- Home

- »

- Advanced Interior Materials

- »

-

Asia Pacific Cooling Tower Market, Industry Report, 2030GVR Report cover

![Asia Pacific Cooling Tower Market Size, Share & Trends Report]()

Asia Pacific Cooling Tower Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Open-circuit, Hybrid), By Material (Steel, Concrete, Wood), By Application (HVAC, Oil & Gas), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-235-0

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Asia Pacific Cooling Tower Market Trends

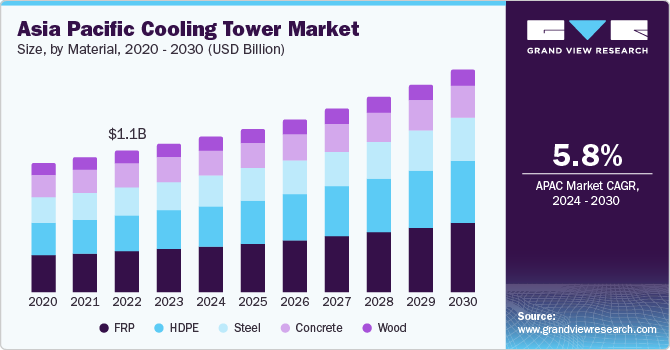

The Asia Pacific cooling tower market size was valued at USD 1.19 billion in 2023 and is projected to grow at a CAGR of 5.8% from 2024 to 2030. The market is expected to witness a surge in demand for cooling towers due to strict government regulations concerning environmental safety and concerns associated with plumes produced by power generation and chemical industries. Cooling towers are an essential part of HVAC systems that maintain a comfortable and cool environment in large commercial buildings such as airports, hospitals, conference centers, hotels, and office buildings. Moreover, growing commercial building construction in the Asia Pacific is expected to drive the demand for the cooling towers market in the coming years.

According to the World Bank, Asia Pacific is a progressive region in terms of economic and population growth. Rapid urbanization, increased investments by governments for industrial set-ep, a cheap labor force, and rising FDI have boosted Asian industrialization. Economies such as China, India, and Japan are the key countries driving the development of manufacturing, and power generation industries in this region. The competition among Chinese capital markets and a few other Asian economies is generating lucrative growth opportunities for various industries, which has, in turn, created a favorable environment for investments in the cooling towers market.

Moreover, in the past few years, the improving economies of China, India, Thailand, Indonesia, and Malaysia have forced governments to frame supportive policies to promote investments in the extraction of natural resources, including crude oil and natural gas. This is expected to escalate the oil extraction units in the region and correspondingly augment the demand for cooling towers in the region. Industrial cooling towers are preferred as they eliminate the heat absorbed in the circulating cooling water systems for petroleum refineries, petrochemical plants, power plants, food processing plants, natural gas processing plants, and other industrial units.

Electricity is one of the fastest-growing forms of end-use energy consumption. Electricity consumption is higher in developed nations than in developing nations. However, as the economies of developing nations progress, the global energy consumption of electricity continues to rise.

As reported by Enerdata in 2021, global electricity consumption rebounded with a 5% growth after a setback in 2020 with a 4.5% decline. Energy consumption escalated in most countries; for instance, China observed 5.2% growth (after a 2.2% growth in 2020), India observed 4.7% growth (after a 5.6% decline in 2020), the U.S. observed 4.7% growth (after a -8.6% drop in 2020), while Russia’s consumption escalated by 9% (after a 4% dip in 2020).

Rapid industrialization, rising disposable income of consumers, and globalization are the key factors leading to a tremendous demand for electricity across the Asia Pacific, particularly in developing economies. To reduce carbon emissions, fossil fuels are being replaced by new technologies, which also consume high amounts of electricity, thus contributing to an increased demand for electricity.

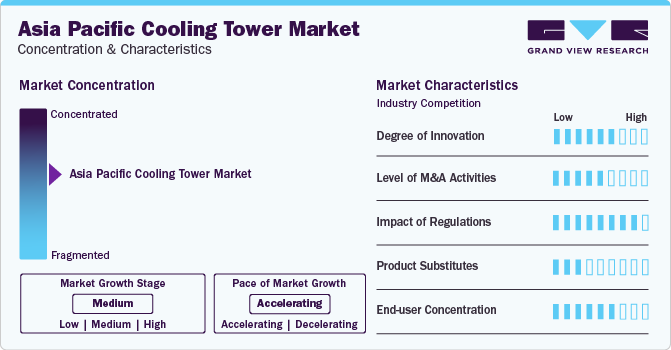

Market Concentration & Characteristics

The global cooling towers market is a highly competitive industry that comprises several established players and new entrants. The market is driven by several factors such as stringent environmental regulations, concerns associated with plume generation, and a rise in commercial construction projects around Asia Pacific.

The market is characterized by a variety of cooling towers, including natural draft, mechanical draft, and hybrid draft, with each type offering specific advantages and disadvantages. Additionally, the market is influenced by factors such as the size, capacity, and location of the cooling tower. The market is also segmented based on application areas such as power generation, chemical processing, HVAC, and food processing. The market is expected to witness significant growth in the coming years due to the increasing demand for HVAC systems, rising concerns over environmental safety, and the growth of commercial construction activities.

Regulations have a significant impact on the Asia Pacific cooling tower market. Governments across the region are implementing stringent environmental regulations to address water scarcity and curb emissions of pollutants, including volatile organic compounds (VOCs). These regulations are positively influencing the market, driving the adoption of more efficient and environmentally friendly cooling technologies.

In terms of substitutes for cooling towers, the rise in demand for energy-efficient air conditioners is notable. With rising incomes and improved access to electricity, air conditioning is becoming increasingly affordable for more people across the Asia Pacific region. However, cooling towers still play a crucial role in industrial applications, where they are used to dissipate heat generated from various processes.

The end-user concentration in the Asia Pacific cooling tower market is quite diverse, spanning several industries. The power generation sector, petrochemical and oil & gas industries, iron & steel and metallurgy, and paper mills are among the major end consumers. The region is also characterized by the presence of one of the largest petrochemical industries, which is considered one of the major end-users of water cooling towers.

Type Insights

Open-circuit cooling towers, also known as wet cooling towers, are the most common type of cooling towers and had the largest revenue share of 40.8% in 2023. These towers are popular due to their efficiency and cost-effectiveness. They function by directly exposing the water to be cooled to the air, allowing a portion of the water to evaporate and cool the rest. This process is highly effective in dissipating heat, making open-circuit cooling towers a preferred choice for many industries, including power generation and manufacturing. However, they do consume a significant amount of water, which can be a concern in regions with water scarcity.

Hybrid cooling towers are projected to experience the fastest growth in terms of revenue, in the Asia Pacific cooling tower market, with a significant CAGR from 2024 to 2030. These towers combine the features of both wet (open circuit) and dry cooling towers. They offer the cooling efficiency of wet cooling towers while significantly reducing water consumption, a feature borrowed from dry cooling towers. This makes them an attractive option in regions with strict water usage regulations or limited water resources. Furthermore, hybrid cooling towers can operate efficiently in a wide range of ambient conditions, making them suitable for various applications. The increasing demand for energy-efficient and environmentally friendly cooling solutions is expected to drive the growth of the hybrid cooling tower segment.

Material Insights

Fiber Reinforced Plastic (FRP) cooling towers had the largest revenue share in the Asia Pacific cooling tower market in 2023. FRP is a composite material made of a polymer matrix reinforced with fibers, which provides several advantages such as corrosion resistance, strength, and durability. These properties make FRP an ideal material for cooling towers, especially in industries where corrosion resistance is crucial, such as chemical processing, power generation, and oil & gas. Despite the higher initial cost compared to other materials, the long-term benefits of FRP, including lower maintenance costs and longer lifespan, make it a cost-effective choice for many businesses.

High-Density Polyethylene (HDPE) cooling towers are projected to experience the fastest growth in the Asia Pacific cooling tower market in terms of revenue. HDPE is a type of plastic that is known for its large strength-to-density ratio. It is resistant to impact, moisture, and many chemicals, making it a suitable material for cooling towers. HDPE cooling towers are lightweight, durable, and recyclable, which aligns with the growing emphasis on sustainability in the industry. The increasing demand for energy-efficient and environmentally friendly cooling solutions is expected to drive the growth of the HDPE cooling tower segment.

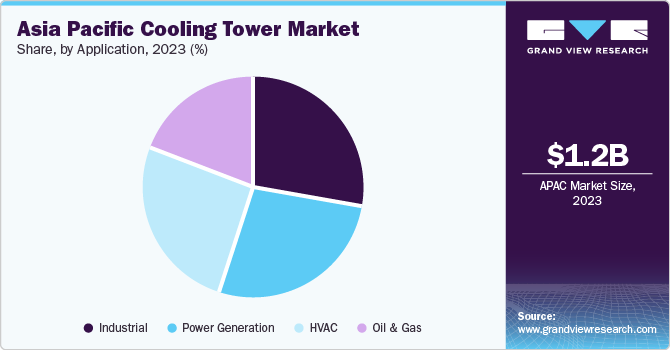

Application Insights

The industrial application segment held the largest revenue share in the Asia Pacific cooling tower market in 2023. Rapid industrialization, particularly in nations like China and India, has fuelled the demand for cooling towers across various sectors, including power generation, manufacturing, and HVAC systems. The industrial sector has also grown significantly, which has benefited the cooling tower industry and the overall market.

The Heating, Ventilation, and Air Conditioning (HVAC) segment is expected to witness the fastest growth in the Asia Pacific cooling tower market in terms of revenue, from 2024 to 2030. The demand for cooling towers in the HVAC sector is driven by the increasing need for energy-efficient cooling solutions in buildings. The growing urbanization in several economies has resulted in an increased number of construction activities, thereby fueling the demand for HVAC systems.

Country Insights

China Cooling Tower Market Trends

China holds the largest market share in the Asia Pacific cooling tower market, accounting for 32% of revenue in 2023. The growth in China’s cooling tower market is driven by the country’s rapid industrialization and urbanization. The presence of many major manufacturers of cooling towers in China plays a significant role in the market, contributing to its growth and development.

India Cooling Tower Market Trends

India is expected to witness the fastest growth in the Asia Pacific cooling tower market in terms of revenue from 2024 to 2030. Factors like the increasing need for tightening legislation, energy efficiency, replacement demand, rising Greenfield projects, and capacity expansion drive the growth in the Indian market.

Key Asia Pacific Cooling Tower Company Insights

The Asia Pacific cooling tower market is characterized by a moderate level of market concentration. The presence of both key and local market players contributes to the competitive landscape.Some key players operating in this market include Hamon and Cie International, Baltimore Aircoil Company, and ENEXIO:

-

Baltimore Aircoil Company (BAC) specializes in designing, manufacturing, and distributing cooling towers, evaporative condensers, and other related equipment. BAC’s cooling towers are widely used in various industries, including chemicals, petrochemicals, power generation, and HVAC systems.

-

ENEXIO Water Technologies is a German-based company that focuses on sustainable water and air solutions. They offer a comprehensive range of cooling tower products, including wet cooling towers, dry cooling systems, and hybrid cooling solutions. ENEXIO’s expertise lies in optimizing water usage, reducing environmental impact, and enhancing overall system performance. Their cooling towers are widely used in power plants, industrial facilities, and commercial buildings across the Asia Pacific region.

Key Asia Pacific Cooling Tower Companies:

- Baltimore Aircoil Company

- ENEXIO

- Paharpur Cooling Towers

- SPX Corporation

- Thermax Limited

- Johnson Controls Inc.

- King Sun Industry Co. Ltd.

- Hamon and Cie International

- Evapco Inc.

- Delta Cooling Towers

Recent Developments

-

In December 2023, the National Company Law Tribunal (NCLT) of India approved the demerger of Thermax’s subsidiaries, Thermax Cooling Solutions Limited and Thermax Instrumentation Limited. This approval will allow the management to focus more effectively on their respective businesses.

-

In March 2023, Johnson Controls announced that the combination of its Metasys building automation system, and OpenBlue Enterprise Manager has helped Microsoft’s Beijing headquarters save 27.9% annual energy consumption. This achievement will boost more such innovation in the industry.

Asia Pacific Cooling Tower Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.25 billion

Revenue forecast in 2030

USD 1.79 billion

Growth rate

CAGR of 5.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, material, application, country

Country Scope

China, India, Japan, RoAPAC

Key companies profiled

Baltimore Aircoil Company; ENEXIO; Paharpur Cooling Towers; SPX Corporation; Thermax Limited; Johnson Controls Inc.; King Sun Industry Co. Ltd. Hamon and Cie International; Evapco Inc.; Delta Cooling Towers

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Cooling Tower Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific cooling towers market report based on type, material, application, and country:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Open Circuit

-

Closed Circuit

-

Hybrid

-

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

FRP

-

Steel

-

Concrete

-

Wood

-

HDPE

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

HVAC

-

Power Generation

-

Oil & Gas

-

Industrial

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Frequently Asked Questions About This Report

b. The Asia Pacific cooling tower market size was estimated at USD 1.19 billion in 2023 and is expected to be USD 1.25 billion in 2024.

b. The Asia Pacific cooling tower market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.8% from 2024 to 2030 to reach USD 1.79 billion by 2030.

b. The open-circuit type cooling towers dominated the Asia Pacific cooling tower market with a revenue share of 40.8% in 2023, on account of several factors including their efficiency and cost-effectiveness.

b. Some of the key players operating in the Asia Pacific cooling towers market include Baltimore Aircoil Company; ENEXIO; Paharpur Cooling Towers; SPX Corporation; Thermax Limited; Johnson Controls Inc.; King Sun Industry Co. Ltd. Hamon and Cie International; Evapco Inc.; Delta Cooling Towers.

b. Key factors that are driving the Asia Pacific cooling tower market growth include with the rising need for sustainable solutions in various industries. The growing industrial sector in the Asia Pacific, particularly in areas such as power generation and HVAC, is also expected to boost the demand for cooling towers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.