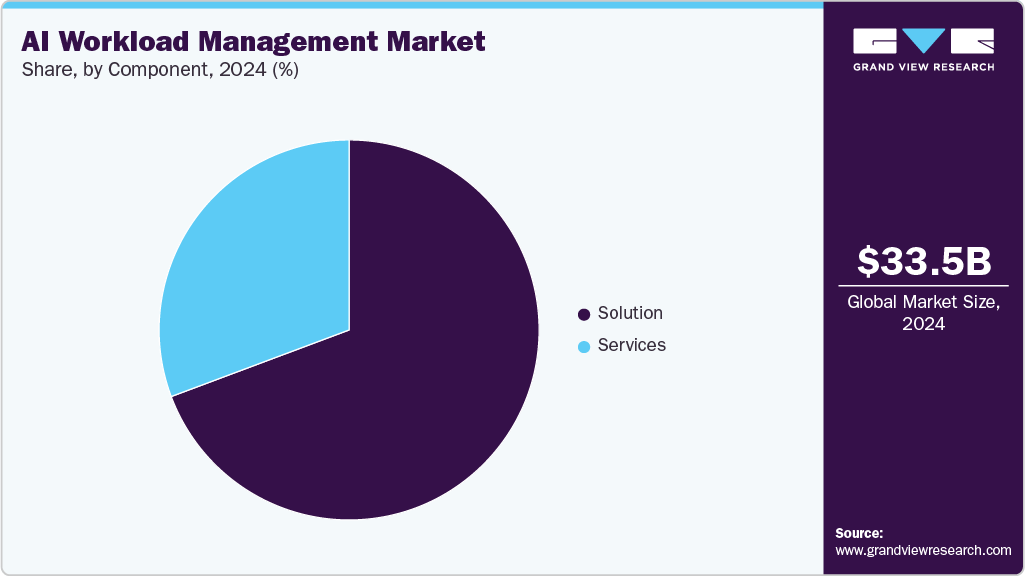

The global AI workload management market size was estimated at USD 33.51 billion in 2024 and is projected to reach USD 478.82 billion by 2033, growing at a CAGR of 34.4% from 2025 to 2033. This growth is driven by the increasing complexity of IT environments, demand for real-time processing and automation, rising volume of data and applications, and cost optimization and operational efficiency.

Key Market Trends & Insights

- The North America AI workload management market dominated with a revenue share of over 36% in 2024.

- The AI workload management market in the U.S. led the North America market and held the largest revenue share in 2024.

- By component, the solution segment led the market with the largest revenue share of over 69% in 2024.

- By deployment, the cloud segment held the dominant position in the market in 2024.

- By organization size, the large enterprises segment held the dominant position in the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 33.51 Billion

- 2033 Projected Market Size: USD 478.82 Billion

- CAGR (2025-2033): 34.4%

- North America: Largest Market in 2024

- Asia Pacific: Fastest Growing Market

The AI workload management market is witnessing rapid growth due to the widespread adoption of artificial intelligence in various sectors such as healthcare, finance, manufacturing, retail, and IT. Organizations are deploying AI models for predictive analytics, automation, and decision-making, leading to increasingly complex workloads that require optimized resource allocation. AI workload management solutions help orchestrate computing tasks, balance workloads, and ensure real-time processing, enabling businesses to achieve operational efficiency. The surge in machine learning, deep learning, and natural language processing applications intensifies the demand for scalable, high-performance workload management platforms to handle large datasets and computationally intensive tasks effectively.

The growing shift toward cloud-based AI deployment, combined with hybrid and multi-cloud infrastructure adoption, significantly drives the AI workload management market. Organizations are leveraging cloud platforms to scale AI workloads dynamically, access High-Performance Computing (HPC), and reduce infrastructure costs. However, distributed workloads across different environments increase complexity, creating the need for intelligent orchestration and scheduling tools. AI workload management platforms enable seamless integration, workload distribution, and cost optimization across cloud and on-premises environments. This is particularly vital for enterprises adopting containerized AI workloads, as orchestration systems such as, Kubernetes integrate closely with workload management solutions to enhance flexibility and reliability.

Businesses are increasingly seeking real-time insights to drive competitive advantage, fueling the demand for AI workload management systems that can process data instantaneously and efficiently. AI workloads, especially in sectors such as, finance, e-commerce, and autonomous systems, require low-latency processing and continuous optimization to ensure accurate outputs. Automated workload scheduling, resource provisioning, and adaptive scaling are essential to prevent performance bottlenecks and minimize downtime. Additionally, the integration of AI workload management with advanced monitoring and analytics enables proactive issue resolution, ensuring uninterrupted service delivery. The push toward automation and operational agility makes AI workload management an indispensable component of AI-driven enterprises.

Deployment Insights

The cloud segment accounted for the largest revenue share in 2024. Cloud platforms offer elastic computing and storage, which is a core driver for AI workload management. AI workloads are highly variable, and the cloud’s ability to scale up GPUs/TPUs and distributed storage on demand reduces provisioning risk and shortens time-to-model. This elasticity also enables experimentation at lower friction, accelerating model iteration. For enterprises moving from pilot to production, cloud scaling removes a major operational barrier and directly supports broader AI adoption across lines of business. Furthermore, cloud-native integrations, managed services, and compliance capabilities also drive the growth of the market.

The on-premises segment is anticipated to grow significantly during the forecast period, driven by the need for robust data security and compliance with stringent regulations in sectors such as finance, healthcare, and government. Enterprises favor on-premises deployment for greater customization, seamless integration with legacy systems, and optimized infrastructure control to handle specialized AI workloads. Additionally, it supports mission-critical applications requiring ultra-low latency, such as real-time analytics and high-frequency trading, by eliminating reliance on external connectivity. These capabilities ensure enhanced performance, operational reliability, and regulatory adherence, making on-premises solutions a preferred choice for organizations with complex, sensitive, and performance-intensive AI requirements.

Component Insights

The solution segment led the market with a revenue share of over 69% of global market in 2024. The growth is propelled by the growing complexity and scale of AI deployments, which demand advanced orchestration, scheduling, and optimization capabilities. Enterprises are increasingly adopting AI workload management solutions to automate resource allocation, ensure high availability, and improve computer efficiency across hybrid, multi-cloud, and on-premises environments. The rise in containerized AI workloads, integration with Kubernetes, and demand for real-time processing further boost solution adoption. Additionally, advancements in analytics-driven workload optimization, predictive resource scaling, and cost management capabilities make solutions essential for enterprises aiming to maximize ROI from AI infrastructure investments.

The services segment is predicted to experience the fastest growth in the forecast years. Organizations are seeking expert assistance to deploy, configure, and integrate workload management solutions into their existing IT and AI infrastructure. Various enterprises lack in-house expertise to manage complex AI workloads, especially in hybrid or multi-cloud environments. Professional services providers help design optimal architectures, ensure seamless interoperability with legacy systems, and align workload management strategies with business goals. The increasing complexity of AI models, coupled with the demand for faster time-to-market, boosts the need for specialized consulting, integration, and deployment services.

Organization Size Insights

The large enterprises segment accounted for the largest revenue share in 2024. The need to optimize complex, large-scale AI deployments, ensuring high performance, scalability, and cost efficiency across global operations, is primarily driving the growth of the segment. These organizations handle massive data volumes and diverse AI workloads, requiring advanced orchestration, automation, and intelligent resource allocation to maximize infrastructure utilization. Rising adoption of hybrid and multi-cloud strategies amplifies the demand for workload portability, security, and compliance management. Additionally, competitive pressures push large enterprises to accelerate AI-driven innovation, enhance decision-making speed, and improve customer experience, fueling investments in robust workload management solutions that deliver agility, resilience, and measurable ROI.

The SMEs segment is expected to grow at the highest CAGR during the forecast period. The SMEs segment in the AI workload management market is driven by the growing need to optimize limited IT resources, enhance operational efficiency, and reduce infrastructure costs through automation and intelligent workload distribution. Increasing adoption of cloud-based AI solutions enables SMEs to access scalable computing power without heavy capital investment, supporting agility and faster decision-making. Rising competition compels SMEs to leverage AI for predictive analytics, real-time monitoring, and process automation to improve productivity. Additionally, advancements in user-friendly AI platforms and managed services lower technical barriers, enabling smaller enterprises to integrate AI workload management solutions seamlessly and drive digital transformation.

Vertical Insights

The IT & telecommunication segment accounted for the largest revenue share in 2024 due to the rapid expansion of data-intensive applications, increasing adoption of cloud-native architectures, and the need for real-time network optimization. The growing deployment of 5G infrastructure and edge computing requires intelligent workload distribution to enhance speed, reliability, and scalability. Rising demand for Automation in IT operations (AIOps) and predictive analytics further accelerates adoption, enabling proactive performance management and reduced downtime. Additionally, increasing cyber threats and compliance requirements push telecom operators to leverage AI-driven workload management for secure, efficient, and resilient network operations, improving service delivery and customer experience.

The manufacturing segment is anticipated to grow at the highest CAGR during the forecast period, driven by the rapid adoption of Industry 4.0 and smart manufacturing technologies, enabling real-time monitoring, predictive maintenance, and production optimization. Increasingly complex, data-intensive operations require AI-powered workload orchestration to manage multi-cloud infrastructure, simulation, and analytics efficiently. The growing need for predictive and prescriptive insights, coupled with integration into MES and ERP systems, enhances operational agility. Workforce skill gaps are accelerating automation adoption, while sustainability goals push manufacturers to optimize energy consumption. These factors position AI workload management as a crucial enabler of efficiency, cost reduction, and competitiveness in manufacturing.

Regional Insights

The North America AI workload management market dominated with a revenue share of over 36% in 2024. The North American market is primarily driven by the rapid adoption of AI and machine learning technologies across enterprises seeking to optimize computational efficiency and reduce operational costs. Increasing demand for automated data processing, coupled with the growth of cloud computing infrastructure and edge AI deployments, fuels the need for advanced workload management solutions. Additionally, stringent regulatory compliance and data security requirements push organizations to implement robust AI workload orchestration tools. Growing investments in AI research and development, along with the proliferation of big data analytics, further accelerate market expansion, positioning North America as a key leader in AI workload management adoption.

U.S. AI Workload Management Market Trends

The U.S. AI workload management market is expected to grow significantly in 2024 due to the robust technological infrastructure and strong presence of AI-centric enterprises driving demand for efficient workload orchestration. Increasing investments in AI research and development, coupled with widespread adoption of cloud-native architectures, support scalable and flexible AI operations. Stringent data privacy regulations, such as, California Consumer Privacy Act, encourage the deployment of secure workload management solutions. Additionally, the growth of edge computing and IoT ecosystems demands optimized AI workload distribution. Enterprises across sectors such as healthcare, finance, and retail are prioritizing AI-driven automation to enhance productivity and reduce operational complexities, fueling market growth.

Europe AI Workload Management Market Trends

The AI workload management market in Europe is expected to grow significantly over the forecast period.Key driving factors of the European AI workload management market include the rapid adoption of AI technologies across industries seeking enhanced operational efficiency and reduced costs. Increasing demand for scalable, automated workload solutions to manage complex data and computing needs fuels market growth. Regulatory support and investments in digital transformation initiatives further accelerate adoption. The rise of cloud computing and edge AI infrastructure enables flexible deployment, while growing emphasis on AI ethics and governance ensures sustainable integration. Additionally, advancements in machine learning algorithms and increasing AI-powered applications in manufacturing, finance, and healthcare sectors drive robust market expansion in Europe.

Asia Pacific AI Workload Management Market Trends

The AI workload management market in the Asia Pacific region is anticipated to be at the fastest CAGR over the forecast period. The Asia Pacific AI workload management market is propelled by rapid digital transformation across industries, increasing adoption of cloud computing, and growing demand for efficient data processing solutions. Expansion of AI-driven applications in numerous sectors, such as manufacturing, healthcare, and finance fuels the need for scalable workload management. Additionally, rising investments in AI infrastructure, supportive government initiatives promoting AI innovation, and a surge in big data generation accelerate market growth. The growing emphasis on automation to reduce operational costs and enhance decision-making efficiency further drives adoption. These factors collectively position the region as a key growth hub for AI workload management solutions.

Key AI Workload Management Company Insights

Some key companies in the AI workload management industry are Amazon Web Services, Inc., Microsoft, and IBM Corporation.

-

Amazon Web Services, Inc., is a prominent player in the AI workload management market due to its robust, scalable cloud infrastructure and extensive portfolio of AI and machine learning services. AWS offers flexible, pay-as-you-go models that cater to diverse enterprise needs, enabling seamless deployment and management of complex AI workloads. Its global data center footprint ensures low latency and high availability, while continuous innovation in AI tools such as SageMaker empowers businesses to build, train, and deploy models efficiently. Furthermore, Amazon Web Services, Inc.’s strong ecosystem of partners and developer community accelerates adoption, solidifying its position as the preferred platform for managing AI workloads worldwide.

-

Microsoft is a key player in the AI workload management market. The company provides a robust Azure cloud platform, integrates advanced AI and machine learning services with seamless scalability and security. Its strong enterprise ecosystem, backed by extensive partnerships and hybrid cloud capabilities, enables businesses to efficiently deploy and manage complex AI workloads. Continuous innovation in AI tools, such as Azure Machine Learning and Cognitive Services, combined with global data center infrastructure, ensures low latency and high performance. Microsoft’s commitment to compliance, industry-specific solutions, and developer-friendly environments further strengthens its position in the AI workload management market.

Key AI Workload Management Companies:

The following are the leading companies in the AI workload management market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services, Inc.

- Microsoft

- IBM Corporation

- Dell Inc.

- Hewlett Packard Enterprise Development LP

- Lenovo

- Huawei Technologies Co., Ltd.

- NVIDIA Corporation

- Advanced Micro Devices, Inc.

Recent Developments

-

In August 2025, Microsoft announced the general availability of OpenAI's GPT-5 in Azure AI Foundry. This integration provides enterprises with advanced AI capabilities, enabling the development of advanced AI applications and agents on Microsoft's cloud platform. This advancement significantly enhances AI workload management by improving scalability, automation, and efficiency in handling complex AI workloads across diverse industries.

-

In July 2025, Amazon Web Services, Inc. introduced Amazon Bedrock AgentCore at AWS Summit New York 2025. Amazon Bedrock AgentCore, a platform designed to securely deploy and operate AI agents on a scale. This tool offers memory management, identity controls, and tool integration, streamlining AI agent development and deployment.By enhancing the efficiency and security of managing multiple AI agents, it significantly optimizes workload distribution and resource utilization in the AI workload management market.

-

In May 2025, IBM Corporation expanded partnership with Oracle to integrate watsonx, IBM Corporation’s premier AI product portfolio, with Oracle Cloud Infrastructure (OCI). By utilizing OCI’s native AI capabilities, this latest advancement in IBM Corporatin’s strategic partnership with Oracle aims to drive a new phase of multi-agent, AI-powered productivity and operational efficiency across enterprises.This integration will significantly enhance AI workload management by enabling more scalable, efficient processing and seamless orchestration of complex AI workloads in hybrid cloud environments.

AI Workload Management Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 44.96 billion

Revenue forecast in 2033

USD 478.82 billion

Growth rate

CAGR of 34.4% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, organization size, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Amazon Web Services, Inc.; Microsoft; Google; IBM Corporation; Dell Inc.; Hewlett Packard Enterprise Development LP; Lenovo; Huawei Technologies Co., Ltd.; NVIDIA Corporation; Advanced Micro Devices, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AI Workload Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global AI workload management market report based on component, deployment, organization size, vertical, and region:

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Solution

-

Services

-

-

Organization Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

Large Enterprises

-

SMEs

-

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

On-premises

-

Cloud

-

-

Vertical Outlook (Revenue, USD Billion, 2021 - 2033)

-

Retail & E-commerce

-

Healthcare & Life Sciences

-

BFSI

-

Government and Public Sector

-

IT & Telecommunication

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global AI workload management market size was estimated at USD 33.5 billion in 2024 and is expected to reach USD 45.0 billion in 2025.

b. The global AI workload management market is expected to grow at a compound annual growth rate of 34.4% from 2025 to 2033 to reach USD 478.8 billion by 2033.

b. North America dominated the AI workload management market with a share of 36.5% in 2024, primarily driven by the rapid adoption of AI and machine learning technologies across enterprises seeking to optimize computational efficiency and reduce operational costs.

b. Some key players operating in the AI workload management market include Amazon Web Services, Inc.; Microsoft; Google; IBM Corporation; Dell Inc.; Hewlett Packard Enterprise Development LP; Lenovo; Huawei Technologies Co., Ltd.; NVIDIA Corporation; and Advanced Micro Devices, Inc.

b. Key factors that are driving the AI workload management market growth include the increasing complexity of IT environments, demand for real time processing and automation, rising volume of data and applications, and cost optimization and operational efficiency.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.