- Home

- »

- Advanced Interior Materials

- »

-

Cooling Tower Market Size & Share, Industry Report, 2033GVR Report cover

![Cooling Tower Market Size, Share & Trends Report]()

Cooling Tower Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (FRP, Steel, Concrete, Wood, HDPE), By Type (Open Circuit, Closed Circuit, Hybrid), By Application (HVAC, Power Generation, Oil & Gas, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-562-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cooling Tower Market Summary

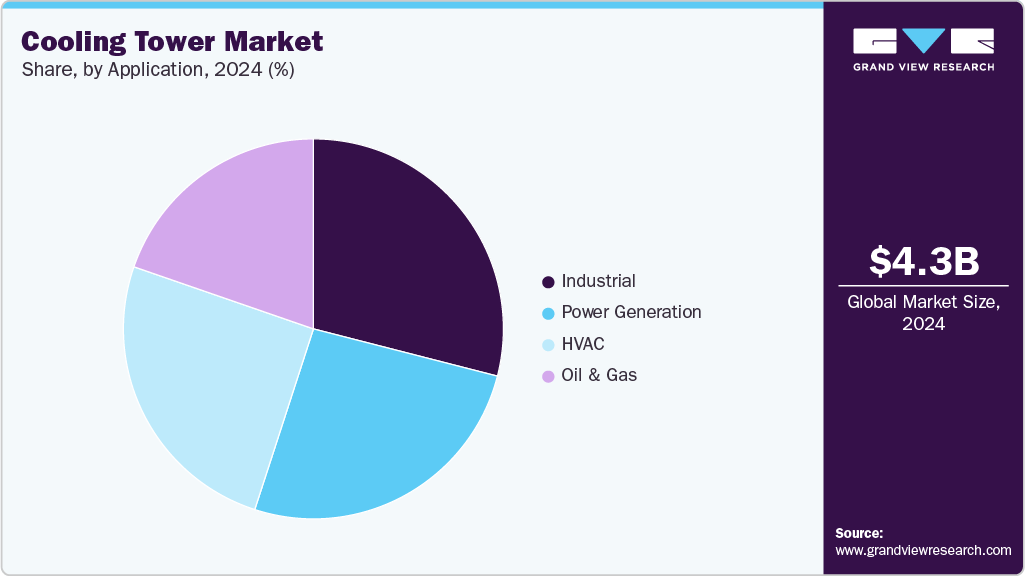

The global cooling tower market size was estimated at USD 4,272.4 million in 2024 and is projected to reach USD 7,459.1 million by 2033, growing at a CAGR of 6.6% from 2025 to 2033. The growing demand for energy-efficient HVAC systems across commercial and industrial sectors is a major factor driving the global cooling tower market.

Key Market Trends & Insights

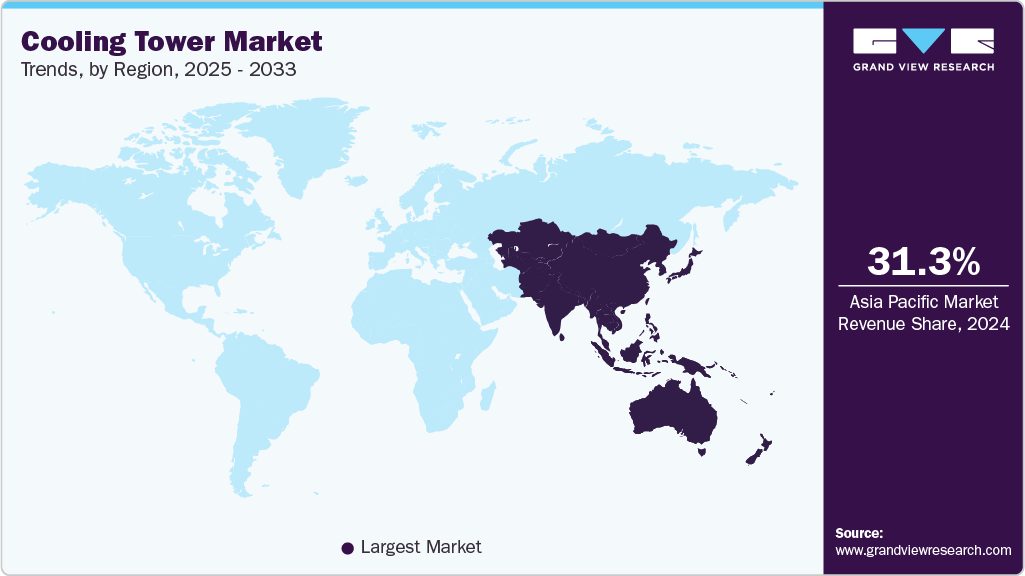

- Asia Pacific dominated the cooling tower market with the largest revenue share of 31.3% in 2024.

- China cooling tower market is witnessing strong growth due to rapid industrialization and large-scale power generation activities.

- By material, Fiber Reinforced Plastic (FRP) dominates the cooling tower material segment and accounted for 28.9% market revenue share in 2024.

- By type, open circuit segment dominated the cooling tower market, with the largest share of 42.4% in 2024.

- By application, the industrial segment accounted for a share of 29.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4,272.4 Million

- 2033 Projected Market Size: USD 7,459.1 Million

- CAGR (2025-2033): 6.6%

- Asia Pacific: Largest market in 2024

Increasing urbanization and rapid infrastructure development in emerging economies have led to a surge in the construction of commercial buildings, data centers, and manufacturing facilities. In addition, the expansion of power generation capacity, especially thermal and nuclear power plants, is significantly driving the growth of cooling towers installations. These plants rely heavily on cooling towers for heat dissipation and maintaining optimal turbine efficiency. Government regulations promoting water conservation and energy efficiency are further propelling innovation in hybrid and dry cooling technologies. The integration of IoT and automation in cooling towers for performance optimization and maintenance prediction also enhances their demand globally.

Market Concentration & Characteristics

The global cooling tower market is moderately concentrated, with a few major players holding a significant market share. These companies focus on technological advancements, strategic partnerships, and capacity expansions to maintain their competitive edge. However, regional and niche players also contribute notably, especially in developing markets. This mix of global dominance and local presence creates a balanced competitive landscape.

Innovation in the cooling tower market is driven by the need for energy efficiency, water conservation, and reduced environmental impact. Manufacturers are investing in smart technologies, such as IoT-enabled systems, for real-time monitoring and performance optimization. Advanced materials and modular designs are being introduced to improve durability and reduce maintenance. Continuous R&D is essential to meet evolving industry standards and sustainability goals.

The cooling tower market has seen a steady level of mergers and acquisitions, as key players seek to strengthen their market position and expand global reach. Acquisitions are often aimed at entering new geographic markets or enhancing product portfolios. Strategic collaborations also assist companies gain access to new technologies and customer bases. This trend supports consolidation in a moderately competitive landscape.

Regulations play a significant role in shaping the cooling tower industry, particularly concerning energy efficiency, water usage, and environmental compliance. Governments and environmental agencies are enforcing stricter standards to reduce carbon emissions and water waste. Compliance with these regulations drives companies to innovate and adopt eco-friendly technologies. Non-compliance can result in penalties, influencing investment, and operational decisions.

Drivers, Opportunities & Restraints

The growing demand for efficient cooling solutions in power generation, HVAC, and manufacturing sectors is a key driver of the cooling tower market. Rapid industrialization and urban infrastructure expansion in emerging economies also contribute significantly. Increasing awareness about energy conservation boosts the adoption of advanced cooling systems. Technological advancements in design and materials further support market growth.

Rising investments in smart infrastructure and green building projects present new growth opportunities for cooling tower manufacturers. The shift toward hybrid and dry cooling technologies in water-scarce regions is opening new market segments. Integration of automation and IoT offers potential for service-based revenue models. In addition, the expansion in data centers and renewable energy facilities enhances long-term market potential.

High installation and maintenance costs can limit the adoption of advanced cooling tower systems, especially for small and medium enterprises. Regulatory compliance and environmental concerns regarding water consumption and drift emissions pose operational challenges. Fluctuations in raw material prices may impact production costs and profit margins. Moreover, competition from alternative cooling technologies can restrain market expansion.

Material Insights

Fiber Reinforced Plastic (FRP) dominates the cooling tower material segment and accounted for 28.9% market revenue share in 2024. The segment growth is driven by its high strength, corrosion resistance, and long service life. It is particularly favored in industrial environments with harsh chemical exposure. FRP requires low maintenance, reducing long-term operational costs. Its lightweight nature also makes installation easier and more cost-effective.

High Density Polyethylene (HDPE) segment is expected to grow at a considerable CAGR of 8.0% from 2025 to 2033 in terms of revenue. High Density Polyethylene (HDPE) is the fastest growing material segment, driven by its durability and resistance to biological fouling. It is increasingly preferred for applications where water quality is a concern. HDPE cooling towers are also lightweight, recyclable, and offer cost-efficient installation. The growing demand for sustainable and low-maintenance systems supports its rapid adoption.

Type Insights

Open circuit segment dominate the cooling tower market, with the largest share of 42.4% in 2024 due to their simple design, cost-effectiveness, and efficient cooling capabilities. They are widely used in industrial processes where large volumes of heat need to be dissipated quickly. These towers use the direct contact method, where water and air interact to remove heat. Their lower initial investment and widespread availability make them a preferred choice across industries.

Hybrid cooling towers segment is expected to grow at a significant CAGR of 7.8% from 2025 to 2033 in terms of revenue. Hybrid cooling towers are the fastest-growing segment, driven by their ability to combine the benefits of both wet and dry cooling systems. They offer improved water efficiency and reduced plume emissions, making them ideal for areas with water scarcity or strict environmental regulations. Hybrid systems are gaining traction in urban and environmentally sensitive zones. Their energy-saving features and compliance with green building standards boost their adoption.

Application Insights

The industrial segment accounted for a share of 29.0% in 2024 owing to its extensive use in power plants, chemical facilities, oil refineries, and manufacturing units. These operations require large-scale heat dissipation systems for efficient and continuous functioning. Cooling towers help manage thermal loads, ensuring operational stability and equipment longevity. Their critical role in process cooling makes them indispensable in industrial settings.

The HVAC segment is expected to grow at a considerable CAGR of 8.2% from 2025 to 2033 in terms of revenue. The HVAC segment is the fastest-growing application, driven by rising demand for air conditioning in commercial buildings, data centers, and urban infrastructure. Increased focus on indoor climate control and energy-efficient systems is boosting cooling tower adoption. Growth in the construction of malls, hospitals, and office spaces further fuels demand. In addition, sustainability initiatives in building design support the integration of efficient cooling systems.

Regional Insights

North America cooling tower market is growing at significant CAGR of 7.0% over the forecast period. The growth is attributed to its advanced industrial base and stringent environmental regulations. The presence of major players and ongoing upgrades in power and HVAC infrastructure further support market growth. The U.S. leads the region with high adoption across oil & gas, chemical, and data center sectors. Technological innovation and a focus on energy efficiency also drive the market forward.

U.S. Cooling Tower Market Trends

The U.S. dominates the North American cooling tower market and accounted for 77.4% share, due to its large-scale industrial base and extensive energy infrastructure. High demand from sectors such as power generation, oil & gas, and data centers drives consistent growth. Strict environmental regulations promote the use of energy-efficient and low-emission cooling systems. Continuous technological innovation and retrofitting of existing facilities also support market leadership.

Cooling tower market in Canada is experiencing steady growth, supported by expanding commercial construction and clean energy initiatives. Increasing focus on sustainable building practices is driving demand for efficient HVAC systems. Government support for industrial modernization and emission control boosts adoption. Growth in sectors such as mining, healthcare, and infrastructure further contributes to market expansion.

Europe Cooling Tower Market Trends

Europe maintains a strong market share, supported by growing demand for sustainable cooling systems and strict regulatory frameworks on emissions and energy use. Countries such as Germany, France, and the UK are leading adopters due to investments in green building projects and industrial automation. The shift toward renewable energy and district cooling systems also fuels demand. Strong environmental policies continue to encourage adoption of efficient cooling technologies.

Cooling tower market in Germany is a key growth market in Europe due to its strong industrial base and commitment to energy efficiency. The country’s focus on sustainable manufacturing and green building standards which are driving the adoption of advanced cooling technologies. Growth in sectors such as automotive, chemicals, and power generation supports increasing demand. Government incentives for low-emission and water-efficient systems further accelerate market expansion.

The UK cooling tower market is growing steadily, driven by rising investments in commercial infrastructure and data centers. The country's increased focus on energy-efficient HVAC systems aligns with its carbon reduction goals. The modernization of aging industrial facilities also fuels demand for upgraded cooling technologies. Supportive policies around sustainability and environmental compliance enhance market opportunities.

Asia Pacific Cooling Tower Market Trends

Asia Pacific is a dominant market and accounted for a share of 31.3% in 2024, owing to rapid industrialization, urbanization, and expanding energy infrastructure, especially in China and India. The region's strong manufacturing and power generation sectors significantly drive demand for cooling towers. Government initiatives supporting infrastructure development and energy efficiency further enhance growth. Rising population and climate-driven cooling needs also contribute to market expansion.

China cooling tower market is witnessing strong growth due to rapid industrialization and large-scale power generation activities. Expanding manufacturing, petrochemical, and steel industries create consistent demand for high-capacity cooling systems. Government initiatives promoting energy efficiency and environmental compliance are accelerating the adoption of advanced cooling technologies. In addition, urban development and data center expansion further support the market growth.

Cooling tower market in India is growing rapidly, driven by increased infrastructure development and rising electricity demand. The expansion of thermal power plants and industrial zones fuels a significant uptake of cooling systems. Government programs like “Make in India” and smart city projects are promoting industrial growth and modern HVAC adoption. Rising temperatures and urbanization are also contributing to greater demand in the commercial and residential sectors.

Middle East & Africa Cooling Tower Market Trends

The Middle East and Africa are emerging markets, driven by expanding construction, oil & gas, and energy sectors. High temperatures and growing demand for HVAC systems are key factors fueling adoption. Governments are investing in desalination, power generation, and infrastructure, creating new opportunities. Adoption of energy-efficient and water-conserving systems is gaining traction amid resource constraints.

Cooling tower market in Saudi Arabia is experiencing notable growth, driven by its expanding power generation and petrochemical industries. The country’s harsh climate and high cooling demand in industrial and commercial sectors fuel the need for efficient cooling solutions. Large-scale infrastructure projects under Vision 2030 are further boosting market opportunities. Additionally, a strong focus on water conservation and energy efficiency supports the adoption of advanced cooling tower technologies.

Latin America Cooling Tower Market Trends

Latin America is witnessing steady growth in the cooling tower market, fueled by development in industrial and commercial sectors. Countries like Brazil and Mexico are investing in energy and water-efficient infrastructure. Growing awareness of environmental sustainability is encouraging adoption of modern cooling technologies. The region's economic diversification is also boosting demand across various applications.

Brazil cooling tower market is growing steadily, supported by rising investments in industrial facilities and energy infrastructure. The country’s expanding manufacturing, chemical, and power generation sectors drive demand for reliable cooling solutions. Growth in commercial construction and HVAC installations also contributes to market expansion. Environmental regulations promoting energy and water efficiency further encourage the adoption of modern cooling technologies.

Key Cooling Tower Company Insights

Some of the key players operating in the market include Babcock & Wilcox Enterprises, Inc., Baltimore Aircoil Company, Cenk Endüstri Tesisleri Imalat Ve Taahhüt A.Åž.

-

Babcock & Wilcox specializes in energy and environmental technologies, with a strong presence in industrial cooling and thermal systems. The company provides modular cooling tower solutions tailored for power plants and process industries. Its focus on decarbonization and waste-to-energy technologies supports sustainability-driven projects. B&W also integrates emissions control and thermal efficiency enhancements in its cooling systems.

-

Baltimore Aircoil Company (BAC) is known for its advanced evaporative cooling and heat rejection solutions across HVAC, industrial, and refrigeration markets. It offers a range of hybrid, closed-circuit, and modular cooling towers designed for energy efficiency and low water usage. BAC emphasizes smart technology integration, such as intelligent controls for performance optimization. The company also focuses on corrosion-resistant materials and low-sound solutions for urban and industrial applications.

Key Cooling Tower Companies:

The following are the leading companies in the cooling tower market. These companies collectively hold the largest market share and dictate industry trends.

- Babcock & Wilcox Enterprises, Inc.

- Baltimore Aircoil Company

- Cenk Endüstri Tesisleri Imalat Ve Taahhüt A.Åž.

- Cooling Tower Systems, Inc.

- Delta Cooling Towers Inc.

- Engie Refrigeration GmbH

- EVAPCO, Inc.

- S.A. Hamon

- Johnson Controls International Plc.

- Kelvion Holdings GmbH

- Liang Chi Industry Co. Ltd.

- Mesan Group

- Paharpur Cooling Towers Ltd.

- SPX Corporation

- Torraval Cooling S.L.

Recent Developments

-

In June 2025, SPX Cooling Technologies expanded its Marley® OlympusV™ Adiabatic Fluid Cooler line by introducing higher-capacity models. This strategic move aims to offer more flexible and efficient cooling solutions for operators and engineers across commercial HVAC, industrial process, and data center applications, reinforcing SPX’s leadership in advanced evaporative cooling technologies.

-

In January 2025, Delta Cooling Towers introduced the TMX Series, its largest HDPE cooling tower line, ranging from 300 to 3,250 cooling tons. Built with a seamless 20-foot sump, it reduces leak risks and simplifies maintenance. The launch includes a new West Virginia facility to support production. The TMX Series offers energy efficiency, durability, and a 20-year shell warranty.

-

In August 2024, Baltimore Aircoil Company introduced the Loop™ Platform, an AI-based system that enhances cooling tower performance. It uses real-time data to optimize efficiency, reduce energy and water usage, and support predictive maintenance. The compact platform integrates easily with existing systems. This innovation aligns with BAC’s focus on sustainability and system longevity.

Cooling Tower Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4,482.1 million

Revenue forecast in 2033

USD 7,459.1 million

Growth rate

CAGR of 6.6% from 2025 to 2033

Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, type, application, region.

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Babcock & Wilcox Enterprises, Inc.; Baltimore Aircoil Company; Cenk Endüstri Tesisleri Imalat Ve Taahhüt A.Åž.; Cooling Tower Systems, Inc.; Delta Cooling Towers Inc.; Engie Refrigeration GmbH; EVAPCO, Inc.; S.A. Hamon; Johnson Controls International Plc.; Kelvion Holdings GmbH; Liang Chi Industry Co. Ltd.; Mesan Group; Paharpur Cooling Towers Ltd.; SPX Corporation; Torraval Cooling S.L.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cooling Tower Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global cooling tower market report based on material,type, application and region:

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

FRP

-

Steel

-

Concrete

-

Wood

-

HDPE

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Open Circuit

-

Closed Circuit

-

Hybrid

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

HVAC

-

Power Generation

-

Oil & Gas

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cooling tower market size was estimated at USD 4,272.4 million in 2024 and is expected to be USD 4,482.1 million in 2025.

b. The global cooling tower market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.6% from 2025 to 2033 to reach USD 7,459.1 million by 2033.

b. Open circuit segment accounted for a share of 42.4% in 2024. Open circuit cooling towers dominate the market due to their simple design, cost-effectiveness, and efficient cooling capabilities. They are widely used in industrial processes where large volumes of heat need to be dissipated quickly.

b. Some of the key players operating in the global cooling tower market include Babcock & Wilcox Enterprises, Inc.; Baltimore Aircoil Company; Cenk Endüstri Tesisleri Imalat Ve Taahhüt A.Åž.; Cooling Tower Systems, Inc.; Delta Cooling Towers Inc.; Engie Refrigeration GmbH; EVAPCO, Inc.; S.A. Hamon; Johnson Controls International Plc.; Kelvion Holdings GmbH; Liang Chi Industry Co. Ltd.; Mesan Group; Paharpur Cooling Towers Ltd.; SPX Corporation; Torraval Cooling S.L.

b. The global cooling tower market is driven by rising demand for energy-efficient cooling systems across industrial and commercial sectors. Rapid industrialization, especially in emerging economies, fuels the need for effective heat rejection solutions. Additionally, growing environmental regulations and sustainability goals are pushing adoption of advanced and eco-friendly cooling technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.