- Home

- »

- Processed & Frozen Foods

- »

-

Asia Meat Extract Market Size, Share & Growth Report, 2030GVR Report cover

![Asia Meat Extract Market Size, Share & Trends Report]()

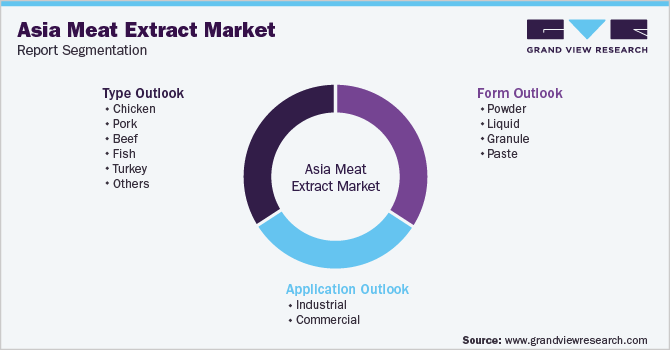

Asia Meat Extract Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Chicken, Pork, Beef, Fish, Turkey, Others), By Form (Powder, Liquid, Granule, Paste), By Application, And Segment Forecasts

- Report ID: GVR-4-68040-056-6

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

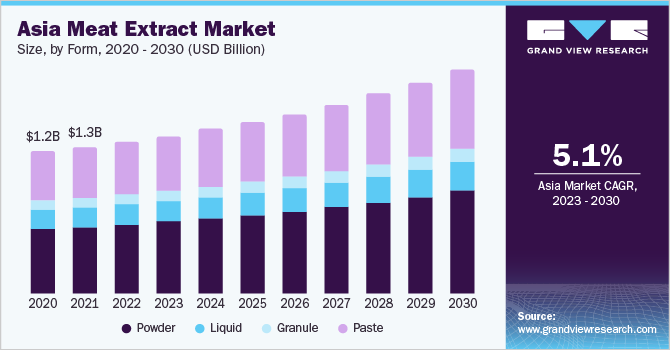

The Asia meat extract market size was valued at USD 1.33 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.1% from 2023 to 2030. The market is anticipated to be driven by the changing diet trends, market developments, and R&D initiatives taken by the major companies in the food sector leading to economic growth in the industry. Increasing consumption of a protein-rich diet and rising health consciousness is anticipated to drive product demand during the next few years. In addition, the growing popularity of beef due to its various certifications, such as halal and kosher is anticipated to contribute to the market growth. For instance, as per the data published by the Food and Agriculture Organization (FAO), the total meat production in the world is expected to reach nearly 366.0 million tons by 2029. Of the total additional output, 76.0% is expected to be dominated by developing countries.

The growing purchasing power of consumers will also support market growth. There is an increased shift from conventional meat to packaged meat products due to fast-tracked life in both developing as well as developed countries, resulting in an increased demand for meat extracts. Moreover, with the growing consumer awareness regarding the consumption of high-nutrition food, the demand for protein is increasing all over the world, thereby augmenting the market growth.

Rising disposable income and urbanization in Asian countries have resulted in consumers looking for the most convenient options available. The demand for convenience has driven processed meat product manufacturing. Moreover, Asia’s population is continuously expanding. The growing urban population in the region is one of the key contributors to the increasing demand for meat and meat products such as extracts, seasonings, flavors, and other ingredients.

In addition, processed meat manufacturers are coming up with new products and adding new flavors to the existing range of products. For instance, according to PT Foodex Indonesia, an Indonesian food seasoning and food ingredients company, provides meat extract manufactured from real meat. Furthermore, with emerging meat extract technology, manufacturers are extracting ingredients from the original meat sources through techniques such as vacuum dry, spray dry, and microwave.

Type Insights

Based on type, the market is segmented into chicken, pork, beef, fish, turkey, and others. In 2022, the beef segment held a dominant position in the market, accounting for a share of 30.5%. Beef extract is a culinary name for the meat extract obtained from bovine animals, including cows and buffaloes. It is one of the largest consumed meat forms in the world and is only second to chicken in terms of volume consumption. The beef extracts segment is driven by the increasing awareness among consumers regarding high protein consumption, which is significantly met by a diet comprising beef meat.

Another factor contributing to the increase in beef extract consumption is certain food safety issues such as chemical residue and pathogen detection in other meat products like pork and poultry. The beef market has shown a slight growth during the past five years owing to the increasing consumption in emerging economies such as China, Thailand, Indonesia, and Vietnam.

The chicken segment is anticipated to expand at the fastest CAGR of 5.7% by revenue during the forecast period.Factors such as population expansion in developing economies and associated double-income families are expected to contribute to rising preference toward packaged ready-to-eat meat products such as soups and noodles. As a result, the chicken meat extracts market is expected to witness growth at a significant rate during the forecast period.

Chicken meat extract is a rich source of essential amino acids and a good source of energy. It is also a good source of nutrients such as proteins, minerals, and vitamins. Chicken meat extract is often used in sports supplements and protein bars due to its high protein content, which is further expected to fuel segmental growth.

Form Insights

Based on form, the market is segmented into powder, liquid, granule, and paste. The powder segment dominated the market with a revenue share of 45.7% in 2022 and is expected to retain its dominance during the forecast period. Meat extract powder is a type of seasoning that is made by dehydrating meat and grinding it into a fine powder.

It is often used to add a rich, savory flavor to a variety of dishes, such as soups, stews, sauces, and gravies. It can also be used to enhance the flavor of meat dishes and other protein-rich foods. Meat extract powders are typically made by simmering pieces of meat in water to extract the flavor, then dehydrating the resulting broth and grinding it into a fine powder.

This process preserves the flavor and nutrients of the meat, making it a convenient way to add depth and richness to a wide range of dishes. Additionally, meat extract powder is shelf-stable and easy to store, making it a convenient ingredient to have on hand in the kitchen.

The increasing use of meat extract powder in a variety of applications, such as stuffing, stock powder, bouillon cubes, seasoning, coatings, nuggets, soup powders, soups, sauces, ready meals, and snacks, is expected to drive the growth of the meat extract market. Additionally, meat extract powder is used in microbiological culture media as a substitute for meat infusion. It is used in the bacteriological examination of materials such as water and milk, and its consistent composition is important for adding nutritional value to meat products.

The paste segment is expected to showcase the fastest CAGR of 5.4% by revenue during the forecast period.Meat extract paste is a type of seasoning made by concentrating and dehydrating meat. It is a highly concentrated source of protein, nutrients, and flavor that is used to enhance the taste and nutritional value of a wide range of dishes. It is a flavoring additive derived from the meat of pork, beef, chicken, fish, or mutton and is used in the manufacturing of soups, sauces, stews, casseroles, pot pies, canned meat items, bouillon & bouillon cubes, gravies, instant noodles, and puffed & baked goods.

Companies such as NH Foods Ltd. and Nikken Foods Co., Ltd., through their intensive and ongoing research & development activities, have introduced variable formulations that balance all the aforementioned concerns of the consumers. For instance, in April 2021, Nikken Foods Co., Ltd. received a bronze medal for its sustainability efforts from EcoVadis, a company that evaluates and rates businesses for the sustainability

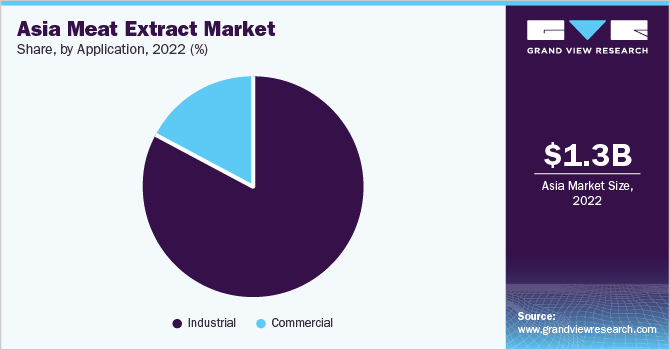

Application Insights

In 2022, the industrial segment dominated the market with a revenue share of 83.3% during the forecast period. Meat extracts from various sources such as beef, pork, fish, chicken, and lamb are used to make a variety of products, including nuggets, stock powder, coatings, bouillon cubes, seasoning, soups, sauces, snacks, soup powders, and ready meals. The consumption of instant foods such as meat snacks, soup, salad, noodles, and other ready-to-eat products that can be cooked quickly is expected to experience strong growth in the coming years due to the increasing number of working professionals in the region.

The commercial segment is expected to record a CAGR of 4.2% by revenue during the forecast period. Commercial eateries and full-service restaurants are either independently owned or owned by chain restaurants. Apart from the dining experience, these places also consider their services and food quality. Therefore, fast-food and full-service restaurants are consumer-dependent and companies in these industries opt for creative offerings to grow their business, such as offering limited-time menus and regional specialties.

Key Companies & Market Share Insights

The companies market their products with customization services. The change in the type of product category, such as seafood, beef, and pork, coupled with the change in taste preference of consumers is likely to increase the customization of the products. Moreover, local players cater to the local market by providing highly customized products with a variety of recipes. Product convenience and its ease-of-use are also important factors in driving their popularity among consumers.

Companies in the meat extract industry are focusing on implementing various strategies to achieve strong business growth and market position, including acquisitions, distribution, and marketing, expansion of production capacity, product licensing, and investments in research and development. Many of these companies rely on a consistent supply of raw materials, such as raw meat, and firm partnerships & agreements with local suppliers to ensure a high-quality product with an improved shelf life.

Some of the key strategies adopted by the prominent Asia meat extract market participants include new product launches, expansions, and acquisitions. For instance, In February 2022, PT. Foodex Indonesia moved its sales & marketing office to a strategic location in Central Jakarta, Indonesia. This relocation was aimed at providing prompt services to consumers in Jakarta. Some of the prominent players in the Asia meat extract market include:

-

NH Foods Ltd.

-

Titan Biotech

-

PT. Foodex Indonesia

-

Inthaco Co. Ltd

-

PT. JINGYOUNG

-

ARIAKE JAPAN Co. Ltd

-

Nikken Foods Co. Ltd

Asia Meat Extract Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.38 billion

Revenue forecast in 2030

USD 1.98 billion

Growth Rate

CAGR of 5.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, Volume in kilotons, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, form, application

Regional scope

Asia

Key companies profiled

NH Foods Ltd.; Titan Biotech; PT. Foodex Indonesia; Inthaco Co. Ltd; PT. JINGYOUNG; ARIAKE JAPAN Co. Ltd; Nikken Foods Co. Ltd

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Meat Extract Market Report Segmentation

This report forecasts volume & revenue growth at the regional and country level in addition to provide an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the Asia meat extract market report based on the type, form, application:

-

Type Outlook (Revenue, USD Million, Kilotons, 2017 - 2030)

-

Chicken

-

Pork

-

Beef

-

Fish

-

Turkey

-

Others

-

-

Form Outlook (Revenue, USD Million, Kilotons, 2017 - 2030)

-

Powder

-

Liquid

-

Granule

-

Paste

-

-

Application Outlook (Revenue, USD Million, Kilotons, 2017 - 2030)

-

Industrial

-

Commercial

-

Frequently Asked Questions About This Report

b. The Asia meat extract market is worth USD 1.33 billion in 2022 and is projected to reach USD 1.38 billion in 2023.

b. The Asia meat extract market is expected to grow at a compound annual growth rate of 5.1% from 2023 to 2030 to reach USD 1.98 billion by 2030.

b. Industrial segment is projected to account for the largest share of 83.2% in 2022 owing to the increasing consumer awareness towards processed meats

b. Some of the key market players in the Asia meat extract market are NH Foods Ltd, Titan Biotech, Inthaco Co. Ltd, PT. JINGYOUNG, ARIAKE JAPAN Co. Ltd, and Nikken Foods Co. Ltd

b. Key factors that are driving the Asia meat extract market growth Asia are changing consumer habits and rise in meat consumption

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.