- Home

- »

- Healthcare IT

- »

-

Artificial Intelligence In Precision Medicine Market Report, 2030GVR Report cover

![Artificial Intelligence In Precision Medicine Market Size, Share & Trends Report]()

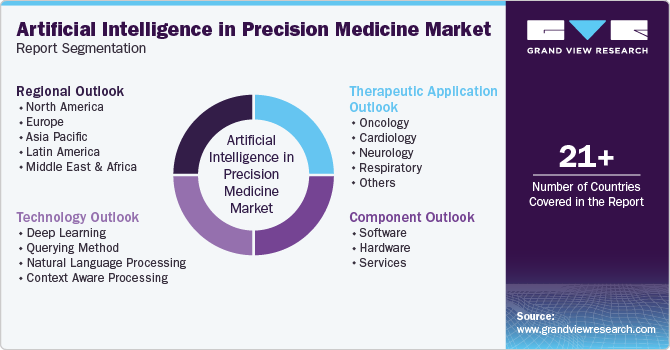

Artificial Intelligence In Precision Medicine Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Querying Method, Context aware processing), By Component (Hardware), By Therapeutic Application (Oncology), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-012-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Artificial Intelligence In Precision Medicine Market Summary

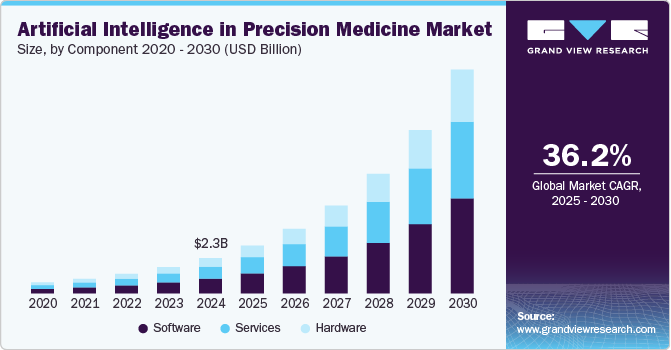

The global artificial intelligence in precision medicine market size was estimated at USD 2.29 billion in 2024 and is estimated to reach USD 14.53 billion by 2030, registering to grow at a CAGR of 36.23% from 2025 to 2030. The market growth is primarily driven by increasing investments in R&D and rising demand for personalized medications.

Key Market Trends & Insights

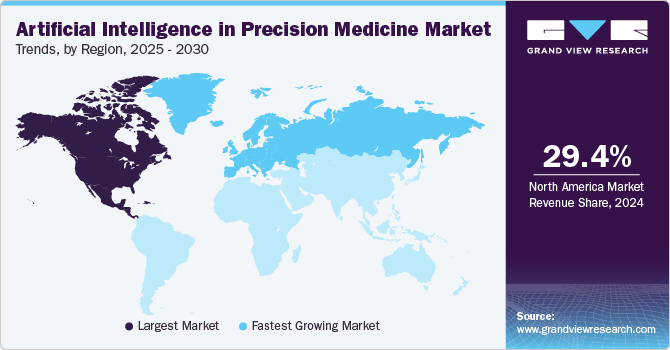

- North America dominated the global market with the largest revenue share of 29.43% in 2024.

- By component, the software segment led the market, holding the largest revenue share of 41.86% in 2024.

- By technology, the deep learning segment dominated the market with a revenue share of 33.60% in 2024.

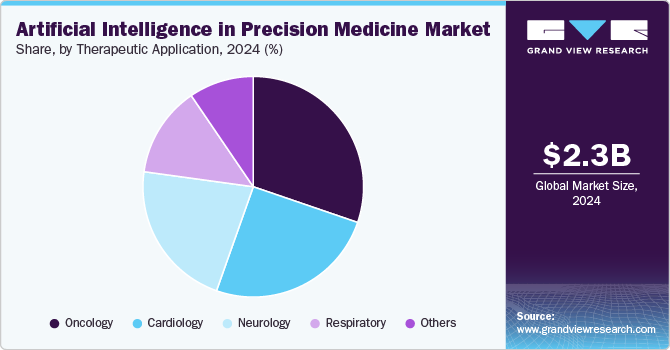

- By therapeutic application, the oncology had a significant revenue share of 30.25% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.29 Billion

- 2030 Projected Market Size: USD 14.53 Billion

- CAGR (2025-2030): 36.23%

- North America: Largest market in 2024

- Europe: Fastest growng market

Collaborations among key companies also play a significant role in driving industry growth. For instance, in August 2022, Enlitic collaborated with GE Healthcare to assist PACS users in enhancing workflow efficiencies through data standardization using Enlitic Curie. The rise in cancer cases across the globe has had a positive impact on the artificial intelligence in precision medicine industry. According to Globocan 2022, globally, around 10 million deaths were caused due to cancer in 2022.

Rising adoption of a sedentary lifestyle and increased alcohol & tobacco consumption are some of the major factors responsible for the rising prevalence of cancer. Moreover, the growing R&D investment drives market growth. The African Access Initiative, a collaboration of corporate and public organizations, focuses on addressing the cancer problem in South Africa by expanding access to cancer therapies & diagnosis and developing a technologically advanced healthcare infrastructure. Furthermore, in precision medicine, wearables play a crucial role in capturing and analyzing data that can be utilized for personalized diagnostics, disease management, and preventive care.

Wearable devices can track changes in physiological parameters and detect early warning signs of diseases, allowing for timely intervention and proactive healthcare. Integrating wearables with advanced analytics and ML algorithms further enhances their potential in precision medicine. By leveraging AI and data analytics, wearables can identify patterns, detect anomalies, and provide valuable insights for disease monitoring, medication adherence, and lifestyle modifications. The growing demand for digital healthcare and clinical health records is another key factor driving the market growth. The increasing adoption of Electronic Health Records (EHRs) and digital health platforms has led to the generation of vast amounts of patient data.

AI technologies, such as ML and deep learning algorithms, have the potential to analyze and derive insights from this data, enabling personalized and precise medical interventions. For instance, in September 2024, Roche expanded its digital pathology platform by integrating over 20 advanced AI algorithms from eight new partners. This collaboration aims to enhance cancer research and diagnosis by providing pathologists and scientists with high-value AI insights, supporting precision medicine for more targeted cancer treatments.

The COVID-19 pandemic positively impacted the market, presenting opportunities for AI-powered computer systems to combat the virus. Various technology companies and startups have been actively working toward mitigating, preventing, and containing the spread of the virus. The outbreak of COVID-19 has also accelerated the growth of the AI market in other domains, driven by the widespread adoption of remote work policies necessitated by the pandemic.

Case Study: Innoplexus - AI-Driven Drug Discovery Platform

Challenge

Traditional drug discovery is slow, costly, and data-intensive, with large volumes of unstructured information from research, publications, and clinical trials that are hard to analyze efficiently.

Solution

Innoplexus developed an AI-powered platform to streamline drug discovery. The platform uses AI techniques, such as computer vision to classify and extract information from PDFs and images, and machine learning to understand context and improve over time. This unstructured data is consolidated into a single dashboard for ease of access.

Implementation

Innoplexus’ platform predicts clinical trial outcomes, helping pharmaceutical companies assess the risks of new drug candidates. For instance, it accurately projected Biogen’s Alzheimer’s drug trial failure with 70-90% certainty, a prediction validated by the trial’s outcome, resulting in a nearly one-third decrease in Biogen’s market value.

Outcomes and Benefits

-

Accelerated drug discovery timelines

-

Ability to tailor drugs for patient subgroups

-

Enhanced drug safety and efficacy

-

Reduction in adverse effects for patients

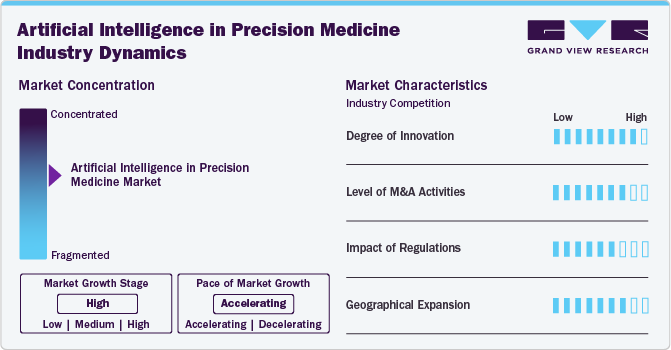

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, level of partnerships & collaboration activities, degree of innovation, impact of regulations, and regional expansion. The agentic AI in healthcare market is fragmented, with the presence of several emerging solution providers dominating the market. The degree of innovation is high, and the level of merger and acquisition activities is moderate. The impact of regulations on industry and the regional expansion of industry is high.

Technological advancements driven by the increasing demand for early and accurate disease treatment, improving patient outcomes, further results in significant innovations. For instance, in October 2024, Aignostics announced securing a USD 34 million Series B funding round to expand precision medicine applications with AI. The funding is expected to support new product development for biopharmaceutical clients, drive U.S. market growth, and advance foundational models in pathology through collaboration with Mayo Clinic. With precision medicine's increasing complexity, biopharmaceutical firms are leveraging AI to improve the efficiency, performance, and scalability of computational pathology for drug development and diagnostics.

The M&A activities, such as mergers, acquisitions, and partnerships, enable companies to expand geographically, financially, and technologically. For instance, in June 2021, Exscientia acquired Allcyte, an AI-based precision medicine firm, to expand its capabilities in evaluating drug responses within patient tumor environments. This acquisition enhances Exscientia’s translational abilities, as Allcyte’s platform uses AI for high-resolution single-cell analysis, clinically validated through studies like EXALT-1. Exscientia aims to integrate this technology across drug discovery to patient selection, furthering its patient-centric AI applications.

The industry has a significant impact of regulations, which are overlooked by several regulatory bodies, as per the region. For instance, the FDA issued a guidance draft in April 2023 to establish a regulatory framework for AI/ML-based devices. The draft outlines the least burdensome approach for continuously improving ML-based Device Software Functions (ML-DSF). The aim is to enhance patient access to secure and effective AI/ML-based devices, ensuring the promotion and protection of general health.

The industry's regional expansion activities are driven by an increasing demand to advance precision medicine, customer base, and technology. For instance, in October 2024, Israel-based Quris-AI announced the acquisition of assets from U.S.-based Nortis. Nortis’s Kidney-on-Chip models, which advance in-vitro drug testing and personalized medicine, are expected to be integrated with Quris-AI’s ML models and patented patient-on-chip system. This combination aims to enhance predictions of human drug reactions, allowing earlier elimination of potentially harmful drug candidates in the development pipeline.

Component Insights

Software had a significant revenue share of 41.86% in 2024 and is expected to grow at the fastest CAGR during the forecast period. The significant adoption of AI-powered software solutions for precision medicine by institutions, providers, and patients is expected to drive the growth of the software segment. In June 2023, Illumina Inc. introduced PrimateAI-3D, an advanced AI algorithm that accurately predicts disease-causing genetic mutations. PrimateAI-3D is expected to be widely accessible to the genomics community through integration within Illumina Connected Software.

Hardware segment is expected to grow at significantly during the forecast period. The growth is primarily driven by the need for high computational power to handle large biomedical datasets, ensure fast processing for real-time diagnostics, and support advanced AI algorithms in personalized treatments. For instance, in July 2024, Insilico introduced PandaOmics Box, an AI-driven hardware platform for on-premise personalized medicine and drug discovery research. The platform integrates PandaOmics, Insilico's proprietary generative biology AI software, with a comprehensive scientific database and high-performance hardware, including chip-level confidential computing capabilities, to enhance data security and computational efficiency.

Technology Insights

Based on technology, the deep learning segment dominated the market with a revenue share of 33.60% in 2024. The growth is driven by advancements in data center capabilities, increased processing power, and the ability to perform tasks autonomously. Deep learning algorithms enable the integration and modeling of diverse patient data across different modalities and time, leading to improved predictions & personalized treatment recommendations. For instance, in May 2023, GE HealthCare received FDA 510(k) clearance for Precision DL, an image processing deep learning-based software within its expanding Effortless Recon DL portfolio. Precision DL delivers image quality advancements linked with Time-of-Flight (ToF) hardware-based reconstruction, such as enhanced contrast recovery, contrast-to-noise ratio, and higher quantitative accuracy.

Natural language processing (NLP) segment is anticipated to grow at a significant CAGR over the forecast period. NLP is anticipated to play a crucial role in expediting the healthcare decision-making process. The benefit of establishing effective algorithms depends on the data quality obtained. A quicker decision-making process will allow physicians to focus on value-added treatment. For instance, in November 2023, GenomOncology announced that City of Hope, a U.S. cancer research and treatment institution, is expected to enhance its NLP pipeline using HopeIQ, a data enablement solution developed by City of Hope and powered by GenomOncology's igniteIQ platform. City of Hope has demonstrated progress in improving patient care through its precision medicine initiatives.

Therapeutic Application Insights

Oncology had a significant revenue share of 30.25% in 2024. The increasing collaborations and partnerships to facilitate innovation and research for advancing cancer therapy is contributing to market growth. For instance, In June 2024, Caris Life Sciences expanded its network of cancer institutions focused on advancing patient outcomes through precision medicine innovations by including the Caris Precision Oncology Alliance (POA).

"We are thrilled to welcome Mass General Cancer Center, one of the world's most respected centers, to the Caris Precision Oncology Alliance. We're eager to work with their researchers and investigators on our shared mission of improving outcomes of all patients affected by cancer through precision oncology research."

-George W. Sledge, Jr., MD, EVP and Chief Medical Officer of Caris

Neurology segment is expected to grow at the fastest CAGR during the forecast period. The growth is attributed to the increasing prevalence of neurological disorders, such as Alzheimer's and Parkinson's disease, which necessitate early and accurate diagnosis. Moreover, advancements in AI technologies, particularly in imaging and data analysis, enhance the ability to identify complex neurological conditions, improving patient outcomes. For instance. in April 2024, NeuroSense Therapeutics Ltd. collaborated with Genetika+ to advance drug development for Alzheimer's Disease (AD). This multi-phase partnership, initiated within NeuroSense's ongoing Phase 2 AD clinical trial, utilizes Genetika+'s technology to derive frontal cortex neurons from patient blood samples, enabling in vitro quantification of drug-induced neuronal plasticity.

Regional Insights

North America artificial intelligence in precision medicine market dominated in 2024 with the largest share of 29.43%. Growth of the market is attributed to the strategic presence of major players, such as Abbott; Danone; Targeted Medical Pharma, Inc.; Nestlé; and Mead Johnson & Company, LLC. For instance, in July 2022, Certara, Inc., which pioneered biostimulation, announced a two-year collaboration with Memorial Sloan Kettering Cancer Center to build new biosimulation software. This collaboration helps companies develop a biosimulation platform for CAR T-cell treatment. Furthermore, CAR T-cell treatment, known as immunotherapy, employs immune system T-cells, which have experienced a unique modification to combat certain types of blood cancer. The increasing demand for personalized treatment is the primary factor driving market expansion in the U.S.

U.S. Artificial Intelligence in Precision Medicine Market Trends

The AI in precision medicine market in the U.S. held the largest revenue share in 2024. The growth is driven by advanced healthcare infrastructure, substantial investment in research and development, and a focus on improving patient outcomes. For instance, in May 2024, U.S. Precision Medicine, Inc. announced its plans to leverage advanced AI technology to support independent research demonstrating the efficacy of its small molecule candidate in targeting and eliminating breast cancer cells.

Europe Artificial Intelligence in Precision Medicine Market Trends

The AI in precision medicine market in Europe is poised to grow at the fastest CAGR over the forecast period. The rising demand for reducing healthcare expenditure and growing patient health-related digital information datasets are fueling market growth. The rising global geriatric population, changing lifestyle, and growing prevalence of chronic illnesses have increased the need for early disease diagnosis and treatment. The increasing government initiatives are fueling regional market growth. The European Cancer Imaging Initiative aims to help innovators and researchers translate real-world oncology data on the quality and scale required to develop new cancer detection, diagnosis, and treatment solutions, especially those based on AI.

The AI in precision medicine market in the UK is expected to grow significantly over the forecast period. Partnerships between various healthcare institutes and industry players contribute to research advancements and practical applications of AI technologies. For instance, in February 2024, a collaborative initiative involving Durham University, the Royal Marsden Hospital, the Institute of Cancer Research (ICR), and tech-bio firm Concr received a USD 1.08 million (EUR 1 million) Innovate UK grant. The AI-VISION project aims to drive advancements in precision medicine.

The AI in precision medicine market in Germany is expected to grow substantially over the forecast period. The growth is divern by increasing strategic initiatives undertaken by market players to advance cancer therapy. For instance, in January 2024, Quibim announced a collaboration with Merck KGaA to develop advanced precision medicine technologies aimed at various cancers.

Asia Pacific Artificial Intelligence in Precision Medicine Market Trends

The AI in precision medicine market in Asia Pacific is expected to grow significantly over the forecast period. The AI in precision medicine market in Asia-Pacific is driven by rising investments in healthcare AI, growing demand for personalized treatments due to a high prevalence of chronic diseases, and supportive government initiatives promoting healthcare innovation. Moreover, various exhibitions provide a platform for market players to introduce advanced healthcare solutions. For instance, in August 2024, Taiwan Web Service announced new enhancements in precision medicine at the BIO Asia-Taiwan Exhibition 2023. Through a collaboration with the Industrial Technology Research Institute, the partnership integrates AI applications with biomedical engineering to develop AI-enabled biomedical tools.

In Japan, the AI in precision medicine market benefits from advanced healthcare infrastructure and strong government support for AI-driven medical innovations, particularly for addressing age-related diseases in its aging population. Collaborations between tech companies, research institutions, and healthcare providers reinforce Japan’s focus on precision medicine. High R&D investment in genomics and bioinformatics and a robust regulatory environment promoting healthcare advancements accelerate AI integration in diagnostics and personalized treatment.

Key Artificial Intelligence in Precision Medicine Company Insights

The market is highly competitive and is dominated by a few large competitors. Key players are implementing various strategies, such as mergers, partnerships, collaborations, and acquisitions, to enhance their market presence.

Several players are actively implementing strategic plans to meet the growing demand. For instance, in May 2021, AdventHealth, a nonprofit healthcare organization, announced its collaboration with Sema4, a health intelligence company. Through the utilization of Sema4's software platform and tools, AdventHealth aims to integrate genomic and clinical data. This collaboration expands AdventHealth's existing genomics and personalized health initiative, which includes investments in precision medicine research, as well as genetic testing, counseling, and sequencing service. Some of the prominent players in the global AI in precision medicine market include:

Key Artificial Intelligence in Precision Medicine Companies:

The following are the leading companies in the artificial intelligence in precision medicine market. These companies collectively hold the largest market share and dictate industry trends.

- BioXcel Therapeutics Inc.

- Sanofi

- NVIDIA Corporation

- Alphabet Inc. (Google Inc.)

- IBM

- Microsoft

- Intel Corp.

- AstraZeneca plc

- GE HealthCare

- Enlitic, Inc.

Recent Developments

-

In October 2024, Aidoc and NVIDIA announced the development of a framework to enhance the deployment and integration of AI tools in healthcare. Named the Blueprint for Resilient Integration and Deployment of Guided Excellence (BRIDGE), this guideline aims to speed up AI adoption across the healthcare sector.

-

In October 2024, GE HealthCare announced announced to lead a consortium dedicated to synthetic data generation for AI in healthcare. The initiative includes industry partners such as Novo Nordisk, Gates Ventures, and Pfizer, alongside academic collaborators like the Fraunhofer Institute, La Fe University, and the University of Bologna. The consortium aims to develop synthetic datasets to enhance AI algorithm training in healthcare applications.

“In the era of precision medicine where treatments target specific gene mutations, new tools are essential to protect patient data privacy. Whole genome sequencing, digital imaging, and electronic health records represent an individual's unique ID, all of which are crucial for providing the best possible care. Yet safeguarding personal data privacy is non-negotiable. Generating effective synthetic databases through artificial intelligence is the only viable way to uphold privacy while advancing precision medicine. Generation of efficient synthetic data bases by using artificial intelligence is the unique way to pursue the goals of maintaining data privacy while offering the tools to advance in precision medicine.”

~ Guillermo Sanz, Scientific Director at IlSLaFe, Hospital Universitario y Politécnico la Fe

-

In May 2023, Google Cloud introduced new AI tools to advance precision medicine and life sciences. The Target and Lead Identification Suite supports pharmaceutical researchers in predicting protein structures and analyzing amino acid functions to enhance drug discovery. The Multiomics Suite facilitates genomic data interpretation, assisting in developing and applying precision therapeutics.

Artificial Intelligence In Precision Medicine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.10 billion

Revenue forecast in 2030

USD 14.53 billion

Growth rate

CAGR of 36.23% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, therapeutic application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

BioXcel Therapeutics Inc.; Sanofi; NVIDIA Corporation; Alphabet Inc. (Google Inc.); IBM; Microsoft; Intel Corp.; AstraZeneca plc; GE HealthCare; Enlitic, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Artificial Intelligence In Precision Medicine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global artificial intelligence in precision medicine market report based on component, technology, therapeutic applications, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Hardware

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Deep Learning

-

Querying Method

-

Natural language processing

-

Context aware processing

-

-

Therapeutic Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Cardiology

-

Neurology

-

Respiratory

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global artificial intelligence in precision medicine market size was valued at USD 2.29 billion in 2024 and is expected to reach 3.10 billion in 2025

b. The global artificial intelligence in precision medicine market size is expected to grow at a compound annual growth rate of 36.23% over the forecast period from 2025 to 2030 and is expected to reach 14.53 billion in 2030.

b. North America dominated the the AI in precision medicine market with a share of 29.43% in 2024. Growth of the market is attributed to the strategic presence of major players, such as Abbott; Danone; Targeted Medical Pharma, Inc.; Nestlé; and Mead Johnson & Company, LLC., among others. Furthermore, advanced healthcare infrastructure, substantial investment in research and development, and a focus on improving patient outcomes drive the regional market

b. Some of the key players of the AI in precision medicine market are: BioXcel Therapeutics Inc.; Sanofi;NVIDIA Corporation; Alphabet Inc. (Google Inc.); IBM; Microsoft; Intel Corp.; AstraZeneca plc; GE HealthCare; Enlitic, Inc.

b. The key factors driving artificial intelligence in precision medicine market are: increasing R&D spending and the rising adoption rate of tailored medications. Moreover, collaborations among key companies and the rise in cancer cases across the globe have a positive impact on the AI in precision medicine market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.